Publications If You Can Do It, Do It Now: Deals In Post-Peak Years Of An M&A Cycle Create More Value!

- Publications

If You Can Do It, Do It Now: Deals In Post-Peak Years Of An M&A Cycle Create More Value!

- Bea

SHARE:

“If it were done when ‘tis done, then ‘twere well it were done quickly.” According to the latest iteration of our study on the last three global M&A cycles, whatever the tragic outcome for Macbeth, companies should “Just do it!”

Over the past three years, in the face of conventional wisdom, our Towers Perrin-Cass Business School M&A study has found that companies continue to create value through M&A. With 2007 looking as if it was the peak year of the current merger wave, companies may be battening down the hatches in 2008 preparing to wait out the storm. But it may be too early for that. Our latest research shows that, on average and based on the last two merger waves, deals done in the year following the peak create more value for their shareholders than those completed during the upswing and peak years of the wave.

M&A CONTINUES TO CREATE VALUE IN CURRENT CYCLE…

Corporates have so far continued to be active in the current M&A wave although private equity firms have tightened their belts due to the sub-prime mortgage crisis and the ensuing reduction of credit lines by lenders.

But is value being created?

For a number of years now the Towers Perrin-Cass Business School M&A studies have examined shareholder value six months following deal close. Therefore the most up-to-date research available to assess value creation in global deal-making is based on the full year 2006 figures. (Our initial take on the 2007 full year figures will be completed in the summer.) According to this, deals conducted in 2006 on average outperformed the market by 9.1%.

This analysis builds on work conducted by Towers Perrin and Cass comparing M&A performance in the current merger wave with the previous two cycles that peaked in 1989 and 1999. It confirms that deals – especially for medium-sized deals – (defined as those worth between $400 million and $1.5 billion, inflation adjusted) continued to work and create value.

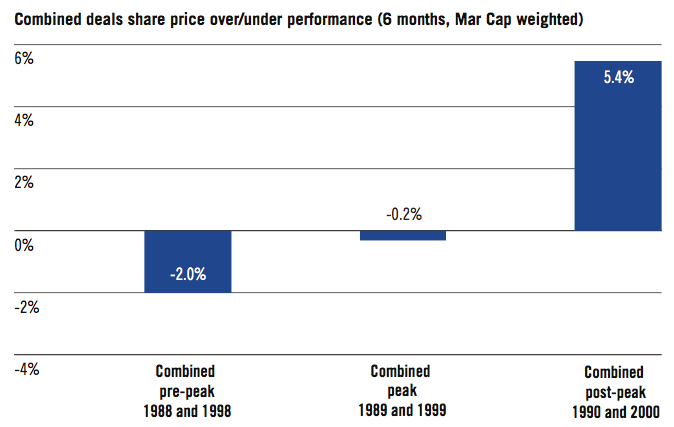

The two previous merger waves give a statistically significant picture of performance in pre-peak (1988 and 1998), peak and post-peak (1990 and 2000) years. The post-peak years show the performance outperformed the MSCI World Index by 5.4% on average over the two periods.

Although, as yet, it is impossible to analyse the 2007 figures – and therefore the current merger wave – to determine how the recent peak year has performed, the analyses previously conducted showed that this merger wave has already been out-performing the previous merger waves in the pre-peak years (and outper- forming the global indices).

We have utilised this logic in predicting that the post-peak year in the current merger wave will continue in the same way as the previous two.

On this basis, our study indicates that companies should not necessarily back away from opportunities even though they may be seeing a falling off of deal activity.

Companies have consistently outperformed the indices each year during the current wave. This fact and our research on three merger waves points to a stellar 2008 in terms of creating shareholder value for those deals that can be done.

NEW TWIST: POST PEAK YEARS ARE EVEN BETTER FOR M&A VALUE CREATION!

Our research now also shows that, historically, deals in post peak years create even greater opportunities!

We are well aware of the inevitable problems around actually executing an M&A transaction in the current climate, not least because of the constraints on leverage and debt financing. However, if past trends repeat themselves, companies who could do it probably should do it.

HOW VALUE IS CREATED

The Towers Perrin-Cass study was initially conducted in 2005 to provide a quantitative analysis of worldwide M&A deal success, with a comparison of the first full year of this merger wave (2004) against prior merger cycles. Based on public data from a number of sources but principally Thomson Financial, it was the first study to provide extensive evidence that, contrary to what was experienced in previous merger cycles, the average M&A deal in this wave generated shareholder value and improved financial performance for the newly combined companies. The same study was repeated in consecutive years, with similar results – M&A deals on average continue to create shareholder value.

Why the change in fortunes? Over the years and working on thousands of transactions, Towers Perrin has identified the following seven critical factors for success:

- Leadership

- Culture

- Total rewards

- Organisation design

- Staffing and selection

- Governance

- HR service delivery.

CONCLUSION

Our latest analysis reinforces the view that corporations should remain positive about the current merger wave and especially the up-side potential for the post-peak year, 2008. It shows that deals continue to offer a potential to create long-term value and achieve deal growth objectives.

The merger wave continues to offer many exciting possibilities for success. The research shows that companies who choose to complete deals in a mindful way, paying attention to critical people issues are on a pathway to sustained success.

THE SEVEN CRITICAL VALUE FACTORS

A company’s ultimate goal during a transaction is to achieve the strategic business objectives of the transformed organisation and maximise long-term shareholder returns. The seven areas of critical value across the M&A life cycle, with embedded project and change management support, deliver measurable results. To a greater or lesser degree, all seven areas of critical value are in play during each stage of an M&A deal. These areas of critical value ensure you optimise employee engagement, which is essential to long-term financial success of any deal.

1. Leadership

During periods of organisation transition and disruption, employees look first to leaders for guidance, motivation and focus. Towers Perrin research shows that leadership becomes the most important driver of employee engagement as companies transform.

2. Culture

The rate of past merger failures highlights the importance of aligning cultures in merging organisations. Assessing the cultures of the acquirer and target; developing a strategy and interventions to create a culture that rewards the right behaviours; developing change management and communication strategies for the transformation; and aligning culture transformation activities with other merger integration work streams are all important activities during a deal acquiring target companies.

3. Total Rewards

Total rewards represents the area of greatest visibility and concern to employees. Aligning the reward programme of the integrated company with overall business objectives is critical to both the short- and long-term success of the transformation.

4. Organisation design

Merging two separate organisations, each with its own unique culture and history, is probably your single biggest challenge in an M&A transformation. Aligning organisational structure and the people and processes of both companies drives synergies and rapidly achieves targeted business results.

5. Staffing and selection

People-related issues are among the most often cited reasons for M&A failures. A strategic approach looking at future organisational needs is required to business plan objectives.

6. Governance

The waves of unsuccessful M&A activity in 1988 and again in 1998 were characterised by less-than-rigorous governance throughout the entire process of identifying and acquiring target companies. A unified corporate direction should be created by identifying a governance framework and associated guidelines that define organisational and individual accountabilities based on desired business outcomes.

7. HR Service delivery

As part of any merger, acquisition, restructuring or divestiture, HR must service a reconstituted employee population. Interruptions in basic HR services can negatively affect workforce engagement and productivity. The HR team must define and design the future state of HR technology; assess, select and integrate HR technology systems to support the needs of the new organisation; and capture key data quickly and effectively using data bridging techniques to be successful.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter