Publications Mergers And Acquisitions: Does The Legal Origin Matter?

- Publications

Mergers And Acquisitions: Does The Legal Origin Matter?

- Christopher Kummer

SHARE:

Emerging Markets Queries in Finance and Business

By Radu Ciobanu

Abstract

There are many concerns in the financial literature that law can influence the financial development of a state and the mergers and acquisitions area makes no exception. In every country’s economy, the mergers and acquisitions play an important role and usually this field is governed by commercial codes and other special laws. So, governments have developed M&A laws in order to expand the states economies and enhance business performances, thus maintaining proper competitive environments for improving business performances. The study aim is to show that the legal origin of a state can influence the characteristics of mergers and acquisitions both in terms of turnover and size of control premium. The database is provided by Zephyr and SDC International M&A and includes aggregated data on acquisitions and mergers for the 2006 – 2010 periods in all countries of the world. We analyzed 30 countries from 4 different legal systems: common law on one hand and French, German and Scandinavian civil law on the other hand. In order to analyze the relation between the characteristics of a state’s M&A market and the legal origin of a state, we conducted several regression models. The M&A market was explained by the average value of a transaction and the size of the control premium, and for the legal system we considered several variables besides the dummy variables for each legal system. To do this, we analyzed business indicators that show how attractive is the legal system of a country for investors. For example, common law countries are considered to be business friendly, so a low number of tax payments and a low number of days required to start a business is recorded in these states. There is an opposite situation in the French and German civil law countries. The results show that a country’s mergers and acquisitions market is influenced by the business environment that the law can create for investors who are likely to invest more in a well regulated markets which can protect the their capital, but also can provide an excellent environment for development and capital gains.

1. Introduction

In recent years more and more works have studied the links between law and finance the starting point being the well-known works of La Porta, Lopez-de-Silanes, Shleifer and Vishny (La Porta et al. 1997, 1998). The theory of law and finance argues that the legal system is a direct cause of a state of financial development and it influences the economic growth of the country.

According to this theory, states have a legislation based on the common law, from medieval England, or the civil law, which have French, German or Scandinavian origin based on the laws of the early 19th century. Common law is found in UK and countries of the former British colonial empire, United States, Canada, Australia, India and others. Its main purpose is resolving disputes based on previous decisions of judges that solved a specific case. This system enjoys a full legal independence from the executive and legislative powers (La Porta et al., 2008). Common-law is dated back in the 16-17 century in US just after the War of Independence of 1776. The main prerogative of the first American Parliament was to limit the power of English kings in reconfirming the feudal privileges of its relatives. The courts have created laws that have led to private property and tried to protect the land against the English crown (Beck et. al., 2003). The common-law is known as the law provided by the courts where the judges have the power in the creation and interpretation of laws (Beck and Levine, 2003). Civil law is much more spread among the world’s countries, it has a greater tradition, its origin is the Roman law and its main characteristic is that it uses different rules and codes to control any situation or activity especially when it comes to economics. Among the states where the legal system is based on civil law, the French civil law is the most spread one so, for now on, when speaking of civil law in relation to the common law we refer mainly to that of French origin. German civil law countries are those found nearby Germany such as Austria, Czech Republic, Slovakia, Hungary, and others such as Greece, former Yugoslavia, and even Korea, China and some ex-soviet countries. (Xu, 2011). The Scandinavian civil law is strictly spread in northern Europe. Even if they are part of the same law family, there are essential differences meaning that the German and Scandinavian legal systems tend to regulate less than the French, so they can be situated between common law and civil law. There are studies that determine formality level of law (Djankov, 2003) and the results were the same as the regulatory level, civil law countries have a higher level of legislative formalization than the common law states.

Modern law has its basis in Roman law, the legal system of antique Rome. The Romans believed that the law must be written to prevent magistrates to apply it arbitrary. In this way the Law of the Twelve Tables appeared and stipulated that no one is above the law. Later Roman law was changed by the Justinian’s code, named after the emperor who ordered it. Here, it is stipulated that the emperor is the only above the law. Roman law has evolved differently in the former Roman provinces, so that in the 18th century the French monarch had unlimited power and established judges only from the members of wealthy families, so he could control the court and protect the monarchy and their interests. The French Revolution changed just this situation, limiting the role of the judge to interpret or create law. Finally, Napoleon unified the legislative system in France under a single code where the state is the only legislator. The code is characterized by high levels of formality (Beck and Levine, 2003), the only power of the judges was to enforce the law.

As in France, the German legal system was reformed by Bismarck with the unification of German states and the power to regulate was given back to the state. Unlike the French code, the German Civil Code in 1900 shows how courts can solve conflicts, ambiguities and interpret the uncovered situations (Graff, 2008). From here we say that the German civil law has evolved over the last century due to this court jurisprudence.

The Scandinavian civil law doesn’t have a known origin. The fact is that it originated with Swedish law reform in the 16th century and is found in the northern countries (Sweden, Norway, Denmark, Finland, Iceland). Scandinavian civil law has the same foundation as the German civil law, with both state regulations and court jurisprudence. The difference comes from the fact that the northern legislation is based on a set of laws and general regulating principles that are applied in any field. Sweden does not have a proper civil code.

There are many regions with a lack of specific regulation, but this is compensated with strong court jurisprudence. In addition to these well known law systems, there are countries with mixed legal systems. For example, in the former Dutch colonies, there are still influences of the legal system practiced in Netherlands in the 17 to 18 Century (English, Roman-Dutch law). South Africa is the best example where there is a hybrid system of civil law, inherited from the Dutch, and the British common law. Another one is the socialist civil- law which is characteristic to states with such a regime: North Korea, Laos, Republic of Cuba etc. It has grown since the formation of communist states and its main feature is the lack of private property so everything is state owned. Influences of this system are still felt in some major economies such as China (La Porta et al., 2008).

Surprisingly a country’s legal system is not stable in time. History gave us examples of situations when countries jumped from one system to another and this can affect not only the legislation, but also the whole economy of the state. A good example is the East European market which has been in continuous development especially after the transformation of the centralized socialist economies, with socialist civil-law, into democratic ones, with mainly French or German civil law. But which were the exact changes? Companies, with headquarters in developed countries, had invested in the emerging economies regions using M&A operations being attracted by an insufficiently regulated market, a workforce not so well paid as in Western Europe and also by the numerous opportunities for development. Political changes in Eastern Europe that had led to the removal of communist regimes also led to the end of the state company, which, in many cases, were financed even if it did not recorded profits. In these conditions, the solution for a former state company was simple: privatization or bankruptcy.

In 2000, after the East European states started negotiations with European Union, the M&A operations fall under regulations of the European Commission and EU laws. This had a positive effects, the success of the transaction is greater, which is shown by the growth of mergers and acquisitions market. This increase can also be due to the favorable economic situation, because the same trend was recorded in Western Europe where, in 2006 there were 30,000 transactions with a total annual value of more than 1000 billion dollars, most transactions had a small value, but the specific is that the majority stake was acquired. With the start of the global economic crisis, M&A had a downward trend until 2010 when it reached a total of only 15,000 transactions yearly and their total value is two times lower than in 2006. Currently we talk about an increase in M&A globally and in the national and international legislation governing this area. The aim of this study is to analyze the influence of the law on the M&A market. In order to do this, we consider that some conceptual clarification of the terms merger and acquisition have to be made, to find the similarities and especially the differences between these two types of operations as they result from the finance literature and, more important, from the legislation. Different from other studies, we analyzed the M&A market not only related to the legal origin of the stat, but also to the country’s business environment. In our view, the legislation can strongly influence the investor’s decision to place his capital in a foreign country business.

Further, the article is organized as follows. The next section presents briefly the main related studies in the aria with a brief overview of the terminology used in this field. Section 3 describes the database and methodology. Section 4 presents and discusses the main empirical results. The final section contains the concluding remarks of the study.

2. Related studies

More and more studies in the last decade show the relation between law systems and the regulations in the economic region and the financial development of the state or companies operating on its territory. La Porta et al. (1999) believe that civil law states have an important role in regulating business than the states with common law. In the same study, however, the authors conclude that protection of outside investors is lower in civil law countries which are more interested in protecting domestic investors. Outside investors are those who hold shares but they can’t control the management of that company. Here we can talk about differences that occur among countries with civil law, such Scandinavian and German laws tend to protect more the foreign investors than French civil law (La Porta et al., 2000). Other studies have studied the relation between the population and number of pages of legislation of a state (Mulligan and Shleifer, 2005), and the result was simple: if the population is higher, the degree of regulation of various activities is greater. This can be explained by the fact that for a larger population, the number of commercial activities is higher and so emerges the greater need to regulate. The same thing is happening in the M&A area where regulation are also defining the key term in this field. In United States, the first country where the M&A market was regulated, the merger is that when a company’s shares are purchased or exchanged for other company assets or liabilities. There are other types of M&A transactions specified there such as the acquisition or sale of assets or shares, when the company acquired becomes a subsidiary of the buyer (Siegel, 2005). In the European Union, the Community law governing M&A market is called the European Community Merger Regulation Law (ECMRL law). Here there are three main types of transactions, defined as “concentration”, that require regulation. They occur only where there is change in control or change in ownership in that company and may result in mergers, acquisition of sole control or association of companies (joint venture). According to ECMRL law, a merger is the situation where two or more companies join, and at least one entity ceases to exist. However, EU law does not rule out the merger in which entities retain their legal personality, but, in this case, they are united in a single economic unit. When it comes to buying a company’s control, the European law is relating this to any change in the existing control, whether is constituted by rights, contracts or other elements that confer a decisive influence on the company. A change of control is found in three cases: buying the majority stake which involves holding majority voting rights, buying a company’s assets and in this case we speak of control over a company activities especially when the transaction object is a license or its brand and finally, the last way is the “acquisition by contract”, a situation that occurs when there is a contractual economic dependence. In the joint company the decision power is divided under an agreement between partners or shareholders. So, in a joint venture, even if is not actually a transfer of control of a company, each party may limit or block decisions taken by the partner and so this must be regulated by law. Interesting is the fact that the M&A legislation has a great contribution when it comes to the financial concept of the transaction involved. Even if there is a diversity of ways to explain them in the financial literature, the general view supports the one from the law. For example, some authors (Damodaran, 2008) state that there are two categories of M&A: one when the company is acquired by another company, which is a foreign operation and one when it is acquired by an insider such as its managers, shareholders or investors. Other authors make a clear distinction between the terms merger and acquisition (Sherman, Hart, 2006). A merger is a combination of two or more companies, where the assets and liabilities of a company are acquired by another company, and although the latter will have a totally different organization, it will not lose its original identity. Acquisition is the purchase of a division, a part or the whole company, especially to diversify product portfolio and customer service. In other studies (Gaughan, 2010) the emphasis is more on the merger and less on the acquisition. A merger is a combination of two companies where only one will survive, the other ceases to exist and the capital and liabilities of the acquired enterprise is simply transferred. This description is quite similar with that presented by the European Commission (European Community Merger Regulation Law – ECMRL, 2004). Other authors were more interested in issues related to the causes underlying the M&A than explaining the terminology of merger and acquisition (DePamphilis, 2010). These causes are different from one period to another and are more or less pronounced depending on the region where the transaction takes place. One of the most important factors would be the synergy effects, so by combining two companies there is an increase in shareholders’ value than the companies as individual components. Another reason for a M&A would be the gain of new markets or entering new industries through diversification. There are transactions taking place without a well-founded basis mainly due to goodwill. A good example is the merger with a well known company or simply purchase a company with a market value under its book value (market-to-book ratio or q ratio <1) (DePamphilis, 2010). Corporate restructuring can be another cause of M&A, because the ability to respond to market changes is enhanced by rapid technological development. In conclusion, governments have developed M&A laws in order to expand the states economies and enhance business performances, thus maintaining proper competitive environments for improving business performances (Lin et al., 2011). Considering these elements, the first hypothesis of our study will be:

H1. The legal origin influence the M&A market

If the legal system has an influence on the financial activity, it has an effect on mergers and acquisitions also. The question is how the legal system can influence the number of transactions, their value and the control premium. The control premium can be estimated by the amount of each advantage after obtaining control position within a company. The control position means that the potential shareholder could change the general policy of the company in order to achieve better performance and increased company’s shareholder value in the future (Dragotă et. al., 2007; Dragotă et. al., 2013). There are studies (Nenova, 2003) which measure the control premium as the value of voting rights purchased to gain control (the control-block votes). The study was conducted for companies operating in all legal systems, and the results show that in countries with common law or Scandinavian civil law the value is less than 10% of the company, while in countries with French civil law the value is at least 25%. Similar results are found in another study (Dyck and Zingales, 2004), the differences between countries control premium is due to corporate governance, market competition and law enforcement power. That concludes our second hypothesis:

H2. The legal origin influence the control premium

The reason why we studied the influence of legislation on the M&A market and the control premium was to show that law has an effect on the M&A process both at the country and company level.

3. Database and methodology

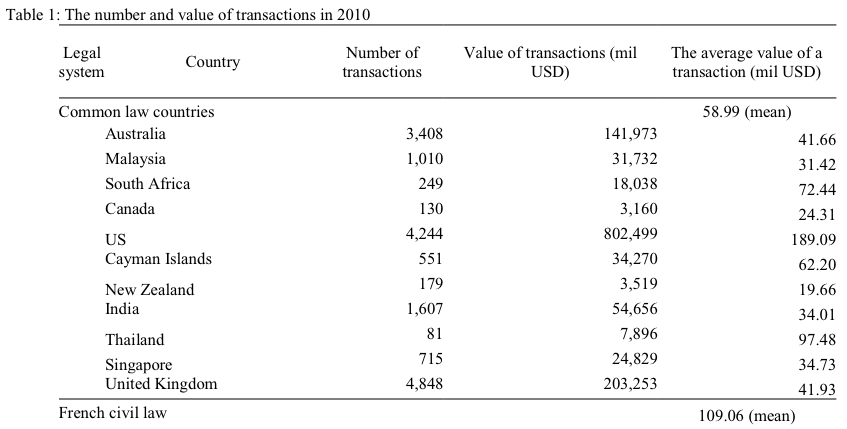

To determine how the legal system is affecting the mergers and acquisition market we used a database that includes the number of transactions and their value in 2010. The data is provided by Zephyr and includes aggregated data on acquisitions and mergers in the last 5 years in all countries of the world. Table 1 present descriptive statistics of M&A for 39 most representative countries both globally and within each legal system. The table shows that the average value of transactions in countries with French civil law origin is approximately double than that of the states of other systems and 60% higher than the global average. A possible explanation is that the French civil-law provides greater protection for internal investors, with controlling power, to other stakeholders.

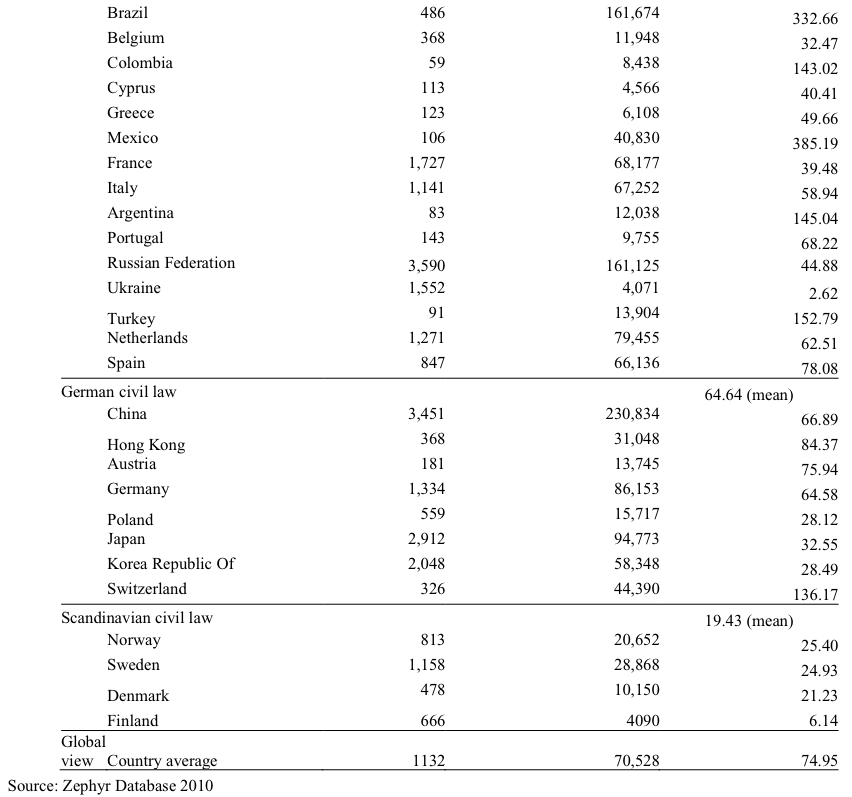

Table 1 presents the number and aggregate value of transactions of the most representative states of the main legal systems (common law, French civil law, German civil law, Scandinavian civil law). Classification of states in each category was done according to La Porta et al. (2008) study. The data come from Zephyr Database that incorporates all types of acquisitions (Acquisition, Institutional buy-out, management buy-in management buy-out) from 1 January 2010 to 31 December 2010. The average value of transactions for 2010 was determined as the ratio of aggregate value and number. However, the high average, 109 million dollars, for countries with French civil law is due to large investment that were realized in this period in the countries of South America, especially in banking and finance (Goddard, 2011). In Brazil, for example, according to Zephyr, the M&A almost doubled in 2010 compared to 2009 and increased 5 times compared to 2005, from 33,000 to 160,000 million dollars. A low value is found in northern states, possible due to the fact that these are already developed countries with lower interest from investors, but also because of different legal system with many areas not covered enough or the lack of a civil code (Sweden). These findings are in accordance with H1. Another aim of this study is to find whether control premium is influenced by the legal system. The data for this study is the value control premium according to the Thomson Reuters – SDC International M&A database 2007. Table 2 contains the control premiums for 30 of the world economies, an average recorded between 1996 and 2006. These are the top 30 countries with M&A activity. This period was chosen because since 2007 the number of transactions and their value decreased globally, many of the 2007-2011 acquisitions were made as a result of the global financial crisis, such as mergers or takeovers to avoid bankruptcy. The methodology for determining and selecting the control premiums is similar to that proposed by Dyck and Zingales (2004), their size being comparable to that found in that study (Deng, 2010). We used data from La Porta et al., 2008 to identify the origin of the legislation of each country studied. We divided the data in the four main legal systems, 9 states with common law, 9 with French civil law, 8 with German civil law and 4 with Scandinavian civil law. Then we determined the average premiums for each legal system, and global average.

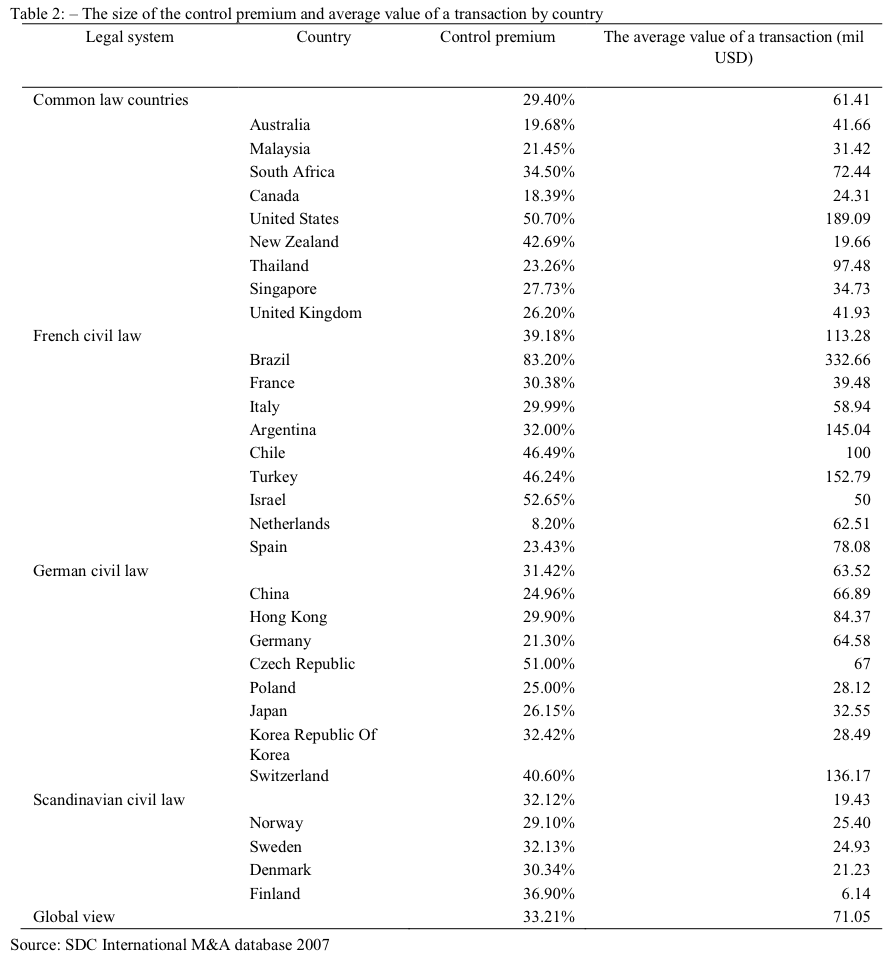

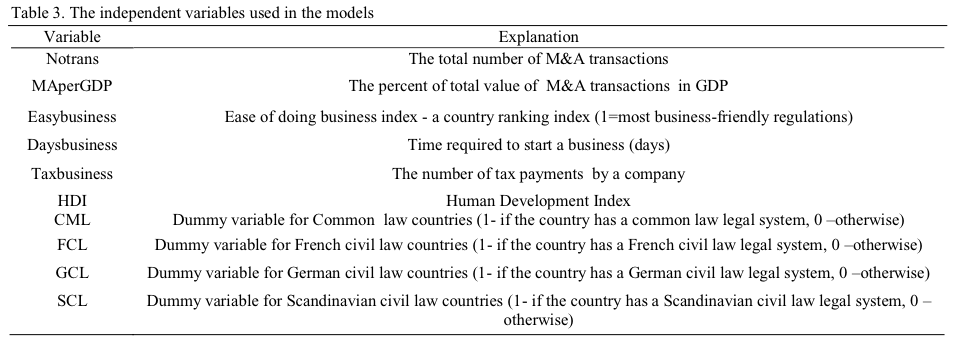

Fig.1. shows the distribution of the control premium’s size. We note that most of the premiums are located between 15% – 45%, and the rest are distributed more to the right. The maximum value is in Brazil, 83.20%, a state that has attracted foreign investors, while the lowest value recorded for the Netherlands, only 8%, as a state with a decrease in the number of transactions in recent years. Using the data in Table 2 we studied the influence of law on mergers and acquisitions. The control premium analysis shows that size is affected by the legal system, but differences between the control premium of the states can also be due to other factors. French civil law states have a higher size first of all, because the states are characterized by a high level of regulation and second of all the increased protection of internal shareholders, which explains why investors are willing to give more for the control position. The global average of control premium is 33% and in French civil law countries this is around 39%. Common law countries have a control premium of 29%, but the U.S. and New Zealand have high recordings, above global average. The differences arise from the differences between the M&A regulations, the shareholders protection, and the economic development. The South-Asian countries had a sustained economic growth after the Asian crisis of 1997-1998. For example, the Malaysian banking industry depended on its efficiency and competitiveness. Therefore, bank managements as well as the policymakers will be more inclined to find ways to obtain the optimal utilization of capacities as well as making the best use of their resources than to continuously expand using M&A operations (Sufian and Shah Habibullah, 2009). This can be a possible explanation why the control premium of these countries is less than average. German civil law and Scandinavian civil law countries have values close to average and the explanation is that the legal system is positioned between the common law and French civil law, in terms of degree of regulation. For further analysis, to highlight the relation between the M&A market and the legal origin of a state we have conducted a model where we consider the average value of a transaction by country the dependent variables. The others variables included in the analysis are presented in Table 3. The main source was the database provided by the World Bank for 2010. All these variables where selected to express some characteristics of the country’s M&A market or legal system. On one hand, the number of transaction and the total value of the M&A transaction on GDP show the interest of the domestic and foreign investor over a country. On the other hand, the business indicators show how attractive is the legal system of a country for investors. For the common law countries these are considered business friendly. There is a low number of tax payments for a company (for example 5 in Singapore, 8 in UK, New Zeeland or Canada) and a low number of days required to start a business (for example 1 in New Zeeland, 2 in Australia, 3 in Singapore). The same situation is in the Scandinavian civil law countries, especially in Norway and Sweden. The French and German civil law countries have a higher value of these indicators (33 taxes to pay in Israel and 119 days to start a business in Argentina).

The HDI is considered a measurement of the social and economical development of a country. For our database, this variable has a higher value for the German and Scandinavian legal systems.

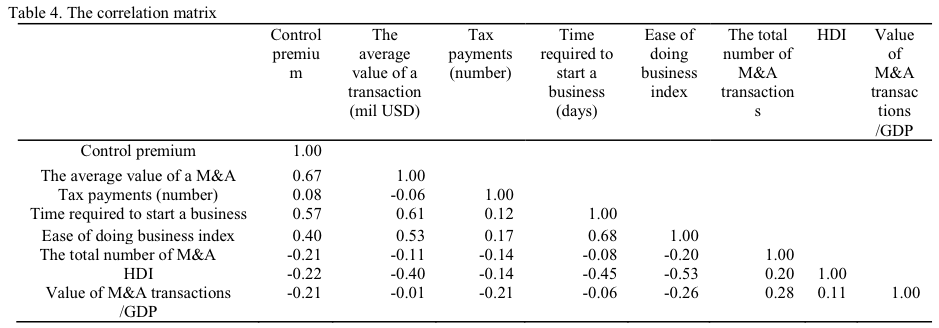

We have also studied the impact of other variables, the GDP per capita, number of new businesses registred or the total value of M&A transactions, but, in some way, these are already included in the variables from Table 3. In the analysis we used logarithmic specifications for variable that were not determined as percent of GDP of in index form. These was useful in order to reduce the data size and for an easier analysis. Our aim was to find the correlations between them and not the size of their coefficients. We have tested for identifying multi-colliniarity. The correlation matrix for the model variables is presented in Table 4. We did not consider in the same regression the variables correlated at a higher level than 0.4.

4. Results

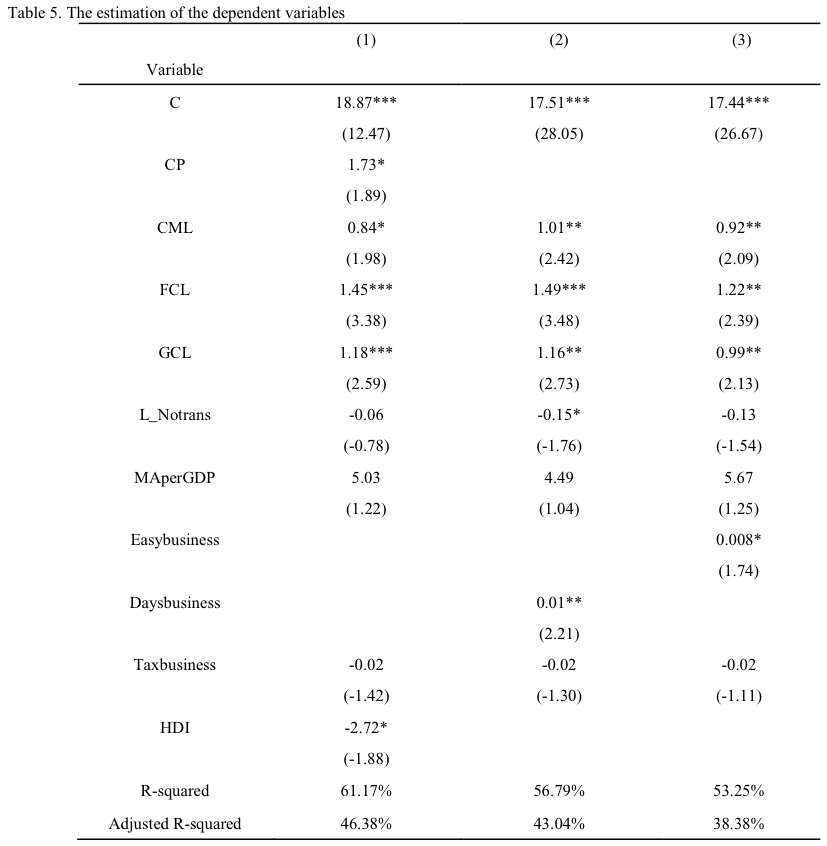

Table 5 presents the regression results for the models conducted. These results are conclusive with the literature (La Porta et al., 1999, La Porta et al., 2000, Nenova, 2003, Dyck and Zingales, 2004).

Model 1 is regression between the average value of a M&A transaction and its determinants. We did not consider in the same regression the variables correlated at a higher level than 0.3. To avoid the perfect multicollinearity for using all 4 legal origin dummies, we used only 3 legal origin dummies in the regression. T-statistics are in parentheses. The symbols *, **, *** represent significance levels of 10%, 5% and 1%. The results are in accordance with the hypotheses. The legal system has an influence over the M&A market. All the legal system coefficients are significant with a positive effect. By the value of the coefficient, the French civil law countries tend to have a higher average value of a M&A transaction, and the common law a lower one.

However, the average value of a transaction is negatively influenced by the number of transactions and surprisingly by the HDI. For example, in the common law countries (US, UK, Australia, New Zeeland, etc) there are a large number of transaction, many of them with at a low value. So, the high number of transactions reduces the average value. On the other hand, many of these countries have a high HDI index, so this could be a possible explanation why the negative correlation between the HDI index and the average value of a M&A transaction. The business environment indicators (days required to start a business and the index for a friendly business economy) are positively related to the M&A market. If there are fast and simply procedures, a country can attract investors that can lead to an increase in the M&A market. The size of the control premium has a positive effect, so in countries with a high value of the premium we will have a high value of the average value of a M&A transaction. This confirms our statistical analysis conducted before, in the end the legal system has an influence on control premium and on the overall M&A market.

5. Conclusions

There are many operations that are specific to the M&A market and each has its features, and for this reason in the literature and the countries laws they are found under different names even if they refer often to the same things. Every developed country has an M&A legislation and attempts to impose notification, control and intervention procedures if the transactions are likely to influence a particular industry or market as a whole. In this study, we highlight that the legal origin can influence the mergers and acquisitions market, the average value of a transaction and control premium. The premiums are higher in French civil law countries than in other legal systems, even if we find a higher number of transactions in countries with common law. The results of our empirical study show that the average value of an M&A transaction is influenced not only by the legal system in general, but also of the regulations governing the companies’ activities. Therefore, the business environment does have a positive influence over the M&A market as some indicators like the number of days required to start a business or the indicators of a friendly business economy are all in favour of investors. In conclusion, we can say that investors are likely to invest more in a well regulated market, even if every law system has its own particularities. Not only that these markets have many regulations that protect the investors’ money, but also they can provide an excellent environment for development and capital gains.

Acknowledgements

This work was co-financed from the European Social Fund through Sectoral Operational Programme Human Resources Development 2007-2013, project number POSDRU/107/1.5/S/77213 „Ph.D. for a career in interdisciplinary economic research at the European standards”. The author is grateful for helpful comments provided by Victor Dragotă. Any remaining errors are mine.TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter