Publications Global Engineering And Construction M&A Deals Insights Q3 2016

- Publications

Global Engineering And Construction M&A Deals Insights Q3 2016

- Christopher Kummer

SHARE:

Executive summary

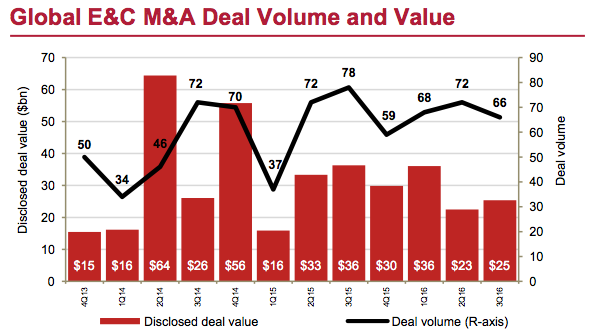

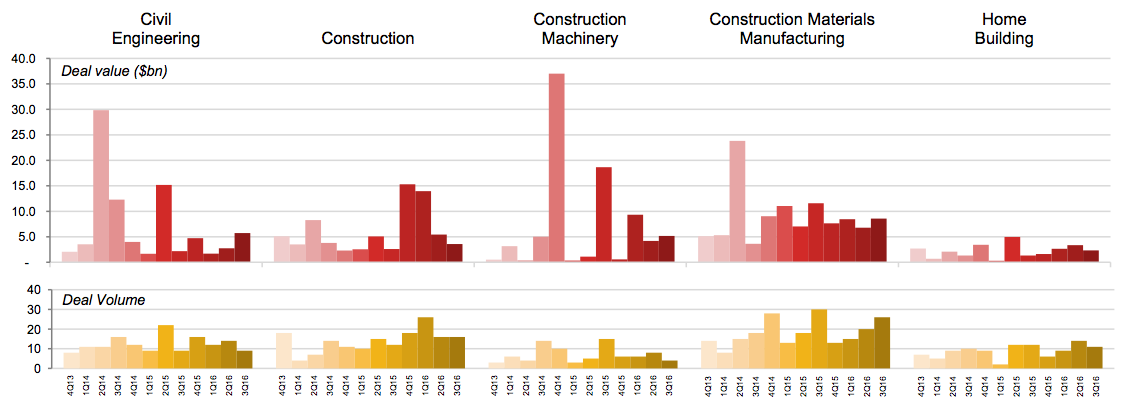

Global Engineering and Construction (E&C) M&A deal values continue to reflect softness in 2016 versus prior years, but masking healthy deal volume. While both value and volume declined in Q3 2016 compared to comparable 2015, on a relative year-to-date basis 206 deals through Q3 2016, outpaces 2015 and 2104 (187 and 103, respectively) demonstrating heightened activity for smaller transactions. There were 66 deals this quarter, with the Construction Materials Manufacturing category contributing 26 and Construction 16 of the 66 deals.

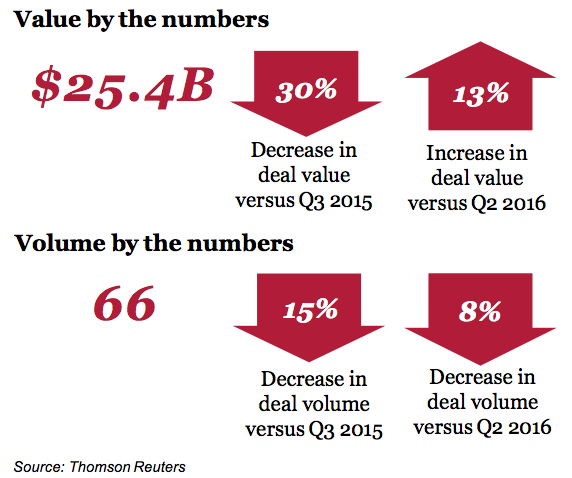

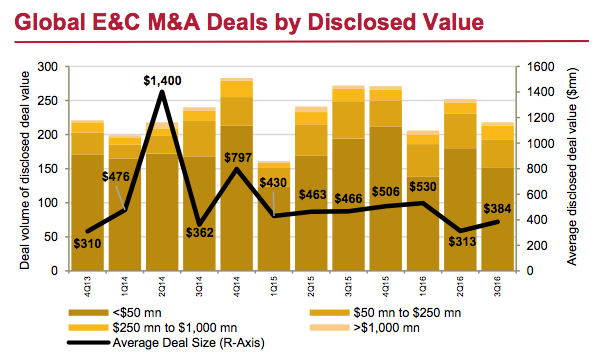

Overall Q3 2016 deal value increased by 13% from Q2 2016 but decreased 30% from Q3 2015. On a YTD basis, 2016 average deal size decreased by 10% to $410 million versus $452 million in 2015. Civil Engineering registered the highest growth on both year-over-year and quarter- over-quarter basis. Construction and Home Building declined 34% and 31%, respectively, from Q2 2016, but increased 38% and 76% when compared to Q3 2015.

There were five megadeals announced in Q3 2016, unchanged from Q2 2016 and Q3 2015. The largest deals were Xinjiang Dushanzi Tianli High & New Tech Co. Ltd.’s acquisition of China National Petroleum Corp.’s E&C assets for $4.2 billion, and Komatsu America Corp.’s acquisition of Joy Global Inc. (valued at $2.8 billion).

“The drop in E&C M&A value does not tell the entire story, with volumes continuing to show relative strength and growth on a YTD basis versus 2014 and 2015. Macro global questions continue to weigh keeping deal size down and relatively concentrated in North America and Asia Pacific.” — Colin McIntyre, US Engineering and Construction Deals Leader

Key trends/highlights

• Deal value in the E&C sector increased by 13% to $25.4 billion this quarter, despite a modest decline in deal volume, indicating an expansion in average deal size in Q3 2016 versus previous quarters in the year.

• Five megadeals were announced in Q3 2016 with a total aggregate disclosed value of $11.5 billion.

• Construction Materials Manufacturing contributed to the largest share in terms of both value and volume in Q3 2016—34% and 39%, respectively. The Civil Engineering category followed with 23% share in deal value (almost doubled from Q2 2016) and recorded nine deals in the quarter.

• In Q3 2016, financial investors deal value decreased by 31% and 37% as compared to Q2 2016 and Q3 2015, respectively. Strategic investors witnessed increase in deal value by 33%, while the number of deals remained unchanged.

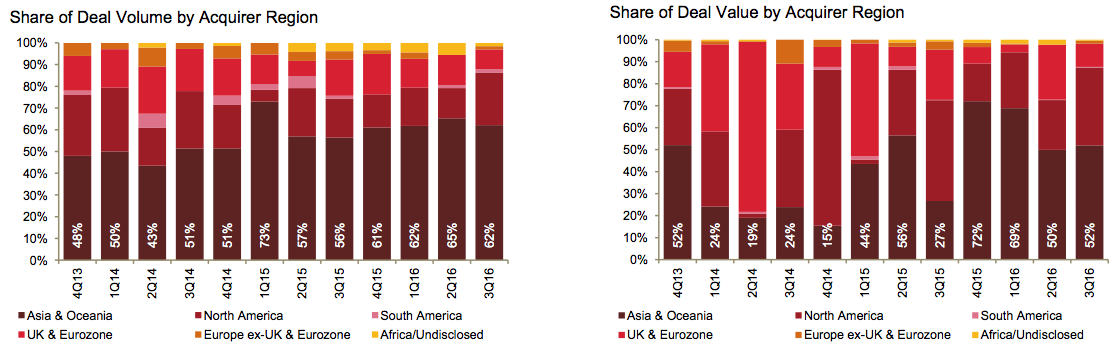

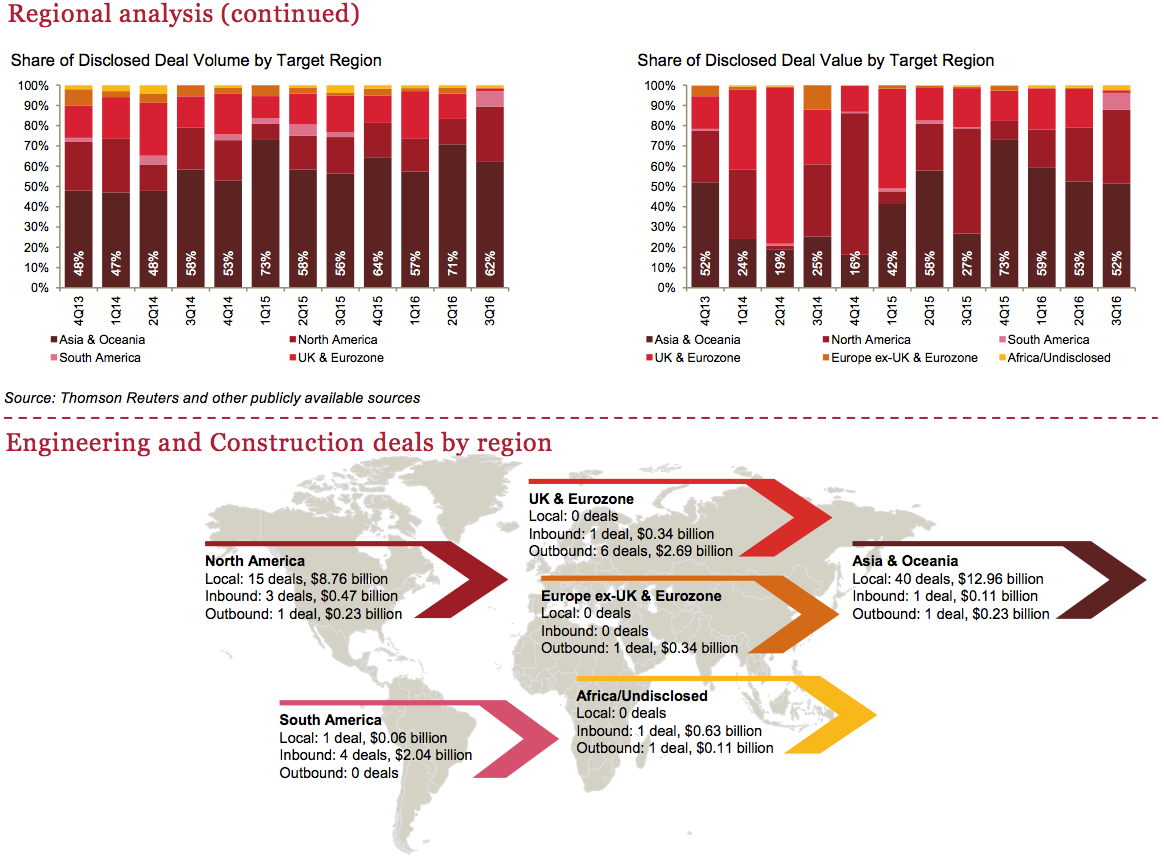

• The Asia & Oceania region and North America remained the two most active regions in E&C transactions, while Europe and other regions lag given certain macro economic conditions.

Highlights of Q3 2016 deal activity

M&A volume dropped

Deal activity in Q3 2016 remained relatively steady. Deal value in the quarter increased by 13% but decreased by 30% compared to Q2 2016 and Q3 2015, respectively.

There were 66 deals announced this quarter, a decrease of 8% (six deals) and 15% (12 deals) compared to Q2 2016 and Q3 2015, respectively.

Largest transaction

In September, Xinjiang Dushanzi Tianli High and Newtech Co. Ltd. announced the acquisition of construction and engineering assets from CNPC for $4.2 billion. The deal accounts for 36% of the total megadeal value and 16% of the total deal value in Q3 2016.

Megadeals

This quarter there were five announced transactions that exceeded a disclosed value of $1.0 billion, which is the same amount as Q2 2016 and Q3 2015. These five deals accounted for 45% of the total deal value for the quarter.

Sub-sector category analysis

Deal activity by value witnessed growth in all E&C categories except for Construction and Home Building. Civil Engineering deal value grew more than double this quarter compared to previous quarter. In terms of volume, Construction Materials Manufacturing is the only category that has grown consistently since Q1 2016 with approximately 30% growth each quarter.

Key trends and insights

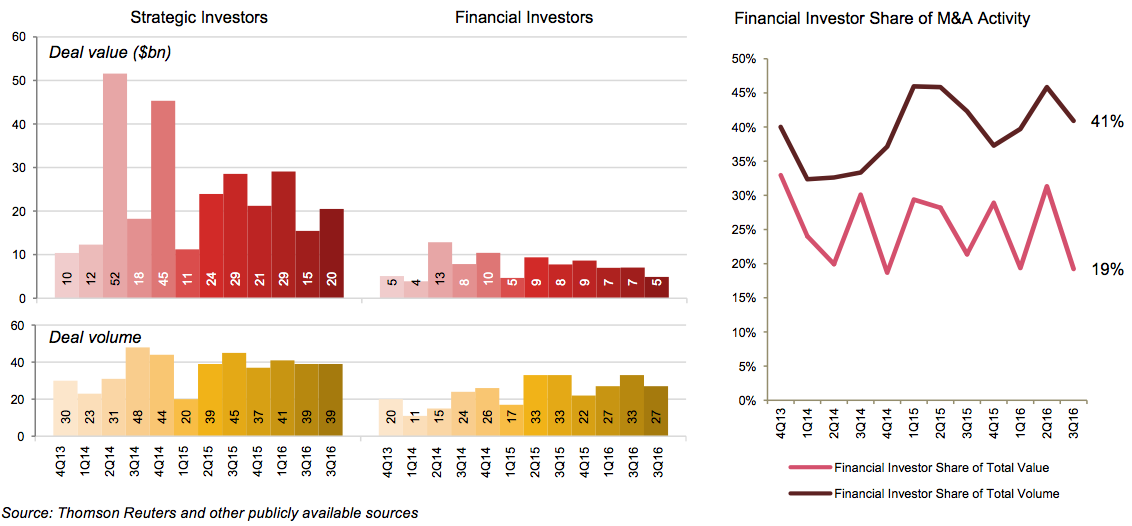

Financial vs. strategic investors

Strategic investors continue to maintain a major share of M&A transactions in E&C, increasing 33% in value and remaining neutral in volume this quarter compared to previous quarter. Financial investors observed decline in both value and volume, decreasing 31% and 18%, respectively, this quarter.

Regional analysis

Local deals (transactions by targets and acquirers within the same borders) continue to account for the majority of E&C transactions. Local deals contributed to 76% of the total deal volume and 78% of the total deal value and included the four largest deals this quarter. While a majority of E&C deals occurred in the Asia & Oceania, the average deal size for the region remains low. Meanwhile, North America saw the highest growth in transactions this quarter compared to Q2 2016.

Our views on the remainder of 2016

Carrying on trends from previous quarters, E&C M&A volume continues to be healthy. The pullback on megadeals is driving an overall deal value and average deal size down versus prior years and unlikely to materially change as we turn the page towards the rest of the year. Ongoing economic uncertainty, Brexit negotiations pending for early next year, and the upcoming US elections are all expected to continue to weigh on deals.

Despite the uncertainty challenging the market, there are questions as to whether companies take advantage of record liquidity levels and a strong dollar, to identify good assets but at value comparative to recent years.

The factors we see influencing M&A activity in the E&C space as we enter the last few months of 2016 largely echo what we highlighted previously:

• Continued high levels of liquidity on balance sheets to fuel non-organic growth opportunities

• Geopolitical uncertainty globally influencing transactions

• Impact of pending Brexit discussions with the other European territories and potential for greater fallout

• Continued strength in the US economy creating opportunities for both domestic and inbound transactions.

Top 10 Engineering and Construction Deals

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter