M&A News M&A News: Global M&A Deals Week of March 25 to 31, 2024

- M&A News

M&A News: Global M&A Deals Week of March 25 to 31, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

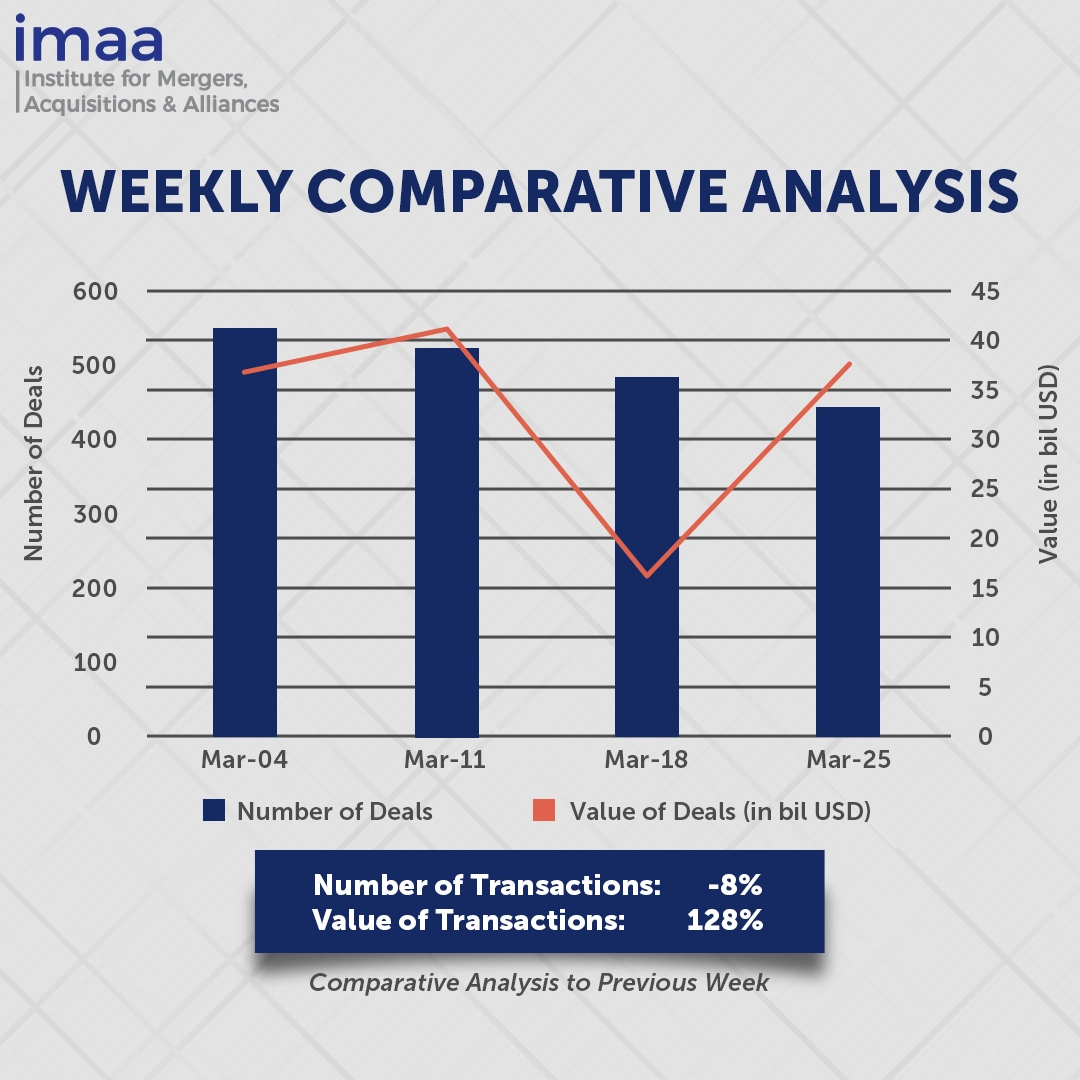

During the week spanning March 25th to March 31st, the global market witnessed 444 Mergers and Acquisitions (M&A) transactions, with a cumulative value reaching USD 37.41 billion. Among these, 14 transactions surpassed the USD 500 million threshold, collectively contributing USD 30.11 billion, representing approximately 80% of the total value for the week.

The standout deal of the week was The Home Depot’s acquisition of SRS Distribution, Inc., valued at a staggering USD 18.25 billion. This acquisition represents Home Depot’s largest venture to date, positioning the company more assertively within the rapidly expanding professional builder and contractor sector. This move complements Home Depot’s recent strategic endeavors in the professional domain, including the USD 8 billion acquisition of HD Supply in 2020, along with two other acquisitions in the previous year: International Designs Group, which owns Construction Resources, and Temco, an appliance delivery and installation company.

Comparing week-on-week data, there was an 8% decrease in the number of deals, declining from 485 to 444. However, despite this decline in deal count, the total deal value has surged impressively by 128%, escalating from USD 16.44 billion to USD 37.41 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of March 25 – 31, 2024 in detail:

Deal No. 1: The Home Depot, Inc. to Acquire SRS Distribution Inc. for USD 18.25 Billion

Deal No. 2: Ingersoll Rand Inc. to Acquire ILC Dover LP for USD 2.33 Billion

Deal No. 3: Keysight Technologies, Inc. to Acquire Spirent Communications plc for USD 1.46 Billion

Deal No. 4: Novo Nordisk A/S to Acquire Cardior Pharmaceuticals GmbH for USD 1.11 Billion

Deal No. 5: Blue Yonder Group, Inc. to Acquire One Network Enterprises, Inc. for USD 0.84 Billion

Deal No. 1:

The Home Depot, Inc. to Acquire SRS Distribution Inc. for USD 18.25 Billion

Home Depot, a leader in the home improvement retail sector, has disclosed its acquisition of SRS Distribution, a building products distributor, for USD 18.25 billion, inclusive of debt. This marks Home Depot’s largest acquisition to date, reflecting its strategic focus on expanding its market reach and catering to a wider customer base.

Specializing in supplying materials to professionals like roofers, landscapers, and pool contractors, SRS Distribution aligns seamlessly with Home Depot’s business model, which currently derives half of its revenue from professional customers and the remaining from DIY consumers.

Through the integration of SRS, Home Depot seeks to reinforce its rapport with residential professional clients and enrich its service portfolio, particularly in catering to complex project requirements, notably in the renovator/remodeler sector. Furthermore, this acquisition positions Home Depot as a key player in specialty trade distribution across diverse industries.

The acquisition is projected to expand Home Depot’s total addressable market to approximately USD 1 trillion, representing an increase of around USD 50 billion.

The transaction is expected to be completed by the end of fiscal 2024, subject to regulatory approvals. Jefferies LLC is leading the financial advisory, with Goldman Sachs providing additional financial counsel for SRS. J.P. Morgan Securities LLC is the exclusive financial advisor to Home Depot.

Deal No. 2:

Ingersoll Rand Inc. to Acquire ILC Dover LP for USD 2.33 Billion

In a strategic move aimed at bolstering its market position, Ingersoll Rand has announced plans to acquire ILC Dover, a leading innovator in designing and producing solutions across various industries, with a notable presence in the aerospace sector. The acquisition is valued at USD 2.33 billion in cash.

As part of this acquisition, Ingersoll Rand aims to establish a strong presence in the life sciences sector within its P&ST segment. This will involve integrating ILC Dover with Ingersoll Rand’s existing life science-focused brands, including Air Dimensions, ILS, Thomas, Tricontinent, Welch, and Zinsser Analytic. With an expected revenue of approximately USD 700 million, this unified platform will enhance Ingersoll Rand’s foothold in the life sciences field and align with its strategic growth objectives.

Ingersoll Rand foresees immediate positive impacts on growth and margin rates from this acquisition. Additionally, with expectations of high single-digit growth in the space and aerospace market over the next decade, the acquisition presents Ingersoll Rand with opportunities to expand its customer base and product offerings.

The deal is expected to close in the second quarter of 2024. Jefferies LLC and Goldman Sachs & Co. LLC are serving as financial advisors to ILC Dover.

Deal No. 3:

Keysight Technologies, Inc. to Acquire Spirent Communications plc for USD 1.46 Billion

Keysight Technologies has announced its intention to acquire the UK-based telecommunications firm Spirent Communications for GBP 1.16 billion (USD 1.46 billion).

Spirent boasts expertise in software, cloud, and automation technologies, crucial as modern communication networks, including the upcoming 6G, increasingly rely on software-driven infrastructures. This transition is fueled by advancements in artificial intelligence and machine learning.

Both Keysight and Spirent share a focus on empowering major technological trends across various industries such as communications, aerospace and defense, automotive, and enterprise sectors. By integrating Spirent’s solutions, Keysight anticipates tapping into new serviceable available market opportunities, estimated to reach up to USD 1.5 billion.

Leveraging Keysight’s extensive customer relationships, industry knowledge, and global presence, Spirent is poised to accelerate its product development and maximize its capabilities to the fullest extent.

This acquisition aligns seamlessly with Keysight’s strategic and financial M&A objectives. Following integration, Keysight foresees enhancements in its gross and operating margins, thereby bolstering its overall performance in the market.

Deal No. 4:

Novo Nordisk A/S to Acquire Cardior Pharmaceuticals GmbH for USD 1.11 Billion

Denmark’s Novo Nordisk has reached an agreement to acquire Cardior Pharmaceuticals for EUR 1.03 billion (USD 1.11 billion). This deal includes an upfront payment and potential additional payments contingent upon meeting certain development and commercial milestones. The acquisition is geared towards fortifying Novo Nordisk’s cardiovascular pipeline, marking a pivotal step in its commitment to addressing heart-related ailments.

Renowned for its pioneering work in RNA-targeted therapies aimed at preventing, repairing, and even reversing heart diseases, Cardior stands at the forefront of innovation in this domain. The cornerstone of this acquisition is Cardior’s lead compound, CDR132L, currently undergoing phase 2 clinical trials for heart failure treatment. Engineered to interrupt and potentially reverse the progression of heart failure, CDR132L holds promise for significantly enhancing heart function and quality of life for patients grappling with this condition.

Novo Nordisk’s strategic focus on cardiovascular health aligns with the pressing global concern surrounding cardiovascular diseases, which stand as the foremost cause of mortality worldwide.

The completion of the acquisition is anticipated to occur in the second quarter of 2024.

Deal No. 5:

Blue Yonder Group, Inc. to Acquire One Network Enterprises, Inc. for USD 0.84 Billion

Supply chain management leader Blue Yonder, Inc. is poised to elevate the industry landscape with its forthcoming acquisition of One Network Enterprises, a Dallas-based company, for a significant sum of USD 839 million. This move is geared towards establishing a robust multi-enterprise supply chain ecosystem.

This strategic initiative aims to offer pragmatic solutions to current supply chain complexities while ensuring preparedness for future challenges.

The integration of Blue Yonder and One Network Enterprises will enable Blue Yonder to better serve customer needs across planning, execution, commerce, and networks. The combined efforts will bring advancements such as improved shipment scheduling, telematics tracking, real-time delivery visibility, and exception management. These enhancements aim to foster better collaboration, accuracy, and cost efficiency in supply chain operations, utilizing AI technologies.

Expected to conclude in either Q2 or Q3 of 2024, this transaction reflects Blue Yonder’s strategic focus on strengthening its position in the supply chain management domain. With approximately USD 1 billion invested in mergers and acquisitions since Q4 of 2023, Blue Yonder continues to demonstrate its commitment to advancing supply chain solutions.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of March 25 – 31, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter