Publications Capital Confidence Barometer – Fit For The Future?

- Publications

Capital Confidence Barometer – Fit For The Future?

- Bea

SHARE:

By Raul Vazquez – Ernst & Young

Our fourth Capital Confidence Barometer reports a surge in confidence in the global economic outlook. Confidence in the global economy has almost doubled in the last six months. Leading companies are now focusing on growth instead of defensive measures.

Capital market conditions remain strong and confidence in many local economies and industries also remains high. However, more recent external factors such as political instability in the Middle East and rising inflation and natural disasters are creating longer term uncertainty. This is leading to mixed messages for M&A.

In the short term M&A appetite is up, with one third of those surveyed looking for a new acquisition in the next six months. Longer term the appetite for M&A declines — albeit from a relatively robust level — as companies identify organic growth as their No.1 priority. The growing valuation gap between buyers and sellers could also constrain M&A appetite. We should see increased levels of M&A in 2011 — but further external shocks may prompt boards to rein in acquisition plans.

For the first time, we compare the views of senior executives in Spain with their peers from around the world. In general terms, we can observe:

- A higher degree of pessimism regarding the duration of the financial crisis

- Companies in Spain are more dependent on bank borrowing

- There is greater reticence towards acquisition growth

- Boardrooms are more focused on liquidity and improving the competitiveness of their businesses

Our latest findings again underline one critical point: how companies manage their capital agenda today will define their competitive position tomorrow. How they raise, invest, optimize and preserve their capital is vital to their future success. The Barometer clearly shows that many leading companies are in a strong position to determine their strategic course, while others are struggling to respond to current market challenges.

About this survey

Ernst & Young’s Capital Confidence Barometer is a regular survey of senior executives from large companies around the world conducted by the Economist Intelligence Unit (EIU).

Our panel, the “Ernst & Young 1,000” is comprised of selected Ernst & Young clients and contacts and regular EIU contributors.

This snapshot of our findings gauges corporate confidence in the economic outlook and identifies boardroom trends and practices in the way companies manage their capital agenda.

Profile of respondents

• Panel of more than 1,000 executives surveyed in February and March 2011

• Companies from 62 countries

• Respondents from over 40 industry sectors

• 559 CEO, CFO and other C-level respondents

• 248 companies would qualify for the Fortune 500 based on revenues

The Capital Agenda

1. Preserving capital: reshaping the operational and capital base

2. Optimizing capital: driving cash and working capital and managing the portfolio of assets

3. Raising capital: assessing future capital requirements and assessing funding sources

4. Investing capital: strengthening investment appraisal and transaction execution

Survey highlights

Our findings point to

• Global confidence surge—the financial crisisis over, or the end is in sight

• Capital market conditions are at a post-crisis high, andl eading companies have refinanced

• New found confidence is resulting in boards focusing on growth

• Short term, M&A activity is set to increase but remains well below pre-crisis levels

• The No.1 strategic priority for companies remains organic growth

Our perspectives

• Global confidence is returning. However, any sustained up turnis likely to be determined by external factors: rising inflation, continued political instability in the Middle East, austerity and tax regimes and the impact of natural disasters on supply chains

• Leading companies have completed refinancing, but for those who haven’t the need is now urgent

• The survey shows that boardrooms are cautiously focusing on growth in light of the above factors

• The reare mixed implications for M&A. At least in the short term, the outlook for M&A activity is getting brighter, and the increasing number of companies planning to acquire and divest in the next six months should increase deal activity. Targets are likely to be emerging market companies in the automotive, consumer products, mining and pharmaceutical sectors

• Longer term, if the external factors stabilize or diminish, we may see a resurgence in M&A

• In the current market the highest priority in the boardroom remains organic growth

Economic outlook

Boardrooms bullish on recovery.

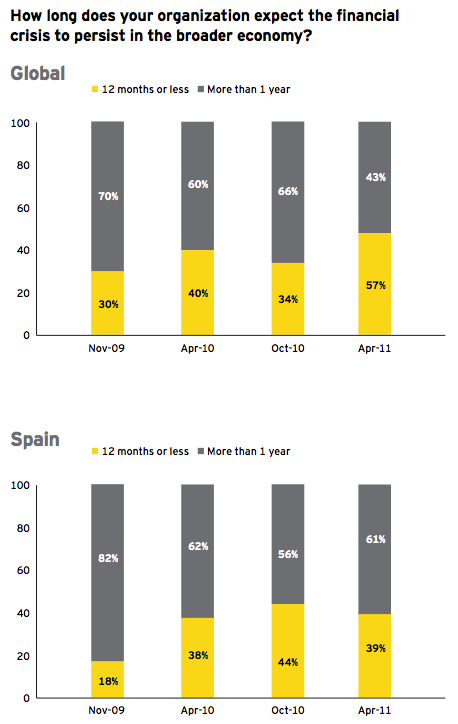

Confidence in the global recovery has surged since October 2010. Buoyed by high equity values, stabilizing capital markets and low interest rates, we are now seeing the first significant increase in confidence from respondents in 18 months. Almost 60% of executives now think that the global economy will have recovered by April 2012. Nearly a fifth believe that the financial crisis is already over.

17% For the first time, we asked, “Does your organization believe the global financial crisis is over?” 17% of all respondents said “Yes.”

61% of companies in Spain believe the financial crisis will persist for longer than 12 months.

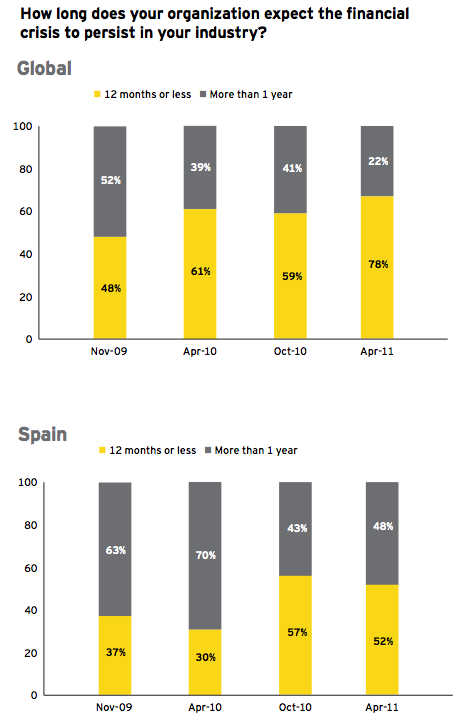

Survey respondents are even more positive when viewing the outlook through an industry lens. At a global level third say the financial crisis is over in their sector, and 78% expect the recovery to be well under way in the next 12 months.

Participants also remain upbeat about their local markets. Two-thirds (66%) are optimistic about their local economy, up from 64% in October 2010. Levels of confidence in Germany and China remain high.

The survey reveals a surprising decrease in confidence in India and Russia. The UK and Spain show the lowest levels of confidence around the world.

40% of Spanish executives interviewed are now more optimistic, compared to 66% at global level.

48% of companies in Spain expect the crisis to last more than 12 months in their industry compared with 22% globally.

Capital markets

Capital market conditions continue to strengthen.

Almost 60% of companies say capital market conditions are continuing to improve. Thirty-eight percent say access to funding for capital projects is not a problem. And balance sheet leverage remains low: only 13% of companies in the survey have a debt-to-capital ratio above 50%; the majority are below 25%.

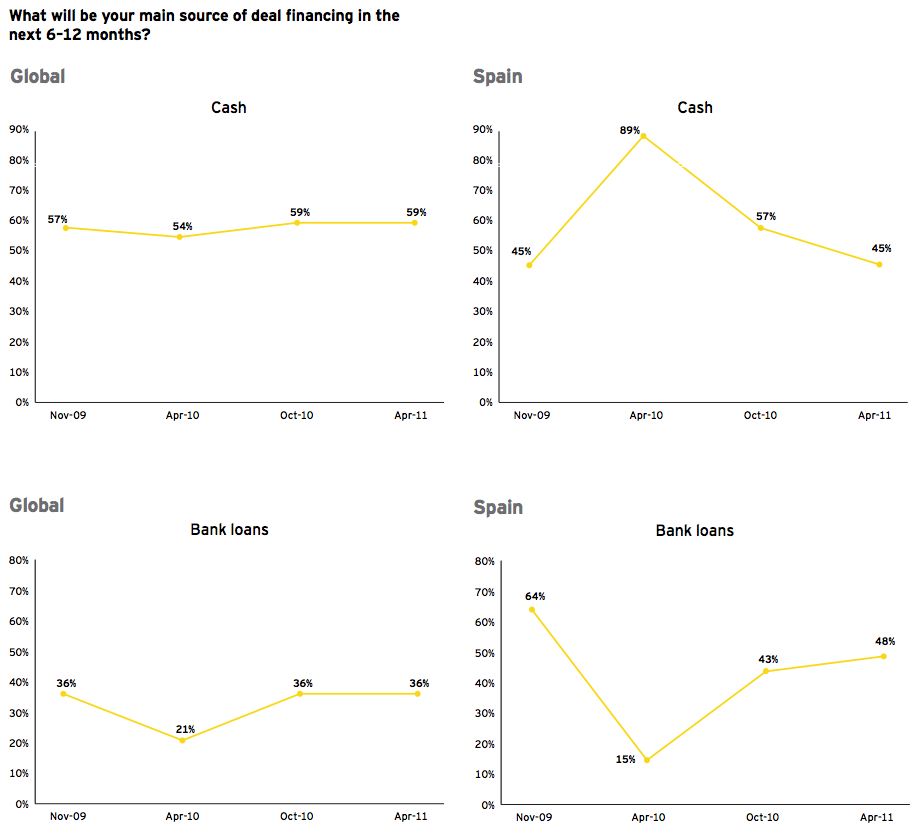

With banks re-establishing their capital positions and interest rates low, financing for deals is increasingly available. The preferred sources for funding over the next six months remain cash and bank loans.

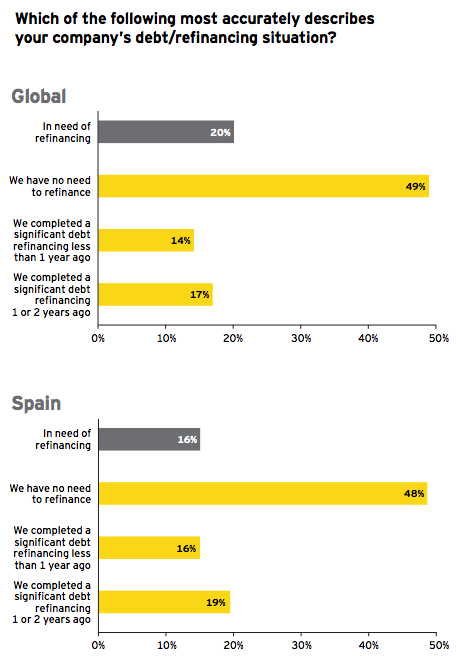

The pressure to refinance is over for leading companies.

Over the past six months, the percentage of companies that have refinanced has significantly increased. Eighty percent of the businesses surveyed say they have completed refinancing, compared with 52% in October 2010. But for those that need to refinance, the speed with which they need funds is increasing rapidly. Nearly two-thirds need to refinance within six months, a three-fold increase since October 2010.

The results point to the availability of financing as a polarizing factor among boardrooms — dividing the corporate landscape into those who are thriving and well-placed to grow organically or through M&A and those who are struggling and lack the capital to compete.

80% all businesses in the survey have now completed or have no need to refinance.

Mergers and acquisitions outlook

Mixed messages for M&A.

The surge in global confidence is encouraging businesses to focus on growth rather than defensive measures.

In the short term, appetite for acquisitions is increasing, but overall, companies are focused on organic growth. This caution is driven by three dominant external factors that have arisen in the past six months: political instability in the Middle East; natural disasters and their impact on supply chains; and tax and inflationary concerns.

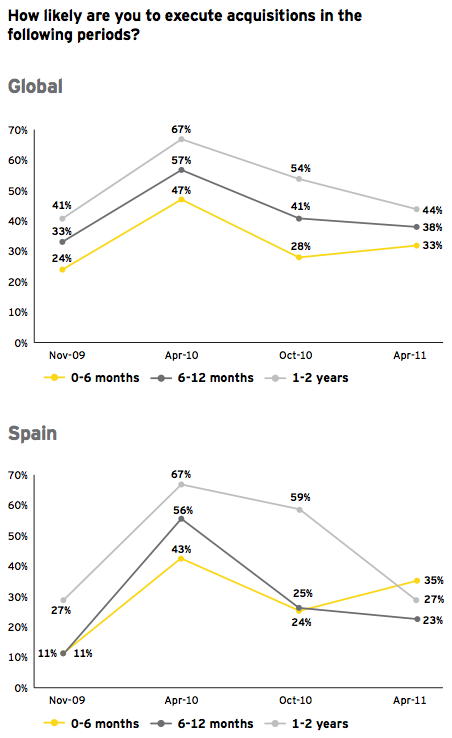

Worldwide a third of companies are likely to acquire in the next six months. Since October there has been an uptick (from 28% to 33%) in the percentage of companies likely to acquire in the next six months reflecting newfound confidence in economic recovery.

Longer term, nearly half of all companies expect to be acquisitive. The proportion likely to acquire in the next one to two years continues to decline. However, if the external factors diminish, we could see this figure increase.

Globally speaking, acquisitive sectors in the next six months include power and utilities, oil and gas, and pharmaceuticals.

35% of Spanish companies surveyed are likely to acquire in the next sex months.

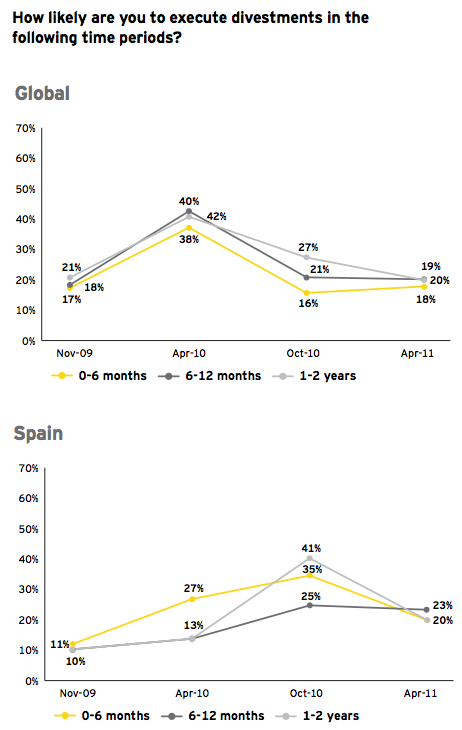

Divestment activity is also expected to rise in the short term. A fifth are likely to dispose of assets. Mirroring the acquisition trend, the percentage likely to divest over the next one to two years falls.

20% of respondents in Spain are likely to make divestments within six months.

Barriers to M&A are increasing.

The No.1 deal breaker now relates to the valuation gap between buyer and seller expectations, which leapt by nearly a third (from 38% to 50%). In October 2010, the biggest obstacle to completing an M&A transaction was stakeholder caution: more than half of companies (52%) cited it as a problem. Stakeholder caution is still a serious obstacle, but it has eased a little (down to 46%).

Management challenges, meanwhile, have grown in significance. Concerns over the uncertainty or complexity of valuations are significant and growing (from 41% to 49%).

Management is additionally demanding a stronger business case before supporting a transaction: the percentage of companies saying that business case thresholds or hurdle rates are blocking deals increased by a third (from 30% to 39%).

case thresholds or hurdle rates are blocking deals increased by a third (from 30% to 39%).

Emerging markets continue to drive growth.

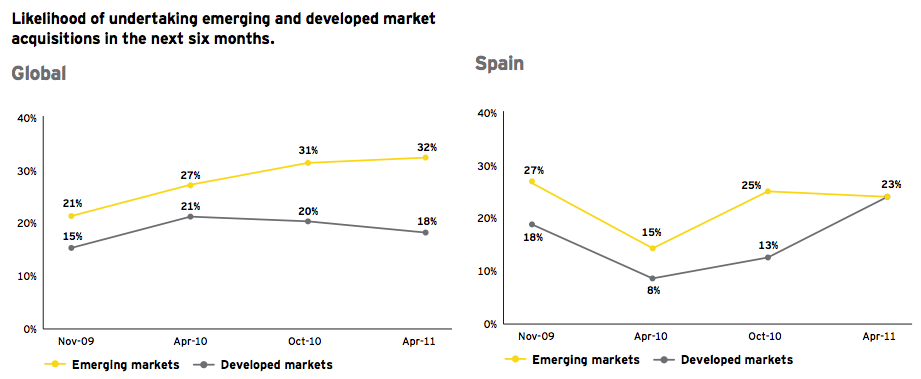

Enthusiasm for globalization and emerging market investment remains strong as companies look for ways of fueling growth.

The percentage of companies saying they are considering an emerging market acquisition within six months is 50% higher than it was in November 2009 and continues to rise. By contrast, interest in developed market transactions is low and falling (to 18% from 21% this time last year).

Sectors most likely to acquire in the emerging markets are automotive, consumer products, mining and pharmaceuticals.

The most popular structure for an emerging market transaction is a joint venture/alliance (29%). This is not surprising given the significant risks associated with an emerging market investment, not least in the areas of business culture and growing domestic protectionism. Moreover, many organizations will be experiencing these risks for the first time.

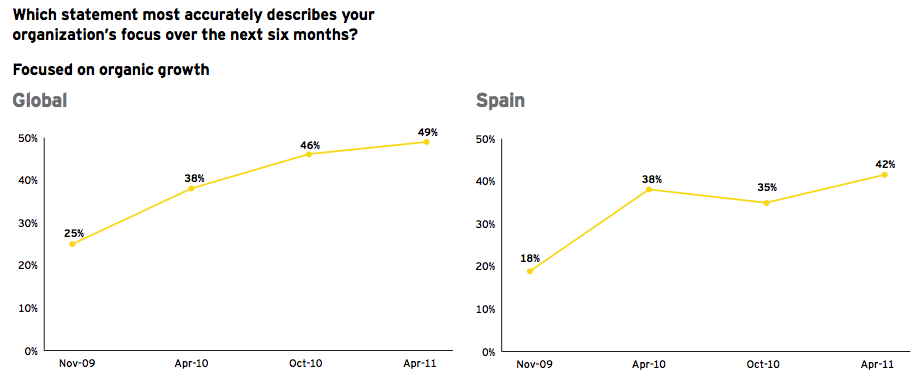

For most the No.1 priority remains organic growth.

Continuing the trend we saw in October, almost half of all companies are focused on organic growth, representing a 100% increase from 18 months ago. By contrast, only a third of companies say they are focused on M&A activity, a small increase on October 2010 but still a fifth fewer than 12 months ago.

Short term fixes remain important, but the focus now is on building sustainable improvements.

In the aftermath of the financial crisis, leading companies took immediate protective steps to preserve cash and reduce costs. Companies are now focusing on improving long term business performance.

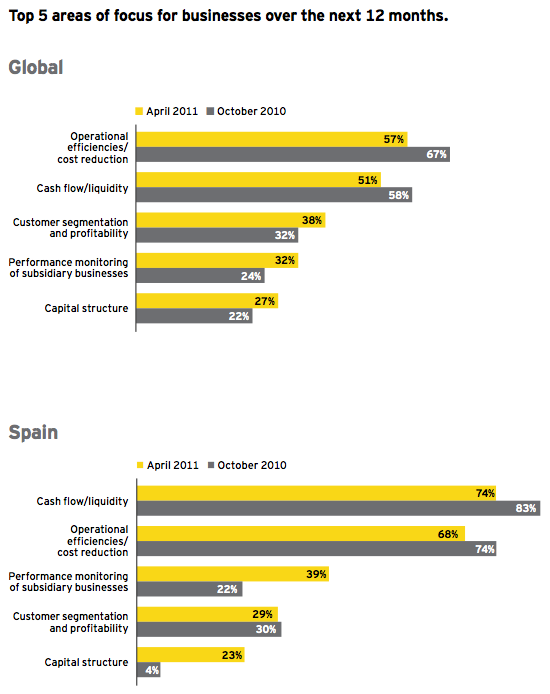

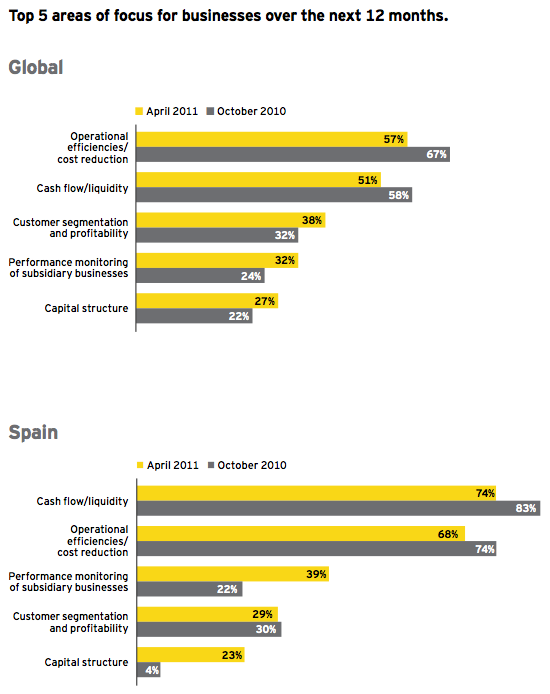

In October 2010, two-thirds of companies were focusing their efforts on cutting costs and improving cash flow. While these remain key priority areas, the percentage of companies planning to give increased focus to them over the next 12 months is falling.

In Spain, cash flow and liquidity issues continue to be the primary focus for companies (74%) closely followed by cost reduction and operational efficiencies (68%).

Companies are now moving on to the tougher challenge of building sustainable improvements into their business operations. Areas where they plan to invest greater effort include customer segmentation, performance management of subsidiaries and optimizing capital structures. There is also increased effort on acquisition integration and tax efficiency which doubled (from 6% to 14% and 5% to 10% respectively).

The two-speed boardroom.

The business outlook is improving for companies that have completed refinancing and started the work of optimizing their operations. But for those left behind, the opportunity to catch up could be disappearing fast. This polarization is clear.

While the majority of companies have refinanced their balance sheets and set a strategic course, 1 in 10 remain focused simply on survival. Such companies will increasingly find themselves with their options diminished. For some, their business model has been permanently impaired.

While the majority of companies have refinanced their balance sheets and set a strategic course, 1 in 10 remain focused simply on survival. Such companies will increasingly find themselves with their options diminished. For some, their business model has been permanently impaired.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter