Publications Aerospace & Defense Cross-Border Joint Ventures: Managing High Complexity, Driving Remarkable Growth

- Publications

Aerospace & Defense Cross-Border Joint Ventures: Managing High Complexity, Driving Remarkable Growth

- Christopher Kummer

SHARE:

By Prashant Parikh, Nicholas M. Florio – Deloitte

Preface

While the shrinking defense budgets in the US and Europe coupled with the robust backlog in commercial aerospace are front and center in the Aerospace & Defense (A&D) industry today, vibrant growth in the form of cross-border joint ventures across new centers of excellence is quietly laying the framework for the long term direction of the A&D industry. Business planning for these joint ventures will potentially demand executives understand a level of complexity that is relatively rare in other industries.

This paper highlights emerging trends in the global A&D industry for capital formation broadly and cross-border joint ventures in particular. Capital formation trends are examined based on the level of debt and equity capital raising in global capital markets by the A&D industry. These trends indicate the shifts in A&D industry dynamics. The key factors examined in this paper will be critical for creating long term value for the A&D cross-border joint ventures.

A&D Capital Raising Trends — Development of a Multi Polar World

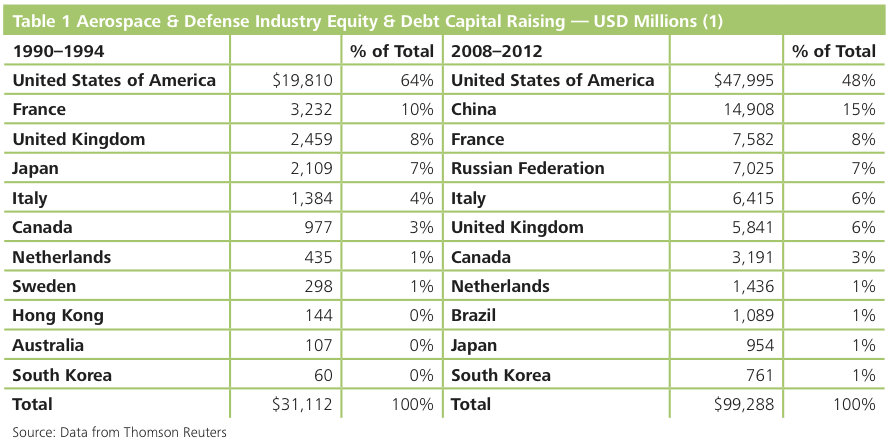

From 1990 through 2012, the A&D industry has raised approximately $308 billion from the global equity and debt capital markets. In the first five years of this period from 1990 through 1994, this capital raising was dominated by the US and Europe. In the last five years from 2008 through 2012, China, the Russian Federation, Brazil and South Korea have entered this mix. The growth of capital raising in these countries is nearly twice that of capital raising in the US and Europe.

While the US accounted for 64% of capital raising from 1990 through 1994, this has declined to 48% in the 2008–2012 periods. What are the trends that are emerging here? These include:

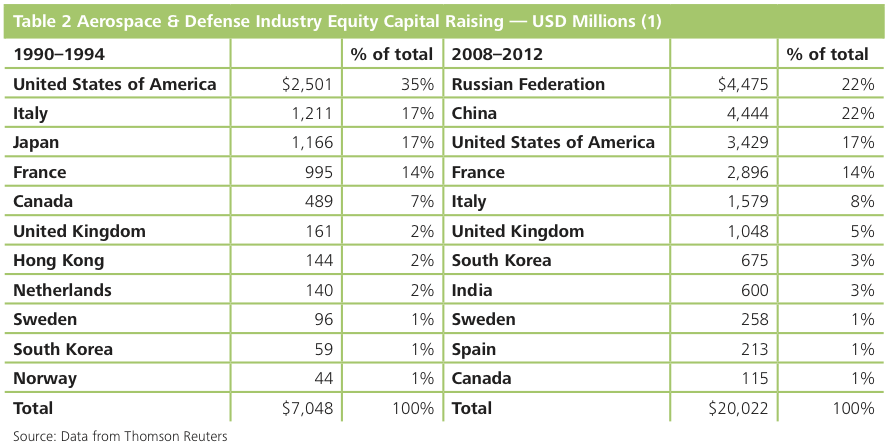

A multi-polar A&D industry: While the defense industrial base outside the US and Europe is relatively young and in an expansion mode, it is likely that the new centers of excellence in China, Brazil, India, South Korea and other such countries will foster the growth of a larger ecosystem in adjacent countries. While significant cross-border mergers and acquisitions at the tier 1 levels will likely continue to be limited due to regulations and national security concerns, the growth of this multi-polar A&D industry may create new inorganic growth opportunities at the tier 2, 3 and 4 levels. In general, technology transfer, manufacturing best practices, marketing excellence and relationships with prime contractors should collectively drive cooperation agreements, joint ventures and M&A at the tier 2, 3 and tier 4 levels in the A&D industry. The level of equity capital raising in the A&D industry is dwarfed by the level of debt capital raising in the period we examined from 1990–2012. In this period, equity capital raising globally was $82 billion while debt capital raising was $226 billion. While the US led the world and accounted for 35% of equity capital raising in the A&D industry in the 1990–1994 period, its fraction in the last five years ranks third after that of Russia and China. Clearly, capital markets have developed considerably across different global regions and this explains a part of the trends. Other notable drivers are discussed below.

Relative differences in maturity and innovation: In the US and Europe, the various sectors within the A&D industry are generally comprised of well-established companies, who are able to fund innovation through cash flows from operations as well as cheaper debt financing; or such innovation is pursued by smaller private companies. In the new centers of excellence, increases in defense budgets, reforms to the defense-industrial policies, and improvements in R&D and production methods are accelerating the expansion of their A&D industry, which in turn is creating a sweet spot for equity capital raising. The differences in the risk-reward proposition in the new centers of excellence will likely attract foreign know-how, resources, and capital. However, interested parties will have to carefully plan their holding and exit strategies, given differences in governance, regulations, political risks and end-market volatilities.

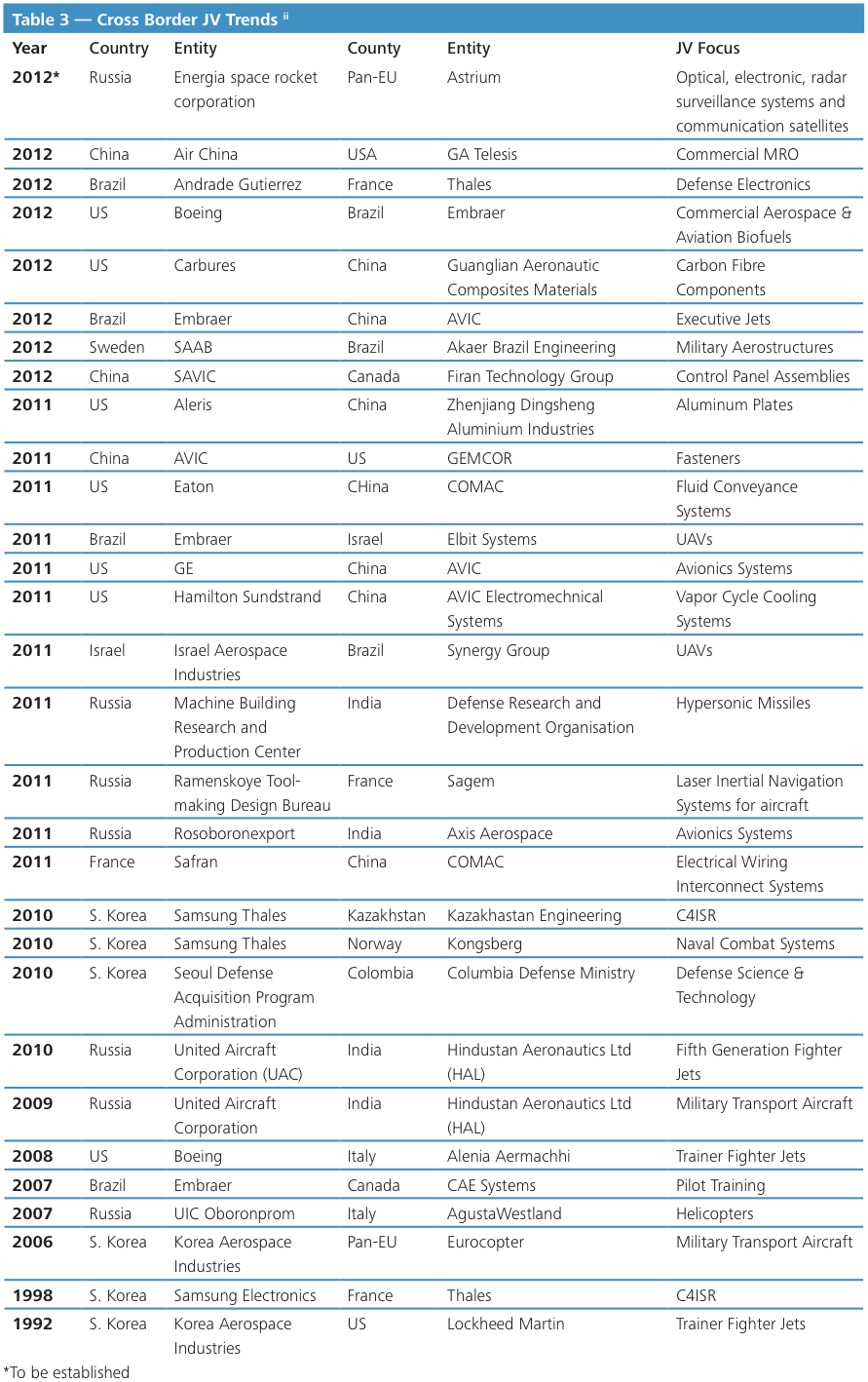

As shown in Table 3, cross-border JV activity is reaching every sector within the A&D industry. While the A&D industry typically has seen relatively low levels of cross-border M&A, given the inherent restrictions, JV activity is providing a highly positive catalyst for the exchange of resources, capital, and technology across border. From C4ISR to shipbuilding, from avionics to business jets, from state owned enterprises to private companies, JVs are providing an enhanced connective tissue that will shape the structure of future growth in the industry. JVs some times are the only way to access certain markets, may allow companies to take on a more manageable level of risk, and meet national security concerns.

So, what are some of the complexities that are built into this development that executives now have to plan for?

1. Nation-state geopolitical alliances: The level of cooperation between nation-states and the medium to longer term stability of these alliances does impact the growth trajectory of A&D industrial bases in various nations. As such, this is a key factor in business planning for A&D cross-border JVs.

2. Decisions about the end-markets that can be targeted successfully: A&D products and services developed and originated from certain geographies find some natural markets that quickly feed growth, given the overall level of import-export activity, while other markets offer obstacles that can be challenging to overcome. Planning for these early can prove helpful in subsequently crafting targeting strategies.

3. The nature of supply chains: A&D supply chains are complex and crucial for achieving business goals. Cross-border JVs offer a new set of challenges to seasoned supply chain professionals to design, develop, and sustain strong supply chains.

4. The ability to change control: Cross border JVs often are entered into with complex exit mechanisms. Business executives should carefully consider options that are available and exercisable to change ownership, and the resulting risk-reward equation. Such planning will not only have to consider local regulations, but also such other elements as the feasibility of pursuing liquidity events both in country as well as potentially interested parties in other geographies.

5. Offset policies and requirements: Offset policies and requirements vary considerably across countries and are one of the principal drivers of JV activity as well as offering a rich source of catalysts for a variety of other business arrangements such as technology transfer, cooperation agreements, and M&A.

6. The value of JV partner contributions: The value of A&D cross-border JVs is built on the complementary contributions of the partners, the ability to tap additional markets as a combination as well as the risks associated with new markets, new products, and joint decision-making.

7. Technology transfer and protection: The new markets offered by cross-border JVs provide new uses for technology, which should be factored in during business planning. In addition, these new markets also will operate in a different legal system that affects the nature of legal remedies available.

8. Lack of familiarity with competition: Competitive dynamics in current markets are often well understood and planned for. However, new markets open up new sources of competition, which may not be apparent at the onset. Measuring and navigating these competitive elements — while maintaining the strength of certain core competencies — is key to cross-border JVs.

9. Marketing collaborations: There are known-knowns, known-unknowns, unknown-knowns and unknown-unknowns. Cross-border JVs offer parties opportunities to explore a number of new known and unknown markets, and evaluate collaboration opportunities.

10. Dispute remediation: A key element for cross-border JVs is planning for venues and approaches to dispute remediation. Understanding the approaches that can be taken and the level of remedies available can smooth out the dispute process if it is appropriately addressed up front.

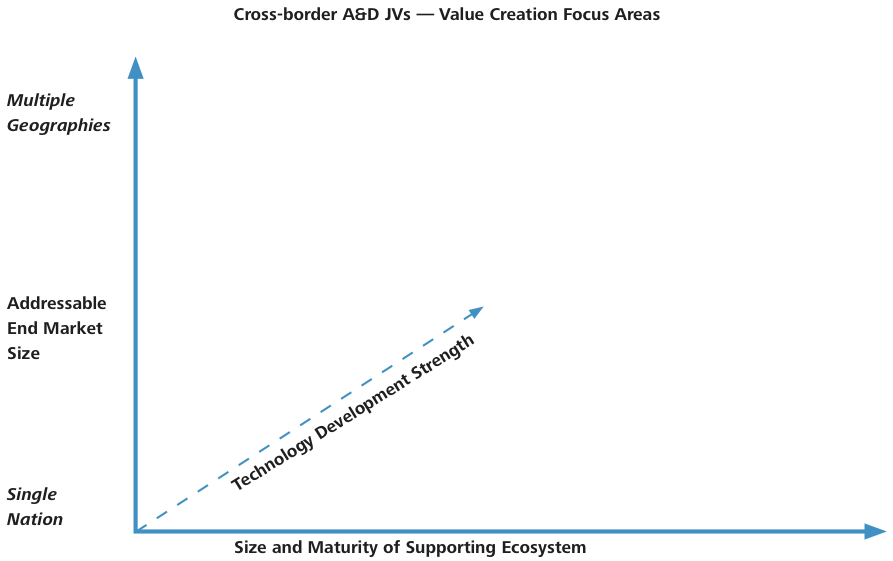

Looking across the broad swath of the cross-border A&D JVs, three factors will likely play a critical role in their long term value creation. Detailed business planning regarding these factors will address many of the complexities noted above.

1. The footprint of the end-markets that can be successfully pursued. That is, will the JV only be successful in the country of its incorporation, or will it be able to successfully target multiple national markets?

2. The size and maturity of the supporting “ecosystem” in which the JV will operate. That is, will the sector in which the JV operates in be supported by similar growth in the supply chain and other supporting sectors, such that higher levels of innovation and efficiency are achievable?

3. The strength of technology development. That is, the degree to which the JV will be able to reach if not surpass the level of R&D capabilities and product strength that is achieved by the market leaders.

Conclusion

By its very nature, the A&D industry has always challenged and exceeded the boundaries of multi-disciplinary progress. In an increasingly interconnected world with increasing transfer speeds for resources, capital and information, cross-border A&D JVs are providing a unique path to value creation. The nature of products that will be created and the opportunities for shareholder value will be of keen interest to the A&D industry. Those entities that achieve excellence will likely create exemplary models for profitable growth.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter