Publications CEE M&A Survey 2006: Maturity, Momentum And Mega-Deals

- Publications

CEE M&A Survey 2006: Maturity, Momentum And Mega-Deals

- Bea

SHARE:

Central & Eastern Europe

Executive Summary

M&A market value tripled since 2004

In line with the UK and continental Europe which last year achieved their strongest M&A performance in recent history, transaction activity in CEE was also extremely buoyant.

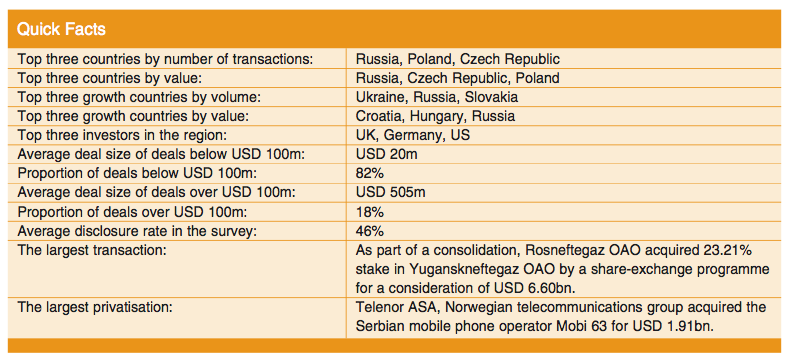

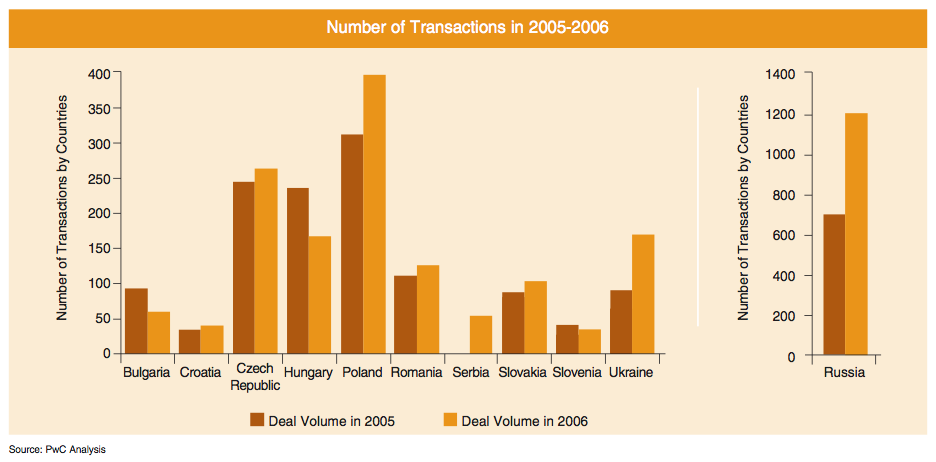

In total 2,527 publicly-disclosed private transactions were completed last year in the 11 countries of the CEE region. Overall, deal volume rose by 37% last year while the total value of these transactions rose by 79% and reached a record-breaking USD 163bn compared with USD 91bn in 2005.

Robust growth in CEE means that M&A market value last year doubled that seen in 2005 and more than tripled the aggregate value of M&A recorded in 2004.

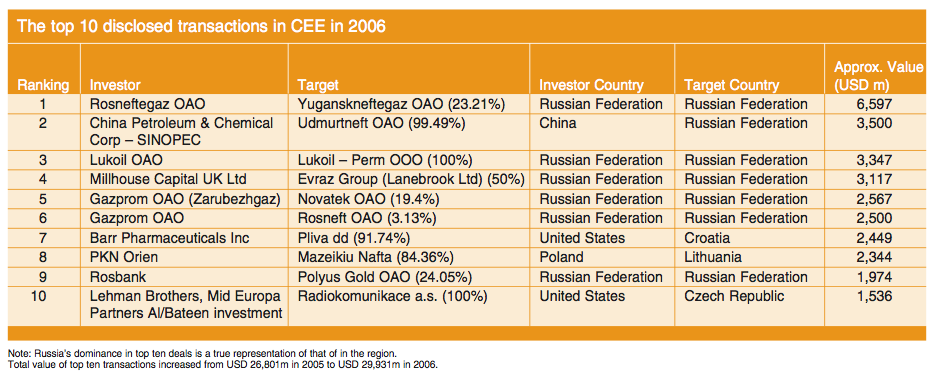

Much of this growth was due to an outstanding performance by Russia which recorded 1,210 transactions totalling USD 111bn during 2006.

As a whole, however, M&A activity in CEE remained strong with new stars such as Ukraine and Serbia beginning to attract considerable investment attention.

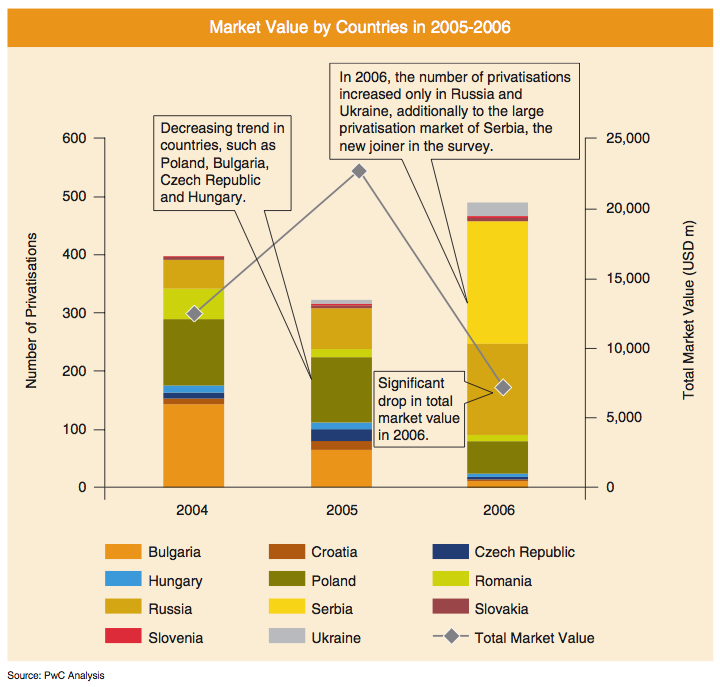

Privatisations up by 52% but down in market value by 70%

The 11 countries participating in this PwC survey – newly joined by Serbia – reported 490 privatisations in 2006. This compares with 322 in 2005. This was due mainly to ongoing programmes in Russia, Serbia and Ukraine. Serbia alone has contributed 210 privatisations to last year’s tally.

In contrast to the generally upbeat M&A trend, the total value of privatisations dropped dramatically last year, from USD 22.8bn in 2005 to USD 7bn in 2006. This could be a positive sign, indicating that much of the CEE region has matured beyond the State sell-off stage. Privatisation activity in the less advanced markets of Serbia, Russia and Ukraine increased last year to account for 80% of total privatisation deal volume in CEE.

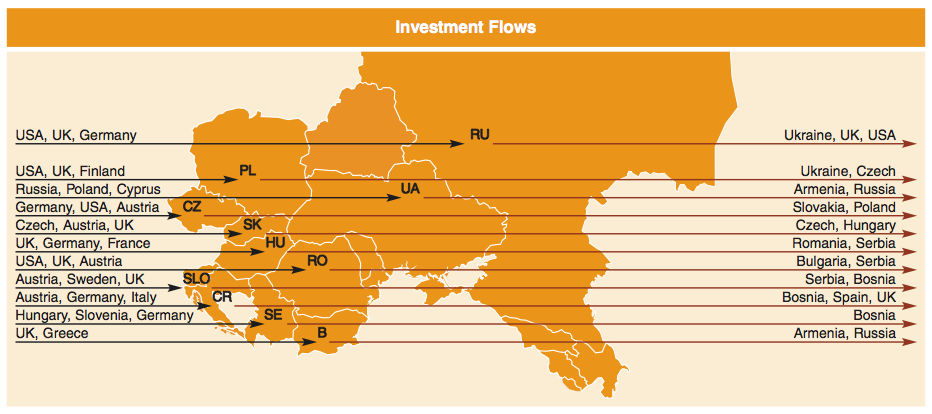

Investment flow moved eastwards

Based on experience from previous years, investment flows continued to move eastwards into Bulgaria, Romania and Russia with large-scale transactions and privatisations. This has boosted investor confidence in the region. In the more matured parts of CEE, notably the Czech Republic, Poland and Hungary, the M&A focus is expected to begin shifting towards mid-sized industry targets and one-off mega-deals.

Domestic activity – Russia and Poland dominate the home front

Domestic deals as a proportion of overall M&A activity (by number) increased by 5% in 2006 – from 56% to 61%. The highest proportion of domestic deals was registered in Russia and Poland, averaging at 70%.

Inward investment dropped by 6%

In contrast, the proportion of inward transactions dropped, in volume- terms, from 40% to 34% of total activity – to 866 transactions. Those countries topping the charts as the most attractive target countries – based on inward deal volumes – were Russia followed by Czech Republic and Poland.

The most active foreign investors in CEE last year were the UK, Germany, US and Austria.

Russia – most active outbound investor

Meanwhile, the 11 countries in this PwC survey closed 248 deals abroad in 2006 – an almost 33% increase on 2005 when 187 international deals were recorded. Russia was the most active outbound investor followed by the Czech Republic, Poland and Hungary.

Industry highlights

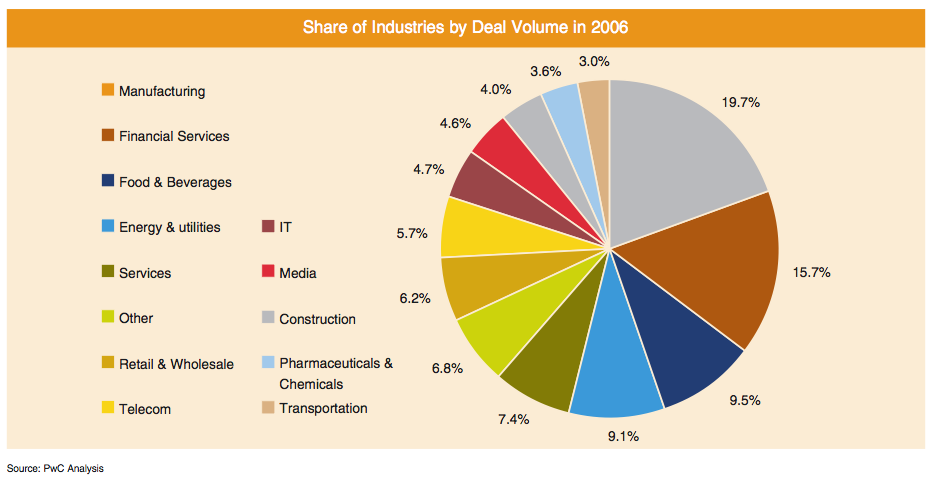

• Top target industries: manufacturing, financial services, food & beverages, energy & utilities

Looking at industry sectors by M&A activity, a similar picture to previous years emerged in 2006 with manufacturing remaining the most active sector. It is followed by financial services, food and beverages and energy & utilities. These four top industry sectors last year represented 54% of the total of deals by volume.

Nearly three-quarters of all financial services transactions closed in CEE in 2006 were concentrated into four countries: Russia, Ukraine, Serbia, and Bulgaria.

M&A activity in the food & beverages sector grew by 47% in terms of deals numbers across CEE last year with growth seen as a general phenomenon across the region.

Meanwhile in the energy & utilities sector average deal size shot-up by 162% from USD 29m to USD 76m while the volume of deals increased by 21%. ‘Hot-spots’ of activity were Russia, Czech Republic, Hungary and Poland.

• Pharmaceuticals & chemicals companies are the ‘most valuable’

The pharmaceuticals & chemicals industry earned the title of ‘most valuable industry’ in CEE with a 344% increase in the average deal size from USD 45m to USD 200m in 2006.

• The greatest increases in M&A activity

However, with regard to year-on-year deal volume growth, construction, transport, financial services and retail & wholesale last year showed the greatest increase in M&A activity.

Transport, with an average deal size of USD 11m, was the least expensive. Despite this relatively low average value, however, this figure is actually seen as an achievement given that deal volumes in the transport sector nearly doubled last year from 47 in 2005 to 76 in 2006.

Market overview

In the 11 participating countries, with Serbia as a new entry, 2,527 transactions were tracked totaling at USD 163bn (USD 161.3bn excluding Serbia) compared to 1,848 deals worth USD 91bn in 2005. Despite upbeat figures showing overall momentum in CEE, the region’s monolithic look of continuous growth and emerging opportunities lost its shine. While combustion engines of the region, such as Russia, the Czech Republic and Poland shifted into a higher gear in terms of producing growing deal volume and market size, others throttled M&A activity. However, overall the entire CEE remained strong and bold with new stars on the horizon such as Ukraine and Serbia.

M&A trends in Europe

The European M&A market achieved its strongest performance in recent history by hosting 5,216 transactions worth USD 1.33 trillion in the year 2006. This represents a 31% increase on 2005 deal value (source: MergerMarket).

The major fundamental expected to pave the way for growth is the long-awaited consolidation accelerated by the single market, common currency and removal of protective regulatory regimes.

The three biggest completed deals in Europe were Arcelor Mittal’s USD 35.9bn acquisition of Arcelor; Intesa Sanpaolo’s EUR 34.5bn purchase of Sanpaolo Imi and Grupo Ferrovial Consortium’s USD 27.4bn acquisition of BAA. The average of the top 5 deals equals USD 26.8bn – Bloomberg reported – with the total value of public deals greatest in banking (USD 262bn), financial services (USD 260bn) and energy & utilities (USD 227bn).

The CEE M&A market represents approximately 12% of the European market (including Russia) compared with 9% in 2005. By overlapping Europe’s M&A market value growth significantly, the CEE region carved a considerably larger share of the European market in 2006.

Is M&A activity in CEE likely to continue to grow – what is the outlook?

According to our 10th Annual Global CEO Survey, nearly half (47%) of all CEOs in the survey have been engaged in M&A activity in 2006 as the main way for financing growth.

Western Europe is the most active geographical theatre for deals (54%). Regardless of geography, however, the majority of CEOs (65%) cite the same principal motivation for pursuing transactions: access to new markets. Other motivations, such as obtaining new products or reducing competition, are seen as significantly less important.

The survey also shows that proximity to target markets is a key consideration – the majority of deals are taking place relatively close to home. Nearly half of all CEOs perceive that cultural barriers are the main hindrances to achieving successful deals. This perception is most pronounced in developed economy CEOs.

In emerging economies, CEOs are likely to be less concerned at the problems of overcoming differences in attitude and approach.

The emphasis on culture indicates that implementing deals, rather than simply executing transactions, is an increasingly critical competence. This involves far more than delivering on financial drivers, but encompasses as well the successful stewardship of people, knowledge and collaboration in the post merger environment. These factors are increasingly seen as decisive to achieving the full value available from M&A activity and CEOs are increasingly aware of them.

Country highlights

Bulgaria

- Market size of USD 2.4bn and deal volume of 64 transactions.

- Total average deal size: USD 52.2m.

- Most active industries: financial services, media, manufacturing and services.

- British investors more than doubled investments in Bulgaria, focusing on services and financial services.

- Third largest privatisation in CEE is the acquisition of Varna Thermal Power Plant by Ceske Energeticke Zavody as (CEZ) for USD 260m.

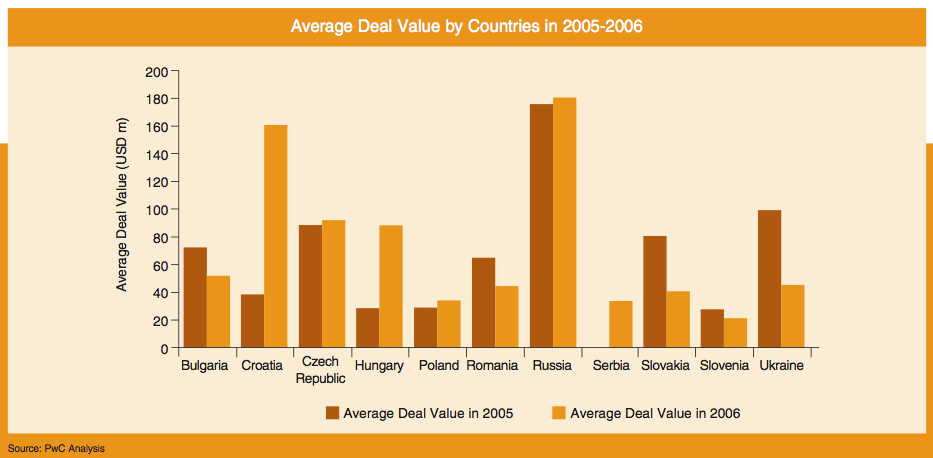

Croatia

- Market size of USD 4.3bn and deal volume of 41 transactions.

- Total average deal size: USD 160.8m.

- Number one for M&A market growth – the value of deals rose from USD 1.2bn to USD 4.3bn.

- Financial services and media deals accounted for 24% and 10%, respectively, of Croatian M&A deal volume by number, outperforming the regional average of 16% and 5%.

- Two mega-deals occurred in 2006, HVB Splitska Banka was bought by France’s Societe Generale and Pliva was acquired by Barr Pharmaceuticals Inc of the US.

Czech Republic

- The M&A is robust by number of transactions in 2006, increasing by 11%.

- Deal volume of 269 transactions.

- Total average deal size: USD 91.8m.

- The Czech was the second largest outbound investor within CEE with 44 outward transactions of which 33 are completed in the region.

- The USD 1.5bn takeover of Radiokomunikace by a private equity consortium – comprising Lehman Brothers, Mid Europa Partners and Al/Bateen investment – was the largest telecoms transaction in CEE.

Hungary

- Along with Czech Republic and Poland, Hungary is an engine of the M&A market in CEE with a deal aggregate of USD 9.8bn.

- Market size of USD 9.8bn and deal volume of 168 transactions.

- Total average deal size: USD 89m.

- Transaction growth of 114% last year by value made Hungary the CEE country with the second-fastest expanding CEE M&A market.

- Deals in the energy & utilities sector increased from nine to 21 transactions, with five transactions completed by French investors.

- Average deal size in financial services, pharmaceuticals & chemicals and energy & utilities last year rose to USD 300m or higher.

Poland

- Market size of USD 10.9bn and deal volume of 398 transactions.

- Total average deal size: USD 33.3m.

- Robust M&A market growth with deal values and volume growing by 38% and 24% respectively.

- IT relevant transactions nearly doubled both in volume and value with the average deal size reaching USD 20m.

- 17 mega-deals in Poland with four USD 100m-plus deals each in the energy & utilities and retail & wholesale sectors.

Romania

- Market size of USD 5.2bn and deal volume of 136 transactions.

- Total average deal size: USD 44.2m.

- Most attractive industries: manufacturing, financial services, media and pharmaceuticals & chemicals.

- Average deal size in financial services reached USD 125m based on 76% disclosure rate in this segment, followed by pharmaceuticals & chemicals (USD 56.8m) and construction (USD 43.3m).

- UK investors doubled their commitments – from 7 to 15 transactions while their US counterparts maintained their presence with 11 closed deals in 2006 compared with ten deals in 2005.

- Mega-deals volume doubled from 6 in 2005 to 12 in 2006.

Russian Federation

- M&A market growth of 111% last year – up from USD 53bn to USD 111bnin 2006, representing nearly 70% of CEE’s M&A market.

- Deal volume shot up from 706 to 1,210 in 2006 of which 922 deals were completed by domestic companies. Deal volume growth of 71% ranks Russia second in this category.

- Russia saw 142 transactions valued at over USD 100m last year. The total average deal size was USD 181m.

- Hottest industries were manufacturing (including metals), financial services and energy & utilities.

- An increased presence from UK and US investors who closed 59 deals in 2006 compared with 42 in 2005.

- Russia closed 102 outward transactions in 2006, and the main targets of Russian investors were Ukraine (22), UK (8) and US (7).

- A total number of 158 privatisations averaged at USD 9.1m.

Serbia

- An M&A market size of USD 1.7bn and 55 completed deals produced and average deal size of USD 33.7m in 2006

- Serbia saw a high proportion of financial services deals, 16 out of total 55 transactions, with an average value of USD 50m.

- Main investors: Austria, Germany, Hungary and Slovenia.

- Retail & wholesale and food & beverages accounted for 25% of all transaction in 2006, both scored well above regional average of 6% and 10% respectively.

- A total number of 210 privatisations averaged at USD 13m.

Slovakia

- Runner-up based on growth of number of transactions in 2006 (103 publicly disclosed deals in 2006, compared to only 81 in 2005).

- Total average deal size: USD 40.4m.

- High concentration of bidders, Austria, Czech Republic and UK accounting for 63% of all inward deals.

- Domestic deals doubled from 18 to 36 transactions.

- Hottest industries: manufacturing, food & beverages and services.

Slovenia

- Market size of USD 664m and deal volume of 36 transactions.

- The total average deal size last year was USD 21.2m.

- Outward deals nearly doubled from eight to 14 last year, focusing mainly on Bosnia Herzegovina and Serbia.

- Hot-spots of Slovenian M&A activity were financial services, manufacturing, media and retail & wholesale. Average deal size of USD 15.5m in financial services sector and USD 71.3m in retail & wholesale.

Ukraine

- The M&A market increased in size from USD 2.3bn in 2005 to USD 3.4bn in 2006, with an average deal value of USD 45m.

- Deal volume rocketed from 85 in 2005 to 171 in 2006 – up 101%, making Ukraine the fastest growing M&A market in CEE.

- Main investors: Russia, Poland and UK.

- Hot industries: manufacturing, financial services and food & beverages.

- Average deal size of USD 114m in financial services, USD 14m in manufacturing, USD 11m in retail & wholesale.

M&A domestic and cross-border activity

Domestic activity

Domestic deals as a proportion of overall M&A activity (by volume) increased by 5% in 2006 – from 56% to 61%. The highest proportion of domestic deals, as in 2005, was registered in the Russian Federation (76%) and Poland (62%). These markets recorded domestic deal activity of 72% and 53%, respectively, in 2005.

A similar trend was noted in countries with less concentrated M&A markets such as Croatia, Slovakia, Slovenia and Ukraine. This could well be due to the strengthening of domestic corporate players keen to capture a larger share of their home markets.

In contrast, countries such as Bulgaria (30%) and Hungary (30%) experienced a significant drop in their proportions of domestic deal activity. This compares with 40% and 52%, respectively, in 2005. Possible reasons for this decline are the higher inflow of foreign capital and the large volume of mega-deals closed, primarily, by foreign investors. However, as PwC has learned from researching previous years, smaller or less ‘interesting’ transactions generally enjoy considerably less press coverage and are often, therefore, inadvertently omitted from the statistics, leading to an under-estimation of deal volumes.

Inward investment

The total disclosed capital invested in companies in the CEE region last year was approximately USD 46bn. This represents a nearly 20% drop over 2005.

In contrast, the proportion of inward transactions dropped, in volume-terms, by 6% – from 40% to 34% of total activity – to total 866 transactions.

The countries topping the charts as the most attractive target countries – based on inward deal volumes – remained unchanged from the previous year. The lead was taken by Russia with 186 transactions followed by the Czech Republic (127), and Poland (121).

The second-tier includes Hungary, Romania and Ukraine which all attracted between 88 and 93 deals. However, Ukraine demonstrated the most improved performance of all CEE countries with its inward deal volume rising by 105% from 43 to 88 transactions last year.

However, inward deal ratios decreased in most CEE countries except Bulgaria, Hungary and Ukraine. Lowered inward ratio was, with exception of the Czech Republic, accompanied by a higher domestic share of all deals. This indicates that M&A activity is increasingly being driven more by domestic players than by foreign investors.

The foreign investors’ role has been overtaken by domestic players who, consequently, have eased up on their dependency upon foreign capital. They have now showed considerable strength and competitiveness in the domestic corporate segment.

However, a contrary tendency was seen in Bulgaria and Hungary. Ukraine posed as an exception in this comparison managing to increase both inward and domestic investment at the same time.

Most active investors – the UK, Germany, US and Austria

The most active foreign investors in CEE last year remained the UK (13%), Germany (11%), US (11%) and Austria (8%).

• UK investors are increasing their presence in CEE in huge leaps. In 2006, 115 deals were completed by UK-originated acquirers and investors compared with 71 in 2005. In addition to closing an increased number of deals in Hungary and Poland – the red-hot destinations during 2005 – UK investors moved eastwards to embrace Bulgaria, Romania and Russia. Additional investments in these three countries numbered 31 (out of the UK’s 44 extra deals over 2005), representing almost 70% of all additional transactions last year.

• US investors maintained their interest in the region, closing 92 deals in 2006 compared with 90 in 2005. Top US targets, by deal volume, were Russia (29), Poland (17), the Czech Republic (15), Romania (11) and Hungary (9).

• Investors from Germany and Austria completed 92 and 72 transactions respectively. While doubling investments in Russia, German companies continued to strengthen their presence in – Central Europe – Czech Republic, Hungary and Poland. Austrian investors distributed transactions across the entire region with special emphasis laid on neighbouring countries and slightly more interest in Ukraine and Russia.

The next most active countries investing in the CEE region, by deal volume, are France (42), Italy (32) and the Netherlands (30). Their preferred industry targets tend mainly to be financial services, manufacturing, utilities and food & beverages companies.

Outward investment

Following the unprecedented growth of outward transactions in 2005, the momentum continued during 2006 with slightly reduced growth figures. The 11 countries participating in this PwC survey closed 248 deals abroad in 2006. This represents an almost 33% increase on 2005 when 187 international deals were recorded. Due to robust growth in outbound deals, the share of outward transactions of all deals increased from 4% to 5% in 2006.

Outbound investors – buyers travel further

As in 2005, the most active outbound investor was Russia with 102 transactions followed by the Czech Republic (44), Poland (29) and Hungary (28). These last three countries closed a total of 101 deals in 2006 compared with 74 in 2005. These top four outward bidders of CEE presented 82% of total outbound deals compared to 74% in 2005.

• The growing figures in terms of both number and concentration of deals indicate where the major M&A powerhouses of CEE are. Russia remained strong at acquiring targets in neighbouring countries such as Armenia (2) Belarus (6), the Baltic States (5), Kazakhstan (2) and Uzbekistan (4), while shifted into a higher gear in penetrating more far-reaching countries such as the UK (8), US (7), South Africa (2) and Canada (1) and others.

• The trio of Czech Republic, Hungary and Poland completed 25 more outward deals last year than in 2005 of which 23 were in Russia, Ukraine and Serbia. Deals in more distant locations were also on a higher level last year with transactions in China, Singapore and the US.

• Similarly,second-tiercountries–suchasSlovakia,Slovenia,Croatia and Ukraine – have also begun to target distant markets with deals in the UK (2), India (1) and Costa Rica (1).

Taken as a whole, the successful acquisition of more far-reaching targets can be seen as a clear sign of the deepening maturity and strengthening competitiveness of the CEE region.

Investment targets

The Ukraine tops the target list with 37 transactions, followed by the Czech Republic (19), Slovakia (18), Serbia (14), Romania (12) and Bosnia Herzegovina (11). These destination countries give a clear indication of the investment strategy of many CEE investors. They tend to acquire neighbouring targets first and then reach farther out to more distant locations as they become more confident. On the other hand, the investment interest by CEE countries in their neighbours reflects their realistic market knowledge and judgement of these territories.

Cross-border interesting hotspots:

• Swedish investors contributed greatly to the boom of incoming deals in Russia by closing 13 out of 27 acquisitions completed in this country in 2006.

• More than one-third of outward acquisitions (10 out of 29) by Polish companies were in Ukraine, the rest of were in Czech Republic, Hungary and Romania.

• Beside Russia (32) and Poland (23), the next most active investors in CEE among PwC survey participant countries were the Czech Republic (31) and Hungary (18). Czech investors favoured Slovakia with 18 deals while their Hungarian counterparts closed the majority of their transactions in Romania, Russia and Serbia.

• Russia’s acquisitions in CEE focused primarily on Ukraine where 22 deals were completed compared with 13 in 2005.

• Anglo-Saxon investors (UK, US, Ireland and Australia) increased their investments in Bulgaria and Romania – the EU’s two newcomers – considerably last year. No less than 46 transactions were executed in 2006 compared with 28 deals in 2005. Of 43 deals by UK and US investors, 26 were completed in Romania and 17 in Bulgaria.

Incentives for foreign investors

A stable or developing macroeconomic situation with low inflation, low unemployment and high GDP indicators, naturally attracts increasing numbers of investors to a region. In those CEE countries where the GDP rate is high, M&A activity is considerably higher.

Economic incentives

Economic incentives mainly consist of tax allowances and other sector, regional or project-based allowances offered by governments which all recognise their ‘investment generator’ impact.

Tax incentives in Serbia, for example, include a low rate of corporate income tax – 10% and even zero corporate income tax exists for new investments made in certain regions where the unemployment rate is high; a ten-year pro-rated corporate tax holiday for investments over EUR 7.5m and the employment of at least 100 new employees and tax credits for investing in fixed assets of up to 80% of the invested amount.

Sector or region-specific incentives are offered by countries such as Bulgaria – which has special state subsidies for investors in the agriculture sector, Russia – which has selected regions as special economic areas regulated by law. The law prescribes benefits, such as a reduction in customs duties, to companies located in these zones that are involved in scientific projects and industrial production.

In Croatia, companies operating in areas under special state care (war damaged) and investing in new companies have special lower tax treatments up to 0% of corporate tax.

Romania offers a wide variety of taxation incentives such as VAT payment exoneration, income tax deductions for investments in industrial scientific and technological parks and very specific incentives distinctively provided for micro-companies, SME, and individuals by case.

In addition to the macroeconomic considerations, Governments in the CEE countries are out to attract foreign direct investors with the introduction of specific incentives.

Non-economic incentives

Besides economic incentives, investors can receive beneficial treatment if, for example, they place emphasis on general environmental and development issues in target countries and remain sensitive towards issues affecting general political stability in corresponding countries.

Generally, investor confidence seems to correlate strongly with EU and NATO membership by target countries which, in turn, results in lower country risk and higher deal volumes. This has recently been observed in Bulgaria and Romania.

In addition, countries which have signed agreements on the mutual protection and promotion of foreign investments or which have other mutual treaties – The Generalised System of Preferences trade programme between Serbia and the US which provides a preferential duty-free regime for more than 4,650 products, for example, – are also more attractive to prospective external investors.

Other features, such as geographic location, infrastructural developments, the quality and cost of labour, and the harmonisation of national regulations with EU policies are key additional considerations for foreign investors. Bulgaria’s proximity to large non-EU markets such as Turkey, and the convenient transport infrastructure and channels (via land, river and sea) in Croatia, for example, represent important advantages for these countries.

Additionally, a reduced administrative burden and shortened procedures for new investors will attract more interest. This has been recognised by Bulgaria in setting up its Agency for Foreign Investments. Serbia also believes that through legal and economic reforms and/or harmonisation, it can offer a European-orientated, business-friendly, market economy and thus attract increasing foreign investment.

Industry focus

Top target industries: manufacturing, financial services, food & beverages, energy & utilities.

There are few surprises among the ranking of industry sectors by M&A activity in 2006 with a similar picture to previous years emerging. Manufacturing remains the titleholder for the most active sector with 499 transactions (384 in 2005) representing 20% and 21% of the deal total, respectively. It is followed by financial services with 16% (13% in 2005); food & beverages with 10% (9% in 2005) and energy & utilities also at 9% (10% in 2005).

These four top industry sectors last year represented 54% of the total of deals by volume, on a par with 2005. However, with regard to year-on-year deal volume growth, construction, transport, financial services and retail & wholesale last year showed the greatest increases.

Mega-deals

‘Mega-deals’ (those valued at USD 100m or more) are another indicator of heightened attention on individual industry sectors with utilities, manufacturing and financial services all ranked highly by this measure. In the utilities sector, the average size of deal in 2006 was approximately USD 76m compared with USD 29m in 2005. Due to a relatively high number of mega-deals in manufacturing, the mid-deal size across CEE almost tripled last year to reach USD 41m. The financial services sector witnessed a similar progression with its average deal size arriving at USD 106m.

Deal distribution by countries

Participating countries seem to vary greatly in terms of their distribution of deals within industry sectors. Czech Republic (24%), Slovakia (23%) and Ukraine (23%) all attracted more manufacturing deals than the regional average of 20%. On the other hand, Bulgaria and Serbia have proved sluggish when it comes to attracting investors into their manufacturing sectors raising concerns about a dearth of suitably attractive targets.

The primary targets within the financial services sector were in Serbia (29%), Slovenia (25%) Ukraine (25%) and Croatia (24%) compared to a pan-regional average of 16%.

Increased activity characterised the energy & utilities sector with ‘hotspots’ in Russia, Czech Republic, Hungary and Poland with many deals driven by anticipated liberalisation, unbundling requirements and high demand for commercial activities in these countries.

As for less generally attractive industries CEE-wide, Russia outperformed the regional mid-figure of 6% in telecoms by 2%. Poland and Hungary did so in IT transactions by 9% and 4% respectively (average – 5%).

Media-related deals showed an exceptional focus on the Balkan states of Bulgaria, Croatia, Romania and Slovenia. These all scored at least 3-6% higher than the average of 5%. The main drivers for this appear to be ongoing liberalisation in these markets and, currently, a relatively low presence of foreign players.

Top target industries: manufacturing, financial services, food & beverages, energy & utilities.

Financial services – focus falls on Russia, Ukraine, Serbia and Bulgaria

Nearly three-quarters of all financial services transactions (397) closed in 2006 were concentrated into four countries: Russia (225), Ukraine (42), Serbia (16), and Bulgaria (11).

Russia and Ukraine

Both countries have several things in common concerning M&A activity in the financial services sector:

• Foreign banks demonstrated a great interest in retail banking market. This led to a number of significant acquisitions by large European banks.

• A fragmented market with low penetration by banks and a relatively large population as well as growing income served as additional motives to invest in the region.

• Other segments of financial services remained nearly untouched or much less attractive to foreign players restricted their acquisition activity to smaller institutions as a platform for further expansion.

One major contrast between Russia and Ukraine is the fresh new tendency among large Russian banks to begin their expansion abroad with the acquisition of several medium-sized banks in the Commonwealth of Independent States (CIS) region.

Market expectations are that deal flow in the financial sector will continue in 2007. However, it is expected to shift into the mid-tier banking segment. Further domestic consolidation may become the major source of M&A deals as smaller banks with higher capital costs find it more difficult to compete with international giants.

Transaction examples:

• United Financial Group (Russia) by Deutsche Bank (Germany)

• Import-Export Bank (Russia) by Raiffeisen Zentralbank Oesterreich (Austria)

• Investberbank (Russia) by OTP Bank (Hungary)

• International Moscow Bank (Russia) by Unicredito Italiano (Italy)

• Ukrsotsbank (Ukraine) by Banca Intesa (Italy)

• Raiffeisenbank Ukraine (Ukraine) by OTP Bank (Hungary)

• UkrSibbank (Ukraine) by BNP Paribas (France)

Bulgaria and Serbia

Both countries have witnessed considerable changes over the last years through mergers, takeovers, reorganisations and restructurings – all of them aimed at consolidating the sector. In contrast to the high concentration of power and control exerted by foreign banks over banking assets – 94% of total assets in Bulgaria and 70% in Serbia –, the rush for second or third-tier banks has shifted into an even higher gear.

Primary factors such as growing deposits and lending activity have kept not only retail banking hot but have also made complementary businesses appealing to existing and new players.

In Serbia, the Central Bank of Serbia’s decision to not issue any more greenfield licenses has forced new entrants to acquire already existing banks, mainly by winning auctions for state-owned banks through privatisation.

Transaction examples:

• DZI Bank AD (Bulgaria) acquired by EFG Eurobank Ergasias (Greece)

• Bulbank (Bulgaria) in integration with local HVB Bank Biochim and Hebros Bank (Bulgaria)

• Niska Banka, Zepter Banka and Kulska Banka (Serbia) acquired by OTP Bank (Hungary)

• Panonska Banka (Serbia) acquired by San Paoli IMI (Italy)

• Privatisation of Panonska banka (Serbia) bought by National Bank of Greece (Greece)

Energy & utilities – Central Europe is buzzing

The energy & utilities sector witnessed overall growth and higher activity in 2006 than in 2005 across the entire CEE region. Average deal size shot-up by 162% from USD 29m to USD 76m while the volume of deals increased by 21%. ‘Hotspots’ of activity were Russia, Czech Republic, Hungary and Poland.

• The buzz around Central Europe’s utilities sector can be deduced from different fundamentals. Liberalisation of gas and energy markets as of July 2007 has forced energy groups to realign and reconsider their strategies

• Compliance with unbundling requirements has resulted in the acquisition and divestment of upstream and downstream activities

• Other factors such as strict EU environmental protection, significant growth in long-term power demand and the prospect of a freer market have also heated an already hot industry further.

In Russia, the consolidation of core oil and gas assets by major government-affiliated companies in 2005 has continued, accompanied by a strong political will of restricting access to strategic resources for international players. However Russian energy companies seek to develop their production facilities and acquire assets abroad benefiting from high energy prices. This foreign expansion is likely to continue in the future.

Manufacturing – the most active sector

Transactions in the manufacturing sector captured more headlines in Russia, Czech Republic, Slovakia and Ukraine than in any other CEE country accounting for more than 70% of the M&A activity. Of all segments of manufacturing, metal and steel industry was the red-hot in 2006 due mainly to global consolidation moves embracing the CEE region.

In Russia, the metals M&A segment showed considerable growth and is now close to the energy & utilities sector. This growth was driven mainly by an increase in deals volume. The wave of consolidation affected base-metal as well as ferrous industry assets and the Russian metals companies also tend to acquire high-tech production facilities abroad. The acquisition of Czech firm MSA of the Dolni Benesov municipality, one of the largest European manufacturers of industrial fixtures, by Russian Group Celjabinskyj Truboprokatnyj Zavod, demonstrates the above point.

Food & Beverages – strong appetite for deals

M&A activity in the food & beverages sector grew considerably in terms of deal numbers across CEE last year with deals up by 47% to 241 from 164 in 2005. The growth was seen as a general phenomenon across the region as expansion embraced Bulgaria, the Czech Republic, Slovakia, Croatia, Serbia, Poland, Russia and Ukraine.

Higher market activity pushed the average deal size down from USD 16m to USD 12m. However the mid-figure in Poland, Romania and Russia stabilised well above average. Deal volume in Ukraine quadrupled indicating a positive trend towards further regional expansion.

The Slovak and Czech food industries witnessed a strong wave of consolidation among bakery and meat processing businesses:

• Czech Delta Pekárny acquired three bakeries in Slovakia (RFT, Peza and Dúbravanka, Pekáren a Cukráren)

• Czech Agrofert acquired 4 bakeries and 3 poultry producers in Slovakia

• The Czech bakery rush also spread to Hungary with Odkolek, a Czech bakery business, buying Vecsay which controls six bakery companies across Hungary

• In meat processing in Slovakia, Tauris was acquired by Eco Invest and Hrádok Masokombinát was bought by Slovak Mecom Agro

The meat industry in Bulgaria was among the most important sectors of the domestic economy with intensive development seen in recent years. The reported output of companies in the sector has doubled over the last five years, in line with a growing trend in the import of raw materials and finished products. Small and medium-sized meat processing companies are pre-dominant in the sector with eight certified for export within the EU.

Construction and Real Estate – rapid expansion

The entire CEE region has experienced rapid expansion in the construction sector. Deal volumes last year were almost double those seen in 2005 – up to 102 transactions from 52 in 2005. Those countries experiencing the bulk of this growth were Russia, Poland, Czech Republic and Hungary.

Average deal sizes in the sector across CEE grew ten-fold last year – up from USD 3m in 2005 to USD 31m in 2006. However, in the growth markets mentioned above (except Poland) average deals were in the USD 87m – USD 105m range. Real estate-related transaction volumes followed a similar pattern last year.

PwC Viewpoint: The Real Estate industry

The trend of strong demand for real estate investment into all types of property in CEE continued during 2006.

For the first time, total real estate investments in CEE exceeded EUR 10bn. Investment continued to be targeted at Poland, Czech Republic, Hungary and Slovakia. More interesting, however, is the clear emergence of Russia and Romania as significant investment markets. Bulgaria and Croatia are also seeing increasing interest and activity. The Baltic states also saw a reasonable number of single asset transactions.

There are also shifts in investments and developments to all real estate asset classes and a move away from national capital cities to regional cities. The capital cities in Central Europe have now largely become ‘core’ markets hence, more opportunistic investors are looking to invest elsewhere. Last year has seen a new wave of property investors in the less developed markets of South Eastern Europe (SEE) – such as Bulgaria and Serbia, where investors are looking for greater returns. However, investors in these countries must give due consideration to their risk/return ratios.

To enhance returns investors are increasingly looking to lock in investment commitments and taking on development risk. To do this, investors are frequently looking to forward purchase properties under development and to buy into ‘platforms’ by taking an equity stake in a developer to secure a pipeline of investment products or to secure the development return. The pressure to get money invested has also led to a number of larger deals with some large retail portfolios changing hands.

On the back of a record year, there is much optimism for continuing real estate investment into CEE. Declining yields are leading to a change in investment patterns with focus on higher return opportunities either through development or moving into the, as yet, less invested countries of SEE. Even against this backdrop, we see no slow down in the countries of Central Europe. Russia in particular seems to offer big possibilities for the future. One thing becomes clear – there will be more of a focus on getting good deals with less room for error around the fundamentals. (Glen Lonie, Partner and Real Estate CEE Industry Leader, PwC Czech Republic)

Privatisations

Privatisations results by country

Even if the privatisation process is no longer on the agenda in many CEE countries, important transactions are still pending or are on the priority list of investors. After years of continuous growth at a regional level and a surge in both the volume and value of privatisation activity in 2005, last year produced, at the first glance, quite contradictory figures. While total value of privatisation deals fell from USD 22.8bn in 2005 to USD 7bn in 2006, at the same time the number of state sell-offs leapt from 322 to 490, giving the region the appearance of a booming market.

For volume of privatisation activity, the power houses of the region were Serbia – 210, Russia – 158 and Poland – 56, which accounted for 87% of all privatisations in CEE.

As for value, the top five sell-offs totalled USD 3.7bn representing 53% of the entire CEE privatisation market. This compares with USD 17.6bn and 77%, respectively, in 2005. Consistently, average disclosed deal values dropped significantly to USD 45m from USD 275m based on a near 100% disclosure rate.

The structure of privatisation activity remained the same at 85% for domestic and 15% for inward deals, respectively. The most active bidders were holding companies in the Virgin Islands (10), Slovenia (6), Italy (5) and Germany (5). Together these nationalities accounted for 36% of a total of 73 inward privatisations. Heightened geographical concentration also applied to the bidders’ respective market strategies. Most interestingly, three of the top bidding nations – the Virgin Islands, Slovenia and Italy – closed all of their deals in Serbia. Other growth privatisation markets, such as Russia and Ukraine, appear to be less favoured by foreign investors.

Privatisations results by industry

With regard to industry sectors, manufacturing took the lead last year with 154 privatisations. It was followed by services (71), food & beverages (53) and construction (49).

Growth industry sectors, based on year-on-year volume growth, were retail and wholesale (467%), services (154%), food & beverages (130%), manufacturing (64%), transportation (58%) and construction (53). Major drivers behind that growth were the trio of Russia, Serbia and Ukraine.

In the flat or declining markets of Bulgaria, Hungary and Poland, utilities privatisations outperformed other segments.

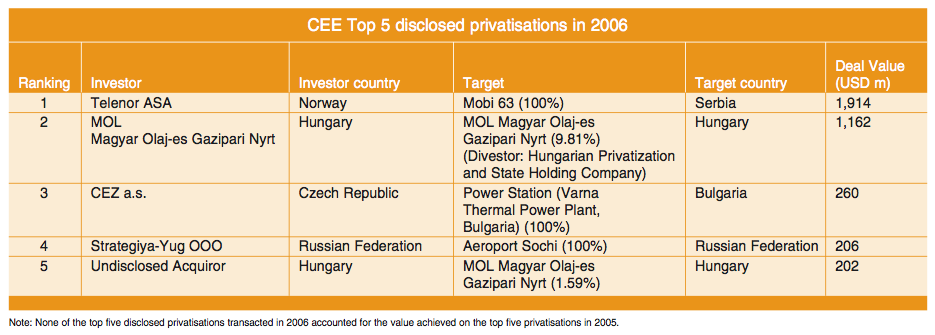

The largest privatisation – Telenor wins the Mobi 63 auction in Serbia.

Telenor, Norway’s largest telecommunications group, acquired 100% stake in Mobi 63 for USD 1.9bn after winning an auction in July 2006. Through this deal, Telenor has acquired a 10-year licence for GSM 900/1800 and 3G operations, and over two million wireless customers. This represents a 45% market share.

Telenor’s presence in Serbia will increase the quality and range of telecom services in the country. In addition, the transaction is a true indication of foreign investors’ confidence in targeting Serbia and Serbian companies.

Transactions of interest

Bulgaria

Complex capital raising to fund international expansion

Prista Oil is the largest lubricant oil producer in South East Europe (SEE) and majority owner of Monbat, the leading batteries producer in Bulgaria. Following the expansion plans of Prista oil and Monbat, the company’s shareholders were in the process of assessing different options for financing its growth plans. This complex transaction involved more than 15 entities in more than ten countries.

PwC assisted the shareholders of the group to analyse different options for fund raising including bank debt and attracting a financial investor as a minority shareholder. Having analysed the advantages and drawbacks of the different scenarios in view of the complex group structure, a preferred scenario envisaged the attraction of a financial investor who could bring fresh equity capital and thus increase further the group’s leveraging capacity.

Croatia

The Spanish manufacturer of sanitaryware products, Roca Sanitario, executed the acquisition of the Croatian company INKER which is in the same line of business as Roca.

Roca Sanitario faced key deal issues which were crucial for the structuring of its purchase price.

PwC understands its client’s issues and was able to advise on all financial and tax aspects of the transactions thus assisting the client to structure the valuation and purchase price.

Czech Republic

Ceské Radiokomunikace, the Czech provider of telecommunication services, agreed to acquire Tele2, a Czech alternative telecom provider and subsidiary of Tele2, the listed Swedish telecommunications group, for USD 15 million. Following the merger, Ceské Radiokomunikace became the largest alternative operator with over 450,000 customers.

Tele2 has been looking for an adviser who could demonstrate real understanding of its business issues and local knowledge of the three markets in which it operated. This was because the group decided to exit simultaneously not only from the Czech Republic but also from the UK and Ireland.

Complex capital raising to fund international expansion

PwC has considerable expertise in the telecommunications industry. We were able to deliver top class telecoms teams in all three countries, demonstrating an unparalleled knowledge of, and contacts in, each of the telecoms markets and a proven ability to execute transactions. PwC Prague was responsible for the sale of Tele2 in the Czech Republic. Despite being in a difficult financial position with added legal complication in the Czech Republic, PwC was able to achieve a positive result for the Swedish sellers.

Hungary

OTP branches out

After a successful series of acquisitions, expanding the network of the Hungarian bank OTP last year shifted into a higher gear. OTP completed eight outward acquisitions totaling USD 1.7bn and representing 25% of all Hungarian outward deals. Four of these were USD 100m-plus ‘mega-deals’.

Besides Romania where it already has considerable strongholds, OTP entered other CEE markets by getting a grip on ‘bridgeheads’ in Serbia, Montegero, Ukraine and the Russian Federation with the acquisition of Niska Banka, Zepter Banka, Kulska Banka, Raiffeisenbank Ukraine and Investberbank.

PwC performed a full-scale due diligence and addressed tax issues to facilitate OTP’s acquisition of Investberbank, one of Russia’s top 50 banks. OTP successfully acquired Investberbank valued at USD 477m – this was OTP’s, and Hungary’s, second largest outward transaction in 2006. PwC additionally assisted OTP in the due diligence on two Ukrainian banks – UkrSibBank and UkrsotsBank – which had been sized-up by OTP as potential acquisition targets. However OTP ultimately found another bank, Raiffeisenbank Ukraine, to be a more suitable acquisition candidate.

As a result of this international expansion, OTP now has a presence in eight countries in the CEE region and serves around 10 million clients via 1,000 branches and electronic channels. As this burst of acquisitions activity calms down, OTP is now occupied with post-acquisition integration.

Poland

The biggest deal in Polish history

PKN Orlen is the largest Polish oil company specialising in the manufacturing, distribution, wholesale and retail of refinery and petrochemical products. In order to strengthen its position in the petroleum market in CEE, the company has decided to take part in the acquisition process of Mazeikiu Nafta – the Lithuanian oil refinery – from Yukos International UK. B.V and the Lithuanian Government.

Throughout the whole acquisition process, PwC worked alongside PKN Orlen on its path to success. PwC contribution to the transaction included multiple due diligence processes. The project required close cooperation between PwC offices in Poland and Lithuania.

The total value of the acquisition was over USD 2.5bn making it the biggest deal in Poland’s history.

Russian Federation

Mega-merger in the food retailing sector

PwC acted as a key adviser for a deal between Pyaterochka and Perekrestok, Russia’s two leading food retailers, whose merger was announced on 18 April 2006.

The merged X5 Retail Group is controlled by Perekrestok’s main owner, Alfa Group.

This deal required expertise in several areas: audit, tax structuring, tax due diligence and business modelling. This was a joint achievement by PwC’s Advisory, Assurance and Tax teams. Based on long-term relationships built up by different PwC service lines with Alfa Group and Perekrestok, PwC was able to understand the client’s requirements and suggest sound solutions within demanding deadlines.

The deal is notable for its size – USD 1.37bn – and because it was a landmark merger that heralded further mega-deals in the retail sector.

Romania

Indian takeover provides international platform

One of the most attractive sectors in 2006, both for the financial and strategic investors, was the pharmaceuticals market in Romania. This is estimated by Cegedim to be worth around EUR 1.6bn in 2006, in terms of wholesale prices.

Ranbaxy Laboratories, India’s largest pharmaceutical company and one of the top ten generic drugs makers has acquired 96.7% stake in the Romanian drugs maker Terapia from the US private equity firm Advent International for USD 324m. Based on management information, the price paid for the takeover of the Romanian pharmaceutical company is 11.6 times the value of Terapia‘s operating income for the last 12 months.

Ranbaxy has production lines in seven countries, subsidiaries in 46 and is present in 125 markets around the world. This will enable Terapia’s products to reach markets such as Brazil, US and other countries of South America. Moreover, Ranbaxy intends to turn its operations in Romania into a strategic production centre for the European and CIS markets.

Terapia reported a turnover of some USD 80m in 2005 of which 30% was generated by exports to 15 European countries, making Terapia Romanian’s largest pharmaceutical exporter. On the domestic market, Terapia ranks second in terms of sales volume with a market share of nearly ten per cent.

Serbia

Cross-border consolidation in the pharmaceuticals sector

Stada, the German generic pharmaceuticals manufacturers, purchased 98% of the Serbian pharmaceutical company Hemofarm. At v475m this was the second largest transaction in Serbia in 2006. The German company also paid USD 147.97 per share for Vrsac, the Serbia-based pharmaceuticals company and purchased 3.3 million shares. That was the most expensive purchase in Stada’s 111-year long history. In 2005, Hemofarm claimed 47.7 percent of sales in the Serbian pharmaceutical market giving it a turnover of EUR 235m.

With factories in Russia and China, Stada also has access to eastern markets as well. According to announcements from Stada, Hemofarm’s shares will be withdrawn from the Belgrade Stock Exchange and will enter the Frankfurt Stock Exchange. Small shareholders in Hemofarm owned 35% of the company’s stock, while the rest belonged to investment funds and brokers. Hemofarm’s management held an 11% stake.

Slovakia

German acquisition in the construction materials industry

Germany’s KNAUF Group became the out-right owner of IZOMAT at the beginning of 2006. Austria’s Radex Heraklith International, the owner of the Heraklith Group that had merged IZOMAT with Slovenia’s Termo Skofja Loka in 1999, sold the group to KNAUF for USD 276m.

IZOMAT is one of the top producers of mineral fibre thermal insulation materials for the construction industry. Its sales increased by 7% in 2005 to USD 56m.

Primary drivers of sales growth were higher production with a slight growth in product prices. Gross profit was 3% higher in 2005 at nearly USD 9m. IZOMAT exports two-thirds of its production, mainly to the Czech Republic, Poland and Hungary and also to the countries outside the EU.

The change in ownership took place in January 2006 when Radex Heraklith International signed a purchase agreement with two subsidiaries of KNAUF Group for the sale of the whole of Heraklith Group, including IZOMAT. The strategy behind the acquisition of IZOMAT is not only to increase production volume and customer service but also to expand into new territories and establish the brand in Europe.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter