M&A News M&A News: Global M&A Deals Week of April 8 to 14, 2024

- M&A News

M&A News: Global M&A Deals Week of April 8 to 14, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

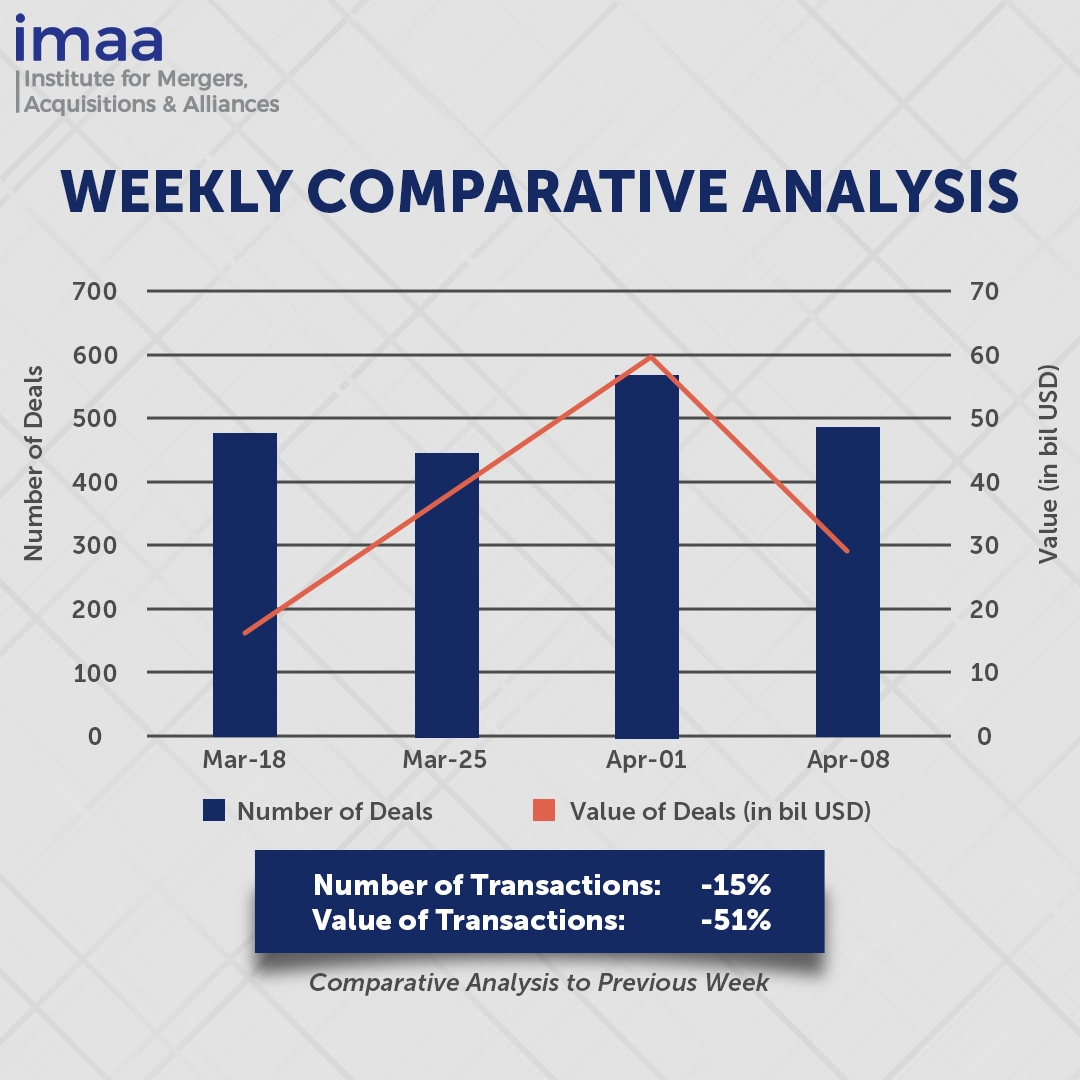

During the week spanning April 8 to April 14, the global market saw 492 Mergers and Acquisitions (M&A) deals, amounting to a combined value of USD 29.39 billion. Among these transactions, 14 deals exceeded the USD 500 million mark, collectively amassing USD 25.12 billion, accounting for 85% of the total deal value for the week.

The highlight deal of the week was Blackstone’s acquisition of Apartment Income REIT Corp. (AIR Communities) for a significant USD 10 billion, showcasing the firm’s confidence in the recovery trajectory of the commercial real estate market amidst prevailing high rates and lingering economic uncertainties in the US. Alongside this notable acquisition, Blackstone also secured Tricon Residential for USD 3.5 billion earlier this year, a company managing 38,000 single-family rentals. This strategic pivot towards rental housing anticipates a sector revival, particularly as the supply of apartments in the U.S. is expected to decline due to a slowdown in construction activity.

A comparative analysis of week-on-week data reveals a 15% decrease in the number of deals, declining from 579 to 492. Similarly, the aggregate value of these transactions witnessed a significant downturn of 51%, plummeting from USD 59.95 billion to USD 29.39 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of April 8 – 14, 2024 in detail:

Deal No. 1: Blackstone Real Estate Advisors L.P. to Acquire Apartment Income REIT Corp. for USD 10.00 Billion

Deal No. 2: Vertex Pharmaceuticals Incorporated to Acquire Alpine Immune Sciences, Inc. for USD 4.90 Billion

Deal No. 3: One Hotels & Resorts AG Acquired Motel One Gmbh for USD 1.36 Billion

Deal No. 4: Vista Equity Partners Management, LLC to Acquire Model N, Inc. for USD 1.25 Billion

Deal No. 5: Mapletree Investments Pte Ltd. Acquired Portfolio of 8,192 Operational Beds Across 19 cities in the UK and Germany for USD 1.24 Billion

Deal No. 1:

Blackstone Real Estate Advisors L.P. to Acquire Apartment Income REIT Corp. for USD 10.00 Billion

Blackstone, a leading asset management firm, has reached an agreement to acquire Apartment Income REIT Corp. (AIR Communities) through its global real estate fund, Blackstone Real Estate Partners X. Blackstone will purchase all outstanding shares of AIR Communities at USD 39.12 per share, in a cash transaction totaling approximately USD 10 billion, inclusive of debt obligations.

AIR Communities boasts a robust portfolio comprising 76 premium rental housing communities, strategically positioned in key coastal markets such as Miami, Los Angeles, Boston, and Washington D.C. Recognizing the significance of these assets, Blackstone intends to invest more than USD 400 million to maintain and enhance these communities, with potential for further investment to support growth.

Blackstone’s strategic focus on rental housing underscores its anticipation of a resurgence in the sector, especially amidst projections of a decline in the supply of apartments in the U.S. due to a slowdown in construction activity.

The transaction is slated for closure in the third quarter of 2024. Serving as financial advisors to Blackstone are BofA Securities, Barclays, Goldman Sachs & Co. LLC, and Wells Fargo, while Citigroup Global Markets Inc. is advising AIR Communities.

Deal No. 2:

Vertex Pharmaceuticals Incorporated to Acquire Alpine Immune Sciences, Inc. for USD 4.90 Billion

Vertex Pharmaceuticals, headquartered in Boston, has revealed plans to acquire biotechnology firm Alpine Immune Sciences for USD 4.9 billion, equivalent to USD 65 per share, payable in cash. This move aims to fortify Vertex’s portfolio in kidney diseases amidst the escalating trend of mergers and acquisitions within the biotechnology sector.

Alpine specializes in developing immunotherapies tailored to combat cancer, kidney diseases, and various severe autoimmune and inflammatory conditions. Their approach involves engineering proteins to modulate the body’s immune response.

Of particular interest to Vertex is Alpine’s leading candidate, povetacicept, currently in mid-stage development for addressing IgA nephropathy (IgAN). IgAN is a grave autoimmune kidney disease with progressive implications, potentially leading to end-stage renal failure. The therapy is anticipated to enter a late-stage trial in the latter half of 2024.

Alpine aligns strategically with Vertex, advancing the latter’s mission of leveraging scientific innovation to develop transformative medicines for serious diseases with significant unmet needs in specialized markets.

The deal is anticipated to conclude in the second quarter of 2024, with Lazard serving as financial advisor to Vertex, while Centerview Partners acts as the exclusive financial advisor to Alpine.

Deal No. 3:

One Hotels & Resorts AG Acquired Motel One Gmbh for USD 1.36 Billion

Proprium Capital Partners, a respected real estate private equity firm, recently finalized the sale of its 35% ownership stake in the Munich-based Motel One Group for EUR 1.25 billion (USD 1.36 billion). The purchaser of this stake was the majority partner of Motel One, One Hotels & Resorts GmbH.

Having acquired a minority share in Motel One GmbH in 2007, Proprium has played a pivotal role in Motel One’s journey. Recently, Motel One underwent a strategic restructuring, separating its property division from its operational business, effective January 1, 2024. This strategic move sets the stage for a potential initial public offering (IPO) in the near future.

Currently, Motel One operates 94 hotels with 26,470 rooms and has plans to add 23 more hotels, totaling approximately 5,500 rooms. Additionally, the company aims to open 13 new hotels by 2026, expanding its presence to 56 European cities.

Motel One’s growth is attributed to its unique design-led hotel concept, a sound and cash-efficient business model, and an entrepreneurial culture. With these foundations in place, Motel One is poised for continued expansion and success.

Morgan Stanley provided financial advisory services for the transaction, while legal representation was handled by Hengeler Mueller and Freshfields, acting on behalf of OHR and Proprium, respectively.

Deal No. 4:

Vista Equity Partners Management, LLC to Acquire Model N, Inc. for USD 1.25 Billion

Vista Equity Partners, a global investment firm with a focus on enterprise software, data, and technology-enabled businesses, is set to acquire Model N, a well-known provider of revenue management software for the life sciences and high-tech industries. The deal, valued at USD 1.25 billion and structured as an all-cash transaction at USD 30 per share, demonstrates Vista Equity’s strategic commitment to broadening its portfolio in key sectors.

Model N’s software is essential for companies in complex industries like pharmaceuticals and life sciences, where pricing structures are intricate and regulatory changes are frequent. It seamlessly integrates with diverse data sources and internal systems, enabling businesses to analyze pricing dynamics, market trends, and demand forecasting. Notable clients such as Johnson & Johnson, AstraZeneca, and AMD rely on Model N’s solutions.

This acquisition benefits Model N’s shareholders financially and aligns with Vista Equity’s long-term growth strategy. By merging with Vista, Model N gains access to more resources, fostering sustained growth and strengthening its market position.

This marks Vista Equity’s fifth acquisition in the past 18 months, following similar successful ventures with Avalara (USD 8.4 billion), KnowBe4 (USD 4.6 billion), Duck Creek Technologies (USD 2.6 billion), and EngageSmart (USD 4 billion).

Pending customary closing conditions and regulatory approvals, the acquisition is expected to be finalized by mid-2024, after which Model N will transition to private ownership, with Jeffries serving as its financial advisor throughout the process.

Deal No. 5:

Mapletree Investments Pte Ltd. Acquired Portfolio of 8,192 Operational Beds Across 19 cities in the UK and Germany for USD 1.24 Billion

Singapore-based Mapletree Investments has made a significant move by acquiring 8,192 student housing beds across 19 cities in the UK and Germany, along with an operational platform from Cuscaden Peak Investments. This acquisition not only solidifies Mapletree’s foothold in the student housing sector but also positions it as a key player in the UK market.

The deal, valued at GBP 1 billion (approximately USD 1.24 billion), includes properties strategically located in key university cities like Bristol, Cambridge, Durham, Edinburgh, Oxford, and York in the UK, as well as Bremen in Germany. These assets seamlessly integrate with Mapletree’s existing student housing portfolio.

The operational platform acquired includes two well-established brands, Student Castle and Capitol Students, providing Mapletree with direct operational control over the acquired portfolio.

With this acquisition, Mapletree’s overall student housing portfolio expands to encompass 33,000 beds across 47 cities in the United Kingdom, the United States, Germany, and Canada, with total assets under management reaching USD 6.2 billion.

Looking ahead, Mapletree remains dedicated to expanding its presence in the student housing market. Leveraging its development capabilities, the group aims to pursue greenfield and brownfield development projects to augment its student housing portfolio, ensuring sustained growth and value creation in the dynamic real estate landscape.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of April 8 – 14, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter