M&A News M&A News: Global M&A Deals Week of May 27 to June 2, 2024

- M&A News

M&A News: Global M&A Deals Week of May 27 to June 2, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

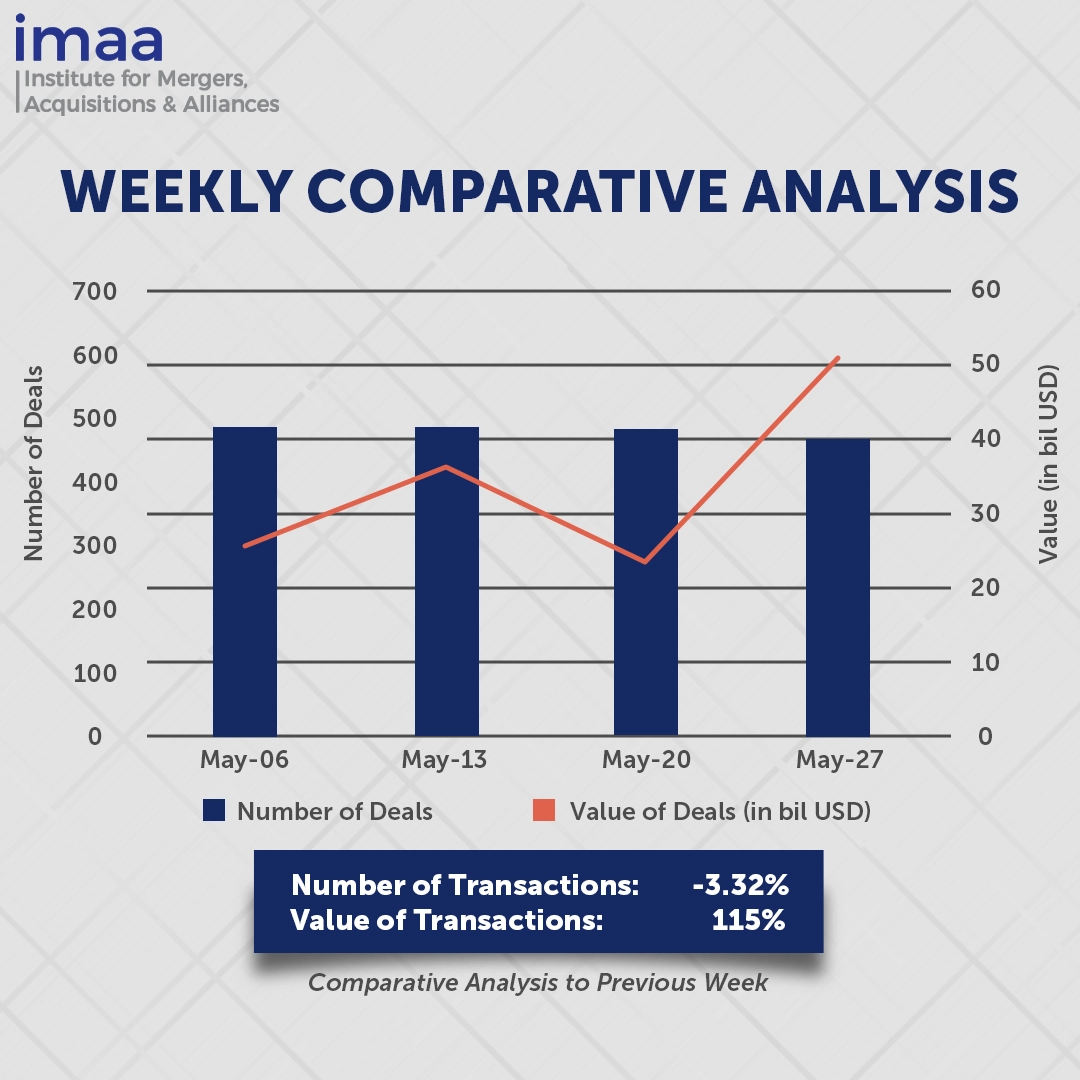

During the week from May 27 to June 2, the global market witnessed an active period in Mergers and Acquisitions (M&A), culminating in 466 deals collectively valued at USD 50.71 billion. Notably, 16 of these transactions exceeded the USD 500 million threshold, amassing a combined value of USD 45.46 billion, representing a substantial 90% of the week’s total deal value.

A significant development unfolded in the energy sector this week with ConocoPhillips’ acquisition of Marathon Oil Corp for an impressive USD 22.5 billion. This move by ConocoPhillips is emblematic of the ongoing trend within the industry, where major players are strategically consolidating to boost production amidst a resurgence in energy prices following the tumultuous period at the onset of the pandemic. Prior to this acquisition, ConocoPhillips had already made significant investments in the Permian, notably through the acquisition of Concho Resources Inc. for USD 13 billion and Shell Plc’s assets in the region for USD 9.5 billion.

Examining week-over-week trends reveals a slight 3% decrease in deal volume, declining from 482 to 466 transactions during this period. However, despite this decrease in deal count, the total deal value skyrocketed by 115%, surging from USD 23.58 billion to USD 50.71 billion, highlighting the dynamic activity and substantial investments shaping the global M&A landscape.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of May 27 – June 2, 2024 in detail:

Deal No. 1: ConocoPhillips to Acquire Marathon Oil Corporation for USD 22.50 Billion

Deal No. 2: T-Mobile US, Inc. to Acquire Wireless Operations and Select Spectrum Assets of United States Cellular Corporation for USD 4.40 Billion

Deal No. 3: Energy Transfer LP to Acquire WTG Midstream, LLC for USD 3.25 Billion

Deal No. 4: Merck & Co., Inc. to Acquire Eyebiotech Limited for USD 3.00 Billion

Deal No. 5: Energy Capital Partners, LLC to Acquire Atlantica Sustainable Infrastructure plc for USD 2.56 Billion

Deal No. 1:

ConocoPhillips to Acquire Marathon Oil Corporation for USD 22.50 Billion

ConocoPhillips is poised to acquire Marathon Oil in a significant oil-stock transaction valued at USD 22.5 billion, inclusive of debt. This strategic move will enhance ConocoPhillips’ presence in key domestic shale regions, spanning from Texas to North Dakota, and extend its reserves to Equatorial Guinea. This acquisition is part of a broader trend of large-scale mergers as energy companies seek new drilling opportunities, anticipating sustained demand for oil and gas.

The acquisition will elevate ConocoPhillips’ market capitalization beyond USD 150 billion, solidifying its position as the leading independent producer and aligning its scale with some of the major players in the industry.

The integration of Marathon Oil is expected to be immediately beneficial to ConocoPhillips’ earnings, cash flows, and capital returns per share. The company anticipates realizing USD 500 million in cost and capital synergies within the first year post-acquisition. This deal will significantly enhance ConocoPhillips’ U.S. onshore portfolio, adding over 2 billion barrels of resources with a projected average supply cost of under USD 30 per barrel WTI.

ConocoPhillips has announced plans to repurchase over USD 7 billion in shares during the first year following the acquisition and over USD 20 billion within the first three years.

The transaction is projected to close in the fourth quarter of 2024. Evercore is acting as the financial advisor for ConocoPhillips, while Morgan Stanley & Co. LLC is representing Marathon Oil.

Deal No. 2:

T-Mobile US, Inc. to Acquire Wireless Operations and Select Spectrum Assets of United States Cellular Corporation for USD 4.40 Billion

In a strategic move aimed at enhancing connectivity in underserved rural areas and strengthening its market position, T-Mobile US has announced plans to acquire the wireless operations and select spectrum assets of United States Cellular Corporation (UScellular) for USD 4.4 billion. This acquisition will be financed through a combination of cash and up to USD 2 billion in assumed debt.

The transaction involves T-Mobile acquiring UScellular’s wireless operations, including its wireless customers, retail stores, and specific spectrum assets.

This acquisition aims to improve T-Mobile’s capacity to offer better connectivity to rural Americans by enhancing nationwide coverage. Customers can enjoy T-Mobile’s value-packed plans with perks like streaming, free international data roaming, and top-notch customer support, all without any switching costs. By prioritizing competitive pricing and customer satisfaction, T-Mobile aims to strengthen its presence in the broadband market and achieve long-term growth and profitability.

As part of the agreement, T-Mobile will secure a new long-term Master Lease Agreement (MLA) for a minimum of 2,015 additional towers owned by UScellular, while extending lease terms for approximately 600 towers already under T-Mobile’s occupancy. This ensures uninterrupted service for UScellular customers post-transaction and establishes a stable revenue stream for UScellular from a key tenant for at least 15 years after the deal closes.

T-Mobile anticipates significant synergies from this acquisition, projecting approximately USD 1.0 billion in annual operating and capital expenditure cost savings upon integration. Total integration costs are estimated between USD 2.2 billion and USD 2.6 billion. A portion of these synergies will be reinvested to enhance consumer options, improve service quality, and foster competition within the wireless industry.

For USCellular, the deal offers improved liquidity and debt reduction, with potential future monetization of retained spectrum assets.

The transaction is expected to close by mid-2025, with PJT Partners LP advising UScellular and Cleary Gottlieb Steen & Hamilton LLP and DLA Piper LLP serving as legal counsel to T-Mobile.

Deal No. 3:

Energy Transfer LP to Acquire WTG Midstream, LLC for USD 3.25 Billion

Energy Transfer LP has entered into an agreement to acquire WTG Midstream in a deal valued at USD 3.25 billion. The acquisition, aimed at enhancing Energy Transfer’s extensive pipeline network in the Permian Basin, involves a payment of USD 2.45 billion in cash and the issuance of approximately 50.8 million new Energy Transfer common units.

As part of the agreement, Energy Transfer will also gain a 20% interest in the BANGL Pipeline, a crucial natural gas conduit spanning approximately 425 miles and connecting the Permian Basin to key markets along the Texas Gulf Coast.

WTG Midstream stands out as the leading operator of the largest privately-owned gas gathering and processing enterprise in the region, boasting an extensive 6,000-mile pipeline network. This infrastructure caters to the Midland Basin, encompassing eight processing facilities with a combined capacity of 1.3 billion cubic feet per day, complemented by two additional plants currently in progress.

The incorporation of WTG assets is anticipated to grant Energy Transfer expanded access to burgeoning reserves of natural gas and NGL volumes, thereby amplifying the partnership’s operations in the Permian and downstream enterprises. Additionally, this integration is poised to generate additional revenue through escalating downstream NGL transportation and fractionation fees over time.

The transaction is slated for completion in the third quarter of 2024. RBC Capital Markets assumes the role of financial advisor to Energy Transfer, while Jefferies LLC fulfills the same capacity for WTG.

Deal No. 4:

Merck & Co., Inc. to Acquire Eyebiotech Limited for USD 3.00 Billion

Merck, a leading biopharmaceutical company, has announced its intention to acquire Eyebiotech Limited (EyeBio), a prominent developer of eye-focused medications, through one of its subsidiaries. The acquisition, valued at USD 3 billion, comprises an initial payment of USD 1.3 billion and additional payments totaling USD 1.7 billion contingent upon reaching developmental, regulatory, and commercial milestones.

This acquisition marks a significant expansion for Merck in the field of ophthalmology, bolstering its existing pipeline with EyeBio’s innovative drug portfolio. EyeBio specializes in the development of clinical and preclinical assets aimed at preventing and treating vision loss resulting from retinal vascular leakage. Among its key assets is Restoret, an investigational tetravalent, tri-specific antibody with potential applications in diabetic macular edema (DME) and neovascular age-related macular degeneration (NVAMD). Restoret is poised to enter a pivotal Phase 2b/3 trial for DME treatment in the latter half of 2024.

For Merck, this acquisition aligns with its strategic objectives of diversifying its revenue streams and mitigating potential declines in revenue, particularly with the impending loss of patent protection for its blockbuster cancer drug, Keytruda, by the end of the decade.

The transaction is anticipated to be finalized in the third quarter of 2024, with financial advisory services provided by Citi for Merck and Centerview Partners LLC for EyeBio.

Deal No. 5:

Energy Capital Partners, LLC to Acquire Atlantica Sustainable Infrastructure plc for USD 2.56 Billion

Energy Capital Partners has announced its acquisition of UK-based Atlantica Sustainable Infrastructure for a total of USD 2.56 billion, equivalent to USD 22 per share, in cash. This move grants Energy Capital Partners access to a diversified portfolio of renewable power assets spanning the United States, Europe, South America, and Africa.

Atlantica’s assets encompass a wide range of sustainable infrastructure, including renewable energy, storage facilities, efficient natural gas operations, electric transmission networks, and water resources across the Americas and select EMEA markets. As of March 2024, the company managed renewable energy plants with a collective capacity of 2.2GW and reported revenues of USD 242.9 million for the first quarter of the year.

With its extensive experience and expertise in the sustainable infrastructure sector, Energy Capital Partners, alongside its global co-investors, aims to bolster Atlantica’s financial capabilities and facilitate its growth trajectory while upholding a steadfast commitment to safety, sustainability, and value creation.

The transaction has garnered support from key stakeholders, including Algonquin Power & Utilities and Liberty (AY Holdings), collectively holding approximately 42.2% of Atlantica’s shares, who have entered into a support agreement with Energy Capital Partners.

The parties involved anticipate finalizing the deal either by the fourth quarter of 2024 or the early first quarter of 2025. Citi acted as the financial advisor for Atlantica, while Latham & Watkins provided legal counsel to Energy Capital Partners throughout the deal.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of May 27 – June 2, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter