Publications Dealing With Uncertainty: Strategies For Overcoming Compliance Risk And Regulatory Challenges In Cross-Border M&A

- Publications

Dealing With Uncertainty: Strategies For Overcoming Compliance Risk And Regulatory Challenges In Cross-Border M&A

- Christopher Kummer

SHARE:

Pharmerging markets report

Introduction

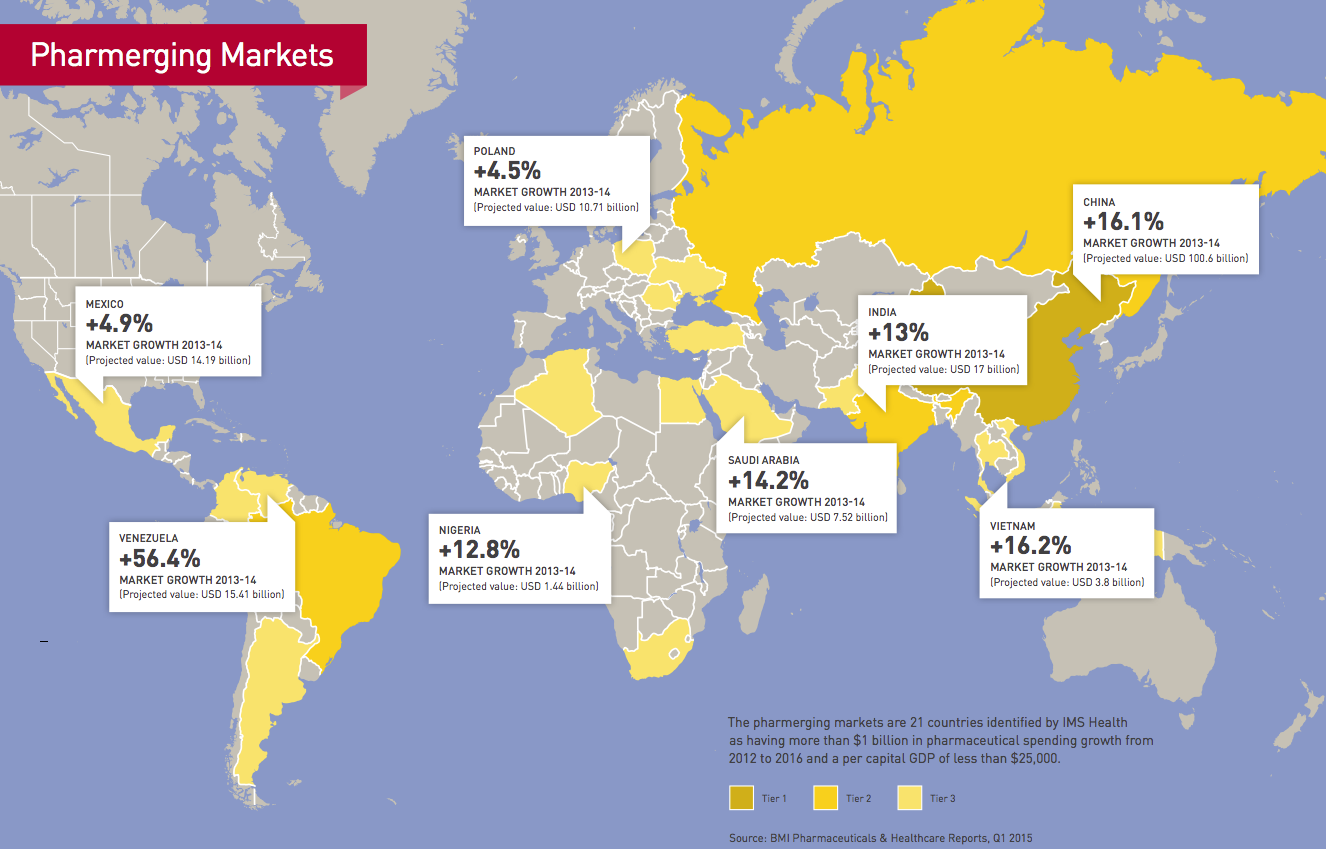

When you look at the numbers, there’s no question why global pharmaceutical companies have set their sights on emerging markets for future growth. From 2012 to 2017, global pharmaceutical sales are expected to rise 13% in the “pharmerging markets,” compared to 2% for the top mature markets, according to the IMS Institute for Healthcare Informatics.

China, for one, is expected to overtake Japan to become the second-largest pharmaceutical market in the world behind the US in 2015. Global drug sales in China are projected to increase 17% from 2012 to 2017, followed by Brazil with 13% growth, India with 12% and Russia with 10%. By contrast, pharma sales in the US are expected to grow little more than 1% during the same time period.

In Europe, they are expected to drop 1% annually.

“Most of the top pharma companies have a strategy in the pharmerging markets because that’s where the double-digit growth is,” says Jane Hobson, Chair of Baker & McKenzie’s Global Life Sciences Industry Group. “They’re not going to get that growth from established pharmaceutical markets like Europe, North America and Japan. So they are expanding into the pharmerging markets and driving a lot of M&A activity.”

The appeal of the pharmerging markets, 21 countries the IMS has identified as major growth opportunities based on pharmaceutical spending and GDP, is simple. Many governments in these markets are making large investments in healthcare, such as the Chinese government’s announcement in 2009 that it would spend USD 124 billion over 10 years to expand healthcare coverage for its 1.3 billion citizens and invest in projects such as upgrading and constructing new hospitals and health clinics in areas ranging from urban centers to remote villages.

Economic growth in these countries is another factor, creating a growing middle class with the means to afford private insurance and out-of-pocket payments for more expensive treatments. And as affluence grows, so does the prevalence of lifestyle diseases such as diabetes, hypertension, high cholesterol and certain forms of cancer, which increases demand for a wider range of drugs and treatments in the portfolios of pharmaceutical companies.

Growing through acquisition

These opportunities are good news for the global healthcare industry, particularly the pharmaceutical sector, as companies struggle to find avenues for growth amid the recent loss of patent protection of blockbuster drugs, pricing pressures, diminishing product pipelines and rising competition from generics. Their challenges are compounded by the fact that creating new medicines is one of the most expensive, risky business ventures in the world. Developing a new drug costs an average of $2 billion, and only 7% of experimental drugs in early-stage trials reach the market, according the Tufts Center for the Study of Drug Development in Boston.

Given this business reality, many major drug companies have been turning to acquisitions and licensing transactions over R&D investment to grow their profit margins and boost share value. In fact, 2014 was a record-breaking year for M&A in the healthcare sector, with deal values reaching USD 363 billion, 94% higher than those in 2013. Of those deals, USD 178 billion were cross-border transactions involving buyers acquiring target companies or assets in countries outside their local markets.

But as any seasoned healthcare executive knows, entering and expanding into new markets can be challenging, particularly in pharmerging markets. Among the challenges global pharmaceutical companies face are strict government price controls, a prevalence of cheaper generics, as well as local business practices, laws and regulations that make it difficult to succeed as foreign investors.

Several pharmerging countries, for example, including Algeria, Indonesia, Russia, Saudi Arabia and Turkey, have policies that favor local drug manufacturers in public tenders. In China and Russia, regulators require that drug companies conduct local clinical trials before their drugs can be approved for sale in those markets.

Even more challenging, these rules and requirements vary from country to country, even within the same region, and can change rapidly, making it difficult to pursue a unified strategy, let alone complete a successful merger, acquisition, joint venture or divestiture involving multiple jurisdictions.

“In global transactions, companies usually want a global closing date and a local closing date for each region,” says Christian Lopez-Silva, Chair of Baker & McKenzie’s Life Sciences Industry Group in Mexico. “In Latin America, that is very difficult because of the huge diversity of regulatory frameworks. Many buyers have learned the hard way that failing to account for regulatory differences can prevent them from closing in certain countries and keep them from achieving the original goal of the transaction.”

Compliance risks and regulatory challenges

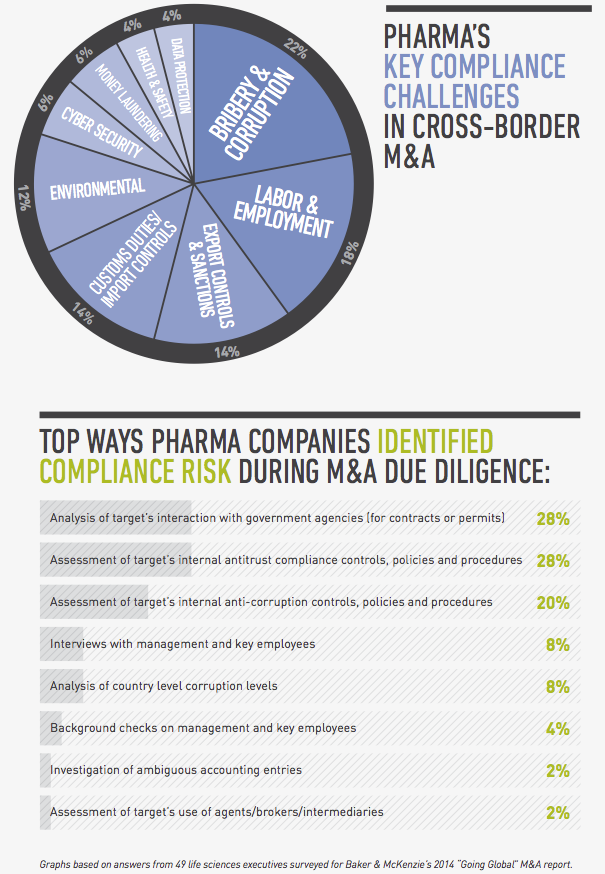

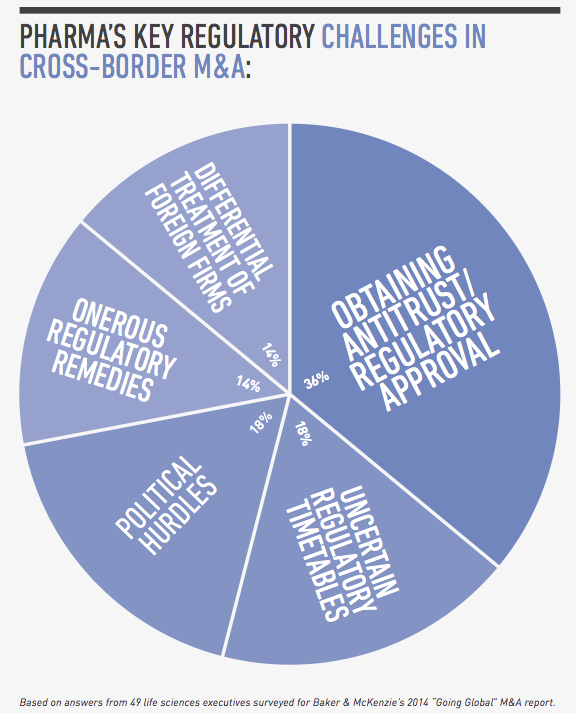

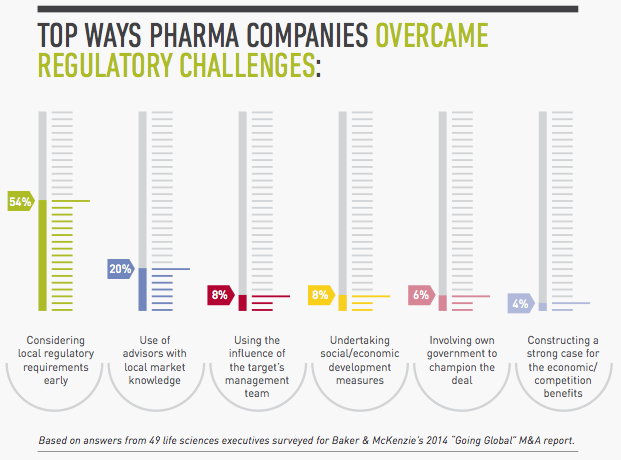

From a legal perspective, compliance risk and regulatory hurdles are among the top concerns for global pharmaceutical companies pursuing cross-border transactions. In a survey conducted by FT Remark on behalf of Baker & McKenzie, 49 life sciences executives identified bribery and corruption, labor and employment issues and customs and export controls as their greatest compliance risks in cross-border acquisitions. As for regulatory issues, they named obtaining antitrust and regulatory approval, uncertain regulatory timetables and political hurdles as their greatest challenges.

“What’s harder than anything when doing transactions in emerging markets is the ever-changing and often contradictory legal framework and political situation,” says Vanina Caniza, Chair of Baker & McKenzie’s Life Sciences Industry Group in Argentina. “In Argentina, for example, decisions may be made for political reasons, rather than based on actual regulations. So when clients want a yes or no answer, many times no such answer is possible and we have to work around mechanisms to protect them and give them a reasonable level of comfort.”

In this report, we seek to identify the key compliance risks and regulatory challenges that global pharmaceutical companies face in cross-border M&A, particularly in pharmerging markets. We also discuss strategies that have helped clients address the primary issues in these markets and overcome the challenges that prevent them from reaching their growth objectives.

Section 1: Compliance Risk

Several years ago, the pharmaceutical industry experienced a significant drop in merger activity and has since been undergoing a period of major restructuring. One such trend has been a succession of tax inversion deals in which US drug companies buy foreign rivals to move their headquarters to countries outside the US, such as the UK or Ireland, to take advantage of lower corporate tax rates, a practice the US Treasury Department has since taken measures to make less attractive.

Another major trend has been divestitures, as pharmaceutical companies sell off certain business units to focus on core therapeutic areas and products or swapping assets so they can specialize in cancer drugs, vaccines, animal health or consumer products and target investment in the areas where they are strongest. Other big healthcare companies have spun off their biopharmaceutical operations into separate public entities to focus on innovation in their high-growth areas.

Bribery and Corruption

Yet no matter the trend, bribery and corruption still top the list of concerns for pharmaceutical companies in cross-border M&A, issues particularly acute in pharmerging markets. One reason for this ongoing anxiety is that governments in pharmerging countries have recently begun enforcing their own anti-bribery laws, in addition to the US government’s increased enforcement of the Foreign Corrupt Practices Act and the enactment of the UK Bribery Act.

“We spend a lot of time on anti-bribery due diligence in these transactions, talking about who we should interview on the ground, how we should follow up if we suspect something and what kind of protections should be in the purchase agreement in the event of identifying issues,” Global Life Sciences Chair Jane Hobson says.

“Companies have to do the appropriate level of due diligence and have a day one plan for addressing any concerns to be able to satisfy the authorities if there’s an ABAC compliance problem found post-closing.”

Local enforcement actions in countries such as China, Indonesia and Brazil have led to scandals and news headlines that have hurt those companies’ businesses, damaged their reputations, and caused other multinational pharmaceutical companies to rethink their strategies in these markets.

Tax liabilities

In addition to bribery, another major compliance risk is whether the target company has been evading taxes, which is common in many developing countries.

“Anti-bribery due diligence alone is not going to get you through all the risk,” Hobson says. “The next big risk is whether the target has paid all its taxes or whether it has been paying them on a wrong basis. So you have to go through a big tax diligence, including whether there may be money laundering issues.”

Labor and employment issues

Another common area of noncompliance is failing to make proper social security contributions. In many pharmerging markets, buyers are often faced with the predicament that the target company pays many employees off the books, classifies them as consultants when they are really employees, or pays a portion of their salaries in cash. This results in the employer either underpaying the amount they should be contributing to social security or avoiding these payments altogether, including the amount they should be withholding from each employee’s paycheck.

“I’ve seen deals fall through because the target company didn’t have adequate compliance standards in areas such as employment, tax and regulatory matters,” Argentina Life Sciences Chair Vanina Caniza says. “Adequate due diligence and transaction planning can help mitigate the buyer’s risk, and lead the deal to a successful closing.”

The liability in the employment cases often arises when an employee leaves the company or becomes disgruntled and sues the employer for unpaid social security contributions in retaliation for other issues. Although employees financially benefitted from the company not withholding social security contributions from their paychecks, they can still sue their employer because it could reduce the amount of social security they will receive during retirement.

This problem creates even greater risk for buyers in regions such as Latin America with a prevalence of family-owned companies that often aren’t managed in accordance with desirable compliance levels, as well as employee-friendly labor cultures. In those jurisdictions, it is often free for employees to sue their employers and the courts tend to favor employees, which makes it more likely that they will win the case and the new employer will be held responsible for repayment.

Section 2: Compliance Recommendations

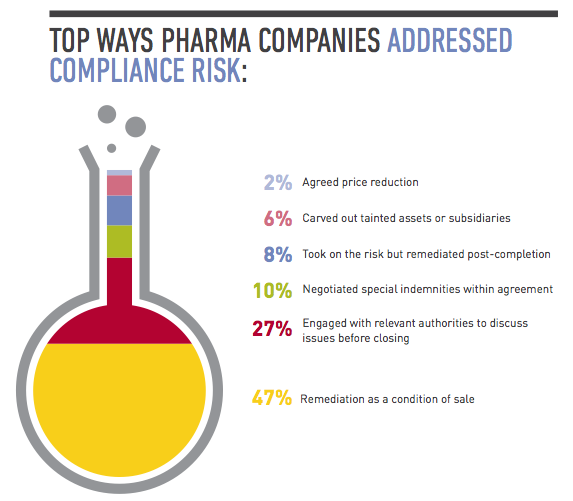

Given the inherited liability that corruption and bribery, labor and employment, and tax issues can create for acquirers in pharmerging markets, what can you do to reduce your exposure? Here are some suggestions to help mitigate the key compliance risks.

1. Conduct risk-based due diligence.

In a perfect world you would have the time and resources to conduct thorough due diligence that would uncover every compliance issue before closing. In reality, you need to take a risk-based approach to this exercise, assessing the target’s level of interaction with government officials, use of third-party distributors and the state of its compliance policies. A target’s participation in a high number of public tenders, for example, is a red flag that needs to be investigated, as is a target that’s operating in an environment in which the requirements for regulatory approvals are not clearly set out in the regulations, giving the authorities excessive discretion that creates opportunities for corruption. If you find evidence of bribery or corruption, you should determine how deep the issue is, whether it’s limited to a few employees or business units, or if it’s a systemic practice endorsed by senior management. Depending on the situation, you may need to carve out troublesome business areas from the deal, build suitable representations and warranties into your documents, include indemnity clauses, and assess whether any issues need to be reported to the authorities. From a practical business perspective, you should evaluate whether the target is so steeped in corruption that it would no longer be a viable enterprise if you stopped the illegal conduct going forward.

2. Remediate on the back end.

Often there isn’t time to conduct thorough due diligence until you’re confirmed as the buyer, such as in an auction sale. In those cases, you still need to conduct basic due diligence while including protections in the purchase agreement that if you uncover major compliance issues later, you can amend or exit the deal. The key then is having a strong post-acquisition integration plan that focuses on compliance. Faced with time pressures, many companies have spent the year after closing conducting third-party due diligence, investigating and remediating areas of concern they didn’t have a chance to focus on during the deal. They’ve also invested time adopting detailed written policies on issues such as bribery, corruption and accounting practices, and implementing protocols for ensuring those policies are followed. Much of this involves training senior management and sales forces, particularly in pharmerging markets. “A lot of domestic companies in China don’t have robust corporate compliance programs or they may have policies but they’re not closely monitoring or strictly enforcing them,” says Tracy Wut, Co-Chair of Baker & McKenzie’s Global Life Sciences Industry Group in China and Hong Kong. “The buyer may need to educate the target’s management on the importance of compliance from the start, and target problem areas quickly.”

3. Be ready for lawsuits.

In acquisitions involving unpaid social security contributions, it’s important to take this issue seriously, given the rise in lawsuits filed by disgruntled employees and cash-strapped governments to recoup these payments.

This risk is compounded by the fact that the pharmaceutical industry in countries like China has annual staff turnover rates greater than 20%, increasing the number of employees who may be motivated to sue their employers. During due diligence, your accountant will typically quantify your social insurance underpayment exposure, a cost you should account for in your deal valuations. “Clients are advised to put some amounts in escrow in case the lawsuits happen,” Argentina Life Sciences Chair Vanina Caniza says.

4. Start fresh.

Sometimes you can’t rectify compliance issues right away. In some countries, for example, you may not be able to retroactively contribute to the government social security fund for unpaid contributions. So depending on the situation, it might be best to decide that you will make proper contributions and withholdings for new hires going forward.

5. Work with local advisors.

Lots of reports will recommend that you work with local advisors on cross-border transactions. But when it comes to compliance risk, here’s the reason why. Local advisors read the local newspapers. They know the players. They know which government authorities are more corrupt than the others. They know the type of illegal payments those authorities might expect. They have filed numerous product registrations in their country so they know what proper documentation looks like, and which registrations may have been granted under suspicious circumstances. They know the local business custom and practices, and the questions to ask the target’s management to assess whether they are doing business legally. They can spot the important issues more quickly, and help you determine the most effective ways to address compliance risks in that market. Because of their familiarity with the local language, culture and legal system, they are also more adept at providing effective post-closing remedial training.

Section 3: Regulatory Challenges

With all the focus on compliance, global companies often overlook regulatory issues when doing transactions in emerging markets, issues that can become major roadblocks. But for companies in the pharmaceutical industry — the most regulated in the world — the stakes are even higher.

For global pharmaceutical companies pursuing cross-border M&A, their top regulatory concerns are obtaining antitrust and regulatory approval, uncertain regulatory timetables, and political hurdles, according to our survey of life sciences executives. These issues are compounded in pharmerging markets because of the evolving, rapidly changing nature of healthcare regulation, the lack of regulatory harmonization from country to country, and the many layers of bureaucracy at the local, provincial and national levels.

“The achievement of your M&A goals is often determined by the regulatory possibilities,” Mexico Life Sciences Chair Christian Lopez-Silva says. “Because of past difficulties, more companies have started to see regulatory challenges as a critical area but few are prioritizing it.”

Obtaining antitrust and regulatory approval

In recent years, merger control authorities in many emerging markets have begun applying greater scrutiny to antitrust filings. This has injected a level of uncertainty into what used to be a routine approval process, and caused major delays in countries like India and China.

Not only can getting antitrust approval in pharmerging markets take months longer, it can be much more complicated. In Argentina, for example, antitrust approval is granted post-closing, which means that years after the deal is completed, the government can decide that the transaction violates antitrust laws and force the buyer to divest part of its portfolio.

Yet getting antitrust approval is just the tip of the regulatory iceberg for global pharmaceutical companies, which must comply with a long list of healthcare requirements related to importing, manufacturing, labeling, advertising and monitoring of its products after they have been released into the market. Just getting a new drug approved by local health authorities can take years, followed by registering the product in every country where the company sells it.

In the event of a business acquisition or divestiture, these product registrations must be transferred to the new entity to permit that entity to manufacture and sell the drugs in that market. In cross-border deals involving multiple countries, this can be time consuming and in some cases, impossible.

In Mexico, for example, only manufacturers are allowed to hold the product registration for drugs sold in the Mexican market. So, for example, if a pharmaceutical company decides to spin off its biologics unit into a newly created entity, unless that entity owns a manufacturing plant somewhere in the world, it cannot hold the product registration that enables the entity to sell those drugs in Mexico. That’s problematic for companies that have decided to undertake a global or regional restructuring for tax benefits or corporate strategy only to find that the structure won’t work in certain countries.

“It’s often the case that if you have three options and one makes more sense from a tax law or labor perspective, it usually does not match with the regulatory feasibility,” Mexico Life Sciences Chair Christian Lopez-Silva says.

Uncertain regulatory timetables

In cross-border deals involving pharmerging markets, global companies are often surprised at how long it can take to get regulatory approvals. The requirements for these authorizations can vary dramatically, as can the length of time it takes to get them, even within the same country.

“Even for basic things like foreign investment approvals, we’ve seen a lot of timeframe variations in China,” China Life Sciences Co-Chair Tracy Wut says. “Within the same city it could take one week to get approval in one district and two to three months in another district. There have been improvements in some cities, and hopefully this issue will be resolved with the promulgation of the Foreign Investment Law, which seeks to remove the approval requirement for a lot of foreign investment projects. As of now, however, it still causes a lot of uncertainty for companies.”

Regulatory delays are often caused by multi-layered bureaucracy and backlogs. Other times they are the result of ignorance of local requirements. In Venezuela, for example, there’s a chain of parties listed in a product registration. If one of the parties changes, you can simply file a notification with the ministry in most cases. But if the manufacturer changes, you have to start from scratch to get an entirely new product registration.

“Sometimes the buyer thinks the product registrations can just be transferred but there might be something that makes that not possible,” says Dianne Phoebus, Chair of Baker & McKenzie’s Latin America Life Sciences Industry Group. “Sometimes companies that aren’t familiar with the local market don’t realize that can happen.”

The result of these delays is that companies can’t sell their products in the local market or must find expensive workarounds until they get approval. In global and regional cross-border deals, it can also mean that transaction closing dates need to be postponed in certain countries because of unexpected regulatory hurdles and unrealistic closing timeframes given the landscape in those markets.

Political hurdles

Another reality of investing in emerging markets is that the rules and regulations can change rapidly without warning, often for political reasons. These changes create great uncertainty for global companies seeking to expand in these countries.

During 2014, for example, there was considerable debate about whether data from multi-regional clinical trials could be used to support drug registrations in China. This arose after two officials at the China Food and Drug Administration wrote a paper opposing the use of data from these clinical trials because they had not been designed with the China FDA approval process in mind.

This position implied that foreign drug companies could no longer add a Chinese clinical trial component to the later phases of an existing multi-national drug study. Instead, they would have to get separate approval from the China FDA before initiating the study and follow local clinical trial regulations, requirements that could delay new drug approvals by more than two years because of backlog at the ministry.

“The multinationals were appalled by this news because if they had to run totally separate China clinical trials, that adds much delay onto the launch of the China product,” says Julian Thurston, a consultant in Baker & McKenzie’s Global Life Sciences Industry Group. “A drug scheduled to be launched in 2015 would now take until 2017 or 2018 to be approved, which would use patent life with the consequence of a major reduction in anticipated sales of the drug during the time there was exclusivity.”

For years, Chinese law has required Western drug companies to conduct clinical trials involving ethnic Chinese participants before they could be approved for sale in the Chinese market because of differences in how the Asian population metabolizes medications. To fulfill this requirement, multinational and mid-sized US and European pharmaceutical companies commonly added one or more clinical trial centers in China during the later phases of studies already underway in the US and Europe. That way, once they finished phase III trials, they could also register the drug in China.

But following the paper written by the two China FDA officials, the ministry verified their position in draft guidelines issued in November 2014. In those guidelines, the China FDA acknowledged that data generated from multi-regional clinical trials could be used to support the registration of drugs in China. That data, however, could only be used to the extent that the multi-regional clinical trial was conducted in accordance with China FDA regulations.

The draft guidelines set out various technical criteria for use of multi-regional clinical trial data but left unclear how drug registrations using this type of data would be treated in China compared to regular import drug registrations — creating continuing uncertainty for global pharmaceutical companies seeking to sell their products in the Chinese market.

Regulatory relief in sight?

Although global pharmaceutical companies face a maze of local regulatory hurdles, there are potential bright spots on the horizon, such as the Pacific Alliance, a free trade agreement among Chile, Colombia, Mexico and Peru that took effect in 2011.

As part of the treaty, the governments of these four countries, which account for one-third of Latin America’s GDP, are trying to harmonize regulatory approvals in the pharmaceutical and medical devices sector. To do so, they have created a business council with trade association representation from each country to determine which healthcare regulations would be the easiest to harmonize and would have the greatest impact on shortening the approval process.

As part of the project, the parties are using multilateral regulatory mechanisms as a point of reference, such as certification processes led by the Pan American Health Organization. The Mexican government has also been taking steps to make Mexico a regulatory portal for Latin America by adopting international best practices for granting approvals and authorizations. As a result, marketing authorizations for drugs approved in one country could also be recognized in the other three countries — a welcomed improvement for global pharmaceutical companies that may finally trigger other harmonizing efforts.

“It has been difficult to harmonize anything in Latin America because of the historic suspicion of international influence,” Mexico Life Sciences Chair Christian Lopez-Silva says. “That’s why many people are looking at this trade agreement with very positive eyes.”

Section 4: Regulatory Recommendations

Given the maze of regulatory requirements that can cause delays and prevent you from achieving your deal objectives, how can you approach the process more effectively? Here are some suggestions to help address the top regulatory challenges.

1. Assess local regulatory requirements early.

To avoid unwelcome surprises, map out the regulatory issues for the approvals and licenses you will need in all the jurisdictions involved in the transaction. Using this analysis, identify the differences in rules and requirements and where you are likely to encounter the greatest challenges. Then devise strategies for managing the regulatory issues in the countries that will be the most complicated. The earlier you start, the clearer picture you will have of what the sticking points will be and how best to address them. “It takes a long time to get a good grip on what the precise regulatory challenges are in transactions involving regions like Latin America where regulatory frameworks lack harmonization,” Mexico Life Sciences Chair Christian Lopez-Silva says.

2. In large cross-border deals, consider regulatory issues first.

In the more complex global or regional transactions involving numerous jurisdictions, you may want to identify your options from a regulatory perspective first, even before considering the tax and labor issues, as well as the corporate vehicle you would use for the transaction and the deal structure. In Brazil, for example, you can only transfer marketing authorizations in de-mergers. “You have to know this early because if you try to plan your deal as a transfer of assets, you will have a big surprise in Brazil where you cannot do that,” Lopez-Silva says.

3. Understand local practices.

In many emerging markets, what the law says often differs from actual custom and practice. That’s why it’s important to seek local advisors who work closely with decision-makers. In Venezuela, for example, the law only allows pharmacists to make regulatory filings on behalf of pharmaceutical companies for the various permits and authorizations they need to sell their products in the Venezuelan market. Because of those pharmacists’ daily contact with the Ministry of Health authorities who make the regulatory decisions, they would be in the best position to predict approval time frames and provide other valuable information. “The pharmacist would know if certain types of products aren’t being approved right now, even though it’s not in the law or in any regulations,” Latin America Life Sciences Chair Dianne Phoebus says.

4. Mobilize your local government relations team.

In the larger pharmerging markets, many global pharmaceutical companies have local government relations teams that can be helpful in overcoming regulatory delays and other challenges. In transactions that could encounter these issues, it’s important to use them. “What we’ve done to expedite regulatory approvals in China is mobilize the client’s local government relations team to lobby government officials,” China Life Sciences Co-Chair Tracy Wut says. “It can be very effective in explaining the importance of the deal. Flying in senior executives to meet the Chinese decision-makers can also have great impact.”

5. Use your target’s influence.

Often your target will also have good relationships with the local authorities, an asset you should leverage to shorten approval times and iron out other regulatory issues. When the time is right, you may want to join with representatives from the target company to meet with local authorities to make sure there’s buy-in for the transaction and to help smooth the process.

6. Establish a project management team.

In more complex multijurisdictional deals, it’s advisable to put together a project management team, either internally or by hiring outside advisors, to oversee the integration of all aspects of the transaction from start to finish.

Without such a team, it’s easy to focus only on certain components of the transaction, such as corporate structuring and tax planning, without accounting for regulatory issues that could derail the project. Having a project management team that holds regular, cross-functional meetings with regulatory, quality, supply chain and QPVV gives you a better chance of achieving your strategic objectives.

Conclusion

For global pharmaceutical companies, the growth opportunities in pharmerging markets are highly attractive. They seek to enter and expand in these markets for good reason. Yet seizing these opportunities often means facing high levels of uncertainty. Some of that uncertainty is unavoidable in cross-border M&A, but there are steps you can take to avoid common pitfalls.

“In cross-border mergers and acquisitions, the mantra from the pharma R&D world applies: the sooner you identify a potential failure, the cheaper its impact will be,” Mexico Life Sciences Chair Christian Lopez-Silva says.

The best strategy for dealing with M&A challenges in pharmerging markets is to analyze the compliance risks and regulatory hurdles early, address the most pressing issues, make the best commercial decisions you can with the information you have, and be prepared for changes.

“The most important thing is for buyers to understand all the risks of a transaction so they can determine which risks are worth taking on, and whether they want to go through with the acquisition,” Latin America Life Sciences Chair Dianne Phoebus says. “In the end it’s a business decision.”

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter