Blog Webinar Recap: AI-Powered Strategies for Talent Integration in M&A

- Blog

Webinar Recap: AI-Powered Strategies for Talent Integration in M&A

SHARE:

Artificial Intelligence (AI) is more than just a tool. It is a transformative force that can shape how businesses approach, manage, and optimize talent integration, especially during Mergers and Acquisitions (M&A). This pivotal intersection of AI and M&A was the focal point of the webinar titled AI-Powered Strategies for Talent Integration in M&A, hosted by the Institute for Mergers, Acquisitions, and Alliances (IMAA). Leading the conversation were Aaron Chaum and Julie van Waveren from Mercer. Together, they explored how AI transcends its role as a supportive tool, emerging as a key player in reshaping talent integration strategies during M&A operations.

Here are the key takeaways from the insightful session on how we can use AI in M&A:

The Crucial Role of Talent in M&As and the Transformative Impact of AI

Talent undeniably plays a central role in M&A across various industries. Aaron and Julie emphasized this by sharing pivotal statistics, shedding light on the primary challenges and prospects in M&A, and illuminating how AI stands to revolutionize these processes.

Here are some highlights from their research:

- A noteworthy 60% of CEOs and CFOs see talent as their biggest challenge in delivering growth and meeting demand.

- Talent skill gaps are a top concern for executives, with 89% of executives expecting their organizations to face talent issues.

- Nearly half (47%) of all transactions don’t meet their financial targets due to people-related risks.

- During an M&A transition, there is an 8% increased likelihood of employees being diagnosed with depression, and a 5% increased likelihood of being admitted to the hospital.

Post-transaction, organizations face the daunting task of retaining their prime talent, often leading to pitfalls such as decreased productivity and disruptions in customer relations. Traditional deal teams have often approached talent considerations by relying heavily on qualitative methods such as management meetings and interviews. However, even after sifting through all that data, the question still remains, are companies keeping the right talent and how can this be processed more effectively while keeping operations as is?

More progressive deal teams are harnessing the power of AI, especially through Talent Intelligence platforms. This AI-driven approach not only enhances talent integration but shifts the focus from merely consolidating background experiences to predicting future skills and capabilities. It’s not just about understanding past talents but anticipating if the acquired talent can meet future business needs. In the face of retention challenges and the evolving landscape of M&As, AI emerges as a game-changer. It offers groundbreaking solutions, especially in domains of talent management, leadership, and organizational culture dynamics, enabling deal teams to strategize and integrate earlier and more effectively in the deal sequence.

How AI can be used for Talent Integration – Client Stories

Aaron and Julie shared two client stories on how they used AI to help their clients.

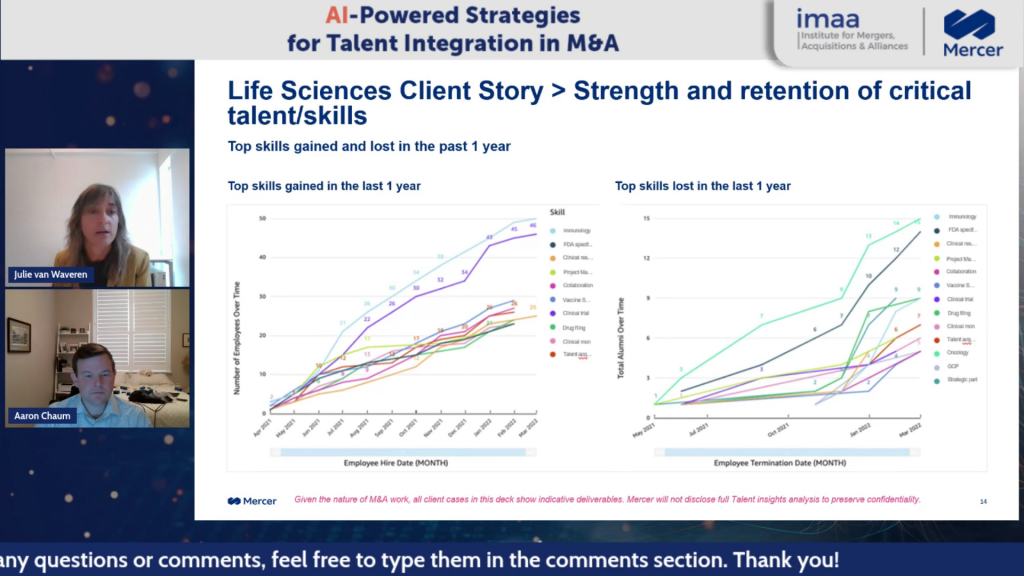

Client Story 1: Uncovering the Black Box of Talent and Skills Pre-close

A global health care organization, during the throes of the pandemic found itself on the brink of a critical deal centered around clinical research and immune development—a sector which was profoundly in demand at that juncture. The M&A team grappled with two pivotal inquiries:

- Is the leadership team worth an investment of $10 million solely for retention purposes?

- Does the company possess the indispensable capabilities in immune and clinical research in alignment with the deal’s overarching strategy?

To address these, the team harnessed AI-driven talent intelligence enabling them to:

- Pit the target midsize company against a group of 3-5 principal competitors in the market to set benchmarks for the quality and quantity of the target.

- Identify the skills and capabilities of the leadership team without human intervention.

While Julie delved deeper into the findings during the webinar (you can watch the full webinar here), the primary insights drawn from this exploration were:

- Using AI-driven talent intelligence can profoundly enhance understanding of talent pre-close, refining the strategic planning.

- Strategizing around the leadership team’s capacity for growth is paramount.

- The importance of devising a detailed retention plan is magnified in such scenarios.

- Proactively anticipating challenges in engagement and guiding the target organization post-deal is essential.

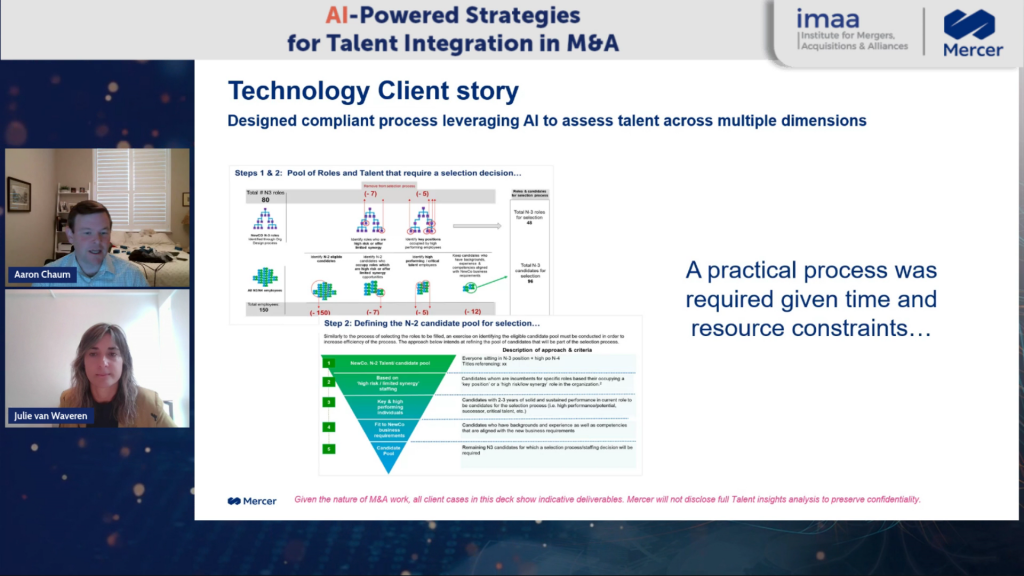

Client Story 2: Leveraging AI to Accelerate People Decisions Post-Close

A technology company aimed to select the best talent from previous acquisitions for its new combined organization. The goal was to position this new integrated company for future market success. The parent company’s main difficulty was in selecting talent in a consistent, defensible, and almost entirely confidential manner, using limited data.

By employing AI-driven talent intelligence, the M&A team managed to:

- Provide a wealth of information to the executive leadership team.

- Successfully identify the best fit candidates in alignment with the required skills and behaviors.

- Ensure that the process was data-driven, defensible, and had the necessary documentation.

Aaron explored these findings during the webinar (you can watch the full webinar here), highlighting several key takeaways. An AI-driven approach offered insights that would otherwise have been unavailable to the client. However, while AI-powered tools have many advantages (speed, accuracy), there are not without constraints. Challenges often arise from inconsistent data availability and varying data management practices among subsidiaries. It is essential to note that the integrity and cleanliness of data are paramount for the effective use of AI tools in talent intelligence.

Final Critical Considerations on AI in M&A Talent Integration

The transformative impact of AI in businesses is undeniable, prompting M&A teams to adapt swiftly. As client conversations underscore talent’s centrality to growth strategies, there’s a pressing need to reevaluate the approach to talent in deals. This entails not only strategic pre-close planning but also efficient post-close integration. With the talent market for critical roles becoming increasingly competitive, AI offers a solution, empowering employees with autonomy and opening up new opportunities. Aaron stresses the importance of overseeing deals throughout their entirety, emphasizing that the true value creation in M&A largely unfolds in the post-close phase. With AI’s capabilities, deal teams can optimize their operations, especially in managing and integrating talent.

Webinar Q&A Highlights

The webinar concluded with a Q&A. Below are the questions and their summarized responses:

Question: Are you speaking from both an acquiring company and a target company perspective?

Answer: The approach that was taken was largely from the deal teams from a buyer standpoint but the same approach can be applied for seller companies. We’ve observed how skills can be leveraged from a value standpoint. This means that one can quantify the quality, quantity, and competitiveness of talent to better inform talent strategies. The main emphasis is that talent is equal to value and what drives growth, and this can be quantified to better inform talent strategies from both a buyer or seller perspective.

Question: What are the limitations of what AI can do in deals?

Answer: One of the greatest limitations is data availability. If there isn’t good, structured, organized, and updated data, then AI’s capabilities are limited. Other challenges are storing, categorizing, and maintaining it. There can be situations where data isn’t reviewable, scrapable, or accessible, or even missing. In such scenarios, the potential of AI becomes severely constrained. The true test for AI-empowered and enabled deal teams is ensuring data infrastructures are well-architected and constantly updated and having good tools to gather and manage that data.

Question: Were there any components/inputs from an organization’s “culture” perspective that went into defining talent management strategy?

Answer: Leadership, culture, and talent are all interconnected. Culture determines how a company or organization operates to deliver results. When assessing skills and an organization, we learn a lot about culture. For example, we are able to map out technical skills and power skills (which speak to how work gets done) which speaks to culture. Beyond this, it is important to understand that talent management extends beyond just the leadership team but also includes the policies, practices, and overall approach an organization adopts. Being able to engage with key people such as HR leads can offer invaluable insights into how talent is effectively managed within the organization. By understanding an organization’s culture, we are better equipped to integrate talent more effectively, understand what drives their way of working, what is essential for retention, and identify aspects that may need change or maintenance.

Question: How do we prepare our deal teams to address talent and AI in deals?

Answer: Teams should prepare themselves from a data perspective, ensuring both the availability of external data from targets and good data hygiene internally. Training and preparing the team for change and the use of new tools, particularly in AI, is also essential.

In conclusion, the integration of Artificial Intelligence in mergers and acquisitions represents a profound shift in how businesses approach talent strategy and integration. The implications shared by Aaron and Julie during the webinar highlight the transformative capabilities of AI in M&A. This synergy extends far beyond just efficient processes; it reshapes decision-making, fortifies strategic foresight, and promises a richer tapestry of opportunities for businesses navigating the complexities of today’s global landscape.

To get the complete insights from this webinar, watch the full replay on LinkedIn, Facebook, or YouTube. If you would like a copy of the presentation, please send us an email at [email protected]

- Tags: Webinar Recap

Stay up to date with M&A news!

Subscribe to our newsletter