Publications Deal Capsule: Transactions In Chemicals & Pharmaceuticals July 2016

- Publications

Deal Capsule: Transactions In Chemicals & Pharmaceuticals July 2016

- Christopher Kummer

SHARE:

By Rita Duran, Helen Christmann, Daniel Pietzker– KPMG

Contributors: Andy Qiu, Austin Wang

HIGHLIGHTS

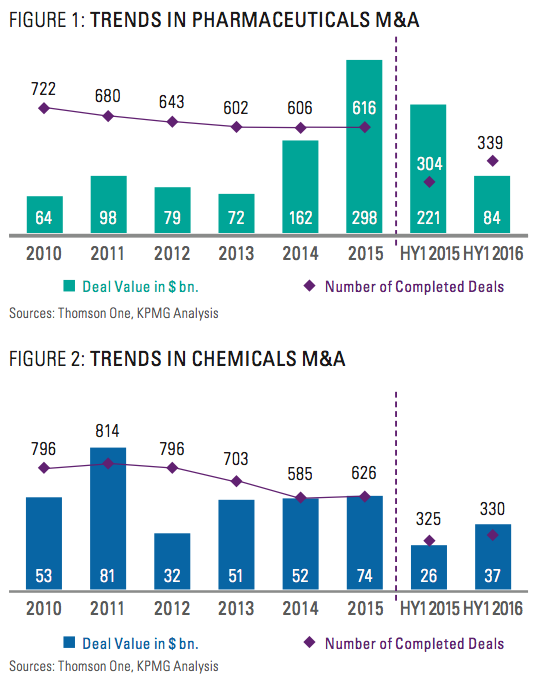

— The number of completed deals remained high in both sectors in HY1 2016. While total deal value for pharmaceuticals decreased, chemicals witnessed a 40% increase in HY1 2016 versus HY1 2015.

— Pharmaceutical M&A was impacted by stock market volatility, while new US regulatory rules struck down the $160 billion Pfizer – Allergan merger.

— Oncology and dermatology were key areas of interest for big pharma, who were especially keen on acquiring biotech assets.

— Consolidation in agrochemicals continued, with Bayer proposing the $62 billion acquisition of Monsanto – the largest-ever all cash deal.

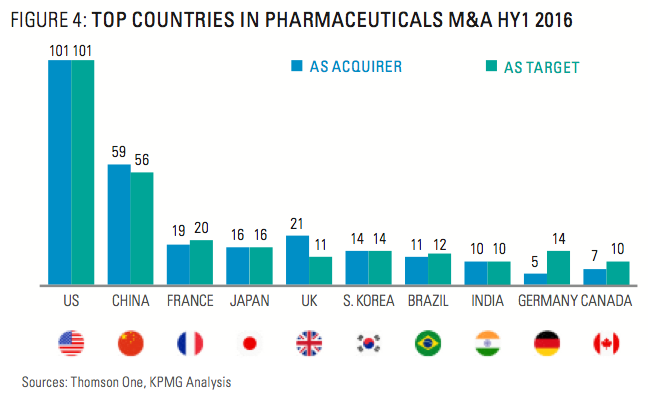

— US remains most active country in both sectors. German firms were strong in chemicals M&A.

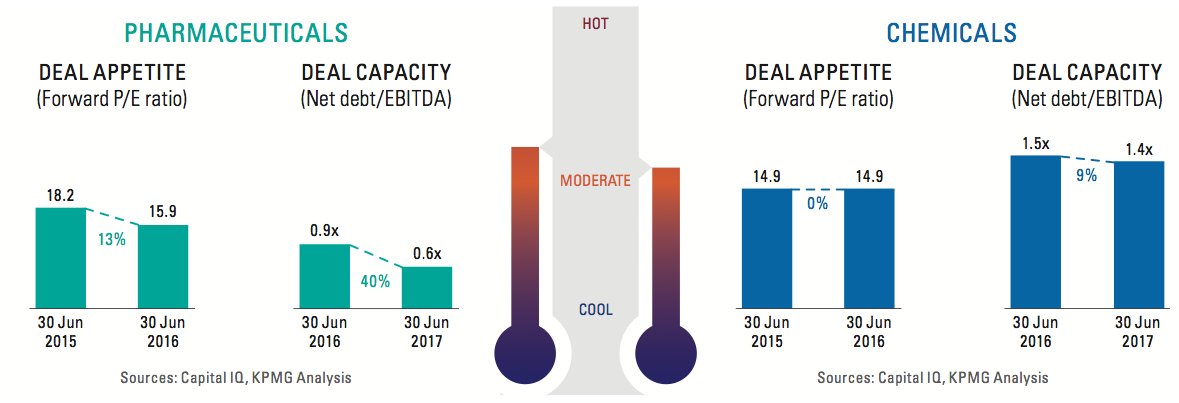

— KPMG’s Deal Thermometer indicates that the environment for M&A activity will remain moderately strong in both pharmaceuticals and chemicals.

“Valuations in chemicals have rebounded and German companies are leading the charge with landmark deals in agro and specialty chemicals” – Vir Lakshman, Head Of Chemicals & Pharmaceuticals, KPMG In Germany

DEAL THERMOMETER HY1 2016

KPMG’s Deal Thermometer signals the environment for M&A deals in chemicals and pharmaceuticals. It combines the appetite for deals (changes in forward P/E ratios) with the capacity to fund deals (changes in Net Debt/EBITDA multiples). ‘Hot’ signifies an environment conducive to deal-making.

Pharmaceuticals

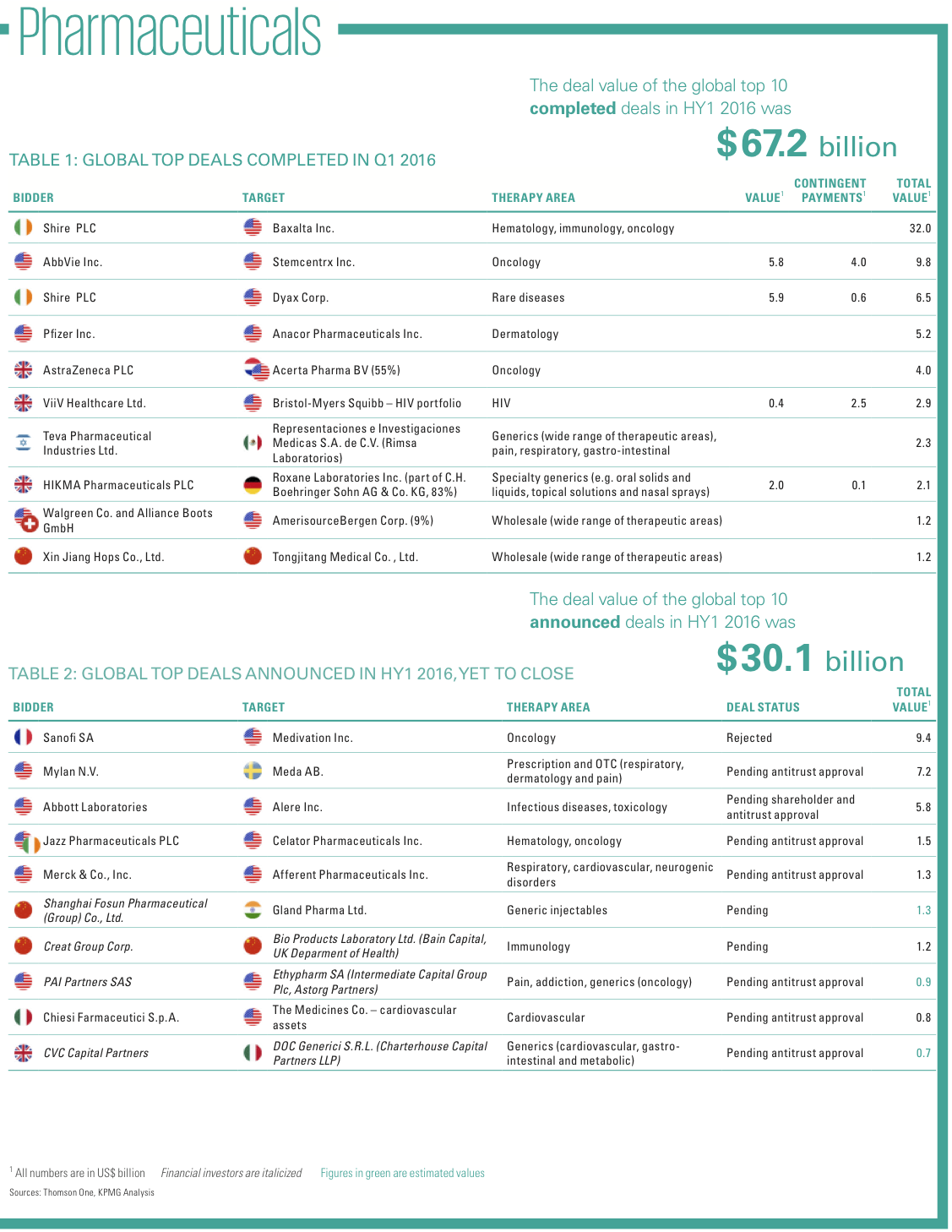

The total value of the top 10 completed deals in HY1 2016 amounted to $67.2 billion versus $190.4 billion in HY1 2015. Only one transaction was above the $10 billion mark. Pharmaceutical firms focused on smaller targets, especially biotechs, to strategically reposition in high growth markets. US remains the most active country.

DEAL FOCUS AREAS

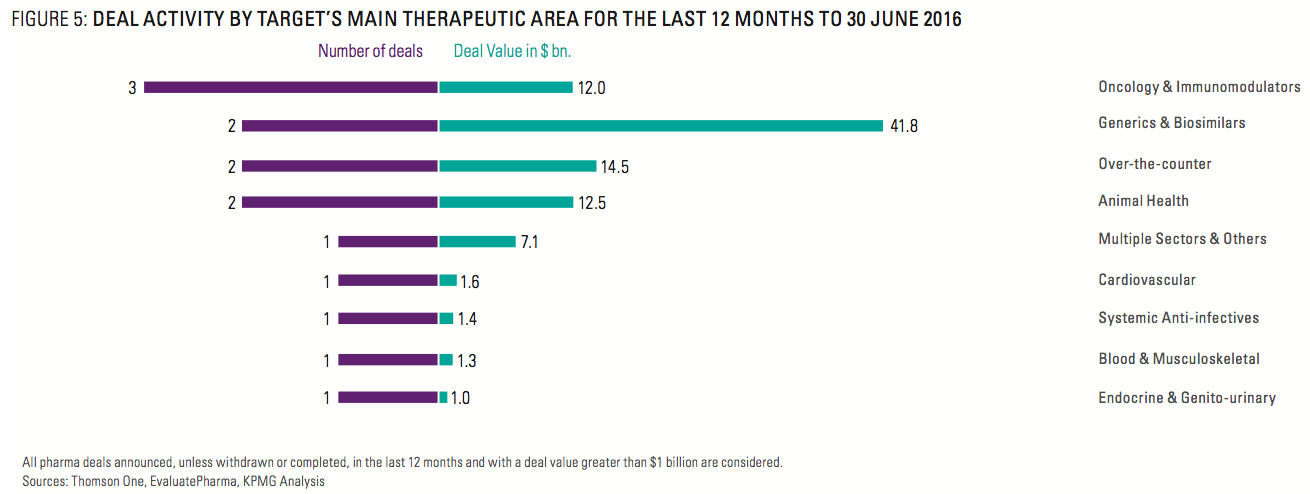

Major pharma players aimed to increase their presence in promising markets in HY1 2016. M&A activity was focused on therapy areas which are expected to grow strongly in the upcoming years.

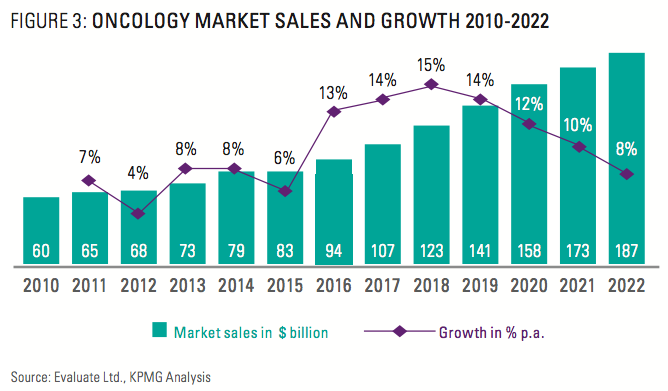

Oncology is one of the growth markets for the industry, projected to more than double in size by 2022 with global revenues expected to increase from $83 billion in 2015 to $187 billion by 2022.

AbbVie Inc. is expanding its oncology business through the acquisition of Stemcentrx Inc., a Silicon Valley biotech. Its main asset is Rova-T, a late-stage lung cancer drug, which has been submitted to the FDA for a breakthrough therapy designation. The deal is worth up to $9.8 billion and is one of the five biggest acquisitions ever of a venture capital-backed company.

AbbVie substantially entered into the oncology business through the acquisition of Pharmacyclics Inc. for $21 billion, one of last year’s blockbuster deals. Through both deals, the US-based company decreases its reliance on Humira, the world’s best selling drug for rheumatoid arthritis which accounted for about 60% of AbbVie’s sales in 2015.

Pharma giant, Sanofi S.A., is looking to ramp up its oncology division, which contributed a mere 4% to its revenues in 2015. The French drugmaker launched a public offer to acquire Medivation Inc., a biotech specialising in oncology, for $9.4 billion. Despite its offer being rejected, Sanofi is looking to engage the Medivation Board into talks. It has in fact initiated a consent solicitation to remove and replace the Medivation directors.

Jazz Pharmaceuticals PLC placed a $1.5 billion bid to acquire Celator Pharmaceuticals, Inc. whose main asset is Vyxeos, a treatment for leukemia which has been granted a breakthrough therapy designation. Other major deals in oncology include the closing of Shire PLC’s acquisition of Baxalta Inc. for $32 billion in Q2 2016 which is to date the largest deal of the year. Baxalta recently put a strong focus on its cancer drug business. Additionally, AstraZeneca PLC acquired a majority stake in oncology biotech Acerta Pharma BV in Q1 2016 for $4 billion.

Novartis AG, stressed the importance of its oncology business by splitting the pharma division into two separate units, one focused on cancer drugs, the other on the remaining pharmaceutical business as, for instance, neuroscience and ophthalmology. Novartis is one of the market-leaders in oncology after acquiring GSK’s oncology business for $16.0 billion in 2015.

Dermatology

While dermatology is one of the smaller pharma markets, it has significant upside potential. Market size is expected to double from $12 billion in 2015 to $24 billion by 2022, mainly driven by ageing western societies. Today’s market fragmentation and rising product complexity is driving market consolidation.

Dermatology has been a strong focus area for Mylan N.V.’s expansion strategy this year, targeting complementary portfolios to add to its existing assets. The US-based company acquired the dermatology business of Renaissance Acquisition Holdings, LLC for $1.0 billion in Q2 2016. Prior to that in Q1 2016, it announced that it would acquire Meda AB for $7.2 billion.

After terminating its mega-merger with Allergan PLC, Pfizer Inc. is exploring options to bolster its drug pipeline. In Q2 2016, the leading US pharma company acquired Anacor Pharmaceuticals Inc. for $5.2 billion. The deal provides access to crisaborole, a topical gel for the treatment of eczema currently under review by the FDA and expected to hit the market in 2017. Analysts predict the gel will become a best seller in the dermatology market, thus earning Pfizer a spot among market leaders.

One of Pfizer’s main competitors in the field is Leo Pharma A/S, which ranks among the Top 5 dermatology players. Pursuing a strong growth strategy, Leo acquired Astellas Pharma Inc.’s dermatology business for $0.7 billion in Q2 2016, enabling new market entry into China and Russia and increasing sales by more than 20% to around $1 billion.

CHINA

While domestic deals continue to dominate Chinese pharmaceutical M&A activity, two of the top 10 announced deals involve Chinese acquirers pursuing foreign targets in HY1 2016.

Shanghai Fosun Pharmaceutical (Group) Co. Ltd proposed the $1.3 billion acquisition of Gland Pharma Ltd., the first FDA approved Indian injectable drugs producer. Over the last ten years, only two Indian targets were acquired by Chinese investors, both by AIF Capital Asia III LP of Hong Kong. Also, Chinese Creat Group Corp. offered to invest $1.2 billion in Bio Products Laboratory Ltd., a leading UK-based manufacturer of plasma therapies.

CAPITAL INDEX

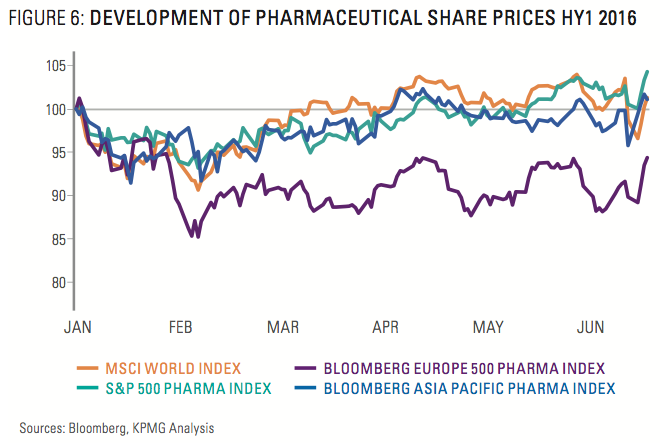

While the S&P 500 Pharma (+4.5%) and the Bloomberg Asia Pacific Pharma (+1.2%) slightly rebounded from their falls earlier this year, the Bloomberg Europe 500 Pharma (-6.0%) did not recover in HY1 2016.

The sub-par performance was driven by declines of major players such as Roche AG (-7.3%), Novartis AG (-7.7%), and Bayer AG (-20.3%). Valeant Pharmaceuticals Inc. lost 81.3%. The industry’s best performing stock was Johnson & Johnson Corp. (+18.1%).

Chemicals

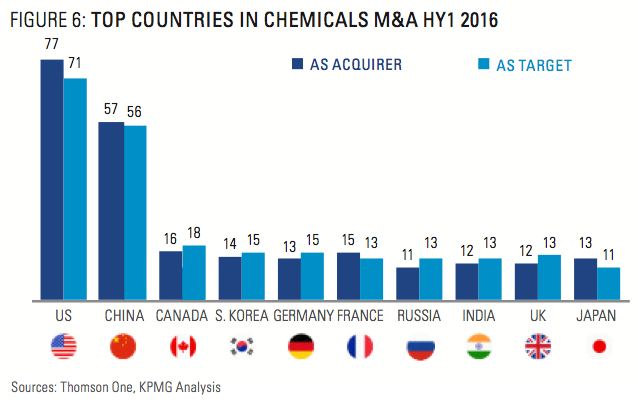

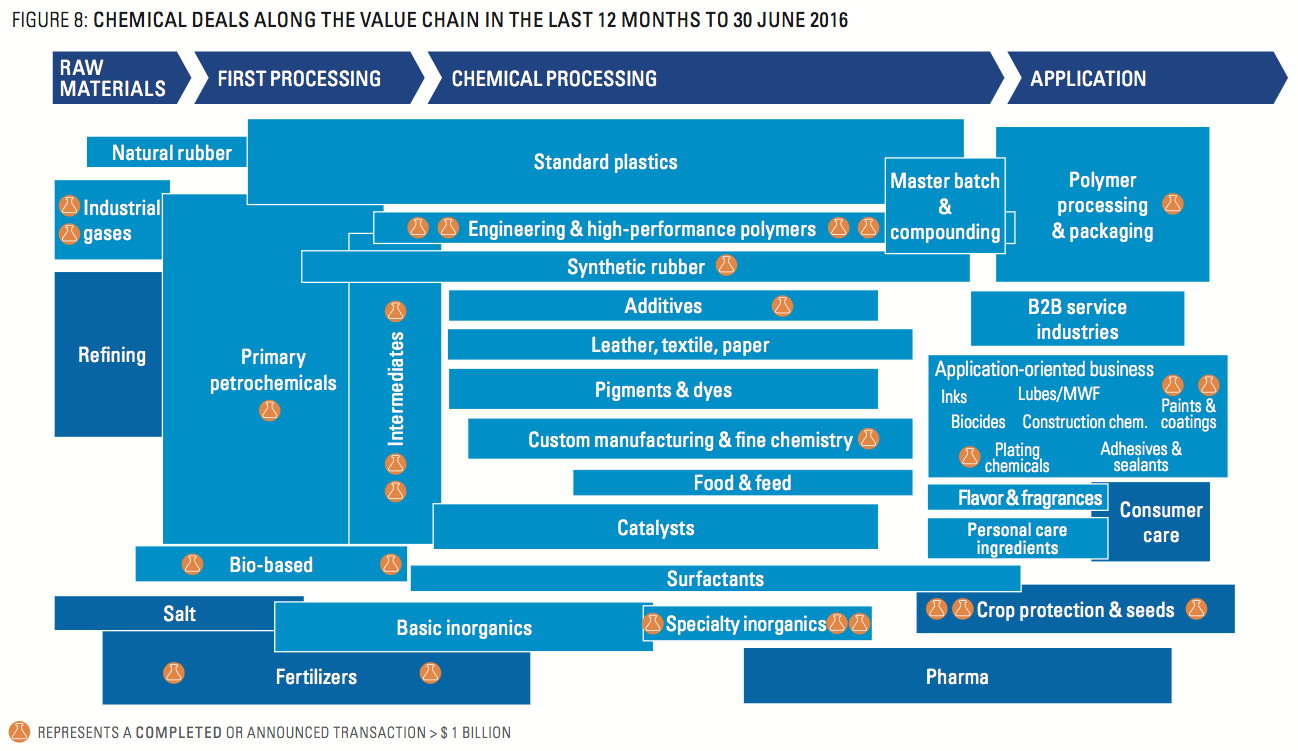

Deal frenzy in the chemical sector continued with the top 10 announced deals exceeding $130 billion. Agrochemicals were the main focus area with two mega-mergers in the pipeline. Germany was among the most active countries with many of its major players pursuing strategic investments.

DEAL FOCUS AREAS

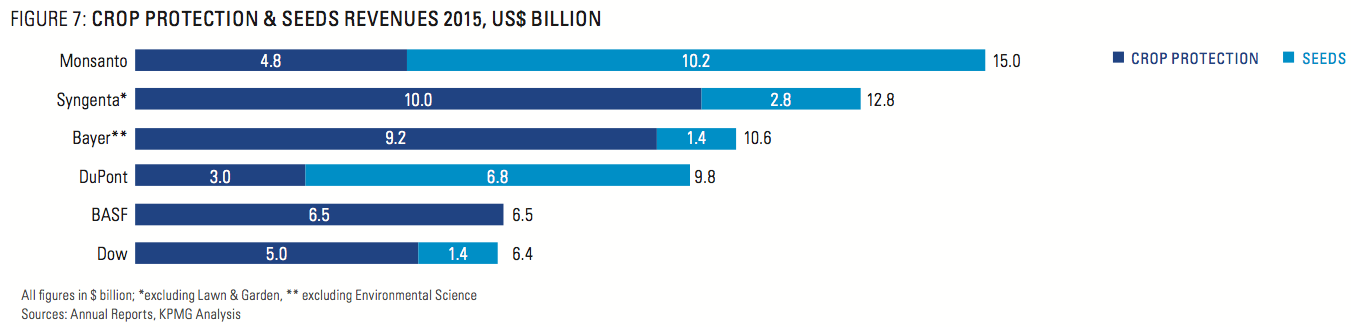

The wave of consolidation in the agrochemicals market continues. The deal frenzy started with the announced Dow DuPont Merger last year, followed by ChemChina bidding for Syngenta in Q1 2016.

Finally, Bayer AG announced a $62 billion acquisition of Monsanto Co. which would propel it to number 1 in the sector. The planned acquisition of Monsanto offers Bayer a complementary portfolio as Monsanto is the market leader in seeds.

The market consolidation followed a pronounced drop in sales last year. As revenues of the global agricultural industry fell by as much as 10% in 2015, farmers cut back on spending. Agrochemical sales declined in conjunction, putting all players under pressure. Selling a broad package of products is generally seen as a successful strategy for the future.

Smaller players in the market are acquisitive as well. CVR Partners L.P. completed the acquisition of Rentech Nitrogen Partners, L.P., a manufacturer of nitrogenous fertilizers, in Q2 2016. The deal is worth $0.8 billion and adds to CVR’s existing fertilizer portfolio.

STRONG GERMAN ACTIVITY

Besides Bayer‘s blockbuster deal, other German chemical firms are active this year as well with a focus on high margin specialty segments.

BASF SE strengthens its position in the coatings market by announcing the $3.2 billion acquisition of Chemetall GmbH. Chemetall’s surface treatment solutions strategically complement BASF’s coatings business.

Evonik Industries AG offered to buy the performance materials unit from Air Products & Chemicals Inc. for $3.8 billion – the largest deal in its history. With 23% profit margin the targeted unit strengthens Evonik’s presence in the US market. The deal allows Air Products to divest non-core assets as planned in order to focus on industrial gases.

Lanxess AG placed a $0.2 billion bid for the Clean and Disinfect business of Chemours Co., serving its position in mid-sized, less cyclical markets which offer high margins. Lanxess also completed the formation of a joint venture for synthetic rubber with Saudi Aramco investing $1.3 billion for a 50%-stake.

CHINA

Market turmoil in China significantly reduced M&A activity at the beginning of the year. However, as markets calmed, deals picked up and China regained its position as the most active country behind the US. The majority of the top Chinese deals are downstream on the value chain.

This is the case with CMOC Ltd., a subsidiary of China Molybdenum Co., Ltd. announcing the $1.5 billion acquisition of Anglo American PLC’s niobium and phosphates business based in Brazil. Thereby, China Molybdenum optimizes the structure of its foreign assets and underpins its position as a market leader. For Anglo, deleveraging is a main priority after stocks plummeted by 75% in 2015 due to concerns with its high level of indebtedness.

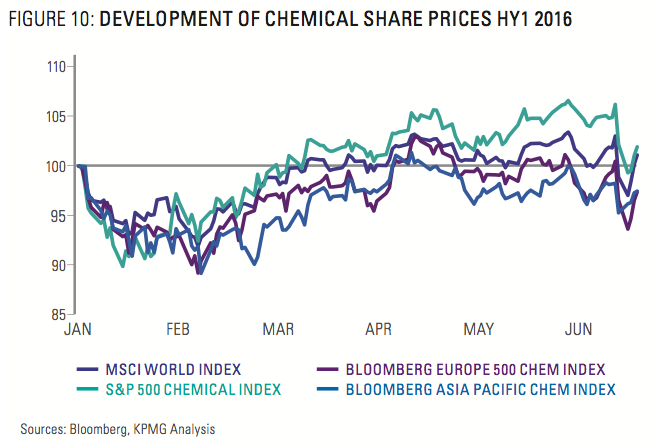

CAPITAL INDEX

Chemical indices recovered from their losses at the beginning of the year with the S&P 500 Chemicals trading at +2.4% YTD. European (-3.2%) and Asian Bloomberg Chem (-3.1%) indices lost slightly in 2016.

Best performing companies among the largest chemical firms globally comprise DuPont’s spin-off Chemours Co. (+53.8%), Indorama Ventures PCL (+39.6%) and Lotte Chemical Corp. (+18.6%).

Asian stocks were hit hard by global market turmoil and sluggish demand. For example, Sinochem Corp. (-31.2%), Mitsubishi Chemical Holdings Corp. (-30.1%) and Sumitomo Chemical Co., Ltd. (-30.5%) recorded significant losses.

BASIS OF DATA PREPARATION

Values and volumes used throughout the report are based on completion date as provided by Thomson Reuters’ database Thomson One as of 30 June 2016, extracted up to and including 1 July 2016, and supplemented by additional independent research. This report includes disclosed and undisclosed values for M&A transactions including minority stake purchases, acquisitions of remaining interest, and recapitalizations and it explicitly excludes self-tenders and spinoffs. The published numbers of deals and deal values are based on the analysis of target companies which operate in the following subsectors:

Pharmaceuticals

— Medicinal chemicals & botanical products

— Pharmaceutical preparations

— In vitro and in vivo diagnostic substances

— Biotechnology – biological products, except diagnostic substances

— Pharmaceutical wholesale (added starting in Q2 2014) Chemicals

— Clay, kaolin, ceramic & refractory minerals

— Chemical and non-metallic mineral mining, except fuels

— Fertilizers and agricultural chemicals

— Industrial gases

— Specialty chemicals

— Chemical wholesale

— Plastics and rubber components

KPMG’s Deal Thermometer is based on financial data as provided by S&P Capital IQ of public companies in the same sector as noted above with a market capitalization at quarter end of at least a $1 billion. For the pharmaceutical sector, this comprises 185 public companies. For the chemical sector, this comprises 178 public companies.

All figures in this report are shown in US Dollars ($) unless otherwise stated.

Sources

Online databases:

— Thomson One (Thomson Reuters)

— Bloomberg

Publications

— Various companies’ press releases

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter