Publications Banking On Consolidation: To Gain The Scale Needed To Compete, Mid-Tier Firms Need To Join Forces

- Publications

Banking On Consolidation: To Gain The Scale Needed To Compete, Mid-Tier Firms Need To Join Forces

- Christopher Kummer

SHARE:

By Doug Stotz, Arjun Saxena and Sanchit Tiwari – PricewaterhouseCoopers

The U.S. banking industry has largely sat out the impressive surge in M&A activity of the last few years. Total deal volume hit a record US$2.3 trillion in 2015 — up 64 percent over 2014. But banks accounted for just 3 percent of the total value, despite the fact that they account for 9.3 percent of total market capitalization. That’s about to change: We believe the pace of M&A in U.S. banking will accelerate sharply in 2016.

The market structure of U.S. banking is obsolete, and the industry’s profitability has been weak for nearly a decade. Regulatory and competitive pressures are making it hard for most banks to grow revenues and profits. The convergence of these trends makes it imperative that banks consolidate to gain scale and lower their cost structures. As a result, we expect significant consolidation among mid-tier players — those banks with between $10 billion and $250 billion in assets.

Despite the failures of several large banks and hundreds of mergers in the past decade, the U.S. banking market remains significantly more fragmented than the markets of other large developed nations. State and federal regulations — particularly a ban on interstate banking — that remained in place until the 1980s discouraged concentration in the banking sector. Although these restrictions have largely been repealed, the U.S. still has more than 15 times the number of regulated depositories as the U.K., Canada, or Australia. The top four to six banks in each of those countries account for 90 percent or more of total deposits. But even the 20 largest banks in the U.S. control only 59 percent of total deposits.

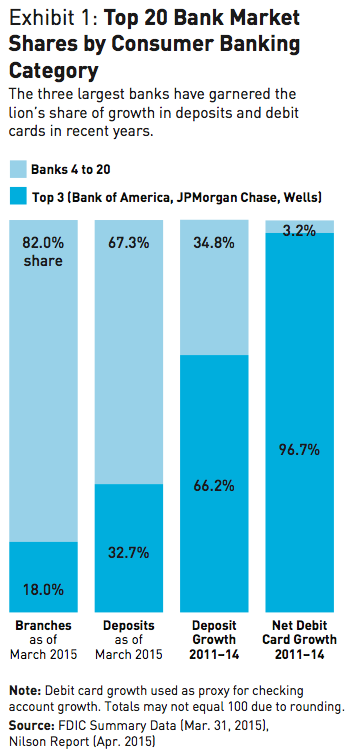

Although the U.S. banking system is fragmented, the very largest banks are capturing most of the growth in key lines of business. Between 2011 and 2014, the three biggest U.S. banks — Bank of America, JPMorgan Chase, and Wells Fargo — accounted for nearly two-thirds of deposit growth and virtually all the net growth in debit cards, which is a good proxy for consumer checking accounts (see Exhibit 1).

Given their scale, these large players can significantly out-invest other banks in brand marketing, data analytics, and digital products and services.

The Revenue and Profit Squeeze

The primary driver for M&A activity is the difficulty that banks face in raising profits. Almost all U.S. banks are confronting significant profitability problems. Returns on equity for 74 percent of banks with $10 billion to $150 billion in assets were below their long-term cost of capital (approximately 10 percent) in 2014.

As a result, price-to-book-value ratios are low by historical standards. And that makes the U.S. banking sector an attractive hunting ground for potential foreign acquirers and for activist investors.

With activism rising through-out the industry, targets are no longer limited to small players, as shown by recent campaigns against larger specialized and regional banks. The activists include Trian Partners (which has targeted BNY Mellon and State Street), Green-light Capital (Citizens Financial, CIT Group), Basswood Capital Management (Hudson Valley Bank, Synovus, Astoria Financial), and Hudson Executive Capital (Comerica, CIT Group). This activity will likely increase. PL Capital has announced a new private equity fund focusing on banks with between $3 billion and $75 billion in assets.

It is clear that banks will have difficulty boosting profits on their own. Merely to raise the return on equity in the sector to equal their 10 percent long-term cost of capital, banks would need to increase cumulative pretax profits by 35 percent — a total of $38 billion per year. This increase would need to come from a combination of cost re-engineering and revenue growth.

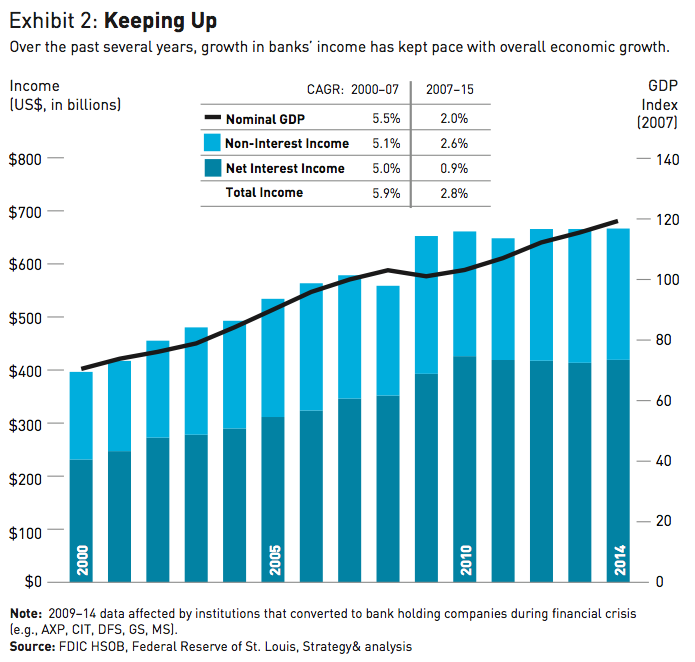

Improving the bottom line is likely to be difficult because the top line isn’t growing much. Overall revenues have been under pressure since their 2007 peak at the crest of the previous business cycle. Net interest income has been flat in the post-2007 era, thanks to low interest rates and a flat yield curve. Digitization and new regulations have also driven down volumes and margins across capital-markets and sales and trading businesses.

Despite the failures of several large banks and hundreds of mergers in the past decade, the U.S. banking market remains more fragmented than the markets of other large developed nations.

Noninterest income has also been flat, due to a series of postcrisis legislative initiatives that adversely affected fee-based revenue in deposit taking, credit cards, and payments. Ongoing scrutiny from the newly created Consumer Financial Protection Bureau has driven down pricing and ancillary revenues in consumer-facing businesses such as mortgages, deposit banking, credit cards, student lending, auto lending, and unsecured lending (see Exhibit 2). Banks have also ceded market share to nonbank players in businesses such as subprime lending, asset management, proprietary trading, and wealth management. In particular, nimbler, non-regulated financial technology players such as LendingTree, Lending Club, and PayPal are intruding into the more lucrative, fee-based businesses of banks such as retail lending and global payments. Technology has lowered barriers to entry for these new competitors. Big data analytics and digital channels may be lowering costs of identifying and marketing to “cherry-picked” prospects.

How Consolidation Can Help

Given the anemic outlook for GDP and income growth, it will be difficult for the U.S. banking industry as a whole to show impressive top-line growth. However, consolidation can yield significant cost benefits. For a typical regional bank with retail and commercial businesses, 30 percent of total costs are variable by volume, 35 percent are driven by the branch network, and another 35 percent are “scalable” costs driven by organizational complexity.

Consolidation can help control costs by shedding excess branch capacity, as well as by spreading fixed regulatory, legal, compliance, and other organizational costs over a larger base. KeyCorp’s proposed $4.1 billion acquisition of First Niagara Financial Group, announced in 2014, is an example. KeyCorp plans to drive significant cost savings via an 11 percent consolidation of branches. Then it intends to reinvest part of the cost savings into online and mobile solutions and digital channels — where transactions are growing significantly faster than branch transactions — as well as in strategic partnerships to improve automation, regulatory compliance, and customer experience.

For some smaller to midsized banks, building scale via M&A is crucial. Under legislation enacted in 2010, regulatory cost and complexity rise sharply for banks when total assets hit thresholds of $10 billion and $50 billion.

For banks nearing these levels, acquiring or merging with another bank can effectively lower these costs by spreading them over a larger base. For example, New York Community Bancorp ($50.3 billion in assets) agreed to purchase Astoria Financial Corporation ($16.5 billion in assets) in a $2 billion transaction announced in 2015. The combined company will have assets of some $64 billion, moving decisively past the $50 billion threshold.

Deals to expand into adjacent products or markets or to add capabilities may also make strategic sense. Examples include RBC’s recent acquisition of City National to add private banking and business banking to its U.S. retail brokerage and capital-markets franchise; Capital One’s expansion into healthcare lending through the acquisition of GE Capital’s healthcare lending business; and Barclays’s acquisition of Logic Group to enhance payment and loyalty technology capabilities.

Vertical integration, such as CIT Group’s 2015 acquisition of OneWest Bank, is another option. The $3.4 billion deal enabled CIT to add a branch banking franchise to its commercial lending and leasing platform, creating greater liquidity and growing net interest margin through replacing wholesale funding with cheaper retail deposits.

Shoring Up the Banking Sector

It is clear that a healthy U.S. banking sector that earns its cost of capital, and that can continue to support the credit, payments, and risk management needs of an expanding economy, would be in the interests of customers, bank shareholders, regulators, and other industry stakeholders. The developments and trends we have outlined, however, demonstrate that significant consolidation is needed to enhance profitability and enable more banks to invest in growing markets and key strategic capabilities such as digitization, analytics, and branding.

The challenge is that regulators are averse to the largest banking institutions (those deemed to be “systemically important”) getting any bigger. As a result, they have argued against further consolidation among top-tier banks. In any event, the national deposit cap, which prevents any single bank from amassing more than 10 percent of total U.S. deposits, would prevent any acquisitions of major depositories by Bank of America, JPMorgan Chase, or Wells Fargo. Several of the nation’s largest institutions are seeking to reduce their scale and complexity as a result of regulatory constraints. So, too, are systemically important nonbank institutions such as GE Capital and MetLife. As a result, these larger institutions are exploring divestitures and spin-offs.

For all these reasons, we believe that the needed consolidation will be concentrated among mid-tier banks. Based on our analysis, $600 billion worth of M&A would be needed to provide enough cost savings to boost the return on average equity of the sector by 2 percentage points — thus allowing it to earn its cost of capital.

Over the next year or more, U.S. bank CEOs, CFOs, and boards of directors should give serious consideration to M&A as a strategic lever. They need to analyze and develop a view on whether they could drive cost efficiencies and revenue synergies as an acquirer, or drive shareholder returns as a target. They should articulate a deal thesis as part of their three- to five-year strategy, and consider whether there are unique capabilities that they would seek to obtain from, or contribute to, a prospective deal. And they should conduct preliminary reviews of potential targets’ balance sheets, as well as their capabilities and customer profiles. Finally, they should explore opportunities to accelerate growth of digital capabilities through investments in, or acquisitions of, financial technology players.

A merger won’t always be a sufficient tactic for midsized banks to gain the scale and operating efficiencies needed to compete in today’s environment. But given the field in which they now operate, it may be a necessary one.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter