M&A News M&A News: Global M&A Deals Week of May 13 to 19, 2024

- M&A News

M&A News: Global M&A Deals Week of May 13 to 19, 2024

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

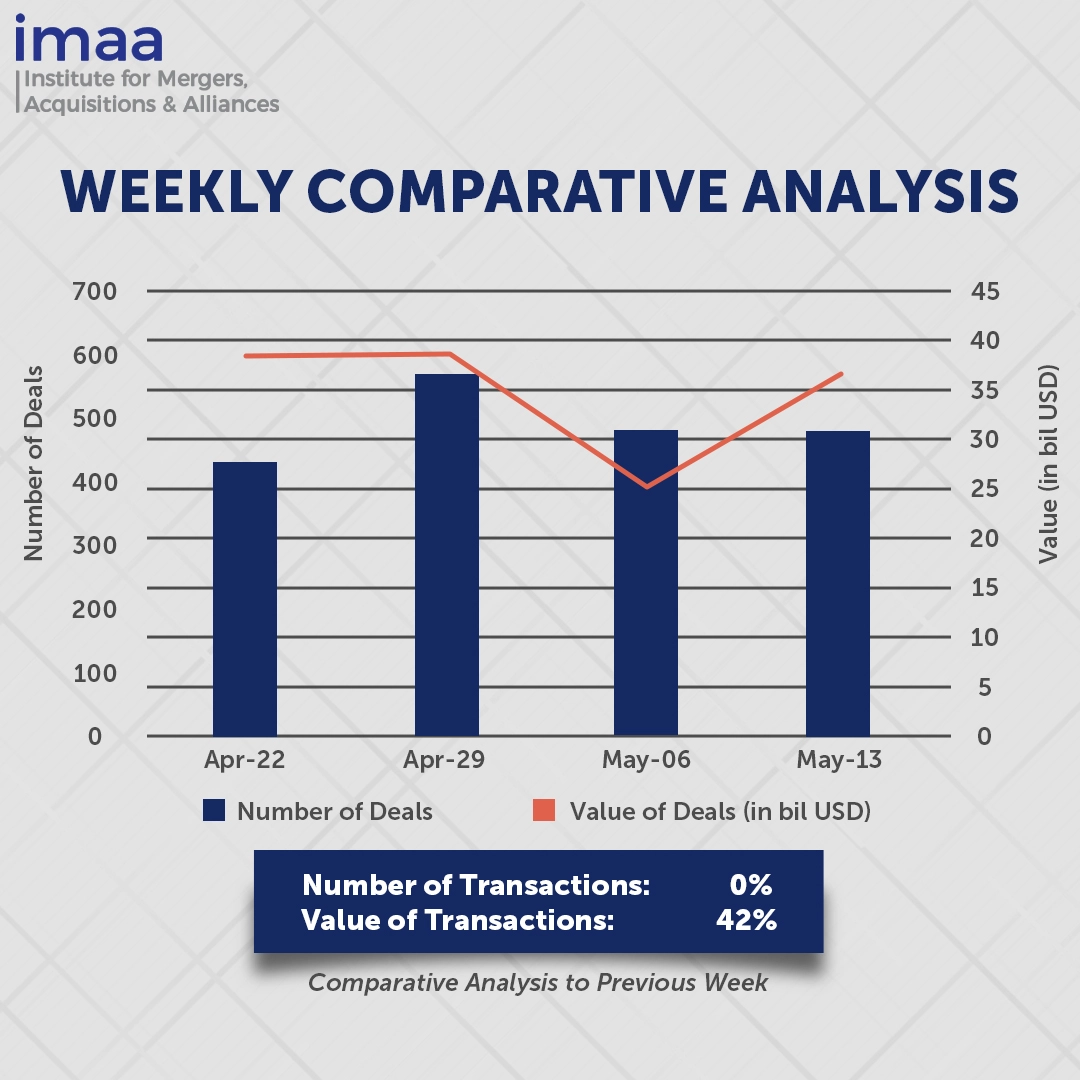

During the week of May 13 to May 19, the global market saw a total of 483 Mergers and Acquisitions (M&A) deals, collectively valued at USD 36.57 billion. Notably, 12 transactions exceeded the USD 500 million threshold, contributing approximately 78% of the total deal value for the week, amounting to USD 28.35 billion.

Taking the spotlight among these transactions was Permira’s acquisition of Squarespace for a substantial USD 6.9 billion. This move by Permira underscores a noteworthy trend of substantial private equity maneuvers, exemplified by recent notable acquisitions by industry leaders such as Thoma Bravo’s acquisition of Darktrace and Vista Equity’s acquisition of Model N. Permira’s track record reveals a strategic focus on investing in tech sectors with promising growth trajectories, evident in their previous partnerships and acquisitions. Squarespace joins a roster of prominent tech firms that Permira has recently taken private, building on earlier acquisitions such as Zendesk Inc. for USD 10.2 billion in 2022 and Mimecast Ltd. for USD 5.8 billion.

Comparing this data to the previous week, the number of announced deals remained steady at 483. However, the deal value surged by an impressive 42%, jumping from USD 25.67 billion to USD 36.57 billion during this period.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of May 13 – 19, 2024 in detail:

Deal No. 1: Accel Partners; General Atlantic Service Company, L.P.; Permira Advisers LLC to Acquire Squarespace, Inc. for USD 6.90 Billion

Deal No. 2: Nippon Life Insurance Company to Acquire Corebridge Financial, Inc. for USD 3.84 Billion

Deal No. 3: KPS Capital Partners, LP to Acquire Innomotics GmbH for USD 3.80 Billion

Deal No. 4: Bank of America, National Association to Acquire Portfolio of approximately 2000 commercial multi-family real estate loans of Washington Federal Bank for USD 2.90 Billion

Deal No. 5: Khazanah Nasional Berhad to Acquire Malaysia Airports Holdings Berhad for USD 2.62 Billion

Deal No. 1:

Accel Partners; General Atlantic Service Company, L.P.; Permira Advisers LLC to Acquire Squarespace, Inc. for USD 6.90 Billion

Private equity firm Permira is poised to acquire Squarespace, a leading website design company, in an all-cash transaction valued at USD 6.9 billion, equating to USD 44 per share.

This acquisition, occurring less than three years after Squarespace’s IPO, highlights the increasing interest of private equity firms in technology companies that facilitate business digitization and branding enhancements.

Squarespace has built a strong global reputation as a creative brand, offering a design-centric platform that empowers entrepreneurs and small businesses to establish and expand their online presence. The majority of Squarespace’s revenue comes from website hosting plans, which provide customers with cloud infrastructure and tools for tasks such as domain name registration and landing page design.

The deal is backed by Squarespace’s current private equity investors, General Atlantic, and venture capital firm Accel, along with Anthony Casalena, Squarespace’s founder and CEO. Collectively, they hold around 90% of the company’s voting shares.

Following the acquisition and subsequent delisting, Casalena will transfer the majority of his shares to the company, which he will continue to lead.

The transaction is expected to be finalized by the fourth quarter of 2024. JP Morgan is serving as the financial advisor to Squarespace, while Goldman Sachs & Co. LLC is advising Permira. Debt financing is being arranged by Blackstone Credit & Insurance, Blue Owl Capital, and Ares Capital Corp.

Deal No. 2:

Nippon Life Insurance Company to Acquire Corebridge Financial, Inc. for USD 3.84 Billion

American International Group (AIG) is divesting its 20% stake in Corebridge Financial, a US-based life insurance provider, to Japan’s largest life insurer, Nippon Life Insurance, for USD 3.84 billion in cash. This acquisition represents Nippon Life’s most significant transaction to date as it aims to establish a stronger presence in the US market.

AIG will offload approximately 120 million shares at an average price of USD 31.47 each. This move aligns with AIG’s strategy to diminish its involvement in the life and retirement sector, which was spun off as a distinct entity in 2022.

Nippon Life Insurance, which serves 15 million clients, is one of Japan’s largest life insurance companies and also has operations in Australia, India, Myanmar, China, Thailand, and Indonesia. has a presence in Australia, India, Myanmar, China, Thailand, and Indonesia. The investment in Corebridge, alongside other U.S. life and annuity companies, is part of Nippon Life’s broader objective to enhance geographical diversification and double its core operating profits by 2035.

The transaction is anticipated to be finalized by the first quarter of 2025.

Deal No. 3:

KPS Capital Partners, LP to Acquire Innomotics GmbH for USD 3.80 Billion

KPS Capital Partners is set to finalize the acquisition of Innomotics GmbH, a renowned player in the global electrical motor and large-drive industry, from Siemens AG, a prominent German industrial entity, for a significant sum of EUR 3.5 billion (USD 3.8 billion).

Innomotics stands out as a premier global provider of essential electric motor and large drive systems, specializing in optimizing customer operations for enhanced efficiency, productivity, and profitability. Its product range includes low voltage motors, high voltage motors, medium voltage drives, and ancillary components, supported by value-added services and solutions. Its sterling reputation is underscored by a robust engineering prowess and a proven track record of successful ventures, catering to diverse and highly technical end-markets. With manufacturing facilities across 16 locations spanning the EMEA, Americas, and Asia-Pacific regions, the company is positioned to leverage global trends towards electrification, energy optimization, digital transformation, urbanization, and the commercialization of alternative energy sources.

With its established reputation for manufacturing excellence and a global footprint, KPS emerges as the ideal custodian for Innomotics, ensuring a conducive environment for sustained growth and development.

This strategic move marks yet another testament to KPS’s stronghold in the European market. Since 2020, KPS has successfully acquired or committed to acquiring 17 businesses, totaling over USD 11.5 billion in value, from top-tier corporate entities across Germany, Belgium, Italy, Ireland, Norway, Switzerland, and the United Kingdom.

The acquisition process is anticipated to conclude in the first half of fiscal 2025, pending customary approvals pertaining to foreign investment and merger control. Bank of America and Lazard have been pivotal in providing financial advisory services to KPS throughout this transaction.

Deal No. 4:

Bank of America, National Association to Acquire Portfolio of approximately 2000 commercial multi-family real estate loans of Washington Federal Bank for USD 2.90 Billion

Washington Federal Bank has struck a deal with Bank of America (BofA) to offload a substantial portfolio of commercial multi-family real estate loans for approximately USD 2.9 billion, marking a significant step in the regional lender’s strategy to mitigate its exposure to the volatile commercial real estate (CRE) sector.

The CRE landscape has faced formidable challenges due to a combination of elevated borrowing costs and diminished occupancy rates, prompting apprehension among both investors and regulatory bodies.

The portfolio being transferred comprises roughly 2,000 commercial multi-family real estate loans, carrying a combined outstanding principal balance of USD 3.2 billion. Under the agreement, Bank of America will acquire these loans at a discounted rate, equivalent to 92% of their total value, amounting to the agreed USD 2.9 billion.

For BofA, this acquisition represents a strategic maneuver, potentially positioning the bank to capitalize on any future stabilization or resurgence in the CRE sector. It also serves to diversify the bank’s assets and bolster its revenue streams. Additionally, post-acquisition, BofA intends to engage in a structured transaction or loan sale with Pacific Investment Management, showcasing a calculated approach to asset management.

Deal No. 5:

Khazanah Nasional Berhad to Acquire Malaysia Airports Holdings Berhad for USD 2.62 Billion

A consortium spearheaded by Malaysia’s sovereign wealth fund, Khazanah Nasional Berhad, and pension fund provider, Employees Provident Fund (EPF), has announced plans to privatize Malaysia Airports Holdings Berhad (MAHB) in a significant deal valued at MYR 12.3 billion (USD 2.62 billion). This transaction marks Malaysia’s largest acquisition in nearly three years.

Joining the consortium are a subsidiary of the Abu Dhabi Investment Authority (ADIA) and investment funds managed by Global Infrastructure Partners (GIP).

MAHB, which manages 39 airports across Malaysia and one international airport in Turkey, operates in rapidly expanding aviation markets driven by regional economic growth, increased air travel affordability, and evolving consumer spending patterns. The privatization aims to facilitate MAHB’s long-term sustainable growth by focusing on airport infrastructure maintenance and upgrades, enhanced passenger services, and improved airline connectivity. These objectives are expected to be better achieved under private ownership, enabling a long-term approach to decision-making and capital investment, as well as access to international technical expertise.

Post-privatization, Khazanah will fortify its stake in MAHB from 33.2% to 40%, while EPF will escalate its ownership from 7.9% to 30%. ADIA and GIP will collectively hold the remaining 30%. Crucially, the Government of Malaysia will retain specialized share rights in MAHB, with both the chairman and CEO mandated to be Malaysian nationals, ensuring continuity in leadership and governance.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of May 13 – 19, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter