Publications Mergers & Acquisitions In Russia In 2007

- Publications

Mergers & Acquisitions In Russia In 2007

- Bea

SHARE:

Mid-market eating a quarter of the pie

By Michael Knoll – PricewaterhouseCoopers

Ten key findings for M&A in Russia in 2007

• Greater competition drove consolidation in numerous industries

• Domestic firms sought vertical as well as horizontal integration

• Foreign strategic buyers sought entry into the fast growing Russian market

• A second wave of foreign strategic buyers is arriving, smaller in scale than the first wave of multinationals

• Foreign financial buyers sought solid yields and upside exposure

• Smaller Russian companies are seeking new capital for expansion to meet drastic market growth

• Large Russian companies are flush with cash and buying abroad

• Many Russian companies of all sizes are seeking the most modern technology and best practices

• Russian M&A is becoming more sophisticated and value-driven

• Strong economic fundamentals will support strong volumes in the mid-market space

Market overview

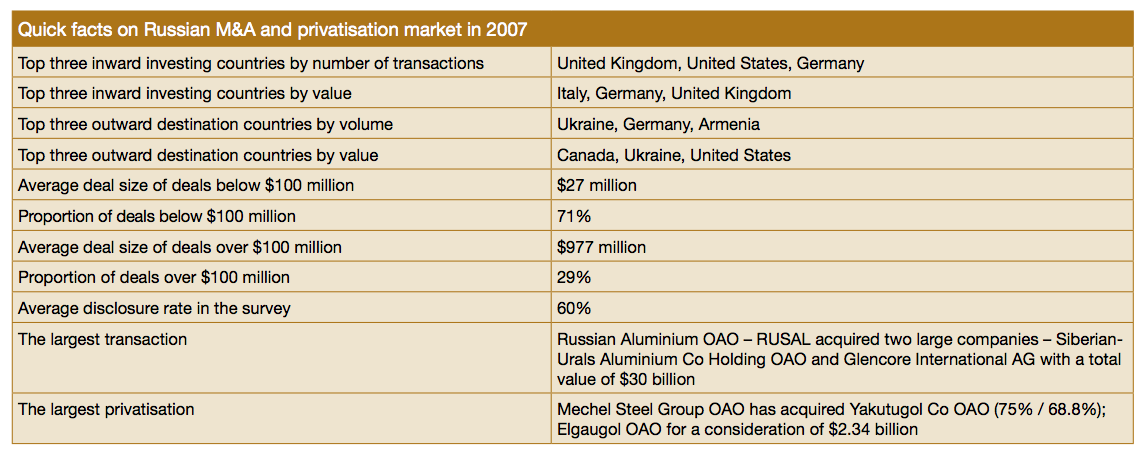

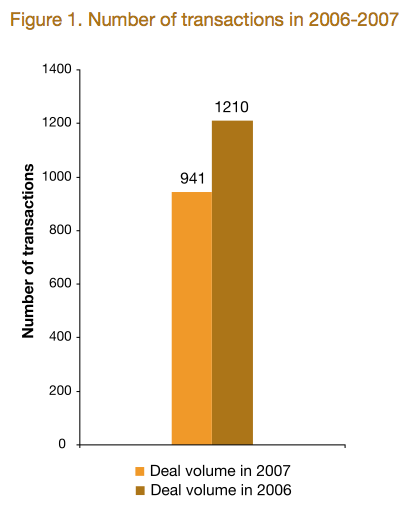

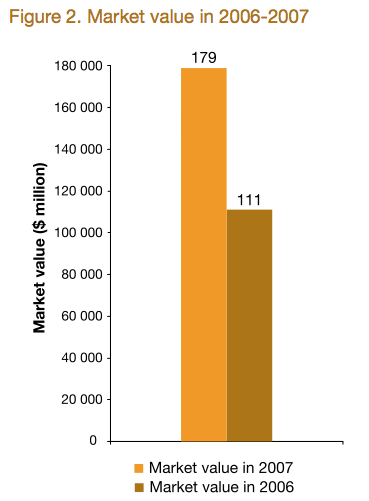

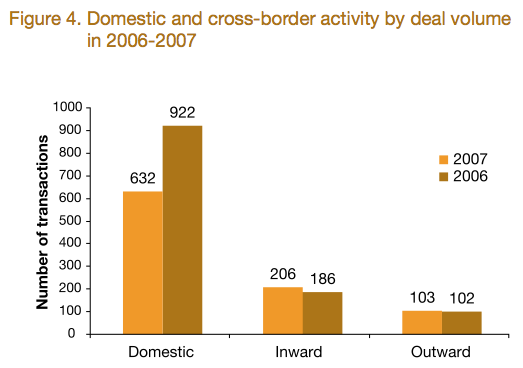

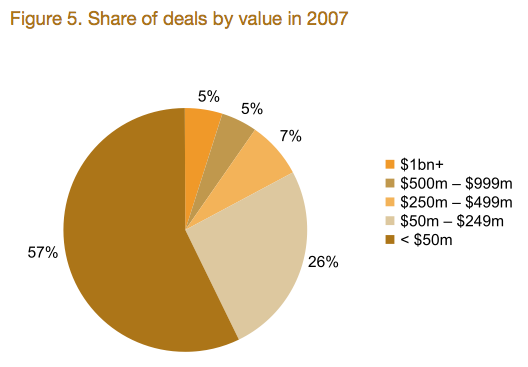

Measured by dollar volume, M&A activity in 2007 in Russia rose another 61% on 2006, registering an estimated $179 billion. This is over three times the $53 billion in deal value created in 2005. The number of deals year-on-year actually fell 22%, from 1210 to 941. However, the estimated average size of deals in 2007 jumped 107%, from $92 million to $190 million.

The average for disclosed transactions also increased, from $181 million to $302 million. This is partially explained by the fact that 2007 saw a substantial number of multi-billion dollar mega-deals. Notably, the number of inward bound cross-border transactions actually increased 10%, totalling 206 versus 186 in the prior year. There was also an increase of 9% in the number of disclosed deals under $100 million.

M&A activity registered a robust 14% of GDP, and contributed to Russia’s continued strong economic growth. Deal making benefited from a favourable environment, supported by strong cross-border interest, domestic liquidity, a strong rouble, and macro-economic stability.

In almost all sectors, financial players were active sellers as well as buyers. Large numbers of foreign investment funds bought minority stakes, typically in the 20% to 25% range in a wide variety of industries, including food and beverage, consumer products, manufacturing and real estate. Russian financial players were particularly active in the utility sector, buying assets ranging from billion dollar generating revenue companies to stakes in small local distribution companies.

Strategic foreign investors sought local partners and entrance into the fast growing Russian economy. Consolidation continued, as domestic firms sought deals to expand market share, to integrate horizontally and vertically, and to achieve broader geographic presence. And M&A activity in the financial services contributes to economic growth particularly by strengthening what is essentially the monetary system of the economy.

The headlines from Russia were dominated by a series of huge transactions completed or contemplated in the hydrocarbons, metals, and electricity sectors. However, while less noticed by the media, the ongoing transformation of the Russian economy continued, including an increase in the number and value of lower- and mid-market M&A transactions. Mid-market M&A activity was strong across virtually all sectors, but deal making was particularly brisk in the financial services, retailing, real estate, manufacturing, and food and beverages segments.

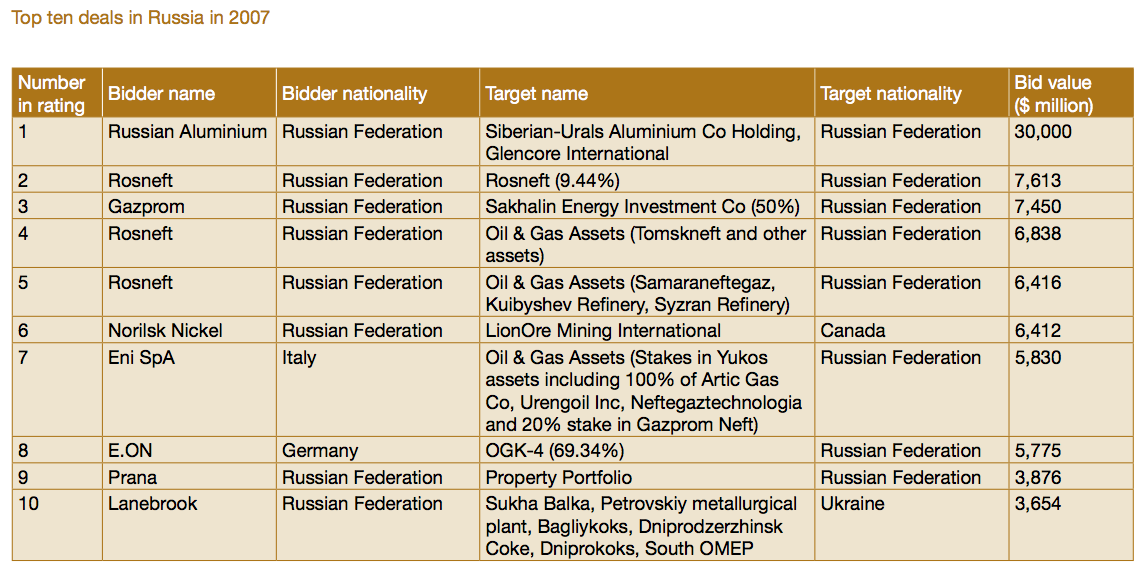

More than half of the activity, measured by value, can be traced to three key sources. The three-way RUSAL–SUAL–Glencore merger created a $30 billion national champion in aluminium. The new RUSAL then proceeded to pay $15.7 billion for a 25% plus one share stake in metals giant Norilsk Nickel. Yukos auctions saw $31 billion of assets sold, the bulk of which were bought by new national oil champion Rosneft. And the restructuring of the electricity sector took large strides forward as RAO “UES of Russia” sold off $20 billion in generating assets to a variety of foreign and domestic strategic investors.

Several themes emerge from the Russian M&A story in 2007. Virtually all business sectors saw robust activity, and average transaction sizes were greater than in 2006. Commercial motivations rather than empire building predominated, as many firms chose to divest non-core businesses in order to bring greater focus to their core activities, and buyers sought opportunities for vertical and horizontal integration.

Foreign acquirers show an ardent interest in buying into one of the fastest growing large economies. And consolidation continued to sweep through most sectors as companies sought to acquire or be acquired in order to achieve economies of scale and the necessary heft to compete in an increasingly sophisticated market. Also notable was the sharp increase in disclosure of deals, with 60% of transactions being disclosed versus only 42% in 2006.

Industries

Oil

Different industries have exhibited different dynamics based on the competitive environment they face. For example, the oilfield services industry, providing services to Russian and international oil majors such as seismic exploration, drilling, and well workovers, is underdeveloped and very fragmented. It also faces tough competition from such international giants as Schlumberger, as well as increasingly sophisticated and complex demands from their customers.

At the same time, about half of oilfield services are provided in-house. But globally, oil majors have realized that divesting these units and contracting their services leads to more efficiency, and Russian majors are beginning to follow this example. Consequently, a handful of mid-size oilfield services firms are acquiring smaller firms, consolidating the industry. By doing so, they are expanding geographically, expanding the range of services they can offer, and diversifying their client bases.

Financial services

In the financial services arena, retail banks and insurers sought new partners and new capital. The dramatic growth rates in retail lending made retail bank networks, especially in the regions, extremely attractive to both foreign and domestic players eager to buy into or expand in a compelling market, and to leverage gains in synergy and investment in technology.

A number of large Russian and European banking groups snapped up small and mid-sized commercial banks. Here, foreigners were particularly active, as Belgian KBC Group acquired Absolut Bank for $953 million, Italian UniCredit completed its acquisition of International Moscow Bank, and numerous other European and American banks bought banks or acquired stakes. Meanwhile, Russia’s Sberbank reached across the border to purchase NRB Bank of Ukraine for $150 million, announcing plans to expand further across the CIS region.

However, many of the good acquisition opportunities have already gone. As a result, even though many owners of small banks would like to sell their business, it has generally become more difficult to find a buyer.

Ongoing consolidation in the insurance business was driven by similar motives: synergies from integration, rapid growth – and new regulation – requiring more capital, and the need for technological improvements. French insurance giant AXA paid $1.16 billion for a 36.7% stake in RESO-Garantia, with a buy-out option. German insurance giant Allianz bought 97% of Russian multi-line insurer ROSNO, while Swiss insurer Zurich Financial Services bought a 66% stake in Russian NASTA Insurance Company. But in dozens of smaller transactions, consolidation continued and foreign strategic investors sought entry into the market.

Beverage

Rapid growing demand in the Russian juice and beverage sectors enticed foreign investors, both strategic and financial. The headline deal was UK private equity fund Lion Capital’s purchase of Nidan Soki, the No. 2 juice producer in Russia, for $500 million. But foreign drinks companies, such as Coca-Cola Hellenic Bottling, sought to acquire brands as well as bottling facilities and warehouse space in Russia.

Electricity

Foreign interest also ran high in the electricity sector. Russia is undertaking a massive restructuring of its entire electricity industry, with the joint aims of attracting needed investment to upgrade infrastructure and creating a competitive market.

As RAO “UES of Russia” disposed of generation assets, Europe’s electricity giants were among the most active bidders. Germany’s E.ON took away the largest prize for sale, paying $8.4 billion for Territorial Generation Company No. 5. Italian Enel also made a major commitment, buying Territorial Generation Company No. 3 for $6.3 billion. However, Gazprom was also a major buyer, picking up controlling stakes in several wholesale generating companies, and several Russian private investment funds dedicated to energy also made major acquisitions.

M&A domestic and cross-border activity

Outward activity

Leading Russian companies continued to expand their M&A horizons beyond the Russian “near abroad”, including some massive acquisitions in North America. Thanks to strong profitability and favourable commodity prices, Russian giants are flush with cash and eager to buy value-adding assets worldwide.

Also, by making purchases in Western countries, Russian firms are buying access to advanced technologies and management talent. Norilsk Nickel bought Canadian nickel producer LionOre for $6.4 billion. And financial-industrial group Basic Element spent $1.5 billion for an 18% stake of Canadian auto-parts maker Magna International. Holding company Sistema acquired Indian mobile telecom operator Shyam Telelink, announcing plans to invest up to $1 billion in the company, and an ambition to gain as much as 10% of the Indian market in the next three years.

Holding company Basic Element acquired substantial stakes in Austrian construction company Strabag and German construction concern Hochtief, both as investments and as compliments to Basic Element’s own construction ambitions in Russia, particularly in connection with the Sochi Olympics in 2014.

Inward activity

European companies ranging from ball bearing makers to switch producers bought manufacturing assets in Russia to expand their production capacities and to explore new markets. Energy intensive firms, particularly in metals, bought electricity generating assets. Steelmakers also sought out transportation acquisitions. And a variety of domestic manufacturers sought to integrate their operations either upstream or downstream. Meanwhile, other firms who had acquired non-core assets in the past sought to dispose them in order to focus on their primary businesses. Consolidation was also a main theme in retailing, as large retail chains like X5 bought regional chains to build national networks.

While a few years ago interest stemmed mostly from multinationals, “a second wave” is under way, where smaller international players come in and try to get into the Russian market. This desire to establish a presence on a quickly developing market with a high growth potential could be driven even more in the coming years by the expectation that developed markets will underperform due to slow growth.

Mid-market

Although IPOs and mega-deals in energy grabbed the headlines, 2007 saw particularly brisk activity in the mid-market arena. As the Russian economy matures, and as its participants become increasingly sophisticated, M&A is emerging as a powerful tool for value creation. After the chaotic privatisations and asset accumulation of the 90s, Russian businesses are seeking strategic and financial partners to improve their businesses and their market positions.

Strategic investors in the mid-market typically buy control. They are integrating their acquisitions into their existing business, and in some instances also buying a foothold into the rapidly developing Russian economy. For sellers, the advantages of a strategic investor include fresh capital to capture growth opportunities, access to technology, and access to western know-how and best practices.

For other businesses, a financial investor makes more sense. Financial investors are looking for high returns on their investment, made possible by the growth opportunities for small and mid-sized companies in a fast growing market. However, they prefer to leave control with the existing owners who built the business. For many of the new generation of Russian entrepreneurs, staying independent is as important as is raising new capital. And private equity interest in Russia has stepped up dramatically as deal makers have realized the opportunities available, and have become familiar with the deal making process in Russia.

Deal drivers

• As the market becomes more mature and open, it also becomes more competitive. Some owners of small and mid-sized businesses conclude that remaining competitive as independents is no longer viable.

• The need for additional capital becomes determinative as competitiveness in rapidly growing markets requires increasingly large investments in production, marketing, and sales.

• With greater competition, installing modern technology and implementing modern best practices is essential. This is especially evident in the financial services, but is increasingly important in all industries.

• There are also succession issues in the Russian market. While the average age of the typical Russian entrepreneur is only around 40, quite a number are over 50 years old and many of them realize that they need to sell when the “time to sell” is still good.

In the mid-market, many sellers were entrepreneurs who, having reached their full potential as independent concerns, sought strategic partners in order to bring their business to the next level of development, seeking both capital and know-how. Sellers showed greater sophistication, as larger numbers sought the services of financial advisors. And because buyers and sellers alike are coming to realize that the ultimate goal of M&A is to create value, more attention is being paid to issues like deal structuring, deal execution, due diligence and post-deal integration.

Financing deals

Financing M&A transactions in Russia has become easier as foreign banks enter the market, and as Russian banks have strengthened their own balance sheets.

Also, the growing sophistication of Russian banking has meant that buyers and sellers have more flexibility in structuring the financing of transactions. Buyers and sellers increasingly are employing creative deal structures in order to create greater value for both parties. For example, the purchase of minority stakes coupled with an option to complete a buy-out, typically in two to three years, results in reduced risk for the buyer and increased ultimate value for the seller.

Challenges

Buyers face a number of issues, which can be challenging but which can also create opportunities. Understanding the legal and regulatory environment is crucial in businesses such as financial services. Valuation is of course important, but particularly because some Russian businessmen are still accustomed to asset based valuation rather than more sophisticated cash-flow based methods.

And although there is an ongoing convergence of norms and behaviour, there are still significant cultural differences which matter, both before a transaction and in the post-deal integration. And the proper tax, financial, legal and operational due diligence is vital.

In summary, M&A activity in Russia in 2007 was strong because the economic fundamentals were strong, and dealmakers had incentives to use M&A as a tool to create value. Foreign financial investors sought access to investments offering an attractive risk-reward ratio and higher yields than available in their home markets, while domestic financials also sought good opportunities.

Foreign strategic investors sought entry into one of the most promising markets in the world and to acquire assets to compliment their global and regional businesses, while domestic strategic investors sought to build their businesses and solidify their market positions. The same fundamentals and incentives should support deal activity in 2008 as well.

We expect to see in the near future continued and growing activity in the Russian mid-market, with a focus on the retail and consumer goods sectors. Both sectors are still fragmented, and Russia is a large consumer market. This offers tremendous opportunities for both large Russian as well as international “consolidators”.

M&A supports the ongoing evolution of the Russian economy. As companies rationalize their operations, achieve economies of scale, and establish national brands and market positions, the quality of goods and services will improve while prices become more competitive. Moreover, as leading multinational companies increase their presence in Russia, they bring with them cutting-edge technologies and management know-how. All of this creates favourable conditions for continued strong economic performance for the Russian economy.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter