M&A News M&A News: Global M&A Deals Week of May 20 to 26, 2024

- M&A News

M&A News: Global M&A Deals Week of May 20 to 26, 2024

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

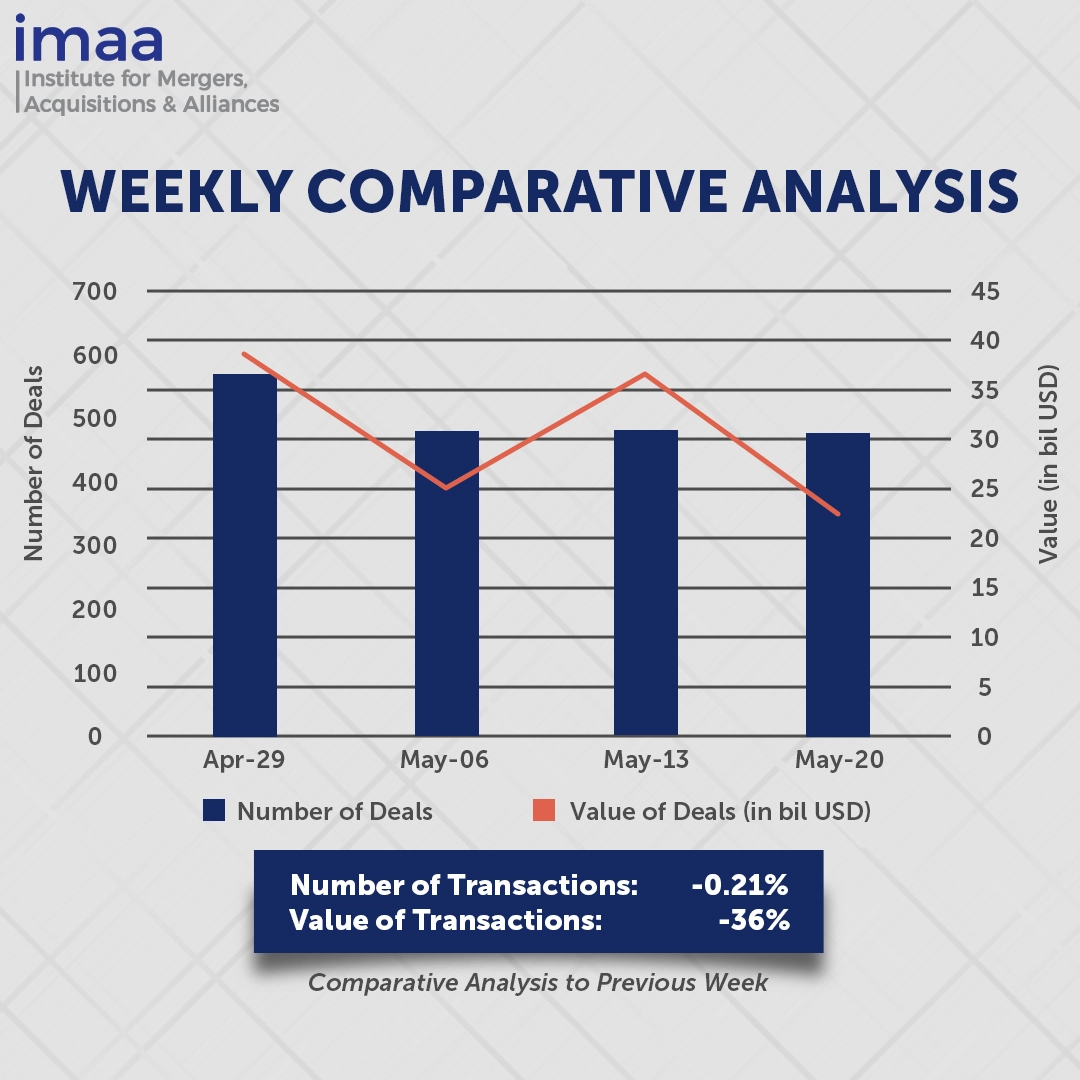

During the period spanning May 20 to May 26, the global market witnessed a total of 482 Mergers and Acquisitions (M&A) deals, collectively valued at USD 23.58 billion. Among these transactions, 17 surpassed the USD 500 million mark, contributing to approximately 83% of the total deal value for the week, reaching USD 19.55 billion.

The standout deal of the week centers on HgCapital’s acquisition of AuditBoard for USD 3 billion. This strategic move is aimed at bolstering Hg’s footprint in North America, building upon its established presence in San Francisco and New York over the past five years. Despite AuditBoard’s prior refusals of takeover offers and its plans for a potential public listing in 2025 or 2026, Hg’s competitive offer led to its swift acceptance after just a four-week review period.

Comparing week-on-week data reveals a marginal decrease of less than 1% in the number of deals, shifting from 483 to 482. This consistency in deal volume has persisted for three consecutive weeks. Conversely, the total deal value experienced a notable 36% decline, dropping from USD 36.57 billion to USD 23.58 billion for the current week.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of May 20 – 26, 2024 in detail:

Deal No. 1: HgCapital LLP; HgCapital Trust plc to Acquire AuditBoard, Inc. for USD 3.00 Billion

Deal No. 2: SouthState Corporation to Acquire Independent Bank Group, Inc. for USD 2.02 Billion

Deal No. 3: Admiral Acquisition Limited to Acquire Acuren from Rockwood Service Corporation for USD 1.85 Billion

Deal No. 4: Biogen Inc. to Acquire Human Immunology Biosciences, Inc. for USD 1.80 Billion

Deal No. 5: CyberArk Software Ltd. to Acquire Venafi, Inc. for USD 1.54 Billion

Deal No. 1:

HgCapital LLP; HgCapital Trust plc to Acquire AuditBoard, Inc. for USD 3.00 Billion

AuditBoard, a leading US-based platform focused on audit and compliance risk, has agreed to be acquired by Hg, a prominent investor in European and transatlantic software and services businesses, in a transaction valued at USD 3 billion. This partnership is expected to drive further growth for AuditBoard as it continues to enhance its platform and expand its global presence.

AuditBoard offers a cloud-based solution for managing audit, risk, compliance, and ESG (Environmental, Social, and Governance) functions. By late 2023, the company achieved over USD 200 million in annual recurring revenue and serves more than 2,000 enterprises, including nearly half of the Fortune 500 companies.

The acquisition highlights the success of AuditBoard’s customer-centric approach and its innovative technology, such as the recently launched AuditBoard AI. The increasing demand for its connected risk platform and related solutions is driving its rapid global expansion.

Hg brings over 20 years of experience in investing in enterprise software companies and will leverage this expertise to support AuditBoard’s unique offerings as it scales. The focus will be on product innovation, international growth, and customer success. HgCapital Trust, the largest investor in Hg, will invest approximately GBP 87.2 million in AuditBoard, with additional investments from other institutional clients through the Hg Saturn 3 Fund.

This acquisition marks one of Hg’s initial ventures on the US West Coast. The London-based firm has been increasing its presence in North America, establishing offices in San Francisco and New York over the past five years.

Goldman Sachs & Co. LLC is acting as the exclusive financial advisor to AuditBoard for this transaction.

Deal No. 2:

SouthState Corporation to Acquire Independent Bank Group, Inc. for USD 2.02 Billion

Regional lender SouthState Corporation has announced plans to acquire Texas-based Independent Bank Group in an all-stock transaction valued at USD 2 billion. This strategic maneuver is geared towards extending SouthState’s market presence into the Texas and Colorado regions.

Per the terms of the agreement, shareholders of Independent Bank will be entitled to receive 0.60 shares of SouthState for each share they currently hold, valuing each share of Independent Bank at USD 48.51.

Post-acquisition, the merged entity will boast total assets of USD 65 billion, deposits of USD 55 billion, and gross loans of USD 48 billion on a pro forma basis. Additionally, the combined company is expected to have a market capitalization of approximately USD 8.2 billion once the deal is finalized.

The acquisition will increase SouthState’s branch network to 343 locations, establishing a footprint in 12 of the 15 fastest-growing metropolitan areas in the United States, solidifying its position as the fifth-largest regional bank in the South.

The transaction is anticipated to close in the first quarter of 2025. Raymond James & Associates has been enlisted as the exclusive financial advisor to SouthState, while Keefe, Bruyette & Woods has undertaken the role of the exclusive financial advisor to Independent Bank Group.

Deal No. 3:

Admiral Acquisition Limited to Acquire Acuren from Rockwood Service Corporation for USD 1.85 Billion

Admiral Acquisition, a specialized special purpose acquisition company (SPAC) headquartered in the British Virgin Islands, is poised to acquire Acuren, a prominent provider of essential asset integrity services in North America, for a total of USD 1.85 billion.

Acuren specializes in pivotal non-destructive testing, inspection, engineering, and laboratory testing services crucial for regulatory compliance across various industrial sectors. With a widespread presence spanning over 135 locations and a workforce exceeding 5,500 individuals in the United States, Canada, and the United Kingdom, Acuren has solidified its leadership position in the field.

This strategic acquisition capitalizes on Acuren’s established market position and seasoned management team, renowned for driving both organic and inorganic growth, alongside Admiral’s expertise. Acuren perfectly aligns with Admiral’s investment criteria, embodying market leadership within its niche, a robust management framework, and attractive free cash flow dynamics.

Upon the transaction’s closure, Acuren will merge with a newly established U.S. subsidiary of Admiral, retaining its identity as a wholly-owned subsidiary under Admiral’s umbrella, and will be publicly listed on the New York Stock Exchange.

The transaction is subject to standard closing conditions and is expected to conclude in the early stages of the third quarter of 2024. Jefferies has played a pivotal role as the lead financial and capital markets advisor to Admiral, while Acuren has been advised by Baird and Harris Williams LLC.

Deal No. 4:

Biogen Inc. to Acquire Human Immunology Biosciences, Inc. for USD 1.80 Billion

Biogen Inc. has recently finalized a deal to acquire Human Immunology Biosciences Inc. (HI-Bio) for USD 1.8 billion, a strategic move aimed at strengthening its lineup of treatments for immune disorders. This acquisition involves an initial payment of USD 1.15 billion, with potential milestone payments totaling USD 650 million.

This acquisition represents a notable step for Biogen, bolstering its presence in the field of immunology. By combining the specialized knowledge of Human Immunology Biosciences in immune-related conditions with Biogen’s global expertise in rare diseases, the company aims to advance the development of innovative therapies.

A key asset included in the agreement is felzartamab, a promising fully human anti-CD38 monoclonal antibody. Clinical trials have demonstrated its effectiveness in selectively depleting CD38+ cells, including plasma cells and natural killer (NK) cells. This capability opens avenues for potential applications that could enhance clinical outcomes across a broad spectrum of immune-mediated diseases.

Furthermore, in addition to the flagship program felzartamab, HI-Bio’s pipeline includes izastobart/HIB210, an anti-C5aR1 antibody currently undergoing Phase 1 trials, with promising prospects for further development across complement-mediated diseases. Additionally, HI-Bio’s mast cell programs, still in the discovery stage, hold promise for addressing various immune-mediated conditions.

Given Biogen’s extensive expertise in both development and commercialization, the company is poised to expedite the advancement of new therapeutics, notably felzartamab, to benefit patients afflicted with severe immune-mediated disorders.

The acquisition is scheduled for completion in the third quarter of 2024. Legal advisory services for Biogen were provided by Covington & Burling LLP, while Goldman Sachs & Co. LLC and BofA Securities, Inc. served as financial advisors to HI-Bio.

Deal No. 5:

CyberArk Software Ltd. to Acquire Venafi, Inc. for USD 1.54 Billion

CyberArk Software Ltd., an Israel-based cybersecurity firm publicly listed in the US, has announced its intention to acquire Venafi, a US-based cybersecurity company backed by private equity firm Thoma Bravo, in a deal worth USD 1.54 billion. In a bid to fortify their enterprise security offerings amidst escalating digital threats, CyberArk will proceed with the acquisition, utilizing USD 1 billion in cash and USD 540 million in shares.

By joining forces, CyberArk aims to fuse Venafi’s renowned machine identity management prowess with its own leading identity security capabilities. This integration is set to forge a unified platform tailored for comprehensive machine identity security across enterprises of all sizes.

The combination of Venafi’s certificate lifecycle management, private Public Key Infrastructure (PKI), IoT identity management, and cryptographic code signing with CyberArk’s secrets management capabilities is expected to enable organizations to better protect against misuse and compromise of machine identities, thus improving security and preventing costly outages. The availability of a comprehensive machine identity security solution, deployable as SaaS or hybrid, will facilitate faster risk mitigation for organizations of all sizes looking to secure modern cloud environments.

With its established leadership in PKI and certificate management, coupled with a strong presence in modern cloud environments, Venafi augments CyberArk’s market reach significantly. The acquisition is poised to expand CyberArk’s Total Addressable Market (TAM) by nearly USD 10 billion, reaching approximately USD 60 billion. Additionally, Venafi is expected to contribute approximately USD 150 million in annual recurring revenue (ARR) post-acquisition.

The transaction is expected to conclude in the latter half of 2024, with Morgan Stanley & Co. LLC serving as the exclusive financial advisor to CyberArk, and Piper Sandler acting in the same capacity for Thoma Bravo.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of May 20 – 26, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter