Publications Post-Acquisition Performance: Contingency Of Acquisition Strategy

- Publications

Post-Acquisition Performance: Contingency Of Acquisition Strategy

- Christopher Kummer

SHARE:

11th International Strategic Management Conference 2015

By Liang-Hung Lin, Yu-Ling Hob, Wei-Hsin (Eugenia) Lin

Abstract

This paper concerns the relationship between acculturation in acquisitions (X1), the acquirer’s acquisition strategy (X2), and organizational integration (X3) between acquirer and target organizations, as well as their interactive effect (X1X2X3) on post-acquisition performance. The empirical results drawn by 154 acquisitions in the Taiwanese electronics and information sector reveal the existence of three-way interaction and show: (1) related acquisition with high degree of acculturation and integration is associated with high performance, whereas unrelated acquisition with low degree of acculturation and high degree of integration is associated with high performance; (2) organizational integration positively moderates the relationship between acculturation and performance; (3) integration has a stronger moderating effect in related acquisitions than in unrelated acquisitions.

1. Introduction

Acquisition has long been an interesting topic in various streams of management literature. In human resources studies, acculturation in acquisitions (X1) is argued to affect employee retention and manager turnover of the target firm (e.g., Cartwright & Cooper, 1993; Larsson & Lubatkin, 2001; Stahl & Voigt, 2008) because employees of the acquired firms constantly face pressure to conform to the norms and values of the acquirers (Haspeslagh & Jemison, 1991). A high turnover of top management team (TMT) and loss of human and social resources in the acquired firm can ultimately have a deleterious impact on acquisitions. Studies of strategic management (e.g., Hill et al., 1992; Miller, 2006) emphasize the importance of the acquirer’s acquisition strategy (X2) and consider different type of acquisition as different means to achieve acquisition gains. In organizational management literature, post-acquisition organizational integration (X3) is argued to be central in theories of organizational design because the execution of a well-designed integration process is important to maximize value creation and minimize value destruction following the acquisition (e.g., Birkinshaw et al., 2000; Puranam et al., 2009).

Scholars studying integration and acculturation describe the choice between complete absorption and autonomy maintenance (Håkanson, 1995; Haspeslagh & Jemison, 1991) as an important initial decision that further shapes integration actions and acculturation processes, and find no type of integration (Puranam et al., 2009; Zollo & Singh, 2004) and acculturation (Nahavandi & Malekzadeh, 1988; Stahl & Voigt, 2008) is ideal in all acquisitions. Three important relationships among acquirer’s strategy, acculturation and organization in acquisitions are also suggested by previous management literature: 1) acquirer’s strategic intension affects the degree of acculturation following an acquisition (Håkanson, 1995; Larsson & Lubatkin, 2001); 2) the extent of post-acquisition integration depends on the strategic contexts (Hill et al., 1992); 3) the degree of acculturation depends on both benefits and costs associated to post-acquisition integration (Larsson & Lubatkin, 2001). Since these three management decisions ( X1 , X2 , X3 ) accumulatively contribute to a successful acquisition, there is a need to develop a integrated model simultaneously examineing their separate effects and accumulated impact on acquisitions. By integrating these three relationships, this study examines the three-way interaction (X1 X2 X3 ) between acquisition strategy, acculturation, and organizational integration, along with its consequential effect on post-acquisition performance.

2. Literature review and hypotheses

2.1. Acculturation and the acquirer’s acquisition strategy

Acculturation in acquisitions refers to the “outcome of a cooperative process whereby the belief, assumptions and values of two previous independent work forces form a jointly determined culture” (Larsson & Lubatkin, 2001: 1574) and whether acculturation is achieved depends upon how well the acquirer manages informal integration process. Nahavandi and Malekzadeh (1988) concern the role of the acquirer’s multiculturalism vs. uniculturalism in the acculturation processes following acquisitions. Acquirers characterized by multiculturalism allow acquired firms to preserve their existing culture and business practice, while acquirers characterized by uniculturalism decisively emphasize the common values, norms, beliefs and reward systems in the merged organization in order to achieve consistency in corporate goals, strategies and practices. In related acquisitions, economies of scale and scope generally result from utilizing tangible (e.g., joint purchase of inputs, joint development of exploratory/exploitative technologies) or intangible (e.g., know-how and knowledge transfer) interrelationships between the acquiring and acquired firms. With tight integration and coordination, redundancy can be minimized through restructuring organizations and redesigning standard operational procedures. From a different perspective, it is suggested that high performance over a prolonged period in related acquisitions requires a strong and adaptive uniculture, and therefore high degrees of acculturation. Conversely, unrelated acquisitions are oriented toward optimizing capital and resource allocation, as well as exploring new products and technologies in new markets or industries (Jones & Hill, 1988). The acquired firms’ complementary resources and capabilities allow the merged entity to explore and take advantages of new opportunities. Nevertheless, due to the fact that the acquirer’s and the acquired firm’s technological capabilities are unrelated, autonomy in the acquired firm and multi-culture in the merged organization should be emphasized. Thus, lower degrees of acculturation are required in unrelated acquisitions.

H1a: In related acquisitions, acculturation positively affects post-acquisition performance.

H1b: In unrelated acquisitions, acculturation negatively affects post-acquisition performance

2.2. Acquisition and organizational integration

Organizational integration, the level of interaction and coordination between the target and acquiring firms (Larsson & Finkelstein 1999), brings activities to be combined within the common organizational boundaries following an acquisition (Puranam et al., 2009), and acquirers can use common authority, incentives and processes to enhance coordination and mutual adaptation to reduce operational costs (Datta, 1991). However, radical changes in the acquired firms could lead to intervention, disruption and crash (Hannan & Freeman, 1987). In Puranam and Srikanath’s (2007) study, two major effects, namely coordination effect and loss of autonomy effect, are identified in post-acquisition integration. Coordination effect usually occurs by minimizing functional redundancy and jointing daily activities, helping the acquirer leverage the acquired firm’s capability. However, loss of autonomy can prevent employees from devoting to explorative activities and damage the acquired firm’s technological capability (Puranam et al., 2006, 2009). Despite that, “organizational integration between jointing firms should have a positive effect on synergy realization because little, or poorly executed integration and coordination are unlikely to produce substantial joint benefits” (Larsson & Finkelstein, 1999: 6).

In additional to its impact on formal structure and systems of the merged unit, organizational integration also shapes informal processes by creating informal communication channels and group identity beneficial to sharing values and knowledge transfer (Puranam et al., 2009). These informal influences may be strengthened if organizational integration also brings high degrees of interaction between the merging firms, along with mutually coordinative efforts to the quality of interaction (Larsson & Finkelstein, 1999). Once acquisition synergy comes from economies of scope exploiting interrelationships between the merging units, a high degree of integration will be necessary in order to promote divisional cooperation and coordination within the new organization. Due to lack of autonomy, activities of the acquired firm increasingly depend on operational and strategic decisions of the acquirer, which may accompany redirection and redefinition of missions and objectives, as well as destroy the acquired firm’s previous identity and culture. In turn, if an acquired firm is active in technological and product domains different from the acquirer, autonomy should be granted, for autonomy helps to maintain identification and culture and causes limited disruption, so that pre-existing technological and manufacturing capabilities may prosper constantly. Thus, acculturation in a related acquisition demands higher integration than in an unrelated acquisition. As the basic premise of this study is that acquisition strategy, acculturation, and organizational integration will interact to determine post-acquisition performance, I propose that

H2: The interaction between acquisition strategy, acculturation, and organizational integration will have a significantly positive effect on post-acquisition performance.

2.3. The moderating role of organizational integration in the relationships between acculturation and performance

Considering systems and procedures, organizational integration typically generates cooperation, coordination, as well as common goals and authority between members of the acquiring and acquired firms. As for informal organizational processes, integration helps to create organizational identity, common knowledge, and informal communication channels (Puranam et al., 2009). In order to realize the potential benefits of the transaction, both related and unrelated acquisitions require sufficient integration (Datta, 1991; Zollo & Singh, 2004), for no or little interaction and coordination are unlikely to generate substantial joint benefits. In light of the contingency perspective, I further argue that acquisition integration, which consists of interaction and coordination, can moderate the relationship between proper acculturation and acquisition performance for two reasons. Firstly, when complex or various tasks are divided into subtasks for different organizational subunits, those subunits in both the acquiring and the acquired firms must integrate their resources to finish the common organizational goals. In order to achieve the whole goals, organizational integration across combined firms is required to establish a common and collective identification, which largely builds on cooperation and common organization goals (Van der Vegt et al., 2003). Secondly, based on social identity theory (Tajfel, 1978) that concerns how people perceive themselves and process information about in-group and out-group, employees in the process of combination tend to perceive dissimilar others as out-group members and may have less helping behaviors (Van der Vegt & Van de Vliert, 2005). With increasing level of integration, however, a member who perceives to be dissimilar from the other group members will frequently interact with the other group members, which can increase helping behaviors and a common organizational identification. Following the logic above, this study argues

H3a: In related acquisitions, organizational integration positively moderates the relationship between acculturation and acquisition performance. H3b: In unrelated acquisitions, organizational integration positively moderates the relationship between acculturation and acquisition performance.

2.4. The strength difference of organizational integration’s moderating effects in different acquisition type

In acquisitions, the level of integration presents the extent to which the functions of the acquired organization are linked to, or aligned with the equivalent functions of the acquirer (Zollo & Singh, 2004). Drawing on Thompson’s (1967) pioneering work, the required extent of post-acquisition integration is determined by the degree of task interdependence, capability transfer as well as mutual learning and adaptation necessary for acquisition implementation (Puranam et al., 2009). Among Thompson’s (1967) model of pooled, sequential, and reciprocal interdependence between divisions, reciprocal interdependence is argued to require the highest degree of integration, whereas pooled interdependence the lowest (Puranam et al., 2009). In related acquisitions, the benefit of potential economics of scope arises from jointly shared or utilized inputs in related activities (Jones & Hill, 1988). Moreover, tangible and intangible resources of the acquiring and acquired firms are exploited to achieve synergy. In other words, economies of related acquisitions are realized through reciprocal and sequential interdependence. In order to coordinate activities between both merged units, high degrees of integration is consequently necessary (Hoskisson et al., 1993). In turn, economies of internal capital markets arising from unrelated acquisitions is primarily understood as markets and hierarchies paradigm (Williamson, 1985), indicating that unrelated acquisitions can overcome external capital market difficulties by using internal auditing and performance monitoring systems. Firms adopting unrelated acquisitions tend to expose the acquired firms to the discipline of an efficient internal capital market, thereby improving the acquired firm’s profitability (Jones & Hill, 1988; Harrison et al., 2001). Additionally, value is established by exploiting top managers’ ability of control unfamiliar firms, which is better than the existing managers of the acquired firm. This strategy also frees top mangers of the acquirer from involving in daily activities of the target firms. Therefore, economies of unrelated acquisitions are mainly realized through pooled interdependence. As a result, unrelated acquisitions, compared with related acquisitions, require relatively less organizational. As H3 predicts that high level of organizational integration can enhance the transmission of proper degree of acculturation to superior post-acquisition performance, this study further suggests that

H4: The moderating effect of organizational integration in related acquisitions is stronger than that in unrelated acquisitions.

3. Method

3.1. Data collection

Focusing on the Taiwanese electronics and information industry, this study collects data at financial, organizational and industrial levels to examine whether the interaction of acquisition strategy, organizational integration, and acculturation influences post-acquisition performance. Corporate financial data were collected from the Securities and Futures Commission databases, Ministry of Finance and the Directorate General of Budget, Accounting and Statistics, Taiwan, whereas organizational level data from the top 1000 Taiwanese electronics and computer firms reported by China Credit Information Service. The former criteria ensure that the acquired firms in the sample were publicly traded. Standard Industrial Classification codes in Taiwan (Taiwanese SIC, rev. 9, 2011, encoded on the basis of International Standard Industrial Classification codes, ISIC 4.0, 2006) were used to define an industry, where firms with two-digit SIC industries are treated as the same industry (Jacquemin & Berry, 1979). Based on the data, 387 of top 1000 firms had undertaken acquisitions between 2002 and 2008. Questionnaires were distributed to divisional managers of these 387 merged units in the next year of the acquisition, and 150 of them were returned. Given that the response rate was only 38%, possible non-response bias was therefore proofed, in which the respondents and non-respondents were compared along the dimension of firm annual sales in the year of 2008 for both the acquiring and acquired firms. The calculated t-statistic values were .34 (the acquirers) and .14 (the acquired firms), suggesting no significant differences between the responding and the non-responding groups.

3.2. Dependent variables

The primary dependent variable, post-acquisition performance, is the change in market value (∆Market Value), where market value is calculated as log (price of outstanding common shares x number of shares + book value of preferred stock + book value of debt) (Miller, 2006). Because the main point of this study is to examine the effects of integrating organizational structure and culture after acquisition, it may necessitate sufficient time to complete post-acquisition integration (Gary, 2005). We focus on the change in the market value over the period surrounding the acquisition. This study requires that the sample firms have three years of data available. The acquisition year (t = 0) is defined as the year that the acquisition is completed, the pre-acquisition year (t = –1) is defined as one year before the acquisition, and the post-acquisition year (t = +1) is defined as one year after the acquisition. Thus, ∆Market Value is measured as the acquirer’s market value in the post-acquisition year (now the target firm is a part of the acquirer) minus the sum of the acquirer’s and target’s market value in the pre-acquisition year.

3.3. Independent variables

The similarity of resource or product-market in both acquiring and acquired firms is often assumed to have positive impact on acquirers’ post-acquisition performance. In this study, business similarity is assessed by industrial SIC codes (Zollo & Singh, 2004) and related and unrelated acquisitions are identified by a binary variable, in which acquirers and target firms in the same two-digit industry will be set equal to +1, otherwise –1. Grounded on Zollo and Singh (2004), this study measures organizational integration by the acquired managers estimating the degree of coordinative activities between acquirer and target firms in (i) joint procurement, (ii) sharing a sales force, (iii) sharing production information, (iv) sharing best practices in various administrative processes, and (v) involving the combination of resources from different divisions to create new business (5-point scale, Cronbach-a= 0.87). Acculturation is measured by the acquired firm’s managers concerning the level of (i) jointly shared meanings fostering cooperation between jointing firms, (ii) a joint organizational culture through activities such as cross-visit, celebrations, and other rituals, and (iii) the existing culture in the acquired firm is forced to change (7-point scale, Cronbach-a= 0.84).

3.4. Control variables and the endogeneity concerns

The major concern with cross-sectional studies is endogenous effects that the diversification choice (e.g., acquisition) is endogenous to performance (Miller, 2006). Considering endogeneity bias, cross-sectional studies may incur problems of endogeneity when inferring the relationship between diversification and performance. This study therefore follows the suggestions in diversification-performance studies and uses leverage, post-acquisition profitability, and R&D intensity to reduce possible endogeneity bias. Leverage is measured as the ratio of the book value of debt to market value, as defined in the dependent variable (Mansi & Reeb, 2002). The acquirer’s Pre- acquisition firm profitability is measured as the three-year average return on asset (ROA) covering the last three years (t–1, t–2, and t–3) before the acquisition. It is examined as industry adjusted profitability by subtracting industry average profitability (industry 3 year average ROA). R&D intensity is the acquirer’s R&D expenditure over total assets in the year before the acquisition (Miller 2006).

3.5. Procedures for testing three-term interaction effects: Centering in moderated multiple regression (MMR) using unstandardized regression coefficients

3.5.1. Procedure 1: Using MMR with centered data to reduce potential multicollinearity problem

MMR is frequently employed to detect interaction effects and is superior to analysis such as comparison of subgroup correlation coefficients (Dawson & Richter, 2006; Kraemer et al., 2001). However, the functional dependence between independent variables and their interaction terms makes MMR sensitive to the supposed multicollinearity problem in most applications. The procedure of centering is therefore recommended as a feasible solution to high multicollinearity (Shieh, 2009a). That is, with predictors and their interaction terms in MMR, the multicollinearity effects are likely to be reduced if all predictors are centered (Shieh, 2009b). The selection of reference value in centering depends on the data scale. In general, mean centering that involves subtracting sample mean from each observed value is recommended in continuous predictors (Shieh, 2009a); ordinal predictors are suggested to be centered at their medians; and binary independent variable should be coded as +1 and –1 (Kraemer et al., 2001).

4. Results and discussion

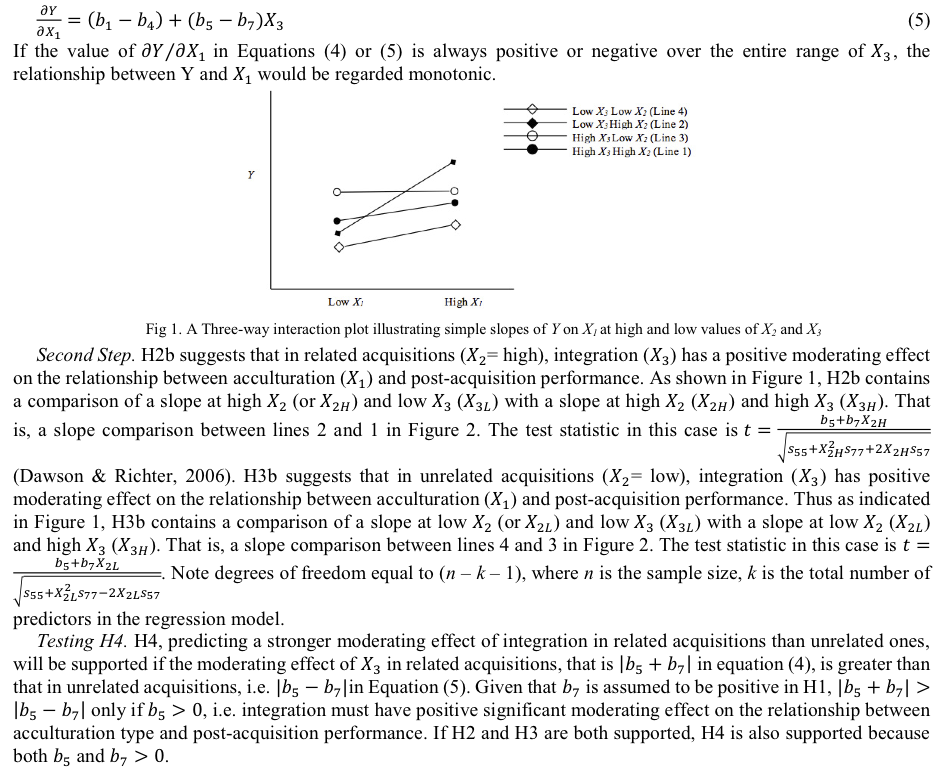

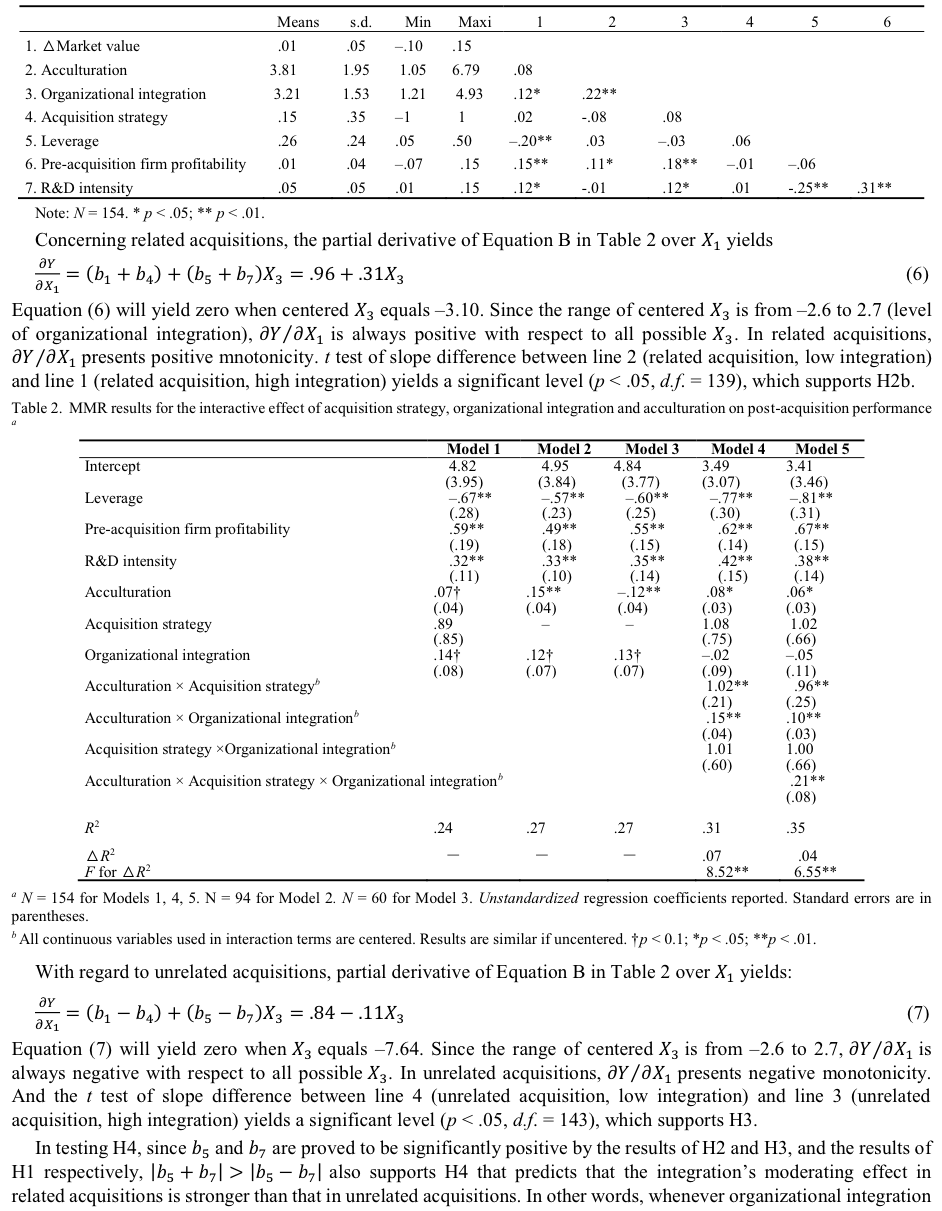

We eliminate the possible multicollinearity by centering independent variables: coding related/unrelated acquisition strategy as +1/-1 for the sake of simplifying calculation in Equation (3), and centering acculturation and organizational integration at their medians. Considering that the recommended uppermost limit of variance inflation factor (VIF) value is 10 (Kleinbaum et al., 1988), value of majors in this study is between 1.20 to 2.05, indicating that the problems of multicollinearity tend to be minimal. Table 1 shows the descriptive statistics for the variables and Table 2 shows the results from MMR to the hypotheses. We used one regression equation of acculturation, acquisition strategy, organizational integration, the interactions between acculturation and acquisition strategy, acquisition strategy and structural integration, as well as acculturation and organizational integration as the independent variables (Equation A) and a second adding the three-way interaction included (Equation B). As indicated in Equation B, the unstandardized regression coefficient of the three-way interaction is significantly positive (b7=.21, p < .01). The introduction of this three-way interaction term also brings a significant increase in R2(∆R2=.04, p < .01) in △market value in acquisitions. The evidence of interaction between acculturation, acquisition strategy and organizational integration supports H1.

Table 1. Descriptive statistics

In general, integration does not have a direct but moderating effect on ∆Market Value. Concerning related acquisitions (see Fig. 2), when there is no integration, the increment of acculturation on ∆Market Value is .34. As integration increases 1 unit, the increment of acculturation on ∆Market value will increase .31 unit, indicating the strength of moderating effect of integration. When integration reaches its maximum, the increment of acculturation on ∆Market value reaches its maximum 1.58, thereby supporting H2. As for unrelated acquisitions (see Fig. 3), when there is no integration, the increment of acculturation on ∆Market Value is .74. As integration increases 1 unit, the increment of acculturation on ∆Market value will increase .11 unit. When integration reaches its maximum, the increment of acculturation on ∆Market value reaches its maximum 1.18, thereby supporting H3b. Given that the strength of moderating effect of integration in related acquisitions (.31) is greater than that in unrelated acquisitions (.11), H4 is hence supported.

In sum, findings of this study show that: (1) the three-way interaction, or contingency between acquisition strategy as well as organizational integration and acculturation have a significant impact on post-acquisition performance; (2) tighter acculturation with higher organizational integration relates to superior performance in related acquisitions; (3) looser acculturation with higher organizational integration relates to superior performance in unrelated acquisitions; (4) integration’s moderating effect in related acquisitions is stronger than that in unrelated acquisitions. In related acquisitions, acquirers, due to their knowledge and technological advantages, tend to impose their culture on acquired firms (Chatterjee, 1986) and pay less attention to autonomy. In order to reduce costs related to knowledge and technology exchange, organizational integration, coordination and cooperation between acquirer and target firm should be emphasized and high degrees of acculturation are therefore suggested. In unrelated acquisitions, acquirers tend to emphasize high level of multiculturalism due to lack of knowledge and technological advantages. Moreover, they avoid intervening in the daily activities of the acquired firms and tend to welcome, benefit as well as honor new partnerships. Hence, low degrees of acculturation are preferred. It should be also noticed that tight acculturation does not mean over intervention from the acquirer, nor “hands-off”. The relationship between headquarters and the merged unrelated divisions could be explained by “the metaphor of the orchestral leader” (Mintzberg, 1998:140). Managers in the acquired firms resemble professional musicians in an orchestra in the sense that they are professional in their own domain. However, they together cannot produce harmonious music without a conductor, whose responsibility is to control elements of music (e.g., pace and tempo) and unify individual musicians by guiding them when to come in and how fast or slow to play. In unrelated acquisitions, managers of the headquarters direct those of the acquired firms towards the common missions of the merged unit with support, instead of empowering them with constraints.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter