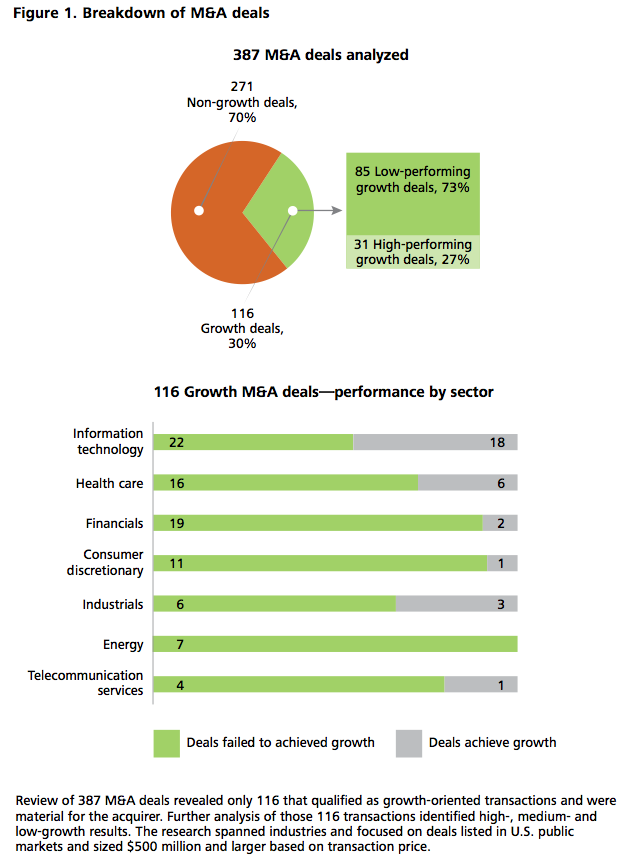

Growth Through M&A: Promise And Reality

by Deloitte

It isn’t unusual for a company pursuing a merger or acquisition to express high hopes that the deal will be a growth engine. The intention, quite reasonably, is that the resulting combination of products, people and pipelines will take the business to new heights. Then reality sets in. The combined business has to deal with a presence in multiple markets, a larger and more diverse customer base, a more complex product and services portfolio, and a high level of people and operational complexity. […] Read more