Publications M&A Trends In Life Sciences And Health Care: Growth At The Global Intersection Of Change

- Publications

M&A Trends In Life Sciences And Health Care: Growth At The Global Intersection Of Change

- Christopher Kummer

SHARE:

By Sarah Murray – Deloitte

Contributors: Phil Pfrang, Scott Venus

Executive summary

Anyone witnessing the feverish deal-making that has swept through the global life sciences and health care industry recently might well conclude that mergers-and-acquisitions (M&A) activity has become the dominant force shaping the industry. According to Thomson Reuters, the global year-to-date value of deals in the life sciences sector alone was $600bn for July 2014, compared with $200bn for the same period last year.

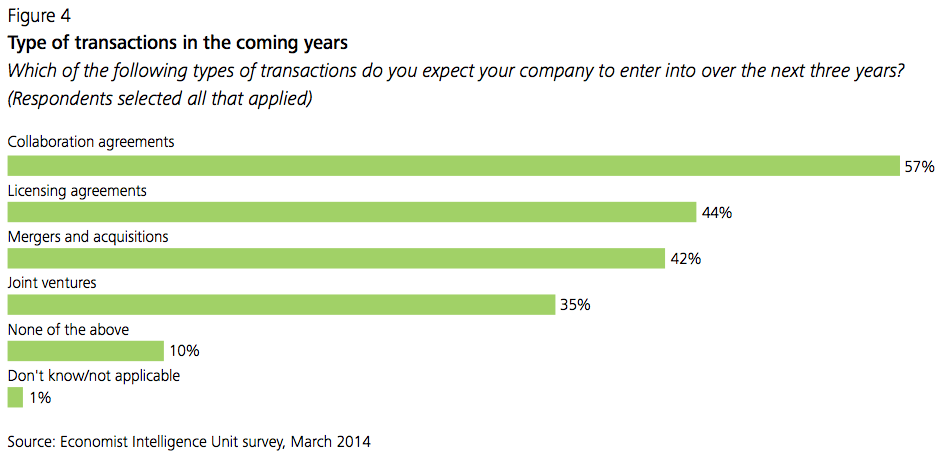

M&A is just one way forward as companies respond to changes in this dynamic and innovative space. This report, based on a March 2014 survey, reveals that partnerships and informal collaborations also form an important part of the picture as companies continue to grapple with a rapidly shifting landscape.

A number of factors are driving changes in the life sciences sector—from financial pressures such as decreased reimbursement and consolidation to the expiration of patents, from the development of new drugs and treatments to health care reforms of various types. Demographic trends, such as aging global populations, are also driving change. In addition to M&A activity, companies are coping by encouraging organic growth, seeking collaborations within the industry and developing new business models.

Tax considerations also influence the structuring of business driven acquisitions, particularly in the life sciences sector. Companies operating on a global scale are looking to restructure for business reasons in ways that allow for the efficient use of foreign capital. Some tax authorities are currently looking at legislative or regulatory action in an effort to try to limit these so-called inversion transactions whereby a corporation’s headquarters is moved to a lower-tax nation.

While M&A activity is on the rise, companies are being more deliberate, even cautious, when considering potential deals; they want to ensure that they’re the right deals to increase capabilities and expand their footprint. This appears to be especially the case for small and mid-sized firms across regions.

This Economist Intelligence Unit (EIU) report, developed in collaboration with Deloitte Touche Tohmatsu Limited, examines the multidimensional factors—demographic, political and economic—that are driving life sciences and health care companies forward into new markets and new opportunities, then analyzes how these companies are responding against this backdrop.

Key findings of our research

Our survey results and executive interviews support the following conclusions:

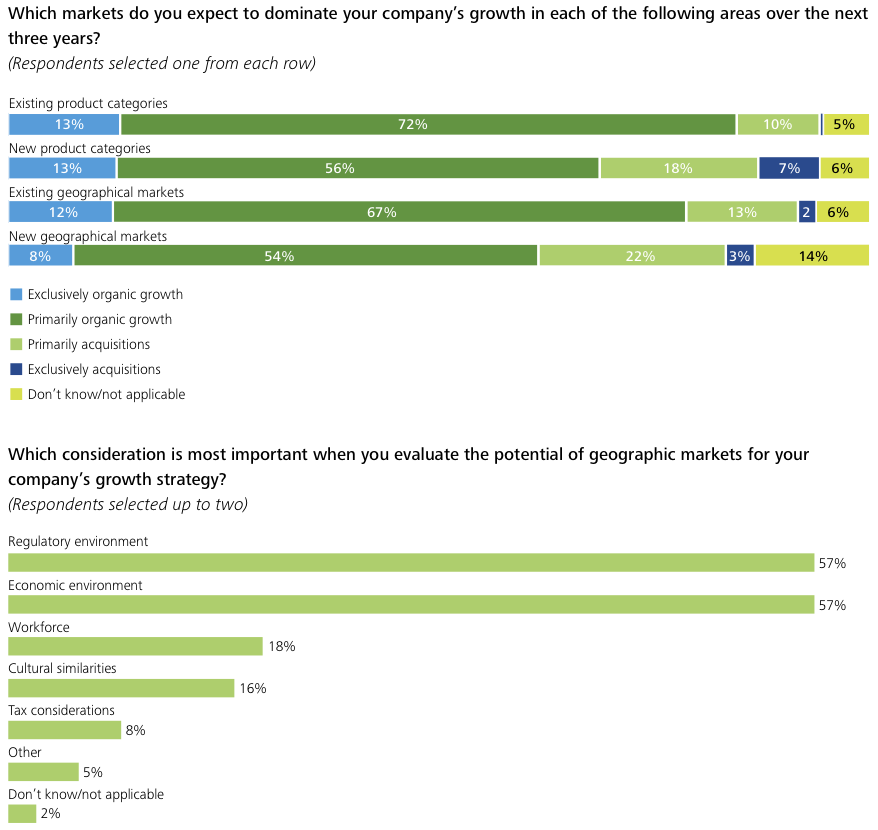

- Economic factors and the regulatory environment are the most important considerations when companies evaluate new markets.

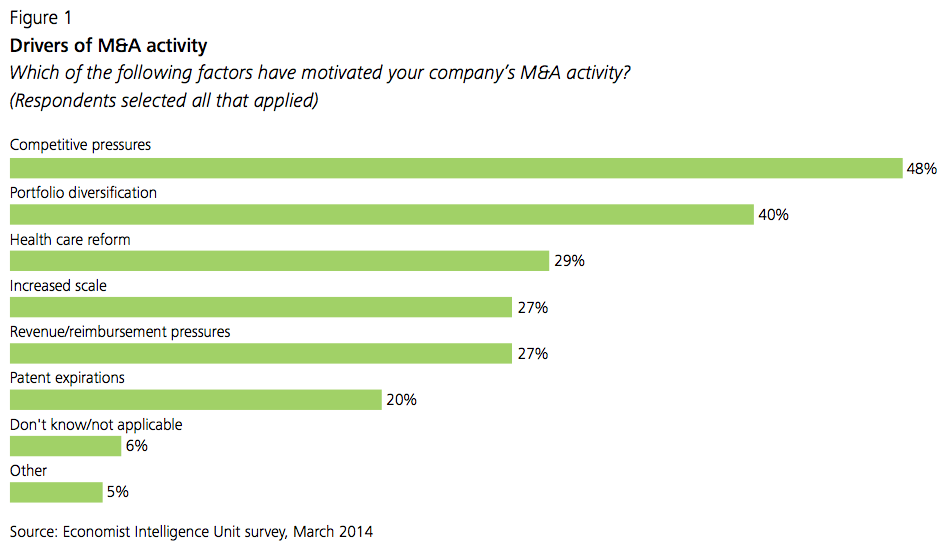

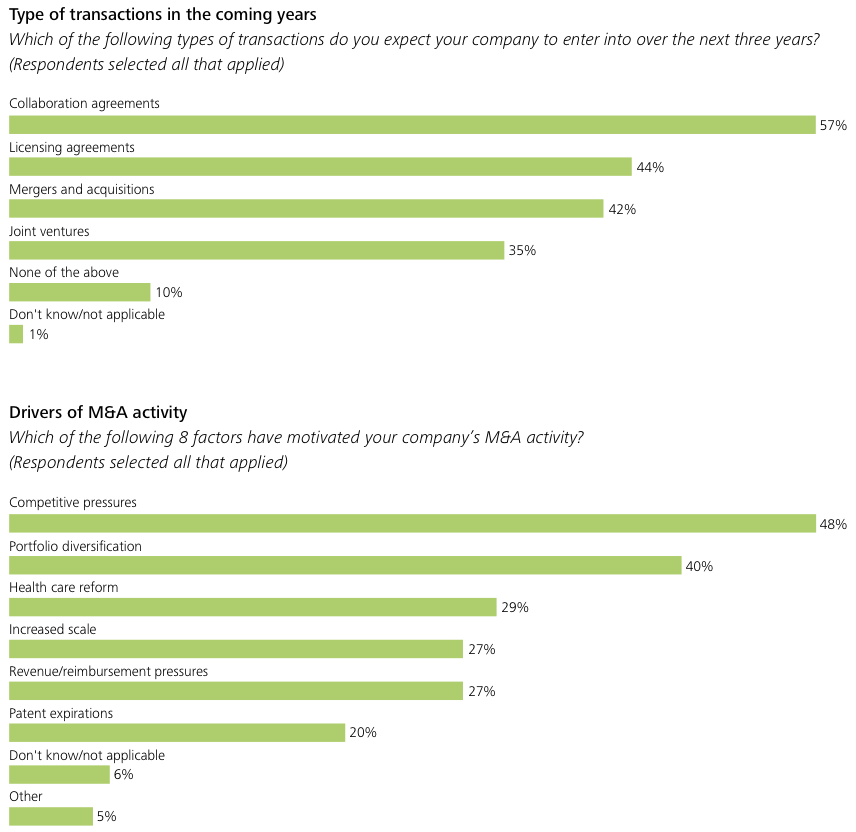

- Competitive pressures, as well as a desire to diversify their portfolios, are the strongest motivators for companies embarking on mergers or acquisitions.

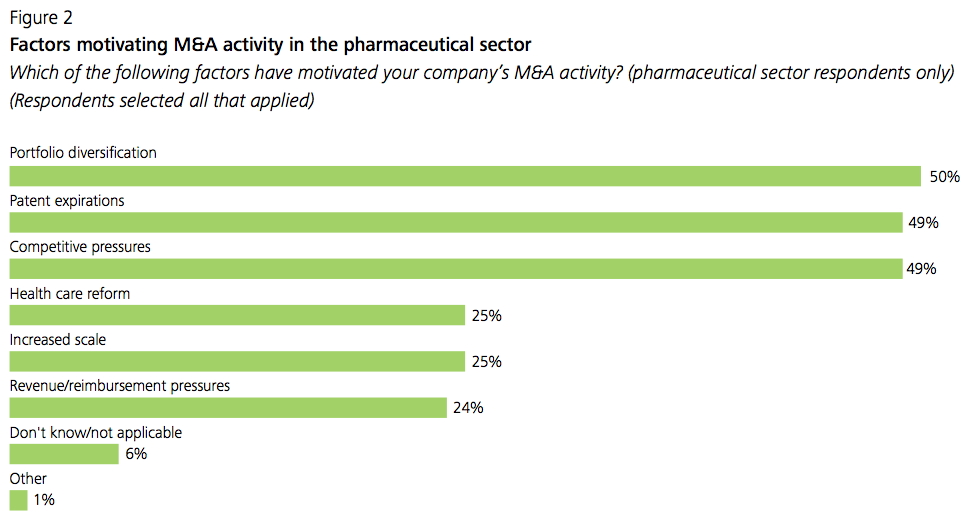

- For almost half of pharmaceutical companies, patent expirations are a motivation behind M&A activity.

- The most experienced acquirers identified tax considerations as a driver of M&A activity.

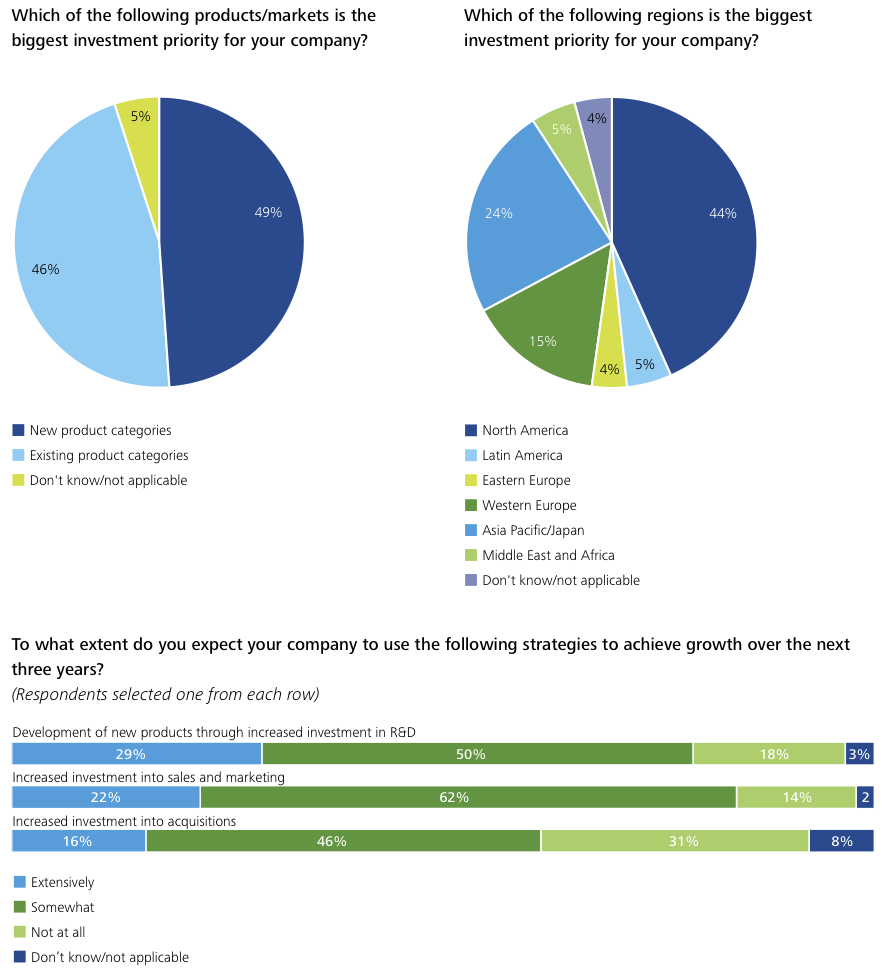

- The North American life sciences and health care market remains the primary investment destination for the industry, followed by the Asia-Pacific region.

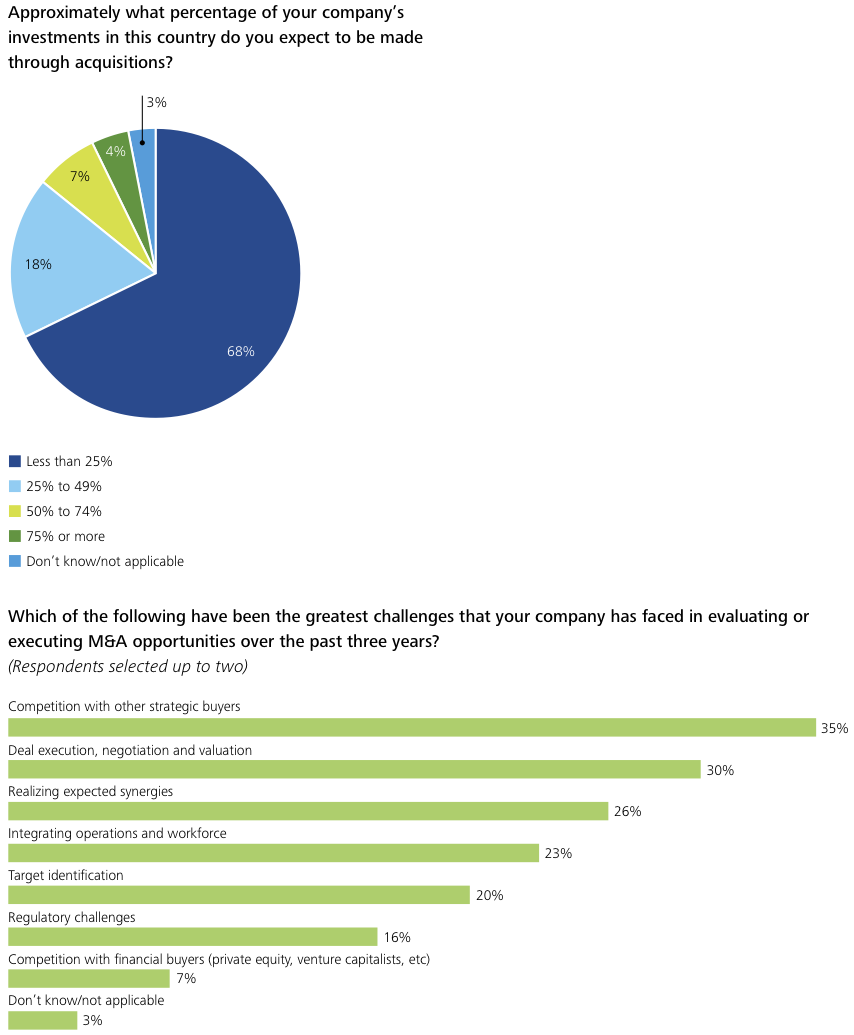

- For most respondents, acquisitions account for nearly 25% of the investments in their target investment country.

- Most companies prefer the familiar, targeting their home markets for M&A deals despite pressure to expand into faster-growing territories.

- Industry executives anticipate an increase in various forms of collaboration, particularly in the pharma sector, to help spread risk.

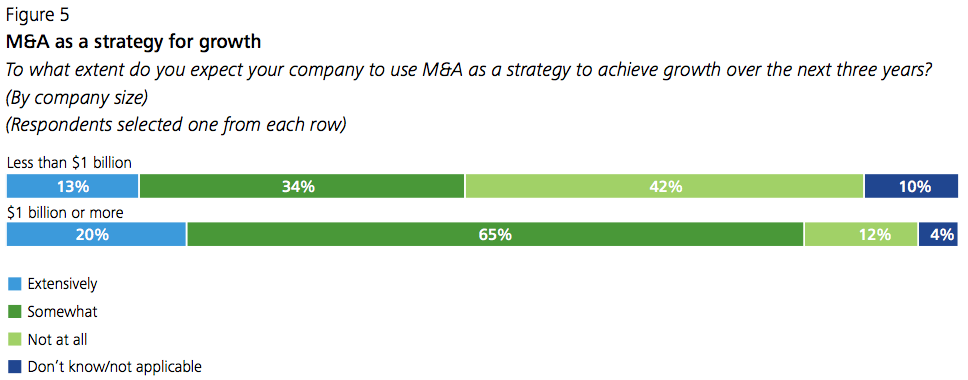

- Among large companies, 70% anticipate M&A activity in the next three years.

Introduction

Worldwide, the pressures of growing demand for health care services—fueled by aging populations and burgeoning middle classes, along with expectations of higher-quality care and a squeeze on funding—have created a perfect storm that is driving a need for new business models. With public finances stretched and austerity measures in place in the aftermath of the global financial crisis, governments in countries from the United States (U.S.) and the United Kingdom (U.K.) to Japan, China and Brazil are rethinking their health care strategies. In such an environment, the need for heightened efficiencies and increased innovation has never been greater.

Accordingly, companies must find new ways to improve the efficiency of their operations, increase their research-and- development (R&D) capabilities, tap into alternative sources of innovation and capture new customers—particularly as demand for health care rises in emerging markets.

M&A deals and licensing agreements have historically been able to create this new pipeline of opportunity and revenue.

These kinds of deals do, however, require careful decision-making to ensure that they make sense economically and match the mission of the organization.

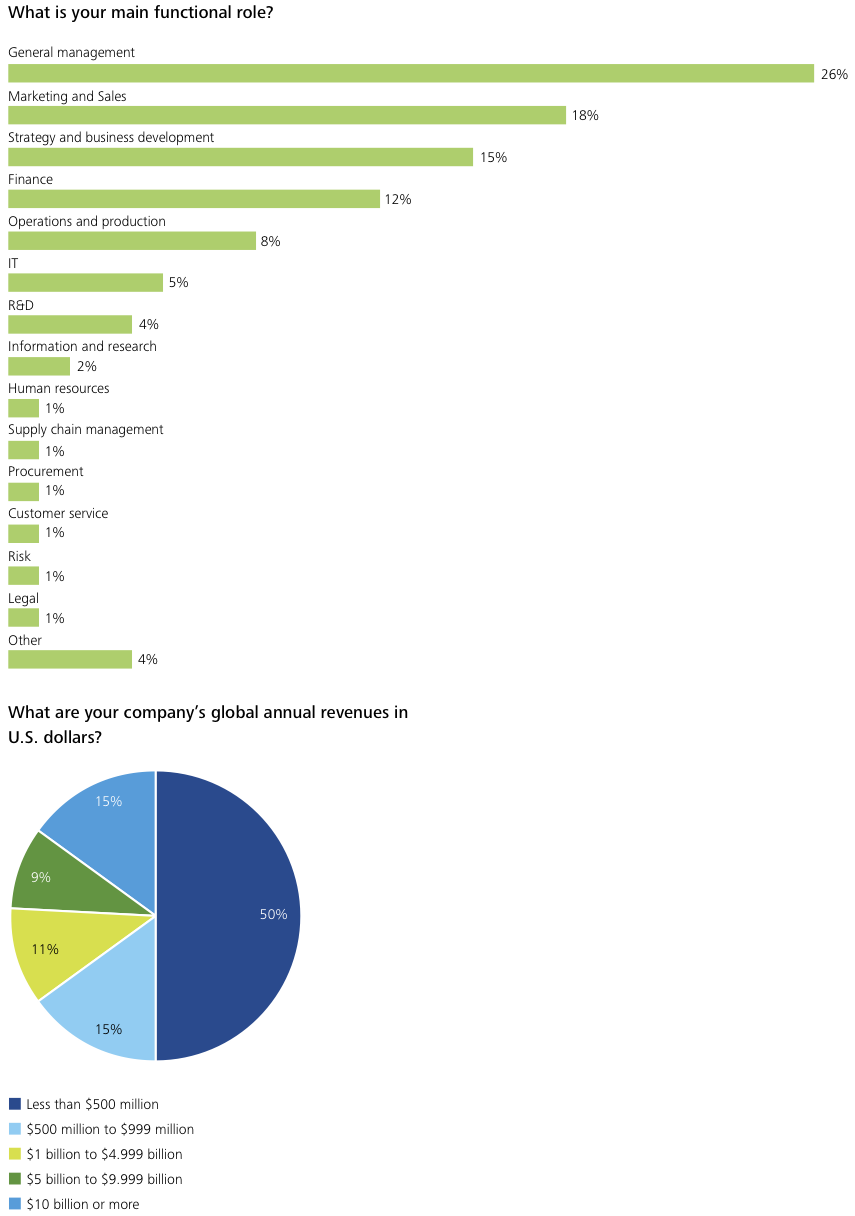

As the survey data indicates, companies are proceeding with care, particularly small enterprises—50% of survey respondents are from companies with annual revenues of less than $500m—for which taking risks is often more difficult. Yet, while the number of reported deals is modest among these respondents, for a small enterprise even one or two deals represent significant activity.

For large companies, M&A remains squarely on the agenda—70% of companies with yearly revenues of more than $10bn say they plan to undertake M&A activity in the next three years.

Consolidation is also evident in the pharmaceuticals sector and, particularly in the U.S., among health plans and large hospital systems.

About the research

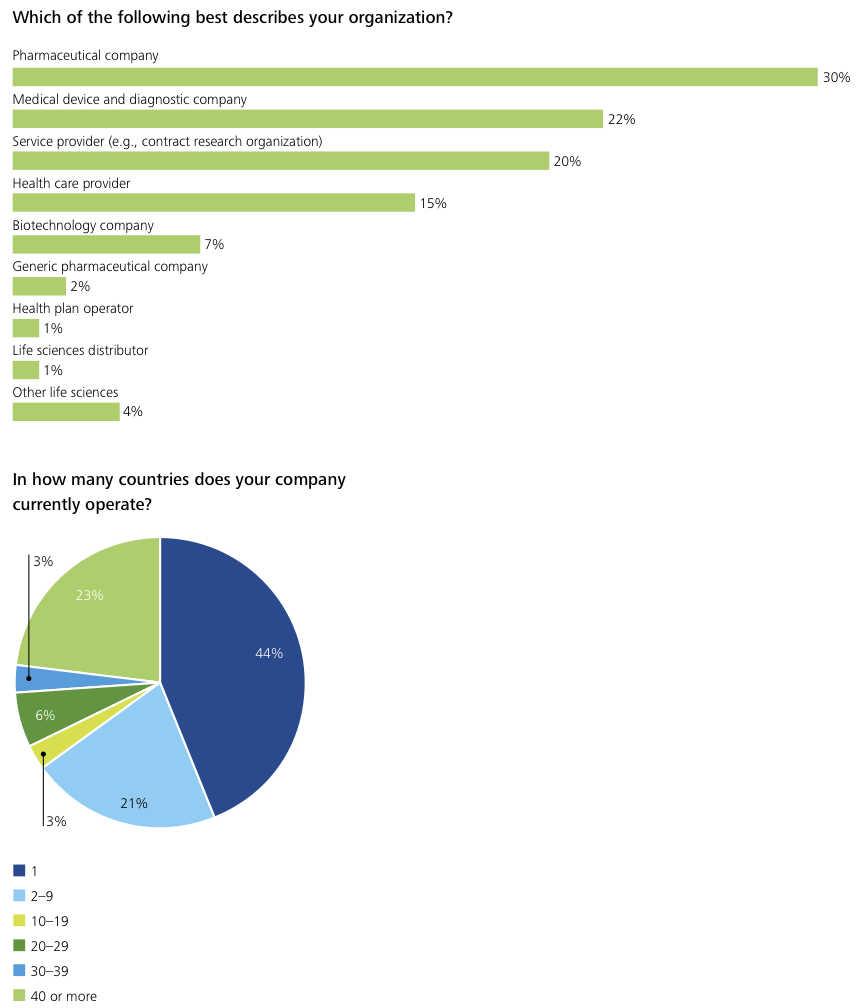

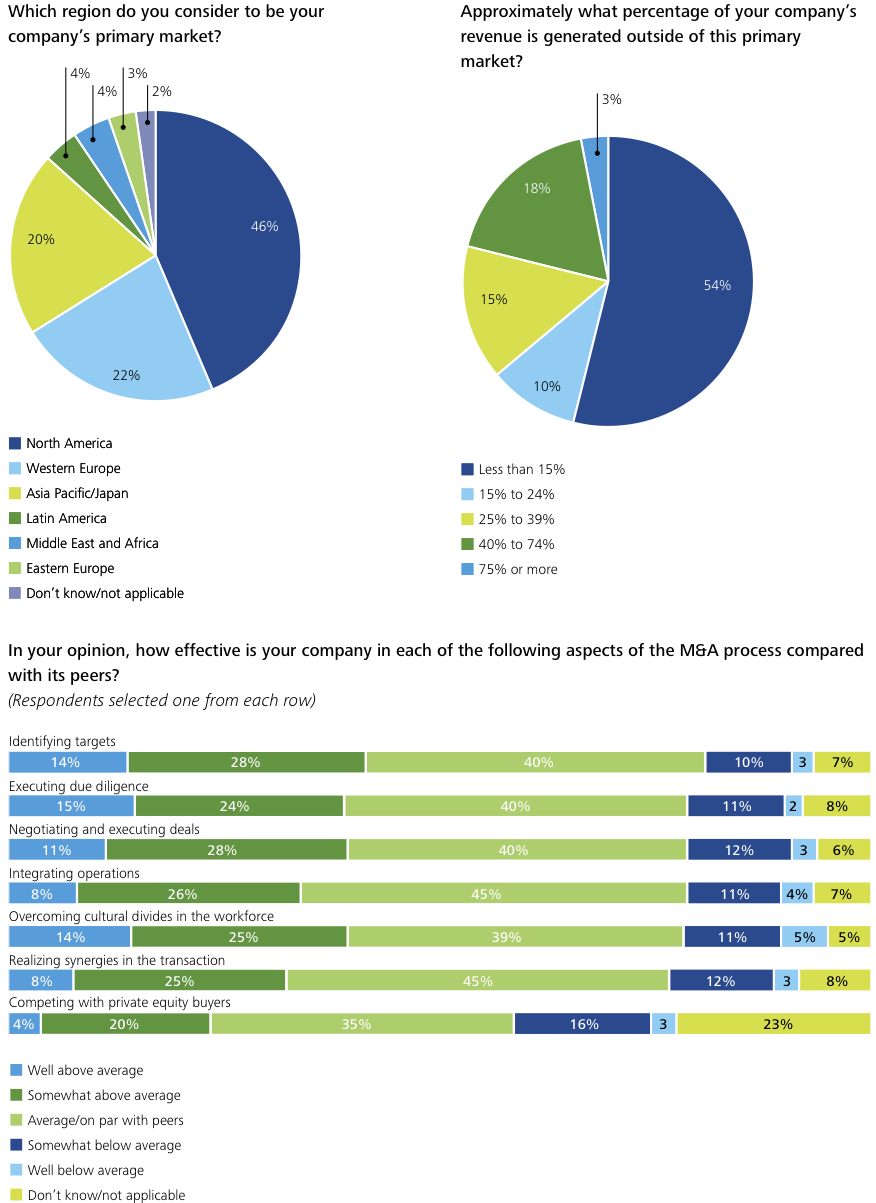

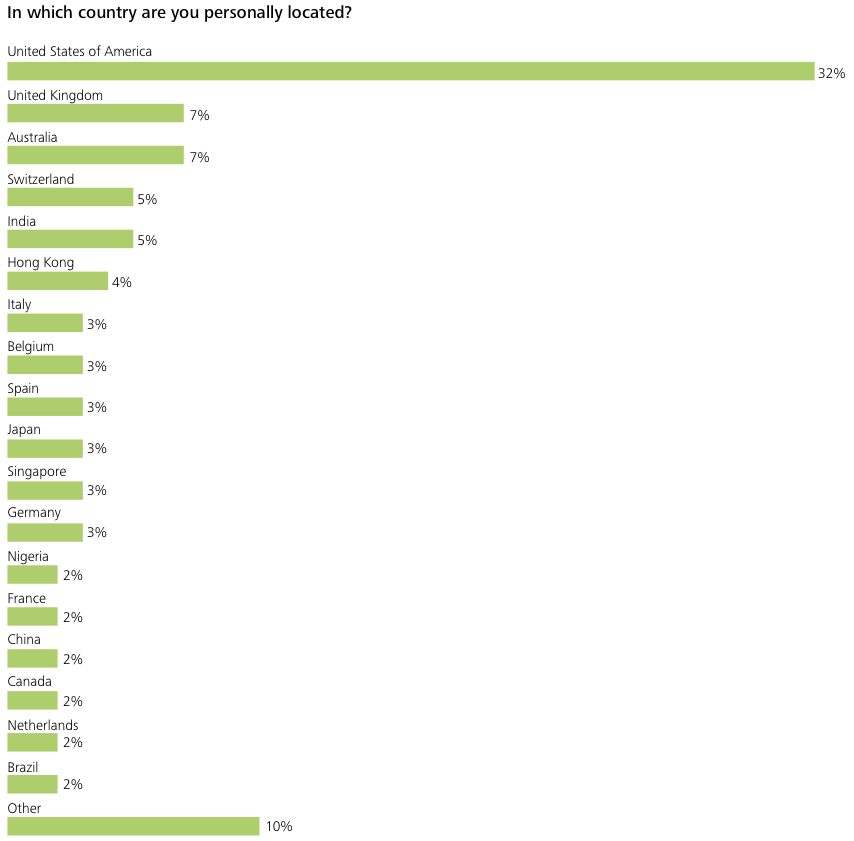

This report is based, in part, on a survey of 240 senior executives from the life sciences and health care industry conducted in March 2014. Respondents represent:

- Pharmaceutical companies (30%)

- Medical devices companies (22%)

- Service providers such as contract research organizations (20%)

- Health care providers (15%)

- Biotechnology firms (7%)

– Some 55% of respondents are C-level or above.

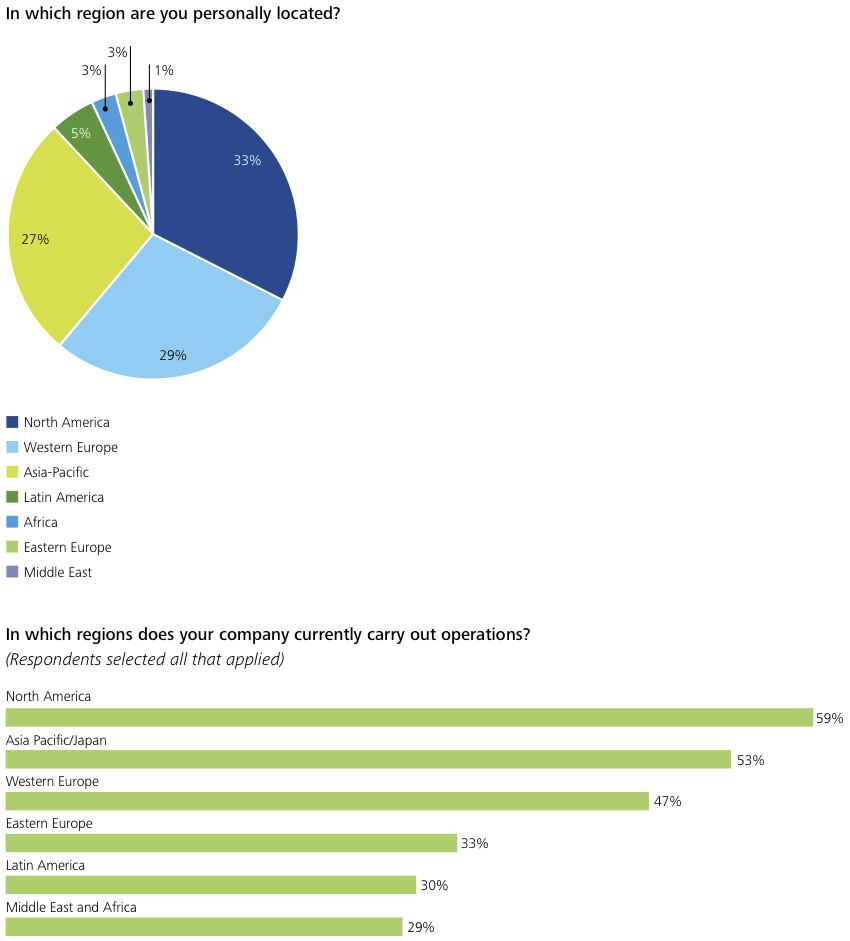

– Respondents are distributed globally, with 33% in North America, 29% in Western Europe, 27% in the Asia-Pacific region and the balance from the rest of the world.

– Respondents also work for companies with a broad range of sizes: 65% represent businesses with less than $1bn in annual revenue, while 15% are with companies reporting more than $10bn in annual revenue.

– In addition to the survey, five in-depth interviews were conducted with senior executives and other leading stakeholders, along with in-depth independent research. The report was written by Sarah Murray and edited by Janie Hulse of the Economist Intelligence Unit.

What drives M&A activity and collaboration?

Increasing financial and competitive pressures

“The number one driver is financial pressure, which, in turn, drives the need for scale,” says Ann Huston, chief strategy officer at the Cleveland Clinic, a globally renowned U.S.-based health care provider. “As we anticipate intensified financial pressures, organizations cannot afford to ignore any opportunity to realize efficiencies and economies of scale.”

Life sciences and health care companies frequently need to do more with less. In Europe, where governments fund much of the cost of care, the impact of fiscal austerity has resulted in health care budgets being squeezed even as demand for care rises. In the U.S., the impact of health care reform, changes to reimbursement structure and the pressure to move from fee-for-service models to value- based care have put already thin margins under further pressure, prompting a search for new efficiencies and new business models (Figure 1).

Scott Hankinson, director of corporate strategic planning at Highmark, the U.S.-based integrated health care system, sees these forces at work in hospitals. “Hospital margins are really depressed,” he says. “Often they are not motivated by growth opportunities as much as by the need for survival.”

Financial pressures are likely to intensify. Around the world, people are living longer but often individuals have one or more chronic conditions requiring extremely costly, long-term, complex care; patients who have several chronic conditions cost up to seven times as much as patients with only one, according to a June 2006 report by the U.S. Agency for Healthcare Research and Quality (AHRQ). In member countries of the Organization for Economic Co-operation and Development (OECD) alone, as the OECD itself reported in 2013, the proportion of people aged 80 years and over is expected to rise from 4% in 2010 to nearly 10% in 2050.

New markets for health care companies

Globally, the economic landscape is shifting, with slow growth in some markets and rapid expansion in others. Opportunities are opening up in emerging markets as rising incomes and increasing access to health insurance create new markets for health services.

This is something Bupa, the U.K.-based global health care company, is currently acting on. It has recently completed acquisitions in Chile, Hong Kong and Poland. “Of the £1.5bn we’ve spent in the past 15 months, about £550m of that was into new countries where we had no presence at all,” explains Stuart Fletcher, the company’s chief executive.

Part of Bupa’s rationale in making these kinds of acquisitions is to bring to the group new capabilities in areas such as primary care and diagnostics. At the same time, the company has had its eye on new markets that have a potential to expand. “Entering new markets—and markets with growth prospects—was a big driver for us,” says Mr. Fletcher.

Patent expirations

As top-selling drugs are coming off patent, pharmaceutical companies will need to either increase R&D or look to acquisitions, licensing or collaboration agreements to fill their product pipeline. According to our survey, some 49% of pharmaceutical company respondents indicate that patent expiration was a motivating factor in their company’s M&A activity (Figure 2).

R&D is also expensive for life sciences companies, driving them to spread risk. “Companies are less willing to take on sole R&D risk for high-risk ventures,” says Dr. Andrew Baum, head of global health care research at Citigroup. “So you’ve had partnering, which tends to bring competitors into greater contact than they’ve had previously.” Survey results show that 61% of pharmaceutical companies expect to enter into collaboration and licensing agreements within the next 3 years, slightly more than medical device 6% companies (44%) that are also heavily dependent on R&D to fill their product pipeline.

According to a November 2013 Bloomberg Businessweek report, drugs going off patent will have a $50bn impact 4% in 2014 alone. “They’re going through a major cliff,” says Citigroup’s Dr. Baum. “Some companies are out of it, but some companies are still going through it.”

Rising demand for care amid health care reforms

Meanwhile, as new drugs and procedures emerge, the demand for higher-quality care is growing. Tech-savvy consumers seek new ways of interacting with the health care system. As technological advances such as 3D-printed implants become commercialized; providers incorporate medical innovations, such as cancer genetics, into their services; as the personalization of medicine becomes commonplace, the quality of treatment will increase.

In response to rising costs and greater demand for health care services, governments are instituting reforms. In the U.S., for example, part of the 2010 Affordable Care Act involves a shift toward value-based approaches (rather than traditional fee-for-service) to treatment, with providers reimbursed for health outcomes.

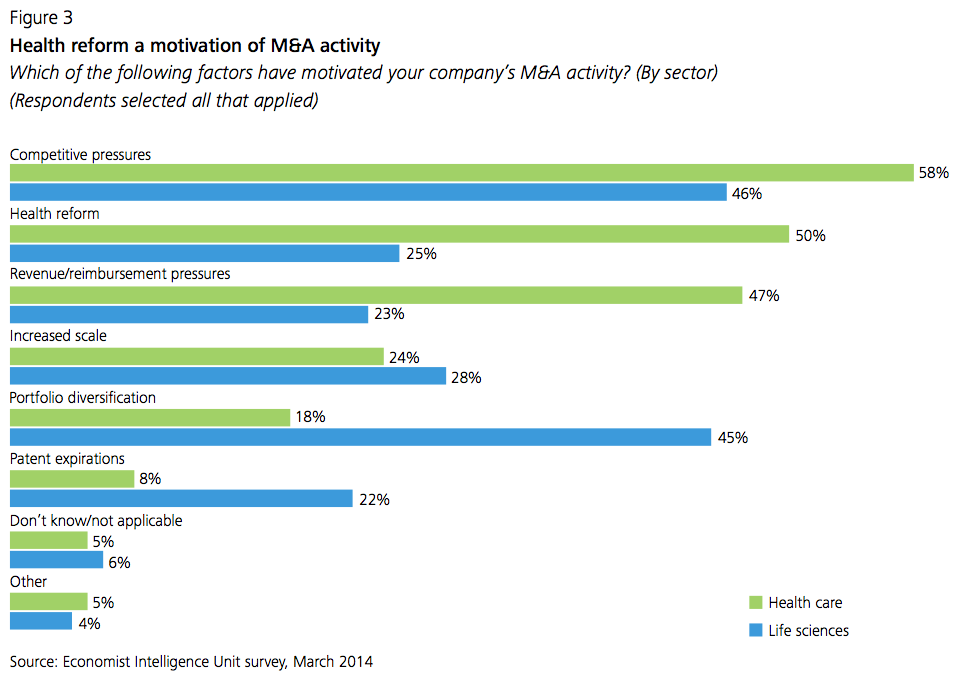

Respondents rank health care reform third—after competitive pressures and the need for portfolio diversification—among the factors driving their company’s M&A activities. Industry sectors, however, are reacting differently to reform. It is not such a significant issue for most life sciences companies, but it is for health care providers and all health plans—with nearly half of the latter saying that health care reform and revenue and reimbursement pressures are motivating factors for M&A (Figure 3).

In the U.S., health care reform’s emphasis on shifting payment structures (i.e., moving from a fee-for-service reimbursement model to incentives for team approaches, lowered costs and increased quality) may make it hard for smaller companies to compete, thus driving an increase in collaborations. On the one hand, because the act expands health care coverage to millions of Americans, an increased pool of insured individuals will result in a bigger market; however, in the case of the expansion of Medicaid, companies now have to or will have to compete in a market in which purchasers are public sector organizations.

“To be successful, you have to compete in that government space and make money with razor-thin margins,” says Highmark’s Mr. Hankinson of the U.S. scenario. “So you have to make pretty significant investments and look at how to control costs. One way to do that is to partner with others and achieve economies of scale.”

Many of the survey respondents agree. The largest percentage (57%) foresees collaboration agreements being the type of transaction their company is most likely to embark on in the next three years (Figure 4).

The shift from a volume-based to a value-based approach will also drive acquisitions or collaborations as organizations seek necessary skills and tools and also move to manage populations. “To survive and thrive in the value-based world, providers need confidence with a different set of capabilities than in the past,” says the Cleveland Clinic’s Ms. Huston. “A truly integrated care model—with care paths geared to reducing clinical variation, care coordination and real-time data analytics—is essential to improving quality and reducing the total cost of care. This model represents a new level of capability that is expensive and takes time to build and install.”

For U.S. companies, the pressure to become more consumer-focused may prompt alliances with businesses outside the health sector. The advent of health plans with higher deductibles will almost certainly drive consumers to seek a higher level of value for their health care dollars. And new generations of users will want to consume health care in the way they do for other products and services.

“There’s a different level of consumerism that brings a need for retail thinking and retail capabilities. Hospital providers haven’t traditionally thought this way and are not particularly adept at these approaches,” says Ms. Huston.

Clearly, the U.S. is not alone in reforming its health care system. Brazil, Canada and China have also taken steps to increase private investment in health care. In Japan, health care reform is an important component of the government’s new economic plans.

Tax considerations

When it comes to encouraging and discouraging investment, the flurry of recently announced cross-border M&As would indicate that tax policies are an important consideration in structuring transactions. The survey results, however, seem to contradict that trend. Regulatory and environmental issues loom much larger than taxes, which barely make the list—only 8% of respondents say taxes are the most important factor in evaluating a geographic region.

Nevertheless, in our survey, the most experienced acquirers do see tax implications as an important consideration, with 21% of buyers who had done 10 or more deals over the past three years saying this was the case.

Life sciences companies are often uniquely positioned to structure a business driven M&A transaction to achieve tax efficiencies. They are, for example, able to achieve better management of the global footprint of intellectual property or the selection of a strategic jurisdiction for the location of the parent company. A number of mega transactions recently announced resulting in corporate inversions appear to have real strategic value, but also appear to be, in part, influenced with tax advantages in mind. Moving forward, regulatory and political scrutiny may limit the tax efficiencies that can be achieved in M&A deals, even if they have real strategic value.

For example, Dr. Baum notes that in deals such as the recent attempted takeover of AstraZeneca by Pfizer, tax considerations inevitably played a role. “The ability, if they had re-domiciled or become a U.K. holding company, to move cash across borders would have been worth an awful lot of money to a pharma company,” he says.

In the June 2014 announcement of a pending acquisition by U.S.-based Medtronic, a medical technology company, of Ireland-based Covidien, a health care technology and medical supplies provider, tax considerations were speculated to weigh heavily in structuring a transaction with real strategic value. It contemplates Medtronic moving its tax domicile from the U.S., where the federal corporate tax rate is 35%, to Ireland, where it is 12.5 %.

Sector responses to a changing landscape

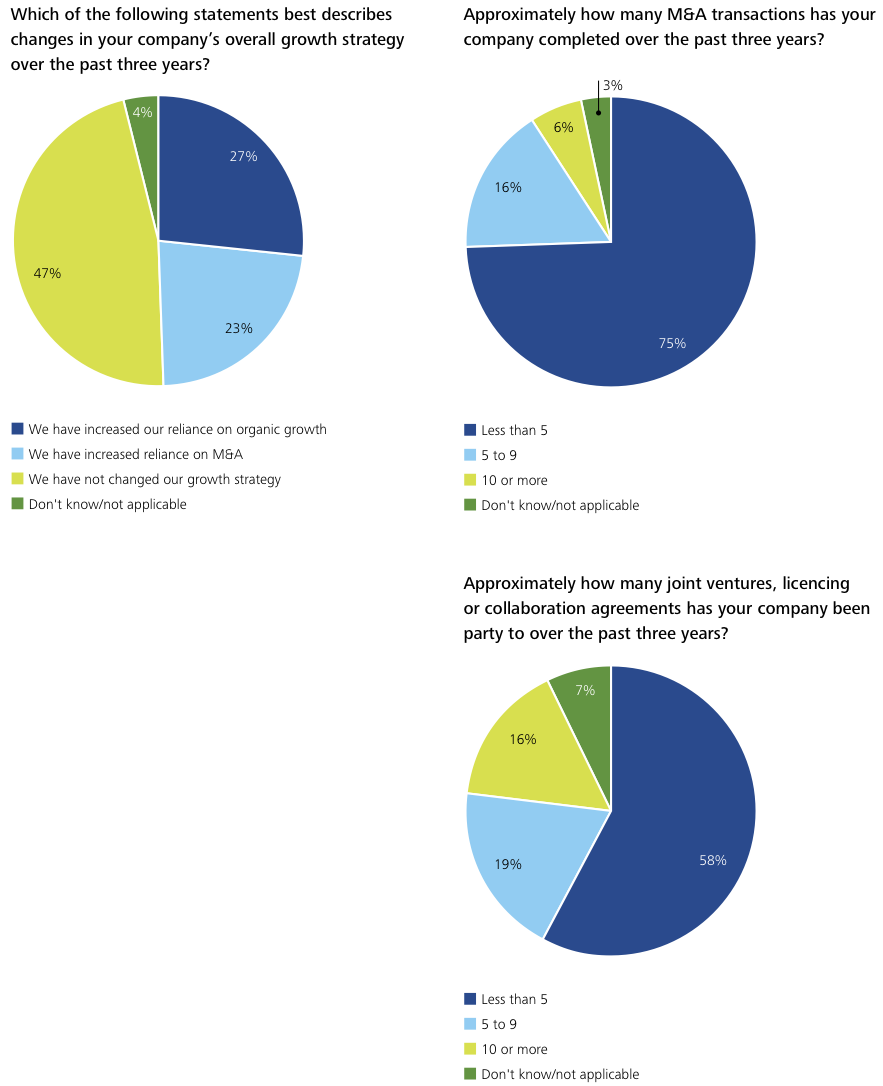

Behind all the hype and the mega-deals that have hit the headlines, our survey reveals that, overall, companies are taking a measured approach to expansion, with most respondents (75%) reporting that they have done fewer than five transactions over the past three years.

However, it is worth remembering that half the survey respondents are from companies with under $500m of revenue; for these firms, participating in even a small number of deals is an ambitious strategy.

At large companies, the picture is very different. The likelihood of companies engaging in M&A seems to be highly correlated to the size of the company. Close to half (48%) of companies with revenues of less than $1bn say they are planning to embark on M&A activity in the next three years (with 13% saying they would use it extensively); this rises to 85% among companies with revenues of more than $1bn (with 20% saying they would use it extensively). (Figure 5).

In the U.S., mergers and acquisitions activity is on the rise among hospitals, increasing by 25% between 2010 and 2012 compared with the previous three years, according to Irving Levin Associates, a health care research firm, which expects M&A to continue to rise.

Some see the advent of mega-hospitals in the U.S. as a cause for concern. “If they’re monopolistic or oligopolistic, they have tremendous pricing power, and they don’t have to watch their costs that carefully,” says Regina Herzlinger, a Harvard Business School professor known for her research in health care. “And if there aren’t appropriate accountability mechanisms, quality also can deteriorate because of the lack of competition.”

While U.S. reform is ushering in sweeping changes, only 25% of companies focused primarily on the North American market indicate health care reform to be a motivating factor for M&A deals, similar to the 24% of respondents based in Asia-Pacific and Japan, the two other regions most sensitive to the effects of health care reform.

M&A transactions: staying close to home

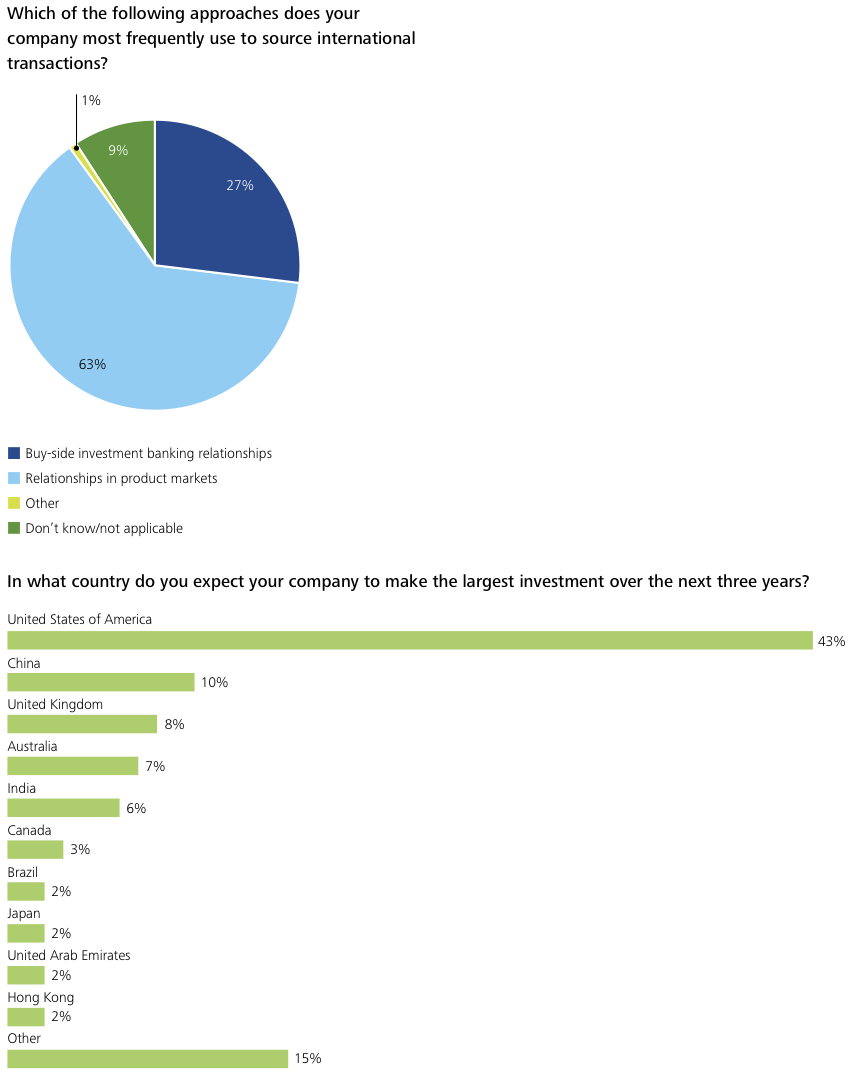

M&A activity is on the rise, but deals are largely taking place within national borders—except in the pharmaceuticals sector, where large global transactions have hit the headlines. Our survey reflects this, with North America emerging as the largest target for health care investment and few companies straying far from their home base (Figure 6).

A more international outlook is found among companies that are serial acquirers (having done more than five deals over the past three years). These tend to operate on a global scale, with 68% of highly acquisitive companies operating in 20 or more countries.

The more countries a company operates in, the more likely it is to be a serial acquirer. For example, 16% of companies that have operations in 2-9 countries and 25% of companies that operate in 10-19 countries are serial buyers, compared with 47% of companies that operate in 20 or more countries.

Moreover, companies appear to be looking to emerging markets for opportunities. In our survey, for example, India, considered by many to be “old news,” is in fifth place—surprisingly high on the list—with 6% of respondents choosing it. China is in second place, after the U.S., with 10% of respondents selecting this market as a target for investment in the next three years.

Meanwhile, 40% of respondents who identified an international market as their priority market selected Asia-Pacific as the main target for acquisitions (the primary market after North America). For respondents who indicated a choice outside their home country, the U.S., China and the U.K. are the top three choices—Brazil and India tie for number four (4%).

The North American health care market remains the primary investment destination, with 55% of respondents from outside North America and 67% of those from the region itself identifying North America as the primary market for investment. Given that the U.S. has the world’s highest level of health care spending; it is perhaps not surprising that North America remains an attractive proposition. Moreover, the U.S. Affordable Care Act may increase the number of insured people by 30m over the next decade—a substantial addition to the market. As of March 2014, 9.5m had already been added.

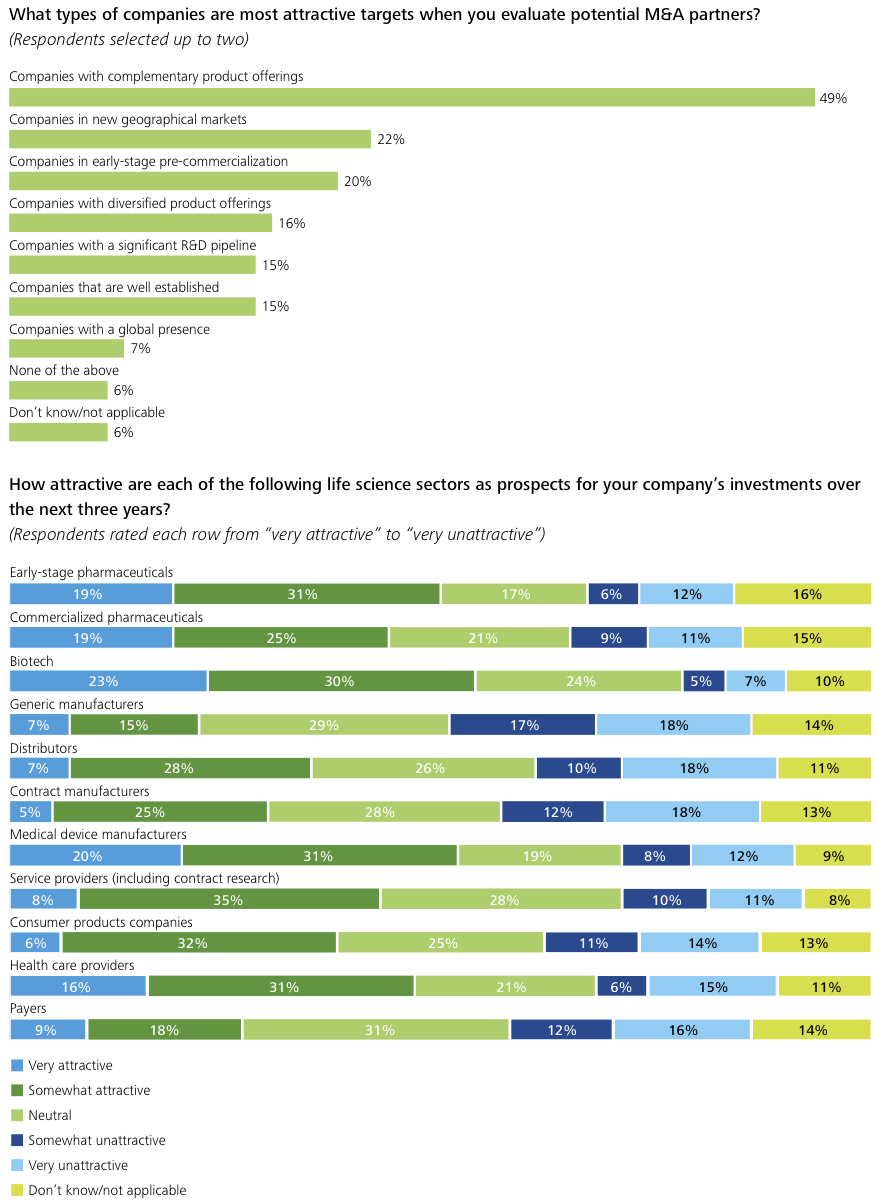

Investment strategies: embracing the familiar

When it comes to the kinds of investments they are making, companies are also sticking to what they know best. The largest portion of respondents (49%) indicates that companies with complementary or similar product portfolios are the most attractive M&A targets.

For example, in April 2014, Zimmer, a leading medical device manufacturer, and Biomet, the orthopedic products group, announced an agreement under which Zimmer will acquire Biomet in a transaction worth more than $13bn.

“That acquisition makes sense because they have very similar orthopedic product lines, so economies of scale in the sales force are going to be substantial,” says Ms. Herzlinger. “Unless there’s massive overlap between product lines, those sales economies of scale will not occur.”

The preference for the familiar may also reflect the nature of the sector. Unlike many products and services, health care is bound by complex regulatory, cultural and ethical concerns. This makes it tougher for companies to move into new markets or change direction, something reflected in the survey, with of the largest group of companies (47%) indicating that they had not changed their growth strategy over the past three years.

Overcoming the hurdles

While the demographic, political and economic factors driving M&A activity and greater collaboration are becoming increasingly compelling, a number of barriers exist to deal-making in the health care and life sciences sector.

Political realities and the limits of geography

This is particularly true when it comes to cross-border transactions. With responsibility for the delivery of services in the hands of national governments and provision models varying widely from country to country, penetrating these systems as an outsider can be a difficult and high-risk proposition.

This is reflected in the location of companies’ operations. In the survey, in each region covered, the largest proportion of respondents selected their own region when asked where they currently conduct operations. For the largest proportion of respondents (54%), less than 15% of their company’s revenues are generated outside their primary market.

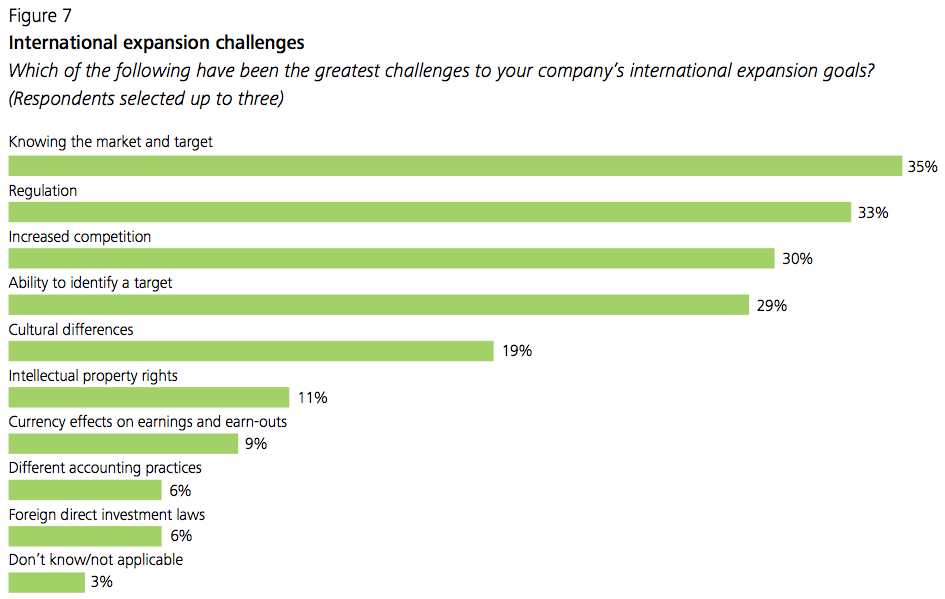

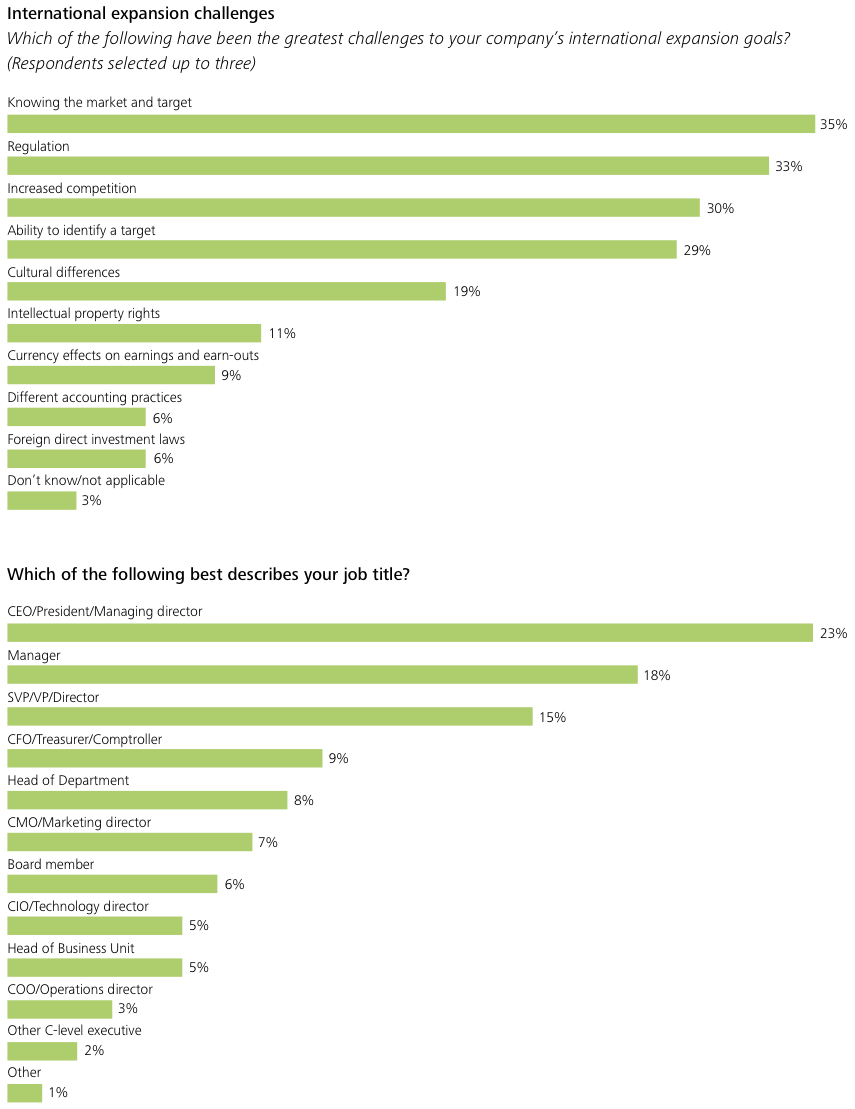

With so many of their business activities taking place at home, it is hard for companies to gain the experience needed to expand across borders, whether organically or through M&A activity. Survey respondents point to lack of knowledge of the market and target as the biggest challenge to meeting their overseas expansion goals (35%). (Figure 7)

The regulatory frameworks in different jurisdictions also deter some. In our survey, this ranks second as a challenge, with 33% of respondents seeing such frameworks as a barrier to international expansion.

In addition to regulatory matters, increased competition (30%) and the ability to identify a target (29%) are considered to be top challenges to companies’ international expansion. Cultural differences can also prove to be a significant hurdle—cited by 19% of surveyed executives. Health plan operators and health care providers are particularly sensitive to cultural issues.

For example, in many countries, blurred objectives between nonprofit community organizations and for-profit enterprises add barriers to the kind of M&A activity seen in other sectors. “As community assets, the mission of nonprofit health care organizations is to improve the health of the community. That’s counter to the business model of how you make a margin,” says Ms. Huston. “That complexity and duality make it very challenging.”

While every enterprise works to maximize a return to its shareholders, the shareholder of a nonprofit health care organization is the community it serves, and the nonprofit’s mission is to grow and use its assets to provide services to that community. “It is likely that for-profit enterprises, whose primary objective is to maximize a financial return, may have a clearer line of sight toward consolidation as a means to increase economic value.”

Another reason for the lag in consolidation in this sector, Ms. Huston notes, is the fundamental nature of nonprofit community-based health care organizations. “They represent assets of the particular community, so it is very hard for trustees of those organizations to give away or entrust them to someone outside the community to manage,” she says. “That is why you often see loose collaborations versus full-asset mergers as an initial step in partnering.”

Internal hurdles

Internal limitations also present barriers. In our survey, few companies see themselves as “well above average” in a range of M&A processes. Many respondents (30%) cite deal execution, negotiation and evaluation as barriers, ranking these second among the challenges to their M&A activities over the past three years.

Companies can build on experience gained from one deal when they embark on others. “It’s a domino effect. We wouldn’t have had the courage to go into Poland had we not had the experience of primary care and diagnostics that we have on a smaller scale in Spain,” explains Mr. Fletcher. “And we would not have stepped in and acquired Quality HealthCare in Hong Kong had we not had the experience and the confidence born of our acquisition in Poland.”

However, for the smaller companies who predominate in our survey, it is harder to take the initial risk. “For small businesses, making a very large acquisition into a brand new country is a high-risk move,” says Mr. Fletcher.

Finally, institutional memory could play a part in deterring companies from investing more aggressively. “M&A in the pharmaceutical industry historically has been highly dysfunctional,” says Citigroup’s Dr. Baum. “While cost savings may have been realized, there’s been incredibly poor allocation of capital subsequently—and that memory has lingered.”

Conclusion

Compared with many industries, health care has been historically slow-moving, hobbled by tight regulation and delivered through national systems that are often difficult for outside investors to penetrate. We are, however, in a time of rapid change and companies are learning that they need to adapt and expand to be successful. Our survey confirms that companies today are looking beyond familiar territory for tomorrow’s progressive growth.

Companies in new geographic markets are cited by 22% of our surveyed executives as the most attractive M&A targets, second only to those with complementary product offerings. The desire to move into new markets highlights the fact that companies are responding to the challenges and opportunities emerging in the industry worldwide. They will need, however, to find new ways to work across borders and with a range of new partners.

“Everyone sees those dynamics of growing demand, increased expectations, growth in emerging economies and lack of funding,” says Mr. Fletcher. “There is now a realization that partnerships of one form or another will be very important in meeting those health care demands.”

In the coming years, the sector will face a wide range of pressures—from regulatory to economic. Keeping pace with the changes will require alternative business models, additional skills, greater efficiencies, new paths to innovation and creative strategies for growth.

Much of this can be achieved by adopting new collaborative business models. In some cases, what will make sense will be for companies to merge with or acquire others to increase capabilities and expand their geographic footprint, particularly if such mergers bring together businesses with similar or complementary services or product lines. On the other hand, some situations will call for looser, more unstructured partnerships.

Either way, to ensure that these strategies succeed; companies will need to break down internal barriers and look outside themselves for sources of innovation. While seldom easy, in the long run and in such a challenging era for health care, those firms that learn how to embrace change, move faster and tolerate risk will be the ones most likely to flourish.

Appendix

Survey results: March 2014 online survey of 240 senior life sciences and health care industry executives, conducted by the Economist Intelligence Unit in collaboration with Deloitte Touche Tohmatsu Limited. Note: Because of rounding, numbers may not tally with total.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter