Publications Due Diligence: Think Operational

- Publications

Due Diligence: Think Operational

- Bea

SHARE:

Discovering “Quick Win” Value In Mergers And Acquisitions

By Jürgen Rothenbücher, Sandra Niewiem – A.T. Kearney

With fewer good acquisition targets, tighter credit markets and skyrocketing deal prices, companies pursuing mergers or acquisitions must be certain that the target in their crosshairs can create value—and quickly. As operational and business knowledge becomes synonymous with a successful merger, more buyers are not only performing strategic due diligence but also operational due diligence to truly understand where value lies within the target company, and to uncover any hidden issues that might disrupt growth.

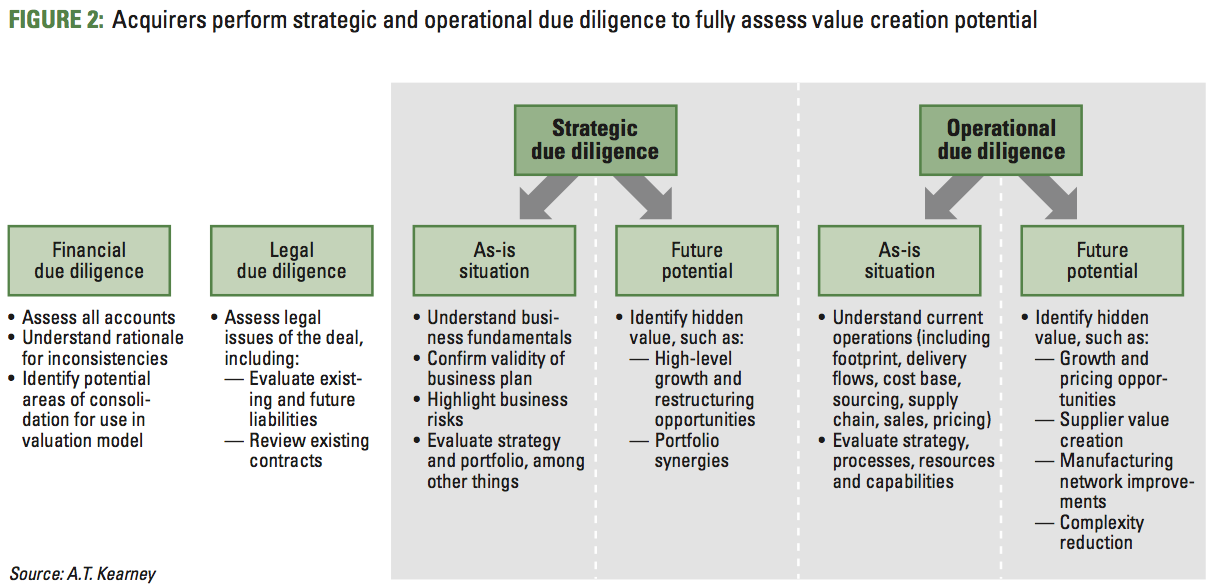

Due diligence is a key activity in mergers and acquisitions (M&A) because it is the point at which both the potential for value creation and the purchase price are determined. Most acquirers perform strategic due diligence—reviewing financial and commercial data—to assess the current state and potential of a target prior to the transaction. Increasingly, companies are going a step further and also performing operational due diligence in an effort to capture value sooner and to dispel any hint of failure.

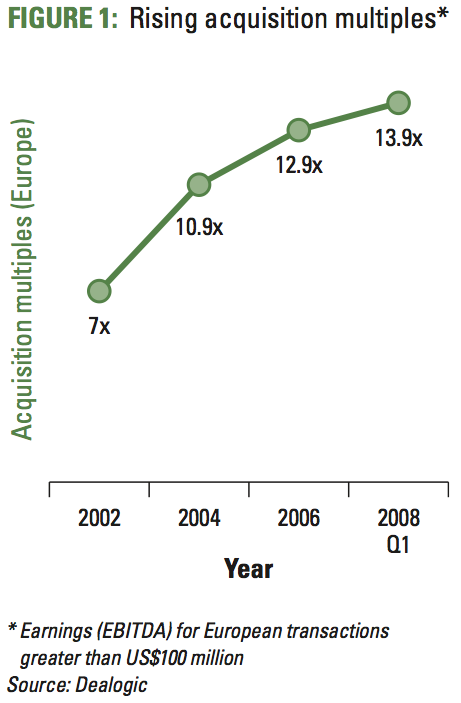

The first movers: Private Equity firms changed M&A forever, setting the bar higher and forcing today’s deals to show value quickly. PE firms used to employ financial engineering and other leverage approaches. But as these approaches fell out of favor due to legislative changes and increasing acquisition multiples, many PE firms began exploring more active, short-term value creation techniques (see figure 1).

PE firms settled on operational due diligence as a strategy for discovering short-term value creation potential such as tangible top- and bottom-line improvements immediately after closing a deal, mitigating any associated risks.

Today, traditional firms are following in the PE first movers’ footsteps. Many firms are conducting operational due diligence to complement strategic due diligence, and are doing so as part of their standard merger assessment. One such case is the $47 billion merger of Procter & Gamble (P&G) and Gillette in 2005. The prompt integration of operational processes, particularly in sales and procurement, led to a speedier integration, smoother transition and faster realization of synergies. At P&G and Gillette, and companies like them, operational due diligence and attentive merger planning are boosting the value of the newly merged company, and quickly.

Firms use operational due diligence as an M&A strategy for discovering short-term value creation, capitalizing on tangible top- and bottom-line improvements immediately after closing the deal.

The Deal Looked Good

Deals that initially appear attractive—in terms of generating short-term value—often fail due to internal and business inefficiencies not noticed during the pre-merger strategic due diligence. Such problems often prevent the new company from capturing value quickly. We can illustrate this using the case of a software firm that acquired two other software firms in 2000. A year later the company sold the two acquisitions for 3 percent of the original price — an incredible waste of money. When asked the reason for the quick sale, company executives pointed to a failed integration. The two targets had a very young and entrepreneurial organizational style compared to the more established acquirer, and their organizations and processes did not match. Many functions that appeared to be similar turned out to perform very different tasks. An operational due diligence performed early in the process would have revealed the risks and the efforts needed to integrate these three businesses long before it was time to evaluate potential synergies. Clearly, determining short-term value creation is becoming an important part of the pre-acquisition process (see “A Complement to Strategic Due Diligence”).

A Complement to Strategic Due Diligence

Lately, some critical voices have been raised against strategic due diligence. Experienced acquirers see the lack of detail and insufficient focus on short-term, operational value. In the pre-acquisition phase, incomplete understanding of a business may result in the loss of an attractive deal to a competing bidder that offers a better price based on more detailed knowledge of the “hidden” value of the target. Or, not knowing the economies of an operation, a potential buyer might also be overly optimistic and overestimate the improvement potential. Post- acquisition “skeletons in the closet” may slow down value creation and—in the worst case scenario—lead to an unsuccessful acquisition. Hence, strategic due diligence performed on a standalone basis falls short and can be risky.

A complementary check-up of the operations mitigates these risks. In addition, operational due diligence provides significant advantages. A true understanding of the business and an early grasp of short-term value levers leads to more benefits realized faster. Looking below the surface is the key to making sure the soon-to-be purchased company provides tangible short-term synergies and quick-win improvements.

A Comprehensive Health Check

Operational due diligence is akin to a comprehensive internal health check of a company—an extra effort that examines short-term value creation potential and helps determine an accurate bidding price. As described in figure 2, operational due diligence focuses on operations and internal data, rather than strategic and commercial aspects, and aims to find “quick win” opportunities to improve performance.

The beauty of operational due diligence is that it is hypothesis-driven—the areas of focus are determined based on the specific target and will vary from case to case. However, there are four areas that are consistently part of, and will benefit from, operational due diligence:

Sales and marketing. Sales capabilities and functions provide the most significant insight into a company’s potential for rapid growth. For example, through management interviews and stages of excellence analyses, operational due diligence assesses the company’s efficiency in marketing, sales and account management and its potential for accelerated short-term growth. Potential buyers often neglect the possibility for profitable growth, including considering pricing opportunities, often because of their seemingly less tangible impact and mid-term focus. However, sales can yield quick, tangible results.

Purchasing. Procurement provides a common source for supplier value creation, particularly in aligning purchasing across divisions, and increasing transparency of external spending. Operational due diligence classifies spending according to categories, suppliers, divisions and regions, and compares results with similar companies. Interviews with purchasing representatives and select suppliers, and sample-spend analyses will also help identify areas for short-term improvements.

Manufacturing and supply chain. Operational due diligence conducts sample site audits and external comparisons to look for relocation and consolidation opportunities in the overall manufacturing network. Also, the review examines shop floors for poorly aligned processes, underutilized assets and redundancies with an eye toward improving operations at individual sites—leading to savings through increased asset effectiveness, improved efficiency, and automation.

General services and administration (G&A). General services and administration is often a tangle of complexity and missed opportunities to fully leverage new technology and outsourcing opportunities. Typically, operational due diligence focuses on areas such as finance, human resources, information technology and sales support to identify prospects for coordinating processes, increasing systems support, and promote shared services, outsourcing and offshoring. The review includes interviews with key managers, resource analysis, quality surveys and the use of external benchmarks.

At P&G, the prompt integration of Gillette’s operational processes led to a speedier integration, smoother transition and faster realization of synergies.

Best-Practice Approach

Operational due diligence uses a systematic approach to assess the top- and bottom-line improvement potential of a target company and to understand the associated risks. The analysis can take between four and eight weeks, somewhat longer than strategic due diligence. The challenge is in gathering hard-to-obtain data and performing in-depth assessments over a relatively brief period of time. The review requires a dedicated team of experts and access to accurate external benchmarks to obtain a comprehensive understanding of the potential for short-term operational improvements and value-creation. For companies that employ operational due diligence in conjunction with strategic due diligence, the benefits gained are worth the extra effort — and could mean the difference between a successful merger and a failed one.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter