Publications Mastering The People Risks In M&A: The Heart Of A Deal

- Publications

Mastering The People Risks In M&A: The Heart Of A Deal

- Bea

SHARE:

The pace of global merger and acquisition (M&A) activity fluctuates depending on the economy, but M&As remain a valuable method to accelerate growth in new regions, expand into new products and service areas or acquire new technologies. However, according to various studies over the last two decades, many M&As have failed to meet shareholder expectations. The people side of an M&A is the biggest challenge for both Finance executives and their HR counterparts. Towers Watson research shows that when organizations properly address the risks related to the people factors early, strategically and with discipline, they can achieve significantly more success.

Towers Watson recently conducted two surveys on the people-related risks in M&A. The first one was conducted with more than 100 Finance executives across Canada in partnership with the research foundation of the FEI (Financial Executives International) in Canada.

The second was with HR executives around the world. With more than 118 responses from Canadian organizations to the global survey (404 respondents globally), the Canadian data were extracted to be fully comparable to the Canadian survey of the Finance executives.

The assessment of the challenges and success factors from Finance and HR in Canada are surprisingly aligned and consistent:

• HR Performance: There is a strong correlation between the performance of HR in due diligence and the success of the deal.

• Better Due Diligence: There is room for improvement in the way the people-related risks are treated at the due diligence phase. The financial impact of people-related risks is often not considered. Many of these risks don’t find their way to the financials of the acquirer — even readily quantifiable risks such as pension volatility.

• Cultural Alignment: Both HR and Finance agree on the top five priorities during integration. The number one differentiator between the very successful deal makers and the less successful ones is the effectiveness of the organization in aligning culture.

• Focus on Success Differentiators: Besides cultural alignment, the most important success differentiators are key talent retention, change management, workforce deployment and leadership alignment. However, the study reveals that the focus of the deal team and the organization’s effectiveness in respect of these factors is moderate at best.

• M&A Readiness: Finally, the results suggest that HR, Finance or both may need to improve their M&A readiness before the next transaction so that HR can be more effective and Finance can better understand the risks associated with the people aspects of the transaction.

“Both HR and Finance need to improve their skills in managing people risks.”

Getting Involved?

M&A deals have various phases, from target evaluation and due diligence, up to implementation. The studies reveal that, although Finance is largely involved in the pre-closing activities, HR is almost exclusively involved as a lead function in the post- closing people-related activities. Only 11% of the survey participants report that HR is also a lead function in the due diligence phase.

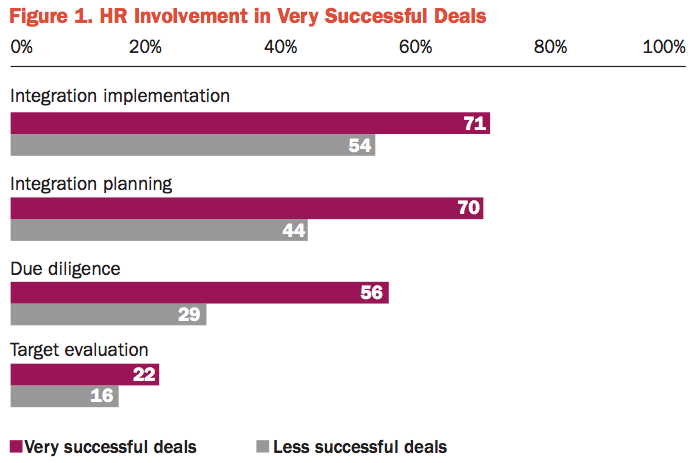

Although in most situations HR does not have a lead role at the due diligence stage, evidence suggests that involving HR in a significant role earlier in an acquisition makes sense. As shown in Figure 1, very successful deal makers involved HR in the due diligence phase, with a handful also involving their HR function as early as the target evaluation phase. In our experience, Towers Watson has found that, provided HR is experienced and has specific expertise in M&A activities, the early involvement of HR (e.g., in due diligence) tends to result in a better assessment of the potential synergies and the different risks to consider in running the acquired operation going forward.

Room for Improvement in Due Diligence

The study shows that most of the risks related to people issues do not find their way into the financial analysis at the due diligence stage. This may be explained by the fact that many of these risks are difficult to quantify. For example, trying to quantify the impact of cultural misalignment may be somewhat subjective and certainly difficult to support when negotiating the price of a business or applying accounting standard rules.

However, some other risks like pension and benefit cost volatility, constructive dismissal issues resulting from significant program reductions or change-in-control payments for executives are much easier to quantify. Interestingly, the study shows that less than 40% of the respondents have reflected these quantifiable risks, one way or another, in their financial analysis. These risks may have a significant impact on the cost to run the business going forward. This may point to a need for more information or better tools to properly estimate the financial risks associated with various factors. As these are people-related risks, HR is often the logical function to analyze this information.

“Evidence suggests that involving HR in a significant role earlier in an acquisition makes sense.”

How to Align Different Cultures

Research shows that as much as 80% of a company’s culture is dependent on the messages and actions of company leadership. The challenge in transforming the culture is often in the translation of strategic priorities into clear actions, ensuring alignment all the way from leadership to employee behaviours.

In order to effectively assess the cultural fit with other organizations, it is important to begin by explicitly articulating the existing culture of the buying organization. Through a web-based activity such as Towers Watson’s Culture Alignment Tool (CAT), this can be done by asking leaders to rank-order defined cultural attributes that best describe their own organization. In addition to identifying the degree of consensus within the leadership team regarding the attributes, the main output provides a description of the culture benchmarked against high-performance companies with similar strategic priorities.

Once the organization’s cultural attributes have been defined in standard terms, a number of basic questions to ask the target company at the due diligence stage can easily be developed. In a typical due diligence exercise, leaders within the target company are interviewed by the potential buyer to better understand their business. As the culture of an organization comes largely from its leadership, adding these few culture-related questions to the standard due diligence process provides a valuable indication about the target’s culture and potential challenges to expect. Only then can proper planning for actions and assessment of the need for change take place, in order to address these cultural gaps and challenges to come.

“The organization’s performance in delivering solutions is not always aligned with the issues having the most impact on deal success.”

Misalignment for Success

Both Finance and HR agree on the top people-related challenges and priorities to address to improve the success of a transaction. Although the ranking order is slightly different for HR and Finance, both agree that the top five challenges are as follows:

- Aligning the different cultures

- Communicating and managing change with employees

- Retaining key talent

- Maintaining employee engagement and productivity

- Integrating compensation and benefit programs

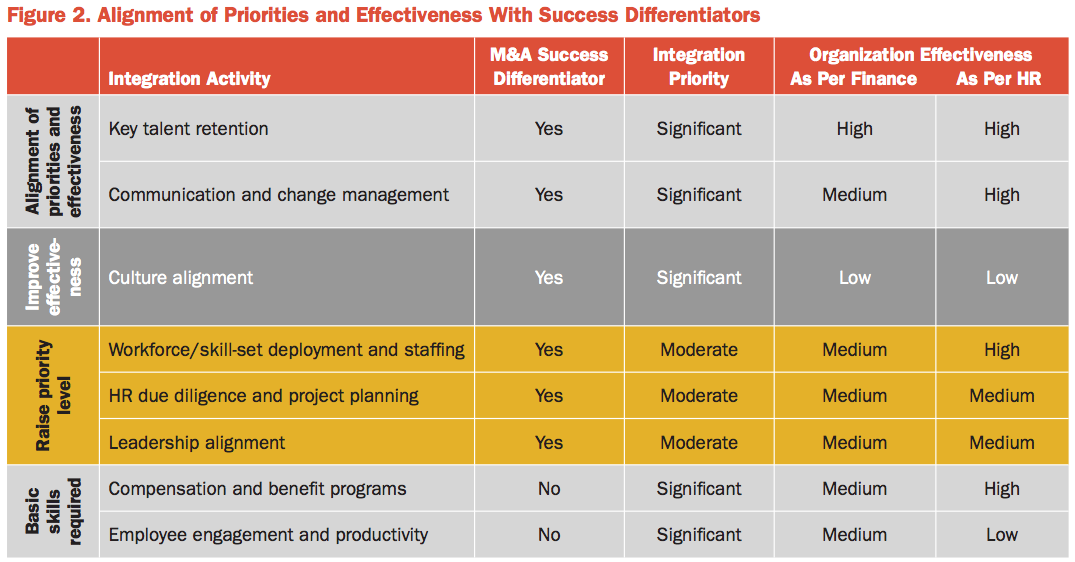

However, as illustrated in Figure 2, there seems to be a misalignment at two different levels:

• Priorities: The very successful deal makers focus on activities that may be different from what most consider as their main priorities during the integration phase.

• Capabilities: The organization’s performance in delivering solutions is not always aligned with the issues having the most impact on deal success.

Figure 2 shows that while the priorities and capabilities of organizations are aligned with some of the success factors (key talent retention, communication and change management), some of the focus could be shifted from certain activities (e.g., compensation and benefit programs) to success differentiators such as culture alignment. Both Finance and HR report that organizations that have been more successful in their past transactions are focusing more on new, nontraditional HR capabilities such as cultural alignment and project management, while other organizations continue to be challenged by more traditional HR aspects such as communication, compensation and benefit design.

What’s Next

Finance executives were also asked what it would take to improve the results of their next deal. As shown in Figure 3, more than 50% of the Finance executives identified the improvement of HR’s knowledge about M&A as the main action to implement, followed by the improvement of HR’s business acumen. It is interesting to note that for very successful deal makers, improving HR’s knowledge is also the number one action to implement, while improving the ability of Finance to quantify people risks, remains a focus for other organizations.

The first step that organizations are taking in order to improve their M&A readiness is to assess their current M&A processes against best practices and ensure alignment between priorities and capabilities. In doing so, many have found that their M&A playbook may be out of date and that the tools they are using concerning human capital issues are incomplete or simply nonexistent. In situations where the internal M&A knowledge of the HR function needs to be rejuvenated, the logical next step is to provide M&A training with the expectation that HR will develop and/ or update their own playbook in respect of people-related M&A matters.

Organizations exploring the possibility of future M&A activity need to understand that HR and Finance departments that jointly prepare for the next deal will have a much greater chance of success. Finance and HR should be partners as early in the M&A process as possible in order to ensure full alignment between priorities that impact the deal success and organization capabilities. In many organizations, for this to happen, both Finance and HR need to step up to the M&A plate and improve their M&A knowledge and skills before the next transaction.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter