M&A News M&A News: Global M&A Deals Week of March 11 to 17, 2024

- M&A News

M&A News: Global M&A Deals Week of March 11 to 17, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

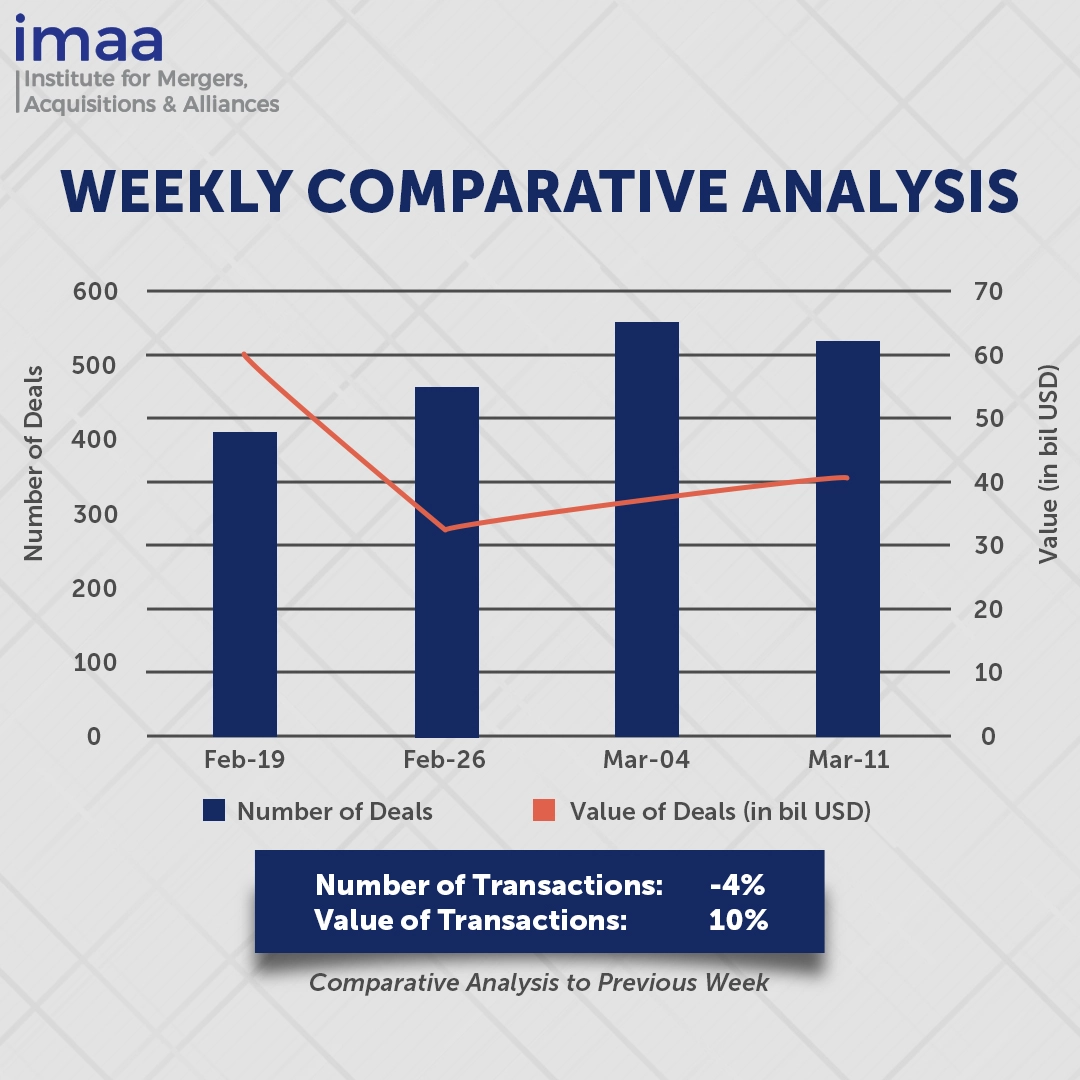

During the period spanning March 11 to March 17, the global market witnessed 526 Mergers and Acquisitions (M&A) transactions amounting to USD 40.63 billion. Notably, 10 transactions exceeded the USD 500 million mark, contributing to a combined value of USD 31.85 billion, comprising approximately 78% of the total deal value for the week.

A significant deal during this period was EQT Corporation’s acquisition of Equitrans Midstream Corp, valued at USD 14 billion. This strategic step towards vertical integration positions EQT as a competitive low-cost natural gas producer in the United States. EQT’s acquisition of Equitrans occurred amid increased merger and acquisition activities within the US oil and gas industry, driven by companies adapting to the evolving energy landscape and regulatory challenges surrounding pipeline projects. As the global natural gas market evolves, US natural gas companies are compelled to refine their business strategies to compete effectively internationally.

Analyzing week-on-week data, there was a slight 4% decrease in the number of deals, dropping from 549 to 526. However, the total deal value experienced a 10% increase, rising from USD 37.06 billion to USD 40.63 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of March 11 – 17, 2024 in detail:

Deal No. 1: EQT Corporation to Acquire Equitrans Midstream Corporation for USD 14.00 Billion

Deal No. 2: Fastweb SpA to Acquire Vodafone Italia S.p.A. for USD 8.71 Billion

Deal No. 3: KKR & Co. Inc. and Viessmann Group Gmbh & Co. Kg to Acquire Encavis AG for USD 3.00 Billion

Deal No. 4: AstraZeneca PLC to Acquire Amolyt Pharma SAS for USD 1.05 Billion

Deal No. 5: ArcelorMittal S.A. to Acquire Vallourec S.A. for USD 1.04 Billion

Deal No. 1:

EQT Corporation to Acquire Equitrans Midstream Corporation for USD 14.00 Billion

EQT Corp, a prominent figure in the US natural gas sector, is poised to solidify its position by acquiring Equitrans Midstream in a landmark transaction. This strategic move aims to forge America’s sole large-scale, vertically integrated natural gas powerhouse, primed to excel on the global platform. Valued at approximately USD 14 billion, including debt, this all-stock agreement represents a notable development in the industry.

Upon completion, the combined entity is set to have an enterprise value exceeding USD 35 billion, highlighting its substantial market presence. With a pipeline network spanning over 3,218 kilometers, the merged company will benefit from extensive coverage and connectivity across EQT’s primary operational regions. This consolidation is expected to streamline natural gas production and transportation, strengthening EQT’s existing portfolio with an additional 2,000 miles of pipeline infrastructure. Situated within key gas-producing regions like Pennsylvania, West Virginia, and Ohio, the merger strategically leverages the region’s importance in the US gas sector.

Projected synergies from the merger are estimated to reach up to USD 250 million annually, with potential upside scaling beyond USD 425 million. This synergy, combined with competitive cost efficiencies and a resilient free cash flow model adaptable to various market conditions, underscores the strength of the combined entity’s operational framework.

Expected to conclude in the fourth quarter of 2023, this transaction will result in EQT stakeholders holding approximately 74% ownership in the combined corporation, with Equitrans shareholders owning the remaining 26%.

Guggenheim Securities, LLC led EQT’s financial advisory efforts, supported by RBC Capital Markets, LLC, whereas Equitrans received advisory services from Barclays and Citi.

Deal No. 2:

Fastweb SpA to Acquire Vodafone Italia S.p.A. for USD 8.71 Billion

Vodafone Group Plc has entered into an EUR 8 billion (USD 8.7 billion) all-cash agreement to sell Vodafone Italia to Swisscom AG, a move aimed at streamlining its operations and improving its share price performance. Swisscom plans to merge Vodafone Italia with its subsidiary, Fastweb SpA Italy.

The merger is expected to create Italy’s second-largest fixed-line broadband provider, positioning itself closely behind Telecom Italia (TIM). This deal also enhances its presence in the business segment and strengthens its position in the mobile market. Over the past decade, Fastweb has demonstrated consistent growth in customer base, revenue, and adjusted EBITDA. Vodafone Italia and Fastweb, currently the nation’s second- and fourth-largest operators respectively, collectively generate an estimated annual revenue of EUR 7 billion.

The proposed merger between Vodafone Italia and Fastweb promises to leverage synergies from their complementary high-quality mobile and fixed infrastructures, along with their respective competencies and capabilities, to emerge as a dominant force in the converged telecommunications landscape.

The transaction is anticipated to be finalized in the initial quarter of 2025, with Evercore Inc. acting as the principal financial adviser to Swisscom, in collaboration with Deutsche Bank AG and JPMorgan Chase & Co. Meanwhile, UBS Group AG has been exclusively engaged as the financial adviser to Vodafone.

Deal No. 3:

KKR & Co. Inc. and Viessmann Group Gmbh & Co. Kg to Acquire Encavis AG for USD 3.00 Billion

Global investment firm KKR & Co. has recently announced its acquisition of Encavis AG, a leading renewable-energy producer based in Germany, in a deal valued at approximately EUR 2.8 billion (USD 3 billion). The acquisition, facilitated through KKR’s investment vehicle, Elbe Bidco “Bidco”, will see a cash consideration of EUR 17.50 (USD 19.13) per share of Encavis. Additionally, Viessmann Group will participate as a shareholder in a consortium led by KKR.

This strategic collaboration not only solidifies Encavis’s position as a key player in Germany’s energy transition but also contributes significantly to the broader renewable energy landscape in Europe. Renewable energy has gained significant traction in Germany, with clean energy contributing more than half of the country’s power production in 2023. Germany’s aim to achieve 80% clean power production by 2030, amidst geopolitical tensions affecting natural gas supply.

With ambitious agendas for solar and wind expansion both domestically and internationally, Encavis is well-positioned to capitalize on emerging opportunities. The financial support from KKR and Viessmann will enable Encavis to pursue growth within the sector, enhance its project development pipeline, and expand into new markets.

Following the completion of the acquisition, BidCo intends to take Encavis private, with plans to delist it from the stock exchange at the earliest opportunity post-closing. PJT Partners is providing financial advisory services for the takeover offer, while the Encavis is being advised by Goldman Sachs.

Deal No. 4:

AstraZeneca PLC to Acquire Amolyt Pharma SAS for USD 1.05 Billion

AstraZeneca PLC, a leading Anglo-Swedish pharmaceutical company, has announced its acquisition of biotech firm Amolyt Pharma for USD 1.05 billion. The deal, conducted on a cash and debt-free basis, involves an initial payment of USD 800 million upon closure, with an additional contingent payment of USD 250 million on achieving a specified regulatory milestone.

This acquisition will fortify Alexion, AstraZeneca’s rare disease division, further enhancing its position in the market. AstraZeneca’s rare disease portfolio, which received a significant boost from the USD 39 billion acquisition of Alexion in 2021, has witnessed substantial growth, reaching nearly USD 7.8 billion in revenue in 2023.

Moreover, the acquisition of Amolyt Pharma expands AstraZeneca’s bone metabolism franchise, primarily with the inclusion of eneboparatide, an investigational therapeutic peptide in Phase III development designed to address hypoparathyroidism, a prevalent rare disease with significant unmet medical needs.

The transaction is expected to be completed by the end of the third quarter of 2024, subject to standard closing conditions. Financial advisory for Amolyt Pharma was provided by Centerview Partners LLC and Goldman Sachs Bank Europe SE.

Deal No. 5:

ArcelorMittal S.A. to Acquire Vallourec S.A. for USD 1.04 Billion

Renowned integrated steel company ArcelorMittal, is set to acquire a substantial 28.4% stake in Vallourec, encompassing 65,243,206 shares at a price of EUR 14.64 per share, totaling a significant EUR 955 million (equivalent to USD 1.04 billion). This strategic investment marks a pivotal move to fortify ArcelorMittal’s foothold in the market for tubular steel, a crucial component extensively utilized in both energy and industrial sectors.

Vallourec’s significant assets include approximately 85% of its 2.2 million tons of annual rolling capacity, primarily situated in low-carbon, integrated production facilities in key markets such as the United States and Brazil—both critical regions for ArcelorMittal’s operations. Moreover, Vallourec’s pivotal role in the energy transition cannot be understated, as it manufactures essential products for hydrogen, CCS (Carbon Capture and Storage), and geothermal applications, aligning with projected growth in demand. Additionally, Vallourec demonstrates a commitment to sustainability through its comparatively low carbon footprint and ambitious environmental targets.

The transaction is slated to finalize in the latter half of the year, marking a significant step forward in ArcelorMittal’s strategic expansion and commitment to sustainability within the steel industry.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of March 11 – 17, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter