Publications Dear CFO, Why IT Does Matter Within M&A Transactions: Insights & Recommendations

- Publications

Dear CFO, Why IT Does Matter Within M&A Transactions: Insights & Recommendations

- Christopher Kummer

SHARE:

By Deloitte

Motivation

Mergers, acquisitions and divestitures (M&A) are the most rapid way for companies to change their business portfolio and to improve their competitive position in the market. M&As fundamentally affect business units almost overnight by adjusting the scope and breadth of how they conduct their everyday business operations, including their products, services, management and reporting structures.

While mergers and acquisitions are intended to improve an organization’s competitive position through realizing synergies, reality shows that they often fail in achieving this goal. More than half of the transactions either fail entirely (aborted transaction) or do not achieve the objectives for conducting the deal.

While mergers and acquisitions are intended to improve an organization’s competitive position through realizing synergies, reality shows that they often fail in achieving this goal. More than half of the transactions either fail entirely (aborted transaction) or do not achieve the objectives for conducting the deal.

For both acquisitions and divestitures IT has become a mission-critical success factor within M&A transactions. Hence, special attention needs to be drawn to integrating the information systems of two entities (or disintegrating information systems in the case of a divestiture) while ensuring unobstructed daily business operations.

This is a complex task for the IT function due to heterogeneous IT landscapes, cross-sectional coordination with other work streams and high time pressure to avoid costly delays. Furthermore, to enable post-merger synergies, new requirements for the information systems may emerge.

In the past IT has repeatedly come up as a showstopper with regard to realizing the expected value (revenue growth, operating margin, asset efficiency, competitive strengths) and cost savings. In particular IT’s complexity and its diverse interfaces into business activities make M&A transactions one of the most challenging business life events companies can undertake.

The achievement of synergies is a vital objective of the post-merger integration phase and is often the rationale for the deal. Thus the success of a deal is critically dependent on synergy realization. IT contributes to synergy realization in two ways, first by achieving economies of scale within the IT function to reduce costs, and second usually to a larger extent, by enabling business-related synergies. The latter may be achieved by supporting and integrating business processes to reduce operational costs or increase revenues.

Despite its practical relevance and business criticality, there is little research on the role of IT within M&As and the impact on the underlying financial business case of the transaction. Only a few studies provide anecdotal evidence on successful M&A cases where a high priority was assigned to IT issues. To address this research gap, Deloitte and TU Munich have conducted this study and surveyed 88 IT and M&A experts.

Successful transactions go hand in hand with successful IT workstreams

Studies on M&A success often report that more than half of the deals either fail entirely or do not reach the objectives that formed the rational for conducting the deal. The perceived success of a deal may however differ and is more or less driven by the success of the integration or carve-out project rather than by achieving long term synergy potentials.

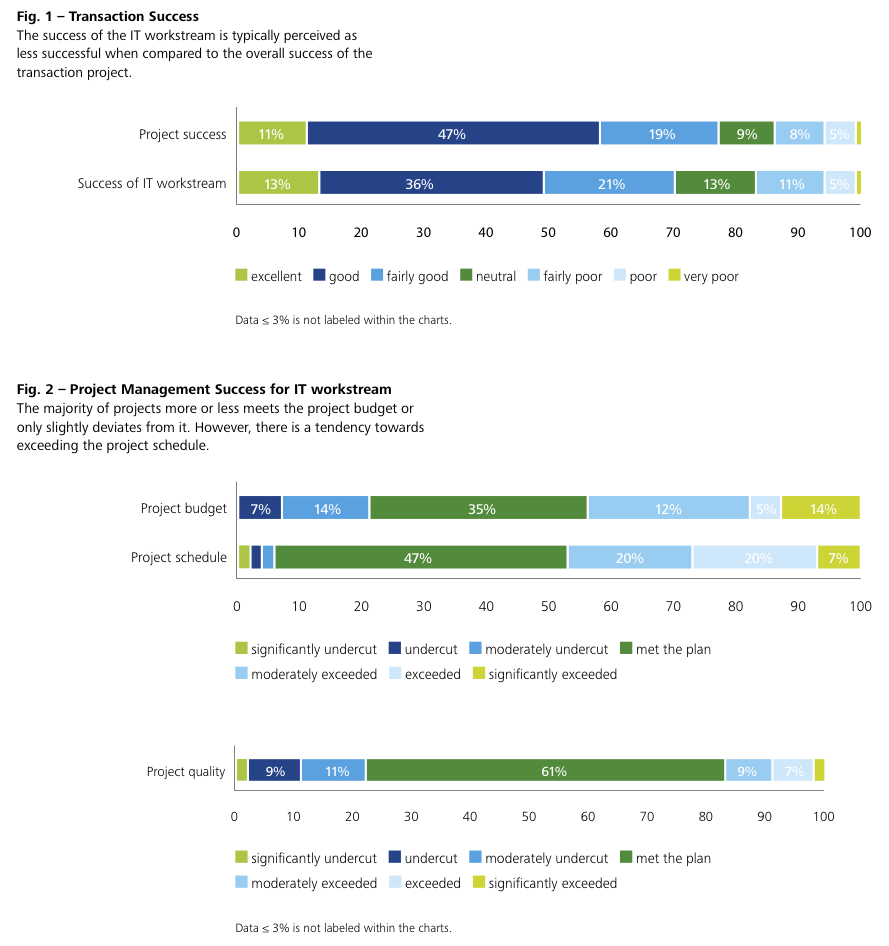

The perceived success of the transactions in this study is rather positive. Nearly 60 % of the deals are assessed as excellent or well executed by the participants. Only 14 % of the deals are found to be poor. Also the perceived success of the IT work-stream is positive. Nearly half of the projects are rated excellent or well executed, compared to 21% that were found to be poor. The results are similar for PMI and Carve-Out projects, with a slight tendency towards a more successful IT workstream for Carve-Out projects. The data also reveals a strong relationship between the overall project success and the success of the IT workstream. Hence, on the one hand the success of the IT workstream is influenced by the overall success. On the other hand, a successful IT carve-out or integration might be a necessity to render the overall project successful.

Similarly to the perceived success, the project management success for the IT Carve-Out or IT PMI project is also rated rather positively. The majority of the projects met the initially set budget, schedule and quality objectives or deviated only moderately. However, there is a tendency towards exceeding the project schedule. Poor project quality, in terms of delivering less than promised, is typically not seen as an option to achieve budget or schedule objectives. In the majority of the cases, project failures were characterized by a miscarriage of all three dimensions of project management success.

Highlight contribution of IT for M&A on board level

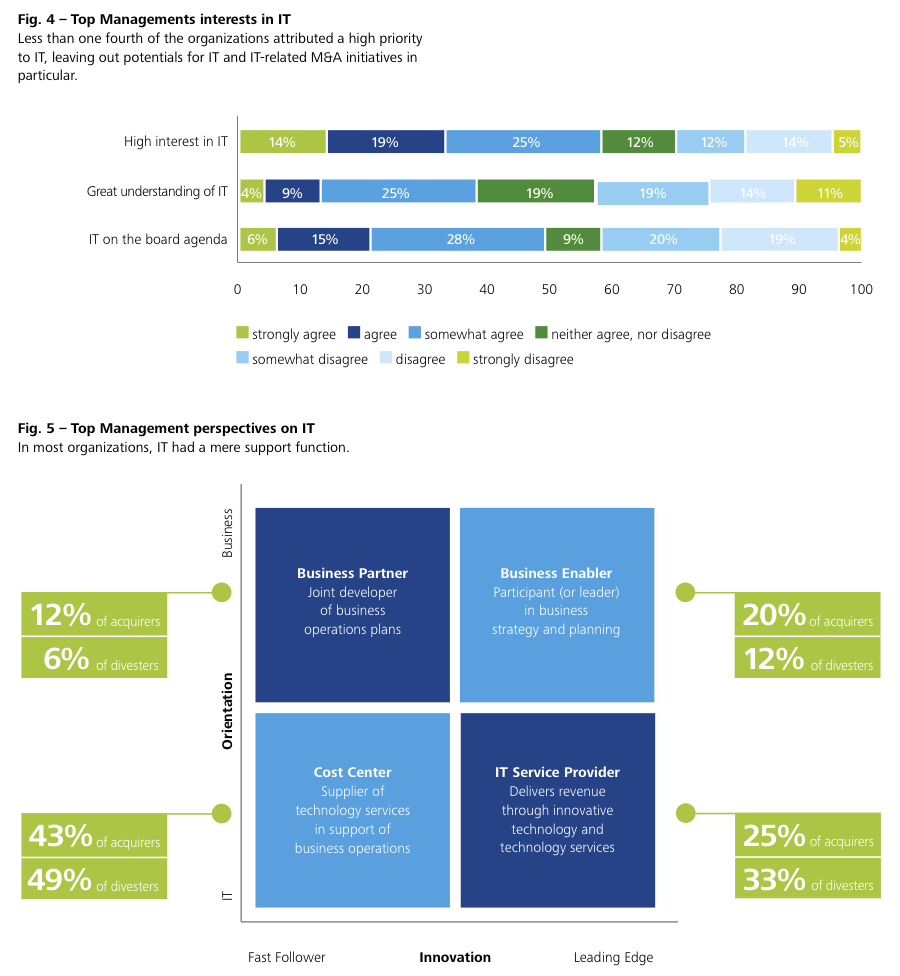

The role and perception of IT varies across organizations. While some organizations see IT as a mere support function, others attribute a competitive advantage to it. Accordingly, the top management perception of IT varies.

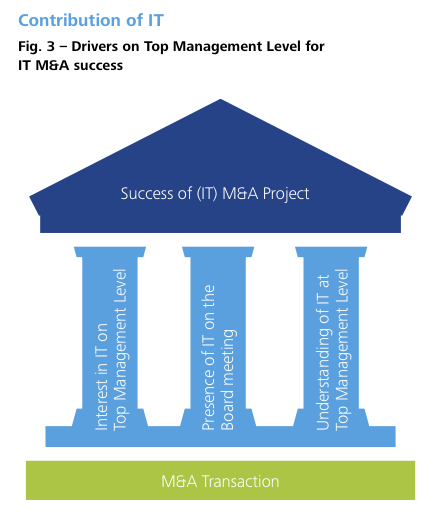

In 70 to 80 % of the organizations in this survey IT was perceived as a support function, being seen as a Cost Center or IT Service Provider. This was also mirrored in the top management perception of IT, with board agendas covering few IT issues. Only 30 % of the participants would agree that their top management had interest in IT topics and even fewer agreed that top management had a good understanding of IT. However, the findings of this study highlight the relationship between top management’s perception of IT and the success of the post-merger-integration. There is a highly significant positive correlation between top management’s interest in IT, its understanding of IT, the presence of IT on the board meeting agenda and the perceived success of the overall PMI and respectively the IT integration project. Involving and discussing IT issues also on a board level, therefore, can truly add value to the business.

Key Take-Aways

To improve the probability of a successful M&A transaction, organizations should:

• Increase top management interest in IT

• Foster top management understanding of IT issues with regard to their individual domains

• Put IT issues routinely on the board agenda

Involve IT considerably earlier in M&A endeavor

Experience suggests that an early involvement of IT in the M&A process is a critical success factor. The carve-out of IT or its integration into an existing organization is very complex and associated with large costs. Hence, involving IT in the early stages helps to create awareness for these success-critical activities, identify IT-related synergy potentials and avoid unnecessary costs.

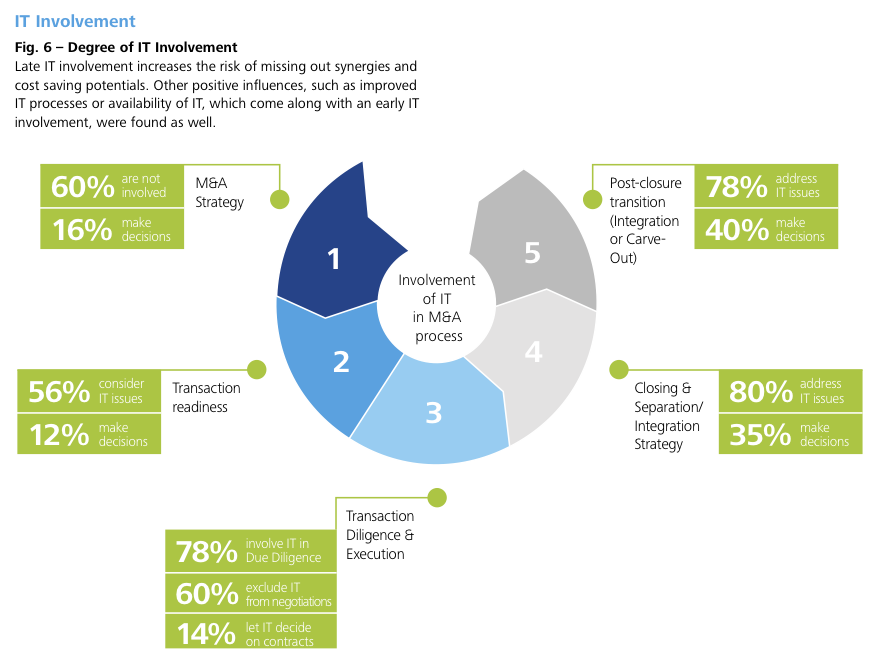

Only a few organizations involve IT in the early phases of the M&A process. More than half of the participants were not even informed (and much less were really involved) about the organization’s M&A strategy, which didn’t allow them to prepare accordingly. Although informed about the strategy, no more than a fifth of the participants were asked for advice or made part of the decision making process. Transaction readiness is also only intermittently assessed from an IT perspective. Just 56 % of organizations actually consider IT issues during the initial due diligence process and merely 12 % allow the IT function to make decisions.

When looking into the effects of an early IT involvement, this study indicates positive effects on IT-related synergy realization. Involving IT early on is positively related to cost savings within the IT function, as this enables the organization to better avoid redundancies. Organizations that have involved IT in the M&A strategy or initial due diligence tended to be better in consolidating applications, achieving better conditions for IT procurement, and using IT projects more effectively. Similarly, IT involvement during contract negotiations is positively related to application consolidation and conditions for IT procurement.

The importance of involving IT in the early phases is largely dependent on the objective of the transaction and the integration process. For instance, organizations that pursue a co-existence integration approach may not benefit from early IT involvement, as information systems are not integrated at all or only to a small extent. Similarly the effects are rather limited when an absorption approach is followed, where the existing IT landscape is rolled out onto the target organization. Once the parent organization’s IT landscape is ready for acquisitions and IT integration capabilities are developed, the procedure of rolling-out IT onto the target can be replicated without an intensive IT involvement during

the early phases. On the other hand, best-of-breed and renewal approaches benefit more from an early IT involvement as the objective is to build an IT landscape that better supports the business processes. Thus synergy benefits result from improved IT quality rather than cost efficiency. Within this cluster, early IT involvement is positively related to the reliability of information systems, the skills and availability of IT staff, better IT processes and the utilization of best practices. Early IT involvement in this cluster further correlates with synergies in the R&D and Marketing & Sales function.

Understanding and correctly assessing the importance of an early IT involvement for every M&A transaction ultimately relies on a well-defined M&A strategy, which determines integration approaches that are planned to be followed.

The study also stresses the importance of conducting an in-depth IT due diligence both for PMI and Carve-Out projects. Involving IT in this phase is positively related to the success of the IT integration or Carve-Out and to complying with the integration project schedule. This can be explained by the fact that a profound knowledge about the state of the IT landscape, the organization and its processes helps to avoid unexpected challenges and enables the project manager to estimate the required tasks more precisely. Above that, an in-depth IT due diligence is positively related to the efficient use of Transitional Service Agreements.

Key Take-Aways

To improve the financial and operational results in M&A transactions, organizations should:

• Make sure to conduct an in-depth IT due diligence before starting the transition

• Utilize IT findings also in the negotiation phase

• Avoid considering IT only as a source of potential risk

• Involve IT early in the M&A process to increase the chance of realizing cost-based synergies within the IT function, and in particular when the objective is to realize IT-enabled synergies in business functions (e.g. in a best-of-breed approach)

Consider the transaction strategy as major cost driver

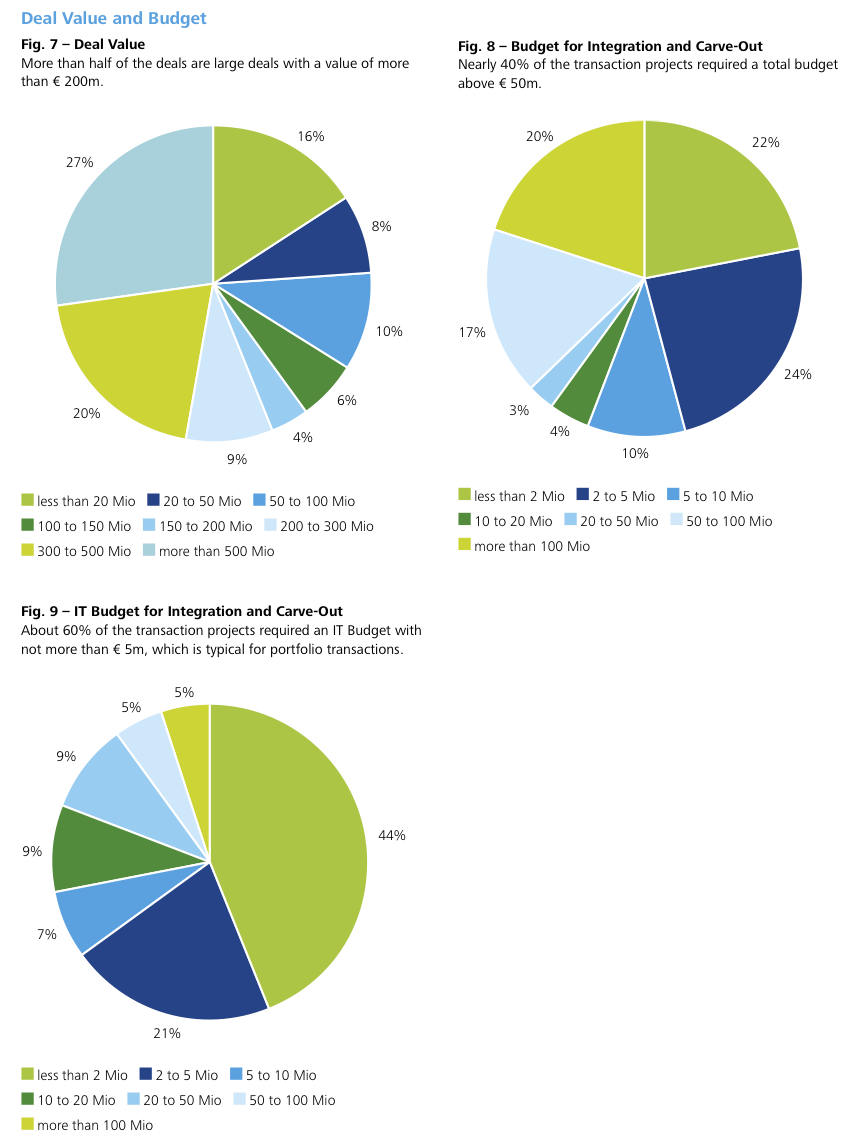

More than half of the deals had a volume greater than € 200m, which is driven primarily by the Carve-Out projects. While 65 % of the Carve-Out projects were greater than € 200m, only 36 % of PMI projects were of a similar size. On the other hand, 21 % of the PMI projects were smaller than € 20m, and in total 43 % were smaller than € 100m. For Carve-Outs, the remaining 35 % were almost evenly spread across the smaller categories.

There is no indication of a fixed size for budgets, as typically the project budget is proportional to the size of the deal. As a rule of thumb, many PMI projects are budgeted with approximately 10 % of the deal value. However, this cannot be seen as a general rule, but can act as starting point for further evaluation. The budget volume rather depends on the transaction strategy. If for example a small deal initiates a major restructuring project, it will require a higher budget. On the other hand, large stand-alone acquisitions may only require a minimal integration budget. Hence, the results vary from small deals of less than € 20m in value and budgets of € 100m and more to deals greater than € 500m and a budget between € 2m and € 5m. Carve-Outs do not seem to follow a similar rule of thumb, but are basically split into two large groups, independent of the deal size. One group with a budget of less than € 5m (38 %) and another group of more than € 50m budget (52 %). This can be explained by the level of integration. While a stand-alone business unit may not require much carve-out activity, a highly integrated business unit is very complex to separate and thus requires a large budget.

Approximately half of the overall budget is attributed to the IT workstream. This highlights the complexity of separating or respectively integrating IT in the context of a transaction. Variations in the IT budget can be explained by the level of IT integration or the initiation of restructuring projects. For example, acquirers with larger IT budgets typically achieved a higher consolidation of the application landscape.

Key Take-Aways

Relying on rules of thumb for budgeting a transaction project (10% of deal value, half of that for IT) is dangerous, but still can act as starting point for further budget planning. A solid budget planning should in addition consider the following key factors:

• Size of the transaction, which might act as an indicator for complexity

• Transaction strategy for Carve-Out as well as for PMI

• Current or targeted level of integration

Choose a deal-specific IT M&A integration approach

To implement a M&A strategy, certain operational activities are required. With few exceptions an acquisition is followed by an integration project that combines the original socio-technical systems of both organizations. Similarly, a divestiture is implemented by a Carve-Out project in which the socio-technical systems of a business unit are separated from the parent orgaization. The terms “IT PMI” and “IT Carve-Out” focus on the activities needed to integrate or respectively separate the target business unit’s IT assets.

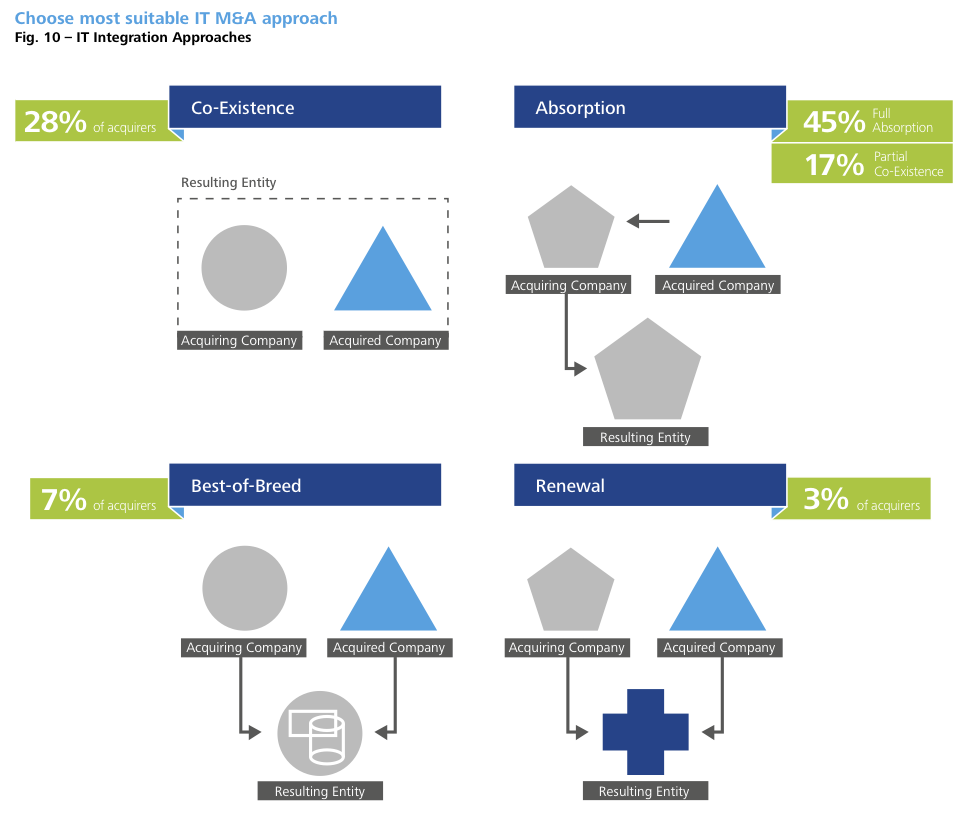

Depending on the objectives of the acquisition, organizations may pursue a different approach for the post-merger IT integration. Typically four distinct integration approaches can be identified. Absorption refers to an approach where the transaction object’s IT resources are retired and replaced by the buying organization’s existing IT resources. The opposite of this approach is Coexistence, where the transaction object’s entire IT resources are retained and bridges to the buying organization’s IT are built only where absolutely necessary, e.g. to ensure financial reporting. The Best-of-Breed approach differs from the aforementioned as a conscious selection is made between the buying organization’s and the transaction object’s information systems. Renewal is an integration approach, where IT resources in both the buying organization and the transaction object are replaced and entirely new IT resources are developed.

Various relationships between IT integration approaches and synergy realization are observable. Most effects can be observed where a best-of breed approach (potentially replacing inferior existing information systems at the acquirer) was followed or new information systems were developed. On the other hand, IT-enabled synergy effects are also observable, when an absorption approach was chosen. If the acquirer’s information systems are adequate, economies of scale can be leveraged by replacing the targets information systems by those of the acquirer. In the case where the IT resources remained untouched, no correlations to synergy realization were found.

When analyzing the variance of the perceived success, difference between the PMI and Carve-Out approaches are observable. The few cases where a Best-of-Breed or Renewal approach was pursued, consistently reported a high PMI success. The perceived success of Absorption approaches ranged from neutral to excellent. In contrast, Co-Existence approaches demonstrated the largest variance, ranging from poor to excellent. The variance of the IT success is quite similar, only for Absorption it is slightly larger towards the negative end. Gradual Transition based on TSAs had the greatest variance among

the different Carve-Out approaches, ranging from poor to excellent. Duplication approaches on the other hand consistently resulted in successful projects. Interestingly, Hand-over approaches demonstrated more variance towards the negative end. This might be explainable when parts of the sold entity are still required by the former parent. Data Extraction was consistently perceived well from an IT perspective, it demonstrated a large variance from an overall perspective. As variance can be interpreted as a measure of risk, it is important to make a conscious decision about the right PMI or Carve-Out approach.

Key Take-Aways

Make sure to choose the right IT integration approach to leverage IT-enabled synergies in business functions. To do so:

• Evaluate the effectiveness and efficiency of existing information systems (before the transaction)

• If the existing systems are not sufficient, consider a best-of-breed approach or develop new information systems, but be aware that is typically the most demanding approach.

• Use Co-Existence approach to learn about the business model, but re-evaluate whether synergy potentials could be leveraged when integrating the business unit at a later point in time, (which will require the integration effort that was initially avoided).

• While TSAs are a handy instrument to win time for conducting the actual Carve-Out / Integration, if wrongly designed they bear high risks and can incur additional costs while the one-time-effort has to be invested anyway.

• The decision for the either preferred IT integration or carve-out approach should be made after considering the IT organization’s strategy (e.g. technology road-map) and maturity (e.g. integration readiness).

Leverage tools and M&A skills

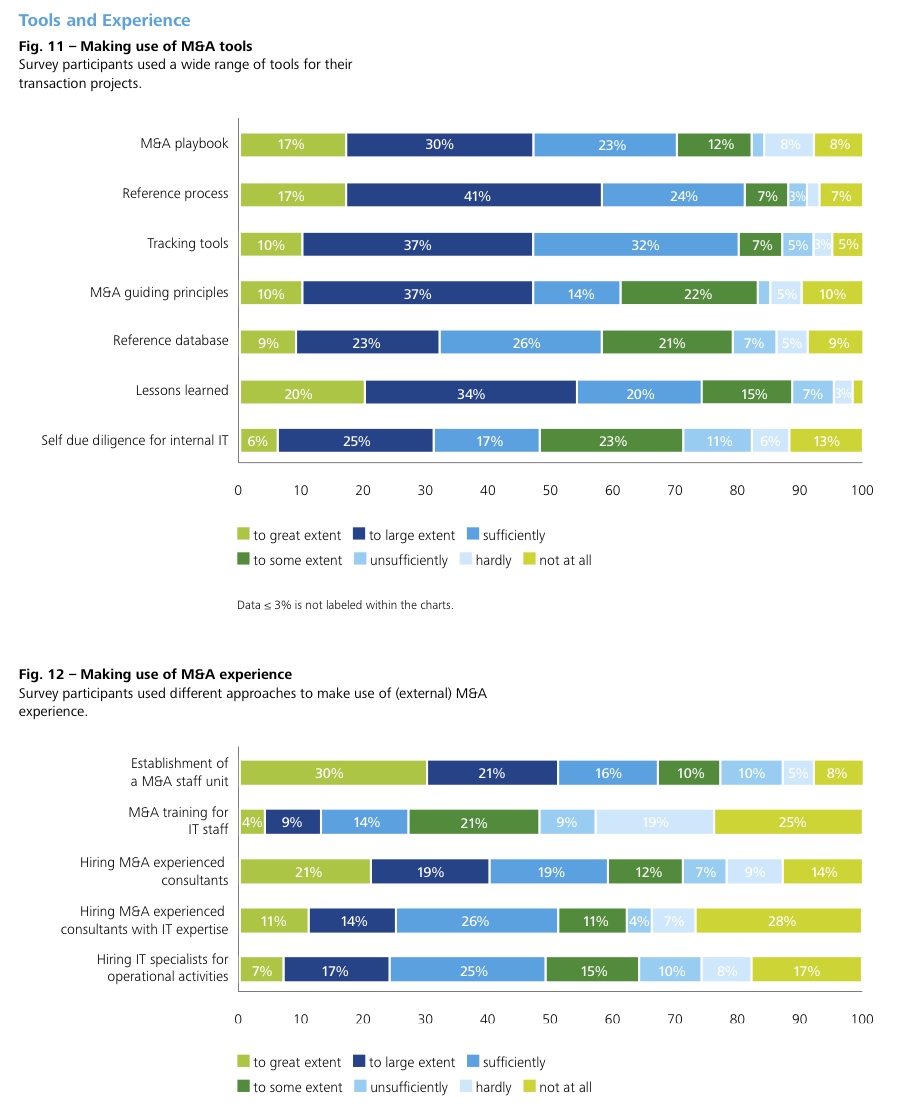

To ensure a successful transaction and realize synergies, organizations make use of different tools and M&A skills. This study reveals a high adoption of M&A tools and the creation of an M&A staff unit, which is not surprising as the majority of participants had prior transaction experience. More than 60 % can actually be considered serial acquirers or serial divesters, with three or more transactions in the past three years.

Nearly 80 % of the organizations have created permanent staff units to unite their M&A experience and further develop tools and skills. Interestingly more than one third has created a M&A staff unit within the IT department. This highlights that some organizations have recognized the importance of IT in transactions.

M&A tools like playbooks, reference processes, tracking tools and lessons learned from previous transactions are widely used. The adoption of these tools does not differ much between Carve-Outs and PMI. The survey shows that the use of these has influence on the perceived success of an acquisition. In particular, the use of reference processes and tracking tools is positively related to both the overall PMI success as well as the success of the IT integration. In addition, they are positively related to synergy potentials within the IT function, such as achievements in consolidating the application landscapes and projects, data quality and IT.

Compared to the other tools, a self-due diligence of internal IT is not as common. Less than half of the organizations reported that they had used it sufficiently. However, the results suggest considering a self-due diligence as it correlates to the success of the IT integration, as well as to synergy realization within the IT function. Once again, this highlights the importance of measures to evaluate and achieve M&A readiness. A similar outcome is reported for the use of tracking tools.

Beside these tools, M&A experience is considered as a critical success factor. While the majority of participated organizations have prior M&A experience, around half of the organizations are acquiring external experience to conduct the transaction. Interestingly, nearly 40 % reported that their hiring of M&A consultants with expertise in IT is insufficient or non-existent. This might increase the risk of neglecting IT-related risks or synergy potentials that might have been recognizable for M&A experts at the interface between business and IT. Another observation is that only a few organizations provide M&A training to their IT staff. This finding does not differ in the cases where the IT department has created an M&A staff unit. This suggests that many internal IT M&A responsibles grew into this role due to accidently doing M&A transactions, but never received a formal training to provide them with profound M&A knowledge.

Although the adoption of these tools is quite similar for PMI and Carve-Outs, they show more benefits in PMI projects. This might indicate that tools primarily developed for PMI might not be as effective in a Carve-Out setting and thus need to be adapted.

Key Take-Aways

To achieve most out of available skills and tools, companies should:

• Utilize established M&A tools (e.g. reference processes, self-due diligence) to ensure transaction success.

• Make use of specific tools for PMI and Carve-Out projects

• Provide basic M&A training to dedicated IT M&A resources tailored to their needs

• Utilize best-of-breed internal and external resources to bridge the gap between the M&A transaction level and the IT operational level

Identify synergies within Business and IT

In order to achieve cost and revenue improvements, organizations need to realize synergies. Corporate synergies are financial benefits that an organization tries to realize when it acquires another organization and occur when both former organizations interact congruently. Cost reduction potentials are realized by eliminating duplicate activities or making use of economies of scale and increasing operational efficiency. Revenue synergies refer to the combined sales potential of both organizations, and value-adding revenue synergies are realized by cross-selling opportunities.

On average, approximately one quarter of the acquirers was able to realize (in some cases significant) improvements across different business functions. Most synergies were realized within the R&D function, Marketing & Sales, Customer Service and Procurement. The majority of organizations reported only minor to no improvements, while around 10 to 15 % of the organizations actually reported negative effects. Divesters struggle even more with realizing synergies. During the Carve- Out project stranded costs need to be eliminated, however, reduced economies of scale might still worsen the cost position in certain functions. In particular the functions Human Resources, Finance and Customer Service tend to be prone for negative synergy effects. Here, more than 20 % have worse conditions than before the transaction, while only 10 % (HR and Customer Service) to 20 % (Finance) report improvements. Again, the majority of organizations reported only minor or no improvements. When analyzing the drivers for synergy realization, this study highlights an increase in operational efficiency, better information availability and improved cross-selling opportunities as the most significant drivers.

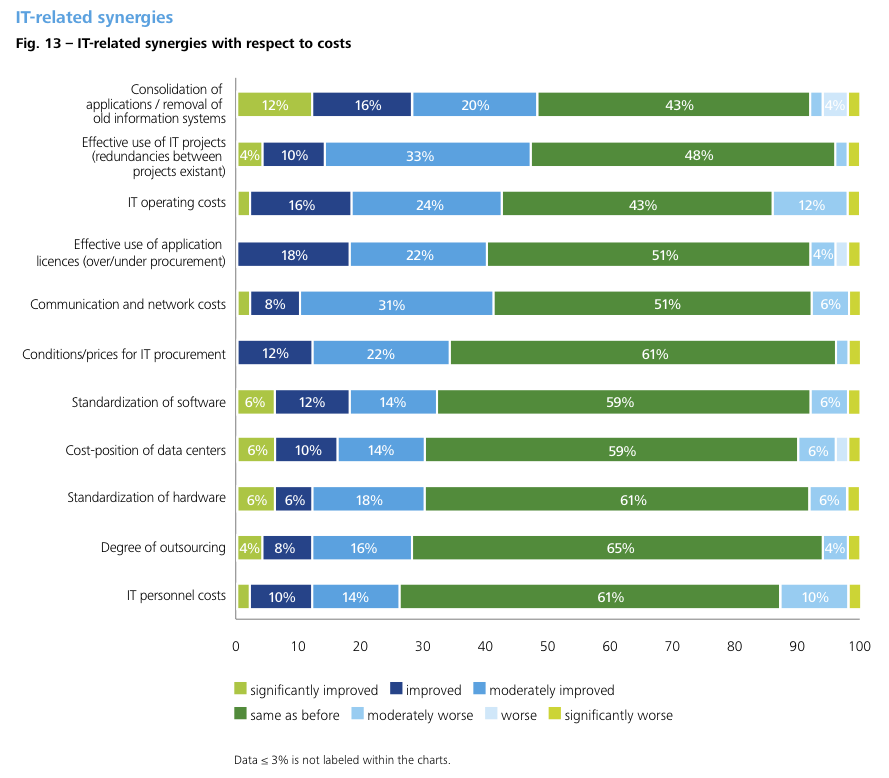

Within the IT function, for acquirers, cost synergies are typically achieved by realizing economies of scale. In contrast, divesters lose economies of scale in the course of the transaction. Thus they need to avoid stranded IT costs and identify options to run their IT function more efficiently. Furthermore, they might also use the window of opportunity to remove information systems that are no longer required and streamline their IT department.

This study reveals that after the transaction, most of the organizations remain with the same IT cost-position as before the deal. On average, less than 20 % were able to considerably improve their IT costs and another 10 to 20 % were able to make minor improvements. The consolidation of applications by removing redundant information systems, as well as the effective use of IT projects, tend to be the easiest target for cost-savings. This stresses the point that several synergies are on the one hand enabled by IT and on the other hand only a limited amount of synergies are actually achieved within the IT function.

For PMI on average 10 to 20 % of organizations actually have their IT cost-position deteriorate, as they were unable to consolidate their IT landscape and struggled with redundant information systems. Conversely, for Carve-Outs there was hardly any deterioration of IT costs, and very few cases had moderately worse IT operating and personnel costs. These cases can be explained by extensive TSAs which cause additional management and operational costs. Economies of scale are typically very low for TSAs as they often need manual handling.

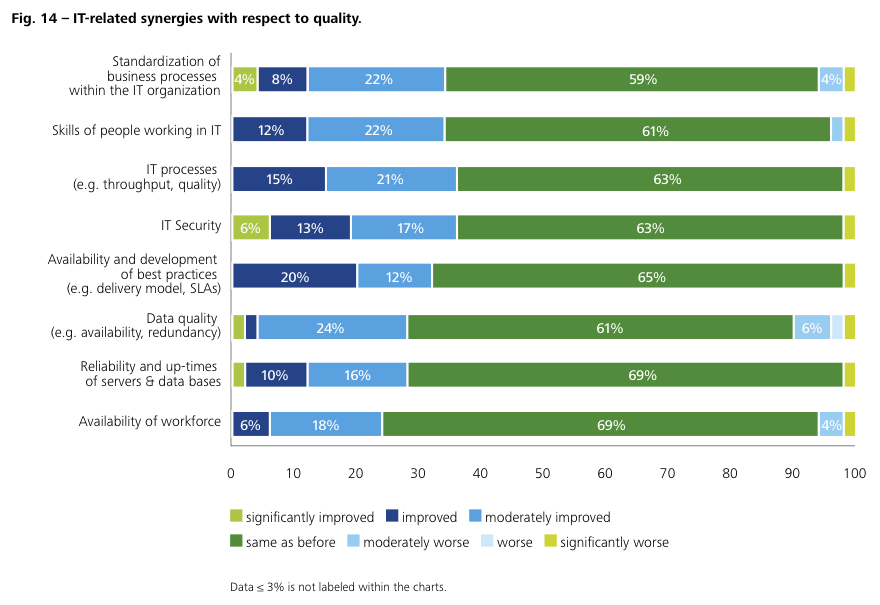

IT-related synergies to improve the quality of the IT function appear to be even harder to realize. On average, 10 to 15 % of the organizations are able to considerably improve their IT quality, while the majority of organizations cannot realize any IT based synergies. Carve-Out projects tended to improve IT processes and data quality, while for acquisitions, maintaining the data quality was stated as a problem for approximately 20 % of the organizations surveyed.

Key Take-Aways

Realizing synergies is one of the key drivers to improve the organization’s financial performance after the transaction. To achieve that you also should:

• Be careful when estimating cost-saving potentials within the IT function, because only a few organizations are able to realize them.

• Be careful about the design of TSAs when undertaking a Carve-Out, as these might prohibit cost-reductions and cause additional management costs.

Target long-term financial performance of IT

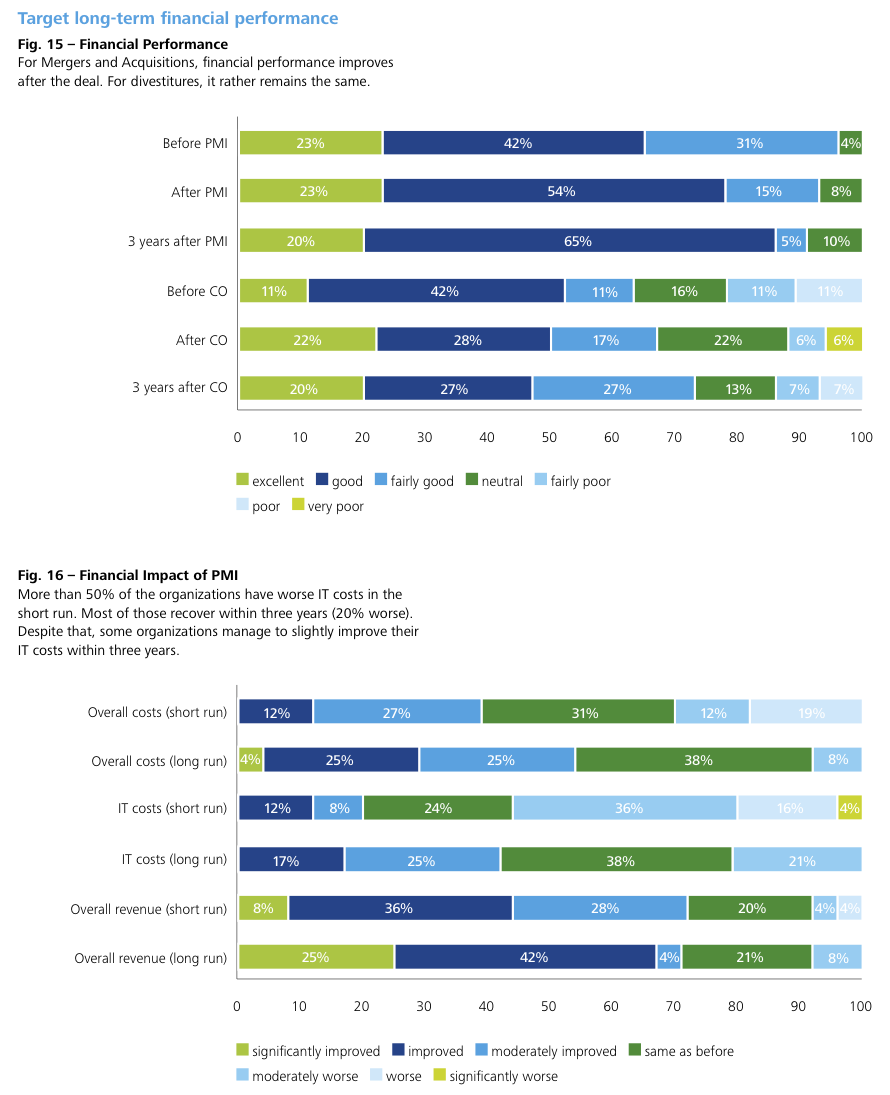

Achieving a better financial performance after the deal and sustaining this performance is the ultimate objective of a transaction. The overall financial performance of acquirers was perceived quite positively before the deal. In none of the cases was the overall financial performance rated poorly. The financial performance increases slightly after the deal, and improves further three years later. While 65 % of the acquirers reported an excellent or good performance before the deal, this number increased to 77 % after the deal and 85 % three years later. The number of organizations reporting a neutral financial performance increases from 4 % before the deal, to 8 % after the deal and 10 % three years later. This suggests that acquirers mainly use M&A deals to strengthen their non-financial performance. While most organizations manage to keep or further improve their performance, some have problems in doing so.

Similarly, the overall financial performance of divesters tends to be rather positive, though more than 20 % report a fairly poor performance. Interestingly, divestitures do not necessarily lead to a better financial performance. The number of organizations reporting an excellent or good financial performance actually decreases from 53 % before the transaction, to 50 % after the transaction and 47 % three years later. Nevertheless, the share of organizations performing fairly well increases in favor of those with neutral or poor performance.

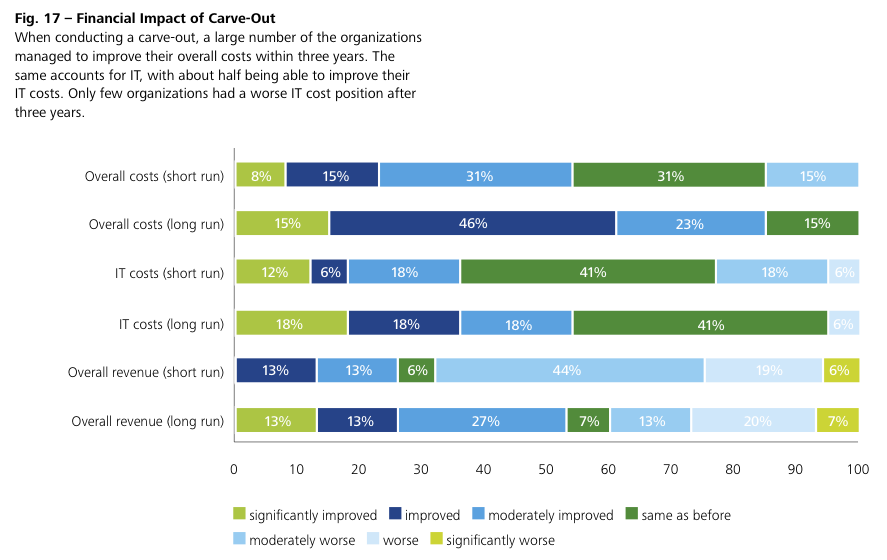

For acquirers, financial performance gains appear to be driven by an increase in overall revenues, rather than cost benefits. While almost half of the organizations managed to improve their short run revenues, only 12 % managed to improve their costs. About one fourth of the transactions actually had worse overall costs in the short run. This is even more substantial for the short run IT costs. More than half of the organizations reported at least moderately worse IT costs in the short term.

This might be an indication that most organizations are struggling to keep their IT costs under control in the course of the transaction. Thus, limited resources are available to actually achieve synergies within the IT function, as a large share of the resources is rather utilized for the support of the business integration activities. This will be especially true for IT-synergies depending on business-synergies, e.g. reducing the number of systems is only possible, once the business processes and functions are integrated.

Within a three year period, most organizations managed to recover their cost position, whereas IT costs improvements remain largely moderate or even moderately worse three years after the acquisition. In the same timeframe, approximately one third of the organizations reported improved revenues. All in all this observation suggests that the IT function requires around 3 years to compensate and recover from the effects resulting out of a M&A transaction.

In contrast to the neutral financial performance impact of divestitures, the majority of organizations managed to realize overall cost improvements. Approximately one fifth of the organizations reported improvements in the short run. Three years later, more than half of the participants were able to improve their overall costs and another 20 % managed moderate improvements. Cost improvements within the IT function are comparatively harder to achieve. Only 18 % achieved (significant) improvements in the short run and 35 % in the long run. Nearly one quarter had worse IT costs in the short run, but most organizations managed to recover within a three year timeframe. This might be an indication that companies are not able to downscale their IT costs and, therefore, suffer under so called “stranded costs”.

Key Take-Aways

Financial impacts resulting out of a M&A transactions are severe, typically:

• Cost benefits within the IT function of acquirers are hard to achieve.

• Realizing transaction benefits and recovering takes approximately three years.

• Improving IT-costs takes even longer and may cause higher costs in the short run. Only few organizations manage to realize short run cost benefits within the IT function.

• The realization of synergies within IT may be dependent on a prior realization of business synergies (e.g. consolidating business processes)

Summary

This study has revealed that there are no prevailing characteristics of successful transactions, nor are there dominant strategies. Small transactions fail or succeed as much as large transactions and stand-alone transactions can be as successful as absorptions. There is also no “silver bullet” that guarantees transaction success. In fact, transactions are unique and thus need a tailored approach; however the study has identified important lessons for successful M&A transactions. Thus, combining common findings with a tailored approach will likely increase the chance of transaction success. The results of this survey have not only confirmed the findings of prior studies, but also provide new and partly surprising findings.

What you probably did already know:

• Several organizations are still struggling to realize cosiderable synergies

• Business synergies mainly result from an increased operational efficiency and improved cross-selling opportunities

• Approximately half of the transaction implementation budget is associated to IT activities

• The opportunity to involve IT in the early phases of the M&A process is often missed

What might be new to you:

• Better information availability, enabled by IT, is a key driver for business synergies

• Early IT involvement is positively related to synergy realization

• Dedicated M&A staff functions are common, even in IT departments

• There is a high adoption of M&A tools among serial acquirers and serial divesters

• Many organizations need approximately three years to recover their IT costs

This study revealed that few organizations are able to realize considerable synergies, neither in their business functions nor within the IT function. This is consistent with other studies, reporting that around half of the transactions fail – keeping in mind that the majority of transactions were perceived as success by the participants. The perception tends to be driven by the project management success rather than by the achievement of the objective to realize synergies. This makes obvious, that different stakeholders may have a different understanding of a “successful transaction”. However, if the focus is not on realizing synergies, the majority of the potential to improve organizational performance and shareholder value is lost. M&A responsibles should thus strengthen their focus on synergy realization. In the following we provide some recommendations to leverage IT-based synergy realization.

Advice for M&A Responsibles

The following is a summary of specific key success factors derived from the findings of this study. It is meant as a non-exhaustive list of recommendations and does not include general success factors such as early communication or talent retention5.

1. Create awareness for the importance of IT

IT is often not considered a strategic, but rather a support function. Thus it does not have much top management attention as long as it runs smoothly. To ensure that CEOs and other board members are aware of the challenges that are associated with IT during a transaction, as well as about its synergy potential, the CIO needs to maintain a frequent, ongoing communication with the top management team. This also helps to achieve and maintain business-IT alignment.

2. Involve IT early in the M&A process

IT is typically not considered a “deal breaker”. Thus, M&A responsibles do not think much about IT until IT issues are raised by the counterparty during contract negotiations or the operative integration or carve-out activities are due. If IT is involved early in the process, IT executives can help target selection and due diligence, uncover potential challenges, high-cost items, and additional synergy potential.

3. Be realistic about synergy potentials

Perpetually, different studies on M&A report failures in realizing the initially intended synergies. M&A responsibles should be aware of the fact that synergies are hard to realize and thus shouldn’t be overly optimistic.

This is especially true if non-IT experts make estimations about IT-related synergy potentials. Once synergies are assessed realistically, the business case for the deal might change.

4. Conduct an in-depth IT due diligence

As IT is one of the most complex aspects of transactions, it is important to develop a good understanding of the target organizations IT environment and which role IT has for the business activities. This helps to avoid IT-related challenges, estimate the effort and budget more accurately, avoid redundant costs and leverage the synergy potential. Utilize the findings in negotiations and use scenario planning to better prepare for the transaction.

5. Assess M&A readiness of the IT function

Besides evaluating the targets IT, it is also important to achieve a full understanding of one’s own IT environment. This helps to identify upcoming challenges, evaluate the efforts and thus assess the synergy potential realistically. This assessment is also valuable to determine the necessary changes of the IT environment before the transaction.

6. Train your IT staff about M&A

The IT staff needs to be aware of M&A issues such as general objectives of deals, but also about the specific logic of the current deal. This helps them to effectively communicate with business people, understand the need to integrate or separate IT and to prioritize activities. Hence, teaching IT staff the basics of M&A helps them to contribute to transaction success by leveraging IT-related synergies.

7. Make use of M&A tools and experience

M&A tools such as playbooks and reference processes have demonstrated their effectiveness. Using established M&A tools help to structure the M&A process and make use of the accumulated M&A experience of its developers. But, be aware that many standard tools are developed for PMI projects and might need adoption when used in a Carve-Out setting.

8. Focus on synergy realization

Synergies are hard to realize and many organizations need several years to accomplish the integration. Once, the necessary activities to ensure daily business operations are achieved, M&A responsibles should prioritize synergy potentials and align their PMI or Carve-Out activities accordingly. Nevertheless keep in mind that you have to do a clean-up exercise within IT for the next 3 years to recover from the deal impact.

As this study has shown, IT can be a lever to realize more synergies both within the IT function and in other business functions. Roughly one fifth of the organizations in this sample have shown that this is achievable.

Appendix

About this survey

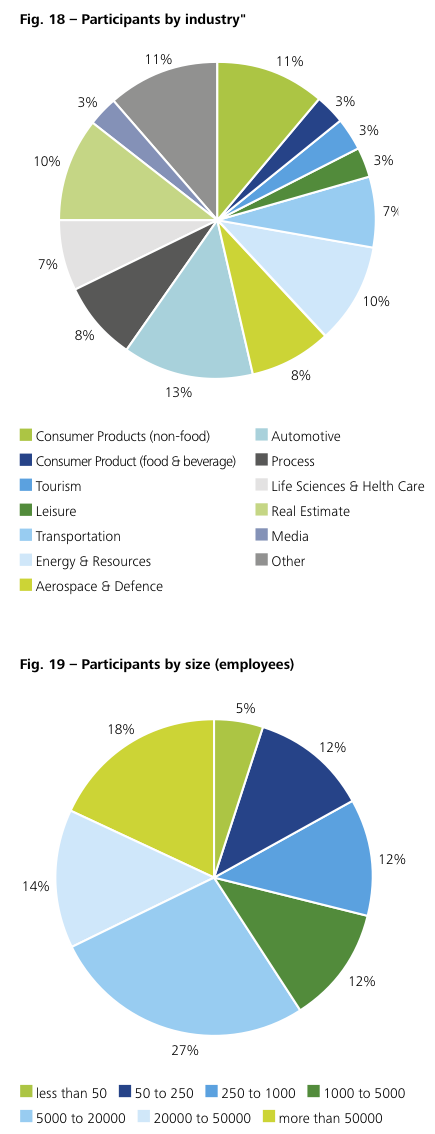

This is Deloitte’s regularly created IT focused M&A survey. It asks for the opinions and expectations of IT M&A experts from various sectors. By providing more transparency towards the impact of and on IT during M&A activities, the findings support corporate leaders before and during M&A transactions. Participants of this survey are predominantly German M&A experts. To gain further insights and better understand the international dimension, it is planned to expand this survey to a global scale.

Methodology

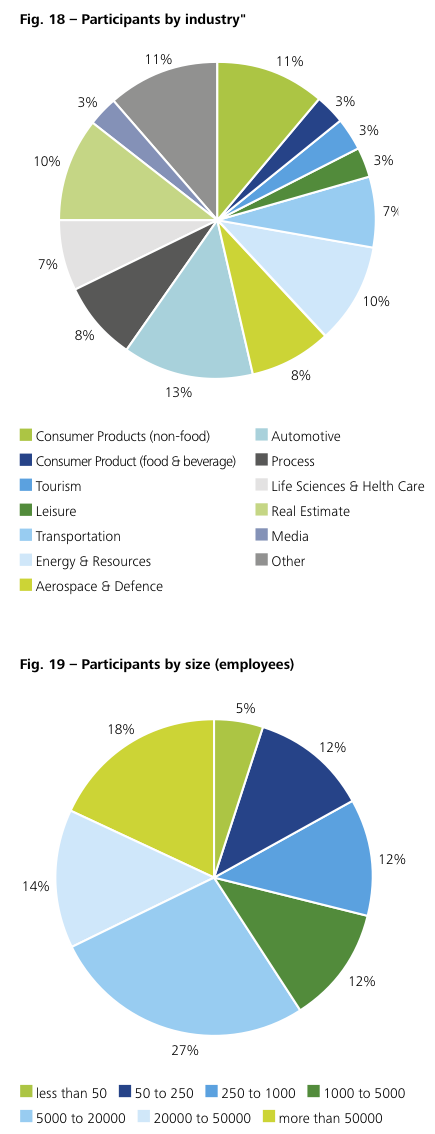

Over a two month period, from the beginning of May, we asked predominantly German IT M&A experts to answer a minimum of 22 questions. To ensure the legibility of this survey we did not include all questions in this result presentation. The participants work in different sectors and for companies of various sizes – in terms of turnover and number of employees.

The survey was completed by 56 participants (34 PMI; 22 Carve-Out). For some descriptive questions on deal size, industry and budget, up to 88 answers could be used. Due to the comparatively small sample size, generalizations are not feasible. This is particularly the case where conclusions are distinguished by groups, as these results might not be conclusive. However, the findings do provide an initial indication.

The findings presented in this report aggregate Carve-Out and PMI cases. Where considerable differences between these two types were identified, these differences are described explicitly. Correlations (using Kendall’s tau; 1-tailed) are reported if they reached a level of significance p≤.05. Caution must be taken when interpreting correlations because they give no indication of the direction of causality. If interpretations are provided in this report, they resemble educated guesses.

We would like to thank all participants very much for sharing their knowledge and experience in this survey.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter