M&A News M&A News: Global M&A Deals Week of December 4 to 10, 2023

- M&A News

M&A News: Global M&A Deals Week of December 4 to 10, 2023

- IMAA

SHARE:

The latest Mergers & Acquisitions (M&A) news, monitored by the Institute for Mergers, Acquisitions, and Alliances (IMAA) highlights the top 5 M&A deals reshaping various industries around the globe. These key deals, standing at the forefront of this week’s business news, signal a broader trend of vigorous activity in the M&A sector.

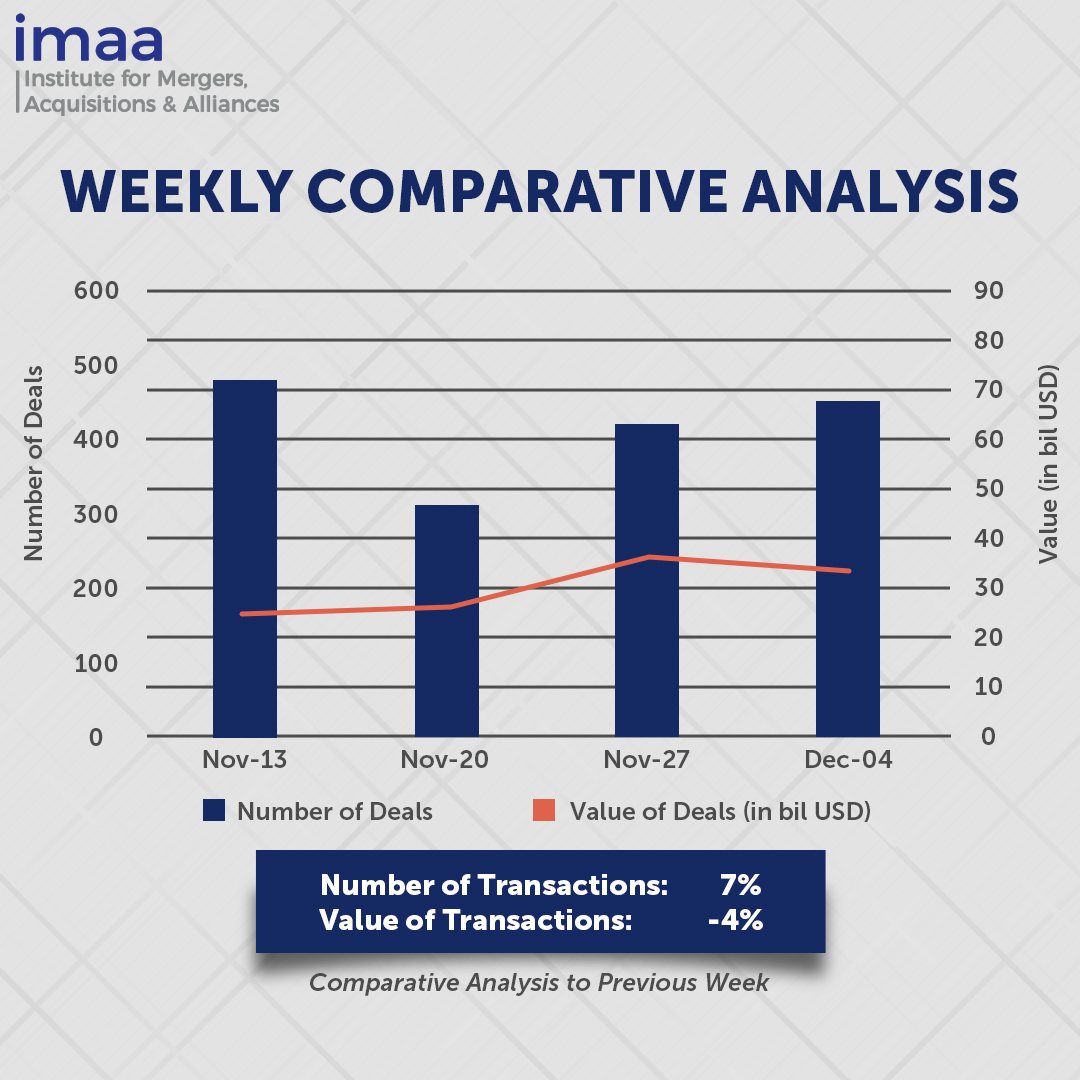

Echoing this trend, during the week of December 4th to December 10th, the global market saw heightened mergers and acquisitions activities, with a noteworthy total of 453 deals amounting to a substantial USD 33.87 billion. Notably, 14 of these transactions surpassed a deal value of USD 500 million, contributing a cumulative USD 25.62 billion. This represents a striking 82% of the total M&A deal value for the week.

In a strategic sequence of developments, AbbVie Inc. has unveiled two noteworthy acquisitions within a mere seven days. The standout transaction of the week is AbbVie’s proposed acquisition of Cerevel Therapeutics, valued at USD 8.7 billion. This announcement follows closely on the heels of AbbVie’s recent declaration of the intended acquisition of ImmunoGen, Inc., a deal valued at USD 10.1 billion. If successful, the ImmunoGen deal would be AbbVie’s largest acquisition since its USD 63 billion purchase of Allergan in 2019.

In a week-over-week analysis, we observe a notable uptick of 6.6% in the global number of deals, climbing from 425 to 453. It is important to highlight, however, that there is a marginal decline in the aggregate value of these transactions, with a 4% decrease from the previous week.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of December 4 – December 10, 2023 in detail:

Deal No. 1: Abbvie Inc., to acquire Cerevel Therapeutics Holdings, Inc. for USD 8.70 Billion

Deal No. 2: Honeywell International Inc. to acquire Global Access Solutions business of Carrier for USD 4.95 Billion

Deal No. 3: Roche Holding to acquire Carmot Therapeutics Inc. for USD 3.10 Billion

Deal No. 4: Kohlberg Kravis Roberts & Co. L.P. to acquire Smart Metering Systems plc for USD 1.80 Billion

Deal No. 5: Changping (Hangzhou) Industrial Holdings Co., Ltd. to acquire CPMC Holdings Limited for USD 0.98 Billion

Deal No. 1:

Abbvie Inc., to acquire Cerevel Therapeutics Holdings, Inc. for USD 8.70 Billion

AbbVie Inc. (United States) has announced a strategic move to acquire Cerevel Therapeutics Holdings Inc. (United States), marking a significant expansion of its neuroscience portfolio. Through this acquisition, AbbVie secures access to Cerevel’s robust neuroscience pipeline, encompassing both clinical-stage and preclinical candidates designed for various conditions, including schizophrenia, Parkinson’s disease (PD), and mood disorders.

This strategic alignment enhances AbbVie’s position in the field of psychiatric and neurological disorders, addressing critical unmet needs for patients. The addition of Cerevel’s potentially best-in-class assets holds the promise of transforming standards of care in these therapeutic areas.

This acquisition is part of AbbVie’s broader strategy to bolster its drug pipeline, particularly in light of generic competition challenging its leading treatments like Humira. In the past week alone, AbbVie demonstrated its commitment to expansion by agreeing to acquire Immunogen, a cancer drug developer, for an impressive sum of nearly USD 10 billion.

AbbVie will acquire all outstanding shares of Cerevel at a price of USD 45.00 per share, resulting in a total equity value of approximately USD 8.7 billion. The transaction is slated to close in the middle of 2024.

Morgan Stanley & Co. LLC serves as AbbVie’s financial advisor in this deal, while Centerview Partners LLC advises Cerevel Therapeutics. This strategic acquisition underscores AbbVie’s dedication to innovation and growth in the dynamic pharmaceutical landscape.

Deal No. 2:

Honeywell International Inc. to acquire Global Access Solutions business of Carrier for USD 4.95 Billion

Carrier Global Corp has successfully reached an agreement to divest its security business, Global Access Solutions (United States), to Honeywell (United States) for a transaction valued at USD 4.95 billion. This strategic move represents the initial phase of Carrier’s portfolio transformation, positioning itself as a global leader in intelligent climate and energy solutions. Simultaneously, Carrier plans to exit its Industrial Fire, Residential and Commercial Fire, and Commercial Refrigeration cabinet businesses. The anticipated proceeds from this separation transaction will be directed towards reducing leverage, aligning with an investment-grade profile and to repurchase the equivalent shares issued to the Viessmann family during the acquisition of Viessmann Climate Solutions last Q2 2023. The expected closure of the deal is set for the second half of 2024.

This acquisition underscores Honeywell’s commitment to realigning its portfolio with three pivotal megatrends: automation, the future of aviation, and energy transition, supported by robust digitalization capabilities and solutions. The inclusion of Global Access Solutions, covering both hardware and software solutions, is projected to be accretive to Honeywell. The acquired business boasts an attractive growth and margin profile, featuring valuable software content, a resilient business model, and substantial sources of recurring revenue. Notably, this transaction introduces three esteemed brands—LenelS2, Onity, and Supra—to Honeywell’s portfolio.

Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC are offering financial advisory services to Carrier, while external legal counsel is provided by Paul, Weiss, Rifkind, Wharton & Garrison LLP and Linklaters LLP.

Deal No. 3:

Roche Holding to acquire Carmot Therapeutics Inc. for USD 3.10 Billion

Roche AG (Switzerland) is set to acquire Carmot Therapeutics (United States), a prominent player in the obesity drug manufacturing sector, in a significant transaction valued at $3.1 billion. The deal structure involves Roche making an initial payment of USD 2.7 billion, supplemented by potential milestone payments of up to USD 400 million.

Carmot’s research and development portfolio feature state-of-the-art clinical stage subcutaneous and oral incretins, showcasing promising potential for treating obesity in both diabetic and non-diabetic patients. With an assortment of preclinical programs in its pipeline, Carmot positions Roche strategically to compete with major industry players like Novo Nordisk and Eli Lilly in the fiercely competitive weight-loss drug market.

While Carmot’s drugs are still in the early phases of development, Roche’s acquisition signals a significant move toward establishing a formidable presence in the obesity treatment landscape. Moreover, the deal grants Roche exclusive access to Carmot’s revolutionary Chemotype Evolution discovery platform in metabolism, which is expected to enhance Roche’s research and development initiatives, expanding its impact across cardiovascular and metabolic diseases.

Carmot is being advised by financial powerhouses Centerview Partners LLC and J.P. Morgan Securities LLC.

Deal No. 4:

Kohlberg Kravis Roberts & Co. L.P. to acquire Smart Metering Systems plc for USD 1.80 Billion

Smart Metering Systems PLC (United Kingdom) has recently finalized the terms of an all-cash private equity acquisition, placing the company’s enterprise value at approximately GBP 1.4 billion, equivalent to roughly USD 1.8 billion. The acquisition proposal is from funds managed by Kohlberg Kravis Roberts & Co LP (United States), a prominent American investment firm and its affiliates.

KKR, through its fund KKR Global Infrastructure Investors IV, specializing in low-volatility critical infrastructure investments, will lead the acquisition. Leveraging its experienced team, risk-based strategy, track record of operational value creation, and global network, KKR aims for attractive risk-adjusted returns.

KKR expresses confidence in Smart Metering Systems, considering it a high-quality business with an exceptional management team, providing long-term, contracted, and inflation-protected cashflow streams. SMS, recognized for its potential in the energy transition, has an established smart meters platform and expanding capabilities in grid-scale battery storage assets and other carbon reduction initiatives. SMS is poised to support the UK Government’s net-zero emissions goal by 2050.

KKR’s operational capabilities, collaborative approach, and experience in energy transition investments make it an ideal partner for SMS in its next development phase. This partnership, with flexible access to long-term competitive capital, aligns with KKR’s offer, recognizing SMS’s model resilience and ensuring sufficient capital for accelerated growth.

Deal No. 5:

Changping (Hangzhou) Industrial Holdings Co., Ltd. to acquire CPMC Holdings Limited for USD 979.80 Million

Changping (Hangzhou) Industrial Holdings Co., Ltd. (China) has announced its strategic move to acquire CPMC Holdings Limited (Hong Kong). The acquisition will be led by Champion Holding (BVI) Co., Ltd., a wholly-owned subsidiary of Changping Industrial. In a collective statement, Champion Holding and CPMC have disclosed that Shenwan Hongyuan, serving as Champion Holding’s financial adviser, will initiate a pre-conditional voluntary general cash offer to acquire all outstanding shares, signifying the intent to privatize CPMC.

The offer price is fixed at HKD 6.87 per share, and with 1,113,423,000 shares currently in circulation, the total cash consideration for all offer shares is capped at HKD 7,649 million or approximately USD 979.1 million. Primarily engaged in manufacturing and selling packaging products for consumer goods such as food, beverages, and household chemicals in the PRC, the group acknowledges the imperative for a strategic business transformation to maintain competitiveness.

Post-acquisition, Champion Holding will emerge as the controlling shareholder. Both Champion Holding and CPMC anticipate that this shift in ownership will provide robust shareholder support for CPMC’s strategic development, enabling flexible decision-making for strategic investments aimed at realizing long-term value. By optimizing regional operations and promoting resource sharing, the combined entity aims to achieve scale effects and synergies, positioning CPMC as a formidable player in the metal packaging industry.

The anticipated delisting of shares from the Stock Exchange, if successfully executed, is expected to yield cost savings for CPMC, relieving it from compliance and maintenance expenses associated with the listing status. This move will grant CPMC the flexibility to explore diverse strategic alternatives in its pursuit of long-term goals.

This concludes our coverage of this week’s top global mergers and acquisitions. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA)

Stay up to date with M&A news!

Subscribe to our newsletter