Blog Webinar Recap: How to Select Peer Companies

- Blog

Webinar Recap: How to Select Peer Companies

SHARE:

Selecting suitable peer companies and applying appropriate multiples are pivotal for accurate valuations. In a recent webinar hosted by the Institute for Mergers, Acquisitions, and Alliances (IMAA), Valutico experts Paul Resch, Greg Brown, and Max Lahrmann delved into the nuanced strategies behind peer selection and multiples application, shedding light on a process that moves beyond mere numerical evaluation to involve strategic decision-making.

Key Takeaways on Effective Peer Selection

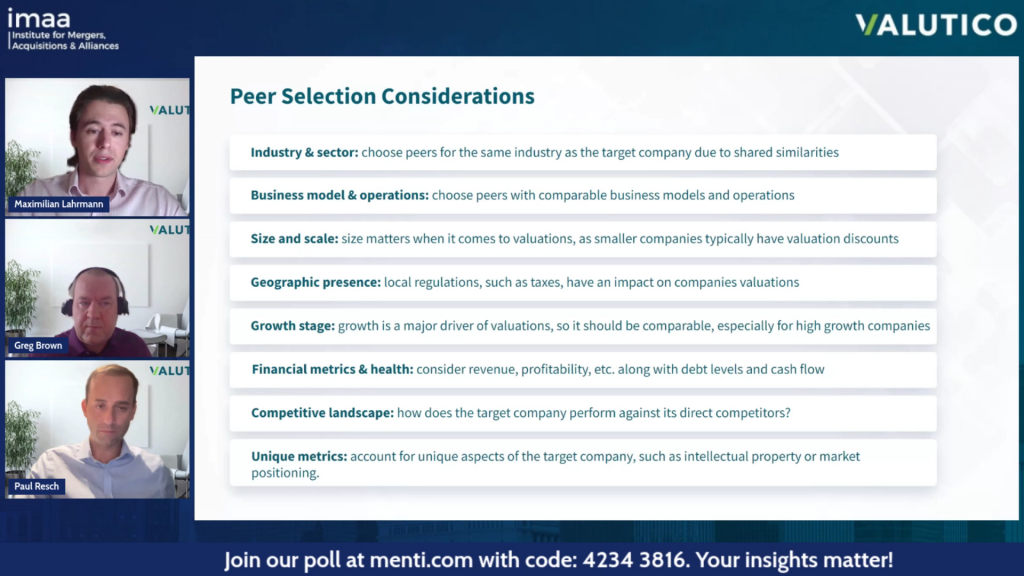

Creating a reliable valuation isn’t simply a numerical exercise. It involves a detailed process where selecting your peer group requires focused attention. Here are some of the considerations discussed during the webinar:

- Industry Relevance: Initially, cast a broad net, then methodically refine. Your peer selections should mirror the industry and sector nuances of your company, fostering a rich baseline for pertinent comparisons.

- Operational Analysis: A meticulous examination of business models and operational methodologies is pivotal. This ensures the chosen multiples are not only comparable but also substantively relevant to the entity being valued.

- Size and Scale: Deliberately align entities of similar size and scale. Navigate through the nuances of applying multiple discounts, particularly when evaluating SMEs, ensuring each application is judicious and defensible.

Remember: Valuation should be highly tailored to each specific case and involves both quantitative and qualitative analyses to form a thorough peer selection. This guide strives to help you navigate through various aspects, laying a solid foundation for fruitful valuation projects, ensuring they are not only accurate but also hold substantial credibility with partners, clients, and stakeholders alike.

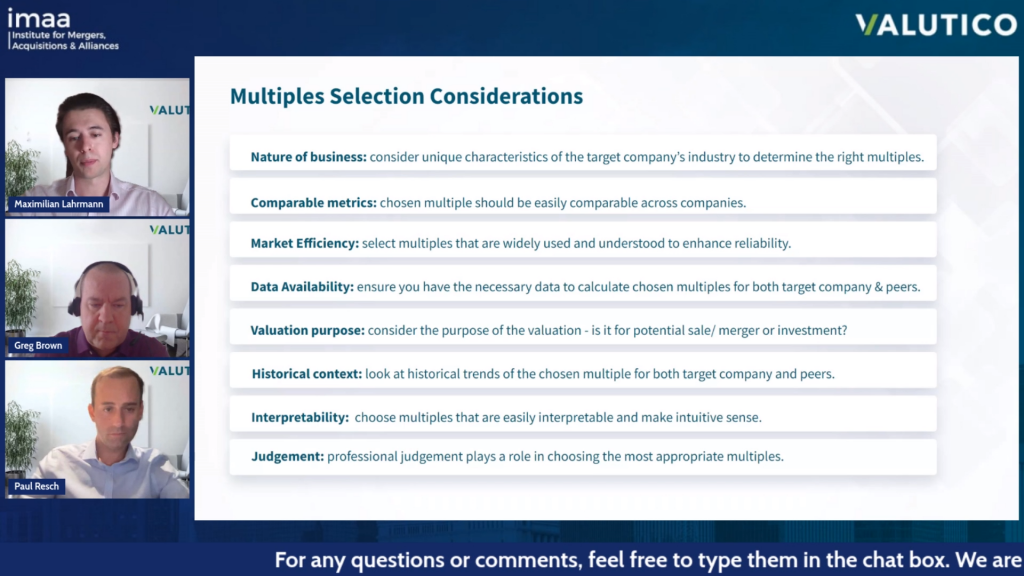

Key Takeaways on Navigating the Nuances of Multiple Selection

Choosing the right multiples is an art and is a crucial step in business valuation, balancing tangible metrics with a keen understanding of the business’s unique aspects. Here are some of the initial considerations highlighted by Valutico experts for a precise yet relatable valuation:

- Business Characteristics: Choose multiples that reflect the actualities of your business. This means considering where your business is at (e.g., startup, scaling, or established) and ensuring the multiple mirrors not just the numbers but also the strategic and operational realities of your company.

- Comparable Metrics: Ensure chosen multiples are similar across peer companies for accurate valuation. While it’s reasonable for similar companies to display similar multiples, occasional outliers may appear. Address outliers unless logically defendable to maintain valuation integrity and precision.

- Market Relevance: Pick multiples that are commonly used and accepted in the market. This ensures that your valuation speaks a language that is familiar and credible to stakeholders, aligning with market norms and expectations.

Remember: Upon selecting your peers and identifying multiples, reassess the multiples for outliers and verify their relevance to assure solid and credible valuation outcomes. Constantly align your multiples and metrics with your initial peer selection to ensure synchronization and consistency throughout the valuation process.

Avoiding Pitfalls in Selecting Comparable Companies

Selecting the right comparable companies is a crucial step in a reliable valuation. Here are some common pitfalls to watch out for during this process:

- Don’t Settle for Surface-Level Analysis: Don’t pick peer companies based only on industry. For example, not all software companies are alike, so looking at the business models and where they operate is vital.

- Don’t Ignore Different Business Models: It’s important to consider various aspects like how companies make their money and what risks they have. A detailed analysis will help you answer any detailed questions about the valuation.

- Watch Out for Bad Data: Using outdated or wrong data can mislead your valuation. Be careful with historical data and ensure it reflects any changes in business models.

Remember: Valuations should be impartial, accurate, and reliable. Ensure ongoing validation of your choices and adjustments as necessary to preserve valuation reliability.

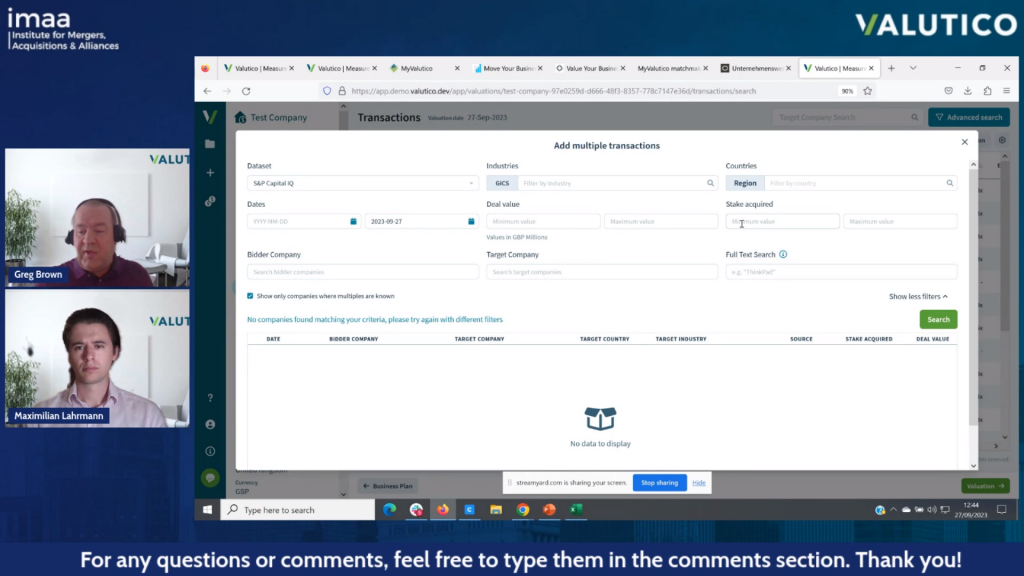

Valutico in Action: Navigating a Real-Time Valuation

Our guest speakers took participants on a practical journey through a real-time valuation using Valutico’s sophisticated yet user-friendly software. This hands-on session provided a live demonstration of applying the aforementioned principles in a real-world scenario, exploring the valuation of an IT Service Company using their platform. We recommend you watch the full webinar recap video here to see the software in action.

Webinar Q&A Highlights

The webinar concluded with a Q&A answered by Paul Resch. Questions discussed during the webinar addressed various aspects and implications of AI and data analytics in valuation and the M&A process. Below are summarized highlights of some key questions and their responses:

- Question: How do you anticipate advancements in data analytics or AI impacting the process of selecting and comparing peer companies for valuation? Answer: Valutico is deeply involved in leveraging AI for valuation, having recently partnered with European professors specializing in AI-based peer group selection and transactions. A newly joined astrophysics PhD data scientist is helping develop systems that utilize natural language understanding to analyze company descriptions and make valuation recommendations, shifting from traditional statistical models to more nuanced, AI-driven approaches. Exciting developments, particularly in intangible evaluation, are anticipated, positioning us at the forefront of this innovative field.

- Question: Is AI used in M&A due diligence stage today and if yes, is this embedded in Valutico?

Answer: While Valutico is not a due diligence company and focuses primarily on valuation, there are connections between the two areas. The future of due diligence could see less human involvement thanks to advanced AI models like GPT, which are adept at analyzing extensive data. Current efforts are underway to automate aspects of due diligence, including red flag and legal reports, even though we’re not directly involved but closely monitor these advancements.

- Question: How useful is your solution for smaller lower mid-market transactions what is the smallest size transaction you typically capture?

Answer: Valutico is specifically designed for mid-market and small-cap advisors, focusing on transactions typically between 3 and 20 million. The platform, while not only for large deals, is continuously being enhanced by aggregating more data sets and developing new models, like one for levels of value relevant to smaller companies. We’re also crafting a benchmarking system using “swarm intelligence” to build consensus on growth rates and margins based on user input. While we have additional exciting features in the pipeline, we invite interested individuals, like researchers in the field, to connect with us on LinkedIn for further discussions.

To dive deeper into the discussion and explore the detailed Q&A, we invite you to watch the full webinar replay, available through the link provided below.

Valuation Principles, Tools, and Beyond

Understanding and applying key valuation principles is crucial in making sound financial decisions. The webinar with Valutico not only laid out essential strategies for peer and multiples selection but also demonstrated how utilizing specific tools, like Valutico’s platform, can significantly enhance and streamline the process. A solid grounding in valuation theory and principles, paired with the right technological aids, sets the stage for more reliable and accurate valuations.

Get the full experience and detailed insights from this webinar by watching the full replay on LinkedIn, Facebook, or YouTube.

- Tags: Webinar Recap

Stay up to date with M&A news!

Subscribe to our newsletter