M&A News M&A News: Global M&A Deals Week of April 22 to 28, 2024

- M&A News

M&A News: Global M&A Deals Week of April 22 to 28, 2024

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

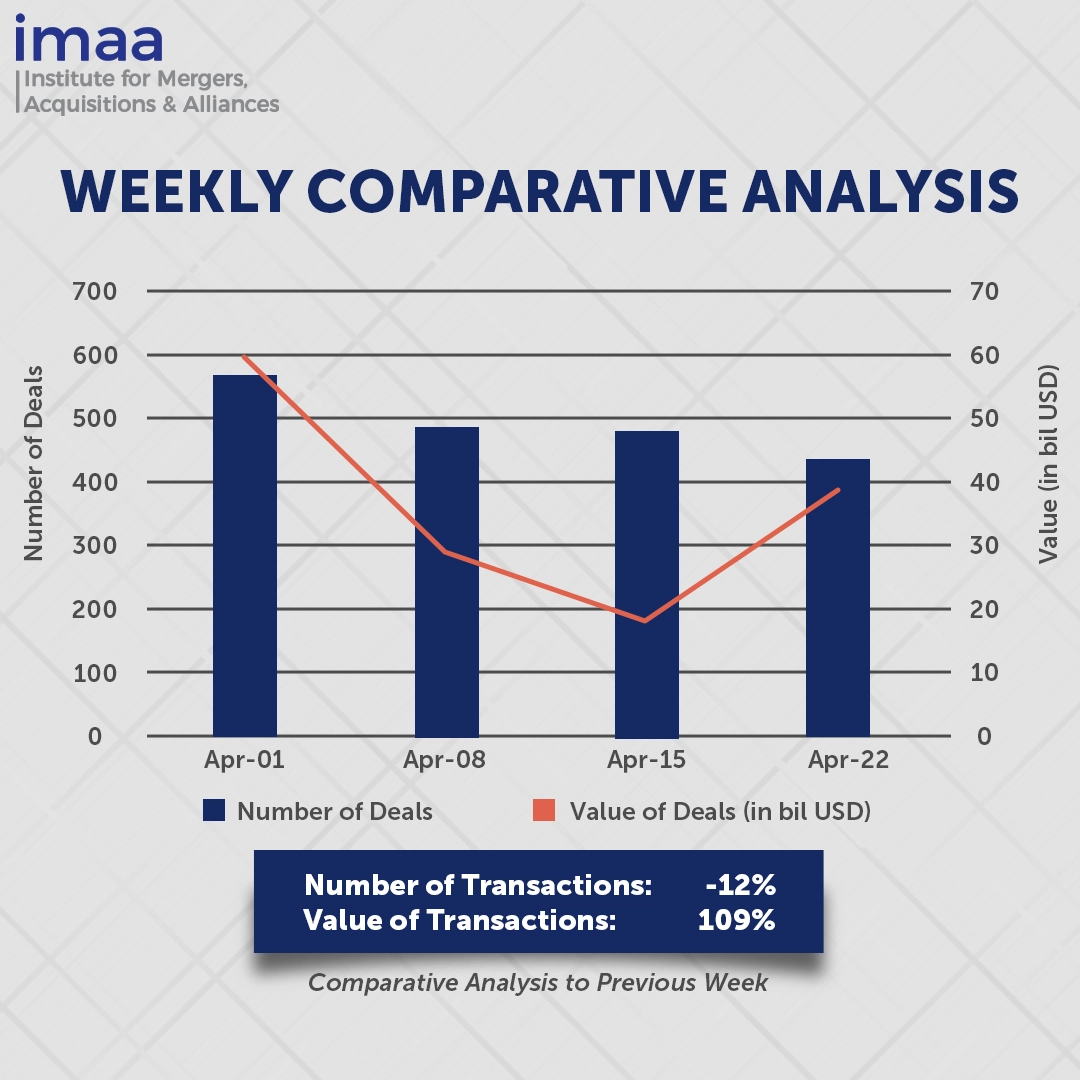

During the week spanning April 22 to April 28, the global market saw 431 Mergers and Acquisitions (M&A) transactions amounting to a combined value of USD 38.57 billion. Among these, 20 deals exceeded USD 500 million, accumulating to USD 32.09 billion, representing 83% of the total deal value for the week.

A notable highlight during this period was IBM’s acquisition of HashiCorp, Inc., valued at USD 6.4 billion. IBM, leveraging its financial strength, has been strategically acquiring prominent companies to aid IT departments in managing intricate hybrid environments. This trend began with the acquisition of Red Hat for USD 34 billion in 2019, followed by the Apptio acquisition last year, and culminating in this week’s deal with cloud management provider HashiCorp.

Comparing week-on-week data reveals a 12% decrease in deal count, dropping from 488 to 431. Despite this decline, the total deal value surged by 109%, rising from USD 18.42 billion to USD 38.57 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of April 22 – 28, 2024 in detail:

Deal No. 1: International Business Machines Corporation to Acquire HashiCorp, Inc. for USD 6.40 Billion

Deal No. 2: Thoma Bravo, L.P. to Acquire Darktrace plc for USD 5.32 Billion

Deal No. 3: GTCR LLC to Acquire AssetMark Financial Holdings, Inc. for USD 2.70 Billion

Deal No. 4: Apollo Global Management, Inc. to Acquire U.S. Silica Holdings, Inc. for USD 1.85 Billion

Deal No. 5: KKR & Co. Inc. to Acquire Portfolio of 19 Purpose-Built Student Housing Properties for USD 1.64 Billion

Deal No. 1:

International Business Machines Corporation to Acquire HashiCorp, Inc. for USD 6.40 Billion

IBM’s strategic move to acquire HashiCorp, a notable software company, marks a significant step in its expansion of hybrid and multi-cloud solutions. Valued at USD 6.4 billion, this acquisition reflects IBM’s focus on harnessing the power of hybrid cloud and AI, recognized as pivotal technologies for modern businesses.

The surge in cloud-native workloads has propelled enterprises to manage an unprecedented number of cloud-based operations. Concurrently, the deployment of generative AI alongside traditional workloads has become a notable trend, further driving the need for comprehensive cloud solutions.

By integrating HashiCorp into its portfolio, IBM aims to accelerate innovation and strengthen its market presence while driving growth and optimizing monetization efforts. This integration will provide clients with a platform to automate workload deployment across various infrastructures, including hyperscale cloud providers, private clouds, and on-premises environments. HashiCorp’s addition complements IBM’s existing strengths, particularly Red Hat, which has contributed to revenue growth since its acquisition in 2019.

HashiCorp boasts an impressive clientele comprising over 4,400 organizations, including industry leaders such as Bloomberg, Comcast, Deutsche Bank, GitHub, J.P. Morgan Chase, Starbucks, and Vodafone. Its solutions are widely adopted within the developer community and utilized by a significant portion of Fortune 500 companies.

The transaction is expected to be finalized by the end of 2024, marking a significant step forward for IBM in its efforts to enhance its hybrid cloud offerings and cater to evolving client needs.

Deal No. 2:

Thoma Bravo, L.P. to Acquire Darktrace plc for USD 5.32 Billion

Thoma Bravo, a US-based private equity firm renowned for its focus on software investments, has entered into an agreement to acquire Darktrace plc, a leading cybersecurity artificial intelligence company headquartered in the UK. The acquisition, valued at USD 5.32 billion, will be an all-cash transaction at USD 7.75 per share.

Darktrace stands at the forefront of cybersecurity innovation, offering artificial intelligence-based solutions tailored to safeguard companies against the escalating threat of cloud-based attacks. Unlike conventional methods that rely on analyzing past incidents, Darktrace’s technology continuously learns and adapts to an organization’s data environment, enabling a proactive approach to cyber resilience.

Thoma Bravo’s extensive two-decade-long expertise in software investment positions it perfectly to leverage its robust platform, operational proficiency, and profound cybersecurity knowledge to propel Darktrace towards becoming a premier cyber-AI enterprise in the UK.

If approved, this transaction would represent another instance of a UK-listed company undergoing privatization by an international private equity firm. To proceed, Thoma Bravo must secure at least 75% of Darktrace’s shareholders’ approval.

The completion of the acquisition is projected for the third or fourth quarter of the year. Thoma Bravo has engaged Goldman Sachs as its financial advisor, while Darktrace has received counsel from Jefferies and Qatalyst Partners throughout the process.

Deal No. 3:

GTCR LLC to Acquire AssetMark Financial Holdings, Inc. for USD 2.70 Billion

AssetMark Financial Holdings, Inc., a prominent provider of wealth management technology solutions for financial advisors, has announced a forthcoming acquisition by the Chicago-based private equity firm GTCR. The acquisition, valued at USD 2.7 billion, entails a per-share cash offer of USD 35.25 for AssetMark stockholders.

AssetMark offers a comprehensive range of technology tools and services empowering independent financial advisors to tailor and oversee client investment portfolios, assess performance, safeguard assets, attract new clientele, and expand their advisory practices. Distinguished by its end-to-end suite and personalized service approach, AssetMark serves a broad clientele of over 9,300 financial advisors and more than 257,000 investor households.

GTCR specializes in investments across high-growth sectors, including financial services and technology, healthcare, information services and technology, and growth-oriented business services. Collaborating with GTCR, AssetMark aims to enhance its client offerings through innovative product expansions while upholding its commitment to exceptional client service.

The acquisition is contingent upon standard closing procedures and regulatory approvals, with the anticipated completion slated for Q4 2024. Morgan Stanley & Co. LLC acted as the exclusive financial advisor to AssetMark, while UBS Investment Bank and Barclays served as co-lead financial advisors to GTCR, providing debt financing assistance for the transaction.

Deal No. 4:

Apollo Global Management, Inc. to Acquire U.S. Silica Holdings, Inc. for USD 1.85 Billion

U.S. Silica, an established player in the industrial silica and minerals sector with a rich history spanning 124 years, has reached an agreement to transition into private ownership through an all-cash acquisition by Apollo Global Management. The acquisition values U.S. Silica at around USD 1.85 billion, with Apollo offering USD 15.50 per share.

The partnership with Apollo Funds offers U.S. Silica access to substantial resources, profound industry knowledge, and increased operational flexibility as a private entity. This strategic move enables the company to leverage market opportunities effectively and invest in innovative capabilities, further enhancing its value proposition for customers. U.S. Silica’s long-standing strengths, including extensive production capacity, premium reserve portfolio, strategic geographic positioning, cost-efficient operations, and robust client relationships, position it favorably for continued success in the industry.

The transaction, set to conclude in the third quarter of 2024, includes a 45-day “go-shop” period during which U.S. Silica, with the assistance of its financial advisor Piper Sandler & Co., retains the flexibility to explore alternative acquisition proposals from third parties. BNP Paribas Securities Corp and Barclays are serving as financial advisors to Apollo Global Management in this transaction.

Deal No. 5:

KKR & Co. Inc. to Acquire Portfolio of 19 Purpose-Built Student Housing Properties for USD 1.64 Billion

KKR is poised to acquire a collection of 19 student housing properties from Blackstone Real Estate Income Trust (BREIT) for a total of USD 1.64 billion. This investment by KKR is primarily drawn from its KKR Real Estate Partners Americas III fund.

The portfolio, boasting more than 10,000 beds, comprises purpose-built student housing assets affiliated with 14 four-year public universities spanning 10 states. Despite this divestiture, BREIT maintains a steadfast commitment to student housing, actively expanding through its student housing arm, American Campus Communities. This entity stands as the largest proprietor of student housing in the United States, boasting a portfolio of over 190 properties, housing approximately 140,000 beds.

Following the completion of the transaction, KKR’s University Partners will oversee the management of the portfolio. University Partners, an entity under KKR, specializes in the ownership and operation of student housing properties nationwide. Including this forthcoming acquisition, University Partners will preside over a portfolio encompassing more than 25,000 beds, translating to nearly USD 4 billion in property value owned by KKR and its co-investors.

This agreement with KKR marks Blackstone’s second significant transaction in recent times. Just earlier this month, Blackstone disclosed its intention to privatize Apartment Income REIT, also known as AIR Communities, in a monumental USD 10 billion deal.

The closure of this transaction is anticipated by the third quarter of 2024. Legal counsel for KKR was provided by Gibson, Dunn & Crutcher LLP, while TSB Capital Advisors and J.P. Morgan Securities LLC acted as financial advisors for BREIT.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of April 22 – 28, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter