IMAA’s 2024 Top Global M&A Deals industry coverage offers an overview of the year’s most significant M&A transactions across eight key industries. This monthly M&A activity overview provides the top 5 M&A deals for each industry, which offers a clear view of major market movements and highlights key players in each sector.

These monthly M&A insights can benefit M&A practitioners, corporate strategists, investment bankers, legal advisors, C-level executives, investors, and policymakers. It aids in identifying market trends, investment opportunities, and strategic decision-making, while also serving as a valuable resource for academic research in finance, business strategy, and economics.

SHARE:

M&A Activity per Industry

Click on any of the category tabs below to view the M&A Activity.

Filter by Month:

M&A Activity in the Consumer Products and Services Industry

The top global M&A deals in this industry list include companies that manufacture and sell goods or services directly to the end consumer, covering a wide array of products from household items to personal care.

January

Consumer Products and Services

- Deal 1: 337 Morrisons petrol forecourts & more than 400 Ultra-Rapid EV sites of Wm Morrison Supermarkets (United Kingdom) was acquired by Motor Fuel Limited (United Kingdom) for USD 3.16 billion.

- Deal 2: Kindred Group plc (Malta) was acquired by La Française des Jeux Société anonyme (France) for USD 2.83 billion.

- Deal 3: Carrols Restaurant Group, Inc. (United States) was acquired by Restaurant Brands International Inc. (Canada) for USD 1.00 billion.

- Deal 4: 204 gas stations and convenience stores of Sunoco LP (United States) was acquired by 7-Eleven, Inc. (United States) for USD 0.95 billion.

- Deal 5: CH&CO (United Kingdom) was acquired by Compass Group PLC (United Kingdom) for USD 0.60 billion.

February

Consumer Products and Services

- Deal 1: VIZIO Holding Corp. (United States) was acquired by Walmart Inc. (United States) for USD 2.30 billion.

- Deal 2: Courvoisier S.A.S. (France) was acquired by Davide Campari-Milano N.V. (Netherlands) for USD 1.30 billion.

- Deal 3: Forno d’Asolo S.p.A (Italy) was acquired by InvestIndustrial (United Kingdom) and Sammontana S.p.A. (Italy) for USD 1.20 billion.

- Deal 4: Global Gaming and PlayDigital Businesses of International Game Technology PLC (United Kingdom) was acquired by Everi Holdings Inc. (United States) for USD 1.16 billion.

- Deal 5: Jackpocket, Inc. (United States) was acquired by DraftKings Holdings Inc. (United States) for USD 0.75 billion.

March

Consumer Products and Services

- Deal 1: SRS Distribution Inc. (United States) was acquired by The Home Depot, Inc. (United States) for USD 18.25 billion.

- Deal 2: Vista Outdoor Inc. (United States) was acquired by MNC Capital Partners, L.P. (Canada) for USD 2.90 billion.

- Deal 3: CWT US, LLC (United States) was acquired by Global Business Travel Group, Inc. (United States) for USD 0.57 billion.

- Deal 4: Autry International S.R.L. (Italy) was acquired by Style Capital Sgr S.P.A.; Q Group International (Italy) for USD 0.34 billion.

- Deal 5: Hilton Paris Opéra (France) was acquired by City Developments Limited (Singapore) for USD 0.26 billion.

M&A Activity in the Software and IT Industry

The top global M&A deals in this sector are at the heart of the digital revolution. This industry list includes companies that develop software, provide IT services, and offer technological solutions driving innovation and efficiency.

January

Software and IT

- Deal 1: ANSYS, Inc. (United States) was acquired by Synopsys, Inc. (United States) for USD 35.00 billion.

- Deal 2: Juniper Networks, Inc. (United States) was acquired by Hewlett Packard Enterprise Company (United States) for USD 14.00 billion.

- Deal 3: Procare Software, LLC (United States) was acquired by Roper Technologies, Inc. (United States) for USD 1.75 billion.

- Deal 4: Pagero Group AB (Sweden) was acquired by Thomson Reuters Finance S.A. (Luxembourg) for USD 0.80 billion.

- Deal 5: Habu, Inc. (United States) was acquired by LiveRamp, Inc. (United States) for USD 0.20 billion.

February

Software and IT

- Deal 1: Altium Limited (Australia) was acquired by Renesas Electronics Corporation (Japan) for USD 5.90 billion.

- Deal 2: Yandex LLC (Russia) was acquired by Multiple Buyers Including Russia-Based Yandex Senior Managers and Oil Company Lukoil (Russia) for USD 5.20 billion.

- Deal 3: End-User Computing Division of Broadcom Inc. (United States) was acquired by KKR & Co. Inc. (United States) for USD 4.00 billion.

- Deal 4: Everbridge, Inc. (United States) was acquired by Thoma Bravo, L.P. (United States) for USD 1.50 billion.

- Deal 5: Marlowe PLC’s Governance, Risk & Compliance Software and Services Assets (United Kingdom) was acquired by Inflexion Private Equity Partners LLP (United Kingdom) for USD 0.50 billion.

March

Software and IT

- Deal 1: Beta Cae Systems International Ag (Switzerland) was acquired by Cadence Design Systems, Inc. (United States) for USD 1.24 billion.

- Deal 2: Jama Software, Inc. (United States) was acquired by Francisco Partners Management, L.P. (United States) for USD 1.20 billion.

- Deal 3: One Network Enterprises, Inc. (United States) was acquired by Blue Yonder Group, Inc. (United States) for USD 0.84 billion.

- Deal 4: SanDisk Semiconductor (Shanghai) Co. Ltd (China) was acquired by JCET Management Co., Ltd. (China) for USD 0.62 billion.

- Deal 5: TASK Group Holdings Limited (Australia) was acquired by PAR Technology Corporation (United States) for USD 0.21 billion.

M&A Activity in the Media and Entertainment Industry

The top global M&A deals in this list include businesses involved in content production, distribution, and various forms of entertainment, reflecting the evolving ways people consume media and engage with entertainment.

January

Media and Entertainment

- Deal 1: STN Video Incorporated (Canada) was acquired by Minute Media (Canada) for USD 0.15 billion.

- Deal 2: Portland Thorns FC (United States) was acquired by RAJ Sports (United States) for USD 0.06 billion.

- Deal 3: Fantasy Sports and Sports Game Development Business Units of SharpLink Gaming Ltd (United States) was acquired by RSports Interactive, Inc. for USD 0.02 billion.

- Deal 4: Mobile Application, Internet Radio and Streaming Business of AppSmartz and RadioFM was acquired by Auddia Inc. (United States) for USD 0.02 billion.

- Deal 5: Certain Assets of Streaming TVEE, Inc. was acquired by Bravo Multinational Incorporated (United States) for USD 0.01 billion.

February

Media and Entertainment

- Deal 1: MultiChoice Group Limited (South Africa) was acquired by CANAL + SA (France) for USD 2.50 billion.

- Deal 2: VIZIO Holding Corp. (United States) was acquired by Walmart Inc. (United States) for USD 2.30 billion.

- Deal 3: Believe S.A. (France) was acquired by TCMI Inc. (United States) and EQT AB (publ) (Sweden) for USD 1.64 billion.

- Deal 4: All3Media Limited (United Kingdom) was acquired by RedBird Capital Partners LLC (United States) and International Media Investments FZ LLC (United Arab Emirates) for USD 1.40 billion.

- Deal 5: Certain Assets Related to the Business of Complex Media, Inc. (United States) was acquired by NTWRK – Commerce Media Holdings LLC (United States) for USD 0.10 billion.

March

Media and Entertainment

- Deal 1: Viacom 18 (India) was acquired by Reliance Industries Limited (India) for USD 0.52 billion.

- Deal 2: The Gearbox Entertainment Company, Inc. (United States) was acquired by Take-Two Interactive Software, Inc. (United States) for USD 0.46 billion.

- Deal 3: BritBox International Limited (United Kingdom) was acquired by BBC Studios Distribution Limited (United Kingdom) for USD 0.32 billion.

- Deal 4: Selected assets from Saber Interactive Inc. (United States) was acquired by Beacon Interactive (United States) for USD 0.25 billion.

- Deal 5: 9 Story Media Group Inc. (Canada) was acquired by Scholastic – 1000815816 Ontario Inc. (Canada) for USD 0.19 billion.

M&A Activity in the Health Care Industry

Focused on improving health outcomes, the top global M&A deals in this industry list includes providers of medical services, manufacturers of medical equipment, and developers of healthcare technologies.

January

Health Care

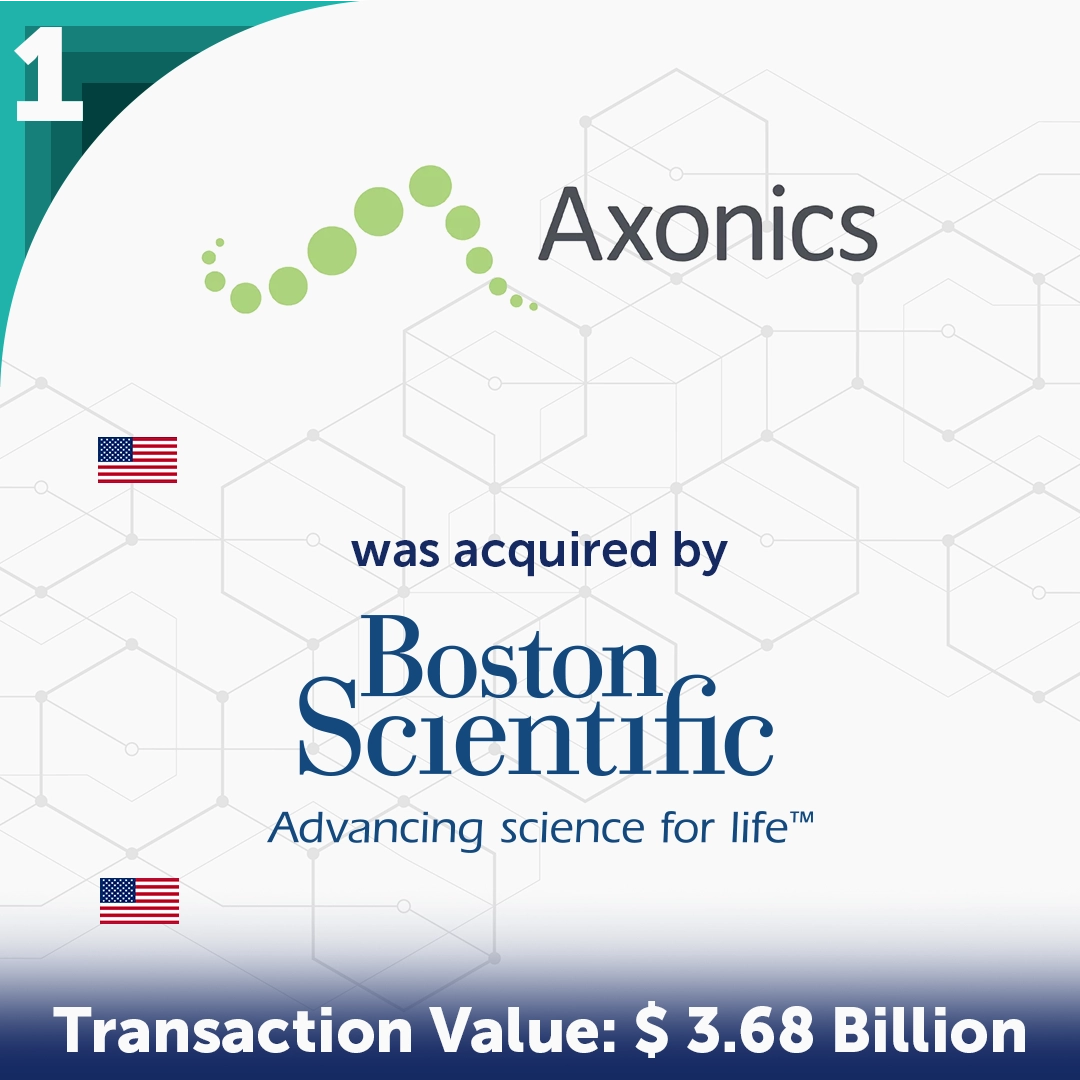

- Deal 1: Axonics, Inc. (United States) was acquired by Boston Scientific Corporation (United States) for USD 3.68 billion.

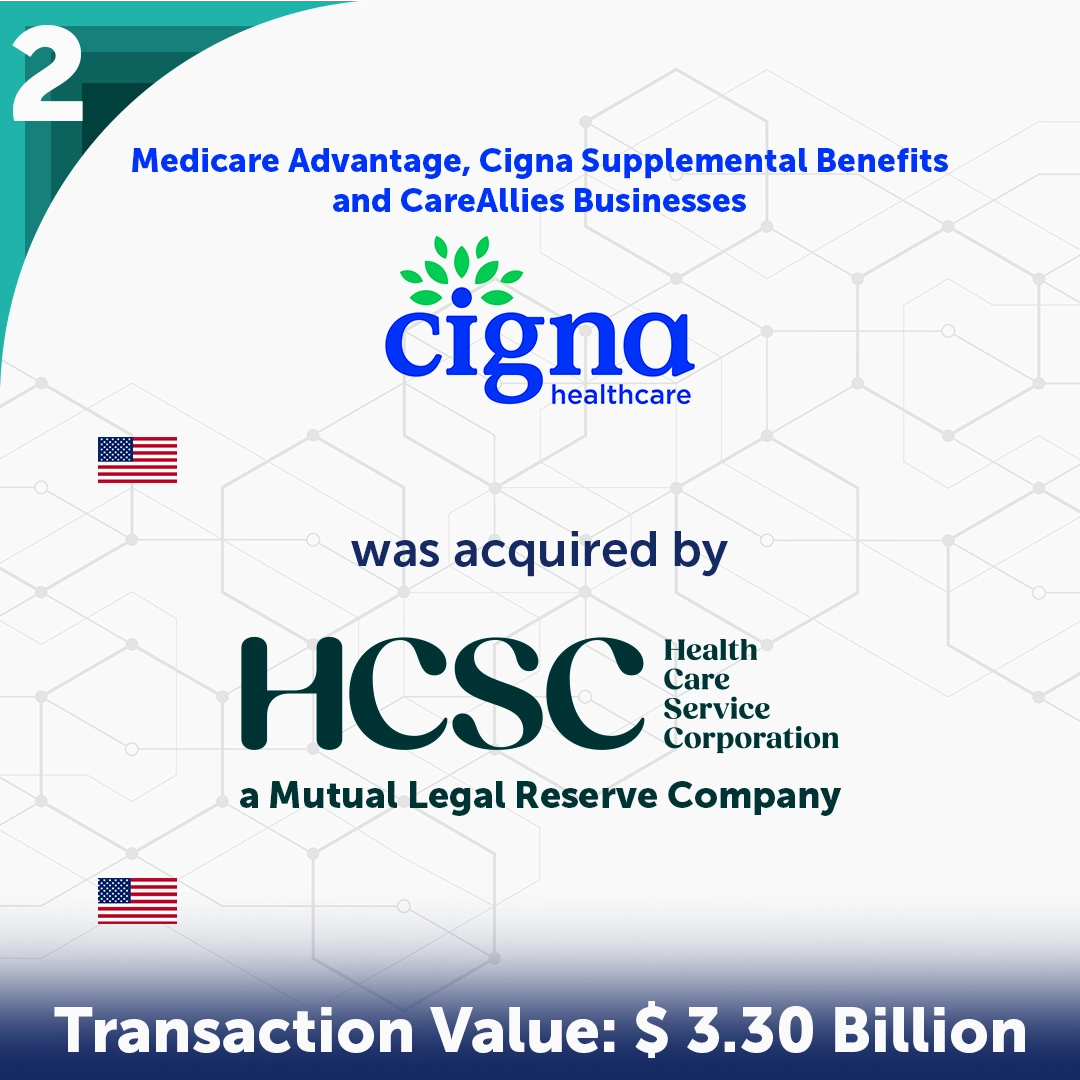

- Deal 2: Medicare Advantage, Cigna Supplemental Benefits and CareAllies Businesses (United States) was acquired by Health Care Service Corporation, a Mutual Legal Reserve Company (United States) for USD 3.30 billion.

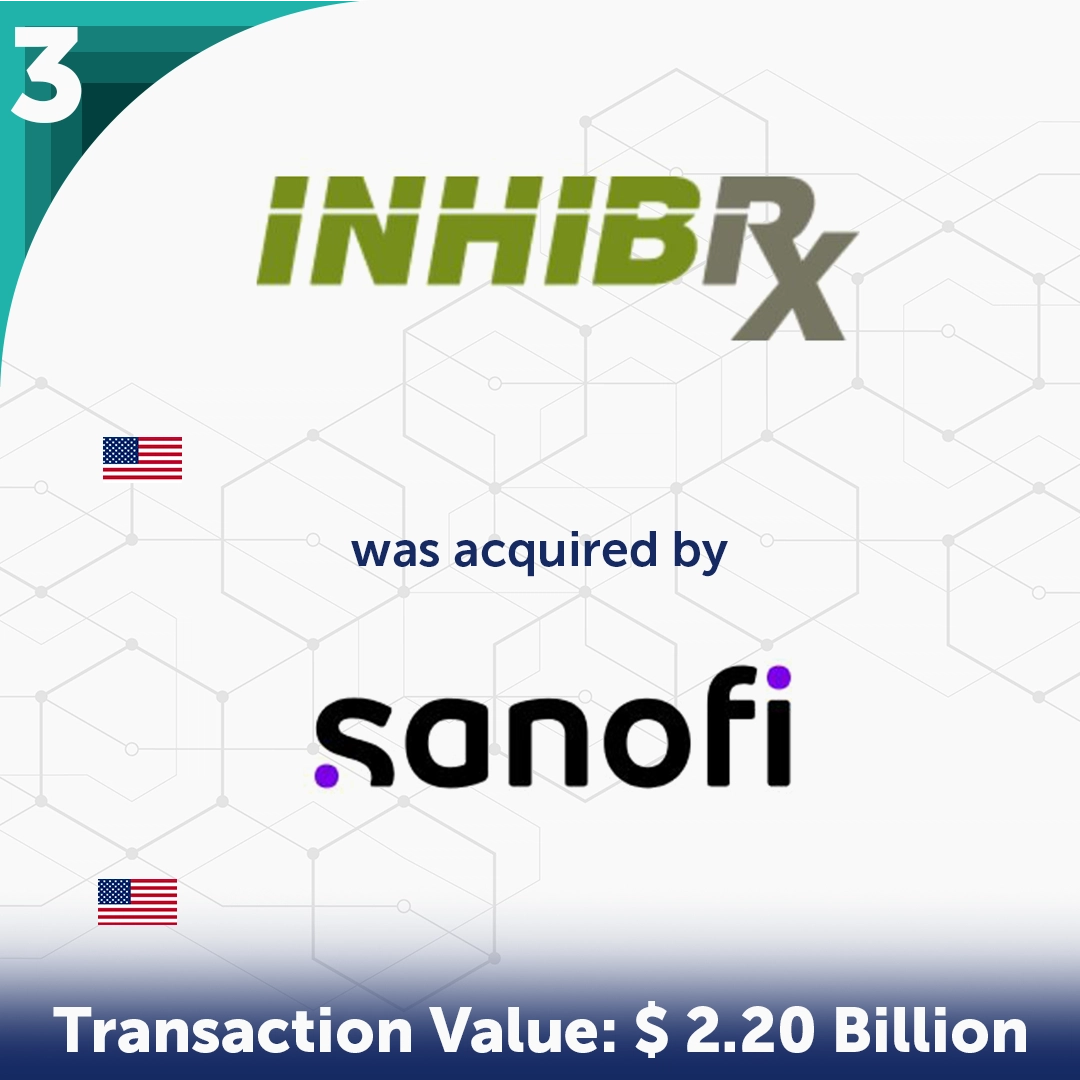

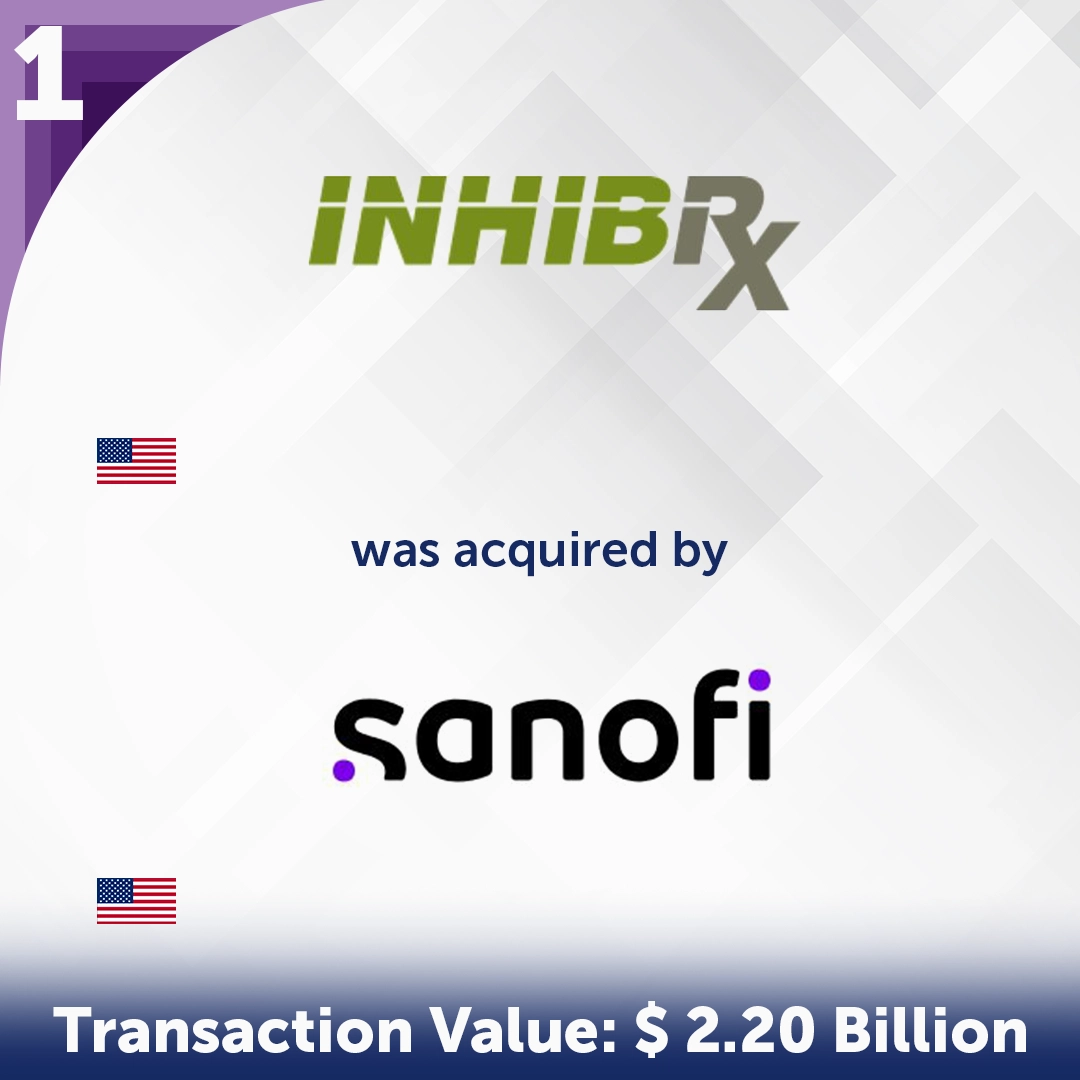

- Deal 3: Inhibrx, Inc. (United States) was acquired by Aventis Inc. (United States) for USD 2.20 billion.

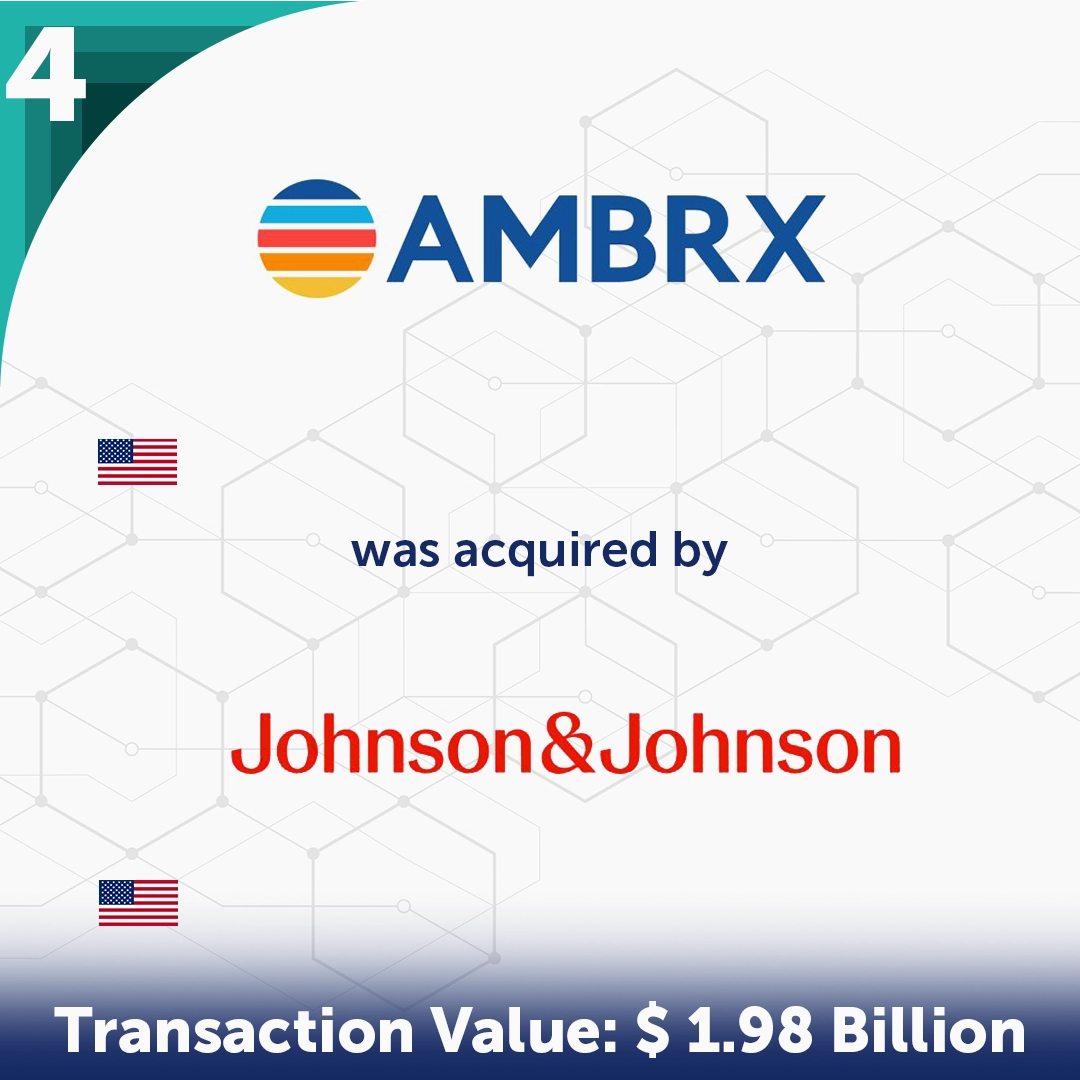

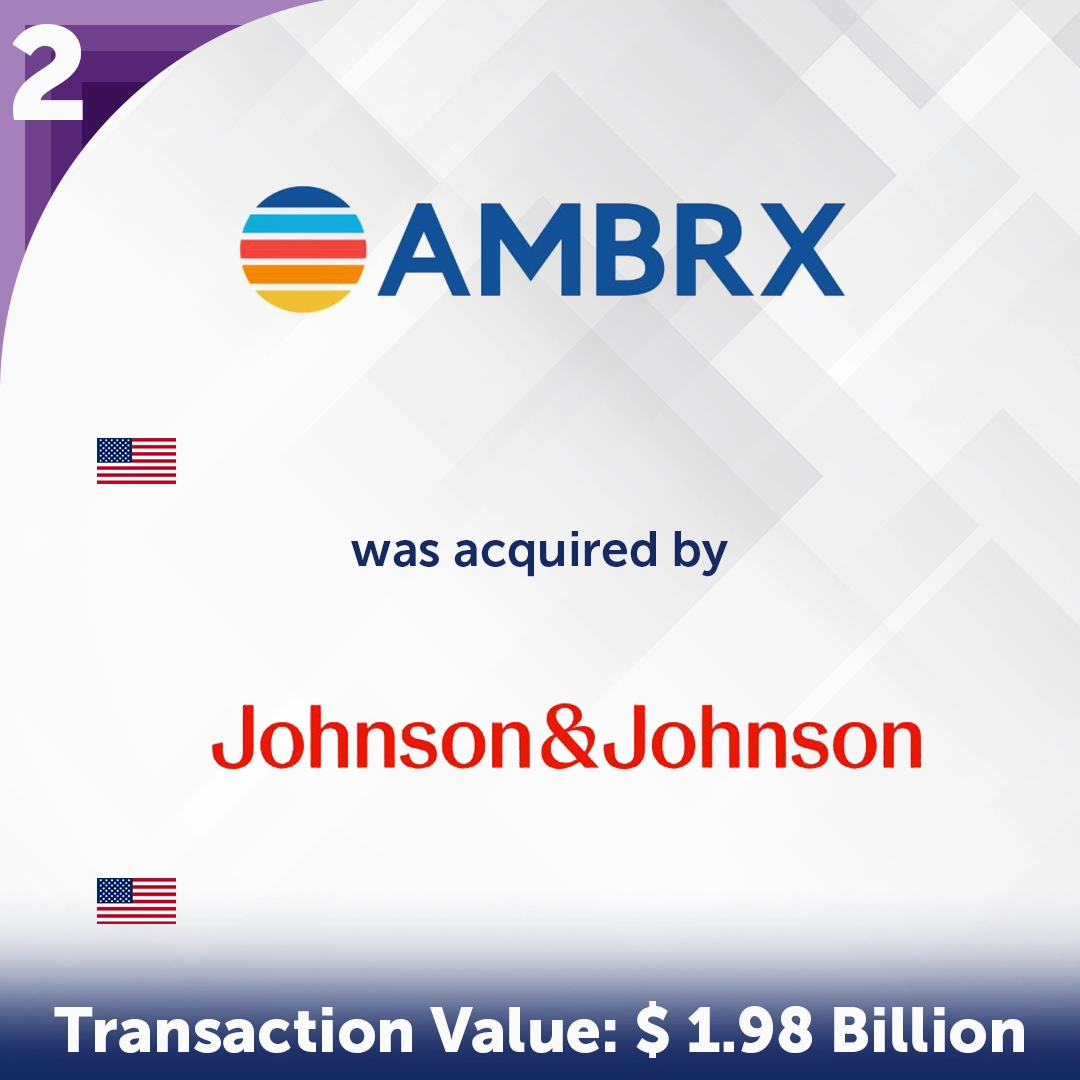

- Deal 4: Ambrx Biopharma Inc. (United States) was acquired by Johnson & Johnson (United States) for USD 1.98 billion.

- Deal 5: Aiolos Bio, Inc. (United States) was acquired by GSK plc (United Kingdom) for USD 1.40 billion.

February

Health Care

- Deal 1: Catalent, Inc. (United States) was acquired by Novo Holdings A/S (Denmark) for USD 16.50 billion.

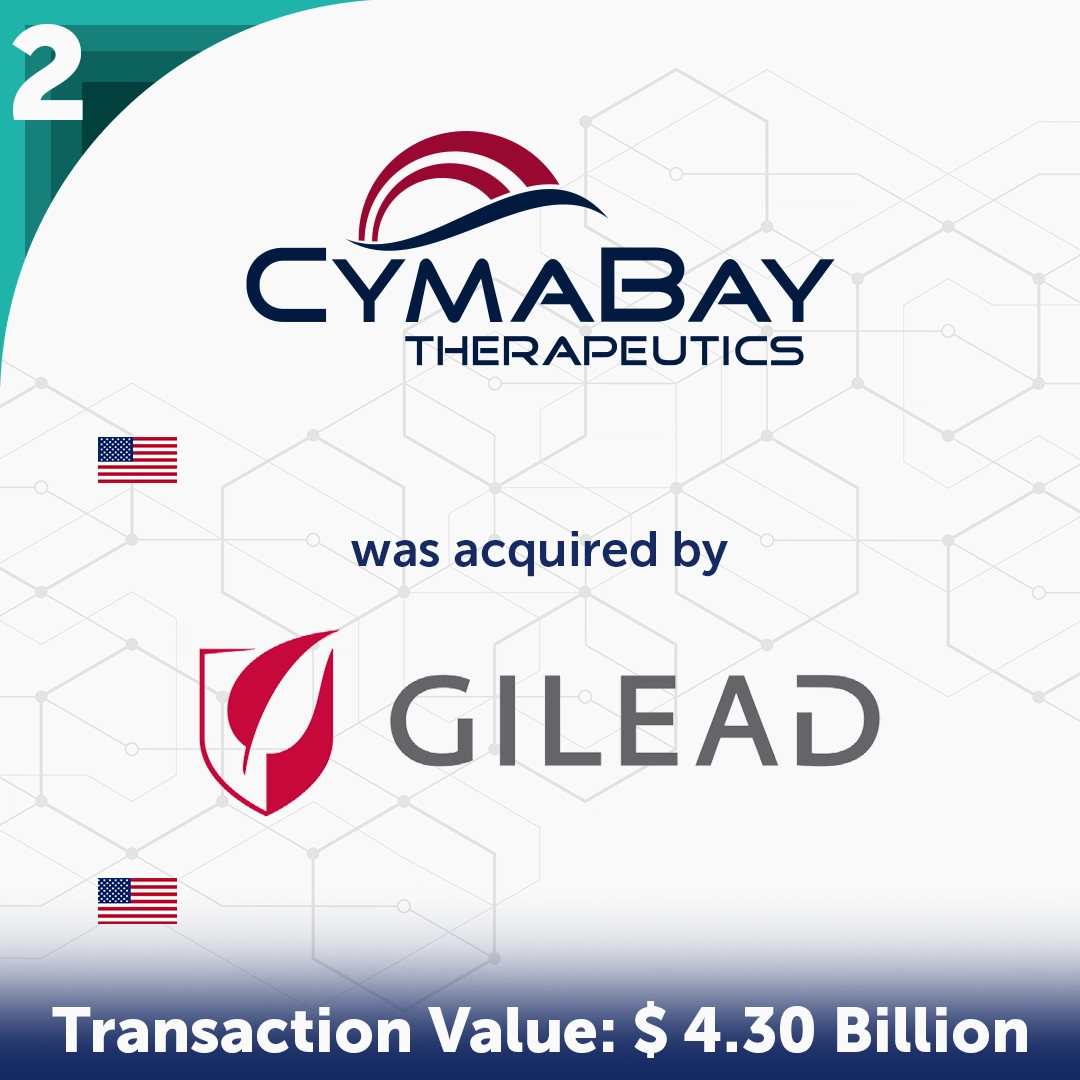

- Deal 2: CymaBay Therapeutics, Inc. (United States) was acquired by Gilead Sciences, Inc. (United States) for USD 4.30 billion.

- Deal 3: China Traditional Chinese Medicine Holdings Co. Limited (Hong Kong) was acquired by Sinopharm Common Wealth Company Limited (China) for USD 3.00 billion.

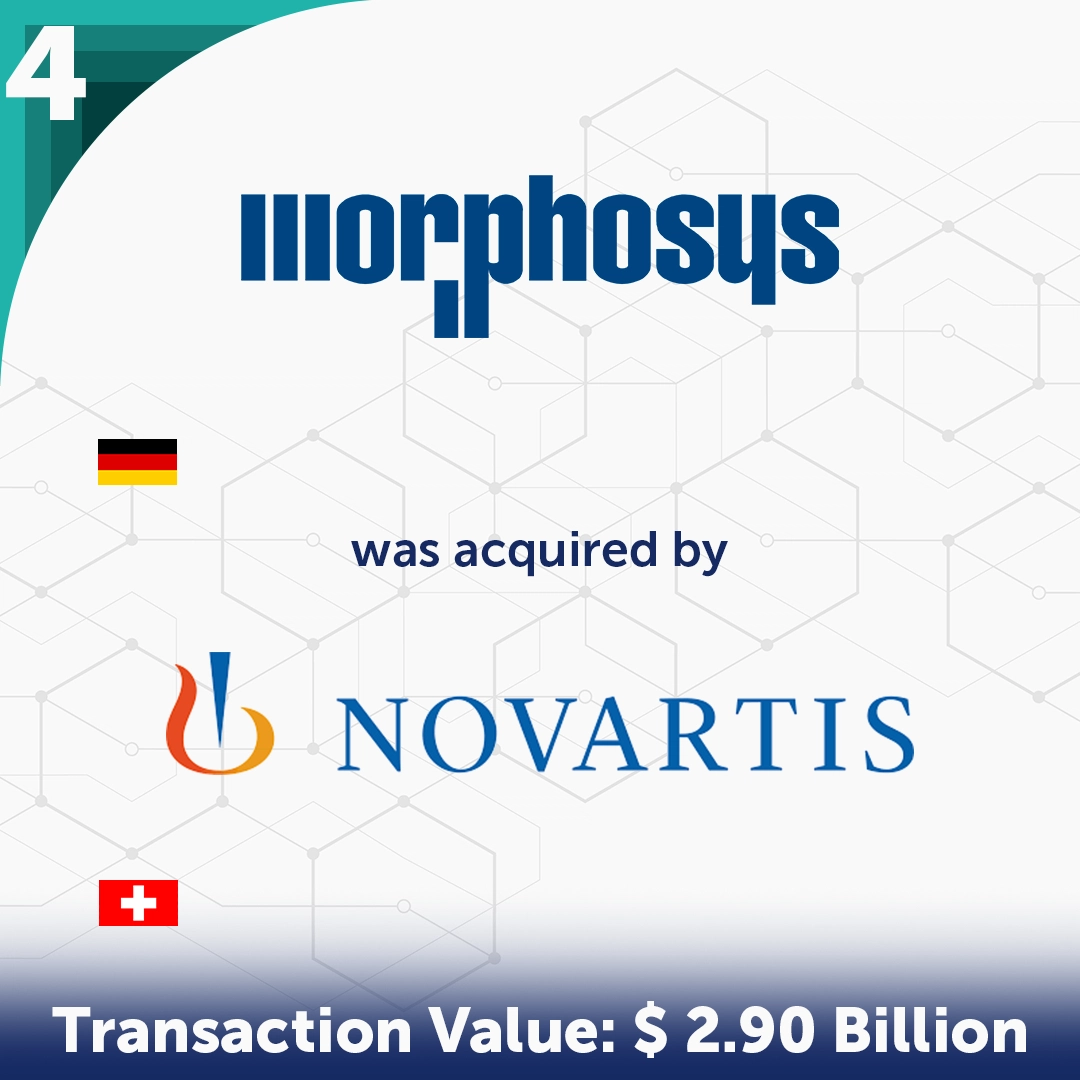

- Deal 4: MorphoSys AG (Germany) was acquired by Novartis data42 AG (Switzerland) for USD 2.90 billion.

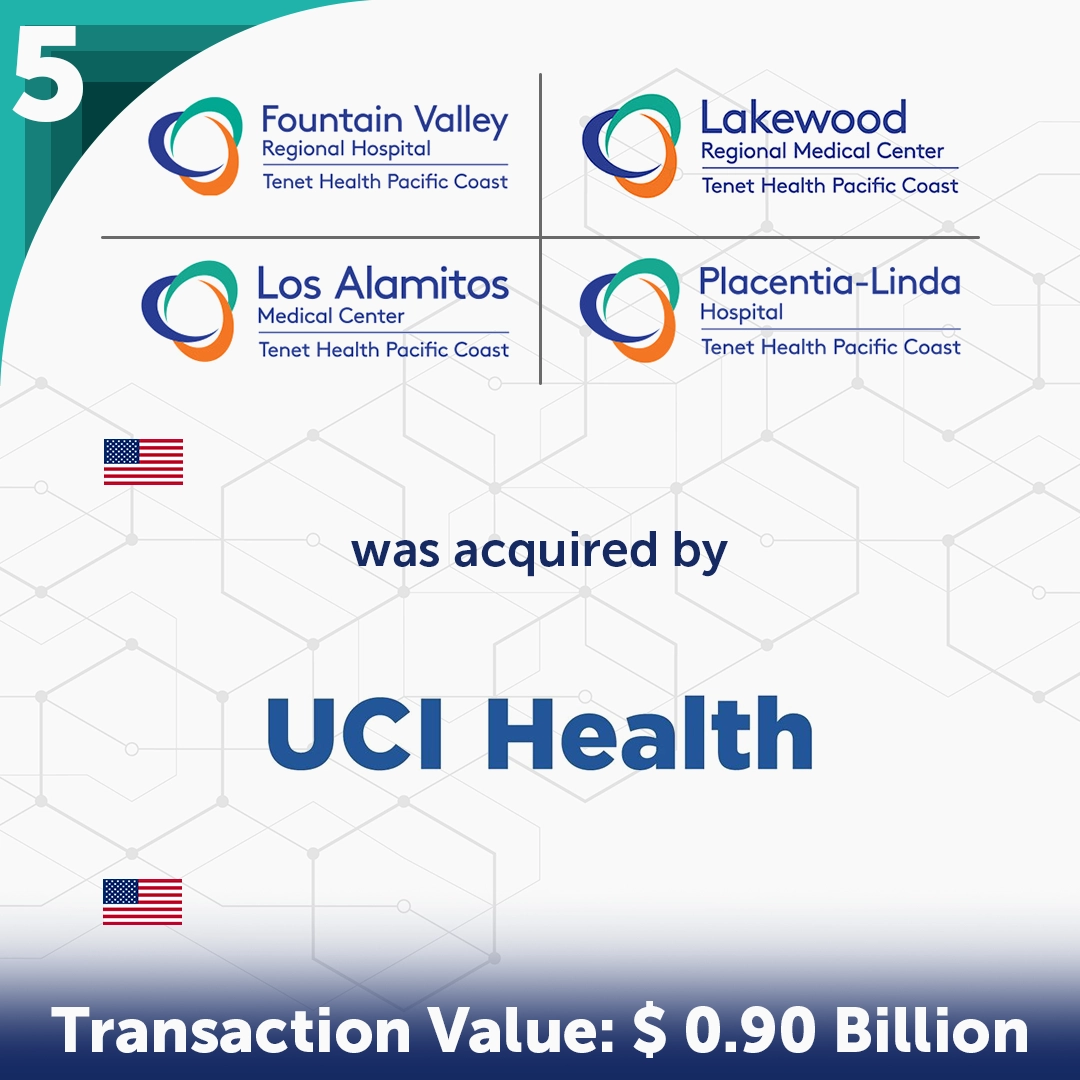

- Deal 5: Fountain Valley Regional Hosp (United States), Lakewood Regional Medical (United States), Los Alamitos Medical (United States), and Placentia-Linda (United States) were acquired by UCI Medical Center (United States) for USD 0.90 billion.

March

Health Care

- Deal 1: Cardior Pharmaceuticals GmbH (Germany) was acquired by Novo Nordisk A/S (Denmark) for USD 1.11 billion.

- Deal 2: Amolyt Pharma SAS (France) was acquired by AstraZeneca PLC (United Kingdom) for USD 1.05 billion.

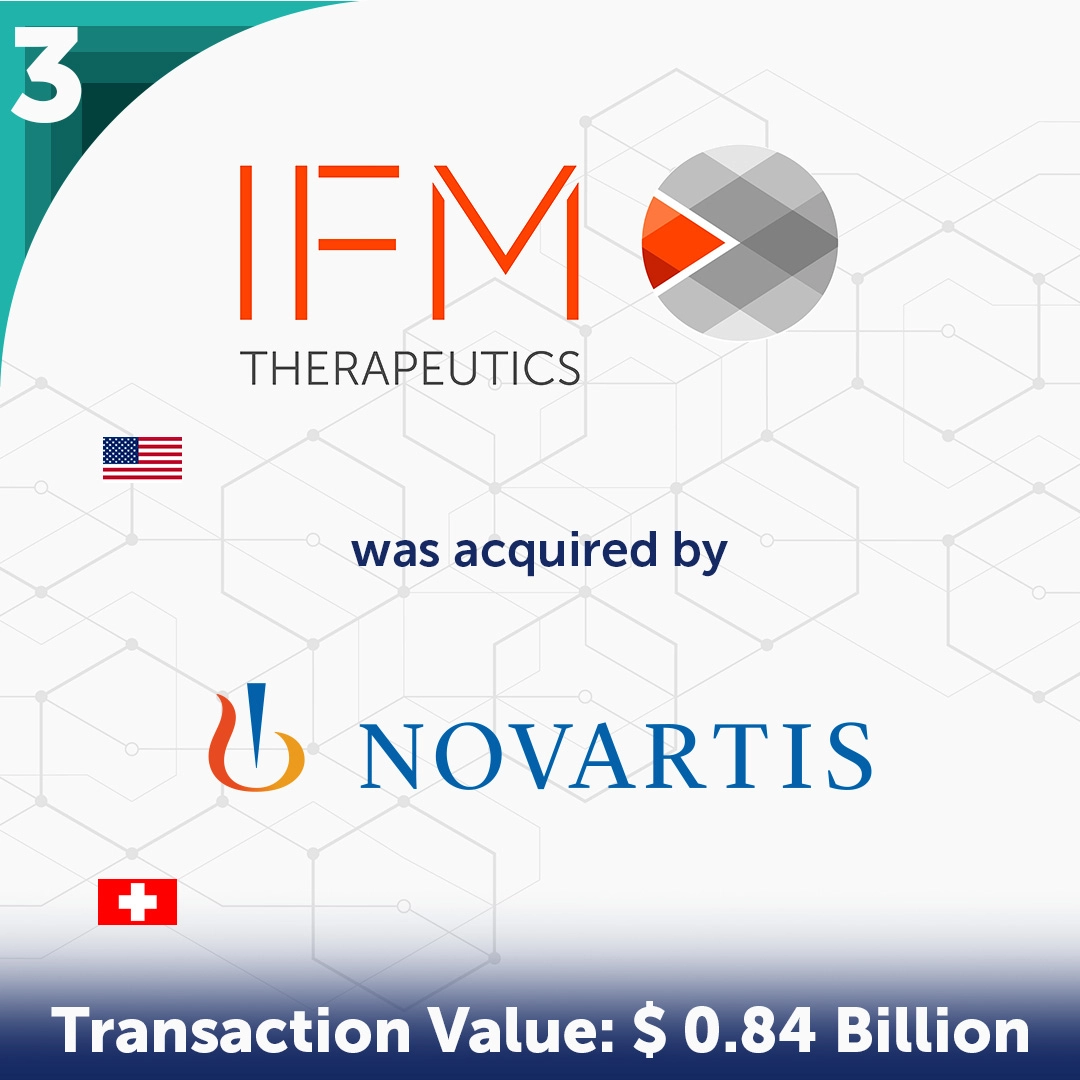

- Deal 3: IFM Due, Inc. (United States) was acquired by Novartis AG (Switzerland) for USD 0.84 billion.

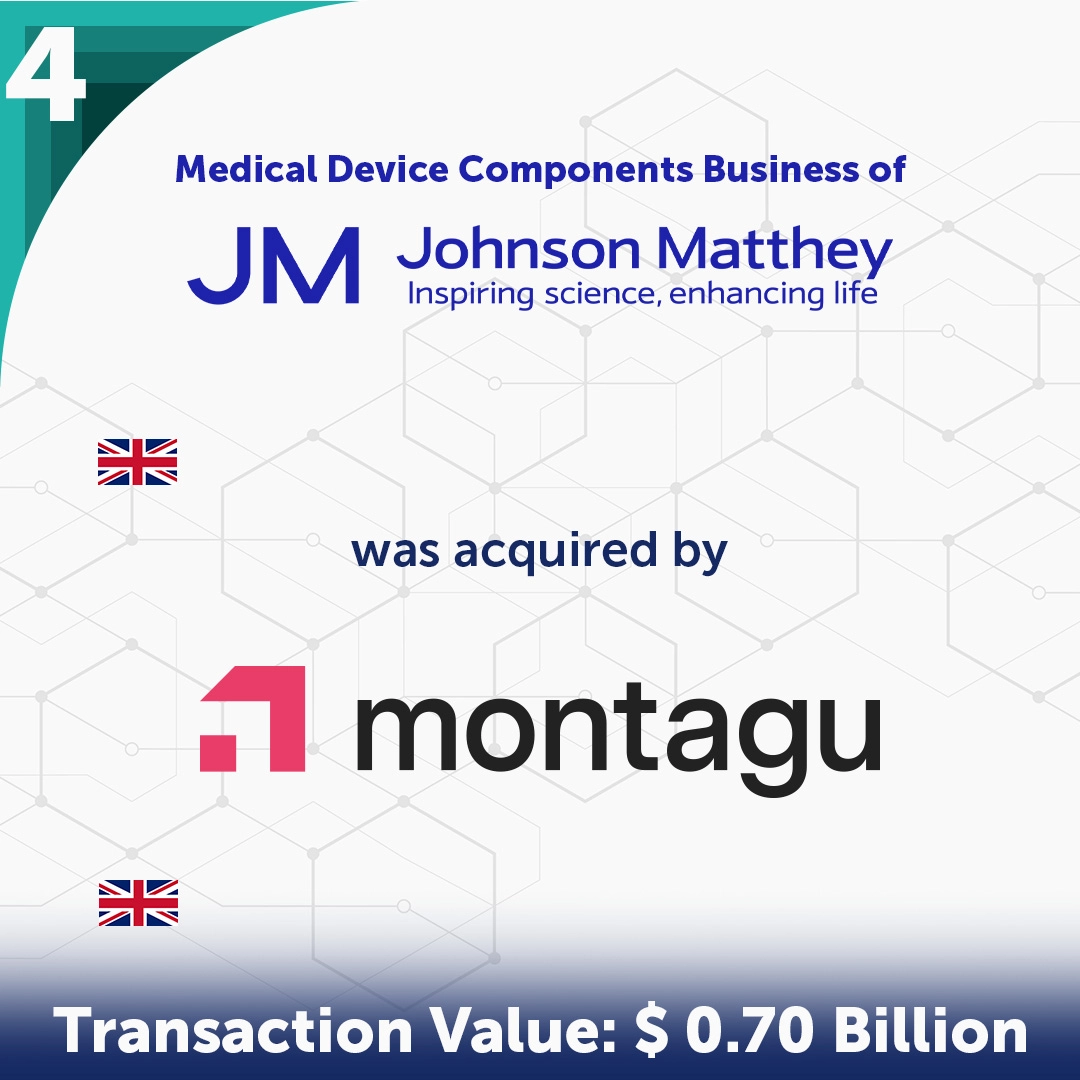

- Deal 4: Medical Device Components business of Johnson Matthey Plc (United Kingdom) was acquired by Montagu Private Equity LLP (United Kingdom) for USD 0.70 billion.

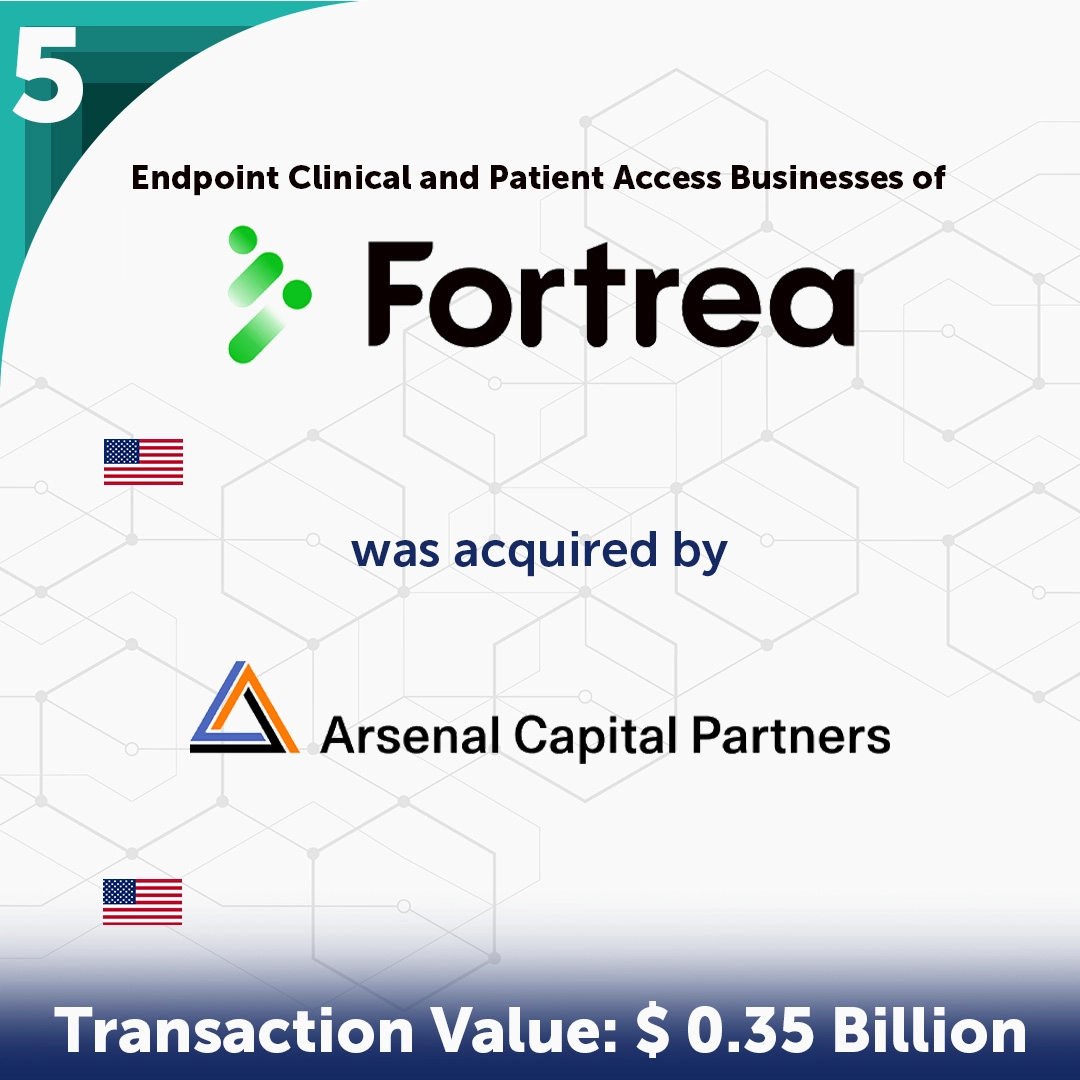

- Deal 5: Endpoint Clinical and Patient Access Businesses of Fortrea (United States) was acquired by Arsenal Capital Partners (United States) for USD 0.35 billion.

M&A Activity in the Pharmaceutical and Biotechnology Industry

The top global M&A deals in this industry list includes companies engaged in drug development, biotechnological research, and the production of pharmaceutical products, aiming to advance medical science and patient care.

January

Pharmaceutical and Biotechnology

- Deal 1: Inhibrx, Inc. (United States) was acquired by Aventis Inc. (United States) for USD 2.20 billion.

- Deal 2 Ambrx Biopharma Inc. (United States) was acquired by Johnson & Johnson (United States) for USD 1.98 billion.

- Deal 3: Aiolos Bio, Inc. (United States) was acquired by GSK plc (United Kingdom) for USD 1.40 billion.

- Deal 4: Harpoon Therapeutics, Inc. (United States) was acquired by Merck Sharp & Dohme LLC (United States) for USD 0.68 billion.

- Deal 5: Calypso Biotech B.V. (Switzerland) was acquired by Novartis AG (Switzerland) for USD 0.43 billion.

February

Pharmaceutical and Biotechnology

- Deal 1: Catalent, Inc. (United States) was acquired by Novo Holdings A/S (Denmark) for USD 16.50 billion.

- Deal 2: CymaBay Therapeutics, Inc. (United States) was acquired by Gilead Sciences, Inc. (United States) for USD 4.30 billion.

- Deal 3: China Traditional Chinese Medicine Holdings Co. Limited (Hong Kong) was acquired by Sinopharm Common Wealth Company Limited (China) for USD 3.00 billion.

- Deal 4: MorphoSys AG (Germany) was acquired by Novartis data42 AG (Switzerland) for USD 2.90 billion.

- Deal 5: China Resources Zizhu Pharmaceutical Co., Ltd. (China) was acquired by China Resources Double-Crane Pharmaceutical Co.,Ltd. (China) for USD 0.43 billion.

March

Pharmaceutical and Biotechnology

- Deal 1: Pharma Solutions Business of International Flavors & Fragrances Inc. (United States) was acquired by Roquette Frères S.A. (France) for USD 2.85 billion.

- Deal 2: Fusion Pharmaceuticals Inc. (Canada) was acquired by AstraZeneca AB (Sweden) for USD 2.41 billion.

- Deal 3: Genentech Manufacturing Facility in Vacaville, California (United States) was acquired by Lonza Group AG (Switzerland) for USD 1.20 billion.

- Deal 4: Cardior Pharmaceuticals GmbH (Germany) was acquired by Novo Nordisk A/S (Denmark) for USD 1.11 billion.

- Deal 5: Amolyt Pharma SAS (France) was acquired by AstraZeneca PLC (United Kingdom) for USD 1.05 billion.

M&A Activity in the Energy and Power Industry

Covering both renewable and non-renewable sources, the top global M&A deals in this industry list include companies involved in power generation, energy infrastructure, and the global pursuit of sustainable energy solutions.

January

Energy and Power

- Deal 1: Southwestern Energy Company (United States) was acquired by Chesapeake Energy Corporation (United States) for USD 7.40 billion.

- Deal 2: NuStar Energy L.P. (United States) was acquired by Sunoco LP (United States) for USD 7.31 billion.

- Deal 3: Callon Petroleum Company (United States) was acquired by APA Corporation (United States) for USD 4.55 billion.

- Deal 4: The Shell Petroleum Development Company of Nigeria Limited (Nigeria) was acquired by First Exploration & Petroleum Development Company Limited, Petrolin Group, ND Western Limited, Waltersmith Refining & Petrochemical Company Limited, and Aradel Energy Limited (Nigeria) for USD 2.00 billion.

- Deal 5: QuarterNorth Energy Inc. (United States) was acquired by Talos Energy Inc. (United States) for USD 1.29 billion.

February

Energy and Power

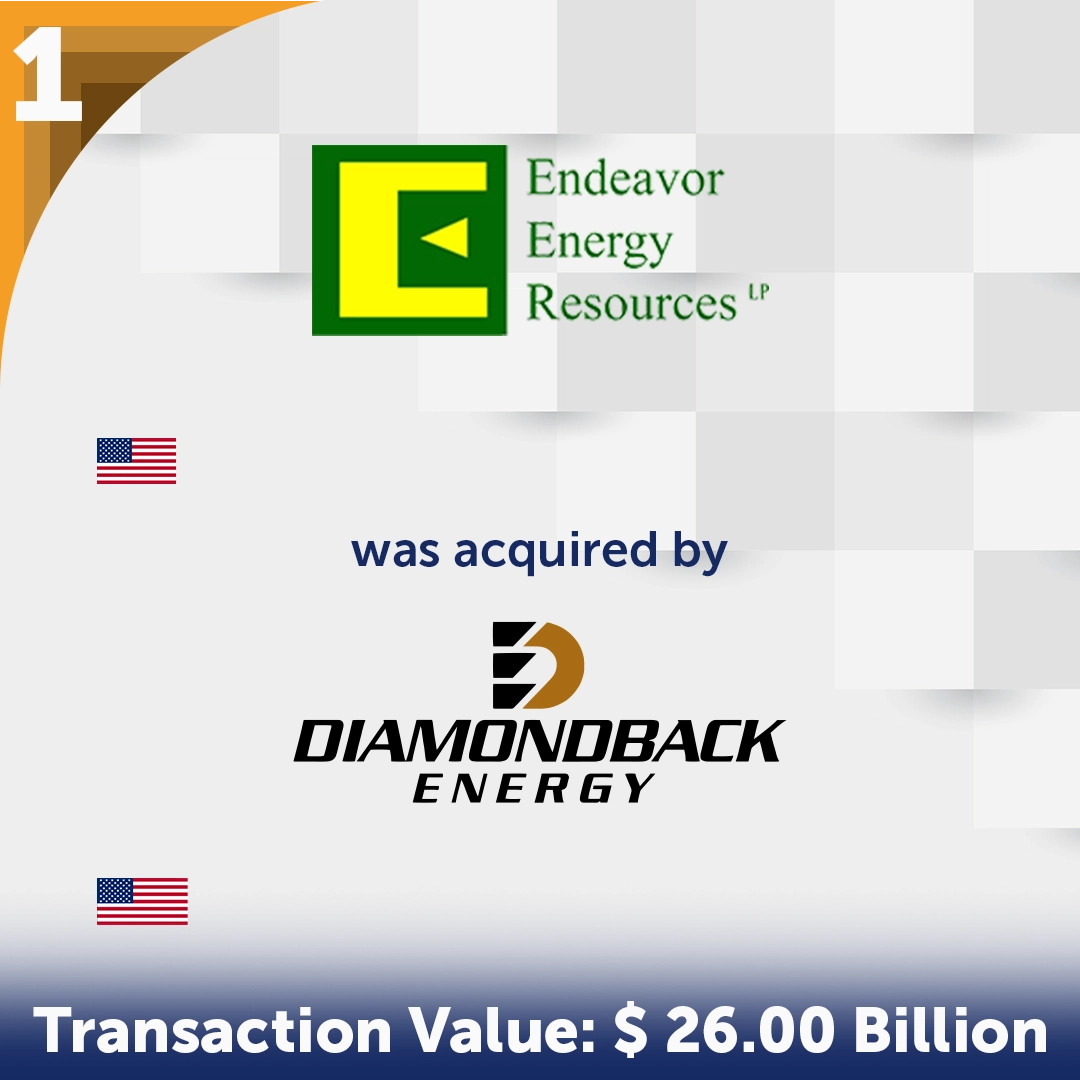

- Deal 1: Endeavor Energy Resources, LP (United States) was acquired by Diamondback Energy, Inc. (United States) for USD 26.00 billion.

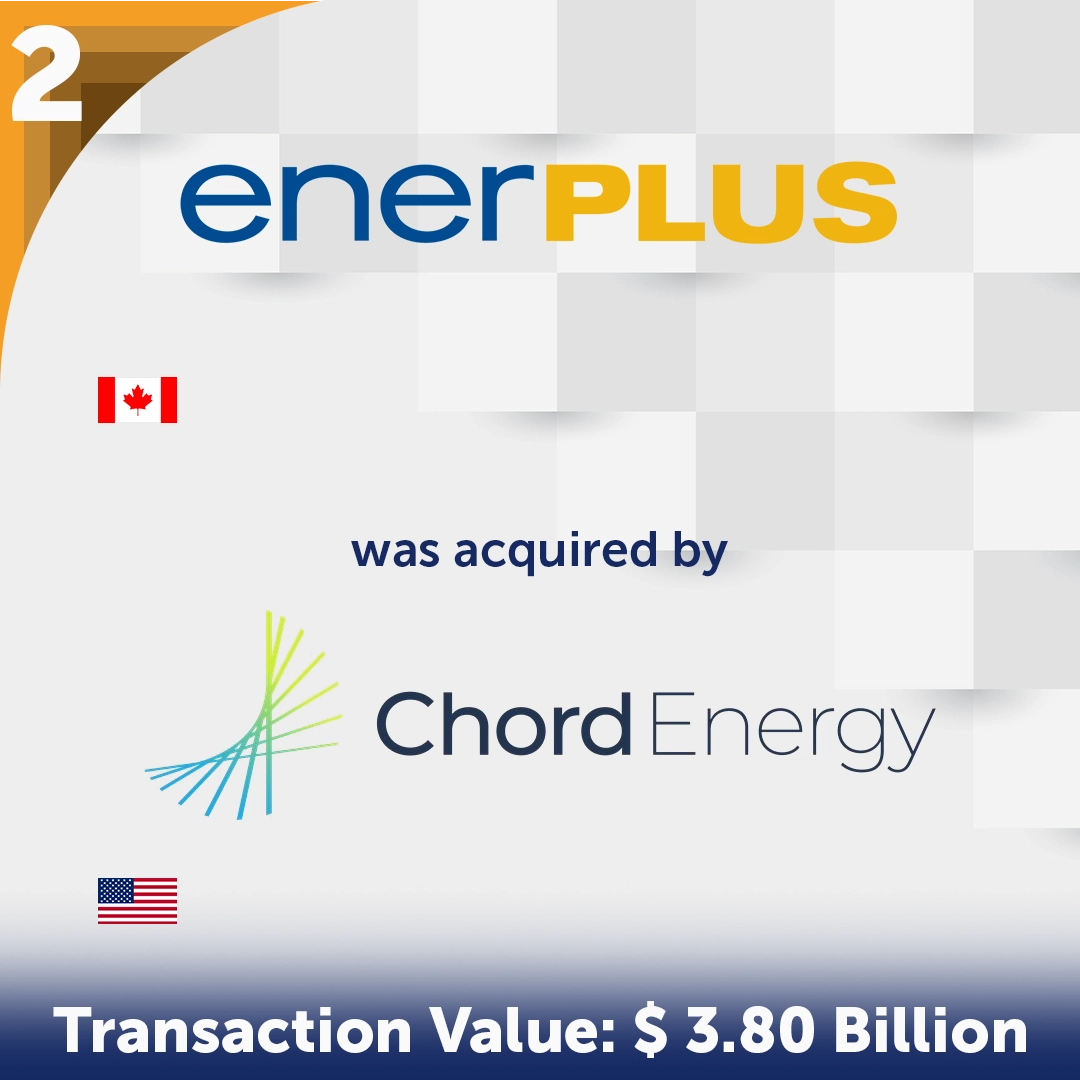

- Deal 2: Enerplus Corporation (Canada) was acquired by Chord Energy Corporation (United States) for USD 3.80 billion.

- Deal 3: Aera Energy LLC (United States) was acquired by California Resources Corporation (United States) for USD 2.10 billion.

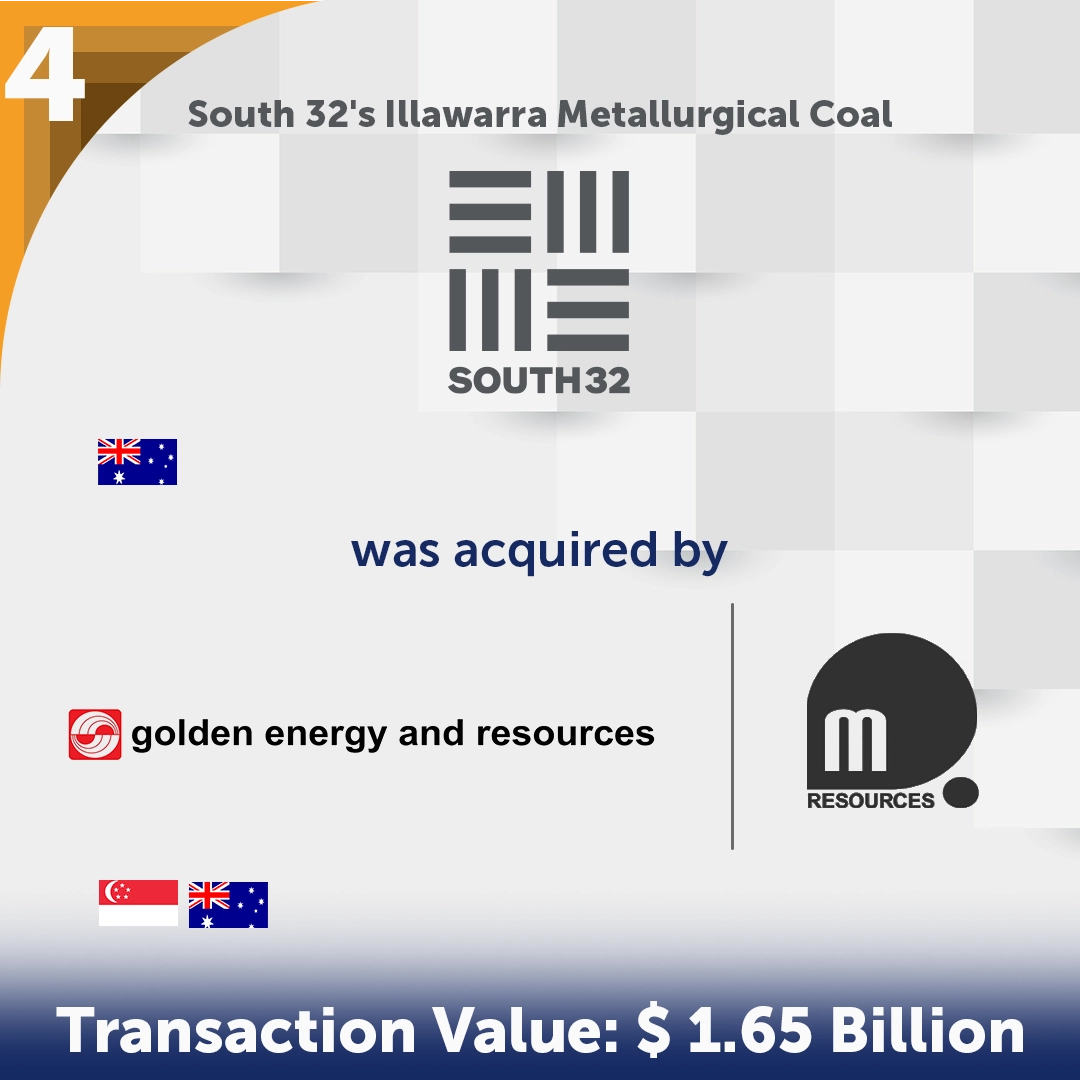

- Deal 4: Illawarra Metallurgical Coal (Australia) was acquired by Golden Energy and Resources Limited (Singapore) and M Resources Pty Ltd (Australia) for USD 1.65 billion.

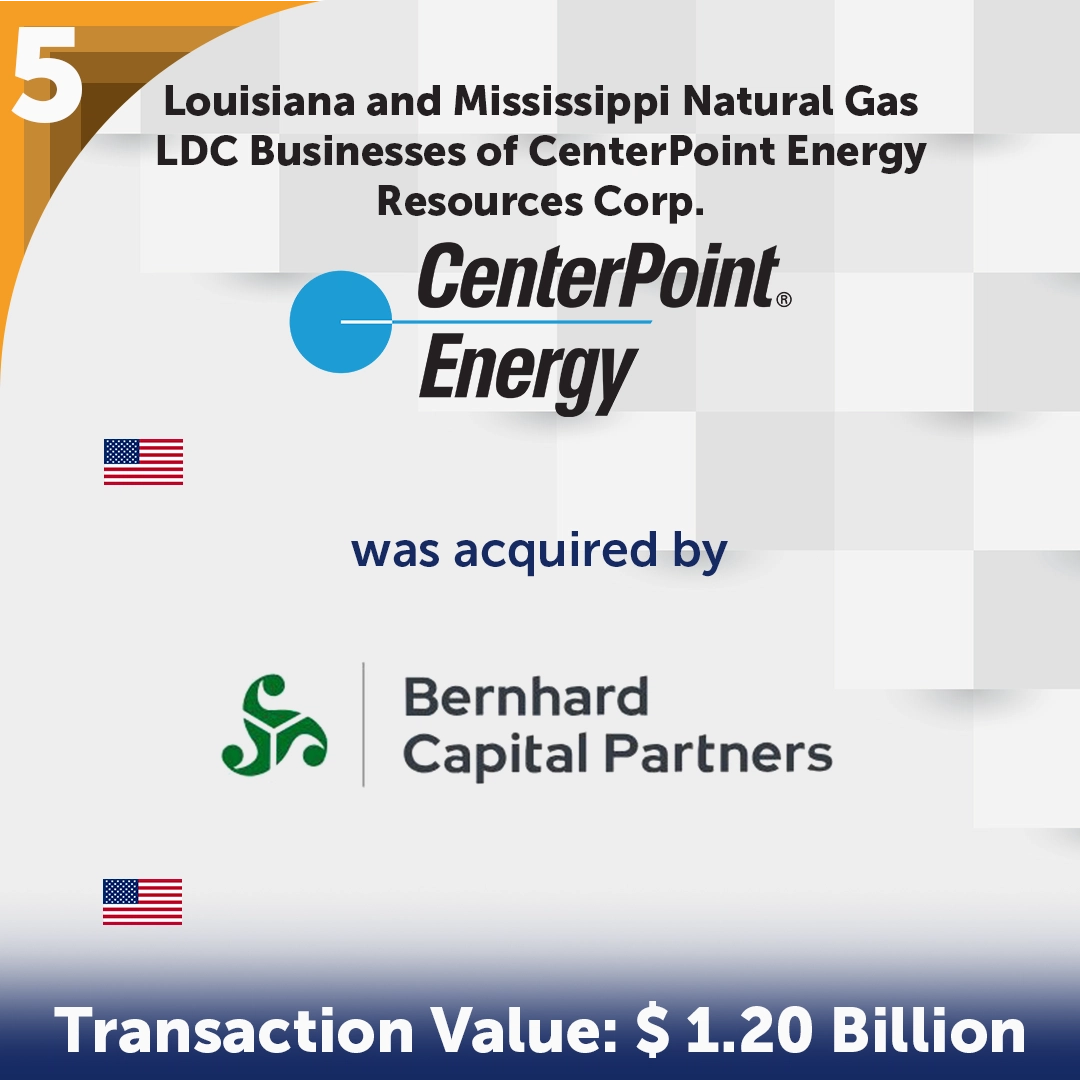

- Deal 5: Louisiana and Mississippi Natural Gas LDC Businesses of CenterPoint Energy Resources Corp. (United States) was acquired by Bernhard Capital Partners (United States) for USD 1.20 billion.

March

Energy and Power

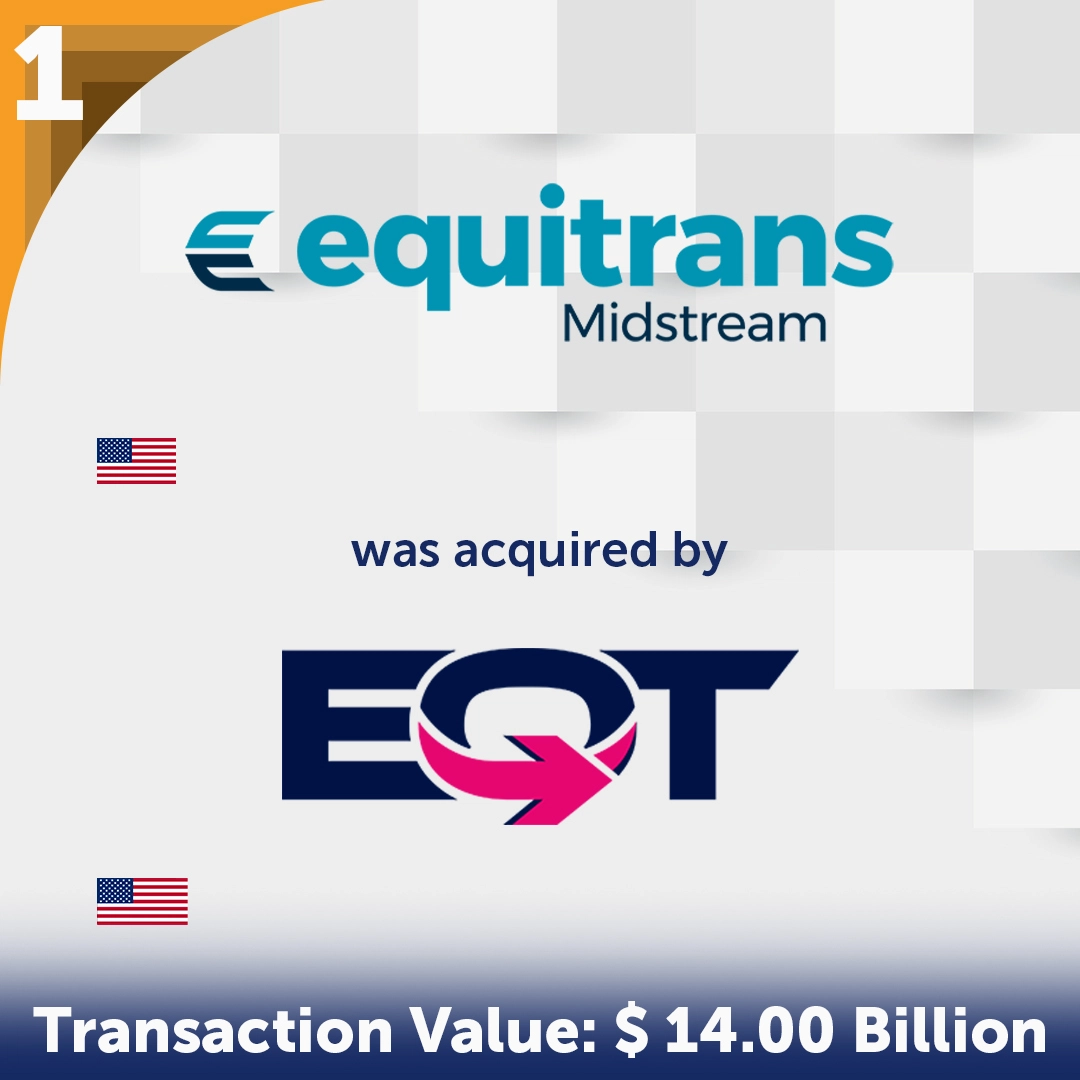

- Deal 1: Equitrans Midstream Corporation (United States) was acquired by EQT Corporation (United States) for USD 14.00 billion.

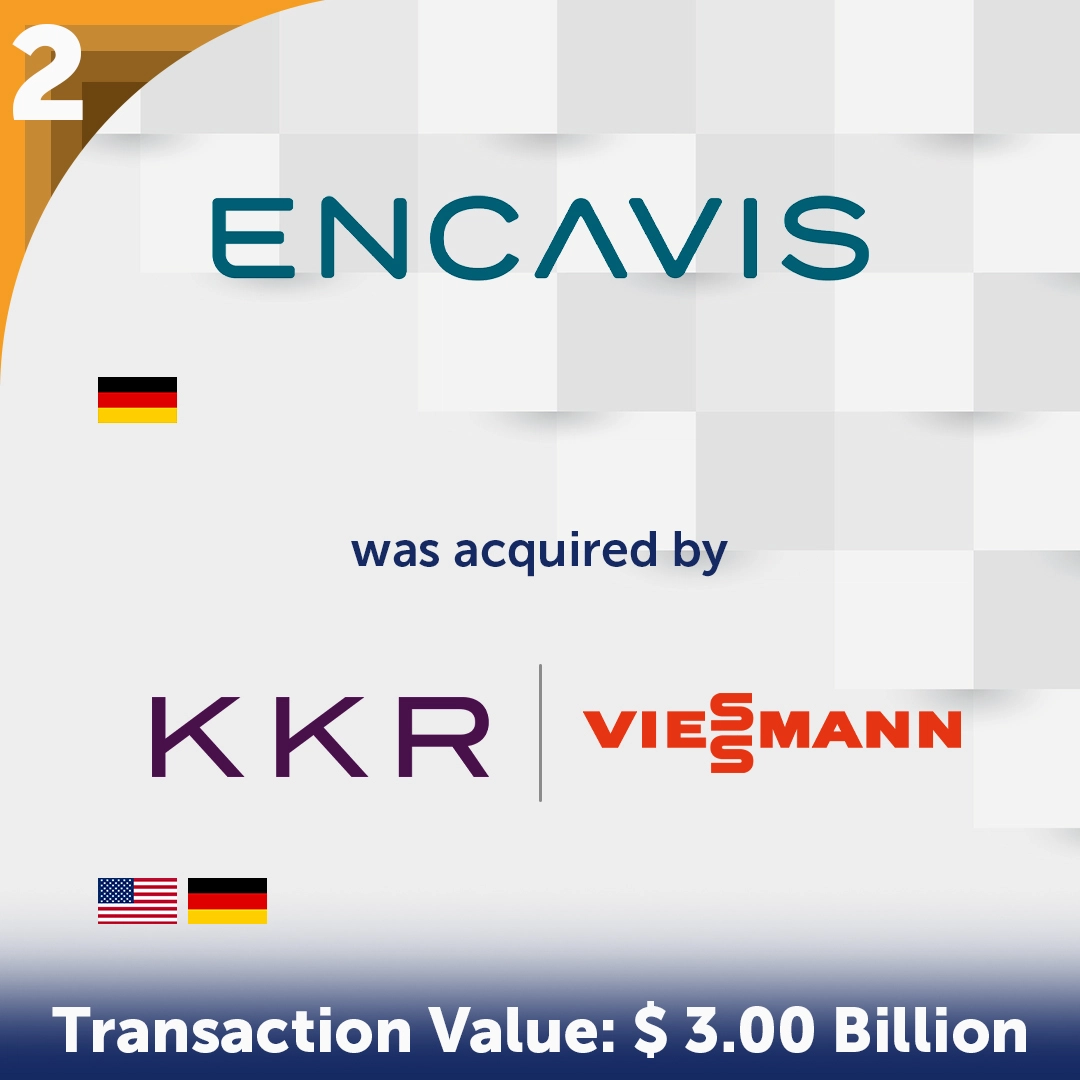

- Deal 2: Encavis AG (Germany) was acquired by KKR & Co. Inc. (United States) and Viessmann Group Gmbh & Co. Kg (Germany) for USD 3.00 billion.

- Deal 3: Avangrid, Inc. (United States) was acquired by Iberdrola, S.A. (Spain) for USD 2.49 billion.

- Deal 4: Electricity distribution activities in some municipalities of Lombardy (Italy) was acquired by A2A S.p.A. (Italy) for USD 1.30 billion.

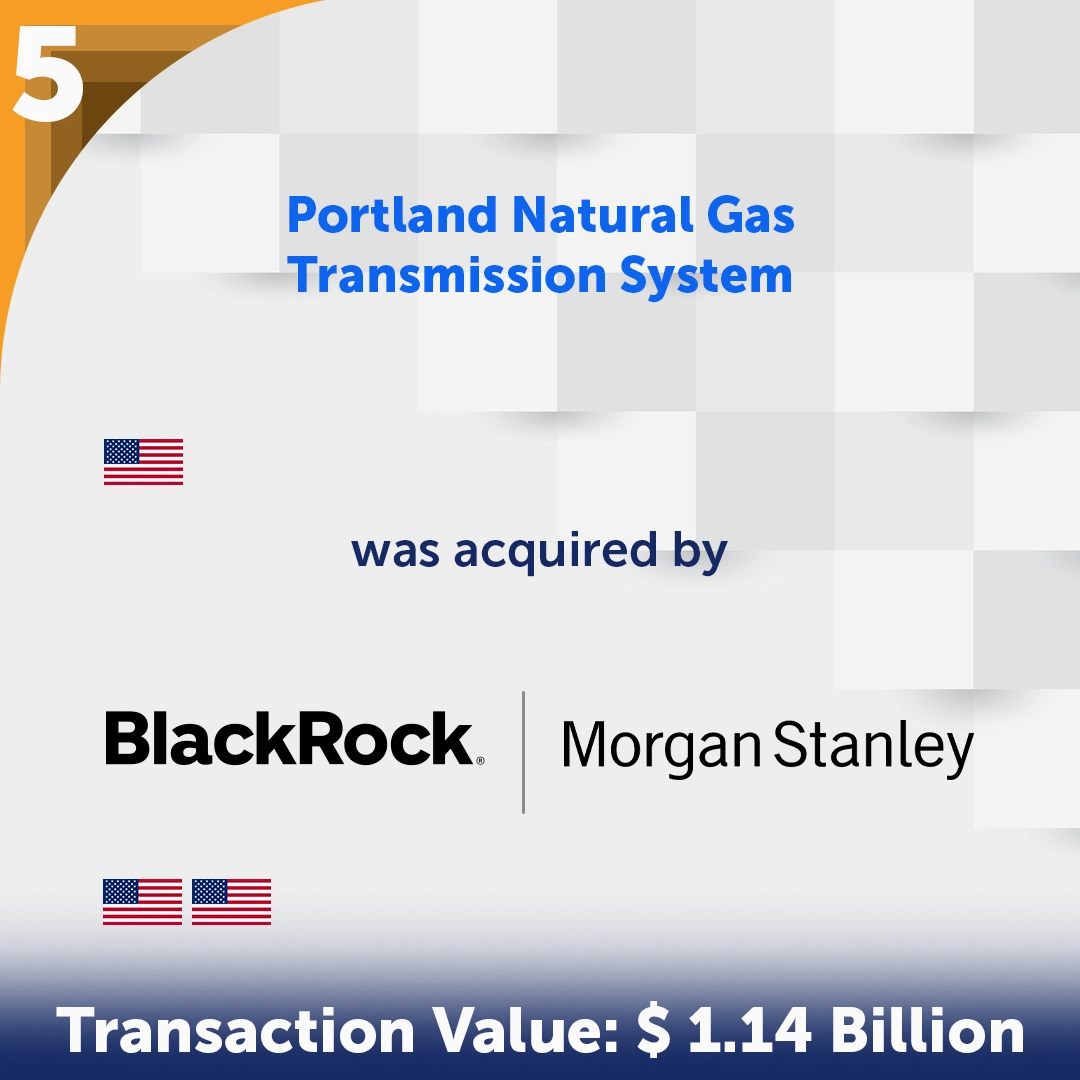

- Deal 5: Portland Natural Gas Transmission System, LP (United States) was acquired by BlackRock, Inc. (United States) and Morgan Stanley Infrastructure Inc. (United States) for USD 1.14 billion.

M&A Activity in the Chemicals Industry

The top global M&A deals included in this industry list includes companies producing chemicals for various applications, from industrial manufacturing to consumer products, highlighting the sector’s role in global manufacturing and technological advancement.

January

Chemicals

- Deal 1: Carpoly Chemical Group Co., Ltd. (China) was acquired by Beijing New Building Materials Public Limited Company (China) for USD 0.57 billion.

- Deal 2: National Petrochemical Industrial Company (Saudi Arabia) was acquired by Basell International Holdings B.V. (Netherlands) for USD 0.50 billion.

- Deal 3: Emulsifiers business of Corbion NV (Netherlands) was acquired by Kingswood Capital Management, L.P. (United States) for USD 0.36 billion.

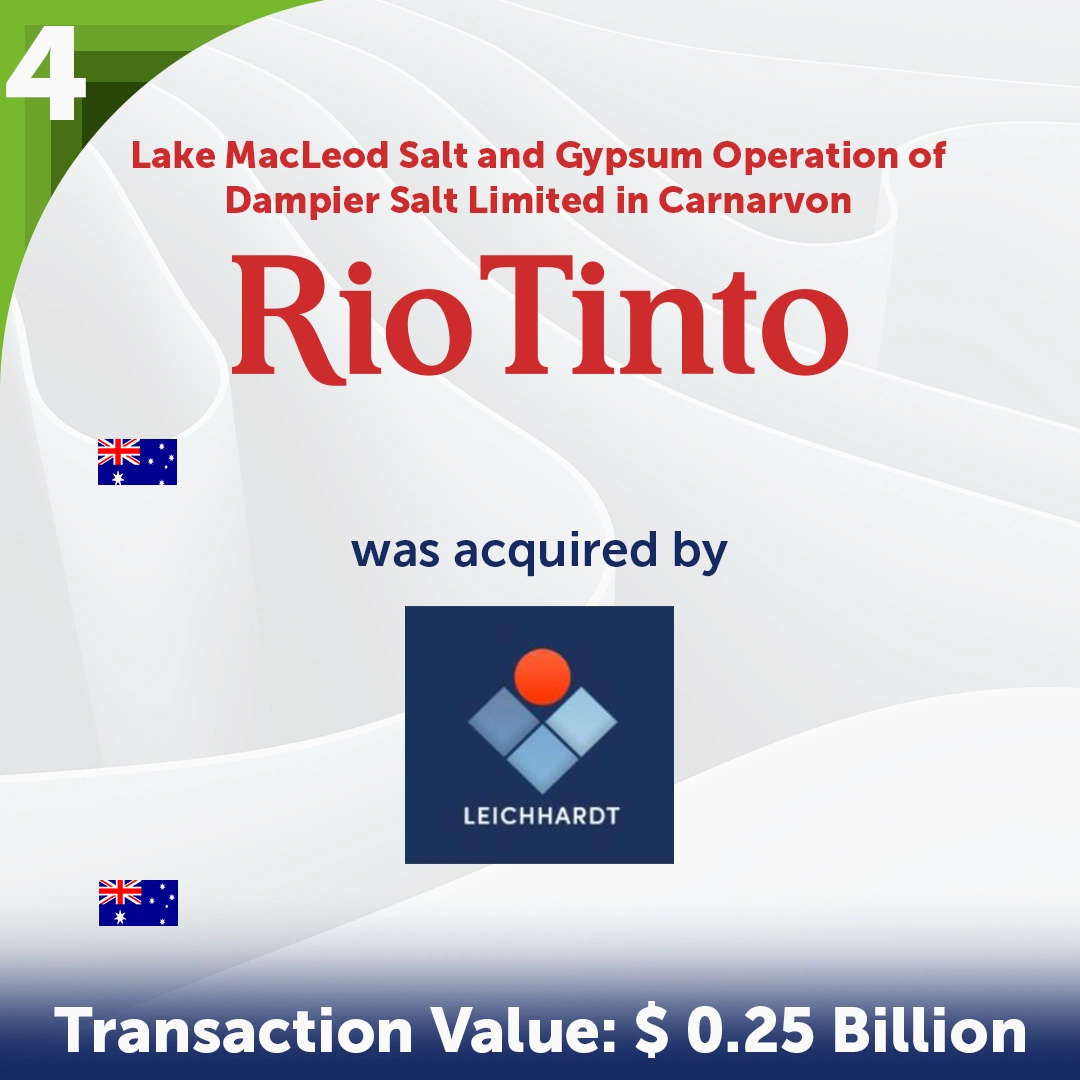

- Deal 4: Lake MacLeod salt and gypsum operation of Dampier Salt Limited in Carnarvon (Australia) was acquired by Leichhardt Industrials Pty Ltd (Australia) for USD 0.25 billion.

- Deal 5: Opals Chemical Technology Ltd. (Taiwan) was acquired by Cheng Mei Materials Technology Corporation (Taiwan) for USD 0.01 billion.

February

Chemicals

- Deal 1: Cyanco Corporation (United States) was acquired by Orica Limited (Australia) for USD 640.00 million.

- Deal 2: Baron Rubber Pty Ltd (Australia) was acquired by Trelleborg Sealing Solutions Germany GmbH (Germany) for USD 300.00 million.

- Deal 3: Astra Mining Company Limited (Saudi Arabia) was acquired by Saudi Lime Industries Company (Saudi Arabia) for USD 43.00 million.

- Deal 4: Wolfgang Freiler Ges.m.b.H. (Austria) was acquired by Teraplast S.A. (Romania) for USD 18.00 million.

- Deal 5: WEILBURGER Asia Ltd. (Hong Kong) was acquired by Kansai Helios Coatings GmbH (Austria) for an undisclosed amount.

March

Chemicals

- Deal 1: Resco Products, Inc. (United States) was acquired by RHI Magnesita N.V. (Austria) for USD 430.00 million.

- Deal 2: Ercros, S.A. (Spain) was acquired by Bondalti Ibérica SL (Spain) for USD 329.00 million.

- Deal 3: Shandong Dongyue Organosilicon Materials Co., Ltd. (China) was acquired by Macrolink Holding Co.,Ltd. (China) for USD 213.00 million.

- Deal 4: Anhui Annada Titanium Industry Co., Ltd. (China) was acquired by Wanhua Chemical Group Battery Technology Co., Ltd. (China) for USD 41.55 million.

- Deal 5: Sudarshan Farm Chemicals India Private Limited (India) was acquired by Best Agrolife Limited (India) for USD 16.61 million.

M&A Activity in the Artificial Intelligence (AI) Industry

Representing the forefront of technological innovation, the top global deals in this industry list includes companies developing AI and machine learning technologies, reshaping industries with intelligent solutions.

January

Artificial Intelligence (AI)

- Deal 1: CSLM Acquisition Corp. (Cayman Islands) was acquired by Fusemachines, Inc. (United States) for USD 0.20 million.

- Deal 2: Laiyer AI (Germany) was acquired by Protect AI, Inc. (United States) for an undisclosed amount.

- Deal 3: Gyant (United States) was acquired by Fabric (Florence Labs, Inc.) (United States) for an undisclosed amount.

- Deal 4: Venue was acquired by Ramp (United States) for an undisclosed amount.

- Deal 5: RoboCorp Technologies (United States) was acquired by Sema4.ai (United States) for an undisclosed amount.

February

Artificial Intelligence (AI)

- Deal 1: Valispace GmbH (Germany) was acquired by Altium Limited (Australia) for USD 20.00 million.

- Deal 2: Mojave Brands Inc. (Canada) was acquired by Light AI Inc. (Canada) for USD 12.00 million.

- Deal 3: Xinapse Co.,Ltd. (South Korea) was acquired by Robo3 Co.,Ltd. (South Korea) for USD 5.00 million.

- Deal 4: Panda Group SPOLKA Z Ograniczona Odpowiedzialnoscia (Poland) was acquired by Fabrity Holding S.A. (Poland) for USD 1.00 million.

- Deal 5: Climate and artificial intelligence (AI) web3 assets of Bot Media Corp. (Canada) was acquired by Metasphere Labs Inc. (formerly called Looking Glass Labs) (Canada) for USD 0.50 million.

March

Artificial Intelligence (AI)

- Deal 1: Shenma Limited (China) was acquired by The9 Limited (China) for USD 15.30 million.

- Deal 2: Bioleaders Corporation (South Korea) was acquired by Moadata Co., Ltd. (South Korea) for USD 11.64 million.

- Deal 3: Binit SRL/Deltanova SA (Spain) was acquired by Substrate Artificial Inteligence, S.A. (Spain) for USD 2.29 million.

- Deal 4: Lumoame Oy (Finland) was acquired by Netigate AB (Sweden) for an undisclosed amount.

- Deal 5: PT DycodeX Teknologi Nusantara (Indonesia) was acquired by PT Multidaya Teknologi Nusantara (Indonesia) for an undisclosed amount.

Expert M&A Data, Accessible to All

The 2024 Top Global M&A Deals from the Institute for Mergers, Acquisitions and Alliances (IMAA) is a tool designed to help M&A professionals and decision-makers obtain the foresight and knowledge needed to navigate the M&A landscape effectively.

With our data, you can:

- Identify Emerging Trends: Stay ahead of industry shifts and emerging trends across key sectors.

- Strategic Decision Making: Leverage our insights for strategic planning, investment decisions, and identifying potential M&A opportunities.

- Competitive Analysis: Benchmark against significant deals to gauge market positioning and competitive dynamics.

As the leading M&A Think Tank, we are committed to providing M&A professionals and those in the M&A field with the most up-to date and data-driven M&A insights. Stay informed, stay ahead, and turn insights into actionable strategies with our authoritative guide to the Top Global M&A Deals in 2024.