Certified Post Merger Integration Expert (CPMI)

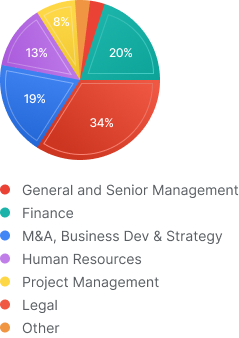

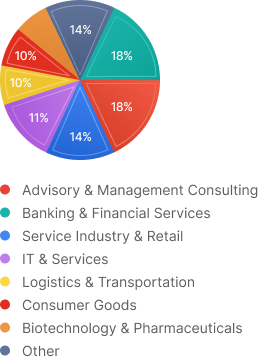

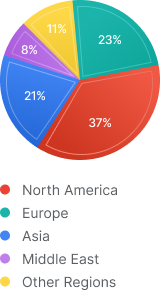

The Certified Post Merger Integration Expert (CPMI) is a tailored program to address the needs of advisors, Human Resource professionals, Project Managers, management consultants, change specialists, corporate M&A and integration teams. The program covers all aspect of the post-merger integration process from planning to implementation. The CPMI program is the only globally oriented Post Merger integration certification in existence and is internationally recognized.