M&A News M&A News: Global M&A Deals Week of April 29 to May 5, 2024

- M&A News

M&A News: Global M&A Deals Week of April 29 to May 5, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

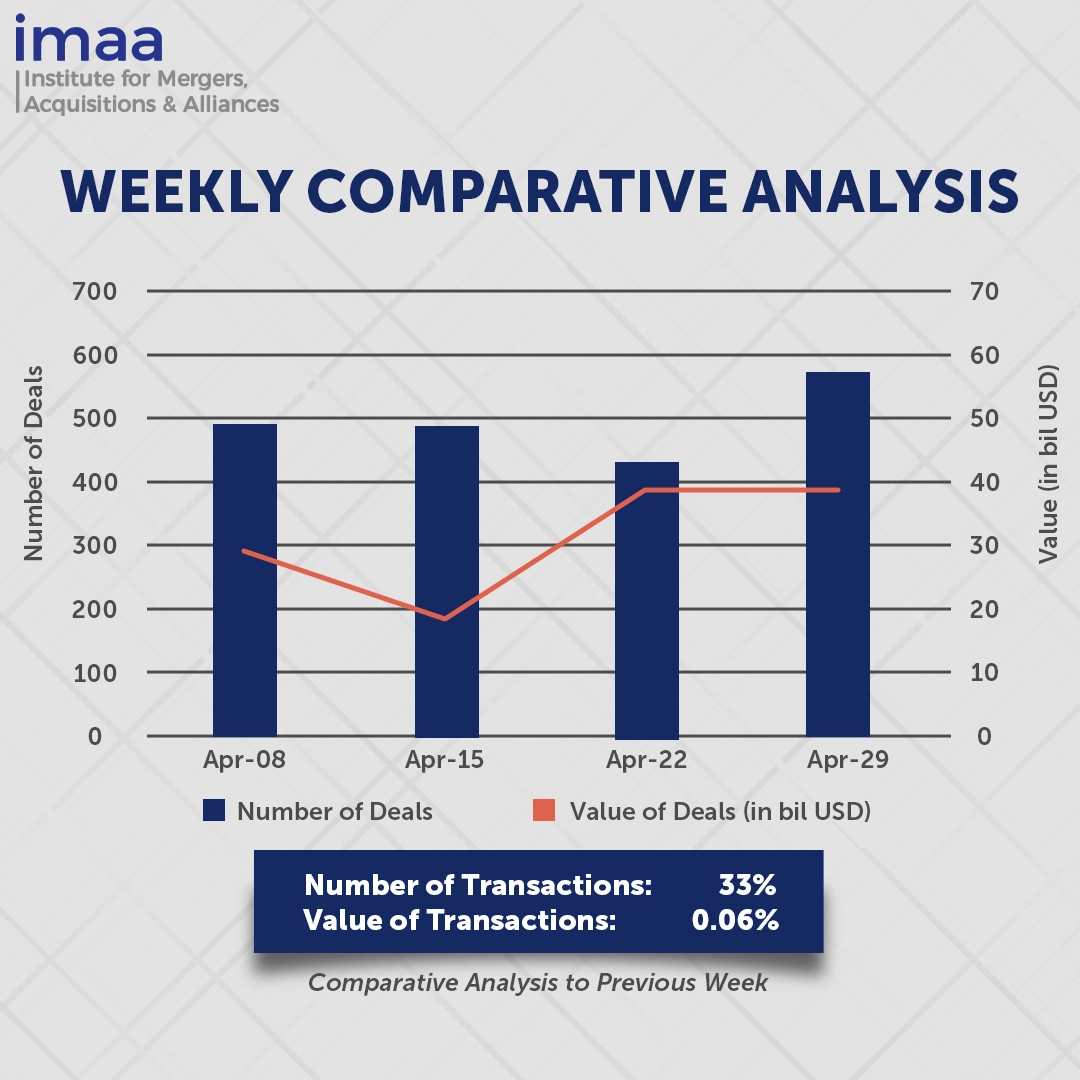

During the week of April 29 to May 5, the global market experienced a total of 574 Mergers and Acquisitions (M&A) transactions, amounting to a combined value of USD 38.59 billion. Out of these, 12 deals exceeded USD 500 million, amounting to USD 29.93 billion, representing 78% of the total deal value for the week.

The highlight deal during this period was the proposed acquisition of Sabadell by Banco Bilbao Vizcaya Argentaria (BBVA) valued at USD 12.8 billion. This deal has the potential to create a sizable Spain-based banking entity with a market capitalization exceeding EUR 70 billion, marking one of the largest European banking deals in recent years. The backdrop for this merger discussion includes the consistent outperformance of eurozone smaller banks compared to larger ones since the beginning of the year, indicating a potential consolidation trend in the eurozone banking sector. This deal reflects the increasing necessity for scale in the European financial sector, driven by competitive pressures and technological advancements.

Week-on-week analysis shows a 33% increase in the number of deals, rising from 431 in the previous week to 574 during this period. This was accompanied by a minimal less than 1% increase in deal value from USD 38.57 billion to USD 38.59 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of April 29 – May 5, 2024 in detail:

Deal No. 1: Banco Bilbao Vizcaya Argentaria, S.A. to Acquire Banco de Sabadell, S.A. for USD 12.80 Billion

Deal No. 2: SES S.A. to Acquire Reorganized ISA S.A. for USD 3.10 Billion

Deal No. 3: Ono Pharmaceutical Co., Ltd. to Acquire Deciphera Pharmaceuticals, Inc. for USD 2.40 Billion

Deal No. 4: UMB Financial Corporation to Acquire Heartland Financial USA, Inc. for USD 2.00 Billion

Deal No. 5: L’Occitane Groupe S.A. to Acquire L’Occitane International S.A. for USD 1.78 Billion

Deal No. 1:

Banco Bilbao Vizcaya Argentaria, S.A. to Acquire Banco de Sabadell, S.A. for USD 12.80 Billion

Banco Bilbao Vizcaya Argentaria, S.A. (BBVA) has proposed a strategic acquisition of Banco Sabadell SA for EUR 12 billion (USD 12.8 billion), aiming to forge a formidable Spanish banking powerhouse valued at approximately EUR 70 billion. BBVA, positioned as Spain’s second-largest lender by assets with a market value hovering around USD 65 billion, sees this move as a pivotal step in consolidating its presence.

Should the merger proceed, BBVA stands to position itself closely behind industry behemoths like BNP Paribas, Crédit Agricole, Banco Santander SA, Société Générale SA, and Deutsche Bank AG, boasting a combined asset base approaching EUR 1 trillion.

Beyond the financial implications, this merger presents an opportunity for BBVA to strategically pivot its focus away from its primary market in Mexico and emerging economies like South America and Turkey. By redirecting attention to its domestic market, BBVA seeks to capitalize on potential revenue streams, especially amid the backdrop of diminishing returns from high interest rates.

While BBVA has expressed its interest, Sabadell’s response to the acquisition offer remains pending, leaving room for further developments in this potential merger.

Deal No. 2:

SES S.A. to Acquire Reorganized ISA S.A. for USD 3.10 Billion

SES SA, a Luxembourg-based satellite firm, has announced its acquisition of Intelsat SA for EUR 2.8 billion (USD 3.1 billion). This move comes after a previous attempt at merging in 2023 fell through.

This acquisition aims to strengthen the position of both companies as multi-orbit operators, enhancing coverage, resilience, and service offerings. With an expanded suite of solutions and resources for innovation, the combined entity can leverage the expertise and track records of both firms.

Projections indicate that the merger will yield EUR 2.4 billion in synergies, with 70% expected to materialize within three years post-closing. Additionally, it is anticipated to drive revenue growth, particularly in the Networks segments, which are witnessing high demand and expansion, constituting 60% of the enlarged revenue base.

The transaction, set to conclude by the latter half of 2025, will be financed through a mix of cash reserves and new debt issuance. Luxembourg will remain the headquarters of the new entity, which will also maintain a significant presence in the United States.

Guggenheim Securities served as the lead financial advisor to SES, with Morgan Stanley as co-financial advisor. PJT Partners provided financial counsel to Intelsat.

Deal No. 3:

Ono Pharmaceutical Co., Ltd. to Acquire Deciphera Pharmaceuticals, Inc. for USD 2.40 Billion

Ono Pharmaceutical, a leading global specialty pharmaceutical company, is in the process of acquiring Deciphera Pharmaceuticals, a pioneering biotech firm in the field of cancer research, for a substantial sum of USD 2.4 billion. This strategic move aims to enhance Ono’s oncology portfolio and expand its reach in the United States and Europe.

Deciphera Pharmaceuticals specializes in kinase drug discovery, with their leading product Qinlock approved for treating fourth-line gastrointestinal stromal tumors (GIST) in the United States and over 40 other countries. Additionally, Deciphera has promising drug candidates, including one for benign joint tumors in late-stage clinical trials in Europe and the U.S., set for submission for approval in 2024. They are also developing a drug for complications of blood cancer treatment, with anticipated peak sales of USD 700 million annually.

The acquisition is expected to be finalized in the third quarter of 2024. Afterward, Deciphera will continue operating as a standalone business within the ONO Group. BofA Securities is advising Ono Pharmaceutical, while J.P. Morgan Securities LLC is advising Deciphera Pharmaceuticals in this transaction.

Deal No. 4:

UMB Financial Corporation to Acquire Heartland Financial USA, Inc. for USD 2.00 Billion

UMB Financial Corp has announced its intention to acquire Hearthland Financial USA Inc. in an all-stock transaction valued at USD 2 billion. This represents UMB’s largest acquisition to date in its 111-year history. Following the completion of the transaction, UMB will hold assets worth USD 64.5 billion, placing it within the top 5% of the 616 publicly traded banks in the U.S.

The merger will create a strong regional banking presence, expanding UMB’s footprint across a 13-state branch network. UMB’s reach will extend to include California, Minnesota, New Mexico, Iowa, and Wisconsin, in addition to its existing presence in Missouri, Illinois, Colorado, Kansas, Oklahoma, Nebraska, Arizona, and Texas.

This transaction is expected to enhance UMB’s private wealth management division, increasing assets under management/advisement (AUM/AUA) by 31% and doubling its retail deposit base. Moreover, it will result in a significant expansion of UMB’s physical network, adding 107 branches and 237 ATMs to its existing 90 branches and 238 ATMs, thereby providing enhanced accessibility and convenience for customers of both entities.

The acquisition is anticipated to close in the first quarter of 2025, with advisory support from BofA Securities, Inc. for UMB and Keefe, Bruyette & Woods, a Stifel Company, for HTLF.

Deal No. 5:

L'Occitane Groupe S.A. to Acquire L'Occitane International S.A. for USD 1.78 Billion

Reinold Geiger, the owner of L’Occitane, has proposed to take the French skincare group private for HKD 13.91 billion (equivalent to USD 1.78 billion). Currently, Geiger’s L’Occitane Groupe holds a controlling interest of 72.39% in the cosmetics entity, which includes eight natural beauty brands and a network of over 3,000 retail outlets across 90 countries.

Under the proposed deal, Geiger’s investment holding company, L’Occitane Groupe based in Luxembourg, will offer HKD 34 per share for the remaining shares. Geiger plans to finance a portion of the transaction using external debt facilities from Crédit Agricole Corporate and Investment Bank, along with financing from Blackstone Inc. and Goldman Sachs Asset Management.

L’Occitane highlights that going private would provide greater flexibility to pursue investments and implement strategies more efficiently. This flexibility is particularly crucial amidst intensifying competition in the global skincare and cosmetics industry, with the emergence of new international and local brands.

J.P. Morgan has been appointed as the financial adviser for L’Occitane Groupe to facilitate the transaction.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of April 29 – May 5, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter