Publications Current M&A Cycle Creates Shareholder Value

- Publications

Current M&A Cycle Creates Shareholder Value

- Bea

SHARE:

EXECUTIVE SUMMARY

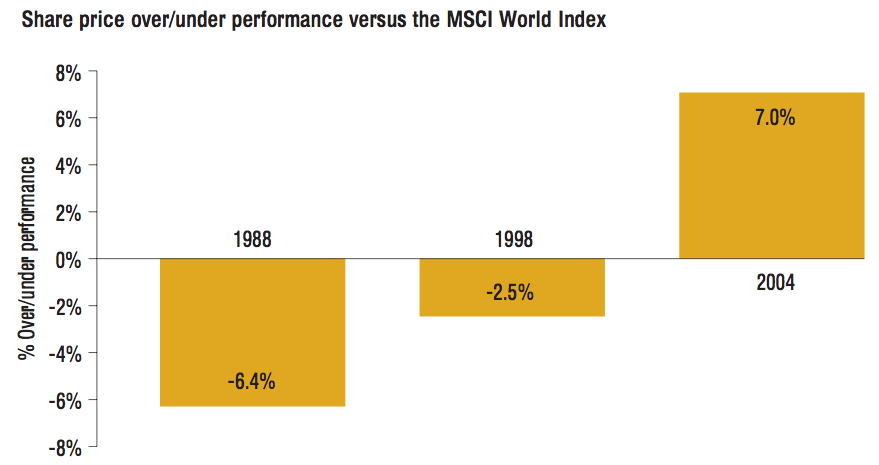

More M&A deals are now financially successful, according to research conducted by London’s Cass Business School, in conjunction with Towers Perrin. The recently completed study found that in 2004, companies involved in M&A deals worth more than US$400 million outperformed the market by 7.0%. By contrast, share performance of companies involved in similar deals at the same point in the earlier M&A cycles of 1988 and 1998 underperformed the market by 2.5% (in 1998) and 6.4% (1988).

This is the first research to show that most companies are now able to realise the financial success of deals. Earlier studies by Towers Perrin and others showed that, in most cases, senior management was unable to unlock the financial value that should result from the synergies and economies of scale of an M&A transaction. In fact, the Cass study confirms, in line with most prior research, that deals in earlier M&A cycles usually destroyed, rather than created, shareholder value.

BACKGROUND

The Cass – Towers Perrin study examined a total of 218 global deals with an inflation-adjusted value of between US$400 million and US$1.5 billion and that were concluded in 1988, 1998 or 2004. The study analysed company performance for a one-year period (six months before and after the deal closing) to determine the relative degree of financial success. (See ‘Comparing three cycles of M&A’ for more on methodology.)

M&As are subject to macro-economic factors such as inflation, interest rates, corporate liquidity, oil prices and geopolitical instability, among others. And while the macro-economy has shifted since 1988, we believe that many of these external factors are smoothed by focusing on share performance relative to a market index, since the macro-environment is comparable for all companies in the indices.

Focusing on share-price performance over the six months before and after an M&A transaction is also imperfect. It is a relatively short time in which to judge the failure or success of transaction. However, this share price does reflect the market’s level of confidence in the merged company’s relative performance and gives some insight into the merged company’s actual six-month performance. The six-month share price also reflects the market’s evaluation of the company’s governance processes and its senior management’s ability to make the M&A work.

METHODOLOGY

Comparing three cycles of M&A

The purpose of the Cass – Towers Perrin research was to identify whether deals in the current merger wave (post-2002) are successful in financial terms, and to find out how they compare to deals in the two prior merger waves. Because it is not yet known whether 2005 will represent the peak of the current merger wave, we chose non-peak years preceding the peak in the earlier waves to provide comparison periods. Years chosen for review were 2004, 1998 and 1988.

All data were obtained from public databases and so do not depend on any company’s participation; this data-gathering method also eliminates interviewer or interviewee bias.

The period of analysis – performance for a one-year period surrounding the closing of a deal – was chosen to allow us to analyse deals conducted well into this current merger wave, but still below the existing peak year of 2005. (2005 may not prove to be the peak year in this merger wave, and thus this analysis may require updating to remain consistent with prior periods. However, we do not anticipate that this will lessen the value of this study.)

Data for the current study have been collected using the Thomson One Banker Mergers & Acquisitions database. Where necessary, we have supplemented these data with information from Datastream and direct data from individual companies, including on-line sources, company annual reports and regulatory filings.

The following are the criteria for the data used in this research:

- Only deals which were completed in 1988, 1998 and 2004 are included

- The acquiring company must be public

- Deals made by subsidiaries or joint ventures are excluded

- Only acquisitions/mergers of companies or business divisions are included (excluding real estate, credit cards, drug portfolios, refineries, etc.)

- Only deals with rank value of US$400 million to US$1.5 billion are included; deals in 1988 and 1998 have been inflation-adjusted

- As a result of the deal, 100% of the target/asset must be owned by the acquirer

- There must be no other restructuring deals valued over 1% of a company’s assets over the six months period before and after the merger/acquisition (ie, only one M&A deal per company in the study’s period)

The data include one year (six months before and after the deal took place) of a company’s performance, liquidity, leverage and solvency ratios on which the success of the deal was judged.

The data comprise 218 deals overall. This sample is sufficient to produce robust and reliable results.

IMPROVING M&A SUCCESS

Towers Perrin’s consulting work on over 300 transactions a year around the world gives us insight into the reasons behind the growing success of M&As. In our view, the general ‘M&A know-how’ has improved significantly. There is now much more experience among all parties involved in M&As, from CEOs, CFOs, COOs and HR Directors to project teams, lawyers and consultants. In 1988 – and to a lesser but significant extent in 1998 – inexperience resulted in M&A transactions conducted by trial and error – both in terms of deal selection (and pricing) and deal execution. Too often, the errors lead to poor financial results.

In particular, we have seen improvements in three areas of corporate behaviour: deal governance; deal selection; and integration focus.

“We did much better on this deal because we did learn from our mistakes in the past” – Executive Vice President & CFO of a large US gaming company

1. Better deal governance

Today, company senior management is much more closely aligned with shareholders in terms of the aims and objectives of corporate transactions. Executive compensation programmes have become more directly linked to shareholder value, making senior managers more focused on delivering share price performance and profitability. This is especially true in an M&A, where managers are now more inclined to approach a deal rationally, with a focus on the financial objectives. In our view a broad array of non-financial motives influenced managers in the 1988 and 1998 merger waves, at the cost of price insensitivity. This resulted in some companies paying a large premium over share price, bidding on targets as a ‘defensive’ manoeuvre, or being caught up in the irrational exuberance of the M&A cycle in such a way that increasing shareholder value was nearly impossible.

Heavier shareholder, media and rating agency scrutiny of management decisions in relation to the creation or destruction of shareholder value is a major reason that senior management is becoming more focused on delivering financial value during an M&A. In addition, M&As have benefited from the widespread focus on more transparent corporate governance processes and practices in recent years, as exemplified by Sarbanes-Oxley and other regulations. While this trend is not specific to M&As, it has been so pervasive that it is influencing all areas of corporate behaviour.

2. Better deal selection

M&A deals are now subject to a more rigorous due diligence process. For many companies, due diligence now includes assessment and quantification of the financial impact of factors that were not considered in earlier deals. For example, most transactions now include detailed analysis of corporate benefit programmes – especially pensions – and their financial liabilities. As a result, in recent years a number of proposed transactions were abandoned after due diligence showed large pension deficits that, in effect, destroyed the economic basis for the deal.

If this more vigorous due diligence process doesn’t fatally weaken the transaction’s business case, it can certainly lead to a more accurate price for the target company. In the past, some M&A activity was characterised by very high-level agreements, which opened the way for materially significant financial surprises to be discovered only in the implementation stage, when it was too late.

“Integration skills come with practice” – CFO of a large international bank

3. Better focus on integration

Corporate behaviour and strategies concerning post-deal implementation also led to stronger financial performance of M&A transactions in 2004. In particular, companies tend to focus on the implementation phase as a time to identify and deliver on the merged companies’ financial synergies. There is growing acknowledgement that retention and engagement of employees at all levels of the organisation in post-deal integration has a direct impact on the operational success of M&As, which in turn is a key driver of M&A financial success.

By including Human Resources earlier in the M&A process, M&A teams have also grown more successful at identifying key people and cultural issues in the due diligence stage. This, in turn, has enabled companies in the implementation phase to swiftly and effectively execute people strategies that support planned synergies. In fact, another Towers Perrin survey on M&A activity in 2004 found that there was a high correlation between deal success and early HR involvement – especially when the key issues that were addressed early included executive issues (such as selection of the top team and the establishment of effective leadership) but also extended to include the integration of the broader workforce (such as the development of a corporate culture for the new organisation).

CONCLUSION

Findings identify opportunity and risk

The Cass – Towers Perrin study indicates that M&A has entered a new, successful era.

We believe this success is a direct consequence of companies’ improved management of the M&A process, from target selection and pricing, to due diligence to implementation. In the future, this learning curve will continue. So, while gaining competitive advantage through M&As is now a legitimate business strategy for growth, continued success will depend on increasingly sophisticated M&A capability. And as due diligence increasingly becomes a more scientific exercise in risk identification and management, the real area of competitive advantage will be in the art of implementation, particularly on the people side.

If M&A has now become a more consistently successful business strategy for achieving above-average share performance, then ignoring M&A opportunities might place companies at risk of under-performance. But if M&A activity is becoming a competitive necessity, it is still a risky one, and companies engaging in this growth strategy would do well to ensure they understand the importance of deal selection, deal management and governance, and post-deal integration. If they do not, they risk becoming one of the relatively few cautionary tales of this wave, or the next.

“We’ve made mistakes and learned so much. We know very well how to follow the proper M&A strategy: how to negotiate; how to complete; how to integrate; how to absorb” – Executive Vice President of a global biotech company

“Investors will remember if you’ve done a bad deal. We didn’t want a bad reputation or a label of overpaying” – Executive Vice President & CFO of a medium-sized regional US bank

“We’ve developed the absolute confidence that we know how to find the companies (to acquire) and then absorb and integrate them” – Executive Vice President of a global biotech company

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter