Publications 2015 Banking M&A Outlook: Poised For A Rebound

- Publications

2015 Banking M&A Outlook: Poised For A Rebound

- Christopher Kummer

SHARE:

By Deloitte

Overview

Following a five-year slowdown in banking sector mergers and acquisitions (M&A), 2015 activity appears to be poised for a rebound across both small and large regional banks. At the same time, the global banking sector is expected to continue its pruning of non-strategic businesses and/or duplicative operational centers, creating opportunities for further business system rationalization and increasing focus on areas of specialization. Key factors supporting a more optimistic view of banking and securities M&A include improved profitability across the sector; accelerating loan growth; less ambiguity on the regulatory front; and an improving U.S. economy, as evidenced by the Federal Reserve’s October 2014 end to the bond purchases (quantitative easing) that have stimulated growth since the 2008 financial crisis.

These improvements notwithstanding, headwinds remain. The market may be challenged by an unexpected extension of the prolonged low interest rate environment, heightened regulatory scrutiny of potential transactions, and cautious acquirers and sellers – with valuations varying widely based on fundamental differences pertaining to each target.

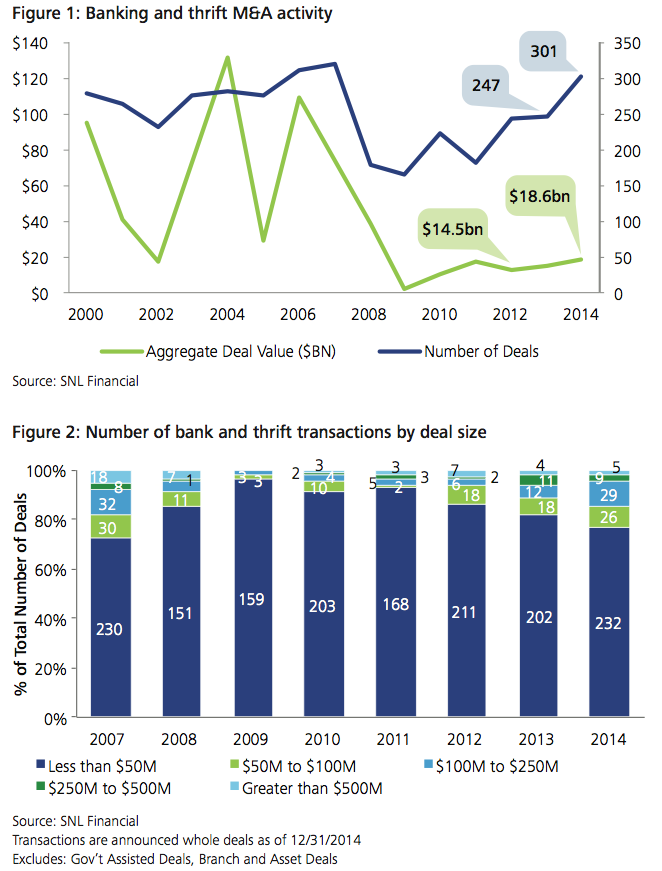

The fact remains that banking M&A activity improved in 2014 – more deals were executed and aggregate deal value improved. Through December 2014, there were 301 deals, more than the 247 for all of 2013. Total deal value in 2014 was $18.6 billion, up from $14.5 billion in 2013 (Figure 1). As important, larger deals also were inked in 2014 (e.g., CIT Group/IMB HoldCo at $3.4 billion deal value, BB&T/Susquehanna at $2.5 billion, Banner/American West at $702 million, First Citizens Bancshares/First Citizens Bancorporation at $676 million, and Sterling/Hudson Valley at $538 million).

As in the previous year, the vast majority of 2014 M&A activity took place at smaller, community banks. Of the 301 deals initiated in 2014, only five had deal value in excess of $500 million, compared to seven deals and four deals in 2012 and 2013, respectively (Figure 2). We expect small deals to continue at the increasing level of the past few years, with more deals over $500 million.

Looking ahead, it appears that transaction volume will continue to increase throughout 2015, with large banks continuing to divest and restructure, and more deals in the middle market as capital-rich banks engage in selective acquisitions, small banks consolidate to gain scale, and some specialty providers look to tap into deposits from traditional depositories. As they plan their M&A strategies, bank boards and executives should consider several factors that may impact M&A readiness, execution, and post-deal integration.

Top issues for banking M&A in 2015

1. Regulatory realities

After years of ambiguity, the banking sector regulatory environment is gaining clarity, as several rules (e.g., Volker, liquidity, and risk retention) have been finalized since last year. The resulting implications for M&A, however, may depend, in part, on the size of the bank. Large banks may find themselves limited to divestitures as a result of the restrictions emanating from Basel III capital requirements, new liquidity rules, stress testing, Systemically Important Financial Institution (SIFI) considerations, and Bank Secrecy Act compliance. Mid-tier banks, meanwhile, may look for deals that “move the needle,” especially if the resulting pro forma entity significantly surpasses the $10 billion or $50 billion bright line regulatory asset size thresholds. For both large and mid-tier institutions, ongoing, elevated costs of post-crisis compliance may also encourage more consideration of alternative operating models. Among small banks, organic growth challenges, need for scale, and increased regulation may be some of the numerous factors that spur M&A activity in 2015. As they face the burden of heightened compliance costs, many small institutions recognize they need to become larger in order to leverage fixed costs, access a larger platform, and meet efficiency and other key performance ratio targets. Increasingly, consolidation for smaller and mid-tier banks has become a viable alternative.

Regardless of their size, banks contemplating M&A transactions in 2015 should consider the following regulatory issues:

LCR and NSFR Rules – In September 2014, U.S. regulators finalized rules on the standardized minimum liquidity requirements for large and internationally active banking organizations with assets of $250 billion and greater. Regulators also modified liquidity rules for smaller banks (i.e., assets of $50 billion to $250 billion). These rules establish a Liquidity Coverage Ratio (LCR) that would require institutions to hold High-Quality Liquid Assets (HQLA) equal to or greater than their projected net cash outflows during a 30-calendar day period under standardized supervisory stress scenarios. Because LCR rules require banks to have more readily available liquid assets, they could cause margins and profitability to decline (especially in a low-interest-rate environment), affect securities repurchasing (repo) agreements, and increase emphasis on retaining and acquiring deposits.

In October 2014, the Basel Committee on Banking Supervision issued the final standard for the Net Stable Funding Ratio (NSFR), which will become a minimum standard in the United States and more than two dozen other countries as of January 1, 2018. Like LCR rules, NSFR is a component of Basel III reforms. It requires banks “to maintain a stable funding profile in relation to their on- and off-balance sheet activities,” thereby reducing the likelihood that “disruptions to a bank’s regular sources of funding will erode its liquidity in a way that could increase the risk of its failure and potentially lead to broader systemic stress.” Both the LCR and NSFR rules may further increase the attractiveness of deposit-rich banks as acquisition targets.

Graduated common equity risk-based capital surcharges on U.S. GSIBs – In September 2014, Federal Reserve Governor Frank Tarullo detailed the Fed’s proposal to impose graduated common equity risk-based capital surcharges on U.S. Global Systemically Important Banks (GSIBs). The proposal is expected to be consistent with the standard in section 165 of the Dodd-Frank Act that capital requirements be progressively more stringent as the systemic importance of a firm increases. Many large banks have been proactively building their capital levels over the past few years in anticipation of this scenario. Bank capital structure continues to evolve towards pure equity capital and the layering-in of Tier 1 Eligible Preferred Instruments (Figure 3).

The increasingly stringent rules on capital and liquidity levels put in place by Congress and the Basel Committee may incentivize large banks to reduce their systemic footprint and risk profile by divesting non-core and/or underperforming businesses and markets, thus lowering their capital usage.

CFPB regulations for banks with retail operations – The Consumer Financial Protection Bureau (CFPB) is playing an increasingly influential role in banking M&A transactions, specifically looking at how banks treat retail customers. In November 2014, the CFPB issued several additional amendments to its 2013 mortgage rules under the Truth in Lending Act to address important questions raised by industry, consumer groups, or other stakeholders. The CFPB is also focused on auto and student lending practices. Banks should understand and focus on potential CFPB-related roadblocks early in the deal process in an effort to avoid going down the path with a deal partner that may not obtain regulatory approval.

CAMELS ratings – Low Capital, Asset Quality, Management, Earnings, Liquidity, and Sensitivity (CAMELS) ratings for prospective buyers and pending government investigations are precluding regulatory approval for certain deals. In general, unless a bank’s CAMELS rating is strong (a 1 or 2), regulators will withhold acquisition approval.

AML, KYC, fair lending, and CRC requirements – Regulators are continuing to scrutinize the anti-money laundering (AML), know your customer (KYC), fair lending, and Community Reinvestment Credits (CRC) practices of any bank seeking to engage in M&A, regardless of size. A buyer or seller’s failure to comply with these rules can be a deal-stopper. CRC reviews are becoming more robust, with regulators frequently mandating significant improvements prior to approving any M&A activity.

While banking confidentiality laws, rules, and regulations may make conducting detailed due diligence on regulatory status a challenge, banks should endeavor to do so and benchmark a target’s regulatory policies and procedures relative to their own and leading industry practices.

Compliance cost burden – For banks of all sizes, regulatory compliance is costly and onerous. Regulatory requirements increase as banks move through the regulatory thresholds at the $10 billion, $50 billion, $200 billion, and SIFI levels. The primary compliance costs are investments in additional systems and personnel – PhDs, risk managers, attorneys and others with specific and advanced skills – to track transactions in a variety of stress scenarios and provide the information regulators require on a consistent basis. Organizations will likely need to continue to build the infrastructure and models to run and interpret various scenarios that regulators are requesting. For example, regulators may expect smaller banks nearing an asset threshold to have the necessary capabilities, systems, and people to comply with the regulations at that next level. Therefore, banks of all sizes may need to revisit their operating models and consider the need to scale their cost structure as a potential deal driver.

BOTTOM LINE

The story of banking’s challenging regulatory environment is not new but it has solidified. For banks looking to grow through M&A in 2015, regulatory restrictions are expected to continue to present challenges. The bigger the players, the more restrictions on M&A; firms need to factor in the “SIFI” potential when considering deals of size or complexity. More stringent regulations may drive and impede M&A in the middle market, while compliance cost burdens may drive smaller banks to consolidate. However, increased clarity may also bring increased confidence. Improving economic trends are providing some banks with greater financial justification to take on regulatory challenges and move ahead with deal-making. Under this scenario, deals that are perceived to solve rather than create regulatory concerns have greater probability of obtaining regulatory approval. While heightened regulatory scrutiny may lengthen the time it takes to complete a transaction, well-capitalized buyers with strong M&A capabilities are announcing and closing deals.

2. Interest rate waiting game

Banks continue to play an interest rate waiting game. Despite assumptions that the Federal Reserve would increase rates in 2014, the U.S. remains in a prolonged low interest rate environment and a steepening of the yield curve has not happened. However, the market is seeing signs that monetary policy is starting to come into play, which could favor an interest rate increase. For example, in October 2014, the Fed ended the bond purchases (quantitative easing) that have stimulated growth since the 2008 financial crisis. And while the Fed declined to raise rates at its December 17, 2014, meeting, most officials still see the first increase taking place sometime in 2015, according to quarterly forecasts released the same day.

Fallout from the current low interest rate cycle includes compressed margins and underperforming bank stocks (relative to the broader market) as investors wait for an uptick in rates and a steepening of the yield curve. The yield curve remained flat from October 2014 to December 12, 2014 (eight weeks), the longest such stretch in 22 years.

Higher rates, coupled with a sustained increase in lending activity, could provide a boost to banks’ battered net interest margins, via higher reinvestment rates, better loan yields, and wider spreads. In turn, greater profits and margins can enhance a target’s attractiveness to potential suitors. Higher rates also could make deposits more valuable. Banks will need to consider the stickiness of their deposits as they evaluate how interest rates may move. One caveat: As interest rates and the yield curve go up, bank valuations also tend to increase. While this is good news for sellers, who can get a higher price for their institution, deals in general may become more expensive.

BOTTOM LINE

In 2015, the key interest rate question may no longer be, “When will rates rise?” but “How fast and how much will rates rise?” Rate increases will likely encourage M&A by enhancing the commercial prospects of many targets. Also, rising rates in the short term may cause market-to-market pain on Treasury portfolios; this may spur M&A by improving profits and margins and, thus, increasing a target’s attractiveness. Understanding Treasury strategy relative to the rate environment will continue as a critical area of due diligence in the current deal environment, as the speed of rate increases may be the single most important indicator of M&A activity.

3. Setting a higher bar for deal value

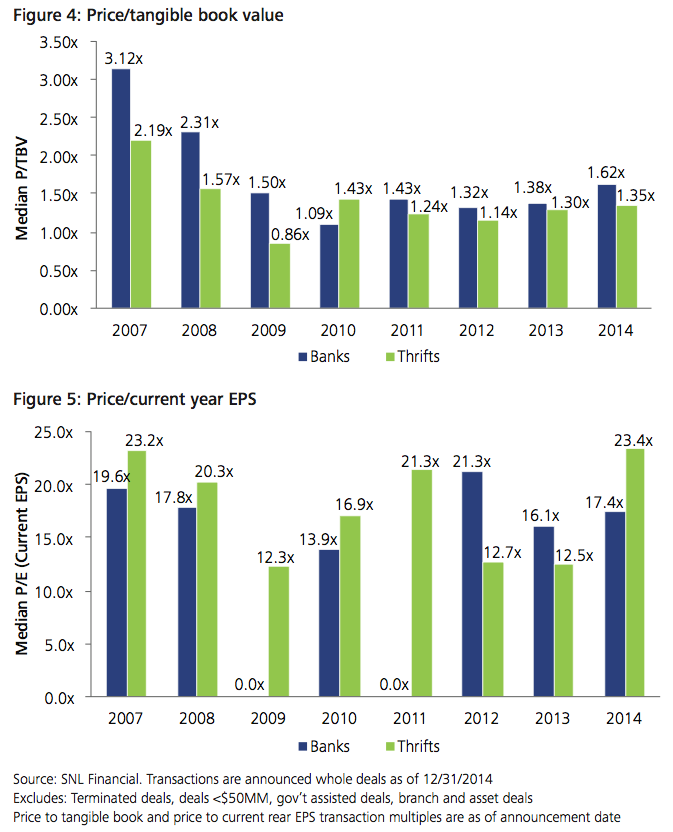

As of December 31, 2014, small cap banks were trading at 1.70x price/tangible book value (P/TBV), mid cap banks at 1.98x, large cap banks at 1.73x, and thrifts at 1.58x – still below historic levels but up from 2013. Transaction multiples, including price-to-book-value (P/TBV) and price/ current year earnings per share (EPS), continue to improve as sales of stronger banks drive recent deal flow. Both bank and thrift P/TBV transaction multiples have improved to 1.62x and 1.35x, respectively (Figure 4). Price/current year EPS is also on the rise. As of December 31, 2014, banks and thrifts had P/EPS transaction multiples at 17.4x and 23.4x, respectively (Figure 5).

Well-priced transactions structured with high EPS accretion and short earn-back periods for P/TBV dilution dominated deals early in 2014, but the latter half of the year saw lower EPS accretion due to higher pricing.

BOTTOM LINE

While banks consider both price/tangible book value and price/current year EPS when evaluating a potential deal, P/TBV remains the more important metric, as it is less influenced by short-term earnings growth. Pricing has recently improved in a meaningful way, heightening sellers’ expectations about where they might sell. But buyers remain cautious. As values deviate from fundamentals, they are likely to question sellers about whether the price is realistic. Based on the current pace of M&A this doesn’t appear to be a major obstacle; however, it may require extra time and effort for both parties to close the value gap.

4. Specialization and rationalization

It appears that banking sector M&A that supports customer, product, or geographic specialization will continue in 2015. Growth has been challenging since the downturn. Therefore, banks have implemented cost-cutting benefits, and have been focusing on which businesses and geographies present growth opportunities and where they have scale to compete.

Regulatory restrictions and low interest rates are making it difficult for global SIFIs and other large banks to acquire depository institutions. Instead, many SIFIs are looking to buy or grow asset-generators to help widen margins and fee-based businesses that are not capital-intensive (e.g., securities brokerages and wealth management advisory firms). This, however, is a crowded field; sellers are limited and increasing M&A activity is driving up prices.

Many large banks are looking at other options, and making tough decisions about which businesses, markets, segments, and products are core or non-core. Some are refocusing on strengthening their domestic operations. Others are rationalizing their global footprint by selectively and carefully maintaining a diminished local presence, exiting certain markets, or selling pieces of business to strategic partners. Some large U.S. banks are “following the customer” by aligning with institutions in other countries.

At home, U.S. banks’ efforts to rationalize branch networks and integrate alternative channels to differentiate the customer experience may drive new M&A (Figure 6). The number and size of bank branches continue to decline nationally; those remaining are evolving and diversifying beyond teller services. Large banks are expected to continue divesting branches in 2015 as a way to exit non-core markets or shed networks acquired through FDIC sales; smaller banks, in turn, have been buying some of the branches to gain local deposits or expand their footprint.

BOTTOM LINE

Many banks are taking a much more extended-enterprise view of their geographic and customer markets, committing capital either organically or via M&A to enhance where they are already well-positioned or where they see potential opportunities. Concurrently, they are exiting low-performing markets and low-margin service lines to improve capital deployment and efficiency. As they look to unlock potential M&A and investment opportunities, banks should assess their core strengths, understand the field and targeted opportunities, and execute transactions with rigor and an eye towards long-term strategic goals.

5. Small banks in the spotlight

Small community banks – generally described as those under $1 billion in assets – are at the epicenter of banking sector M&A, with some in a fight for survival. Many small banks are finding it difficult to fund expansion and/or capital improvements; are burdened by the cost and effort of regulatory compliance; and are experiencing board fatigue. These institutions recognize that they no longer can “go it alone” – they need economies of scale to survive.

Typically, large banks forego small bank acquisitions in favor of purchases that “move the needle,” but there is a growing trend of small, similar-size banks coming together in mergers of equals (MOEs). Consolidation can provide the financial, operational, and personnel scale small banks need to meet market, regulatory, and shareholder expectations.

Seeking scale to survive is not the only reason that small banks are engaging in M&A. Some institutions have talented C-suite executives who see growth opportunities in merging with other small institutions, with sellers attracted to the potential of a rising combined stock price over time. In addition, numerous small banks are located in desirable geographic areas – those with higher-than-average growth rates or household incomes – that can give acquirers a more desirable footprint. Also, there may be less “red tape” when transacting at the small, community bank level. Finally, as small banks become more comfortable with regulatory reporting requirements – institutions that pass the $10 billion mark are subject to formalized stress tests and increased regulatory requirements – many are adopting a “go big or go home” approach to serial acquisitions that will place them well above the next threshold to help balance additional regulatory supervision and compliance costs against the benefits of increased scale.

BOTTOM LINE

Today’s successful, profitable small banks tend to share some characteristics: They rationalize their footprint in markets with shrinking populations or incomes and grow via acquisitions in targeted areas with increasing populations or incomes. They “own” their zip code and are such an important presence in a geographic area that they can profitably compete against big banks. These community banks are taking advantage of their strong balance sheets, M&A skills, and improving regulatory clarity to become serial acquirers – buying smaller banks at the rate of two to four deals a year to grow assets and customers, and expand their footprint.

6. Non-traditional providers encroach on traditional banking space

The banking business is being redefined, as services traditionally provided by depository institutions continue to move outside the banking system. In recent years this movement included residential lending and servicing. Today, non-traditional providers are encroaching in areas such as card processing, consumer lending, and business treasury services. The proliferation of these disruptive innovators threatens to disintermediate banks from their customers, will likely add to banks’ revenue and margin challenges, and may prompt a new wave of technology- and capabilities-focused M&A as banks respond to the challenge.

Non-traditional market entrants and private equity firms have been benefitting from holes in the current banking system – the un-banked and under-banked markets, for example – to engage consumers with new lending and financing vehicles that are easier, more convenient, and less risky than existing models. While profitably serving the under-banked has long been a challenge, these organizations are using technology – sometimes acquired through M&A – to cost-efficiently offer check cashing, money transmitting, prepaid cards, and similar products and services.

A number of hurdles exist for non-banks operating in or planning to enter this space, not the least of which is intense regulatory scrutiny. Both the Justice Department and the CFPB are seeking to safeguard consumers outside the banking system from predatory pricing (e.g., payday lenders) and other abusive and deceptive practices. For example, the CFPB is expected to regulate prepaid cards; such a move may open the door for banks already accustomed to regulatory compliance to provide these cards in a less costly way than non-banks and recapture some revenue and market share.

The payments space is a hotbed of activity, with new competitors introducing technology-based alternatives to bank-issued credit cards. Examples include mobile payment applications (e.g., Apple Pay, LoopPay, and PayPal) which give consumers the ability to make secure payments using their smartphone at any physical merchant and mobile wallets (e.g., Passbook and Google Wallet) that house all of a consumer’s credit and debit products. These innovations are designed to “envelop” the consumer and, thus, add a new level of disintermediation for traditional bank providers. Today, non-traditional payment vendors are getting their feet wet by acting as the “face” to the consumer while banks continue to provide the traditional back-office services. Tomorrow, when these vendors more fully understand the potential benefits they can gain from these consumer relationships, will they be content with what they have or will they go after banks’ part of the relationship too? Or might federal regulators step into the payment system and decide who will be able to provide specific services?

Banks should also be aware of non-bank competitors’ inroads with merchants, especially as the latter face significant costs and disruption related to their transition to Europay, MasterCard, and Visa (EMV) protocols by replacing magnetic stripe readers with new, more secure terminals capable of reading chip cards. As of October 2015, all U.S. merchants must have these terminals installed; if not, they accept liability for fraud, not the card issuer. Many merchants are questioning how effective EMV will be in coming years when more and more people are using mobile devices to make payments. Merchants also like how mobile payment gives them the opportunity to download offers and promotions in real time.

There is also growing interest in integrated payments, in which payment providers go beyond their traditional role as the “pipe” between a merchant’s store, the card network, and issuing banks to help merchants solve business problems – from working capital management to advanced marketing analytics – and making their merchant relationships “stickier.” Vantiv, Inc.’s acquisition of Mercury Payments Systems (completed in June 2014 at approximately 17.7x Adjusted EBITDA) is a good example of this. The acquisition is expected to enable Vantiv to further expand its set of payments solutions, “including online and omni-channel commerce capabilities, to Mercury’s roster of technology partners and dealers.”

Banks may need to address the growing challenge of non-traditional competitors sooner rather than later, or they risk revenue and market share leakage. Nevertheless, many large U.S. institutions are reluctant to introduce new products or services that could cannibalize lucrative existing offerings, such as credit card issuers who want to protect the very healthy two-to-three-percent margin they currently earn on transactions – these banks might consider developing alternative card products or ways of moving money that circumvent actual card use. Other banks are identifying both traditional and non-traditional ways to compete against market disruptors – recent data shows that banks have even taken share away from non-banks in some areas.

In the credit and payments space, for example, there is room for innovation in wealth management and retirement. And while banks’ recent willingness to provide more financing to non-banks for lending (e.g., commercial or mortgage loans) has increased the overall lending capacity of these organizations, many banks have the option and ability to move some of this business in-house if they are willing to have direct loans on their balance sheet. In addition, some banks are acquiring non-traditional lenders to gain books of business or innovative technologies. Finally, banks that prefer not to compete directly against new market entrants in, for example, basic payment processing and servicing, are looking to add revenue streams in adjacent areas. These may include education payments, financial protection products, extended or micro-insurance, and mobile applications that re-establish a direct bank-to-consumer connection.

BOTTOM LINE

Wherever non-traditional providers find parts of the traditional banking value chain to be attractive, everything is up for grabs. In the loans and payments spaces, in particular, banks are finding their share and margins being eroded by technology-savvy competitors. In addition to protecting their traditional offerings, banks should consider making strategic investments in adjacent spaces, different business models, and emerging technologies so they can compete in and benefit from a non-traditional marketplace. Banks need to decide where they will play. The industry still needs someone to underwrite risk and manage regulatory compliance. Banks have the experience and infrastructure to do both but what are banks going to do about strengthening the consumer/merchant experience and their brand? Continue to go it alone and develop solutions in-house? Create partnerships? Acquire individual technologies or entire competitors? Depending on regulatory and market conditions, any or all of these options could prove to be a net positive for M&A.

7. Adapting M&A strategies for today’s deal environment

Most serial acquirers are adept at generating value from M&A. They have a well-prepared business development team and constant dialogue with investment bankers to identify potential targets. They conduct thorough due diligence; follow a playbook; and are effective at integrating and generating synergies from an acquisition. Importantly, these banks also have the capabilities and infrastructure necessary to comply with applicable regulatory requirements – and they involve regulators early in the deal process. In short, serial acquirers are prepared to go through the M&A process – an essential strategy for any bank, regardless of size, that is contemplating a transaction.

While the banking sector may have few serial acquirers, there are numerous prospective buyers who have been sitting on the sidelines and may be ready to re-enter the game. Before moving ahead, however, acquirers should be mindful that almost nine in 10 respondents to Deloitte’s 2014 M&A trends survey indicated that transactions completed in the past two years have not generated their expected value or return on investment. Execution gaps/failure to capture synergies, economic forces, and market or sector forces are the three main reasons why transactions did not generate the expected value for their company. Banks contemplating M&A should focus on the factors that can help contribute to deal success and those that may cause a deal to fall short of its desired potential. As part of their readiness preparations, organizations should:

• Assess whether a potential target is a true strategic fit. An acquisition should provide the scale, capabilities, or market presence needed to move a bank’s strategic plan forward in a significant way, particularly if the deal has the potential to cross an asset size threshold.

• Conduct a thorough self-assessment (e.g., technology scalability, in-house versus managed service provision, talent gaps, control robustness) focusing on how and where an acquisition might make significant improvements or create redundancies.

• Consider more than the direct financial aspects of due diligence. Deals tend to fail to meet targeted returns due to subtle issues such as synergy miscalculations or invalid assumptions, unanticipated operating costs, and higher-than-expected compensation costs. Therefore, due diligence should be much more functionally focused than it was prior to the financial crisis.

• Demonstrate regulatory readiness. Before engaging in M&A, both buyers and sellers should verify that they can demonstrate regulatory compliance and that they have addressed any deficiencies examiners may have found in their institutions.

• Consider making a relatively large acquisition rather than numerous small ones. Regulators may not view favorably serial acquirers who fail to fully integrate their acquisitions. Also, investors generally want to see the synergies each deal creates before banks acquire multiple times.

BOTTOM LINE

Generating value in today’s M&A environment is likely to require that bank boards and senior executives pay heightened attention to market conditions and deal dynamics that extend beyond due diligence and pro forma transaction metrics. These are likely to include changing regulations, a target’s risk profile, and the combined entity’s post-acquisition integration needs.

Moving forward

Indicators that the banking sector is emerging from the end of a trough cycle signal increased M&A in 2015. Among potential drivers (both positive and negative) are an uptick in job creation and other improving economic conditions, the potential of rising interest rates after a prolonged low-rate environment, EPS and organic growth challenges, a heightened regulatory burden, and the need for scale.

Facing inroads by both traditional competitors and new market entrants, banks of all sizes will need to plan and play smart. As acquisitions, consolidations, and divestitures continue to rationalize the playing field, winners will likely be characterized by:

- Attractive demographics in their geographic footprint

- Diversified business mix and product set offerings, including business units that are not capital-reliant

- A strong core deposit base

- A solid earnings profile that can be augmented by both organic growth and opportunistic M&A

- Sufficient size and economies of scale to absorb heightened regulatory/compliance costs

- Strong capital and liquidity positions with additional readily accessible sources available

- Risk management as a strong competitive advantage A prudent and opportunistic approach to lending, together with an experienced and networked loan officer base

- A seasoned management team with credibility among stakeholders, including regulators, rating agencies, and investors.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter