Publications Evaluating M&A Through A Changing Utility Lens: A Fresh Look At M&A’s Role In Power And Utilities

- Publications

Evaluating M&A Through A Changing Utility Lens: A Fresh Look At M&A’s Role In Power And Utilities

- Christopher Kummer

SHARE:

By Gregory Aliff, Brian Boufarah, Suzanna Sanborn, Trevear Thomas – Deloitte

Introduction

The U.S. power and utilities industry stands at the center of converging forces that are poised to reshape traditional business models. In the electric power sector, the often repeated chorus includes moderating demand, aging infrastructure, rising environmental compliance costs, and shifting customer expectations. Adding to the din are mounting competition from distributed generation providers and other new market entrants, and declining regulated rates of return on equity. In the natural gas distribution sector, local gas distribution companies (LDCs) also face high capital expenditures to rejuvenate utility infrastructure, while allowed rates of return are falling. At the same time, swelling supplies of shale gas have LDCs scrambling to sort out the range of implications for their regulated operations.

As these forces converge, debate focuses on how much they will alter existing business models and when these disruptive changes will arrive. For some, “when” is now. For others, it may be months or years away. But whatever the timing, marketplace dynamics suggest a re-evaluation of current corporate strategies is in order for nearly everyone. Which strategies are most likely to drive incremental value for customers and shareholders — not only by controlling costs and growing revenues, but also by addressing enterprise risks associated with a market in transition?

Merger & acquisition (M&A) stands out as one of the more compelling and potentially expedient strategies for delivering value in the near-term and managing strategic risks to the business. But M&A is generally not among the top options regulated power and utility companies consider, in part because they anticipate a variety of barriers. These come in the form of complex and challenging regulatory requirements, long approval timelines, and uncertainty concerning the boundaries of alternatives available to them. The companies may also avoid M&A because it is difficult to articulate and quantify its benefits beyond traditional synergy savings related to reduced operating costs.

This guarded stance, however, may be outdated. The forces transforming the industry, combined with changing market conditions, are shifting the lens through which power and utility companies view M&A. And the new lens reveals expanded opportunities for win-win scenarios that benefit both customers and shareholders. Traditional synergistic cost savings, which typically flow largely to customers in a regulated environment, will continue to be a powerful impetus for M&A activity. But so will transactions that yield enhanced competitiveness, innovation, increased reliability and resilience, and compliance with environmental and other regulatory mandates.

These changing marketplace dynamics suggest the time may be ripe for power and utility companies and their regulators to expand the dialogue about M&A, re-evaluating how it can help companies execute critical elements of corporate strategy, while simultaneously benefitting customers and shareholders.

Electric companies feel the big squeeze

In the U.S. electric power industry, many companies are finding themselves “stuck in the middle” as both their top and bottom lines are being squeezed. In terms of profit margins, wholesale power prices fell sharply in 2012 due to record low natural gas prices and, although they have recovered slightly in 2013-2014, they have remained at relatively low levels, apart from winter price spikes in the Northeast. This has reduced margins for merchant/non-regulated generation assets. Regulated operations have not fared much better. Mainly due to low interest rates, allowed return on equity (ROE) has been declining for regulated subsidiaries – falling on average from 11.58 percent in 2000 to 10.02 percent in 2013.

These cyclical economic stressors, however, pale in comparison to the protracted capital investment demands being placed on the industry. Some analysts suggest the electric power industry in the United States will need upwards of $1 trillion in capital investment over the next two decades to modernize aging infrastructure and comply with new regulatory requirements, especially environmental ones. Capital expenditures by investor-owned utilities are expected to reach $95 billion in 2014, after which they are slated to drop to $86 billion in 2015 and $82 billion in 2016, mainly due to the completion of large generation projects. However, the ongoing need for infrastructure upgrades and environmental compliance is expected to continue, with the industry seeking recovery and fair returns on these necessary investments. This has already been the pattern over the last five years, with the number of comprehensive base rate cases expanding from nine in 2000 to an average of 50 cases annually from 2009-2013.

For electric companies, this urgent need for investment is occurring in tandem with moderating electricity demand. Coming off two successive years of demand declines in 2011 and 2012, electricity growth turned positive in 2013, but barely, growing only 0.12 percent. Improvements in energy efficiency and entrenched customer attitudes and behaviors imply this trend may continue. In fact, the Deloitte reSource 2014 Study found that energy management is becoming a core business competency. Since the study was first conducted in 2011, 9 out of 10 companies have consistently indicated they have energy management goals in place, and they have been making incremental progress each year against those goals, reducing their electricity consumption by 12 percent on average in 2013, compared to 9 percent in 2012 and 8 percent in 2011. Similarly, an attitude of resourcefulness has become entrenched among residential consumers, with 65 percent indicating they plan to use about the same amount of electricity in 2014 as they did last year, and 26 percent believing they will use less.

As their customers increasingly seek to manage their energy consumption, electric companies are also encountering increased competition from new market entrants, such as providers of distributed generation technologies, i.e., solar photovoltaic, combined heat and power units, fuel cells, microgrids, and small-scale battery storage solutions.

An environment where the costs to generate and deliver a kilowatt hour (kWh) of electricity are rising and revenues, in terms of future kWh sales, are flat or declining is clearly not sustainable over the long run. The drumbeat for electric companies to take action has been getting louder, and despite the aforementioned obstacles, they appear to be increasingly incorporating M&A into their strategies as one of the levers they can pull to confront the impending disruption to the traditional electric sector.

M&A provides a strategic lever for electric and gas companies

In 2013, the electric power industry deal count rose 18 percent year over year, including eight corporate deals, compared with two in 2012. Overall deal value nearly doubled year over year, to $19.3 billion, partly due to major corporate deals such as Berkshire Hathaway’s $5.6 billion acquisition of NV Energy. This activity, particularly the asset deals, reflected a variety of strategic approaches. Some companies chose to rebalance their investments in regulated and nonregulated businesses, while others sought to shift risks within their generation portfolios, often moving toward environmentally compliant forms of generation. Still others decided to exit certain businesses to focus on their core competencies. In a recent wave of deals, some integrated electric companies have sold or are selling their merchant/nonregulated assets, given ongoing low margins and high capital expenditure requirements for these businesses. Going forward, some companies have announced their intentions to continue on this path, including Duke Energy, with its planned sale of 11 Midwestern coal and gas-fired power plants to Dynegy, Inc.

At the same time, independent power producers (IPPs) have doubled down on their core businesses by acquiring more merchant capacity. After becoming the largest independent U.S. electricity producer with the purchase of GenOn Energy in 2012, NRG Energy acquired most of Edison International subsidiary Edison Mission Energy’s generation assets in October 2013.

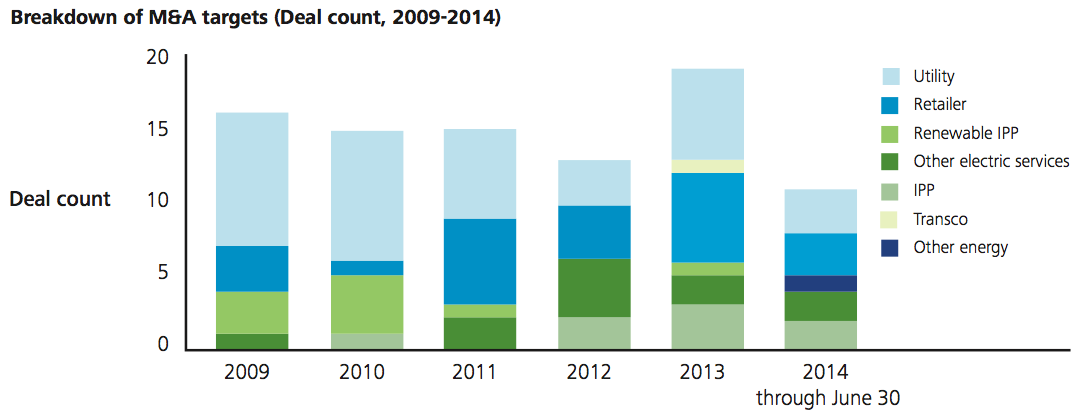

In addition to the traditional strategies noted here, electric companies are also pursuing M&A to evolve their business models and better position themselves for the disruptive phase the industry is entering. Corporate deals in the electric power industry are beginning to reflect companies’ desire to expand into emerging areas through an increase in nonconventional purchases. From 2009-2011, 53 percent of the deals focused on conventional electricity businesses, targeting companies such as vertically integrated electric companies, IPPs, and transmission companies, while 47 percent of deals focused on nonconventional companies, such as renewables, power/gas retailers, and other alternative energy and service providers. However, in 2012-2013, the proportions have essentially flip-flopped, with deal volume shifting to 43 percent conventional and 57 percent nonconventional. Examples in 2013 include Centrica PLC’s North American subsidiary, Direct Energy, which acquired the Texas-based electricity retailer Bounce Energy; and Leidos Holdings, Inc., which acquired bio-mass-based Plainfield Renewable Energy Holdings.

While expansion into nonconventional businesses is rising in importance, M&A is still attractive to many electric companies for a conventional reason: leveraging economies of scale. Companies continue to see M&A as a key lever for fulfilling their mandate of delivering safe, reliable, affordable, and now environmentally responsible, electricity. In essence, they are seeking to combine in order to become larger, financially stronger companies with reduced risk profiles; to take advantage of synergies to decrease costs; and to strengthen their balance sheets in response to very large capital investment programs. From 2013 into 2014, the market saw several major deals in pursuit of such goals, including MidAmerican Energy/NV Energy, Exelon Corporation/Pepco Holdings, Inc., and Wisconsin Energy/Integrys Energy Group.

In April, 2014, Exelon Corporation announced the acquisition of Pepco Holdings Inc. The two companies’ combined electric and gas utility businesses will serve approximately 10 million customers and have a rate base of approximately $26 billion.

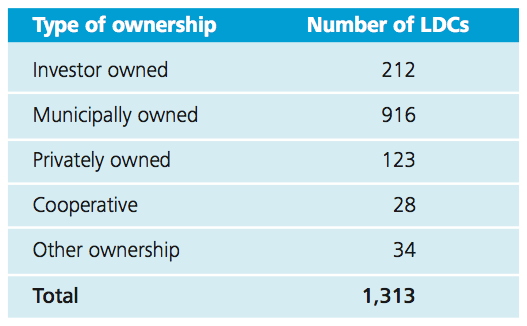

Like their counterparts in the electric power sector, natural gas distribution companies are also evaluating M&A as a means to offset the two-horned dilemma of earnings constraints and rising expenses. Capital expenditures by natural gas companies increased 31 percent from 2000-2012. In parallel, ROE has declined by nearly two percentage points since 2000, from a national average of 11.34 percent to 9.68 percent in 2013. Pursuing consolidation as a means of withstanding these pressures particularly makes sense in the gas distribution business, since it is more fragmented than the electric power industry. There are over 1,300 gas LDCs in the United States, and the U.S. Energy Information Administration’s natural gas data reveals the following ownership breakdown:

In 2014, Laclede Group, a Missouri-based public utility holding company, announced plans to acquire Alabama Gas Corporation, a subsidiary of Energen Corporation. Laclede expects to benefit from increased geographic and regulatory diversity.

Some are looking to consolidate to achieve scale, reduce operating expenditures, and attract the capital needed to rebuild aging infrastructure and upgrade systems. Others are either actively looking to be acquired or are becoming attractive targets for integrated energy companies seeking to expand the regulated earnings portion of their income portfolios and potentially position themselves to take better advantage of the markets created by abundant, low-cost natural gas supplies. Recent deal activity reflects these motivations.

Interest in the natural gas sector is not limited to the distribution side of the business. Energy holding companies and gas LDCs are also investing in midstream pipelines and storage facilities as a means to grow their regulated operations and to participate in business opportunities associated with the North American shale revolution. In 2013, there were 15 deals, up from 10 in 2012, in which integrated energy companies bought or sold midstream companies or assets. One example is NorthWestern Corporation, which acquired several midstream assets and an 82 percent interest in Havre Pipeline Company LLC from Devon Energy Corporation in 2013. Others are seeking to achieve similar objectives not through outright acquisitions, but instead by entering joint ventures (JVs) and by forming master limited partnerships.

In June 2014, NextEra U.S. Gas Assets, LLC, an indirect, wholly owned subsidiary of NextEra Energy, Inc., announced a letter of intent for a JV with EQT Corporation to construct and own the Mountain Valley Pipeline project. The project will connect Marcellus and Utica natural gas supply to demand centers in the Southeast region of the United States. Some believe demand for natural gas in southern markets is poised to grow significantly as power producers there seek to comply with clean air regulations imposed by the U.S. Environmental Protection Agency (EPA) through more gas-fired generation. In its North American Integrated Market Model Reference Case, Deloitte MarketPoint projects power sector demand for natural gas in parts of the southeastern region will increase at approximately twice the rate of the underlying electricity demand growth.

Macroeconomic drivers stir the pot

The benefits of economies of scale, stronger balance sheets to meet rising capital requirements, and the allure of new, and often diversified, revenue streams have largely driven M&A activity for power and utility companies in 2013 and through the first half of 2014. Moving ahead, these drivers are not only expected to remain relevant but also to pack an added punch. Shifting market conditions, such as rising interest rates, will likely increase the urgency for power and utility companies to consider M&A as a strategic option.

Over the last few years, the industry has benefitted greatly from low interest rates in the United States, which have provided the obvious benefit of lowering the cost of debt financing and boosting equity performance. As of July 2014, the dividend yield on utility companies was still about one percentage point above Treasury bonds, down from spreads as great as three percentage points during certain periods after the financial crisis of 2008. Widely perceived as being less volatile than many investments in difficult economic times, these spreads have made utility stocks even more attractive, thus pushing up stock prices and satisfying shareholders — at least for the time being.

The abnormally low interest rates seen over the last few years, however, will not last forever. While the federal funds rate is expected to remain at near zero levels a bit longer, the Federal Reserve intends to normalize rates as the job market recovers. Barring unforeseen market developments, interest rates, therefore, will likely start trending upward.

Already, power and utility company stock prices may be reflecting these shifting economic headwinds. On the equity side of the equation, the stock performance of pure electric companies, small diversified utilities, and large diversified utilities has trailed gains in the S&P 500 index from June 2013 through June 2014.

The debt side of the equation has also taken a hit: Barclays recently downgraded the entire electric sector of the U.S. high-grade corporate bond market to underweight, saying it sees long-term challenges to electric utilities from solar energy, and that the electric sector of the bond market is not pricing in these challenges right now. If others follow suit, the industry may find itself confronting new capital challenges.

In the end, all of these developments point to rising cost of capital and potentially declining utility equity prices in the future. As the inverse of the conditions that have benefitted the industry in recent years takes hold, power and utility companies will investigate new avenues for enhancing shareholder value, with corporate M&A being one of the alternatives on the table.

Benefits expand beyond synergies and sheer size

Heretofore, synergistic cost savings have been the “go to” rationale for most mergers, and they will likely remain so. For instance, Duke Energy, which acquired Progress Energy in July 2012, reports it has achieved approximately $275 million in cumulative fuel and joint dispatch savings to date (Q1 2014), which is in line with the projected $687 million in savings over five years it had guaranteed to customers in North and South Carolina at the time of the merger. The merged entity also expects to achieve 5-7 percent in annual nonfuel operations and maintenance savings beginning in 2014, which once again aligns with original projections.

While synergistic cost savings are still a principal factor, today other types of synergies are gaining in importance — if not becoming an imperative for some companies. These include synergies related to information technology, such as advanced metering infrastructure and other smart grid technology, customer relationship management, and advanced data analytics. Larger entities may well be positioned to afford, as well as more readily take advantage of, these high-ticket systems and technologies. Indeed, it is conceivable that a utility that has not yet deployed smart meters may wish to acquire or merge with one that has, not only to obtain the technology itself but also the knowledge of how to successfully deploy and drive value from it. The same could apply to technologies and leading practices related to cyber risk and environmental compliance.

For instance, in the wake of the EPA’s recent proposal for cutting carbon emissions from existing power plants, some electric companies could potentially benefit not just by acquiring or merging with companies with low carbon profiles, but also by tapping into the expertise of companies that have already deployed large-scale renewables or implemented comprehensive energy management programs.

Asset optionality is another emerging synergistic benefit of M&A activity being evaluated by some companies. An entity with a diverse portfolio of assets may be viewed as having more flexibility to maximize the value of those assets as marketplace dynamics change, and conversely to better manage potential downside risks.

New frontiers of opportunity emerge

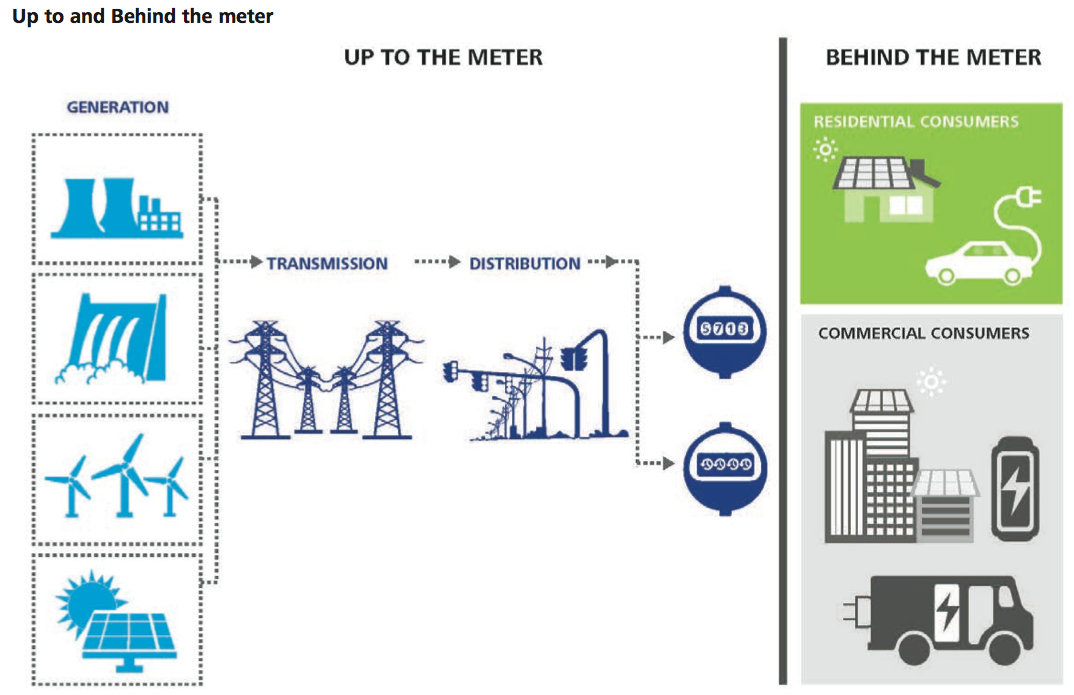

Power and utility companies today are evolving their business models in an effort to access new earnings streams, leverage capabilities and customer relationships, and create incremental value for business and residential customers. For electric companies in particular, this potentially means acquiring companies or assets that generate and deliver “clean” electricity up to the meter, or that provide new products and services to customers behind the meter. While few have pursued these paths aggressively yet, more and more are starting to question whether the following types of scenarios could fit into their strategies:

Up to the meter options include acquiring:

- Companies with centralized renewable generation or utility-scale storage assets

- Businesses with transmission and distribution capabilities to transport electricity generated from utility-scale renewables

- Retail energy providers

- Energy analytics/information providers

Behind the meter options include acquiring:

- Businesses that provide building efficiency software, home energy management systems, entertainment services, home security, and home automation technologies and services.

- Providers of distributed generation technologies such as solar photovoltaics, battery storage systems, fuel cells, and microgrids. Indeed, power and utility companies are already participating in the solar photovoltaic value chain, including Edison International, NRG Energy, Inc., Duke Energy Corporation, and Southern Company.

Regarding behind the meter opportunities, the Deloitte reSource 2014 Study found that 27 percent of residential consumers named installing solar panels as among the top five most important things they could see themselves doing to save electricity in the future. Nearly 40 percent are “extremely/very interested” in installing solar panels, if they could do so through a financing or leasing arrangement with no out-of-pocket expenses. And, while consumers have yet to widely adopt technologies such as smart thermostats or home automation systems to control heating, lighting, home security, and more from their smart phones and other devices, one in four say they would definitely or probably purchase a smart energy application for $250 – and almost half would purchase an application for $175 with a $75 rebate.

Interestingly, the reSources 2014 Study also found that 47 percent of consumers are interested in sourcing other services from their electricity providers. The top services indicated by consumers were:

- Internet: 36%

- Cable TV: 27%

- Telephone: 21%

- Home security: 18%

Price and convenience were the primary motivators for consumers considering purchasing these services from their electricity providers.

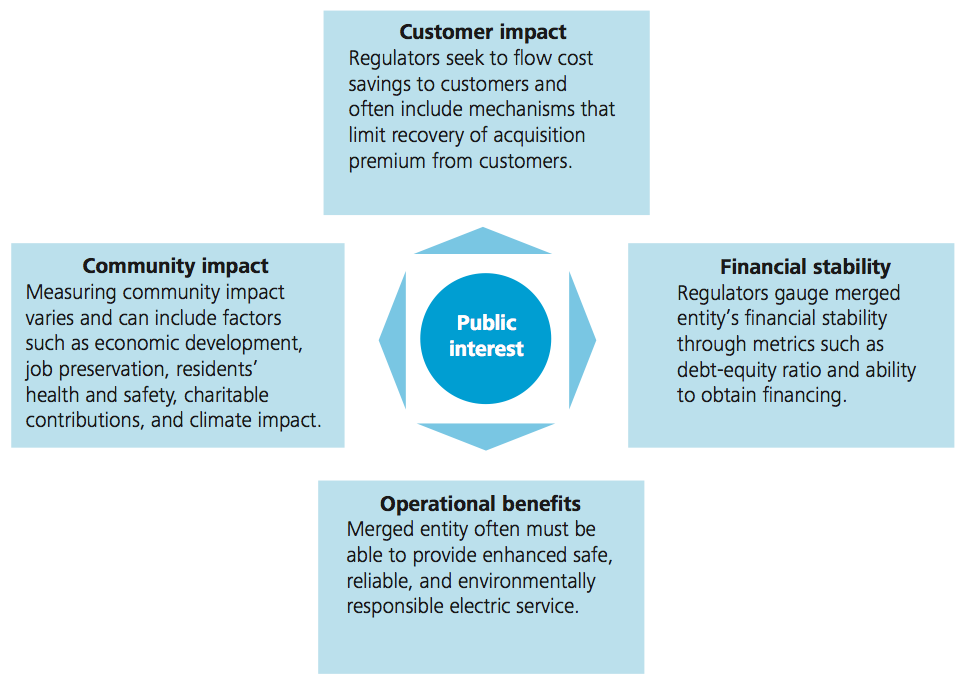

Utility regulation: From barrier to facilitator

The rationale for M&A in a regulated utility context is broadening beyond the traditional view that a utility merger or acquisition should be substantially justified on the basis of synergy cost savings that flow through to customers. M&A can now be viewed as a lever a company can pull to achieve a variety of strategic objectives that benefit customers and shareholders alike beyond the quantifiable, and generally short-term, impact on customer electricity prices. Accessing lower-cost capital, managing enterprise risks (such as achieving environmental compliance and mitigating cyber attacks), and lowering the overall corporate risk profile through enhanced asset optionality are just a few of the corporate objectives that M&A can advance. And, while achieving these objectives may not directly result in lower prices for utility customers, the inherent advantages of a healthy enterprise ultimately benefit the company’s regulated operations and its customers over the long term.

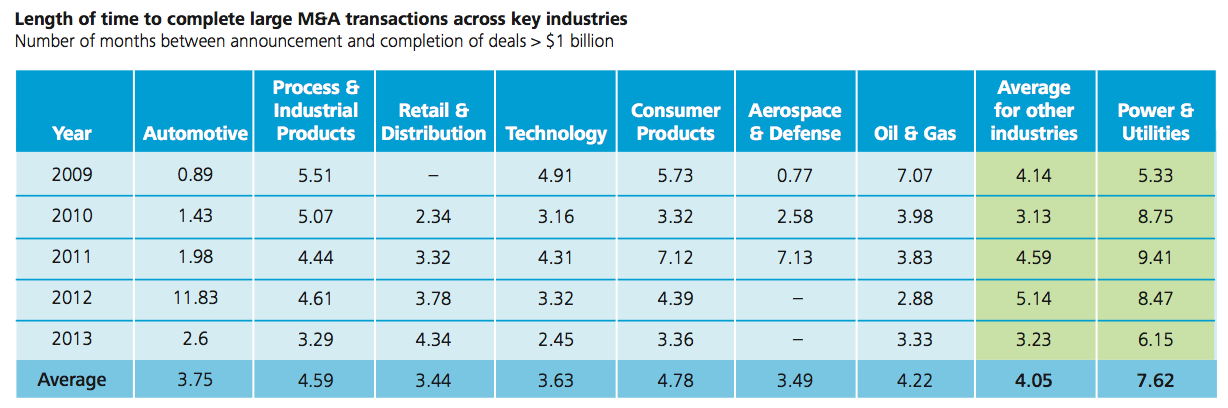

Despite increasingly compelling reasons to consider M&A as a strategic option, power and utility companies are often reluctant to move forward because they see the regulatory barriers to completing a successful transaction as being too high. The regulatory review process for merger approvals can be a painstaking and complex process, on the part of the entities involved as well as their regulators. The time to complete deals in the power and utilities industry is long when compared with other commercial enterprises, and sometimes transactions are abandoned simply because too much time has elapsed.

Lack of clarity around the rules of the road also presents a barrier. Although “public interest” is the key theme for regulatory approvals, each state interprets it differently. Most states require the merger to be a “net benefit” to customers in terms of reliability and price. A few states, such as Maine, follow a “no harm” policy, where the expected costs of the transaction must not exceed the anticipated benefits. Some states, such as Arizona and Maryland, require mergers to meet both standards.

In addition, proposed transactions are often subject to conditions added by regulators (often in more than one state) in an effort to demonstrate that a specific, tangible “balance” has been achieved between the interests of customers, employees, and the communities in which the companies operate. For instance, the Public Utilities Regulatory Authority of Connecticut approved the proposed merger of Northeast Utilities and NSTAR in April 2012, subject to requiring Connecticut Light and Power, a subsidiary of Northeast Utilities, to forgo recovery of $40 million of the approximately $260 million of costs incurred in 2011 as a result of Tropical Storm Irene and an unexpected October snow storm. Additionally, for a period of at least seven years, Northeast Utilities was required to maintain its principal board and executive offices, their functions, and staff in Hartford, Connecticut, as well as keep the headquarters of Connecticut Light & Power, Yankee Gas, the transmission business, and Northeast Utilities’ call center operations in Connecticut. In addition, the merged entity was required to keep charitable donations and civic commitments to Connecticut at levels consistent with those that occurred in the previous five years and to preserve the aggregate number of line workers in both Connecticut and Massachusetts.

Newly emerging M&A opportunities, such as acquiring businesses behind the electric meter, raise new questions concerning what is feasible and what is not from a regulatory perspective – because there are often no precedents. In many instances, power and utility companies do not know whether these types of acquisitions will be regulated; and even if they will not be, it is unclear to what extent they would be allowed to do business in the geographies where the parent company has regulated operations. Even in the best-case scenario, where state commissions have begun to develop new constructs for the rapidly changing electricity landscape, they can only go so far before being constrained by policy limitations. Some of the emerging business opportunities companies may wish to consider will require new state legislation if they are to become viable options, because the laws in most states regulate what companies can and cannot do under their utility franchise agreements.

Changing the dialogue

The time is ripe for power and utility companies and their regulators to re-examine the role M&A can play in creating new win-win scenarios for customers and shareholders as the fundamental electricity business model evolves. Open communication in an environment of mutual trust and respect is essential to identifying reciprocal benefits and it is more likely to occur outside the investigations and proceedings associated with a proposed transaction.

Several areas for potential examination include:

Restructuring the allocation of synergy savings to incentivize M&A

The vast majority of the known synergy savings in an M&A transaction typically flow to customers, generally within a short timeframe. The more “speculative” benefits are left for shareholders, and in many cases are only realized over a much longer period.

Restructuring the allocation of synergy savings to incentivize M&A

The vast majority of the known synergy savings in an M&A transaction typically flow to customers, generally within a short timeframe. The more “speculative” benefits are left for shareholders, and in many cases are only realized over a much longer period.

But in today’s environment, a merger or acquisition can produce a variety of benefits for customers within the purview of providing safe, reliable, environmentally responsible — and yes, affordable — electricity. Is it not time to examine the benefits of M&A to customers in this broader context, perhaps allowing greater sharing of synergy savings as an economic incentive for utilities to execute strategic transactions?

This sharing, or “re-allocation,” of synergy savings can be accomplished in a number of ways, including:

- Increasing the percentage of known synergy savings that flow to shareholders

- Allowing the utility to retain “permanent” speculative benefits, if realized, over longer periods of time

- Permitting recovery of all or a portion of acquisition premiums through electricity prices.

Examining the playing field for the utility and its nonregulated affiliates behind the meter

The evolution of electricity-related customer services behind the meter is accelerating, with growth in distributed generation, electricity storage, and energy efficiency applications already surpassing commonly held expectations. These advancements simply did not exist when today’s utility franchise agreements were executed. Consequently, the limits placed on utilities, and often on their nonregulated affiliates, concerning permissible electricity services in franchised geographies may no longer serve customers in the way they were intended. Policymakers at the time could not have anticipated the plethora of new customer value propositions and the explosive growth of businesses operating behind the meter.

While clarity in terms of the utility’s role and opportunities behind the meter is a broader matter, such clarity is particularly needed within the context of M&A. As electric companies evaluate their strategic alternatives, understanding their opportunities and constraints in this rapidly growing area is paramount. Where the regulatory objective is to maximize the value to electricity customers (i.e., safe, reliable, environmentally responsible, and affordable electric service) lack of clarity concerning the utility’s role and opportunities may well deprive customers of legitimate benefits offered by technological advances behind the meter.

A re-examination of the role that pilot programs can play may also be warranted, as electric companies and their regulators work toward better defining what is permissible behind the meter. Well-structured and executed programs provide the opportunity for demonstrating proof of concept, measuring customer response and receptivity, and fine-tuning based on lessons learned — all in a relatively low-risk environment for customers, regulators, and the utility or its nonregulated affiliate.

In some respects, these approaches collectively suggest movement across the continuum from “net benefit” to “no harm” to customers. This shift may go beyond the regulators’ current authority and require state legislative action. While challenging, this may be necessary if the objective is to provide sustainable value to customers that looks beyond the short-term electricity price implications.

Conclusion

In an era of fundamental change and disruption, there are many unknowns. However, there is one thing that is almost certain: For most power and utility companies, the status quo is not a viable option. These companies will adapt their strategies to changing marketplace dynamics — and to the degree their businesses are regulated, their opportunities are presently limited. Therefore, the time has arrived to re-consider the effectiveness and the unintended consequences of these limitations.

Both utilities and regulators acknowledge that delivering incremental value to customers is the top priority. To do this, they will need to open a constructive dialogue to explore potential win-win scenarios for providing safe, reliable, affordable, and environmentally responsible energy to customers — regardless of the source of the electrons. They also need to examine new ways of supporting the development and execution of corporate strategies designed to mitigate risks to the enterprise and take advantage of appropriate opportunities in a rapidly changing marketplace. If power and utility companies and their regulators can shift the lens through which they view M&A, it can emerge as an important lever in balancing the interests of customers and shareholders — one that should not be feared but instead embraced by all parties.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter