Publications Operational Due Diligence: Investment Management And Funds

- Publications

Operational Due Diligence: Investment Management And Funds

- Christopher Kummer

SHARE:

By KPMG

How KPMG can help you

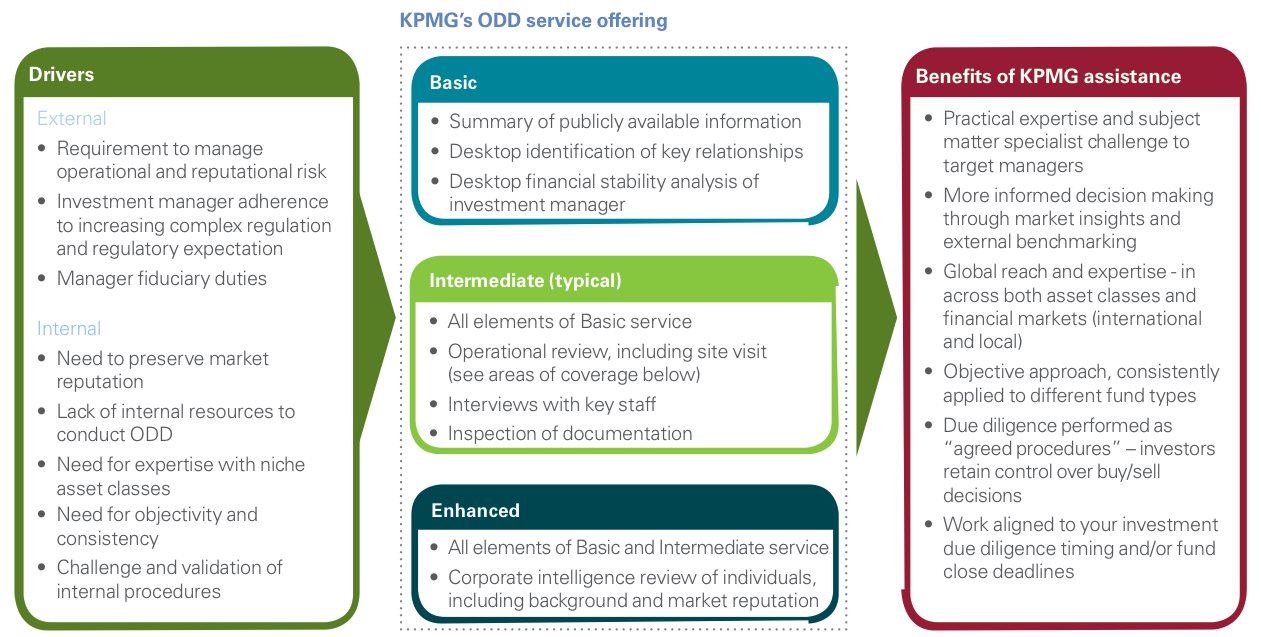

Operational due diligence (ODD) over investment managers has never been more critical. Recent scandals such as Madoff and Weavering have served to underline the growing importance of ODD in the minds of investors. Adding in other factors such as an increasingly complex regulatory environment and the investors’ search for the alpha generating, operationally sound investment managers becomes increasingly difficult. KPMG ODD specialists have extensive experience of conducting operational due diligence procedures over a broad range of strategies, including hedge fund, infrastructure, private equity and traditional asset managers. Our global network of ODD specialists and local subject matter experts challenge and assess key aspects of the target manager. These aspects include tone at the top, compliance culture, risk management and conflicts of interest. We conduct a tailored set of due diligence procedures to answer the questions that matter most to member firm clients.

Overview of KPMG’s approach

An approach tailored to your needs

KPMG ODD specialists provide advice and assistance on Operational Due Diligence to a variety of member firm clients across the financial services industry including banks, fund distributors, pension funds, other institutional investors and Sovereign Wealth funds. KPMG’s approach can be specifically tailored according to the needs of each client’s circumstances. The key stages of KPMG’s approach to a “typical” scope review are summarized below and illustrated in the case studies that follow. Our overall aim is to adopt a highly collaborative approach, drawing on both deep industry experience as well as insights gained from our significant due diligence work.

Scoping/defining procedures

- Agreeing scope of procedures to be performed

- Defining reporting format, assessment benchmarks, logistics and timescales.

Documentation review

- Review of the fund’s corporate documents, prospectus, audited financial statements

- Review of the manager’s documents including the compliance manual, disaster recovery plan, pricing policy, etc. This helps to facilitate our understanding of the fund and manager and assists us in identifying areas which may require further clarification during our on-site work

- Identification of service providers eg administrators, auditors, custodians, prime brokers etc.

On-site visit

- Meetings with key staff

- In depth discussions on the management of the company, fund structure, investment execution processes, back office operations and controls, pricing and valuation

- Performing walkthroughs of the key operational processes and controls and observing the operation of such controls

- Discussions with senior management and review of oversight activities over third party service providers.

Service providers review

- Independent verification of service providers identity and scope of services being performed

- Meeting with the service providers and review of relevant documentation

- In depth discussions on services provided and controls in place.

Reporting

- Reporting factual findings in a formal report

- Provide indicative scoring against agreed benchmarks (where required).

Key areas of coverage

Just as investment managers and funds vary in size, complexity, and strategy, no two operational due diligence reviews are the same. While we tailor our specific procedures to meet the particular needs of our clients and the type of fund/ investment manager subject to review, the typical areas we will examine, at a minimum, are set out below.

Case Studies

KPMG firms work with a number of clients including fund distribution platforms, private wealth managers, family offices, pension schemes and sovereign wealth funds. We have worked both in an outsourced capacity and alongside our firms’ client’s in-house specialists. The case studies below highlight some of our experience, and we would welcome the opportunity to explore how we can assist you.

Global Investment Bank – Structured Credit Division

Client issue

Our firm’s client, the structured credit division of a global investment bank was looking to promote third party credit structured funds managed by external third party managers. The bank had concerns over reputational risk following the collapse of Lehman Brothers and the high profile fraud case involving Madoff.

KPMG services

KPMG in the UK assisted with the development of a set of agreed due diligence procedures to be applied to a number of third party managers and proposed funds. Such procedures included:

- desktop review of general information

- desktop analysis over the financial stability of the target managers

- on-site review of risk management arrangements and specific walkthrough procedures of key operational processes and controls.

As part of our work, we agreed a set of performance benchmarks against which we assessed the arrangements in place at each manager/fund. The procedures were consistently applied across a range of UK and European managers and their related funds. Types of fund included hedge funds, infrastructure funds, structured credit and distressed debt funds. The results were then reported to the bank for each manager/fund.

Benefits

By establishing a set of performance benchmarks, the bank was able to objectively assess whether there was any excessive reputational risk resulting from their commercial relationship with each manager. The results of the ODD reviews enabled the bank to satisfy its own risk management and assessment procedures concerning the appointment of third parties.

US Pension Fund

Client issue

Our client, a U.S. pension fund, was enhancing its existing investment platform and associated investment strategy to move towards ‘direct’ investments in private funds (hedge funds, private equity funds, real estate funds, infrastructure funds) and away from ‘indirect’ investments through fund of funds. As part of this evolution, our client’s Audit Committee requested an industry point of view on the content and structure of its current operational due diligence program (“ODD”). In addition, our client was interested in how it would need to evolve its current ODD program to respond to the increased complexity of direct private fund investing (the ‘readiness assessment’).

KPMG services

KPMG assisted our client’s Audit Committee, Chief Financial Officer (“CFO”) and Chief Investment Officer (”CIO”) by providing an operational due diligence (“ODD”) program framework for their consideration. Our client requested that KPMG conduct ODD on new hedge fund managers to which our client was allocating direct investment capital. KPMG implemented our ODD program (including proprietary assessment and verification procedures with respect to 3rd party service providers) and provided reports of findings to the Audit Committee, CFO and CIO. In addition, our client participated in on-site fieldwork with KPMG’s subject matter professionals to facilitate knowledge sharing.

Benefits

Through the implementation of an enhanced ODD program, our client is well positioned to accelerate the re-positioning of the current portfolio, emphasizing direct investments.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter