Publications Taxation Of Cross-Border Mergers And Acquisitions: Vietnam 2014

- Publications

Taxation Of Cross-Border Mergers And Acquisitions: Vietnam 2014

- Christopher Kummer

SHARE:

By KPMG

Introduction

The Vietnam tax environment for mergers and acquisitions (M&A) continues to evolve. Although gaps remain, new rules may allow for new planning opportunities. The continued development of the rules shows a trend towards converging with international norms. This chapter provides basic information to potential investors and deals with both asset and share purchases.

This chapter proceeds by addressing three fundamental decisions which face a prospective purchaser:

- What should be acquired: the target’s assets or its shares?

- What should be the acquisition vehicle?

- What issues should be considered in financing the acquisition vehicle?

Tax is, of course, only one part of transaction structuring. In Vietnam, the enterprise law primarily governs the legal form of the transaction. However, an acquisition in Vietnam may involve a number of government approvals. The Investment Law, Vietnam’s World Trade Organization (WTO) commitments and licensing procedures also play a significant role.

Although improving, the laws and regulations in Vietnam are still not very well established. Investors into Vietnam should not expect the same degree of legal certainty that is available in more developed jurisdictions.

Recent developments

Current Vietnamese environment

Vietnam has seen a general trend of increased investment since its entry into the WTO in 2007. As a member of the WTO, Vietnam is required to adhere to its WTO commitments and adopt more international rules.

Although Vietnam committed to many positive changes to its legal environment as part of its WTO membership, there remains a considerable lack of guidance available regarding the execution of such commitments.

During the past year, M&A activities in Vietnam have been increasing, as Vietnam is once again perceived as a promising growth market. The primary investors have been from Japan, Korea and Taiwan, but increasingly other investors are becoming active in the market. In 2014, Vietnam’s M&A activity should continue to grow as foreign investors continue to view Vietnam as a promising market. The Trans-Pacific Partnership currently under negotiation may also drive more interest in M&A activities in Vietnam.

New legislation issued in 2012 and 2013

A significant number of laws and regulations (Decrees and Circulars in Vietnam) were issued in 2012 and 2013 that may have an impact on Vietnam M&A activities:

- new Law on Corporate Income Tax (CIT) 2013 was issued to amend the respective Law on CIT in 2008, and a related new Decree was issued (effective as of 2014).

- new Law on Value Added Tax (VAT) 2013 was issued to amend the respective Law on VAT in 2008 and a related new Decree was issued (effective as of 2014).

- new Circular 32/2013/TT-NHNN was issued providing guidance on the use of foreign currencies within the territory of Vietnam.

Asset purchase or share purchase

An acquisition of a company in Vietnam can take the form of a purchase of assets or the purchase of shares (technically, ownership interests in the case of a limited liability company – LLC). The choice of method of acquisition is affected by factors such as the potential corporate tax rate on gains, VAT, transfer taxes and tax attributes.

Many acquisitions in Vietnam occur in the form of share purchases because of some non-tax and licensing issues. However, assets deals may be more desirable in some cases due to potential liability issues and the ability to rebase the asset value for tax depreciation purposes.

Foreign investors must establish (or already have) a Vietnamese entity to hold assets in Vietnam for investment purposes. For existing Vietnamese entities, the business license may need to be amended to allow for the expanded activities following the purchase of assets.

The establishment of a Vietnamese entity or amendment to the business license can be a lengthy process and may entail multiple approvals. therefore, in most cases, the purchaser is likely to purchase the shares in the target Vietnamese entity.

Some of the tax considerations relevant to each acquiring method are discussed later in this chapter. The advantages and disadvantages of each method are summarized at the end of this chapter.

Purchase of assets

A main benefit of the purchase of assets is the avoidance of secondary tax liability from a share acquisition, so less due diligence is required.

The acquisition of assets must be substantiated by legitimate tax invoices and other supporting documents, e.g. sales invoices and sales contracts.

Purchase price

In Vietnam, the valuation of assets for transaction purposes is a matter of mutual agreement between the seller and the buyer. However, using commercially justifiable valuations is important. The authorities may look to market value (based on their data sources) and have the power to deem values and thereby taxes payable on gains from transactions if they are not satisfied that the transaction reflects commercial realities.

The sale of assets is subject to VAT in most cases (at a default rate of 10 percent). The seller of the asset is subject to CIT at 22 percent (25 percent before 1 January 2014) on the gain from the asset transfer.

Goodwill

Tax in Vietnam is applied on an entity-by-entity basis (i.e. no group consolidation for tax purposes). Acquired goodwill may be amortized over a maximum period of 3 years.

Depreciation

The CIT rules allow the cost of assets to be written off against taxable profits by means of tax depreciation where certain conditions are met. Depreciation of both new and used fixed assets is calculated based on the historical cost and useful life of the fixed assets within the regulated time frame.

Under Vietnamese rules, an asset is considered to be a fixed asset for tax depreciation purposes where all the following conditions are met:

- there is a high degree of certainty that a future profit will be obtained from utilizing the assets.

- the useful life of such asset is at least 1 year.

- the value of such asset is at least 30,000,000 Vietnamese dong (VND) (approximately 1,400 US dollars – USD).

An enterprise should itself determine the useful life of its fixed assets within the regulated timeframe.

The depreciation timeframe for plant and equipment is from 2 to 30 years, depending on the types of equipment.

The depreciation timeframe for intangible assets is from 2 to 20 years. Like goodwill, patents and know-how are not considered as intangible fixed assets for tax purposes and may only be amortized over 3 years.

Tax attributes

In the case of an asset transfer, the unused tax losses normally remain with the company. Tax losses and incentives cannot be transferred in an asset acquisition. these tax attributes remain with the company or are extinguished. There are no specific rules for the acquisition of an entire business (and not in the form of share deal) for CIT purposes in Vietnam.

Where share acquisitions of companies are made, tax attributes can be preserved but conditions and limitations apply.

Value added tax

The transfer of most assets in Vietnam is subject to VAT.

Current law imposes VAT on goods and services at three rates: 0 percent, 5 percent, and 10 percent. The standard VAT rate is 10 percent.

There are no specific rules in Vietnam related to the transfer of a going concern and favorable VAT treatment.

The seller is required to issue VAT invoices for the sale of the asset, and VAT must be added to the sales price and indicated in the invoice issued. This VAT becomes input VAT of the buyer, provided the assets are used in business activities that are subject to VAT.

Business establishments are not required to declare and pay VAT on the following transactions:

- capital asset contribution for establishing an enterprise

- transfer of assets between dependent cost accounting entities

- transfer of assets on demerger, division, consolidation or conversion of form of the enterprise.

VAT applies separately from transfer taxes, and, in some instances, both taxes apply.

Asset registration tax (stamp duty)

Properties are the most notable assets subject to asset registration tax. Unlike many jurisdictions, the amount of asset registration taxes in Vietnam is capped, making it typically a less material issue. When the assets subject to registration taxes are transferred, the new registered asset owner is required to pay the applicable asset registration taxes.

Specific asset registration tax rates apply to certain kinds of assets listed in the regulations. For properties, the rate is 0.5 percent. However, as noted above, the materiality of this tax is often limited as the amount of such asset registration taxes payable on any asset cannot exceed VND500 million (approximately USD24,000), except for cars with fewer than 10 seats, aircraft and cruisers, which have no such cap. Asset registration taxes must be declared and paid no later than 30 days from the transaction date.

Asset registration taxes are not applicable to share transfers.

Purchase of shares

The purchase of a target company’s shares may be preferred in some cases to preserve tax incentives or losses of the target company. In most cases, foreign investors are permitted to hold a maximum stake of 49 percent in a public joint stock company. In most other cases, foreign ownership is not restricted unless specifically provided for under Vietnam WTO commitments for certain industries and sectors. This liberalization since 2009 has created a more open investment environment for investors, especially in combination with the gradual removal of restrictions on the capital holding ratio of foreign investors in specific sectors in line with WTO commitments.

Capital gains tax

Capital gains from the sale of shares are normally subject to capital gains tax at 22 percent as of 1 January 2014 (previously, 25 percent). The taxable gain is determined as the difference between the sales proceeds less investment cost and transfer expenses.

However, gains from the sale of shares in a public company or listed company, which are technically recognized as securities, can be subject to tax at 0.1 percent of the gross sales proceeds (replacing the capital gains tax applicable on net gains).

Tax treaties may provide certain protection from the above taxes. Use of an offshore holding company may also provide certain opportunities for tax mitigation on exit.

Tax indemnities and warranties

The tax exposures of a target company can be transferred to the purchaser after the share purchase transaction is complete. Therefore, the purchaser should pay close attention to the target company’s tax compliance status. For this reason, customary tax due diligence exercises are important for identifying significant tax issues in M&A transactions.

As the target company’s contingent liabilities may transfer to the purchaser, the tax indemnities and warranties for contingent tax liabilities should be thoroughly addressed in the transaction agreements.

Tax losses

Tax losses of a company can be carried forward for up to 5 years, starting from the year in which the losses are first incurred. accordingly, losses incurred by the target company prior to the transaction may continue to be offset against the taxable income of the company after the transaction. There are no specific shareholder continuity tests in Vietnam.

Group relief for losses does not currently exist in Vietnam.

Pre-sale dividend

In certain circumstances, the seller may prefer to realize part of the value of their investment as income by means of a pre-sale dividend. The rationale here is that after-tax retained earnings can be freely distributed to the corporate investor (in or out of Vietnam) without suffering further Vietnam WHT. Therefore, the dividend reduces the proceeds of sale and thus the gain on sale. As the rules in this area are frequently changed, each case must be examined on its facts before entering a proposed transaction.

Annual remittance of dividends abroad may be made only where the company has completed the declaration of CIT for the relevant financial year, issued audited financial statements and received clearance from the tax office.

Profit and/or dividend remittance is not allowed where the financial statements of the target company show accumulated losses.

Choice of acquisition vehicle

Several potential acquisition vehicles are available to a foreign purchaser of a company in Vietnam, and tax factors often influence the choice. In addition to local foreign invested companies, the main types of vehicles for acquiring shares or assets in Vietnam include the following entities.

Local holding company

Foreign investors rarely use this vehicle as it may require obtaining a license from the Vietnam authorities, which can be onerous and time-consuming. In addition, as there are currently no tax consolidation rules in Vietnam, there is no tax group benefit from such a vehicle.

Foreign parent company

Foreign purchasers normally choose to use a foreign parent company structure, which produces certain tax benefits. Dividends paid to foreign parent companies are not subject to Vietnamese withholding tax (WHT) as long as they are paid from after-tax profits of the subsidiary.

Interest payments to a foreign parent company (i.e. shareholder loan) are subject to WHT at 5 percent.

Tax clearances

A company is required to conduct tax finalization with the local tax authorities up to the time of the decision on the consolidation, division, merger, de-merger or conversion.

Repatriation of profits

After fulfilling all tax and financial obligations, foreign investors can repatriate their after-tax profit out of Vietnam, without any further WHT for corporate investors and with 5 percent WHt for individual investors.

A foreign parent company is subject to CIT of 22 percent on the gains arising from a sale of shares or WHT of 0.1 percent on the gross sale proceeds (when selling shares of a subsidiary, provided the shares are considered as securities under Vietnam law, i.e. the target is a public or listed company).

Foreign investors may seek a tax exemption on income from the transfer of capital in Vietnam under a tax treaty between Vietnam and the respective foreign country where relevant.

Non-resident intermediate holding company

An intermediate holding company resident in a favorable treaty territory may be a popular structure for deals in Vietnam, but attention should be paid to Vietnam’s new anti-treaty shopping provisions, introduced in a circular that applies as of early 2014. Typical intermediate holding company jurisdictions include Singapore, Hong Kong, some european countries and low-tax jurisdictions.

Choice of acquisition funding

Debt

Investors may choose to fund their acquisition by debt arranged locally or from offshore.

However, for Vietnamese legal entities using debt to fund the acquisition, interest expenses incurred may not be deductible for Vietnam CIT purposes.

Under the domestic tax regulations, debt financing arranged locally does not attract WHT. However, for cross-border financing, an interest WHT rate of 5 percent applies. Of approximately 60 tax treaties currently in force, only the tax treaty with France provides tax exemption for interest on commercial loans. The other treaties generally specify a maximum interest WHT rate that is equal to or higher than the Vietnamese 5 percent domestic rate.

Deductibility of interest

Interest expenses are typically deductible against taxable income in the Vietnamese entities. There are no thin capitalization rules as such; however, an equity-to-debt ratio is specified in the investment certificate by virtue of specifying the charter capital (equity) and investment capital (debt capacity = total investment capital less charter capital). In the past, this was restricted to 30:70. there is now no such specific restriction, but, in practice, it is difficult to convince the tax authorities to license a highly leveraged venture.

The tax-deductibility of interest is limited to 1.5 times the basic interest rate announced by the State Bank of Vietnam as of the date of the loan. Additionally, foreign loans need to be registered with the State Bank of Vietnam before the interest and related expenses are allowed as deductible for CIT purposes on the part of the borrower.

Interest payments on loans used as contributions to charter capital (equity) and interest payments made before a legal entity has commenced production and business are normally not deductible for CIT purposes.

Withholding tax on debt and methods to reduce or eliminate it

The interest payment on debt from a non-resident party in Vietnam is subject to WHT at 5 percent, unless reduced under a tax treaty.

Treaty relief is not automatically granted to beneficiaries unless conditions for tax exemption or reduction are met. Prior approval from Vietnamese tax authorities must be obtained before the exemption has effect. Professional advice should be sought to comply with requirements on tax treaty claims under both domestic laws and treaty provisions.

Hybrids

Hybrids are not used in Vietnam.

Deferred settlement

An acquisition often involves an element of deferred consideration, the amount of which can only be determined at a later date on the basis of the business’s post-acquisition performance. Depending on the structure, the seller may only be exposed to Vietnamese taxation once income/gain from the future amount is realized.

Other considerations

There are a number of relevant rules that are subject to frequent changes. Before proceeding with acquisitions, investors should seek professional advice on a range of related issues, such as foreign exchange control, repatriation of funds, and limitations on foreign ownership.

Concerns of the seller

Corporate seller of shares/interest

Under CIT law, Vietnamese corporate sellers are ordinarily subject to 22 percent tax on any gain. Foreign corporate investors are subject to 22 percent tax on any gain (when selling the capital contribution in the subsidiary) or WHT of 0.1 percent on the gross sales proceeds (when selling shares of a subsidiary, provided the shares are considered as securities under Vietnamese law, i.e. the target is either a public or listed company).

Individual seller of shares/interest

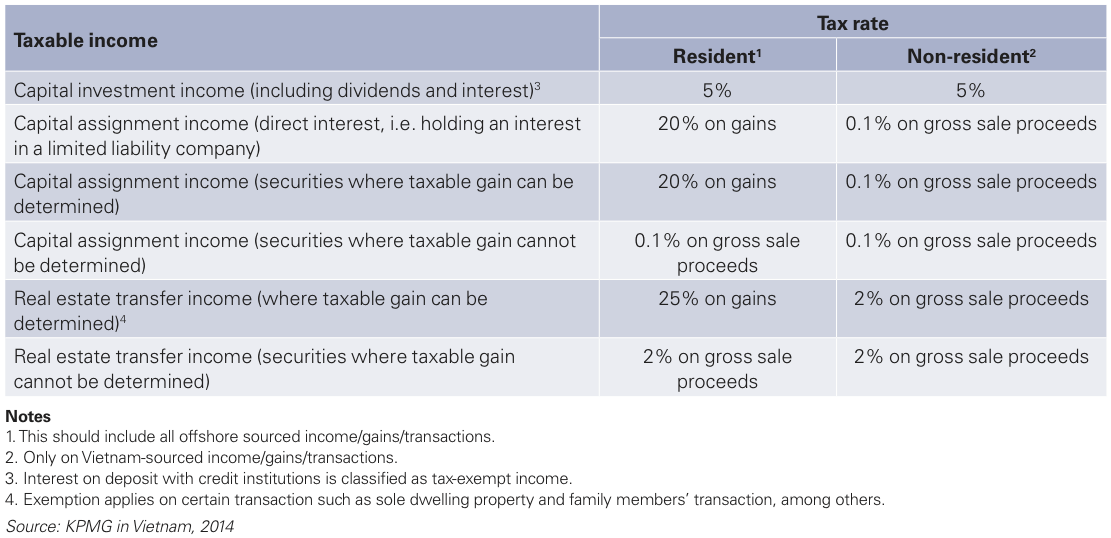

Pursuant to the Law on Personal Income Tax (PIT), an individual seller is subject to tax on capital investment and capital assignment at the rates in the following table.

Company law and accounting

Company law

Vietnamese legal entities are mainly governed by two laws: the Law on Investment (LOI) and Law on Enterprise, as well as related regulations.

Vietnam does not have a specific company law as do many more developed jurisdictions. The Law on Enterprises (which includes partnerships and other business enterprises) does not have detailed provisions related to M&A activity.

Additionally, in Vietnam, the licensing of various activities by a range of government authorities can be time-consuming and administratively burdensome.

Vietnamese legal entities that are most relevant for M&A purposes take one of the following forms:

- multi-member LLCs

- single-member LLCs

- shareholding companies.

Under the LOE, enterprises may be divided, separated, consolidated, merged, converted or dissolved. Each entity is generally subject to corporate income tax of 22 percent on the net profits of the business (subject to a range of incentives).

Generally, new foreign businesses in Vietnam, except for banks and insurance businesses, are not required to set up and contribute after-tax profits to any compulsory reserves. therefore, all after-tax profits can by fully remitted overseas.

While a foreign investor is entitled to contribute capital or purchase shares in Vietnamese companies, certain sectors and industries have government-imposed limits on the equity ownership allowed to foreign investors. The general principle is that both foreign and domestic business entities are entitled to make capital contributions, purchase shares or acquire interests in all companies in Vietnam, except for:

- public companies, including listed companies (49 percent cap remains in place)

- businesses operating in certain specialized industries

- equitized state-owned enterprises (SOE)

- specific limitations set out in Vietnam’s commitments to the WTO for a number of industries.

Accounting standards

In Vietnam, Vietnamese accounting standards No. 11 predominantly determine the accounting treatment of business combinations. Generally, these standards should be applied to business combinations using the purchase method.

A business combination may be structured in a variety of ways. Under the accounting rules, this may involve the purchase by an entity of the equity of another entity, the purchase of all the net assets of another entity, the assumption of the liabilities of another entity, or the purchase of some of the net assets of another entity that together form one or more business. The transaction may be effected by the issue of equity instruments or the transfer of cash, cash equivalents or other assets, or a combination thereof.

An acquirer must be identified for all business combinations. The acquirer is the combining entity that obtains control of the other combining entities or businesses.

A business combination may result in a parent-subsidiary relationship, in which the acquirer is the parent and the acquiree is a subsidiary of the acquirer. In such circumstances, the acquirer applies this standard in its consolidated financial statements. The parent includes its interest in the acquiree as an investment in a subsidiary in any separate financial statements issued by the parent.

Group relief/consolidation

There are no tax group relief or consolidation rules in Vietnam.

Transfer pricing

Vietnam transfer pricing rules are currently being aggressively enforced, especially for foreign invested entities, some of which the media perceive as abusing transfer pricing practices to evade taxes. Transfer pricing rules normally apply where the parties to a transaction are under common control. Transactions caught by the rules are required to meet the arm’s length standard. Broadly speaking, Vietnam follows the Organisation for Economic Co-operation and Development guidelines but with local modifications.

Dual residency

Dual residency is not applicable in Vietnam.

Foreign investments of a Vietnamese company

In practice, outbound investment is not common as Vietnam is primarily an inbound investment destination. However, the Vietnamese government does have specific rules related to such activities. Vietnamese companies are required to obtain specific approval/permit from the licensing authorities to make investment overseas.

The Vietnamese company is required to repatriate back to Vietnam all profits earned from investment projects within 6 months from the date of completion of the project. Other detailed rules may also apply.

Comparison of asset and share purchases

Share purchases lead to ownership of part or all of the target company, which can preserve licensing benefits of that target entity but can also lead to the potential inheritance of the past tax liabilities. Another key factor in determining whether to use an asset or share deal in Vietnam is that the purchase of asset is subject to VAT, and the purchase of shares is not.

To be able to purchase Vietnamese assets, the buyer must establish a Vietnamese entity to hold the assets. Sales of assets are taxed at 22 percent of the gain, while share transfers can be taxed at either 22 percent of the gain or at 0.1 percent of the gross sale proceeds, depending on the type of shares being transferred and where required conditions are met.

Advantages of asset purchases

- The full purchase price can be depreciated or amortized for tax purposes (including acquired goodwill).

- No previous liabilities of the company are inherited.

Disadvantages of asset purchases

- A foreign investor must have an entity in Vietnam for purchasing of assets.

- Possible need to renegotiate supply, employment and technology agreements, etc.

- Benefits of any tax incentives and tax losses incurred by the target company remain with the seller (but may be lost altogether).

Advantages of share purchases

- Purchaser may benefit not only from tax losses but also from CIT incentives of the target company.

- Share purchases are not subject to VAT.

Disadvantages of share purchases

- Purchaser is fully responsible for all past/inherent liabilities, including current tax and debts as well as any liabilities arising in the future as a result of past activities of the company.

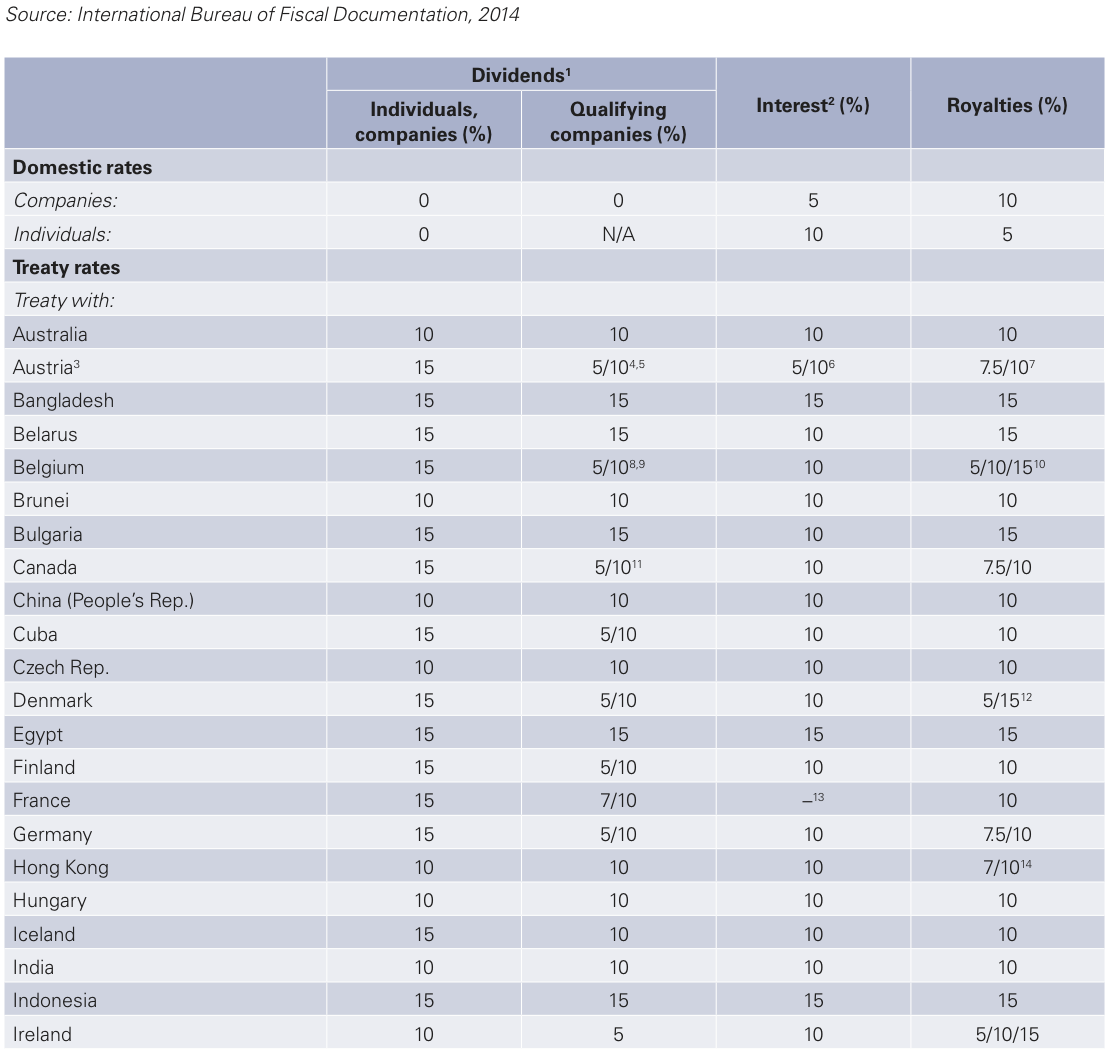

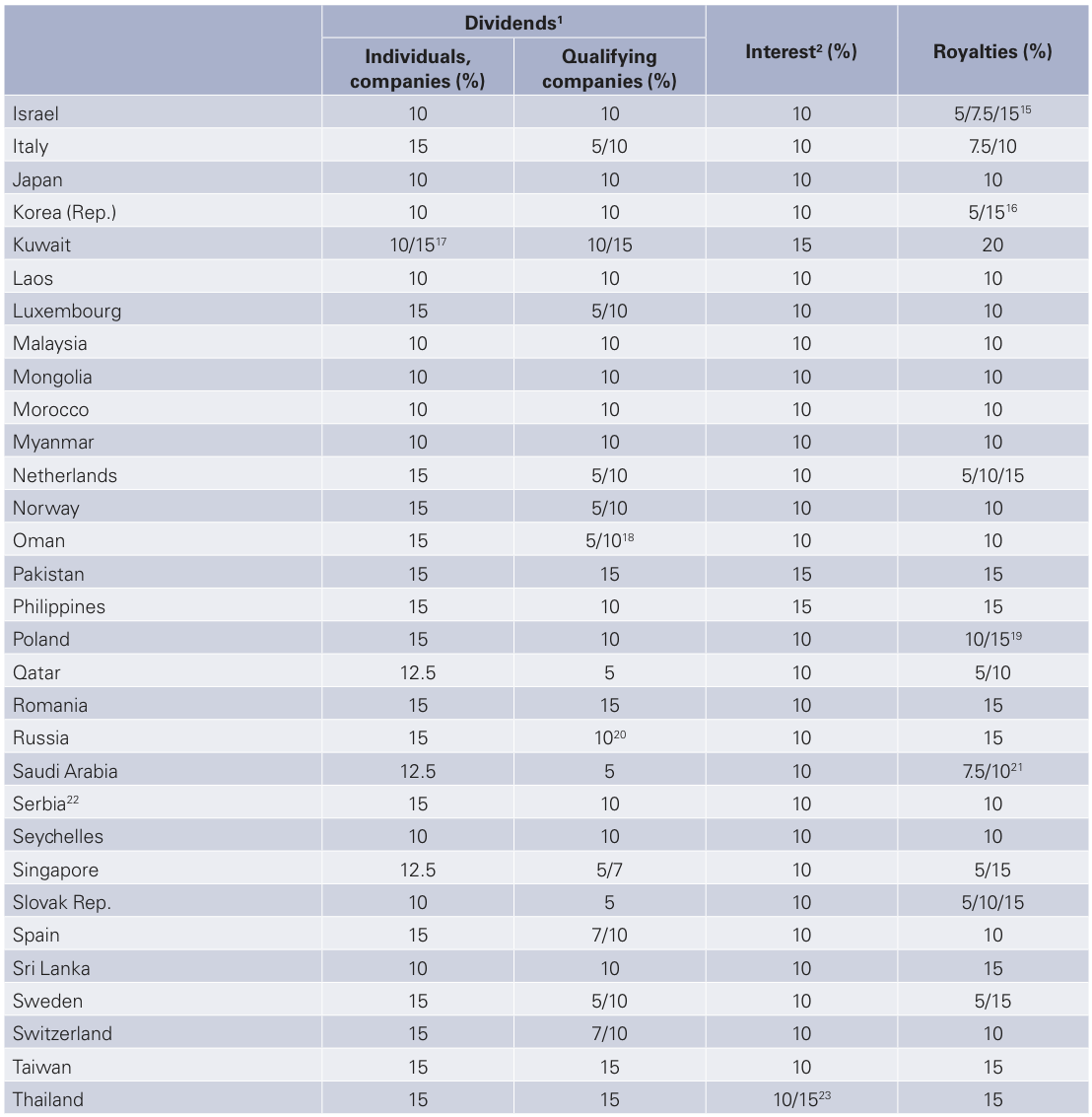

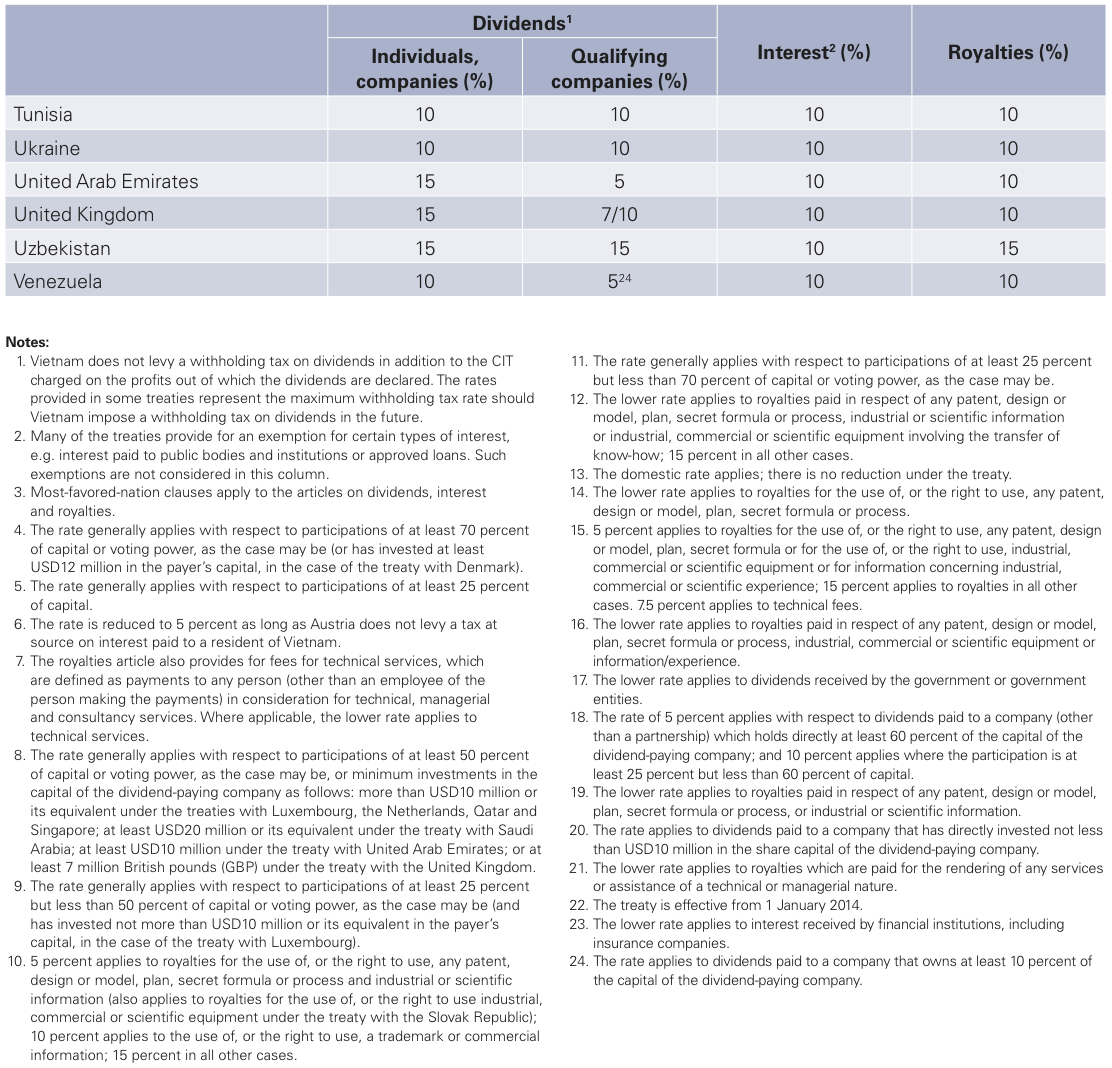

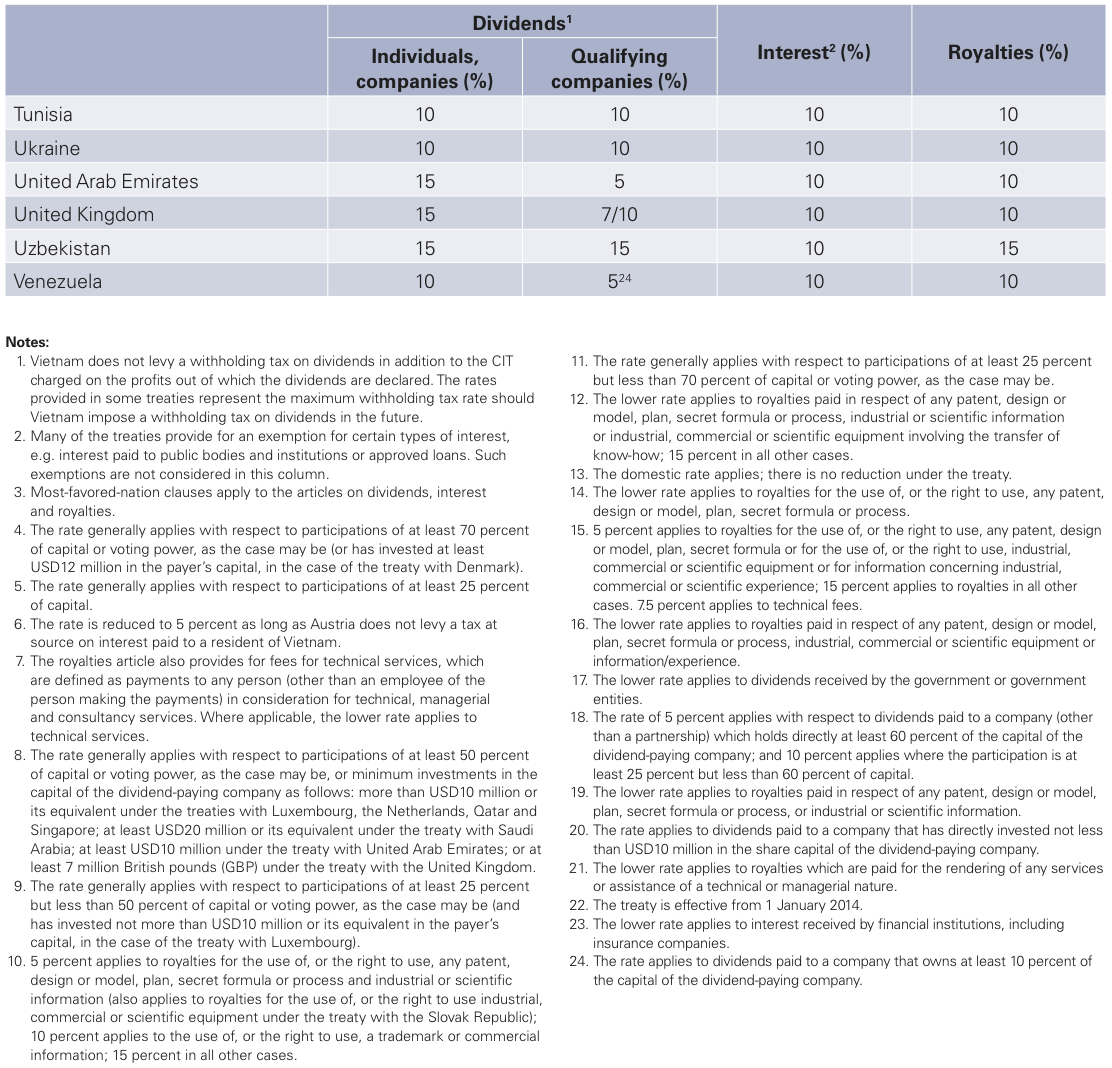

Vietnam – Withholding tax rates

This table sets out reduced WHT rates that may be available for various types of payments to non-residents under Vietnam’s tax treaties. This table is based on information available up to 1 August 2013.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter