Publications HR Rises To The Challenge: Unlocking The Value Of M&A

- Publications

HR Rises To The Challenge: Unlocking The Value Of M&A

- Bea

SHARE:

EXECUTIVE SUMMARY

“You can buy the best company in the world and kill it in the first 30 days.” — Senior HR Executive

With mergers and acquisitions reemerging as a key business strategy for many organizations, the billion-dollar question is whether the next wave of deals will prove more successful than many of those struck during the late 1990s. New Towers Perrin research suggests the answer will be yes for many organizations, thanks in part to some hard lessons learned about the critical people issues involved in integrating businesses successfully.

To understand what companies have learned from their past M&A experience and how human resource professionals view their role in future deals, we surveyed more than 200 HR executives of large and midsize companies in the United States and Canada through our ongoing TP Track research program (see Appendix, page 16, for details on the study and sample group). Here’s what we found:

HR believes it is well positioned to meet many key M&A challenges, although respondents agree the thorniest issues — virtually all around people and culture — haven’t gotten much easier. What’s changed is that companies are paying more attention to these issues and are bringing HR into the process earlier, contributing to rising success rates in recent deals.

What’s also changed is the extent to which HR executives feel confident in taking on M&A challenges and the difference this preparedness seems to make in getting results. While most respondents deem their functions at least partially ready to address a range of M&A challenges, a quarter view their organizations as fully ready across the board. Significantly, this group reported better results than the others in several key areas involving employees, including productivity and motivation. Even more interesting, there appears to be a relationship between readiness to address M&A challenges and how well a company performs financially, as measured by total shareholder return (see “A Business Case for M&A Readiness” ).

■ The “soft” issues remain the hardest ones. Heightened success notwithstanding, no one has found a solution for dealing with the thorniest issues in M&A: those involving people. Virtually all respondents agreed these issues are critically important — and difficult to resolve. Topping the list are leadership, employee communication, talent retention and cultural alignment — arguably predominant concerns for HR at all times, but particularly critical in a merger, acquisition or other type of major organizational change.

Below is a closer look at our key findings. The remainder of the report provides complete highlights of the survey results, which are based primarily on the responses of those participants directly involved in M&A activities. Some of our respondents also share their observations in the “Voices of Experience” sections of the report, which draw on follow-up interviews we conducted.

■ Recent deals are delivering results. Unlike many mergers of the late 1990s, deals completed in the past few years appear to be paying off. Our respondents indicated that almost four out of five of their companies’ recently completed mergers and acquisitions had met strategic objectives. This finding is consistent with a 2002 survey we did of M&A activity in Europe (see “The Historical Perspective,” page 3). It suggests companies are learning from past mistakes, and that they may be taking a more disciplined approach to deal making overall, motivated in part by the current emphasis on fiscal restraint and corporate governance.

■ HR comes aboard earlier. One reason for growing M&A success is that HR now tends to get involved much earlier than before and can influence key decisions that affect the success of integration activities later in the process. In another survey we conducted on this issue in 2000, less than 40% of respondents had any meaningful involvement in pre-deal or due diligence stages. Today, by contrast, close to two-thirds are involved in due diligence. And those numbers are poised to jump significantly in the next three years.

“HR should be involved from the start and must acquire as much data as possible on employees, benefit plans, costs and the companies’ cultures. Effective due diligence by HR may tip the decision whether or not to proceed because HR can see things the legal and finance people don’t see.” — Survey participant

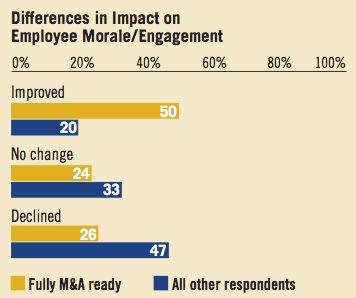

■ While employee morale often drops in a restructuring, greater M&A readiness on the part of HR can help limit the duration and intensity of adverse employee reaction — or even turn it around altogether. Our respondents recognize that anxiety comes with the territory for employees on both sides of a deal, and even the most successful deals can have a negative impact on morale and engagement, at least for a period of time. However, this is a key area where HR readiness can make a difference. Those respondents who judged their functions fully ready not only reported less of a decline in morale and engagement following recent M&A activity, but also were more than two times as likely as other respondents to say morale had actually improved.

■ Those fully ready for M&A do some things differently. Our analysis of the companies that view themselves as fully ready for the next wave of M&A reveals some telling differences in how deals are managed compared with the rest of our sample. These companies:

- involve HR earlier in the process

- pay more attention to the people implications throughout the process

- have clearly defined objectives for their deals

- feel a greater sense of urgency about addressing difficult people issues in the critical three- to six-month period following announcement of the deal, thus helping establish a sound foundation for ensuing merger integration activity.

The lesson here is that there are some actions that can help companies avoid some of the well-charted pitfalls to successful corporate restructuring. Over time, these preparations begin to show up in a variety of ways, including improved employee reactions, higher performance and better financial results.

People Issues and Honest Communication Are Paramount

A major retail organization leaves nothing to chance in doing M&A transactions. The company’s executive committee selects targets and involves functional experts throughout the due diligence process to make sure each transaction makes sense, from both a business and people perspective.

“We do a complete assessment from every angle,” reports the company’s Vice President for Human Resources and Administration. “We assess talent, the company’s business model, hiring trends, data integrity and the long-term prospects for both associates and products. We use set cost analyses and benchmarks to inform our decisions, and nothing is haphazard. We send in an experienced team to assess each target.”

Although getting the lawyers to agree on details is always a big hurdle in closing a deal, people issues are invariably the most challenging, this HR executive notes. The company learned the hard way to address those issues head on following a particularly rough integration several years ago in which it failed to communicate with the acquired workforce.

“Now we communicate to everyone and get in front of people face to face,” she reports. “We very quickly give employees an apples-to-apples comparison of their benefits so they see the good, the bad and the ugly. People can deal with the facts, so we don’t sugarcoat.”

The Historical Perspective

This is the third M&A study we’ve conducted since 2000 among HR and business executives. A brief look back at our prior research underscores the changing corporate perspective on people issues and how growing attention to these issues has contributed to enhanced success rates.

■ The late-90s wave — disappointment on the financial front. In 2000, we published Making Mergers Work: The Strategic Importance of People, based on research conducted jointly with the Society for Human Resource Management Foundation among 440 senior HR professionals around the world. Significantly, we found that most deals between 1995 and 2000 failed to live up to key business and financial objectives. In fact, almost half of the deals we studied from that era were significant failures from the shareholder perspective, based on a comparison of total shareholder returns (stock price appreciation plus dividends) in the three-month period just prior to each deal and over the three years thereafter. What’s more, HR typically was not involved in pre-deal or due diligence activities. Given this relative lack of up-front focus on people, it’s not surprising that people issues were frequently cited as key obstacles to merger success among respondents to this survey.

■ The European perspective — gaining experience and improving results. In 2002, we published The Role of Human Capital in M&A, based on a study of 132 European business executives conducted with the Economist Intelligence Unit (available in the publications section of towersperrin.com). While people issues still topped the list of reasons for merger failures, companies were already paying closer attention to these issues — and many were realizing more success with their deals. For example, among 50 large mergers completed by European companies between 2000 and 2002, almost half (45%) of the companies studied outperformed their industries (based on stock price appreciation) in the year immediately following a major merger or acquisition.

MORE DEAL MAKING VIA A GROWTH AGENDA…MORE SUCCESSFULLY

After peaking in 1999, M&A activity declined sharply in 2000 and has gradually increased in recent years. Almost all of the companies in this survey have been involved in some level of deal making during the past three years, with fully 88% of respondents reporting a merger or acquisition, and somewhat smaller numbers reporting a divestiture or spin-off (57%) or a joint venture (40%).

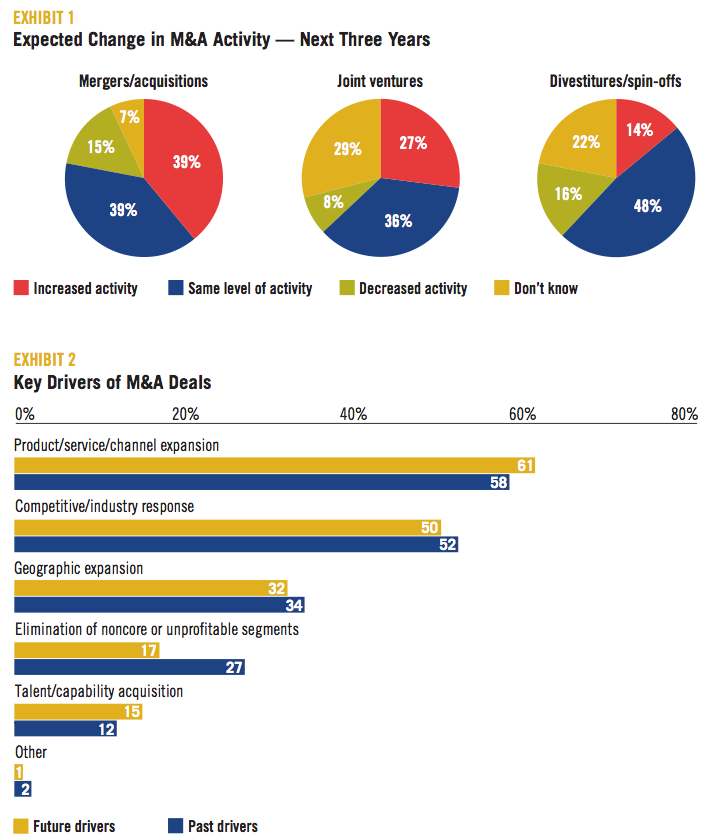

Our respondents also confirm projections that M&A activity is on the upswing, indicating their current level of deal making is likely to accelerate in the years ahead. Most of the anticipated activity focuses on what we might call “growth” restructuring (mergers, acquisitions or joint ventures), with far less around a consolidation or slim-down agenda (Exhibit 1).

Not surprisingly, the drivers of this projected increase in activity are also growth oriented, most often including product, service or channel expansion (Exhibit 2). Those respondents who cite talent acquisition as an objective tend to be in heavily knowledge-based industries, like technology and telecommunications, where specialized skills are critical and can be reasonably acquired in this way.

With companies poised to step up M&A activity, pressure to make these transactions work will invariably intensify. The good news here is that respondents feel they’re on solid ground and have laid a good foundation for improving success rates. As noted earlier, most view their companies’ recent M&A activity as having substantially met the kind of strategic objectives outlined in Exhibit 2. Indeed, on average, the respondents reported substantially achieving their strategic objectives in:

■ almost 79% of recent mergers and acquisitions

■ 85% of divestitures and spin-offs

■ over 71% of joint ventures.

These numbers may seem, at first blush, surprisingly high, even considering the trend toward improved results seen since our 2002 European study. Given numerous studies documenting disappointing financial results from major deals, is this a realistic perspective?

Two points are worth noting in this regard. First, these statistics represent only one measure of success: individual respondents’ judgments about the effectiveness of their company’s deals in meeting specific strategic objectives. While that’s certainly a relevant measure, it doesn’t reflect whether companies will realize financial benefits from these transactions, since that may not be clear for some time. In other words, it’s not the whole story and not meant to be that.

Second, deal making has changed somewhat since the late 90s. As noted earlier, companies are taking a more disciplined approach to M&A overall.

In addition, recent statistics show that companies are now pursuing somewhat smaller deals than in the past. This alone may make success more attainable, especially in the context of meeting the organization’s strategic or business goals.

Measuring Outcomes Helps Ensure Long-Term Success

A leading global IT wholesaler that plans to continue its rapid growth through acquisitions focuses on two key outcomes in doing deals: how well the target fits its business model and the expected return on the company’s investment. The company’s deal team is led by finance and legal, with HR closely linked into the process every step of the way. “HR is the third of three partners,” says the company’s Corporate Vice President for Human Resources Strategies and Programs. “Finance, legal and HR have a standing weekly call to discuss current and prospective deals. As a group, we decide when it makes sense for HR to go in deep.”

HR typically moves into a more prominent role whenever the target poses “big ticket” people issues like challenges in retaining key talent, collective bargaining issues or significant pension liabilities and costs. Based on their past deal experience, the company’s finance and legal executives have a good appreciation of the people challenges involved and a good sense of when to tap into HR’s expertise.

This working partnership has enabled the company to build an impressive track record of success in its past deals, both in terms of the speed of integration and in the return delivered to shareholders. In fact, carefully measuring these returns is a hallmark of the company’s approach. Company leaders track the return on invested capital by country for each deal they’ve done. Also critical to this organization’s success: a well-oiled communication effort that simultaneously manages the key messages and the flow of information both internally and externally.

HR’S EXPANDING M&A ROLE

While the jury may be out on the longer-term financial outcomes of deals in many cases, that in no way minimizes the solid achievements in M&A implementation that companies have made in the last few years. And based both on our data and consulting experience, we believe HR’s growing involvement in all phases of deal making is a contributing factor.

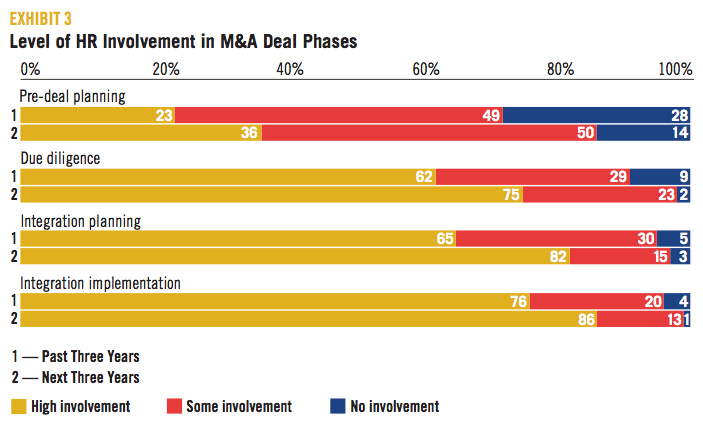

Traditionally, HR came to the party relatively late in the process — typically after a deal was announced — and had limited, if any, involvement in pre-deal and due diligence stages. In our 2000 survey, for example, just 39% of the respondents reported any significant involvement in due diligence, despite the fact that this is the stage where companies look at key pay and benefit issues, including the magnitude of potential liabilities they may be assuming.

Today, by contrast, 62% of our respondents said they’ve been highly involved in due diligence for recent deals. And fully three-quarters expect to be highly involved in this phase in future deals (Exhibit 3). Even pre-deal involvement is on the rise, with just over a third of respondents anticipating significant involvement in this very early phase.

One reason for the jump in HR’s due diligence involvement is the surge in under financed pension liabilities, which have become a significant issue in a number of recent transactions. It’s the rare deal today in which HR does not work closely with its finance and legal counterparts to advise company leaders on the potential cost and risks of pension plans during the financial negotiations.

However, due diligence is also the stage to begin addressing some of the other people issues we know are ultimately critical to success. In our experience, companies have much to gain from broadening the due diligence lens beyond a pure numbers focus to encompass important people issues. In particular, this includes:

■ Securing the top team — Company leaders should begin thinking about the selection process and rewards needed to retain the new organization’s leaders and deal with departing people.

■ Managing the messages — Even at this stage, the company should begin planning the communication program — from senior leaders and frontline supervisors to the formal company media — to help tell a consistent story about the deal’s potential benefits, practical challenges and why employees should want to be part of the new organization.

MANAGING M&A’S IMPACT ON PEOPLE

As noted earlier, a restructuring of any kind is a major change event, and we know change invariably breeds anxiety among the people involved — often reducing people’s level of engagement and willingness to deliver discretionary effort on the job.

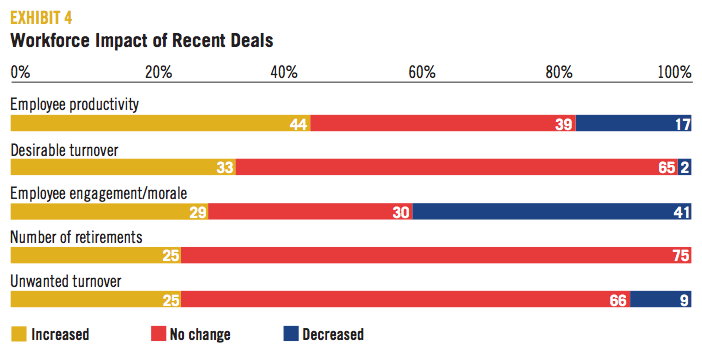

So it’s hardly surprising that our respondents reported mixed results in terms of how recent deals have affected employees. As Exhibit 4 shows, for example:

■ Productivity gains are common, but far from universal. To some extent, productivity gains are almost automatic after a merger or acquisition, due to elimination of overlapping positions or functions and related economies of scale. And indeed, respondents were two and a half times as likely to report productivity gains as declines following recent deals.

At the same time, only 44% felt productivity had risen. This suggests companies may not be fully capitalizing on operational synergies or, worse, may be falling victim to the kind of behaviorally based performance declines that come about when employees are disengaged, too often absent (in body or spirit) or simply doing the minimum required to get by.

■ Morale and engagement more often suffer than improve. Disengagement is, in fact, part of the fallout from M&A activity in many cases, with 41% of respondents reporting declines in morale and engagement. Because there’s a direct line of sight between high employee engagement and sustained business performance (see Understanding What Drives Employee Engagement, our 2003 study of 40,000 employees, on towersperrin.com), this finding may well explain why less than half of the sample has seen increases in productivity (defined in the context of discretionary effort).

■ Employee turnover — both desirable and unwanted — is more likely to increase. Turnover is another one of those M&A facts of life, but the goal, obviously, is to minimize the loss of needed talent while maximizing the departure of redundant or low-performing functions and individuals.

However, this does not yet seem to be occurring to the degree companies might like.

A quarter of our respondents reported increases in unwanted turnover, compared to just 9% who saw it decline, a clear concern given the importance of retaining key talent and the likely talent gaps ahead. In a similar vein, only a third of our respondents reported increases in desirable turnover, which suggests many companies are missing opportunities to streamline the workforce when they have the chance.

In light of these employee actions and reactions, it’s no surprise that people issues remain the most critical area to address — throughout the process, but particularly in the initial three- to six-month period of a deal. And this reality has not changed over the years, nor will it going forward.

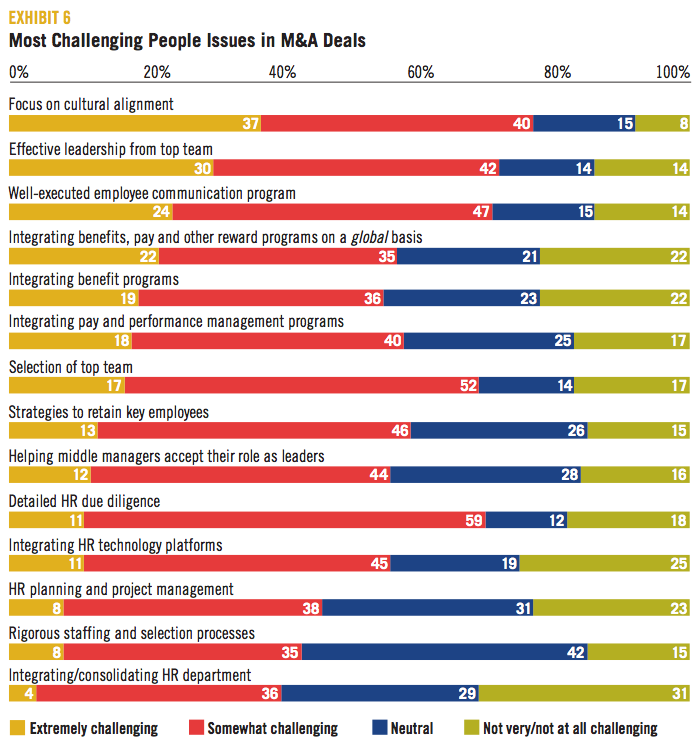

For our current respondent group, like those in our prior surveys, there are no substitutes or shortcuts when it comes to selecting and supporting the leadership team, implementing an effective employee communication program and retaining key talent (Exhibit 5). These are also among the issues that remain most challenging for companies — with cultural alignment the toughest of all (Exhibit 6).

When leadership, communication, retention and cultural issues are addressed early on, the new organization can devote more time to issues like integrating rewards, HR technology platforms and the HR function itself. These issues typically require more detailed technical analysis and longer lead times for effective implementation. In fact, we often recommend that HR tackle function consolidation later in the process because it typically needs more resources to support leaders and employees during the early stages.

“HR needs to become as involved as possible in the preliminaries before the deal is finalized. Different cultural and pay/benefit issues should be dealt with as soon as possible in the process and may be deciding factors in whether a deal will benefit both sides. HR needs to review the documents carefully and push hard about leadership and culture until heard because everyone will have to live with the outcome.” — Survey participant

THE READINESS FACTOR: WHAT IT IS AND WHY IT MATTERS

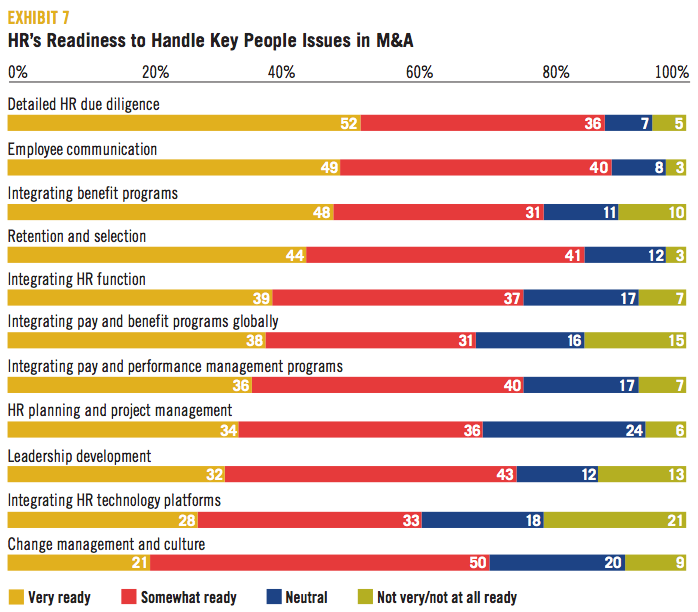

Our research confirms HR’s growing sense of confidence in its ability to provide both strategic and tactical advice in future deals. No less than two-thirds — and typically more than three-quarters — of the respondents reported that their organizations are at least somewhat ready to navigate the challenges in the next wave of deals, although their degree of readiness varies widely depending on the specific challenge.

And in general, the tougher the challenge, the fewer there are judging themselves fully ready. For example, 52% of the respondents believe they’re very ready to assist with due diligence. Far fewer — just 21% — view themselves as very ready to lead change management and culture integration efforts.

Still, roughly a quarter (26%) of our total sample rated their organizations very or somewhat ready to manage all of the key M&A activities outlined in Exhibit 7. This constitutes our designated “readiness group.”

When we did some additional analyses with this group, we found some interesting differences. Specifically, these ready companies had better results in managing employee impact and, also, interestingly, better business outcomes over time than the rest of the survey respondents (see “A Business Case for M&A Readiness”).

So what sets the fully M&A ready companies apart? Specifically, they:

■ Tend to do more deals than other respondents — This highlights, again, that experience really does count, especially in cross-border deals.

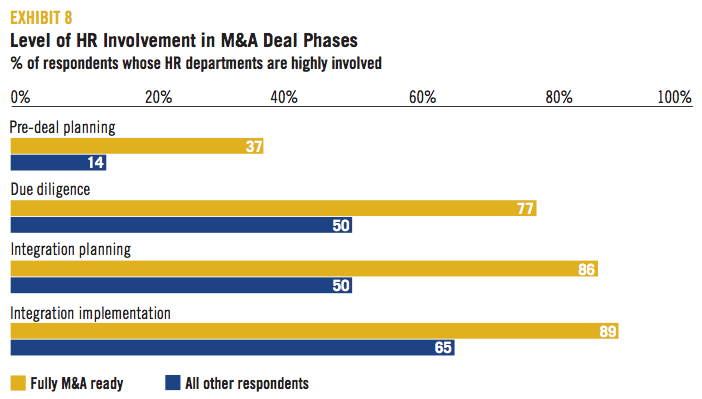

■ Involve HR earlier in the process — Our fully ready respondents are more likely to report a high level of HR involvement in M&A activities across the board and twice as likely to report that HR is highly involved in pre-deal planning (Exhibit 8, page 10). This finding underscores the advantages of involving HR from the very outset.

■ Are more likely to have a growth agenda and clear objectives for their deals — Our fully ready respondents are far more likely to cite product, service or channel expansion as a key driver for their deals than the other participants. What’s more, they show no uncertainty about their companies’ M&A objectives. In our experience, it is critical for HR executives to have a clear understanding of the key business goals of each deal, including the marketplace and financial objectives as well as the people goals.

■ Are more likely to tap external HR advisors for help with multicountry due diligence and planning — This further confirms the benefits of experience in transactions where the risks are high, the need for speed is critical and cross-border issues add additional layers of complexity to the analysis.

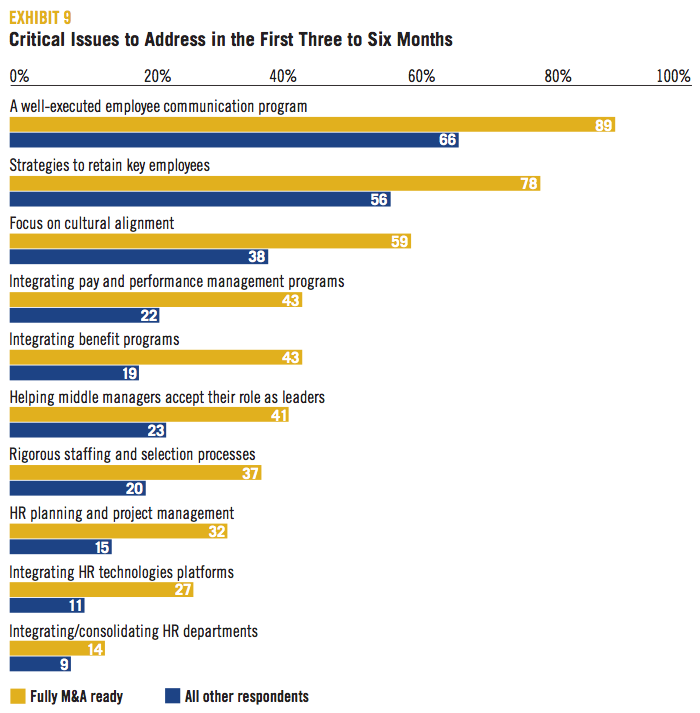

■ Are more inclined to move quickly in the first few months after deals are announced — As Exhibit 9 shows, our fully ready respondents are more likely to view a host of issues as critical to address in the first three to six months — from communication and retention to more programmatic areas like pay and benefit integration.

This sense of urgency is consistent with our own consulting experience, in which we routinely advise clients to follow the “100/80 rule” and be ready to accept the risks that come with operating 100% fast and 80% right. Good preparation — in terms of having established processes and tools for due diligence and integration planning — can make a big difference in helping organizations move quickly.

■ Have a better appreciation of the challenges involved in getting key implementation activities right — Although it may seem counterintuitive, the fully ready respondents are significantly more likely than the other respondents to view a number of core integration activities as somewhat or extremely challenging. This suggests that seasoned M&A veterans have a more realistic view of the challenges they face in managing an effective communication effort, integrating pay and benefit programs, consolidating HR departments and helping middle managers play their appropriate leadership roles. Our respondents who feel best prepared to support M&A take these key people-related steps very seriously and don’t underestimate the difficulty of managing them effectively.

In short, these companies focus more attention and resources on the people issues early on and throughout the process, but also receive a faster payoff in terms of realigning the workforce to support the new business direction.

“Be bold and err on the side of moving fast and making tough calls. Don’t try to drive change incrementally over a long period, thinking it will make the change process more palatable — it has tremendous risk and performance impact.” — Survey participant

A Business Case for M&A Readiness

Does having an HR department that is fully prepared to manage the challenges of M&A make any difference from a business perspective? To help answer this question, we collected total shareholder return (stock price appreciation plus dividends) for the past three years for more than 50 of the responding companies and identified higher- and lower-performing groups based on their three-year TSR relative to their respective industry averages.

We then looked at the fully ready group for whom we had such data and compared their financial results versus those of the other companies for which we obtained TSR data. We found that the fully ready companies were far more likely to fall into the high-performing group — by more than a two-to-one margin (37% versus 16%) — while the rest of our sample were more likely to show up in the lower-performing group. While this isn’t a causal relationship, it points to a link between readiness, improved success and, over time, a better bottom line.

Even more noteworthy is that the fully ready respondents reported far better outcomes than the other respondents on key people measures like employee productivity, turnover and engagement. Specifically, they were:

■ almost twice as likely to report increased productivity following deals (60% versus 36% for the other companies)

■ more than twice as likely to report increases in desirable turnover (54% versus 24%).

Finally, as the chart to the right shows, the fully ready respondents reported an impressive track record on employee engagement, with half of these respondents reporting increases in morale and engagement following a restructuring, and only about a quarter reporting declines. These percentages are almost reversed for the other respondents.

Do Dedicated Teams Make a Difference?

Overall, 30% of our respondents reported their company has a dedicated M&A team that manages the entire deal process. Not surprisingly, such teams are more common in companies that face greater M&A challenges, either because of their size or the volume of deals they do. Are there advantages to a dedicated team? Yes and no.

While companies with dedicated teams are no more likely than others to view themselves as fully ready across the spectrum of M&A challenges, they are more likely to judge themselves ready to manage some core merger integration activities — including leadership development, integration of pay and benefit programs globally, and integration of HR technology platforms — than are companies without such teams. The responses also suggest that companies with dedicated teams may do a better job of avoiding negative workforce outcomes.

Whether there’s a dedicated team in place or not, it’s important to involve HR early in deal planning and due diligence and to bring the right mix of skills and experience to the table, supported by effective tools for managing information and communicating among the individuals involved. Also important: carefully coordinating and managing the handoffs between different work groups or teams at various stages of the process to ensure that key issues and activities don’t fall through the cracks.

PUTTING IT ALL TOGETHER

Ultimately, our survey presents heartening evidence that HR is poised to play an increasingly significant role in this arena, in part because of widespread understanding of the critical importance of people issues in M&A success.

While concerns about rising pension and other people costs may have prompted HR’s original invitation to the table, the challenge now is to build on that advantage and expand the role it can play across the board.

Clearly, there has never been a better time for HR to move down this road. And equally clearly, being ready for M&A can make a significant difference in terms of the people and business outcomes of deals. In thinking about your organization’s readiness to take on the challenges of your next transaction, our experience suggests that there’s a fairly short list of actions that companies must get right to ensure deal success.

■ Manage the deal price and people risks. For HR, this involves helping ensure that company leaders fully understand potential people costs and risks (e.g., pension liabilities).

■ Manage the messages. Company leaders need to articulate both the overall vision for the transaction and how the organization’s people are likely to be affected — fast.

■ Secure the top team and key talent. It’s critical early on to define retention programs that support the key merger objectives.

■ Prioritize and manage activities. Not all people issues have equal weight and urgency. Understanding the deal objectives helps you focus on those with the greatest potential impact.

■ Develop a workable change management plan. Use a detailed merger integration process that incorporates change management techniques.

■ Design and implement the right staffing model. Staffing decisions do far more to signal the organization’s values than formal communications.

■ Align total rewards. Be sure to consider the strengths and weaknesses of both organizations’ programs and use the opportunity of the deal to make changes that better support the future business direction.

■ Measure synergies. Be realistic about synergy targets and the effort required to achieve them. Then carefully track progress against the financial model.

How HR works in addressing these business issues is also important.

■ Involve HR professionals early (especially those who can speak in finance terms).

■ Build a coordinated due diligence and integration process that addresses the implications of the people liabilities and the so-called “soft stuff.”

■ Be transparent about the deal strategy. (If it’s not a merger of equals, don’t say it is.)

■ There’s no such thing as too much communication (despite what senior leaders might think).

■ Focus your attention on the big-ticket reward items and those sensitive policies and perks that employees hold sacred.

■ Never underestimate the challenge of managing multiple work streams.

■ Track actual versus planned synergies and be honest with the organization about progress toward the goals.

■ Be fast, flexible and bold — a well-executed 100/80 solution is often best for everyone involved.

“The devil is in the details. It’s the one-offs that create the most work.” — Survey participant

Learning Cultural Sensitivity — the Hard Way

A global consumer products manufacturer has paid close attention to culture alignment ever since one of its biggest deals of the 1990s produced significant talent flight and widespread disengagement among the acquired employees. In that high-profile deal, the company did not bring sufficient sensitivity to two decisions that made sound business sense, but angered the acquired workforce:

■ immediately bringing the acquired employees into the company’s benefit plans, with little attention to the important symbolic role that benefits often play in defining corporate cultures and values

■ closing many of the acquired facilities too quickly, forcing employees to make relocation decisions before they were ready to commit to the new organization.

“We learned it pays to be more flexible and to be more sensitive to the acquired culture,” says the company’s Director of Shared Services for North America. “You can’t just ram a lot of change down people’s throats and expect them to jump on board.”

As a result of this experience, HR plays a more integral role on the company’s deal team today. In the past, finance and legal drove the due diligence process and expected HR to tie up the loose ends during the integration. “That was a recipe for disaster,” this executive notes. “With HR more involved from the beginning, we’re better positioned to assess the people risks and begin planning for the compensation and benefit integration issues as well as other cultural challenges.”

Structured Process Seals the Deals

What are the secrets to M&A success for a global manufacturer that considers 20 deals each year on average and closes half a dozen or more acquisitions annually around the world?

“Discipline, communication and accessibility of the top team,” says a company HR executive — supported by highly structured due diligence and integration processes that are driven by a corporate Office of Mergers & Acquisitions reporting to the CFO. “It’s all written down and very collaborative. We use documented Web-based tools and data rooms with set matrices and templates for everything. The Web-based tools are especially helpful for the bigger deals, allowing us to have complete collaboration among HR, legal and treasury so that every document gets reviewed from multiple perspectives.”

This executive adds that the company also moves quickly to augment its internal team with outside experts when needed to get deals done. “We will pick up the phone and get the right resources. These deals can be quite complex, and we want to get things right.” For this veteran of the M&A trenches, the biggest challenge is often obtaining the right information and documents from targets to conduct a thorough due diligence from a people perspective. Lack of communication from senior leaders during deal negotiations can also complicate the process of preparing for the announcement and planning for the first 100 days.

“You can buy the best company in the world and kill it in the first 30 days,” he points out. “We aim to migrate the other company’s employees to our payroll in the first 60 days in order for all of our systems to work. We can’t do anything until our employee data is accurate and people have online access. We also tackle the loyalty thing immediately because we want the new employees to start thinking about our company and our stock performance, so we spend a lot of time up front educating people about our stock purchase plan and savings plan.”

APPENDIX: ABOUT THE RESPONDING COMPANIES

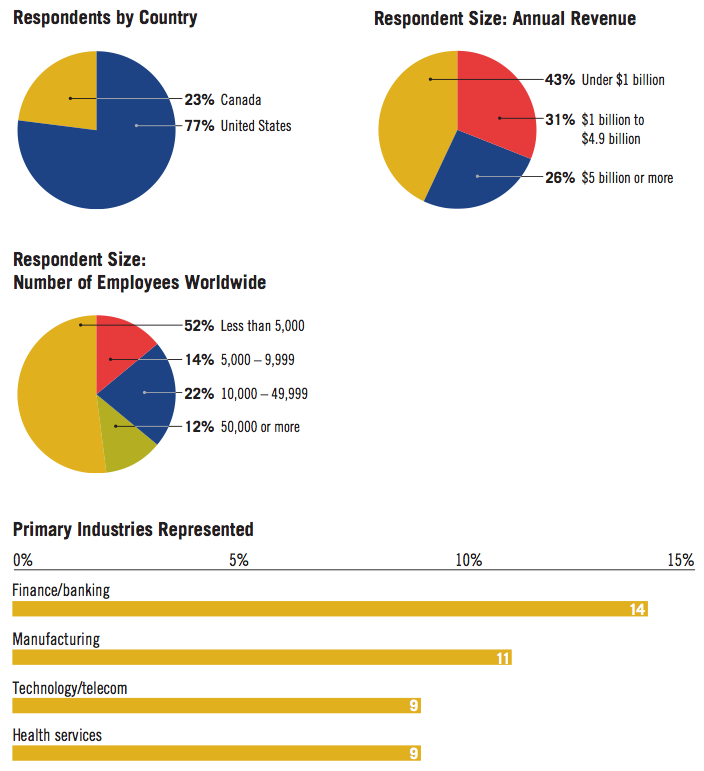

This TP Track survey on M&A issues was conducted via an online questionnaire in the summer of 2004. Below are breakdowns of the 201 respondents by industry, country, number of employees and annual revenue.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter