Publications Central & Eastern European Mergers & Acquisition Survey 2004: Romania Report

- Publications

Central & Eastern European Mergers & Acquisition Survey 2004: Romania Report

- Bea

SHARE:

By Emilian Radu – PricewaterhouseCoopers

It is a pleasure to present to you our latest report on the mergers and acquisitions (M&A) market in Romania in 2004, in the light of the recent regional developments. As in our previous report we have a special section dedicated to privatisations.

The survey included over 1,200 publicly disclosed private sector transactions and over 350 publicly disclosed public sector transactions in nine countries of the region (Bulgaria, Croatia, Czech Republic, Hungary, Poland, Romania, Russia, Slovakia and Slovenia).

2004 was an extraordinary year for Romania from many economic points of view, and M&A activity was not an exception. The economic growth outperformed authorities expectations being the highest of the past 15 years, inflation dropped in 2004, for the first time, below 10 %, and foreign direct investments reached USD 5 billion (EUR 4 billion), revealing an increased interest from foreign investors. There is no doubt that the big privatisations have driven the FDI to such high levels, but also the economic and political stability as well as the perspective of EU entry in 2007 has positively influenced the foreign investors preferences.

The long awaited start of the privatisation in the energy sector has been successfully accomplished, with the sell of major companies to strategic investors. Thus the integrated oil company, gas distribution companies and two of the electricity distribution companies have changed ownership. The energy sector privatisation is seen by investors as a key element of the country’s efforts to join the European Union in 2007.

The M&A market has also seen important development, as a large number of domestic companies continued to consolidate their position in a more competitive market, while foreign investors are more and more attracted by the Romanian market with its still low labour costs but skilled labour force. The most active industry sectors from the M&A perspective were manufacturing, telecommunications, financial services and food and beverages.

For the next couple of years, other important privatisations are expected, for which privatisation processes have already started or are to start in 2005, such as the electricity distribution companies and power holdings in the energy sector, the Romanian Commercial Bank and the Savings House in the financial services sector, or National Radiocomunications Company and Postelecom in the telecommunication sector.

The flow of capital from abroad will most likely continue to increase through mergers and acquisitions, as the low wage costs combined with the low political and economic risks, will most probably indicate Romania as a perfect place for relocating production of EU companies.

For the next couple of years, it is expected that the EU accession process will continue to shape the economic environment in Romania, increasing the competitive pressures, and leading to a greater need of strategic investors or consolidation through mergers and acquisitions.

M&A – Key findings

A number of 42 publicly available private sector deals were completed in 2004, revealing an increasing trend for the M&A activity (33 in 2003 and 30 in 2002).

The value of the M&A market has grown significantly in 2004, the market estimate being of USD 1.4 billion. Comparing with 2003, this represents a 157% growth, one of the highest in the region. However, Romania ranked sixth of the nine CEE countries surveyed, in terms of market value, same as in 2003, behind the more developed markets such as Russia, Czech Republic, Poland, Hungary and Slovakia.

What is even more important is that the average disclosed deal size grew from only USD 8 million in 2002 to USD 18 in 2003 and USD 41 million in 2004, showing an increased capitalization of companies.

The involvement of foreign investors in the M&A activity in Romania was rather high in 2004 compared to 2003. The foreigners were responsible for 76% of all deals, revealing the Romanian companies’ preference for strategic partners with superior financial capabilities instead of local companies, in order to help them face the increasing competition from the Western products.

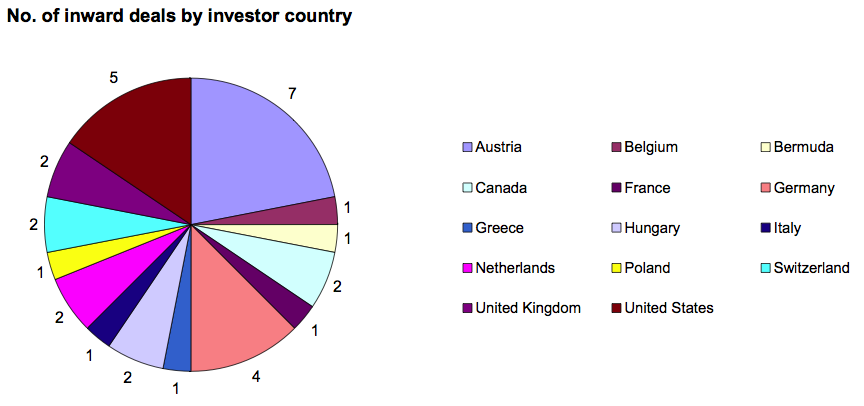

The top investors were Austria with seven deals, followed by the US with five and Germany with four. Austria also is the top investor in terms of deals value, with around USD 433 million, major investors being Kronospan, Immofinanz, Meinl European Land or Lasselsberger, followed by Canada with USD 300 million (TIW increase of shareholding in Mobifon) and Hungary with USD 117 million (in acquisitions made by OTP Bank and MOL).

The most dynamic sector remained manufacturing (eight transactions), as in the previous year. One position up in 2004, is the telecommunication sector with seven transactions. Not only that this sector is one of the most dynamic of the economy but it also generated a large number of deals due to the consolidation process. The liberalization of the telecommunication market in 2003 has opened the competition for fixed telephony and the telecommunication companies evolving from CATV and internet providers are strengthening their position through mergers and acquisitions in order to diversify their services and take a piece of the incumbent fixed operator market.

Privatisations – Key findings

The 53 publicly disclosed transactions in the public sector were estimated to some USD 2.9 billion in 2004, a record figure for Romania.

The bulk of the foreign capital came from only four investors which committed around USD 2.7 billion for the majority ownership in five major companies in the oil, gas and electricity sectors.

After a slow start and many delays due to various reasons, including international unfavorable conditions, the privatization in the energy sector finally happened. The need of massive funds in order to align Romania’s energy infrastructure with those of the EU countries as well as the permanent pressures from the IMF, the WB and EU for restructuring and privatization of the sector has lately accelerated the privatization process.

The key objectives of these privatisations were to attract strategic investors with a relevant experience in the specific field, which can invest significant amounts of money for the modernisation of the companies, enabling also the respective companies to strengthen their financial position. The new investors entering the energy market are expected to bring substantial benefits to both companies, and the competition environment.

The most significant privatisation in the country’s post-communist history is the privatization of Petrom, the Romanian national integrated oil company and the largest Romanian company in terms of turnover (estimated Euro 2.3 billion for 2004) and market capitalization (Euro 7 billion as of middle March 2005). The successful bidder was the Austrian OMV which agreed to pay USD 1.86 billion (Euro 1.49 billion) for 51% stake in Petrom ( Euro 669 million for a third of the company’s shares and another Euro 830 million for a capital increase in order to hold a majority stake), according to public sources. Other bidders included Hungary’s MOL and the US Occidental Oil and Gas Holding Corporation.

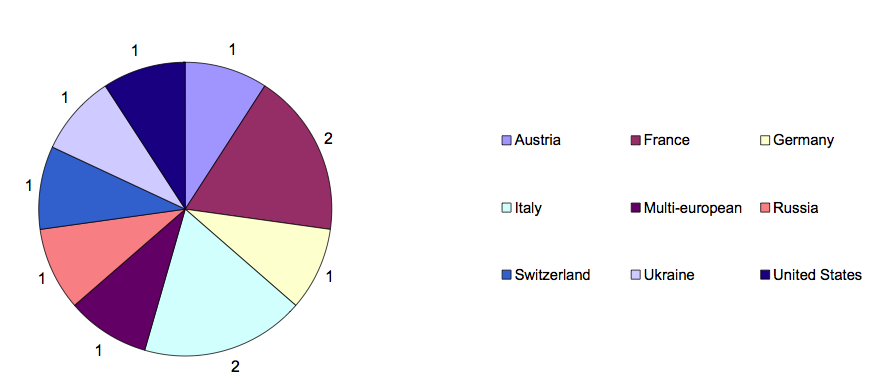

Additional major public sector deals of 2004 included the privatization of the two electricity distribution companies, Electrica Banat and Electrica Dobrogea with the Italian company Enel, and the two gas distribution companies Distrigaz Sud and Distrigaz Nord with Gaz de France and respectively the German E.ON Ruhrgas.

Thus, the privatization in the energy sector has pushed Romania ahead, ranking third in terms of total value of privatizations after Poland and Russia, while in 2003 it was in the fifth position.

Except the four major transactions, the average disclosed deal size was of only USD 4 million. For these transactions, the deal size does not necessarily reflect the real value paid, as investors also took over some of the companies’ debts.

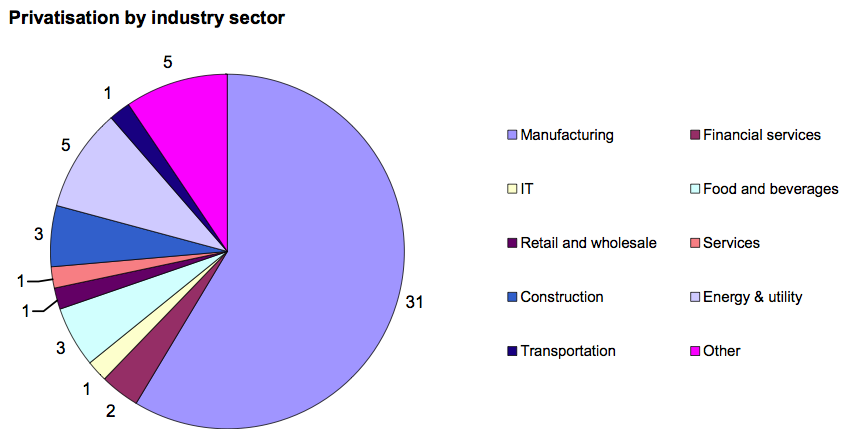

The largest number of privatizations took place in the manufacturing sector as in 2003, while the energy & utility sector attracted the bulk of the investments.

Foreign capital was involved in only 11 deals of the total 53, but the total capital invested in the country by foreigners accounted for 97% of the total estimated market.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter