Publications Comparative Analysis Of Mergers And Acquisitions In The New Member States Of European Union

- Publications

Comparative Analysis Of Mergers And Acquisitions In The New Member States Of European Union

- Christopher Kummer

SHARE:

By Dušan Baran, Darius Saikevicius

Abstract

Mergers and acquisitions in the new member states of European Union (EU-10) are investigated in the study. The author concentrates on mergers and acquisitions value creation issue in the region. Event study methodology is employed to investigate the scientific problem of value generation as a consequence of analysed transactions. Findings of the study show that there is statistically significant positive effect observed when analysing value variations as a result of mergers and acquisitions taking place in the EU-10 region. However, there are great differences observed when different countries or groups of countries are analysed in EU-10. This finding supports the conclusions of previous researches in the field stating that value creation in mergers and acquisitions varies greatly in separate regions or countries. It was also found during the research that transactions taking place in the Baltic states have generated the highest value increase in EU-10 during the period of 2004–2013.

1. Introduction

While mergers and acquisitions have been a common part of economic transactions in North American and Western European markets for more than half a century, yet this specific type of transactions has been very rare until the last decade of the 20th century in the 10 countries of Central and Eastern European region, which together today are known as EU-10 bloc. The first wave of mergers and acquisitions in the region took place in the 1990s and was mainly fuelled by the shift from regulated economy models to market-based economic systems and subsequent privatisation processes. As the result, the market of mergers and acquisitions is only starting to count its third decade of activity in the region and, consequently, not only public opinion but also academic literature is full of ambiguous assessments of the phenomenon.

Central and Eastern European region, the core of which includes EU-10 bloc countries further investigated in the study, in 2013 was the fourth in the world by both the value and number of executed mergers and acquisitions transactions lagging behind only from North America, Western Europe and South-East Asia (Zephyr annual, 2014). Although there were high growth rates of mergers and acquisitions activity recorded and the market is approaching activity levels which are common for developed countries, the academics highlight the fact that the main features of the market of the mergers and acquisitions in the countries included in the analysis are to a great extent different from patterns observed by earlier researches in North American and Western European markets. Thus, thorough analysis based on mergers and acquisitions market statistical data in the EU-10 region is necessary and would significantly contribute to the better evaluation of the market in the analysed countries. Such study would also enable comparison with researches conducted in other regions of the world.

In the reviewed context the purpose of the research presented in this paper is to evaluate the value generated in the mergers and acquisitions transactions in the EU-10 region countries as well as to find out intra-region differences of value generation level. The paper is based on long lasting author’s research in the area of mergers and acquisitions and is partially grounded by previous publications of the author in the field of mergers and acquisitions activity in the region of Central and Eastern Europe. Calculations and research results presented in the study are based on event study methodology.

2. Literature review

The United States and Great Britain prevail in the research conducted in the field of mergers and acquisitions as most often analysed countries. The above-mentioned countries have a rich history of mergers and acquisitions studies dating back to the 1960s. Meanwhile in the Continental Europe academic studies in the field of mergers and acquisitions started to appear more constantly only in the 1990s, as earlier papers such as landmark publication by Mueller (1980) have been quite rare practice in the European scientific society.

The topics dominating the worldwide mergers and acquisitions research arena have been systemised by Larsson and Finkelstein (1999), who classified ongoing research in the area of mergers and acquisitions according to the economic discipline attributable to the specific aspect of the problem. Following this logic, mergers and acquisitions are analysed within the frameworks of following disciplines:

1. Strategic management: addresses the reasons and different types of transactions;

2. Economics: main topics include cost optimisation, economy of scale and scope, market power issues;

3. Finance: representation of shareholders, issues related to the value creation of the companies;

4. Research of organisations: examines the processes of the implementation of transactions and integration processes, as well as the issues of corporate culture matching;

5. Human resource management: in the context of the transaction, issues of management and staff motivation and communication are addressed.

However, not all scientific research trends of mergers and acquisitions are equally numerous: Golubov, Petmezas, and Travlos (2013) in their publication highlight the main three issues examined by scholars: research of the main motivation for mergers and acquisitions to take place, publications analysing the history and cycles of mergers and acquisitions and studies addressing the value creation in the process of mergers and acquisitions.

The status of mergers and acquisitions scientific research in EU-10 can be regarded as scarce with academics mainly dealing with such issues as general trends of market of mergers and acquisitions in the region, transactions taking place in financial sector and analysis of mergers and acquisitions as an integral part of foreign direct investment. During the analysis of scientific mergers and acquisitions publications in EU-10, it has been noted that Poland dominates the research flow. However, this observation is not surprising at all having in mind the fact that Poland is by far the largest mergers and acquisitions market in EU-10 (as it will be presented in more detail later in the next chapter Poland was also dominating the sample of transactions analysed in this research).

Niemiec and Niemiec (2007) in their publication conclude that in the case of the analysed region mergers and acquisitions dominate the structure of foreign direct investment. Nevertheless, Havrylchyk and Jurzyk (2007) documents that higher profitability ratios are achieved by greenfield investments rather than mergers and acquisitions.

Analysing another broader mergers and acquisitions research stream in EU-10 – namely the mergers and acquisitions in the financial sector – it should be noted that authors (Eller et al., 2006, Fritsch et al., 2007 and Havrylchyk and Jurzyk, 2008) draw the common conclusion that transactions, which took place in the banking sector in EU-10, had positive effect on acquired companies’ (e.g. banks) performance. Moreover, it is stressed that there is positive impact for the whole economy of target country observed. In addition, there has been link found between mergers and acquisitions activity in the banking sector and further development of the financial system.

Review of papers which deal with general trends of mergers and acquisitions in EU-10 has revealed following observations. Sakali (2012) report the findings that in case of EU-10 or broader Central and Eastern Europe region the financial crisis of 2008–2009 has fostered significant changes in the mergers and acquisitions market with different motivations for transactions emerging (e.g. targets of transactions being companies hit by the crisis). However, statistical data provided by Zephyr (Zephyr, 2014) shows that even during the crisis the number of mergers and acquisitions transactions has remained on the growth path.

Finally, analysis of EU-10 mergers and acquisitions market related scientific publications has led to conclusion that many authors (e.g., Jacoby, 2014 and Kazmierska-Jozwiak, 2014) report the observation that trends prevailing in EU-10 mergers and acquisitions market are different from analogical developments found in other regions. For this reason a priori application of theories formed on the basis of empirical data obtained from other regions to assess the market of mergers and acquisitions in the new European Union member states (EU-10) will provide non-objective results. This observation as well as the fact discussed above that the mergers and acquisitions market in the EU-10 region is still a poorly explored phenomenon has motivated the research presented in the following chapters.

3. Methodology and data sample

The design of the study is aimed at evaluation of the value generated in the mergers and acquisitions transactions in the EU-10 region during the selected analysis period and to compare value generated in the mergers and acquisitions in the EU-10 across different countries of the region.

The most common method to analyse value creation as the result of mergers and acquisitions is event study method firstly introduced by Dolley in 1933 (MacKinlay, 1997) and further developed and systemised by Fama, Fisher, Jensen, and Roll (1969) into a powerful scientific tool allowing a scientist to identify the impact of the selected event or a selected group of events on the price of particular security (or their group). The method is based on the efficient market hypothesis and enables to analyse only those companies, which are traded on the stock exchange. Simplified event study methodology algorithm has two main steps. Firstly the return of a security during selected time period around the transaction (e.g. event window) is calculated. Then this return is corrected by a comparative index return for the same period, which finally delivers the abnormal return attributable to the specific event. By calculating the abnormal returns of multiple securities, cumulative average abnormal return indicator (further abbreviated as CAAR) can be found, which is already supposed to be statistics based estimate of impact which the specific event has on value of company shares or other securities. Brown and Warner (1985) improved the event study methodology by providing the scientists with essential observations on statistical significance of the method, thus allowing to effectively test whether the event study methodology derived research results are statistically significant. This improvement made the methodology fully eligible for academic studies.

The further presented study conducted by the author is mainly based on methodological instructions provided by aforesaid authors. In addition to that, MacKinlay (1997) paper was employed as comprehensive event study methodology source when performing the research.

The geography of the research encompasses the EU-10 region consisting of the following countries: Lithuania, Latvia, Estonia, Poland, Bulgaria, Czech Republic, Cyprus, Hungary, Malta, Romania, Slovakia, and Slovenia. The analysis of the sample countries includes 10 year period starting on 2004.01.01 and ending on 2013.12.31. The start of the time frame reflects the fact that 2004 was the year marking the significant EU enlargement process when 10 new member states (EU-10) joined the European Union.

According to Zephyr (Zephyr, 2014), the total number of announced mergers and acquisitions transactions in the EU-10 bloc over a period of 2004–2013 exceeded 20.404 (including 7747 listed companies). 82% of the announced transactions were completed. An even greater proportion of transactions were successfully conducted when targets were listed companies, i.e., of 7747 transactions 6967 transactions were implemented or 90%. It is noteworthy that only those transactions were studied that involved acquisition of companies registered in the EU-10 countries, while the reverse type of transactions were not addressed in the research. The sample was defined by six key criteria as follows:

1. The company’s shares over the acquisition period were listed on a stock exchange.

2. The exact date of the announcement of the ongoing transaction is known.

3. The transaction has been successfully completed.

4. Further analysis included only transactions that were classified as acquisitions, mergers, management or institutional buy-outs. The initial sample (510 transactions) also included 9 joint venture establishment deals with the acquisition transaction features, but none of these transactions were included in the final sample (consisting of 154 transactions).

5. Further screening stage involved the selection of only those transactions during which at least 10% of company stake was acquired, while the final investor’s stake after the transaction was not less than 50% of the shares.

6. The final stage involved the selection of only those transactions where the company which participated as the “target” of the transaction had a comprehensive history of stock trading necessary for conducting a research, i.e. at least 90 trading days prior to the transaction and 30 days after the transaction. In addition, from the final sample transactions were rejected that had been carried out between the related parties (the redistribution of shares within the group of companies and between the entities controlled by the same individual) and based on the experience of many studies (e.g., Andrade, Mitchell, & Stafford, 2001) duplicate transactions were rejected as well. That is, if the same company earlier than three years ago was the object of the similar transaction, the sample included only the first transaction.

The study was conducted by calculating logarithmic returns for three different event windows: starting 30 days before the event and ending 30 days after selected event (−30;30), starting five days before the event and ending five days after event (−5; 5), starting on the event date and ending 1 day after selected event (0; 1). The abnormal returns for each security were computed by using national indexes, the variations of which during event windows were subtracted from nominal security price change. The significance of the results obtained from all event windows included in the study has been verified by applying statistical tests. It should be noted that, according to Corrado (1989) and Cowan (1992) publications, to verify the results obtained by event study method, non-parametric tests have been used together with parametric t-test.

4. Findings of the study

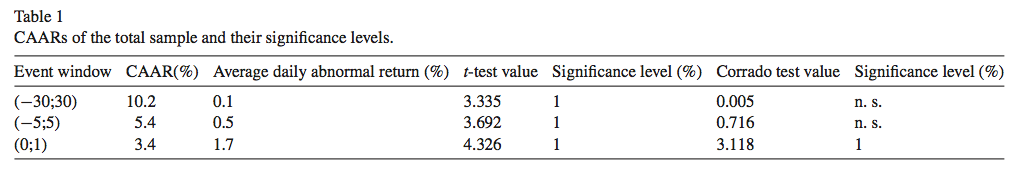

After conducting the study it was investigated that CAAR indicator within a period of 61 days around the event date (−30;30) is 10.2%, thus an average of additional 10.2% of the value was created for the acquired companies’ shareholders as a result of mergers and acquisitions transactions announced over a period of 2004–2013. As presented in Table 1, the statistical significance of CAAR indicator in both tests (parametric t-test and non-parametric Corrado test) confirmed the significance of results at the level of even 1% in the case of the smallest event window, which is closest to the date of the event (0; 1). The t-test values suggest that in the case of all the assessed three windows the results are significant at the level of 1%, while Corrado test results propose to reject 61 days (−30;30) and 11 days (−5;5) event windows as insignificant.

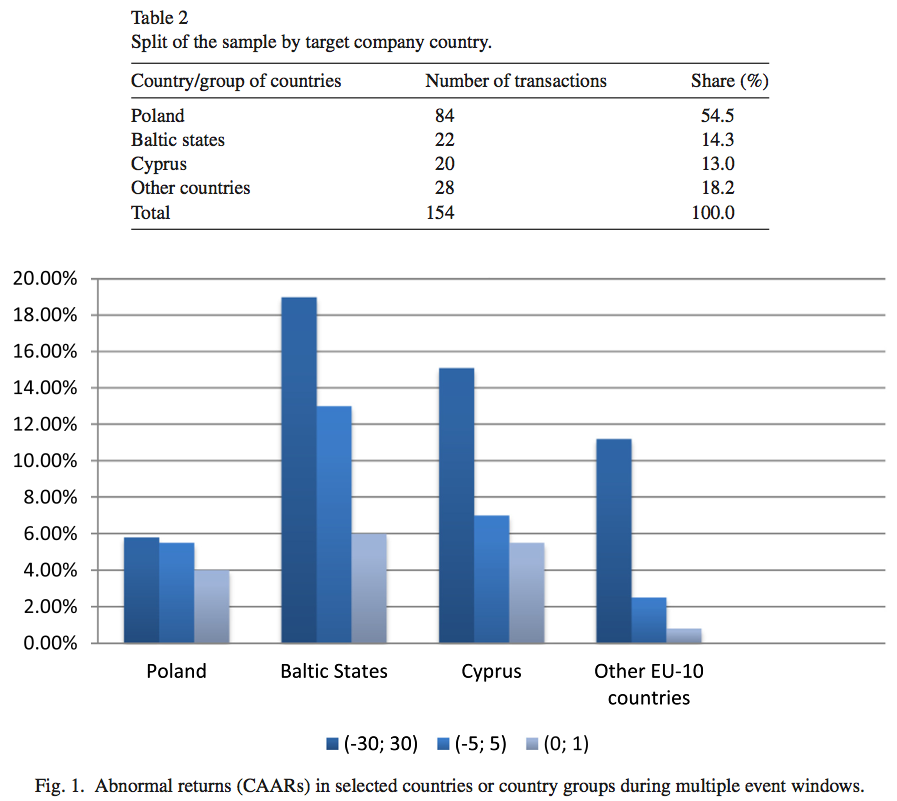

In the total sample of 154 companies included in the sample, separate EU-10 countries are unevenly represented. For example, there could be found no historic security price data for Slovakian companies on Bloomberg while performing the research. For this reason none of the Slovakian companies have been represented in the sample. In cases of other countries there were only few transactions found with security quotes data available (e.g. Malta – 2 transactions, Hungary – 3 transactions, Estonia – 4 transactions). Thus cross-country comparison could not be efficiently performed for countries represented with small numbers. For this reason, the total sample has been split into four groups, only Poland and Cyprus which had highest numbers of transactions (allowing statistically significant conclusions) were analysed as separate countries. The split is presented in the Table 2.

As it can be seen from the Table 2, 55% of mergers and acquisitions transactions in the sample fell to Poland followed by the Baltic states and Cyprus, which accordingly account for 14% and 13% of the transactions included into the sample.

Fig. 1 data shows that transactions with Polish targets create less value than the same transactions taking place in Baltic states or Cyprus. For example, in case of the longest event window of 61 days (−30;30) transactions in the Baltic states created three times more value as compared to Polish transactions. Although to a lower extent, but when comparing Polish and Baltic mergers and acquisitions as the drivers for value changes of the target companies, the remaining event windows show similar patterns – transactions in the Baltic states generate much higher value increases.

Thus the clear distinction should be made for transactions taking place in the Baltic states, as these transactions are by far creating the highest value growth. Meanwhile, mergers and acquisitions in Cyprus also show high value creation rates. Transactions taking place in the remaining EU-10 countries result in high value creation rate only if the longer 61 days (−30;30) window is analysed: 11.7% value increase recorded. However, other countries’ group lags behind when comparing the smaller event windows.

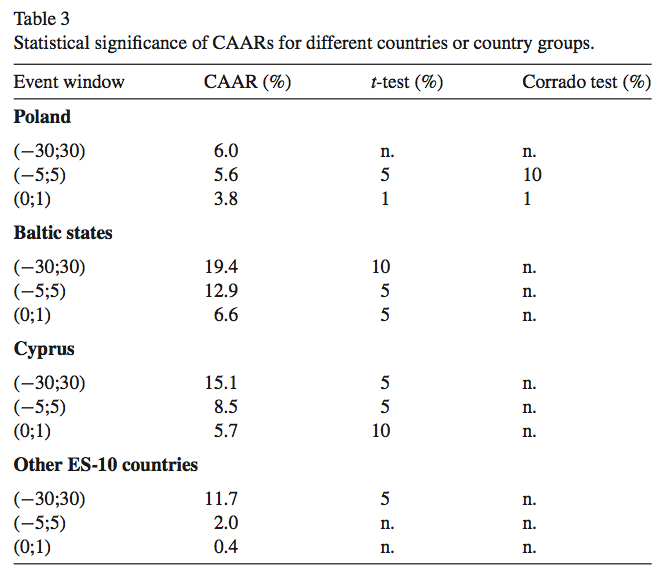

After analysing the value creation rates in different countries of EU-10, it is necessary to evaluate them on the basis of statistical tests. The data in Table 3 shows that the CAAR indicators of the Baltic countries and Cyprus are significant in all three windows in accordance with t-test, while in the case of Poland significant results were observed only in shorter windows, but their significance is confirmed by both types of tests. In the case of the group of other countries, only the long window of 61 days (−30;30) was confirmed to be significant by the t-test.

5. Conclusions

The analysis presented in the study has proved that in case of EU-10 region mergers and acquisitions positively affect the value of target company. The cumulative average abnormal return resulting from analysed transactions during the 2004–2013 period has totalled to 10.2%. However, when statistical tests were applied it turned out, that only t-test approves all three event windows results to be significant whereas Corrado test only supported the smallest 2 days (0;1) window abnormal return to be significant.

Further analysis of value creation in mergers and acquisitions transactions across different countries of EU-10 generated the following findings: the greatest abnormal returns are achieved in the Baltic states (6.6–19.5% depending on event window length) followed by Cyprus (5.7–15.1%), while transactions taking place in Poland lead to much lower returns (3.8–6.0%). However, analysis of Polish mergers and acquisitions has proved to be significant by both statistical tests (in case of smaller event windows), whereas Cypriot and Baltic results are confirmed by only the t-test.

Due to the lack of securities price data the sample of the study has been limited to a relatively small number of transactions. For this reason, it is advised for other scholars to make efforts to derive additional data, as broader base may generate more accurate research results. However, the results of the study already clearly show that the value creation process influenced by mergers and acquisitions varies greatly across different countries of EU-10 and thus the issue is an important scientific issue. On the other hand, such results of the research support the findings of earlier publications in the field (Mueller, 1980), which also documented that value creation differs greatly when separate countries are analysed.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter