Publications Corporate Tax Rate And Recent Inbound And Outbound Mergers And Acquisitions Activity In The United Kingdom

- Publications

Corporate Tax Rate And Recent Inbound And Outbound Mergers And Acquisitions Activity In The United Kingdom

- Christopher Kummer

SHARE:

3rd Economics & Finance Conference, Rome, Italy, April 14-17, 2015 and 4th Economics & Finance Conference, London, UK, August 25-28, 2015

By Victoria Garkusha, Paul Joyce, Christopher S. Lloyd

Abstract

In the light of the substantial changes to the corporation tax policy implemented gradually by the United Kingdom government over the course of past 6-7 years this paper looks to consider the impact this change had on the mergers and acquisitions activity of foreign companies in the United Kingdom and vice versa. The tax rate has changes from 28% in 2009 to 21% in 2014 and further, having been flat 30% for a decade prior to that.

We investigate possible statistical relations between this trend and activity from both host and home countries in mergers and acquisitions deals in the context of the financial crises and subsequent recovery. We also try to exploit few other key features from the hypothesis of tax competition such as: productivity cutoff, as well as the so-called proximity-concentration theory to test the influence of the tax rate changes in home and host countries on deals volumes and values. Scope of testing included mergers and acquisitions transactions where UK business involved with countries of one of three clusters: native English speaking (such as the United States, Australia, Ireland); developed European (e.g. Germany, Sweden, Netherlands), and conditional South (China, India, Turkey, etc).

Using different sources, United Nations Conference on Trade and Development, World Economic Forum Reports, and World Bank data to gather information on corporate taxes, Gross Domestic Product (GDP), GDP per capita, trade openness, and business sophistication, we also employed countries’ proximity factor to estimate the impact of the corporate tax. The results did not confirm anticipated influence on the mergers and acquisitions activity – based on empirical evidence it appears that lowering the UK tax rate effect demonstrates either opposite sign to what could be expected, or is redundant and not significant at conventional level of probability.

Introduction

The shift from uncertainty to consumer confidence along with improving economic and financial environment in 2014 has attracted significant amounts of new capital back into the market in the UK. Other factors such as growing liquidity inflow, variety of traditional funding sources and new entrant lenders also have contributed and enabled the increase in M&A and restructuring activity in the UK and worldwide.

We would try to consider the impact of the movements in corporate taxes on M&A levels, and to verify if lowering of the UK rates has really positively influenced inbound activity from foreign businesses in the country, and vice versa. In order to account for the heterogeneity, three different capital flows to and from the UK were considered – namely the US and native English speaking countries, developed European countries and emerging Asian economies, with an aim of assessing the extent to which each of pairs is dependent upon the UK tax policy, as well as upon own tax rates of these groups.

1. Worldwide trends by the end of 2014

The long anticipated boom in M&A activity seems to have finally realized itself in H2 2014, albeit not as unconditionally and univocally as expected by some. Year 2014 brought a shift from uncertainty to consumer confidence, which along with improving economic and financial environment has attracted significant amounts of new capital back into the market.

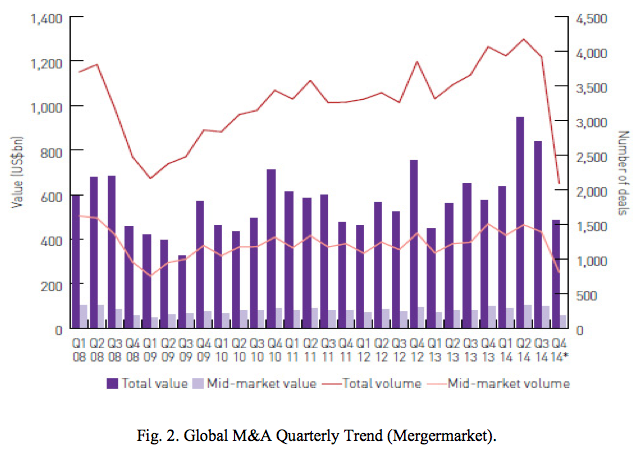

Though at the point of when this research has been carried out the Y2014 statistics has not been fully finalized, according to data from Mergermarket – 12,693 transactions had taken place worldwide by the start of November 2014, down by 12.5% compared to the same period in 2013; It should be noted however that for the same comparative period total deal values have leapt by more than 10% to $2.456bn. This trend is mostly attributable to series of high profile deals in 2014 (eg in UK- sale of GlaxoSmithKline’s oncology division to Novartis for £8.6 bn in April, Vodafone Group’s 10-bn acquisition of Spanish Cable operator Grupo Corporativo ONO in July 2014, as well as the purchase of Sheffield-based jet engine components manufacturer Firth Rixson by New-York based metals technology company Alcoa for $2.85 bn in November). But generally speaking one can observe that these activities are only recovering the pre-crisis pace, though there are several distinct signs of future growth.

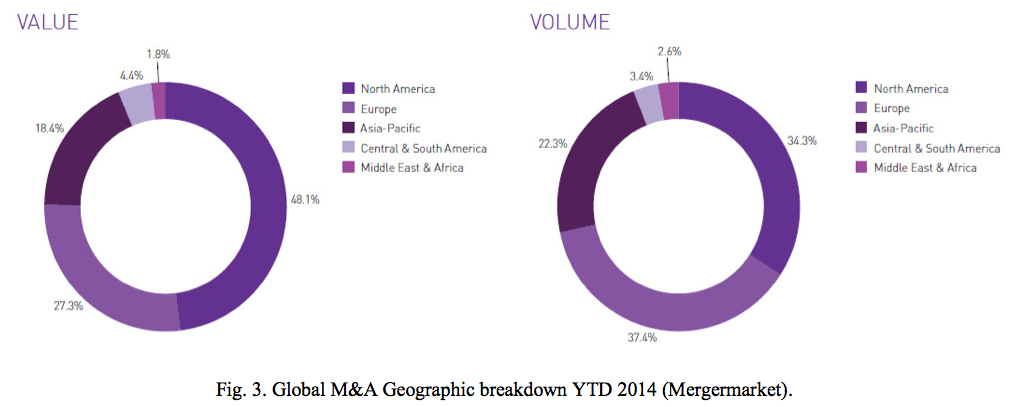

It can be noted, however, that there are often different reasons and incentives for such a rise apart from the business confidence and availability of cash in hand. The latter certainly have beaten the relatively recent preceding results, reaching record highs, but the breakdown by regions shows that the M&A activity is more modest outside of the US. North America is indeed driving the process, particularly cross-border activity, followed by leading European, Canadian and Chinese strategic investors.

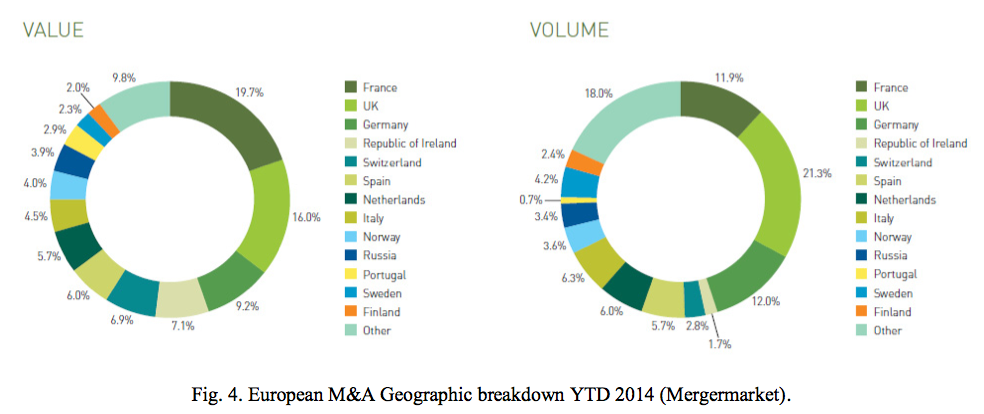

Unsurprisingly so, the growth is rather non-uniform across the globe. Firstly, the corporate sector from developed economies have been accumulated significant amounts of cash, spending only small part of it on capex and acquisitions. That combined with cheap and easy available debt and low interest rate has allowed them to use the advantage for mergers and restructuring, which complements organic growth as a leveraged tool to boost revenue, increase market share and capture greater efficiency savings. The US firms, followed by Canada and developed European countries – namely the UK, Germany, France, Netherlands, Switzerland, were not only seeking, but also providing targets for the largest number of cross border deals. In that way Allianz jointly with AIMCo, EDF Invest and Hastings Funds Management agreed to purchase for $3,233M Porterbrook Rail Finance, one of the three major UK rolling stock leasing companies, while effective August 2104, Rolls-Royce Holdings PLC completes $3,346M worth acquisition of Rolls-Royce Power Systems, formerly Tognum AG, a German holding company.

With the receding euro crisis in 2014 there were evident signs of substantial investment and restructuring trend in Europe. On one hand, a variety of M&A and restructuring projects was brought to life on the basis of liquidity inflows and the availability of traditional and alternative investment instruments, especially for big corporate players. As a consequence, it has been easier for them to raise funds for large scale projects essentially contributing to the overall M&A value.

It thus appears that a lot of transactions have taken place as businesses in North America and Europe have sought opportunities in each other’s market, with big players possessing an advantage over small and medium enterprises. The rest of Europe and emerging markets demonstrate more modest progress – which can be attributed to less dynamic economies. From Mergermarket data, number of deals dropped by 14% to 2,724 in 2014 in line with the global trend as noted earlier. Africa has been badly affected by the emerging markets damping, which means less demand for minerals and commodities produced, accompanied with political risks and Ebola outbreak, resulting in 12% decline to 230 deals for the period in question. Though China reported 21.3 % growth to $111bn in the value of M&A deals in 2014, most of the activity is regionally inbound, when the buyers are other companies from Asia. The leading sectors in terms of the M&A in 2014 also reflect the markets with greater level of activity in general.

Political and economic issues have also been influencing M&A activity. This can be well illustrated through the trends in the Chinese markets: businesses from China (as well as other more advanced Asian investors) are interested in mature markets bearing lower risks. But Chinese investors need to go through rigorous internal and external processes to secure approval for a deal- which is why the 2014 boost to Chinese outbound activity this year has been strongly correlated with the government’s approval threshold for the M&A transaction value to $1 bn. Another factor in a global trend in the number of deals with US companies targeting European businesses, has been tax inversion strategies with a view to reallocating headquarters and benefiting from lower corporate taxes. The new rules unveiled by US Treasury Department in September could reduce the volume of inversion deal making and have the biggest impact to companies that invert to gain lower-cost access to un-repatriated profits, or earning held overseas. For instance, the Treasure rules are seen as possibly deterring Pfizer from making another AstraZeneca bid after $118bn takeover attempt failed in May 2014. The restrictions would not affect already deals that have already been completed, however most pending deals could become more costly for the buyers. This also affects such high profile projects as AbbVie Inc $54.7bn deal to acquire Shire Plc, and Medtronic’s $42.9bn takeover of Covidien Plc.

1. The UK trends by the end of 2014

In the UK the situation is rather optimistic: continuing economy growth, lowering inflation combined with unemployment rate and growth in consumer confidence as well as corporate sectors have created favorable environment for M&A activity. But it took some time for favorable conditions and financial instruments availability to coincide with corporate confidence and corporate risk appetite. Similarly for the most of developed economies in Europe and worldwide said time lag can also be attributed to the processes of completion and registration of such deals, which could take six to nine months, making the boom to only have started to become substantially visible from the H2 2014, and carried onto the H1 of 2015.

It is however already fair to say, that in the UK economy, where the shift has been even more evident than on average in Europe, growing liquidity inflow, variety of traditional funding sources and new entrant lenders remarkably supported increasing M&A activity.

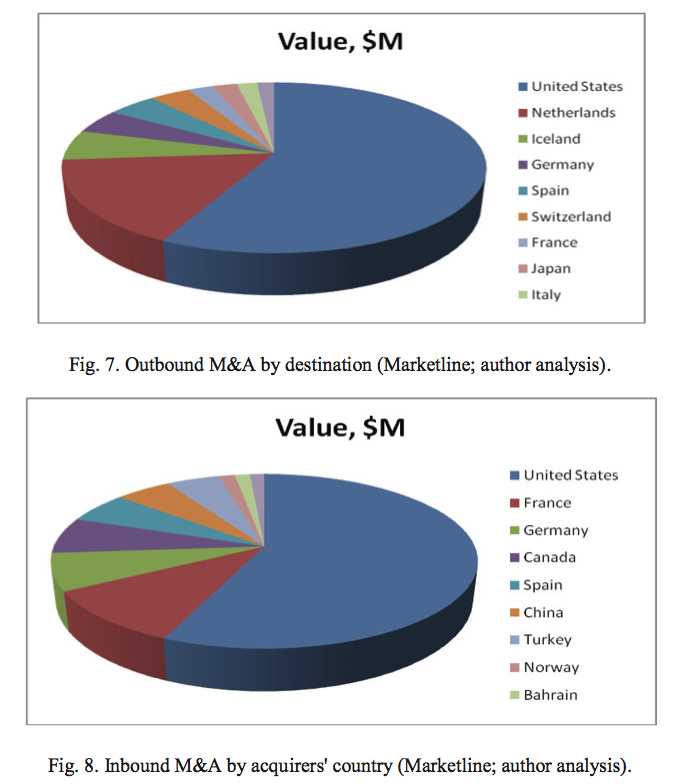

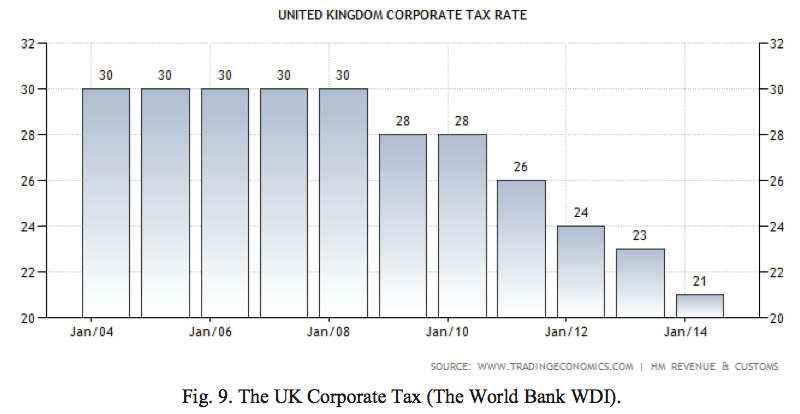

UK targets are of great demand from US and European acquirers, as well as from Global South (including Asian and Middle East). At the same time, UK companies, particularly multinationals, are seeking US, European and emerging markets targets. The non-organic growth offers additional opportunities to the contemporary business via cross-border as well as domestic acquisitions depending upon company’s profile and strategy. External and internal factors can have different effect in each case, and we distinguish domestic deals from outbound and inbound ones.

In accordance with general trends, US companies play leading role in both directions, followed by acquirers from Europe who wants to invest in a growing economy. The Far East is again another source of inbound investments due to slowing growth in China and the near-stagnant economy in Japan. Noticeably, Japanese corporations are buying assets that some of the UK domestic investors perceive as low growth, but this growth is fast enough compared to what they would have had access to in China.

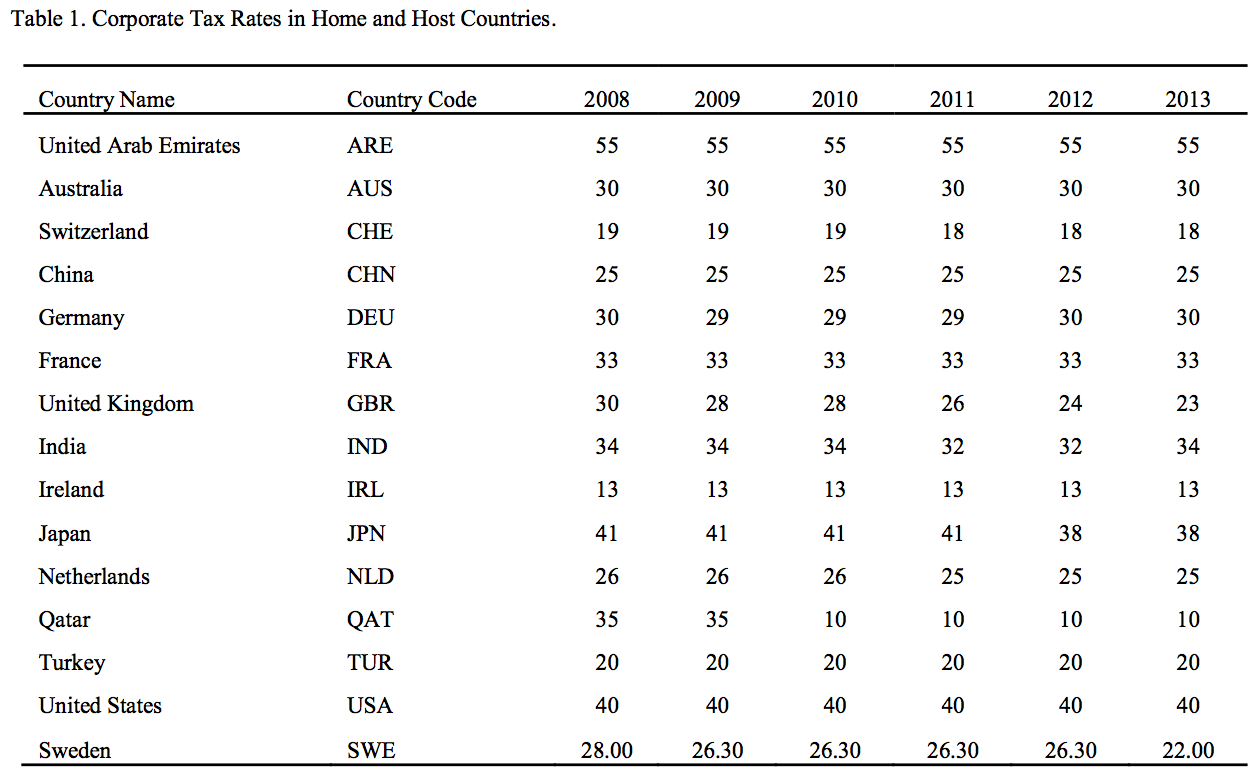

The UK Government has undertaken a series of measures aimed at boosting the competitiveness of UK’s businesses last years. Thus HM Revenue & Customs has been systematically introducing a decrease in the corporate tax rates since 2009 and we are particularly interested in this paper in possible effects of this policy on M&A deals.

2. Statistical Results

2.1. Theoretical background

Numerous and extensive researches have been undertaken covering different issues of M&A activity including those dedicated to corporate taxes and tax competition. Not purposing to recall all of them in a kind of essay, but to mention, the most widely accepted is a theory suggesting that companies with higher productivity are more likely to move capital and shift profit, benefiting from factor price differentials abroad, Liberini (2014), Dailami et al. (2012), Baldwin and Okubo (2009). Accounting for comparison between fixed costs related to a FDI decision and transport costs, there are different productivity cutoffs in favor of each choice, Baldwin and Okubo (2009). Some of authors assume more productive firms that outgrow home market as self-selecting for exporting or purchasing subsidiary, and concentrate on tax competition games between home and host countries, Krautheim and Schmidt-Eisenlohr (2011). It is also proposed that multinationals are more prone to profit shifting and companies already having at least one foreign subsidiary before, are much more probable for next acquisitions abroad, Liberini (2014).

Another cluster of researches is related to so-called proximity-concentration theory which focuses around economic issues of the host and home countries. Essential factors here are the distance between them, the extent of trade openness, and differential access to domestic or international finances, Dailami et al. (2012), Baldwin and Krugman (2004). The influence of differences in the speed of diffusion of scientific and technological advances is also under consideration, although less empirical evidences found to support its significance. This tradeoff between proximity to the customer versus concentration of production tends to be shifted from exporting goods to acquiring subsidiaries especially if transport costs and trade barriers are high enough. It is also noted, that the expansion from emerging South to developed North is more boosted by political stability and wider market opportunities, and less frightened by economic and financial risks.

3.2 Data sources and description

The dataset used to undergone statistical OLS simulation is Marketline M&A database, collecting deals from as early as 1964 on 16,206 companies worldwide, though up to 2004-2005 it appears fragmentary and possibly incomplete. We also make some sampling to filter only deals with available values of not less than $1M, and remove record duplications, which leaves 6,493 companies with 61801 deals. Different additional sources, UNCTAD Stat, HM treasury, Bank of England, and World Bank data were used to gather information on GDP, GDP per capita, Foreign reserves, Private capital share, Corporate tax rates, etc.

3.3 Econometric models

The standard OLS regression is applied to the gravity-like formula following Dailami et al. (2012), where both proximity-concentration and factor proportion hypotheses are aimed to catch up. Thus, the econometric model used in the form of an augmented gravity model that specifies that the number of cross-border M&A deals originating in country i (“home”) and destined for country j (“host”) at time t, Mi,j,t is a function of each country’s output in that period, Yi,t and Yj,t , the (time invariant) bilateral distance between them, Di,j , and additional factors:

Mi,j,t = β1,k Yi,t + β2,kYj,t + β3,k Di,j + Γ’k Xi,t +Λ’k Zj,t + Φ’k Bi,j,t +Ψ’k Gt + εi,j,t (1)

where X and Z are vectors of home- and host-country characteristics, respectively, B is a vector of other variables capturing the bilateral economic relationship between the home and host countries, and G is a vector of additional controls representing global macroeconomic and financial conditions. Variables considered within X and Z are informed by the different theoretical approaches outlined above. These include, inter alia, Corporate tax rates, GDP growth (corresponding to the factor proportions hypothesis), trade openness (corresponding to the proximity-concentration hypothesis), patents granted (corresponding to technology transfer arguments), and international reserve holdings (corresponding to political economy explanations).

To account for countries heterogeneity both equations are tested over three streams of pairs, the UK with the US, developed Europe (Germany, Switzerland, Norway), and Global South (China, Korea, Qatar and conditionally Japan). The M&A volumes and values are investigated against general output, tax rates, and other political and economic factors, and the distance between host and home countries. Time and pair dependences were statistically tested using EViews 8.1 apparatus with significance at 1%, 5% and 10%. The robustness was estimated with both White’s heteroscedasticity consistent covariance and Newy and West’s HAC method allowing for autocorrelation.

3. Empirical Results

The time dependence of the corporate taxes was considered over seven years after the crisis, i.e. 2008 through to 2014, though it should be noted that 2014 data is limited in its ability to provide meaningful analysis, as at the time of the research the complete set for all the countries on financial parameters, such as GDP, GPC, etc – was not available. These have been treated as extrapolation, to compare estimates made on the model.

Table 1 contains corporate taxes for some host and home countries. We do not explore the difference between Statutory and Effective tax rate, and did not distinguish between counties applying tax exempt and tax credit , as the latter is almost out of use in the countries if interest.

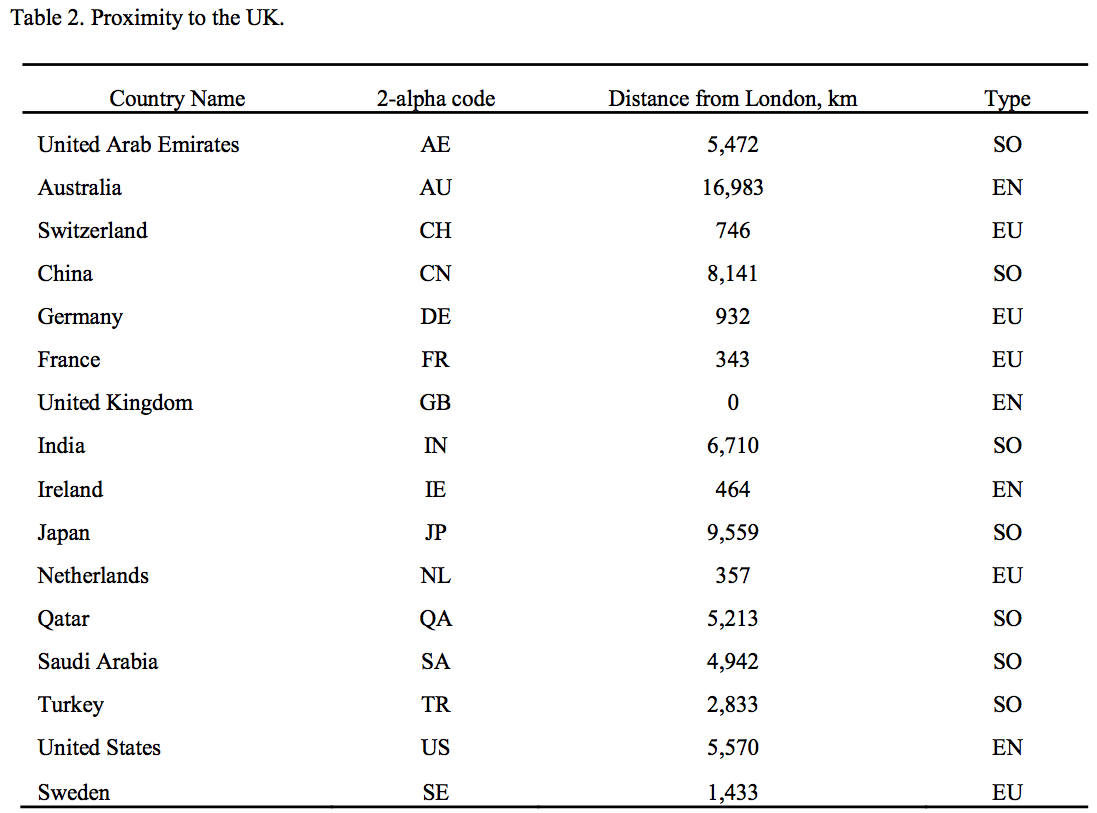

The distance between countries, traditionally calculated as the distance between their capitals, is awaited to play essential explanatory role, though its influence on M&A might appear either positive or negative, depending on competition versus export choice. Additional factor Type describes closeness of language and culture, so as Commonwealth countries and US are referred as EN because of common language, European countries are obviously EU, and SO denotes conditional South. Examples for some countries are presented in Table 2.

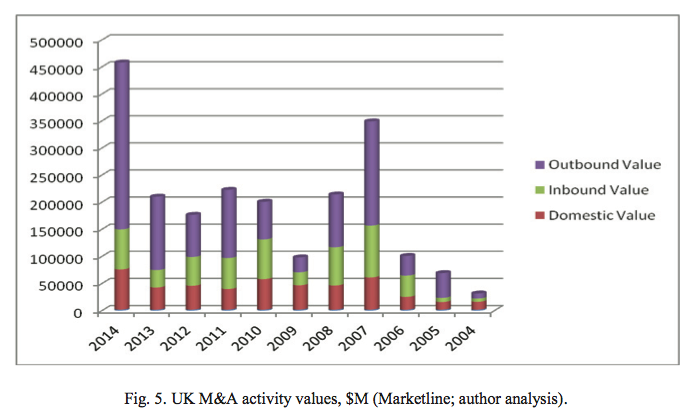

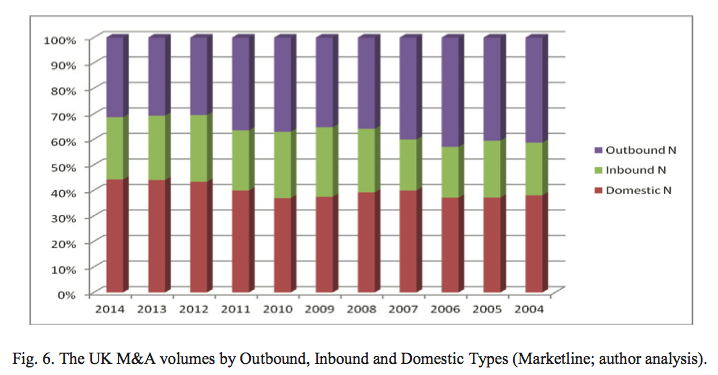

A wide variety of papers have been written on different models of the tax competition and the influence of corporate tax on companies’ behavior from point of view of cross-border expansion. These show and explain conditions under which firms are choosing either to stay at home, or to expand, which in turn could mean just to export or participate in foreign enterprises, wholly or partly owned. In this paper we consider the impact of the UK policy of incrementally lowering the corporate taxes. The rate undergoes designed changes, from 28% in 2009 to record low 21% in 2014, having been flat 30% for a decade before that. To investigate possible statistical relations between this policy and activity from both host and home countries in M&A deals was employed Marketline data contained inbound, outbound and domestic transactions involving UK companies. In this notification the term inbound refers to foreign participation in the UK businesses, while outbound means mergers and acquisition abroad by UK companies. Domestic denotes M&A of UK companies by other UK companies. We limited transactions extracted from the database by ≥ £1m deal which corresponds to the increase of the identification threshold by the ONS at Q1 2010 from £0.1m to £1.0m.

To form panel data, some traditional variables such as: GDP in constant prices, GDP growth, GDP per capita, Domestic Credit, and Corporate Tax were used from the World Bank’s World Development Indicators. Additionally, for the measures of trade openness following parameters have been used: number of documents required in each country for export/import activity, WDI data (2008-2014), as well as Foreign Direct Investment (FDI) and business sophistication ranks – to reflect possible influence of general trade; all data was taken from annual WEF Global Competitiveness Report for the periods under consideration, World Economic Forum (2008-2014). It should be noted that certain care must be taken in delivering this analysis because of limited data (numbers of periods and countries available to be used for conventional statistics), so additional measures for robustness were taken. Though the stimulation is on an equation in log-linear form, which often reduces effects of heteroscedasticity, it still might prove influencing.

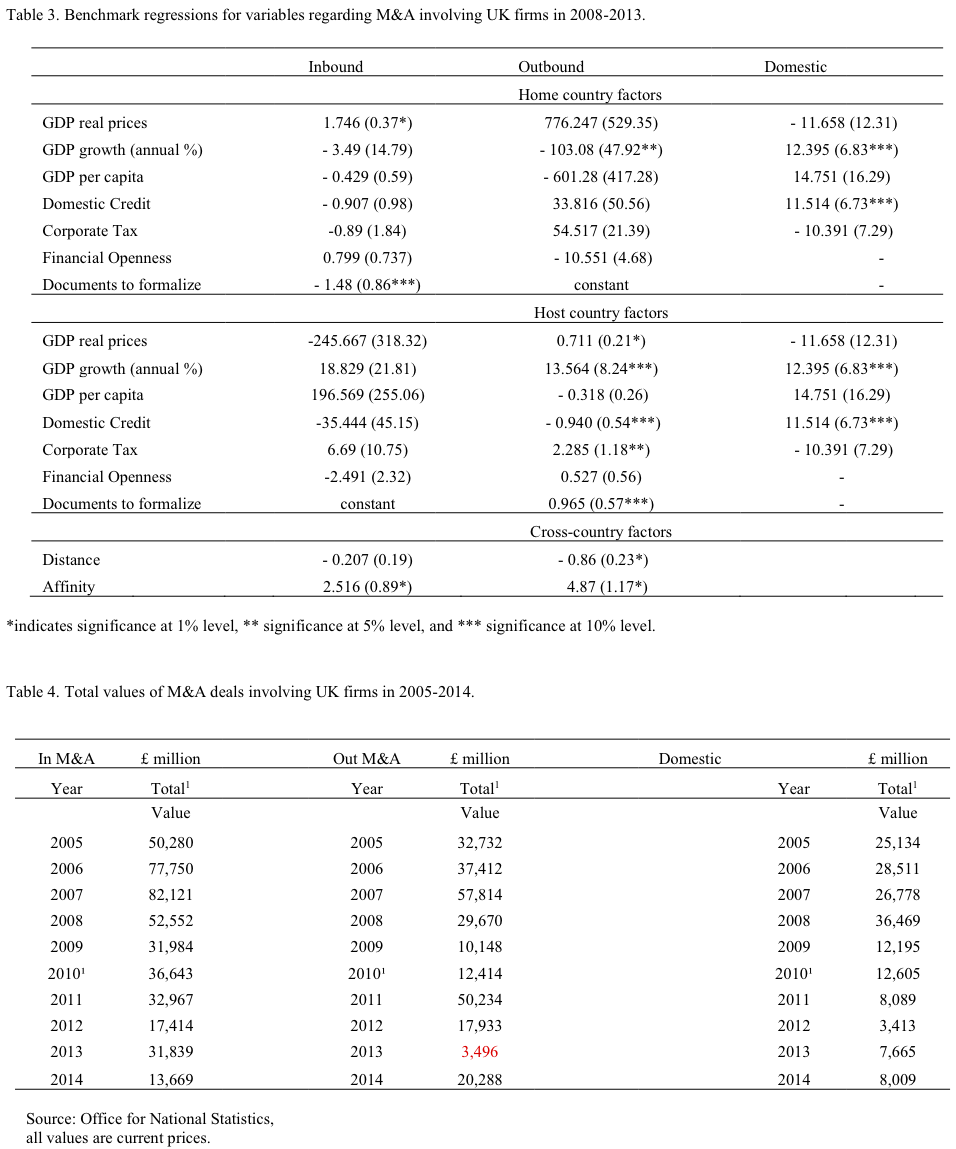

The results generated are presented in Table 3. Both host and home countries’ corporate tax rates were analyzed in all cases, except domestic M&A, where only one country participates. One can notice that in general inbound M&A do not show expected negative sign on corporate rate, while the outbound relationship is predictably positive. Also, the factor estimates are in most cases not consistent, and not persistent in volumes under different sets of regressors used. The only reliable behavior has been observed in the newly introduced parameter- Affinity (En), which is responsible for the closeness of countries to each other, from a cultural and language point of view, with geographic proximity playing somewhat secondary, though also persistent role. In that way the parameter Affinity is assumed 8 for native English speakers, such as the UK, the US and CW business, 6 for European countries, and 3 for conditional South. The geographic proximity is considered by different authors as a key factor in international business relations, though there is also anticipation, that 21st century technologies could make it less so decisive, and some additional instrumental variables such as telephone/Internet traffic, or existence of bilateral agreements, Liberini (2014), Krautheim and Schmidt-Eisenlohr (2011), are employed in the analysis. Evidently there is some rationale, and though the choice is somewhat conditional and arbitrary, the parameter proved the consistency.

It appears that the UK tax policy positively influences general wealth, GDP, growth, and GDP per capita, but at the same time the impact on cross-border activity is insufficient, if not negative. The same applies to corporate tax rates of other countries, host when it corresponds to outbound activity, or home in case of inbound deals. Obviously, unlike the classical model, the UK cannot serve as a ‘tax heaven’, and there are other factors determining the behavior of investors. In outbound direction, the estimates are of positive sign, though the regression on corporate tax rate does not prove the most influencing in comparison to others. There is clear correlation with affinity and trade openness, though the latter sometimes bears opposite sign, which in turn can find an explanation that some more closed economics prefer FDI rather than exports, Baldwin and Okubo (2009).

To further explore the influence of corporate tax rate of home and host countries, redundancy and irrelevance tests were performed. The results more so supported than rejected the null hypothesis (that both host and home corporate tax rates are redundant and irrelevant for inbound M&A values). At the same time, for outbound activity tests rejected null hypothesis at 5% level, though separate consideration of home and host corporate rates showed that only foreign taxes can be referred as relevant, while home (the UK) rates irrelevance could not be rejected at conventional significance level. So, only host corporate tax rate factor looks relevant, and with expected sign, with all the rest irrelevant and with opposite sign or close to zero.

By the time of concluding the paper the full official data on 2014 from most sources was still not available, and that will be the case until September 2015 – February 2016, and some preliminary statistics from ONS additionally confirmed the trends, Table 4, Office for National Statistics (2008 – 2013). Even with possible latest correction for 2013, as it was for 2012 FDI data, some prediction can be allowed, using M&A and FDI reports jointly.

Applying regression on the M&A flow we can obtain an inference for the aggregated model and perform some kind of forecast for the 2014. The result is presented in Fig. 10.

4. Conclusion

The results prove corresponding to Liberini (2014) in that the coefficient are significant and positive for outbound and almost non-significant for domestic acquisitions, but contradictory positive for inbound flows. The sign, however, is negative for trade openness, because the proximity of a host country could turn the export option more preferable. The distance per se is not so influential, thus, UK-US and UK-South are approximately equally distant with different results for these pairs.

As a whole it can be stressed that despite continuing recovery after the crisis, M&A activities in the UK, both inbound and outbound, as well as domestic, demonstrate a declining trend, where despite selective success stories, volumes and values of M&A deals are still far from pre-crisis levels. Substantial proportion of companies are continuing to accumulate liquid assets, focusing on allocating those to interior needs as well as internal infrastructure transformations, and not hurrying to invest abroad, Deloitte M&A Index (2014), Deloitte Survey (2014). Changes in corporate tax rate did not confirm anticipated influence on the M&A activity – based on empirical evidence it appears that the lowering the UK corporate tax rate effect either demonstrates opposite sign to what could be expected, or is redundant and not significant at conventional level of probability.

Appendix A.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter