Publications Cross-Border Deals Tracker: Tracking Deal Flows Between Developed And Developing/Emerging Economies

- Publications

Cross-Border Deals Tracker: Tracking Deal Flows Between Developed And Developing/Emerging Economies

- Christopher Kummer

SHARE:

By KPMG

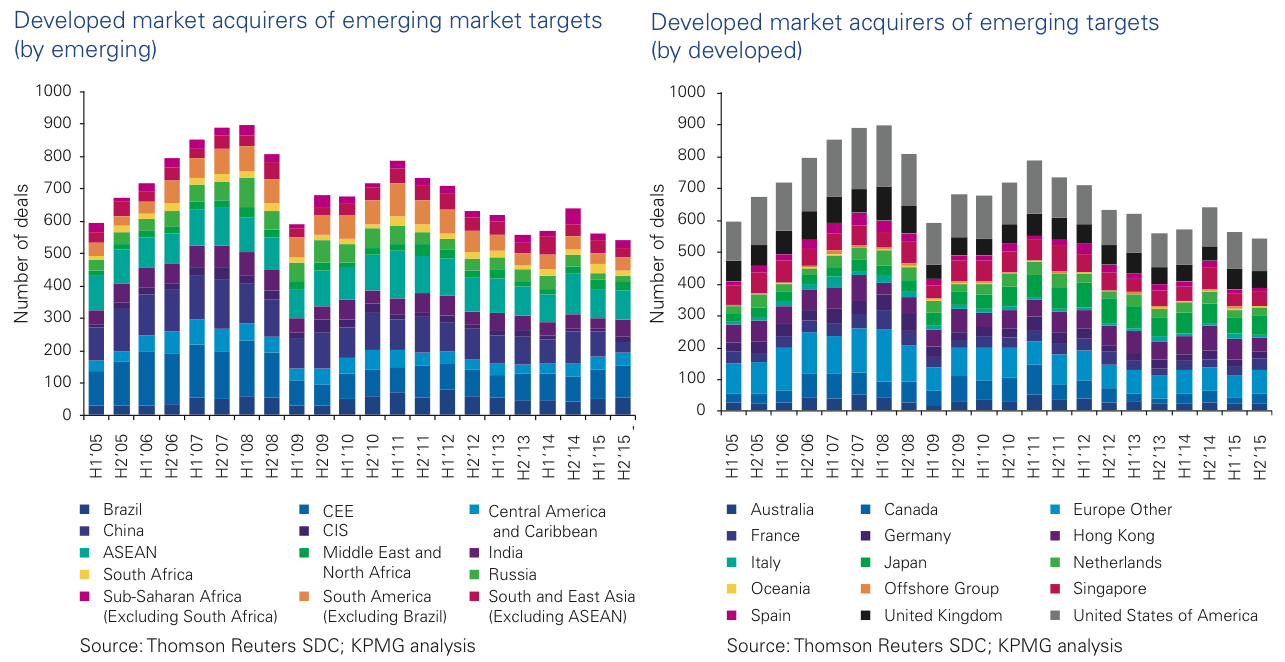

The Cross-Border Deals Tracker (Tracker), formerly the High Growth Markets International Deals Tracker, looks at deal flows between 15 developed economies (or groups of economies) and 13 high growth economies (or groups of economies). The Tracker is produced every 6 months to give an up-to-date picture of cross-border merger and acquisition activity, with the current edition featuring deals between July to December 2015.

Established in 2003, the Tracker includes data from completed transactions where a trade buyer has taken a minimum 5 percent shareholding in an overseas company. All raw data is sourced from Thomson Reuters SDC and excludes deals backed by government, private equity firms or other financial institutions.

M&A investments into emerging markets continue to decline

The latest deals data shows that the volume of developed market investments into emerging markets (D2E) hit a 10-year low over the second half of 2015, but emerging market deals with one another showed strong growth over the same period.

Between July and December 2015, the number of D2E deals fell by 3 percent to 541, the lowest number in 10 years.

The yearly total is also the lowest in 10 years, at 1101 D2E deals, 9 percent down on 2014. The fall-off is the second period of decline, following a revival in D2E transactions during the second half of 2014. In contrast, the volume of transactions where both the acquirer and the target were in an emerging market (E2E), increased by 25 percent.

Increased M&A transactions between emerging markets

We are hitting a new era in emerging markets. Emerging market companies are more comfortable with larger and more complex deals. — Leif Zierz, KPMG’s Global Head of Deal Advisory

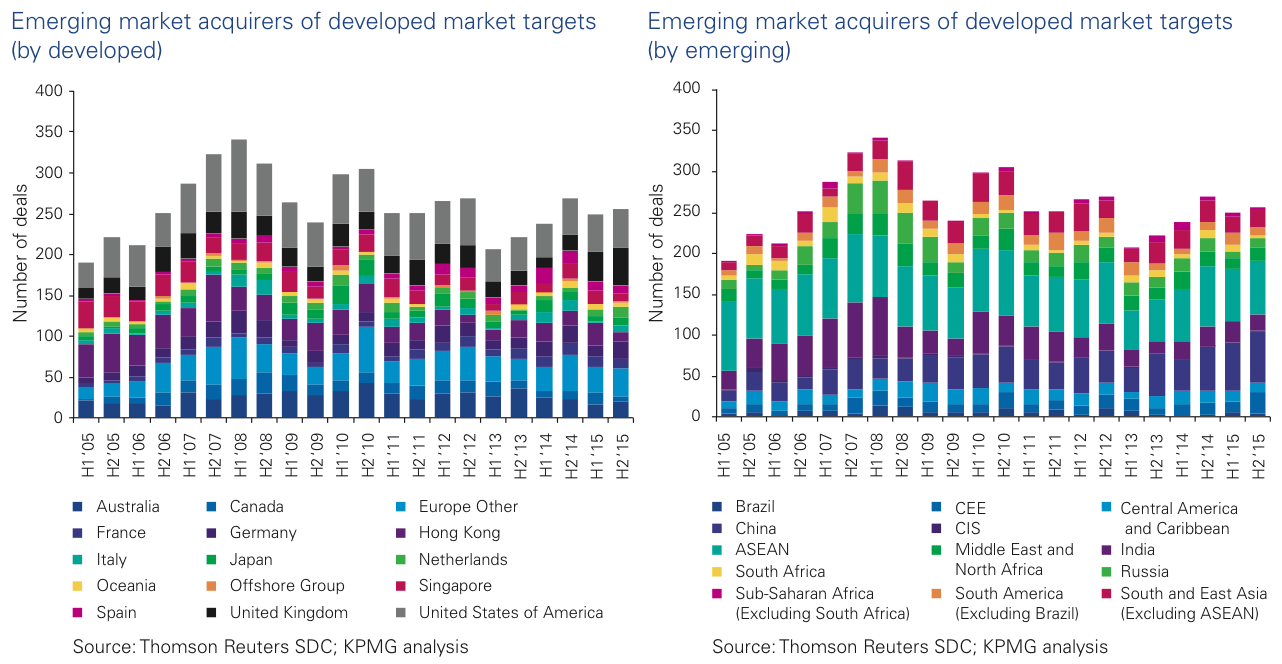

Deals between investors and acquirers who were both in emerging markets (E2E) were a big feature of overall emerging markets M&A during the latter half of 2015.

E2E deals rose significantly (25 percent) during the last 6 months of the year, to 149 deals, a similar volume to that achieved during the same period in 2014 (152). However, the yearly total for 2015 was not so positive — down 8 percent on 2014. “We are hitting a new era in emerging markets,” said Leif Zierz, KPMG’s Global Head of Deal Advisory. “Emerging market companies are more comfortable with larger and more complex deals. China and the CEE, for instance, are not shying away from significant investment in the right markets.”

The number of deals involving Chinese acquirers of emerging markets targets increased by 78 percent, from nine to 16 deals. This included seven deals in South and East Asia, excluding ASEAN and three in CIS.

Other markets that saw big increases in outbound E2E activity were CIS at 400 percent (up from one deal to five, three of which were in Russia), Middle East and North Africa (325 percent), South and East Asia excluding ASEAN (up 60 percent), CEE (up 50 percent) and Sub-Saharan Africa excluding South Africa, (up 50 percent).

D2E transactions lose their lustre

Buffeted by slower growth rates in China, economic and political instability in some key markets, and continued low interest rates in the United States, D2E acquirers appear to be shying away from investments into emerging markets.

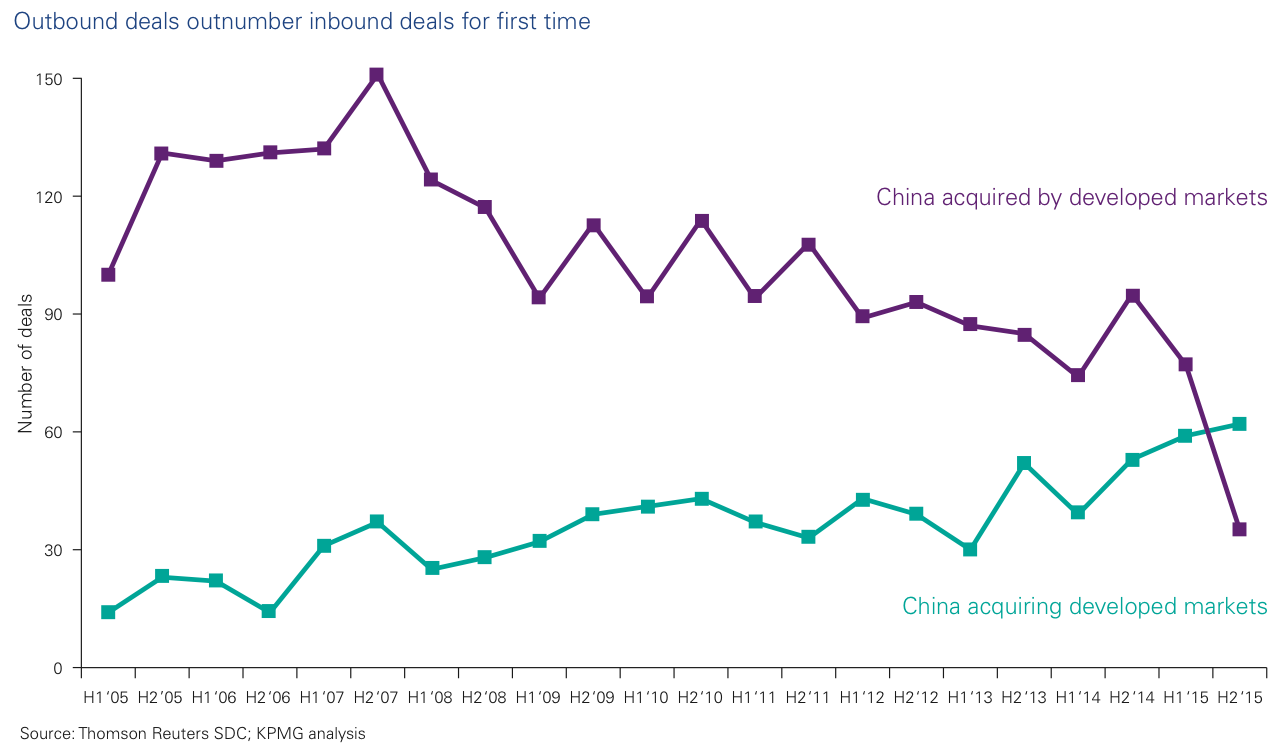

Perhaps surprisingly, the biggest single decline in D2E activity was investments into China, a major focus of foreign direct investment activity over the past few decades. The number of D2E transactions involving Chinese targets declined by over 50 percent, from 77 in the first half of 2015 to just 35 in the second half — a 10-year low.

Another key market to see a significant reduction in D2E investment was South East Asia, excluding ASEAN. D2E transactions here reduced from 42 during the first half of 2015 to 27 in the second half — a drop of 36 percent.

It wasn’t all bad news, however. A number of important emerging markets maintained a similar level of D2E activity throughout 2015, including some notable upticks. D2E deals involving Indian targets, for example, increased from 35 to 54 — a possible indication that the business-friendly reforms of the Indian Government are beginning to have a positive impact. The United States, Japan, Singapore and the UK were the biggest investors here.

In South America excluding Brazil, inbound D2E activity rose from 34 to 42 deals in the second half of the year, while D2E deals into Central and Eastern Europe (CEE) saw a small increase from 92 to 99.

“Investor sentiment in India has improved significantly with the government undertaking several initiatives to make India an attractive investment destination. The ‘Make in India’ initiative that seeks to convert India into a global manufacturing hub has also gained significant visibility among overseas investors,” said Vikram Hosangady, Head of Deal Advisory, KPMG in India.

In times of greater uncertainty, developed market companies will more closely scrutinize unfamiliar regions to assess the level of risk. — Phil Isom, KPMG’s Global Head of M&A

E2D deal volumes remain steady

The volume of deals involving emerging market acquisitions of developed market targets (E2D) showed more resilience during 2015, increasing by 2 percent from 250 deals to 255 deals during the second half of the year. The yearly total of 505 deals is only one fewer than in 2014, indicating that emerging market investors remain confident in the returns offered by investment into developed markets.

“M&A is a critical tool for achieving growth throughout the developed world and, increasingly, in emerging markets,” said Phil Isom, KPMG’s Global Head of M&A. “In times of greater uncertainty, developed market companies will more closely scrutinize unfamiliar regions to assess the level of risk.”

The biggest E2D investors were ASEAN, with 66 transactions involving developed market targets between July to December 2015, up from 64; and China, which saw a 5 percent increase in E2D deals to a 10-year high of 62.The increase in Chinese E2D acquisitions was the fourth consecutive half-yearly increase. The yearly total of 123 E2D deals was also a 10-year high.

The highest increase in outbound E2D deals was CEE, where the volume of deals rose by 50 percent from 13 to 26, mostly to other European countries. Increases for E2D were also shown in Middle East & North Africa, and Russia, of 23 percent and 22 percent respectively. The notable exception to this trend was India, where the volume of outbound E2D deals declined by 24 percent from 25 to 19.

In terms of targets, the UK showed a major increase in inbound deals from emerging markets, up by 29 percent from 35 to 45. Other significant increases were in Australia (from 17 deals to 21), Germany (from 13 deals to 21) and Japan (from six to 11).

Hotspots

China

Investors from developed markets looking for M&A opportunities in China kept their hands firmly in their pockets during the latter half of 2015. Possibly spooked by the continuing slowdown in Chinese growth rates, the volume of inbound deals from developed countries into China plummeted by over 50 percent, from 77 to 35 deals — the lowest number in at least 10 years. The combined 2015 yearly total of 112 is also a 10-year low.

Over half these 35 investments came from Hong Kong (22), down from 43 deals in the previous 6 months. Three came from the United States (down from 11) and two came from Singapore (down from six). Only Japan maintained its level of M&A investment in China, completing six deals in each half of the year.

“Economic concerns about China are real, but are not necessarily a huge damper on M&A market in the medium term.There remain very attractive opportunities for overseas investors. Specifically, China is ageing, so healthcare is a big opportunity. The technology sector too is buzzing, with a lot of capital being deployed and still more emerging,” said Ryan Reynoldson, Head of Transaction Services, KPMG China.

It was a different story in terms of outbound M&A deals from China into developed markets. Chinese E2D deals increased for the third six-month period in a row, up by 5 percent to 62 — the highest six-monthly total for 10 years.

The highest number (12) were transactions in the United States, compared to 11 in the previous semester. The biggest losers were Canada and Hong Kong, which saw Chinese E2D deal volumes drop by 57 percent (from 7 to 3) and 60 percent (15 to 6) respectively.

In contrast, Australia saw Chinese E2D deals rocket three-fold from 3 to 9 between July to December 2015, and Europe (Other) saw a 133 percent increase from 3 to 7.

“Chinese companies are becoming more savvy international buyers. Although the RMB is at its lowest point for a number of years, there is no end in sight for transformative deals. Chinese private and state-owned companies are aggressively looking to acquire new technology and enter new markets in order to become stronger in their home markets and more internationally competitive. However, making foreign investments is becoming more expensive and there is increasing enforcement around capital outflows. This makes it a little harder for privately-owned businesses to get money out,” said Reynoldson.

The biggest growth in Chinese M&A activity was in outbound deals to emerging markets (E2E), which rose by 78 percent in the second semester of 2015, from 9 to 16 deals.

The main focus for Chinese E2E deals was South and East Asia excluding ASEAN, which saw seven deals (up from six), and CIS which saw three (up from 0).

There were only five inbound E2E deals into China during the second half of 2015, down from 14 in the previous semester. This is the lowest six-monthly total by far in the last 10 years.

India

India was the stand-out market for D2E deals during the second half of 2015, with inbound transaction volumes rising by 54 percent to 54. This is the highest number of inbound D2E deals since the first half of 2012.

The biggest investor was the United States, with 17 deals (up from 14), followed by Singapore and Japan, with seven deals each. Singapore, in particular, more than doubled its volume of M&A deals into India, as did the UK, which saw the number of D2E Indian deals increase from two to five.

India was a notable exception in the generally positive E2D deal data, too, but for different reasons — outbound E2D deals involving Indian acquirers declined by 24 percent. Most of this decline was accounted for by a falling away of deals into the United States, where deals involving Indian acquirers fell from 14 to just five during the last six months of 2015. Interestingly, Indian deals into the UK rose from one to six over the same period.

For other emerging markets, India clearly remains a country ripe with opportunities. The number of E2E deals into India increased by 243 percent, from seven to 24, over the latter half of the year. Deals from CEE investors (up from zero to three), ASEAN investors (up from three to nine) and Sub-Saharan Africa, excluding South Africa (up from two to seven) accounting for much of this increase.

“Relaxed FDI norms in many sectors in India, including multi-brand retail, telecom, insurance and defense, along with faster approvals for businesses being put in place by the new government, is expected to strengthen the investment potential of India further in 2016,” said Vikram Hosangady, Head of Deal Advisory, KPMG in India.

“Together with the government’s pro-business stance, it has provided much needed impetus to deal activity in India. From a market perspective, the measures undertaken by the Reserve Bank of India in building currency reserves and curtailing inflation played a key role in helping the country ride through external uncertainties.

The upward momentum is expected to continue in the coming year. 2015 saw a clutch of deals in the consumer internet space, with private equity investments flowing into the e-commerce market. Looking ahead, infrastructure, e-commerce, pharmaceutical, healthcare and technology are key sectors that will gain the attention of investors. Investors will most likely hail from the United States, UK and Japan, as they have both the deal appetite and the capacity to take advantage of India’s huge growth potential,” said Hosangady.

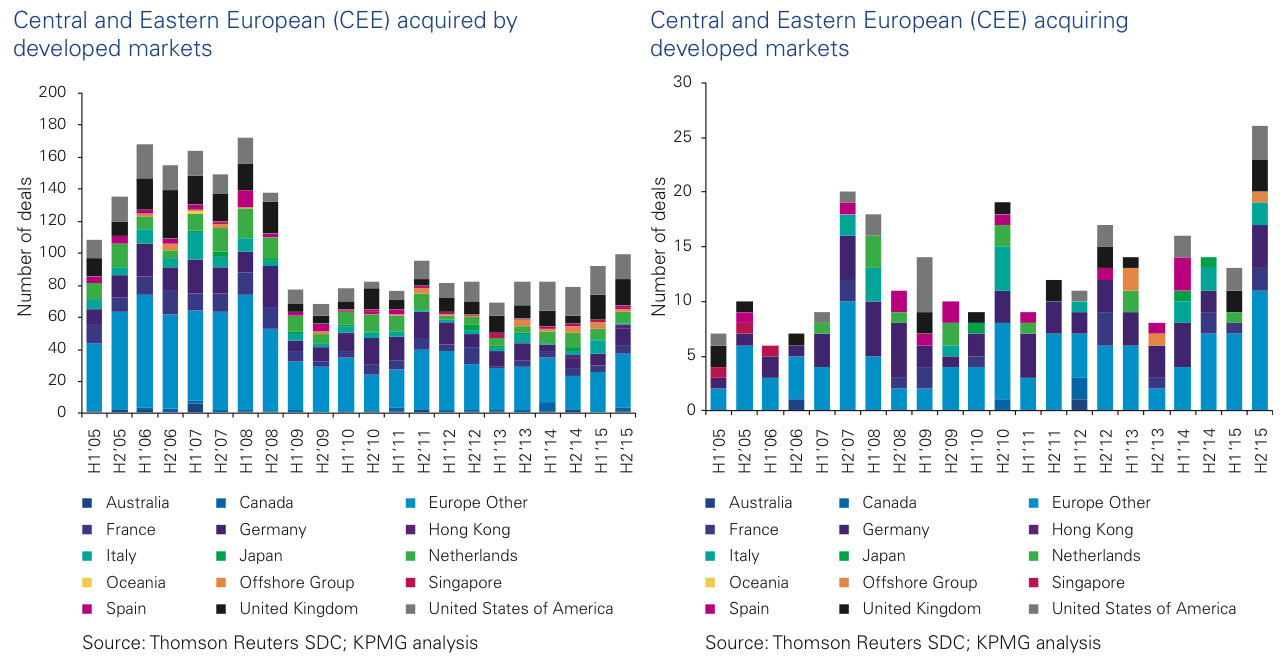

CEE

Central and Eastern Europe (CEE) saw an increase in both inbound D2E deals, up by 8 percent from 92 to 99, and outbound E2D deals, where the 50 percent increase in deal volumes was the highest of any emerging market.

The vast majority of inbound D2E deals into CEE were from other European markets, perhaps seeking opportunities in ‘safer’, still growing markets closer to home. Europe Other accounted for a third of the E2D deals (33, up from 26), with the UK on 17 and Germany with 11.

The other signifcant investor was the United States, with 15 deals (down from 18).

It is outbound deals into developed markets where CEE stands out, however. The main recipient of CEE M&A investment was Europe Other, where there were 11 deals with CEE acquirers, up from seven during the previous semester. There were another four in Germany, compared to none in the first half of the year. The UK and the United States accounted for three deals each.

E2E deal volumes involving CEE targets or acquirers were also up. E2E deals with CEE targets increased by 37 percent, from 19 to 26. The vast majority of these (19) involved Russian acquirers. E2E deals involving CEE acquirers, meanwhile, rose by 50 percent, from four to eight. Five of these were investments into Russian targets, up from two in the previous 6 months. The other three were transactions with Indian targets, compared to none during the first half of the year.

Alex Verbeek, CEE Head of Deal Advisory at KPMG said that, “CEE markets are quite developed now and the deal data possibly lags the reality on the ground. There is more competition on the market in terms of M&A. Prices have gone up as there are simply not enough opportunities within the CEE region, so more mature CEE companies are branching out and investing more in Western Europe, some over a billion dollars.”

Another key trend, said Alex, is that, while developed countries are still investing in CEE, some foreign investors are leaving the region, including Russia. In contrast, China is stepping up to fill this gap and is on a massive foreign investment program in the region.

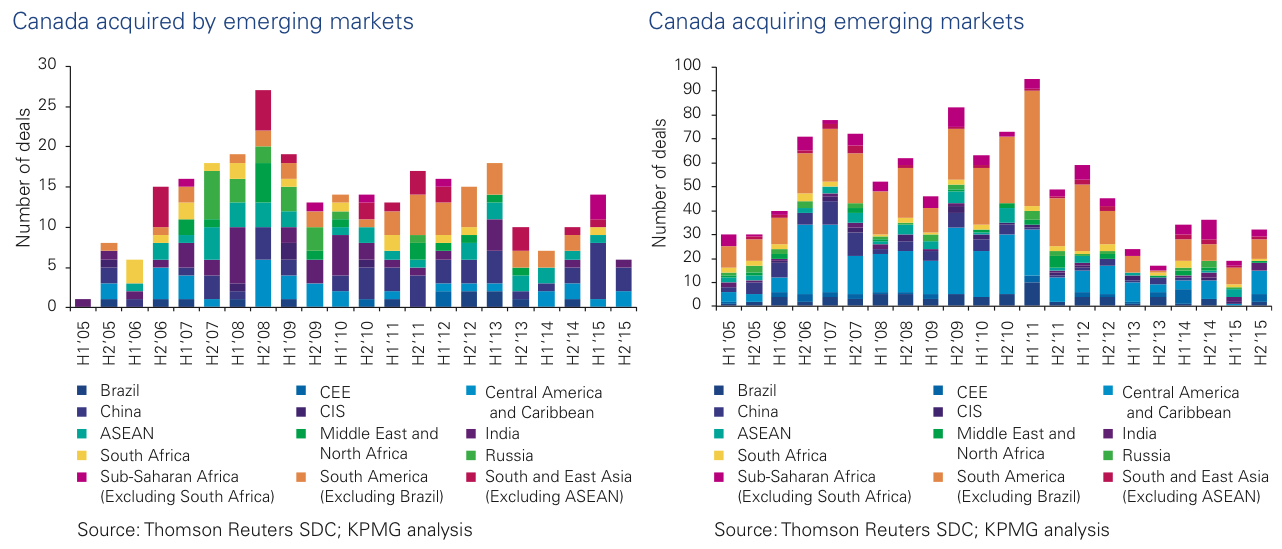

Canada

Canada saw inbound E2D deals plummet by 57 percent from 14 to six in the second semester of 2015. Three of these involved Chinese acquirers, down from seven, two from Central America and the Caribbean, and one from India.

Outbound D2E deals from Canada into emerging markets were much more positive, however, increasing by a healthy 68 percent — the highest increase in D2E activity of any of the developed markets covered in the Tracker. Around one-third of these (10, up from one) were transactions involving targets in Central America and the Caribbean, a region that accounted for just one D2E deal from Canada during the previous 6 months. A further eight were investments into South America excluding Brazil. CEE, India and Sub-Saharan Africa excluding South Africa accounted for another three deals apiece.

According to Peter Hatges, President of KPMG Corporate Finance in Canada, it is sometimes difficult for Canadian companies to do transactions with emerging markets due to legal and cultural differences. Nevertheless, some pension funds and institutional funds are looking to South America to diversify their assets. At the same time, he says that the current exchange rate environment will probably lead to a slowdown in pension fund acquisitions outside of Canada.

“Since Canada is dominated primarily by oil and gas and mining, specifically in the extractive industries, it tends to invest in these same industries in foreign markets which are more common in South America. Conversely, industrial sectors in Canada, such as the automotive industry, are of little interest to foreign investors.

However, inbound transactions are looking affordable, particularly if the currency is American. Canada is still seen as a stable and safe investment environment, which has driven investments in the past,” said Hatges.

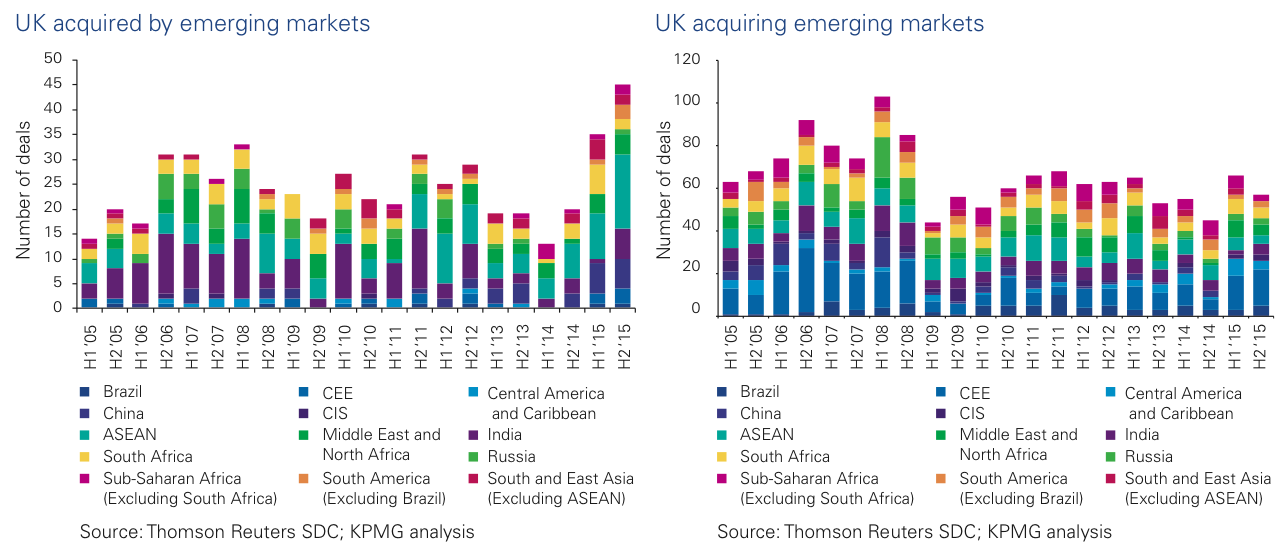

UK

The UK showed a major increase in inbound deals from emerging markets (from 35 to 45), which was fairly exceptional for E2D deals. The UK saw increased deals from India (from one to six), ASEAN (nine to 15) and South America excluding Brazil, from one to three. In fact, the volume of E2D deals from India was the highest six-monthly total since the second half of 2012, while the volume of inbound deals from ASEAN was a 10-year high. The notable decrease in inbound deals was South Africa (six to two).

Outbound transaction levels were less buoyant. The overall volume of D2E deals out of the UK decreased by 14 percent, from 66 to 57. Most emerging markets saw a decline in M&A transactions from the UK. The most notable exceptions were India, where deals involving UK acquirers rose by 150 percent, from two to five, and Brazil, where inbound E2D transactions from the UK increased from three to five.

“The UK was perceived to be ahead in the economic recovery in 2015, especially within Europe. So when investors were looking to get capital out of emerging markets, due to market instability, and into developed markets, they looked at those markets with the strongest potential. In addition, markets like India and certain countries in ASEAN have strong historic ties with the UK, which is another factor when corporates in those countries are looking at M&A opportunities in developed markets,” said Andrew Nicholson, head of M&A for KPMG in the UK.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter