Publications Mergers & Acquisitions Quarterly Switzerland – First Quarter 2010

- Publications

Mergers & Acquisitions Quarterly Switzerland – First Quarter 2010

- Bea

SHARE:

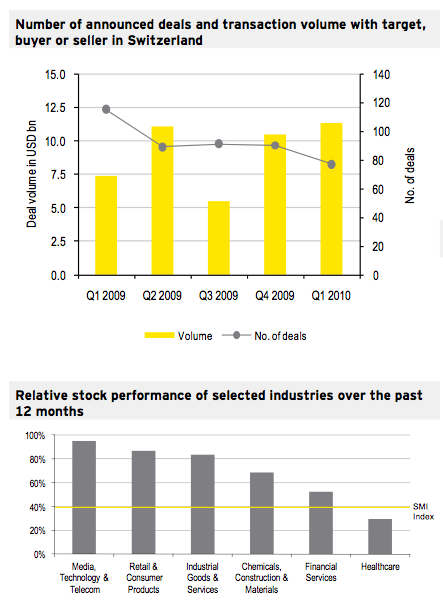

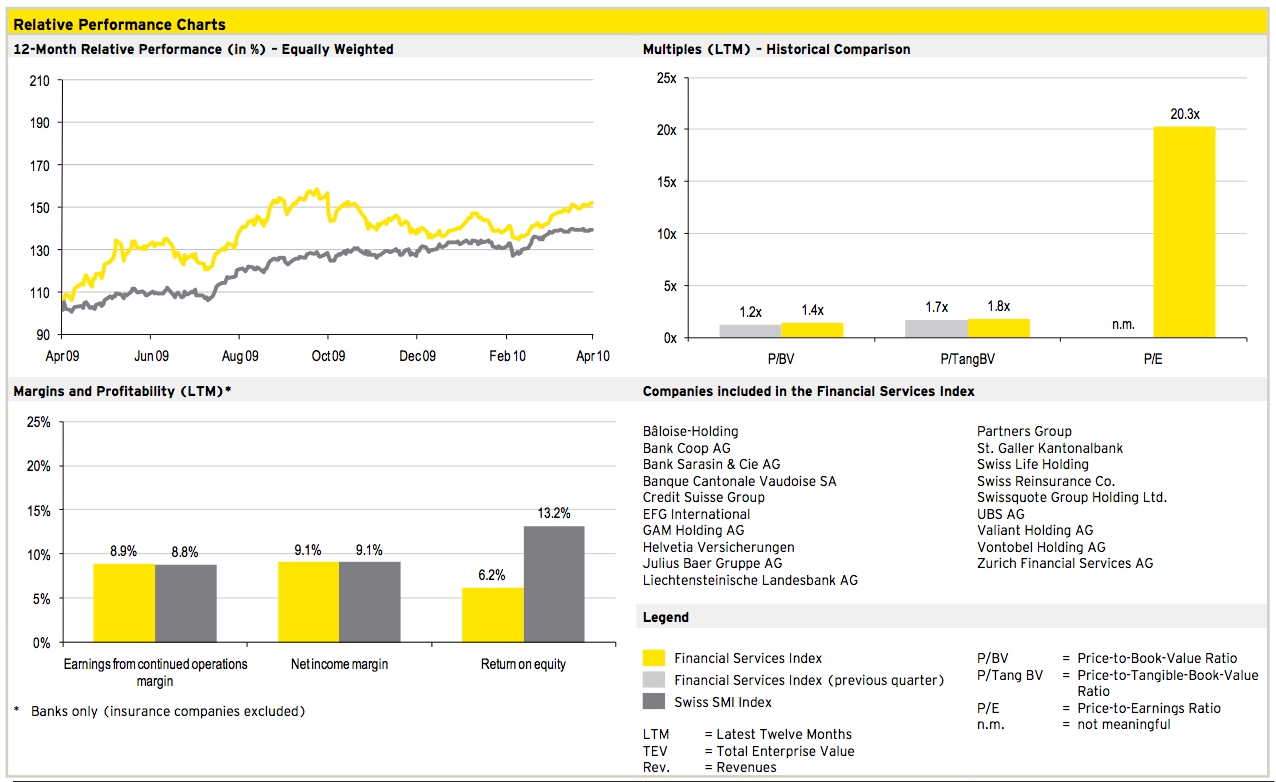

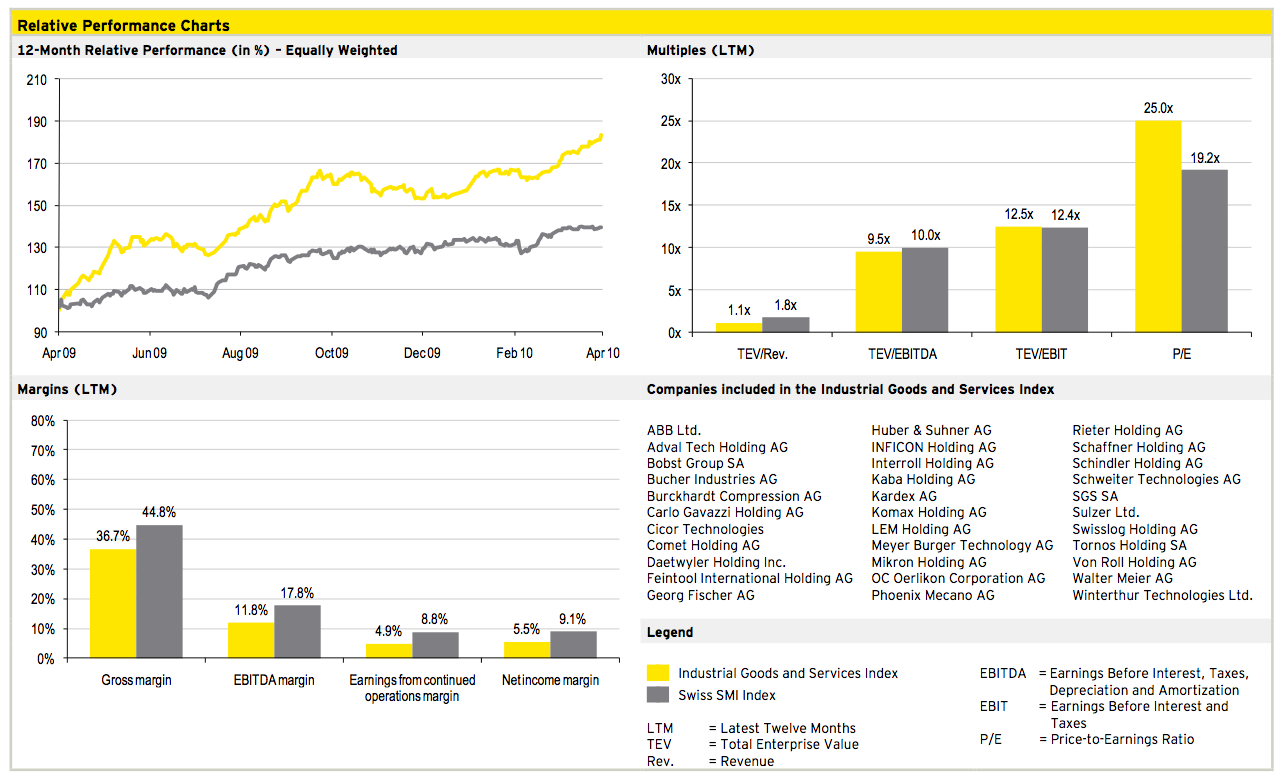

In the first quarter of 2010, the slight increase in transaction volume in Swiss M&A activity compared to Q4 2009 shows signs of a stabilizing M&A market. Stock performance in Switzerland was positive for the fourth consecutive quarter, with an overall increase of 40% compared to the end of Q1 2009.

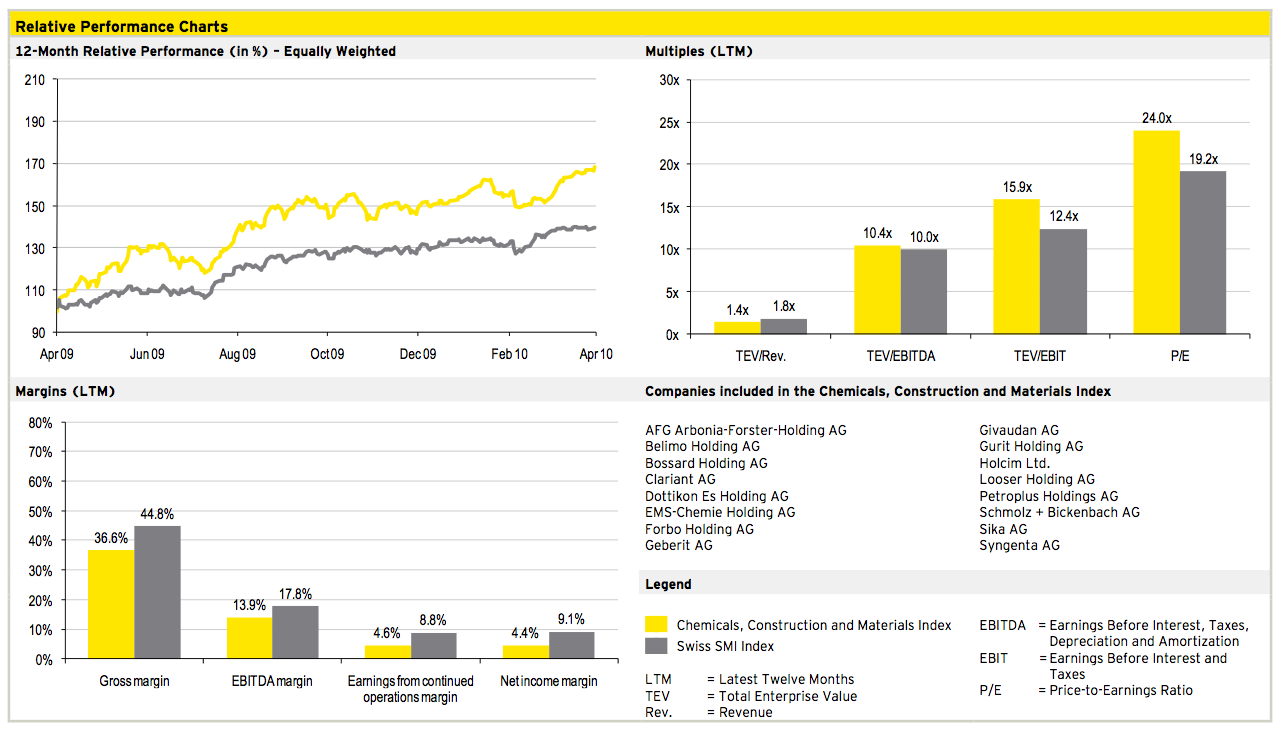

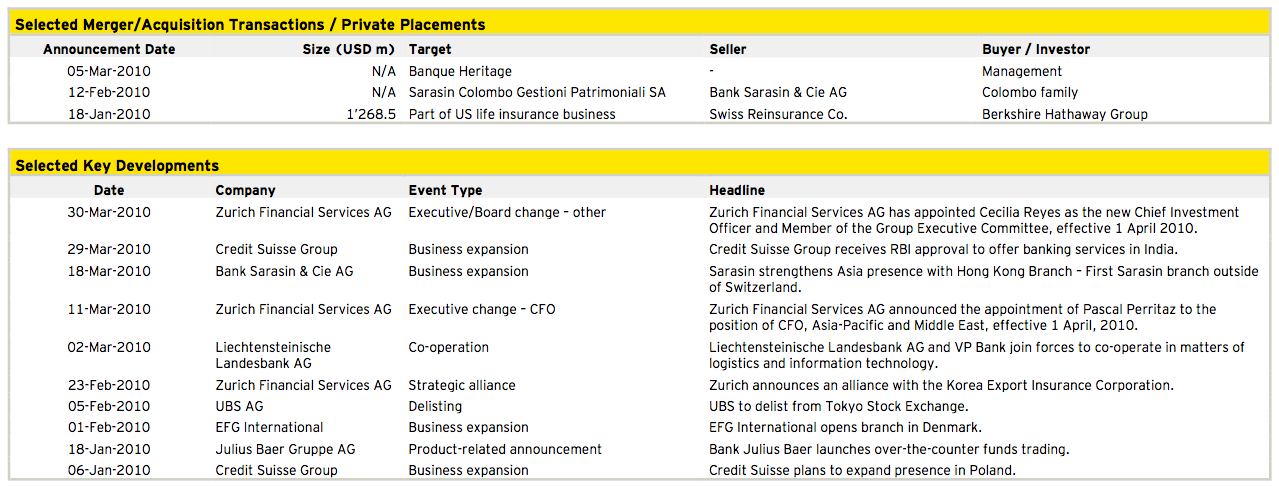

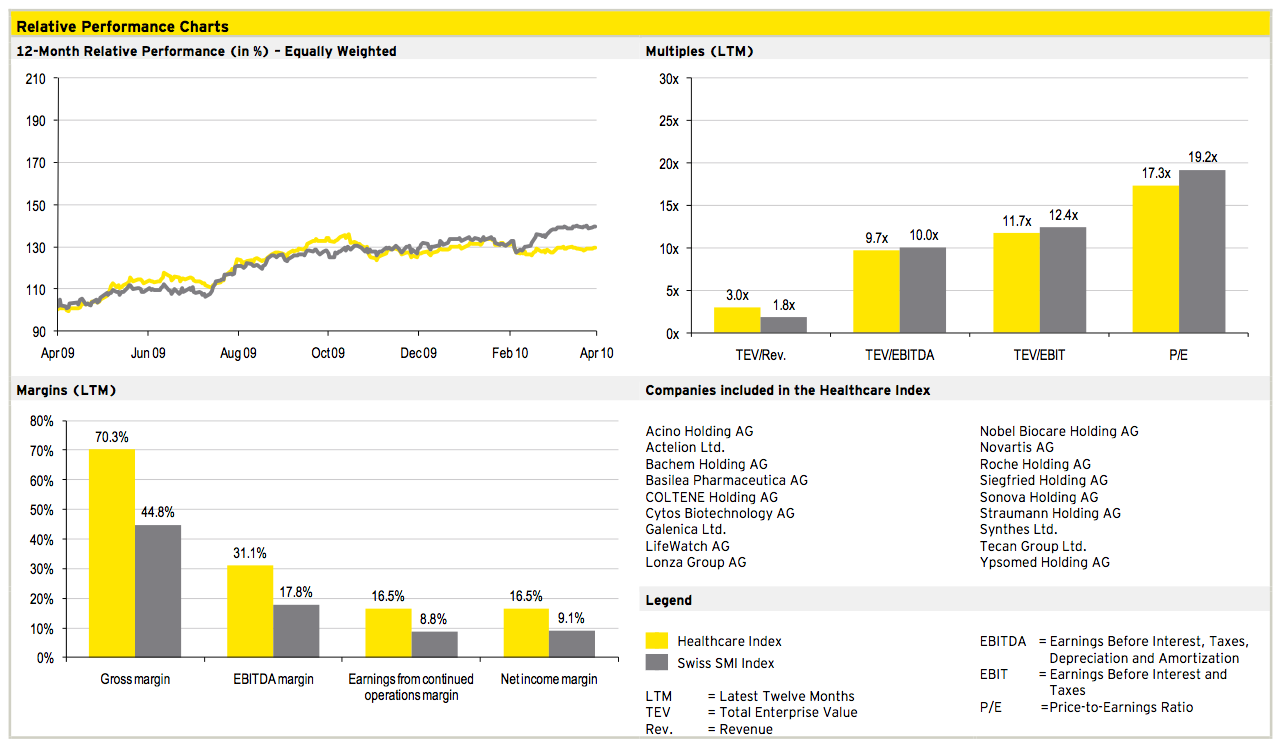

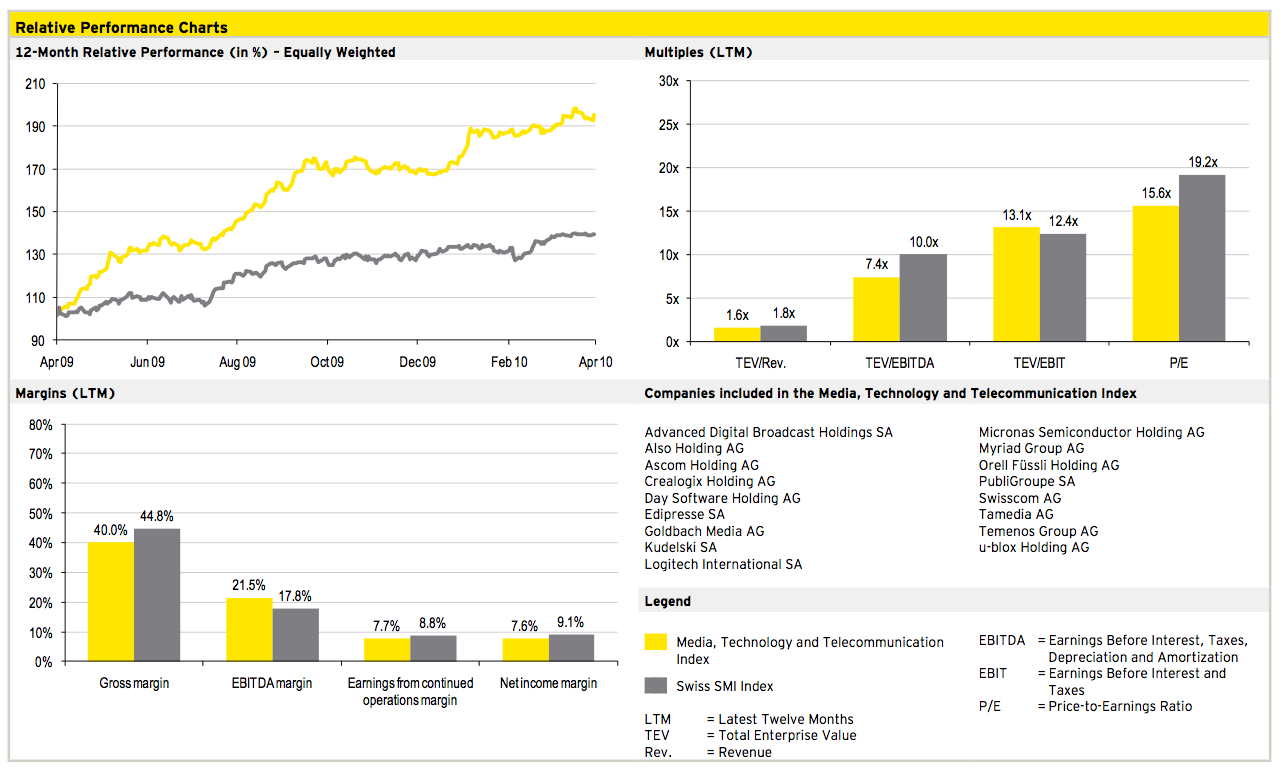

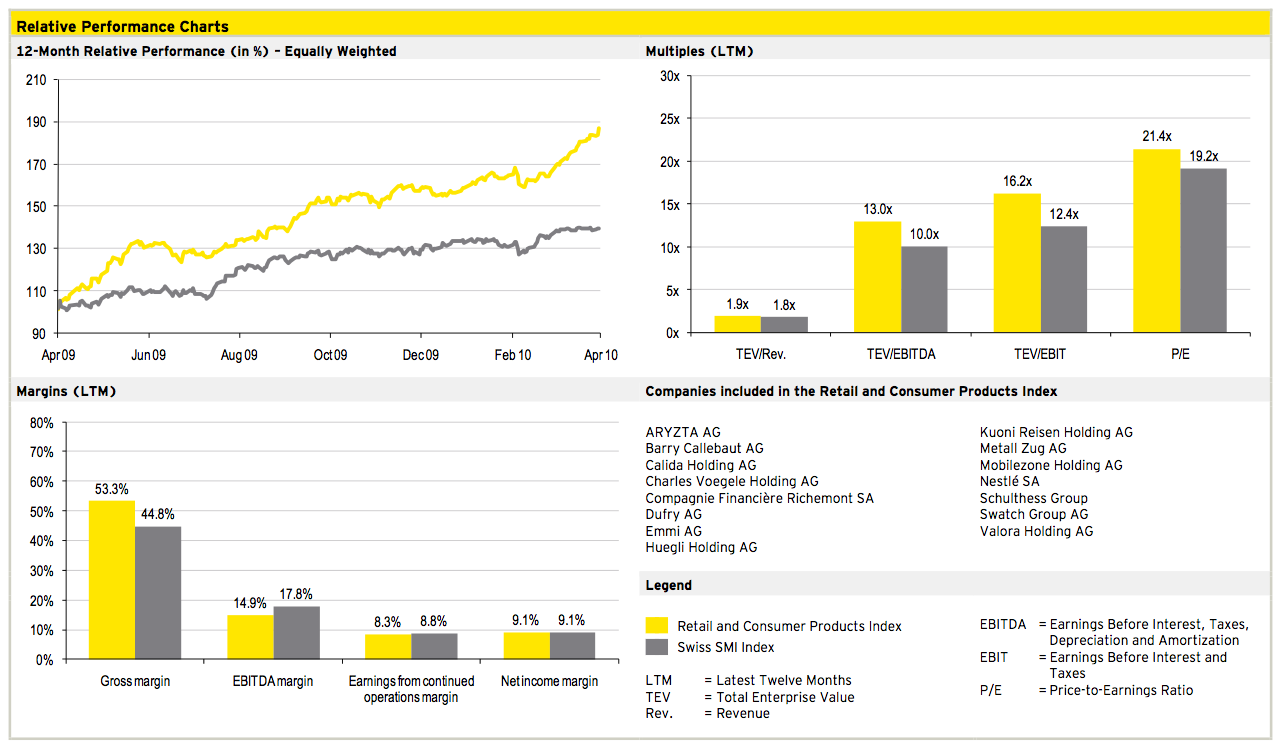

In comparison to Q4 2009, valuation multiples increased for the industrial goods and services industry as well as the retail and consumer products industry. Healthcare along with chemicals, construction and materials showed a decrease in valuation multiples compared to the previous quarter.

Swiss M&A Market Q1 2010 and Outlook for 2010

M&A Market Q1 2010

Swiss M&A activity in terms of transaction volume increased by approximately 50% to over USD 11bn in the first quarter of 2010 compared to the first quarter of 2009. However, the number of Swiss M&A deals declined by more than 30% year-over-year in the first quarter of 2010. First quarter 2010 numbers exclude the acquisition of an additional 52% equity stake in Alcon Inc. by Novartis AG from Nestlé SA. This transaction was already reflected in the second quarter of 2008, when Novartis first announced the transaction.

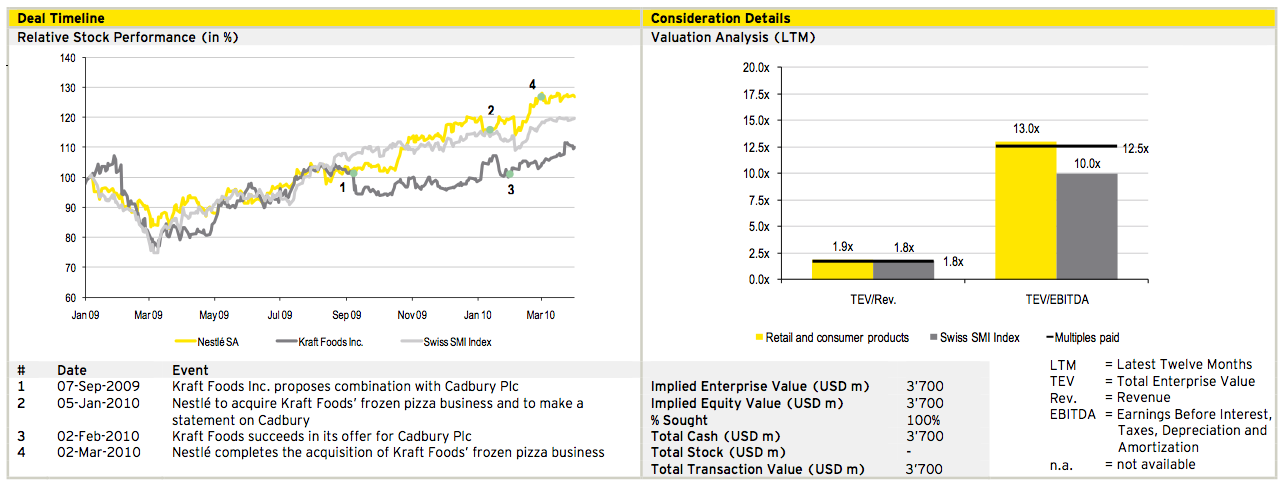

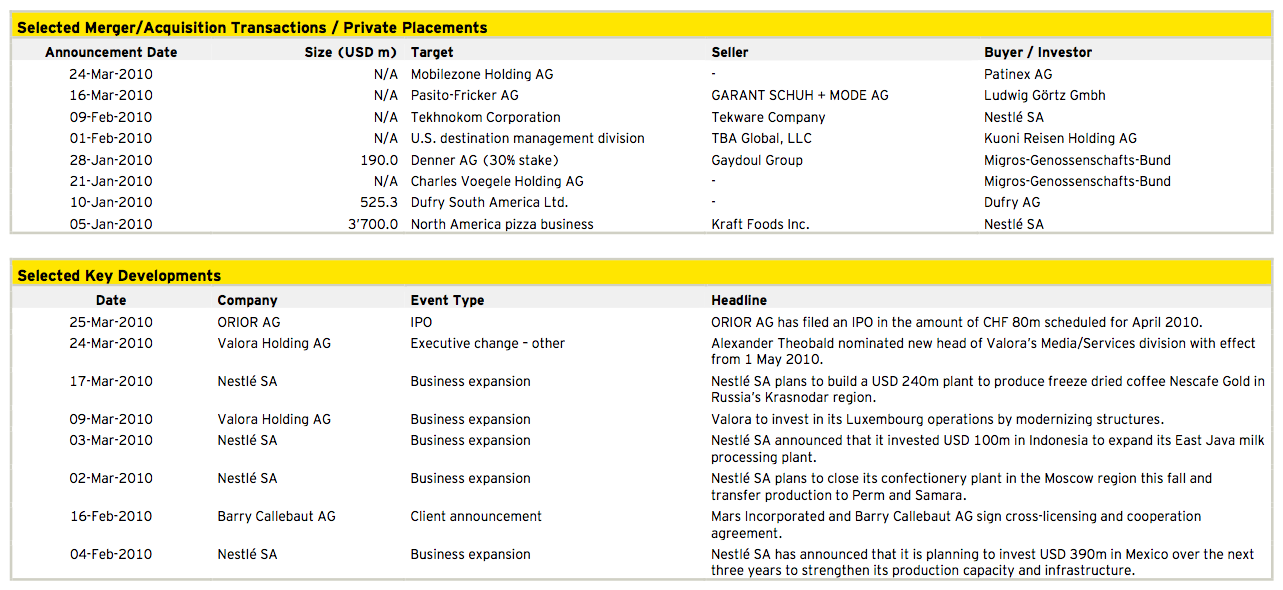

The largest M&A transaction in the first quarter of 2010 was the announced acquisition of Kraft Foods’ frozen pizza business in North America by Nestlé for USD 3.7bn. Further details on Nestlé’s acquisition are available in the section Deal of the Quarter.

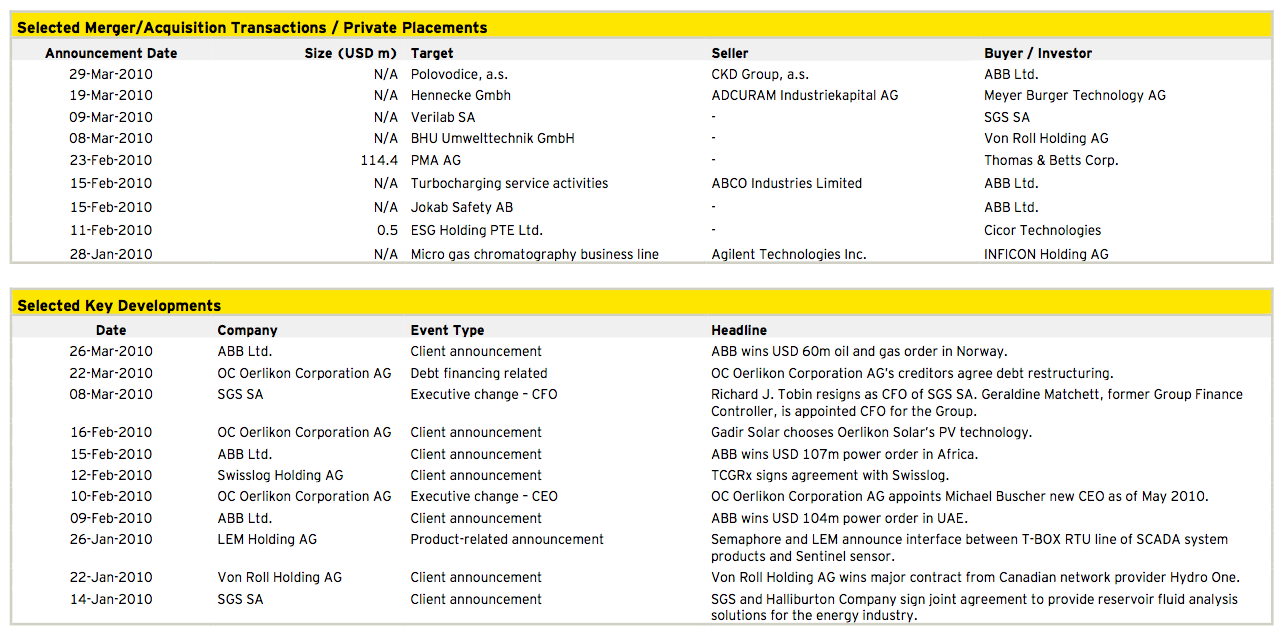

During Q1 2010, stocks continued to rise and added to their positive stock performance in 2009. Since 31 March 2009, overall stock performance was very strong with the SMI index increasing by almost 40%. The industry with the highest stock performance over the past 12 months was media, technology and telecommunication. In comparison to other industries, healthcare stocks underperformed. This is mostly due to a returning appetite for riskier, less defensive stocks.

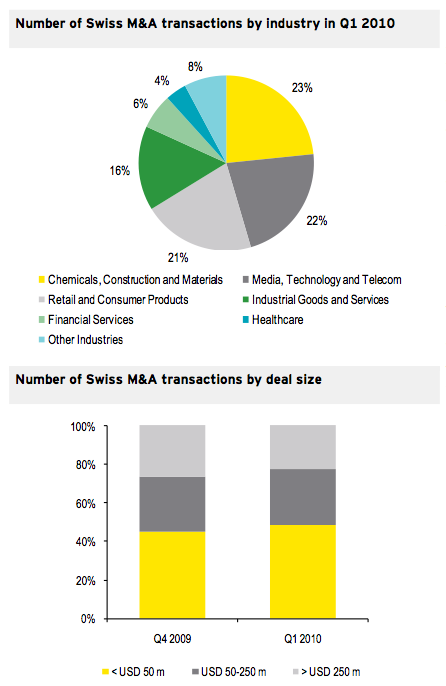

Transactions by industry and size

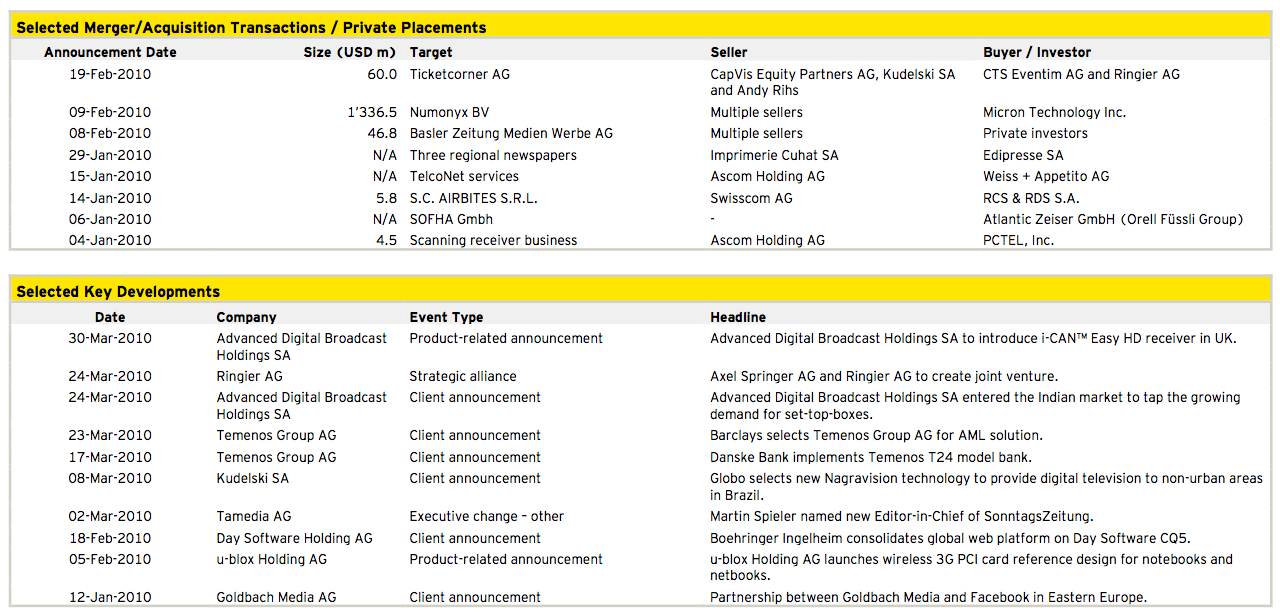

During the first quarter of 2010, the most active industries in terms of number of transactions were chemicals, construction and materials as well as media, technology and telecommunication accounting for 18 and 17 M&A transactions, respectively.

The largest transaction in the chemicals, construction and materials industry was Glencore’s announced acquisition of Prodeco for USD 2.3bn. In this transaction, Glencore exercised its call option to buy back Prodeco, which Glencore sold to Xstrata one year prior for the price of USD 2.0bn.

The largest transaction in the media, technology and telecom industry was the acquisition of Swiss-based Numonyx by US-based Micron Technology for USD 1.3bn. The acquisition will allow Micron to further enhance its presence in the global memory product provider market by strengthening its product portfolio to include DRAM, NAND and NOR memory products.

Although the first quarter of 2010 showed an increase in average deal volume, the number of large M&A transactions valued above USD 250m decreased from 11 to 7 deals compared to the fourth quarter of 2009. The acquisitions by Nestlé and Glencore contributed significantly to M&A deal volume in Q1 2010. The level of activity in large transactions is in-line with the first three quarters of 2009 with 5 to 6 transactions on average. In addition, approximately 50% of all deals with disclosed transaction values were priced below USD 50m in the first quarter of 2010.

Outlook 2010

In March 2010, the Swiss State Secretariat for Economic Affairs (SECO) raised its expectations for GDP growth in 2010 from 0.7% to 1.4%. Although economic indicators of foreign countries affecting the Swiss economy as well as a slowdown of domestic demand could endanger the economic outlook for Switzerland, consumer sentiment and the overall economic climate brightened during Q1 2010 leading to the increase in GDP forecast. Unemployment is projected to remain at its current level of 4.1%.

Although the overall economic situation continued to stabilize during the last quarter and the stock market recovered significantly, the outlook on M&A activity for the full year 2010 remains cautiously optimistic.

In terms of M&A transactions by industry, the consolidation trend in the Swiss wealth management sector is expected to continue. Further activity is expected to stem from Swiss manufacturing and consumer goods companies, which successfully navigated through the white water of the financial crisis and emerged with strong balance sheets. Although market conditions still remain uncertain, these companies are now in a position to slowly shift their focus from surviving the financial crisis to consider transactions postponed during the past two years.

Although debt financing slowly becomes more readily available, the overall conditions to receive bank financing for M&A transactions remain tough. As a consequence, private equity firms are expected to continue focusing on operational improvements instead of increasing financial leverage in M&A transactions. The rise in stock market valuations also increases the probability of public exits for investments of private equity companies; hence, IPO exits might become an attractive alternative to generate cash again. However, trade sales and secondary market transactions are still expected to be preferred by private equity firms in the forthcoming months. Hence, deal activity from private equity houses is forecast to stabilize or increase slightly during the upcoming quarters. This is further spurred by several private equity companies still owning large pools of uninvested capital to be deployed soon.

Deal of the quarter

Deal Summary

In this edition, our Deal of the Quarter features the acquisition of Kraft Food Inc.’s frozen pizza business in North America by Nestlé SA for USD 3.7bn on 5 January 2010. Through this acquisition, Nestlé added brands such as Tombstone, California Pizza Kitchen, Jack’s and Delissio to its portfolio. According to Nestlé, the North American frozen pizza business of Kraft Foods achieved revenues of USD 2.1bn and an EBITDA of USD 297m in fiscal year 2009 and has enjoyed double-digit growth over the last four years.

On 5 January 2010, Kraft Foods also announced that it would use an amount equivalent to the net proceeds from the sale to fund a partial cash alternative as part of its offer for Cadbury Plc. On the same day, Nestlé announced in a press release that it would not make a formal offer for Cadbury.

Deal Rationale

► Already a key player in North America’s frozen food segments of prepared dishes and hand-held product categories, Nestlé gains leadership in this market by acquiring Kraft Foods’ North American frozen pizza business.

► The business fits with Nestlé’s focus on delivering convenient, premium, wholesome and nutritious frozen food to consumers around the world.

► Kraft Foods is able to further focus on priority global brands and segments. In addition, the company delivers its shareholders an attractive return.

► The acquisition is expected to increase Nestlé’s earnings per share in the first full year of ownership.

► Synergies were estimated at 7% of sales and are expected to be fully realized within five years.

Industry Overview

Chemicals, Construction and Materials

Financial Services

Healthcare

Industrial Goods and Services

Media, Technology and Telecommunications

Retail and Consumer Products

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter