Publications Firepower Fireworks: Focus, Scale And Growth Drive Explosive M&A

- Publications

Firepower Fireworks: Focus, Scale And Growth Drive Explosive M&A

- Christopher Kummer

SHARE:

Firepower Index and Growth Gap Report 2015

Biopharma M&A rockets to record heights in 2014

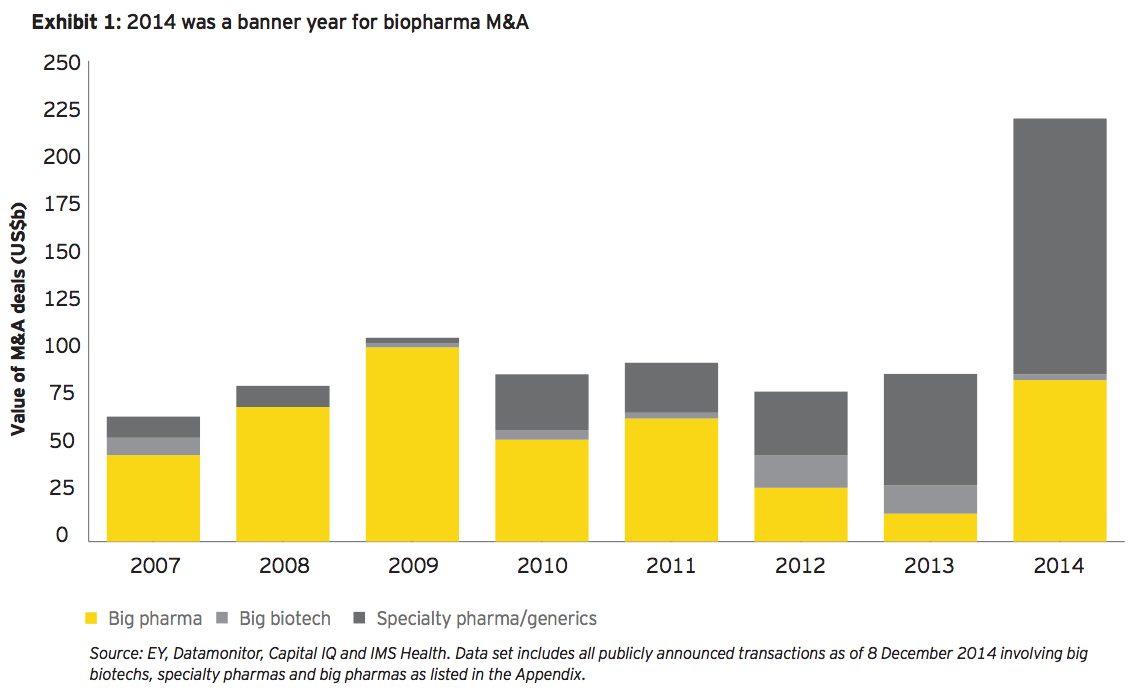

Kaboom! Record biopharma M&A exceeded US$200 billion in 2014, well over twice the average annual deal volume seen in the last decade, as companies used deal making to satisfy the strategic imperatives of increasing focus, scale and/or growth. A convergence of forces fueled the fireworks, including rising equity valuations, historically low interest rates and prodigious firepower (see Exhibit 1).

Big pharmas, largely absent over the past few years, played a bigger role in 2014’s pyrotechnics, spending nearly US$90 billion on M&A to close — or attempt to close — “growth gaps” (see box for definition). However, the lion’s share of big pharma deals that transpired were primarily sales and purchases of operating divisions. (Had two transformative acquisitions — Pfizer’s bid for AstraZeneca and AbbVie’s take-out of Shire — moved forward, big pharma’s growth gaps would have narrowed.) Importantly, the intra-pharma transactions that occurred were well received by the market. As a result, valuations rose and boosted firepower.

While big pharmas focused on rationalizing their portfolios primarily via intra-pharma transactions, specialty pharmas delivered the biggest deal headlines of the year as they sought to gain the scale necessary to be competitive in a challenging global pricing environment.

Perhaps nothing illustrates the disruptive forces now altering the competitive landscape more than this fact: in 2014, the Ireland-based generics-cum-branded drug company Actavis, which had a market capitalization of less than US$10 billion in 2011, announced two M&A deals that, together, were roughly equal to all of big pharma’s transactions combined. Moreover, the two specialty pharmas that chose to pair up with Actavis — Forest Laboratories and Allergan — were among a select group of potential big pharma targets that could have meaningfully closed growth gaps. In a year full of deal making drama and surprises, Actavis/Allergan, and the activist-hostile pursuit that drove the deal, was nothing short of firepower fireworks.

To gain more insight into 2014’s M&A dynamics, as well as the future climate for M&A, we updated the EY Firepower Index, a metric we first launched in January 2013 to quantify companies’ capacity for conducting acquisitions.

Definitions

The growth gap is the difference in the sales growth of a biopharma company or biopharma sub-sector (e.g., big pharma) relative to overall drug market sales. It is based on IMS Health’s global drug market forecast and analysts’ estimates of company sales.

The EY Firepower Index measures a company’s ability to do M&A based on the strength of its balance sheet. Together, a company’s market capitalization, cash equivalents and debt capacity provide the “firepower” for deals. Thus, a company’s firepower increases when either its market capitalization or its cash and equivalents rise — or its debt falls. For more details about the methodology and the assumptions underpinning the EY Firepower Index, please see the Appendix.

Big pharmas, largely absent over the past few years, played a bigger role in 2014’s pyrotechnics, spending nearly US$90 billion on M&A to close — or attempt to close — “growth gaps.”

Top trends of 2014

- Big pharmas were active deal makers in 2014, centered on intra-pharma deal making, including divesting non-core products or businesses to create more strategically focused franchises.

- Powered partly by tax efficiencies, specialty pharmas orchestrated a number of transformative acquisitions in 2014, a trend we anticipate will continue in 2015 as companies in this space seek greater scale to be globally competitive in an increasingly price- and value-sensitive world.

- The majority of the big pharmas we track continue to underperform the industry in terms of revenue growth. Their growth gap is estimated to be US$100 billion in 2017, at a time when there is a strong correlation between high growth and increased shareholder returns.

- As market valuations for target companies continue to increase, big pharmas with significant gaps must reinvigorate their deal making strategies, leveraging divestitures, bolt-on acquisitions and more creative structures to build comprehensive franchises in therapeutic areas where they are, or can be, market leaders.

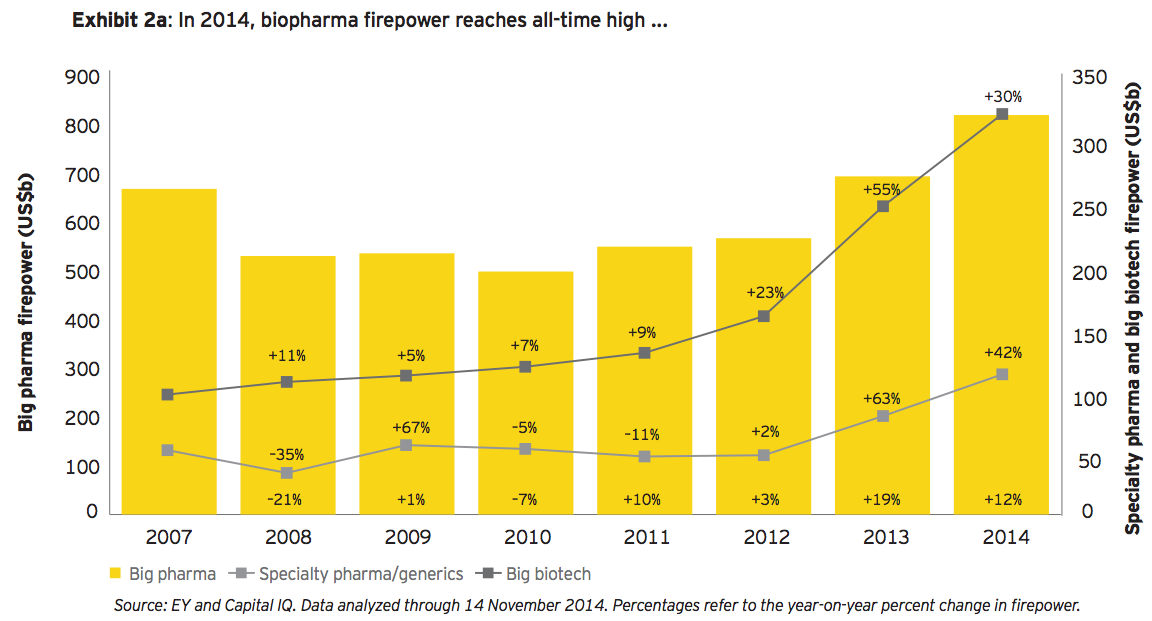

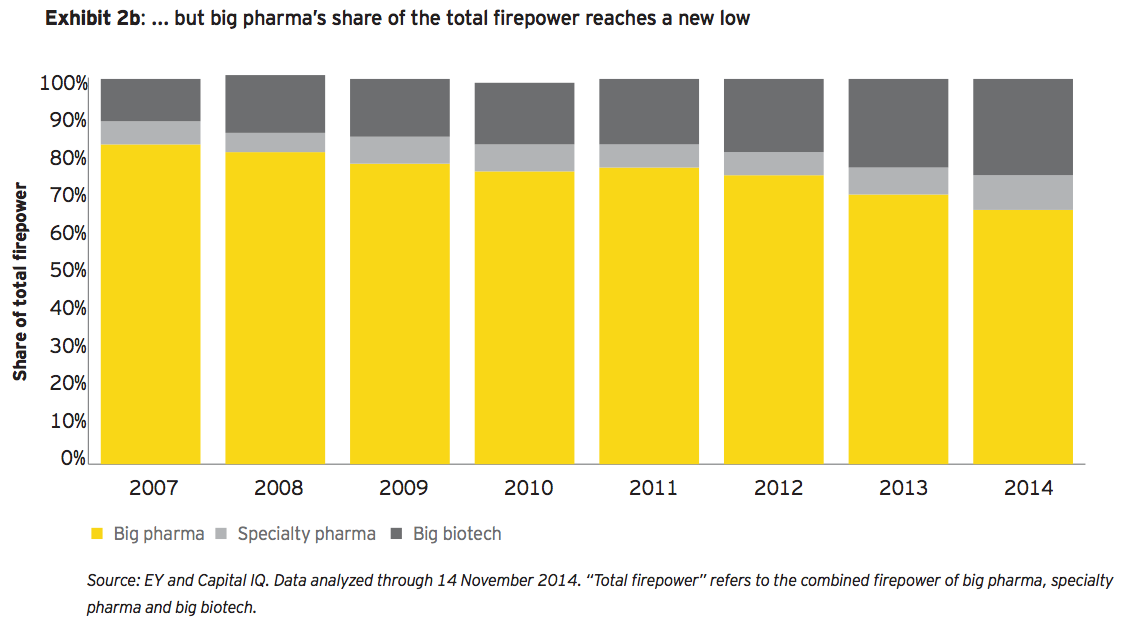

In prior editions of this report, we predicted that specialty pharmas would be bigger acquirers thanks partly to the tax-efficient strategies at their disposal. We also noted the tremendous growth trajectories of big biotechs, which collectively have continued to introduce innovative products. In 2014, we saw both those forces in action, bolstering the firepower of specialty pharmas and big biotechs. As a result, big pharmas’ share of firepower fell for the fourth year in a row, hitting a new low of 66%.

This declining relative firepower comes at a time of rising market valuations, complicating the strategic priorities of certain big pharmas, namely the subset of companies with growth gaps. Indeed, 2014 will likely stand out not just because of the record deal making that took place, but because market values of targets reached heights that precluded some important players from buying growth targets. Unless this trend reverses in 2015, pharmas with revenue gaps may not have the requisite firepower to use transformative M&A to alter their growth trajectories without using a large — and potentially dilutive — proportion of equity as consideration.

Although big pharma share prices have outperformed the major indices, historical data suggest aggressive top-line growth has been one of the most important factors driving superior returns. In the absence of other ways to drive shareholder value, companies with growth gaps understand the urgency of closing those gaps. For a few big pharmas, where replenished pipelines are poised to deliver accelerated growth over the next few years, transformative M&A may not be necessary and there is a greater ability to stay the course.

Indeed, the premium price tags associated with transformative acquisitions may make M&A less appealing regardless of whether a company has a sizeable growth gap. As rising valuations for many attractive growth targets may be harder to support, we believe deal making strategies in 2015 should include:

- Additional divestitures of non-strategic businesses, franchises or products that are not market leaders (or that lack a clear path to becoming front-runners)

- Targeted M&A to acquire additional depth in product areas where therapeutic expertise already exists

- Increased use of contingent deal structures, such as option-to-acquire agreements that enable companies to gain access to pipeline assets that could fuel future revenue growth

Even companies with the least firepower should be able to execute these strategies successfully. In most cases, closing growth gaps will likely require a portfolio of deals rather than one or two larger transactions.

2014 will likely stand out not just because of the record deal making that took place, but because market values of targets reached heights that precluded some important players from buying growth targets.

Firepower reaches new highs while big pharma’s share reaches new lows

As the bull market continued through 2014, most life sciences sectors outperformed the broader indices. As of 23 December 2014, the New York Stock Exchange biotech index (BTK) had increased 50% year-over-year, while the pharmaceutical index (DRG) was up 16%, outperforming both the Dow Jones Industrial Average (8%) and the S&P 500 (12%).

These dramatic increases in valuation, driven by renewed confidence in pipelines and recent drug launches, propelled industry firepower to an all-time high of nearly US$1.3 trillion in 2014. The big biotechs and specialty pharmas that we track enjoyed the greatest annual gains in firepower, notching, respectively, spikes of 30% and 42%. In absolute dollars, big pharmas continue to have the most firepower. In aggregate, however, their firepower increased only a modest 12% year-over-year. As a result, their share of total firepower fell for the fourth straight year to a new low of 66% (see Exhibits 2a and 2b).

Focus and scale drove 2014’s biopharma deals

This shift in firepower has major implications for life sciences transactions. As M&A competition across the sector continues, big biotechs and specialty pharmas now have the capacity to do the kinds of major acquisitions that were mostly within the grasp of only big pharmas just a few years ago.

As big pharmas continue to create more focused businesses, there is ample opportunity for additional selling and buying of assets.

Big pharma: finding focus

There is a growing realization that deep expertise in a disease indication buttresses commercial success, particularly as it relates to market access and reimbursement. When companies develop solutions across the care paradigm, they have a competitive edge because they can better leverage their infrastructure in that disease segment. In addition, this therapeutic focus could enable new contracting mechanisms with more stringent health care buyers.

An analysis of 2014’s transactions suggests that as big pharmas returned to the deal table, creating focused businesses was a key priority. In certain cases, this meant selling off business units or products that had been deprioritized; in other cases, it meant buying available assets to create sufficient scale.

As big pharmas continue to create more focused businesses, there is ample opportunity for additional selling and buying of assets. Many big pharmas have established products businesses that align strategically with the interests of specialty pharmas, which have plenty of firepower — and the desire — to do more deals. These businesses could be a fertile source of future divestitures, even though big pharmas have not yet signaled a widespread desire to consummate such transactions. More likely, companies may seek to divest non-core assets such as their animal health and consumer health businesses, leveraging the proceeds to acquire bolt-on capabilities (either individual products or businesses) that solidify their therapeutic positions.

That’s essentially what Merck & Co. did after the US$14.2 billion sale of its consumer business to Bayer closed in October 2014. In December, it announced the US$9.5 billion purchase of antibiotic developer Cubist Pharmaceuticals, a transaction that Merck’s senior management estimates will add US$1 billion in revenue to the big pharma company’s top-line in 2015. Equally important, the deal solidifies Merck’s position in the anti-infective space at a time when there is growing recognition of the economic costs associated with drug-resistant infections. Concurrently, Bayer’s announced intention to divest its material science business in 2015 will move Bayer wholly into the life sciences arena, setting the stage for future M&A.

Merck was hardly the only big pharma company interested in bulking up in a disease area in 2014. Both Novartis and GlaxoSmithKline took important steps in that direction when they orchestrated the sales of their vaccines and oncology businesses to each other. For both companies, the complicated transaction, which also included the creation of a consumer-health joint venture, helps each narrow its business focus and enhances independent aims of pursuing market leadership positions in high-growth health care sectors.

Specialty pharmas: seeking scale

While big pharmas were mostly focused on creating strategic franchises, specialty pharmas pursued transactions that provided the scale to compete globally. Whatever you thought of specialty pharmas’ actions — destiny made manifest or mere hubris — the resulting firepower fireworks, worth more than US$130 billion, were impossible to ignore.

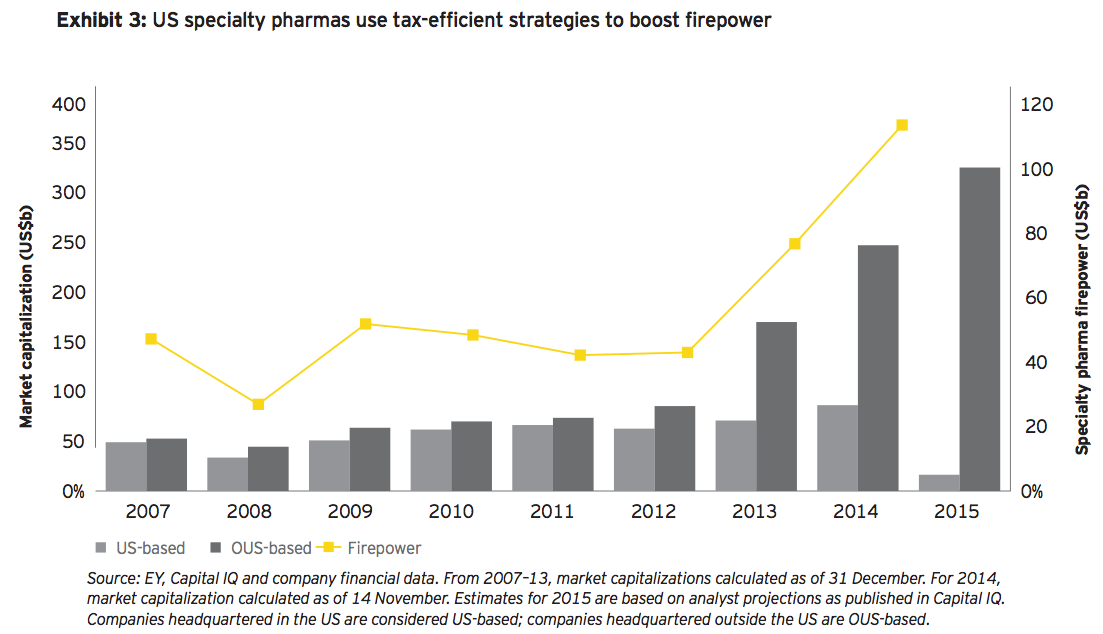

Specialty pharmas’ deal making ascendancy is directly linked to the more tax-efficient strategies they have assimilated since 2010, when Valeant Pharmaceuticals acquired Biovail. Between 2010 and 2014, as the advantages of inversion-driven firepower evolved into a strategic imperative, specialty pharmas began migrating outside the US with increasing frequency. When the recently announced deals close in mid-2015, 12 of the 14 specialty pharmas in our universe will be incorporated outside the US. The lower tax rates and positive investor reactions to the moves help bolster the firepower of specialty pharmas. In turn, this firepower accrual enables further deal making (see Exhibit 3).

Case in point: Actavis’ escalating M&A story. In 2013, Actavis issued US$8.5 billion in stock to acquire Warner Chilcott, its mature brand revenues and other assets, including its Irish domicile. As a result, earnings growth accelerated, the market applauded and firepower rose by more than Warner Chilcott’s deal value. Less than six months after that deal closed, Actavis struck an even bigger deal that consumed almost all of its available firepower: the US$25 billion acquisition of Forest Laboratories.

But again, as the market responded to accretive pro forma 2015 guidance and the potential growth opportunities inherent in a combined Actavis-Warner Chilcott-Forest, the combined company’s valuation doubled by the time the deal closed in July 2014. Not only had Actavis effectively replenished its firepower with the Forest acquisition, but three months later, it found itself in the unlikely position of playing the white knight in the year’s biggest transaction. As a result, Actavis has effectively catapulted into the realm of big pharma.

Growth matters

When the Actavis/Allergan transaction closes in the first half of 2015, Actavis’ management estimates the new company will be one of the industry’s largest and fastest growing, with an enterprise value that ranks sixth overall and an estimated top-line growth rate of more than 10%. As such, the transaction should act as a wake-up call to big pharmas.

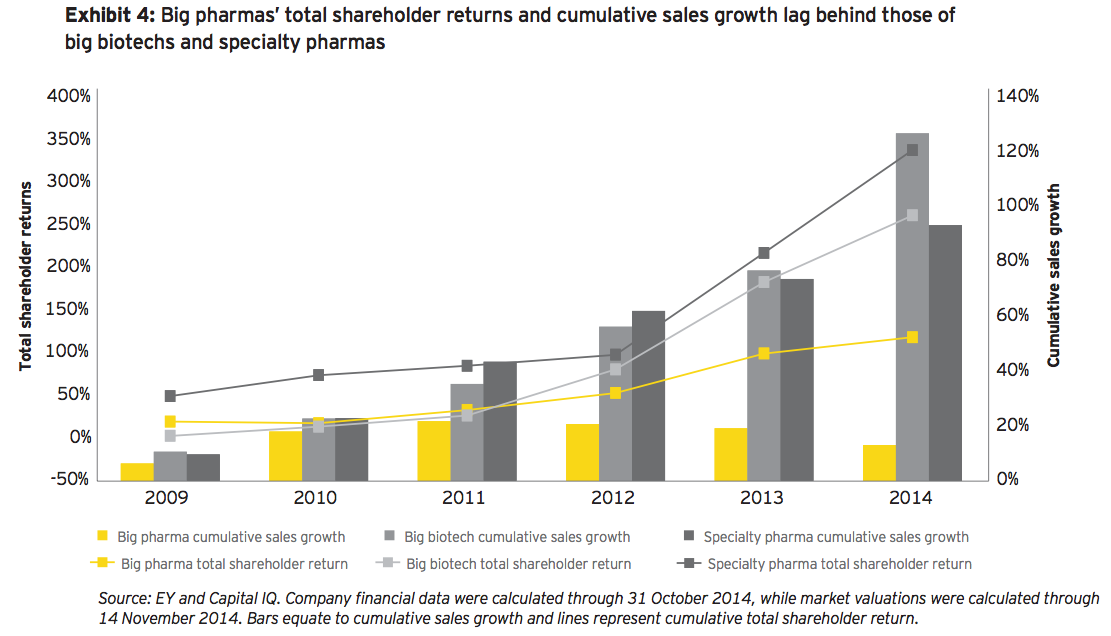

Why? As Exhibit 4 shows, superior growth has delivered superior returns. Over the past five years, biotechs and specialty pharmas delivered cumulative growth that was more than five times that of big pharma and provided total shareholder returns of 257% and 332%, respectively. In the same five-year period, big pharma’s total shareholder returns increased 116%, which was roughly in line with the major averages and made the sub-sector a safe haven during the recent financial downturn. However, looking ahead to 2017, big pharma’s projected annual growth rate remains anemic, at just over 1%. Through that year, the big biotechs and specialty pharmas in our data set are projected to enjoy double-digit growth.

As discussed in last year’s report, big pharma’s outperformance relative to the S&P may have dampened the urgency of boards and investors to pursue aggressive top-line growth. But the reality is, if companies want to generate top returns for their shareholders, they must aspire to be among the industry’s top-tier growth leaders. And to meet that aspiration, many companies, especially a number of big pharmas, must take additional steps.

Recall that since 2010, when a significant number of blockbusters lost exclusivity and new products faced tougher launches due to reimbursement headwinds, the vast majority of the big pharmas in our data set have struggled to keep pace with the overall growth of the industry. That has resulted in a persistent growth gap for big pharma.

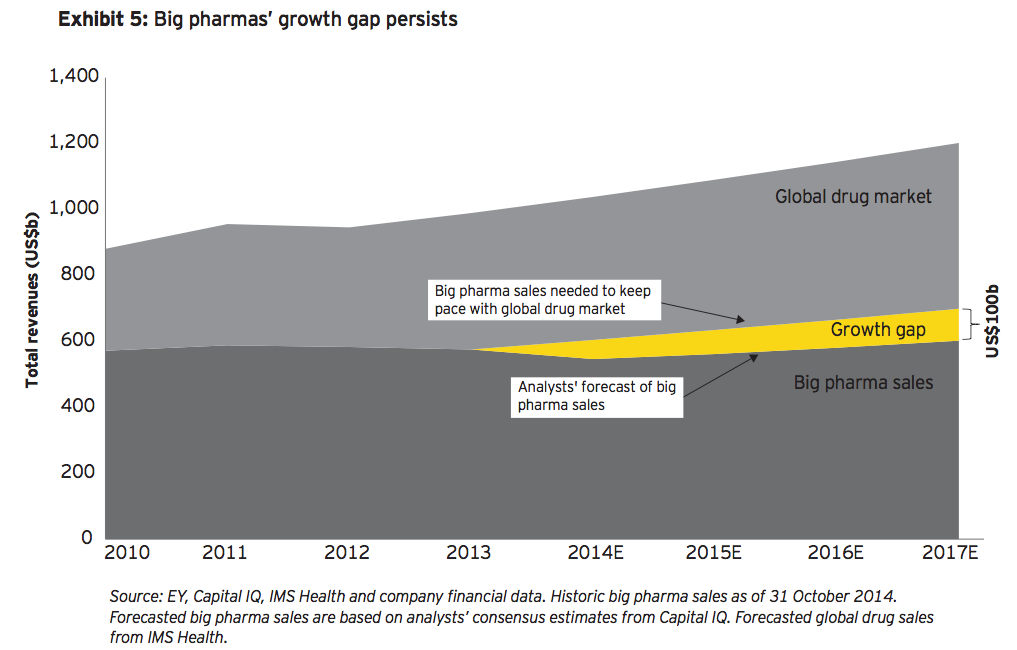

In our January 2013 report, Closing the gap?, we estimated three years of flat-to-negative growth contributed to a US$100 billion gap for big pharma in 2015. This gap hasn’t closed. Based on IMS Health’s November 2014 projections that global pharmaceutical spending is accelerating, and will increase at a compound annual growth rate of 4% to 7% over the next five years, we have recalculated big pharma’s forward-looking growth gap. Using these data, we have found that from 2013 to 2017, it is US$100 billion (See Exhibit 5).

The uncomfortable truth is that for big pharmas with growth gaps, using transformative M&A to close their revenue shortfalls is more difficult, not to mention more expensive. Moreover, from a growth perspective, there is a risk that this subset of big pharmas will fall even further behind, as other players, most notably specialty pharmas, continue to ink aggressive acquisitions.

Consider the following:

- Since 2013, 3 of the 24 biotech and specialty pharma targets we cited as worthy candidates to close growth gaps — Onyx Pharmaceuticals, Forest Pharmaceuticals and Allergan — have been or will soon be acquired, but none have been purchased by big pharmas.

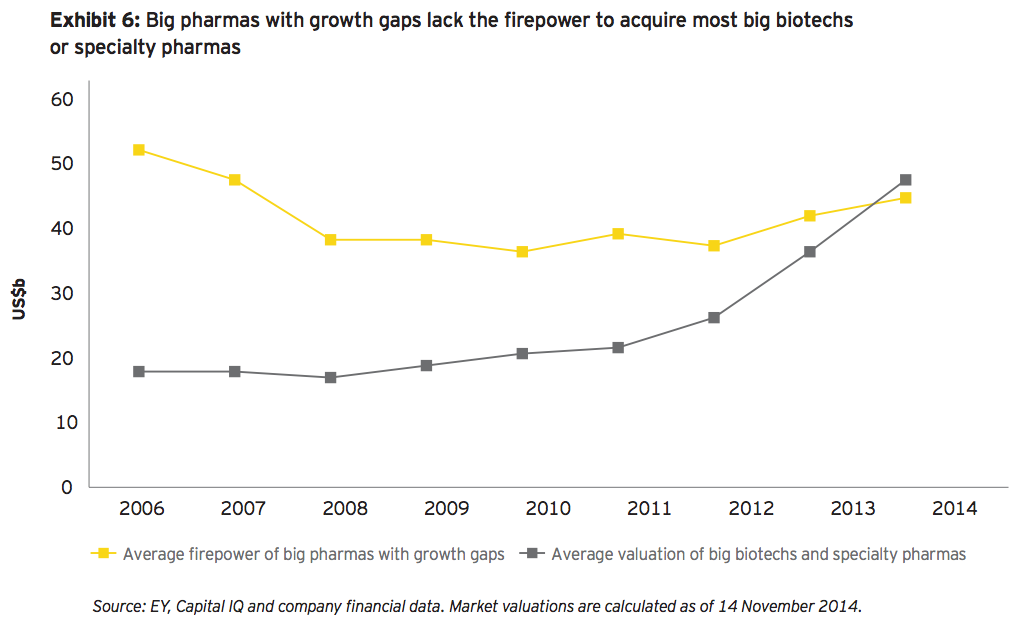

- When we published Closing the gap? in 2013, just 2 of the 24 targets had valuations that put them beyond the reach of the pharmas that had growth gaps. Now, one-third of acquisition targets with high growth potential are out of reach for the big pharmas with growth gaps.

- Expanding market valuations help explain why big pharma’s pool of target companies has shrunk so considerably. As shown in Exhibit 6, valuations for the pool of potential growth targets with projected 2015 sales over US$1 billion rose, on average, 164% from 2011 to 2014. Over that same period, however, the firepower of the big pharmas with growth gaps in our data set increased just 16%.

- In this context, it comes as no surprise that certain big pharmas expanded their quest for growth by acquiring more focused product portfolios and pipelines, because such transactions provided similar growth potential at more reasonable valuations.

The outlook for 2015

Closing growth gaps remains a challenge for many big pharmas. However, companies enter 2015 with bolder aspirations and a continued emphasis on therapeutic focus and/or adding scale. Rising industry firepower, bolstered by some company-specific divestitures and access to relatively cheap debt, should continue to fuel M&A momentum as biopharmas work to build strategic franchises.

Since nearly every specialty pharma company in our data set is now domiciled outside the US, the tax advantages of these incorporations will enable M&A that adds revenue growth, while delivering accretive earnings growth. This scenario puts pressure on big pharmas looking to close growth gaps via transactions. Challenged to bridge their growth gaps in an era of declining relative firepower and rising valuations, this subset of big pharmas faces a strategic question: how can they best position themselves for a return to future growth?

Big biotechs, in the meantime, generated exceptional top-line growth — more than 30% through the third quarter of 2014 — as a result of new product launches and strong pipelines. Largely absent from 2014’s deal making, their growth fueled a dramatic rise in firepower, which doubled from November 2012 to October 2014. At the end of this period, big biotechs’ share of firepower increased from 19% of the industry’s total to 25%. This means biotechs have an arsenal of “dry powder” at their disposal for strategic M&A.

As more companies enter faster-growing therapeutic battlegrounds such as hepatitis C and oncology, the increasing product competition creates headwinds that threaten to decelerate big biotechs’ continued growth. As we enter 2015, biosimilars are looming larger and several bio-blockbusters are now in the crosshairs of generic industry players. It remains to be seen whether, and how, big biotechs will use M&A to reverse potential growth slowdowns.

Multiple factors should support high premiums for acquisition targets in 2015. With less margin for error, getting valuation, diligence and integration right is more critical now than ever.

As boards and senior management teams take stock of their strategic priorities in response to the moves of competitors and evolving investor expectations, we believe the following factors will further influence 2015’s M&A activity:

• Growth still matters: The stronger shareholder returns associated with faster-growing biotechs and specialty pharmas will continue to be a factor that drives big pharmas to consider transactions. Coupled with IMS Health’s upward projections for industry drug sales, there is additional pressure for big pharma management teams to do deals to close growth gaps.

• Premium valuations for targets likely to persist: Multiple factors should support high premiums for acquisition targets in 2015. First, there is a scarcity of high-quality growth assets, particularly in valuation ranges that are affordable to a majority of companies. As competition for these assets grows, premiums generally rise, a situation witnessed in 2014. Second, given nearly all specialty pharmas are now domiciled outside the US, this situation helps set a new higher threshold for premiums that can be supported by lower tax rates. Third, the growing relative firepower of several big biotechs and specialty pharmas means these firms can — and increasingly will — compete head on with big pharmas in the acquisition arena.

Indeed, specialty pharmas have already shown a willingness to use their firepower. In 2014, this group deployed virtually all of its available firepower (US$113 billion) for M&A, while big pharmas deployed just 10% (US$84 billion). As these factors continue to affect deal premiums for the best assets, business development executives must sharpen their analysis across the transaction life cycle. In short, with less margin for error, getting valuation, diligence and integration right is more critical now than ever. Moreover, the scarcity of quality assets has raised their strategic value, creating an environment that contributes to rising premiums. What are the available alternatives if a target of interest falls into the hands of a competitor? What’s the downside of losing a deal?

• Look for more divestitures and bolt-on acquisitions: Because targets are likely to continue to command high premiums in 2015, transformational M&A may be a strategic alternative open to only a select few. In such an environment, we are more likely to see greater emphasis on divestitures and bolt-on acquisitions by a broader cadre of biopharmas. This scenario furthers the climate for M&A generally. Future transactions will also be dictated by relative firepower constraints and companies’ willingness to embrace more novel deal structures. In particular, we could see even greater use of contingent deal structures that preserve capital while enabling companies to lock up rights to products at earlier — and on a risk-adjusted basis, more cost-effective — development stages.

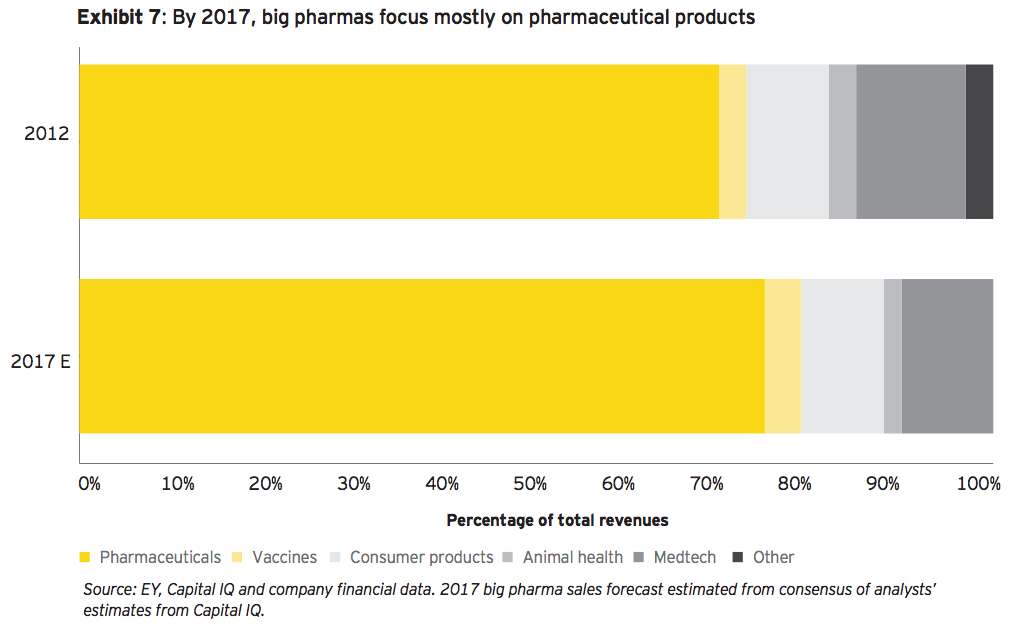

• Focus remains a top priority: The imperative to build strategic franchises will be an important theme for future transactions. Because of the current commercial climate, we expect companies to concentrate their deal activity in therapeutic areas where they have already created — or see a strong possibility of creating — a market-leading position. Already, many big pharmas are migrating away from a diversified business model toward one based mostly on the sales of branded pharmaceuticals (see Exhibit 7). Given current deal flow, we estimate that by 2017, prescription drugs will comprise 75% of big pharmas’ portfolios, up from 70% in 2012.

As companies build strategic franchises across fewer disease areas, this shift toward branded pharmaceuticals could accelerate. Divesting adjacent businesses (e.g., animal health and consumer products) would create additional firepower to enable companies to execute transactions that are aligned with their more focused therapeutic priorities. Activist big pharma investors could also prod companies to pursue divestitures, given recent transactions have been associated with superior shareholder returns. Finally, as companies concentrate on building these strategic franchises, they will identify gaps in their pipelines that may further accelerate their M&A agendas.

The strategies outlined above are not mutually exclusive. Nor are they simply a sign of what we believe will come to pass in 2015. Indeed, used in concert, these tactics offer all biopharmas, particularly those with existing or future growth gaps, the means to bolster their firepower, improve their commercial viability and return to sustainable industry growth rates while offering superior returns for shareholders.

Whether the ambition is focus, scale or growth — or some combination thereof — the efficient deployment of firepower to create strategic franchises better positions companies to prevail in a rapidly changing health care climate.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter