Publications Mergers & Acquisitions Quarterly Switzerland – Fourth Quarter 2010

- Publications

Mergers & Acquisitions Quarterly Switzerland – Fourth Quarter 2010

- Bea

SHARE:

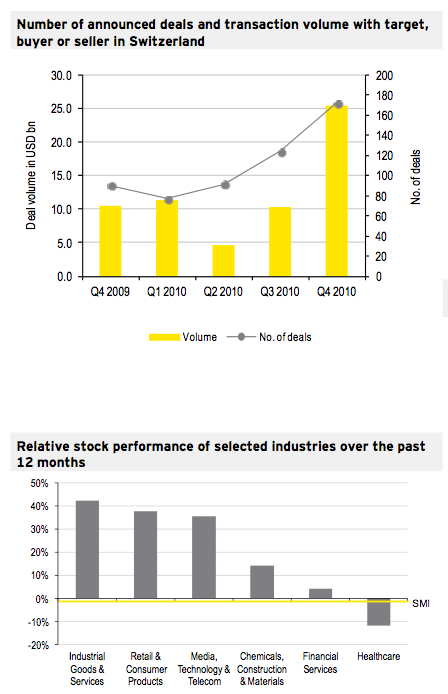

The Swiss M&A market recorded a strong fourth quarter in 2010 as the number of transactions as well as deal volume increased significantly compared to the fourth quarter of 2009 and the third quarter of 2010. General conditions for M&A transactions were favorable in the latest quarter and are expected to remain upbeat in the short to mid-term, as outlined in our outlook for 2011.

Swiss M&A Market Q4 2010 and Outlook for 2011

M&A Market Q4 2010

The Swiss M&A market closed the fourth quarter of 2010 as the strongest quarter since Q4 2008, both in terms of number of transactions as well as deal volume. The number of M&A transactions almost doubled compared to the last quarter of 2009 while deal volume rose by more than 140%.

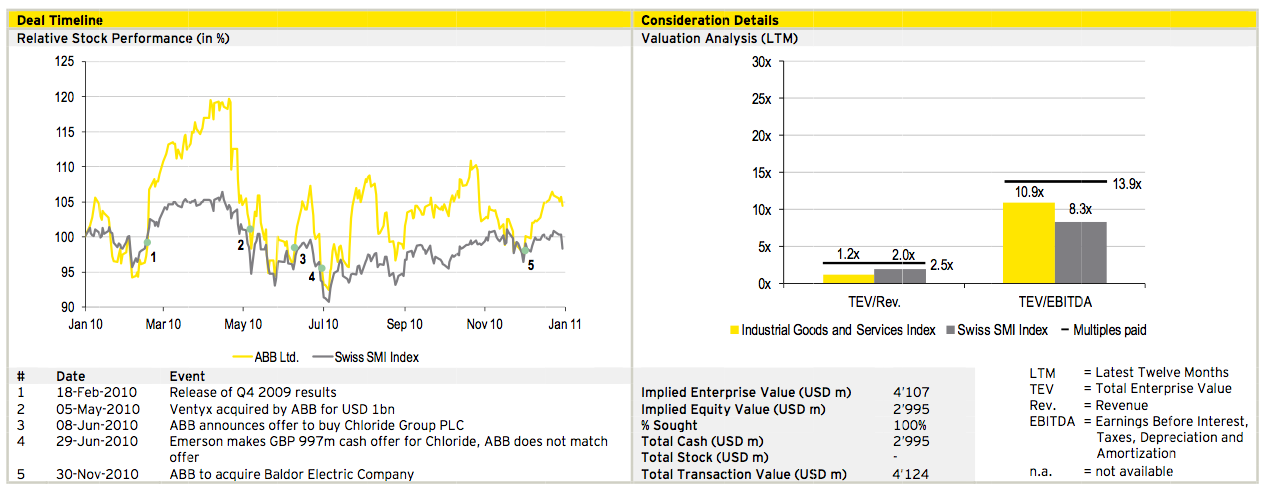

The largest transaction announced in the final quarter and calendar year 2010 was the proposed merger of Novartis AG with Alcon Inc., whereas Novartis intends to buy all remaining outstanding shares (23%) of Alcon for a total consideration of USD 11.8bn. In November 2010, ABB Ltd. announced the acquisition of US-based Baldor Electric Company for USD 4.1bn, the second largest domestic transaction in 2010. This transaction comes on the heels of ABB’s acquisition of Ventyx Inc. for USD 1.0bn in May 2010.

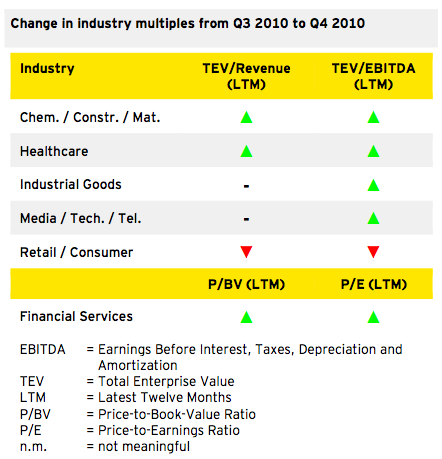

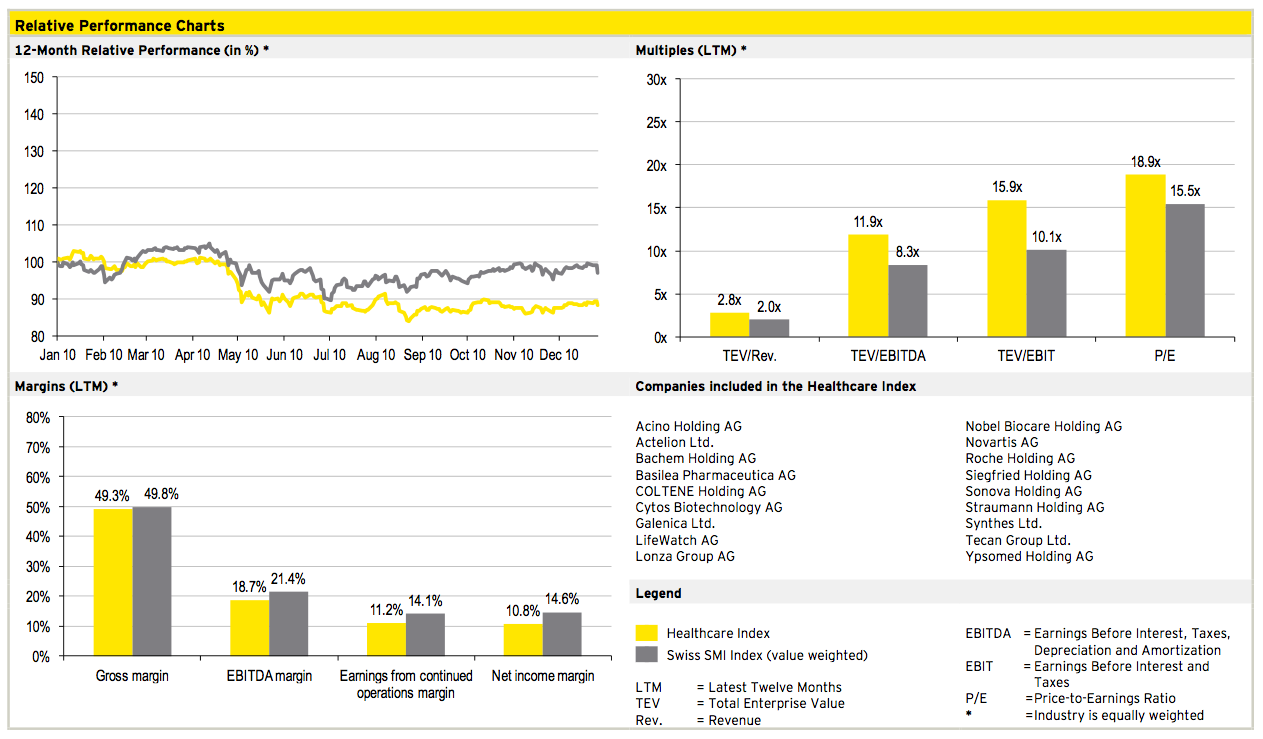

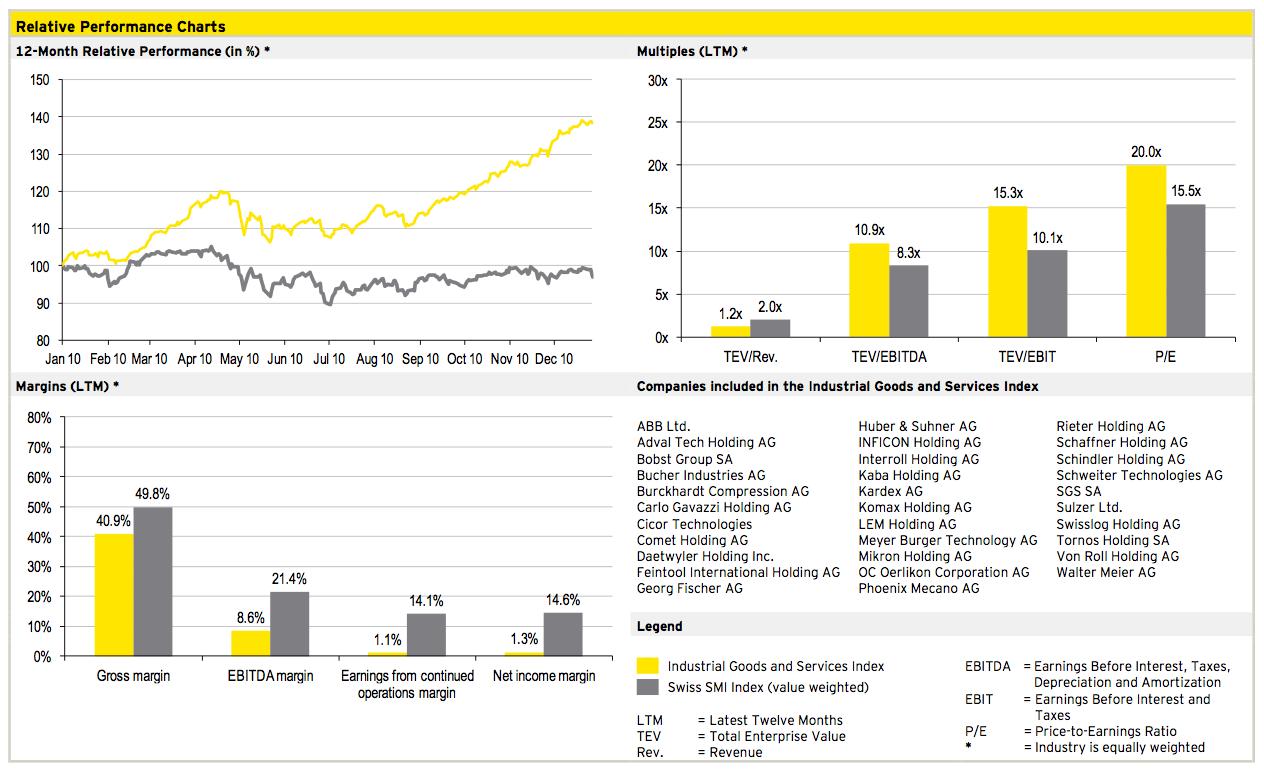

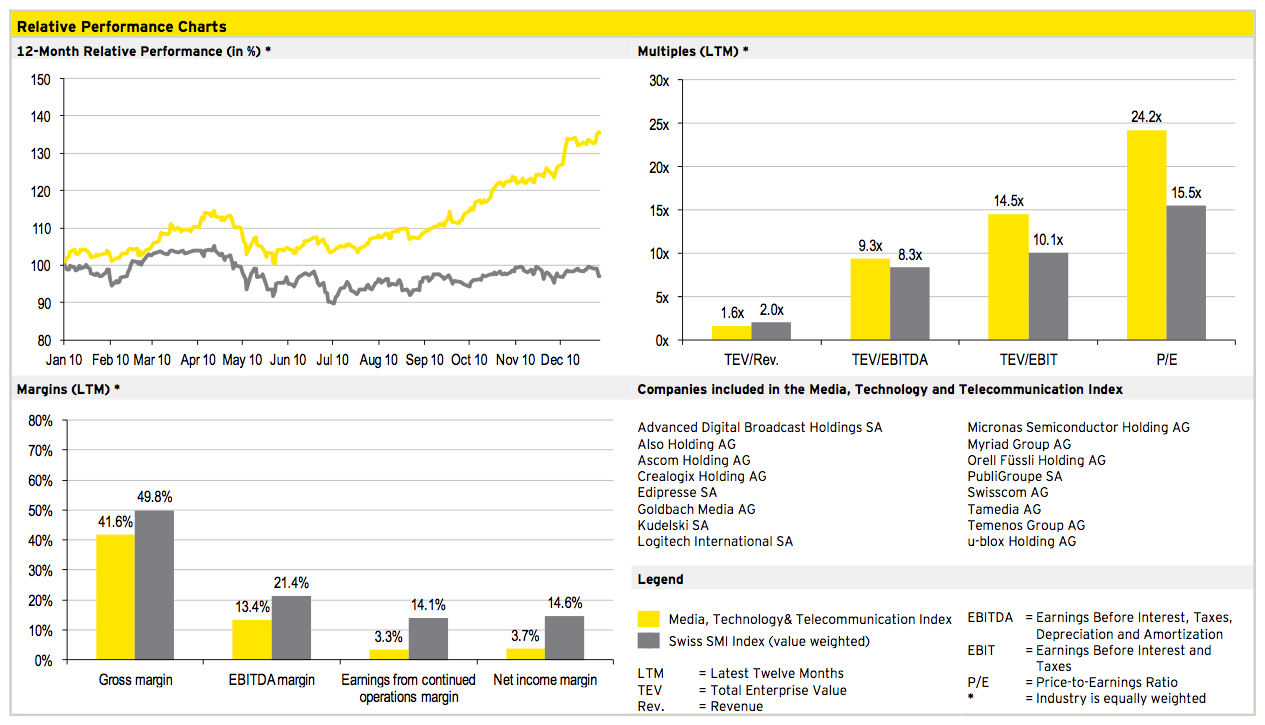

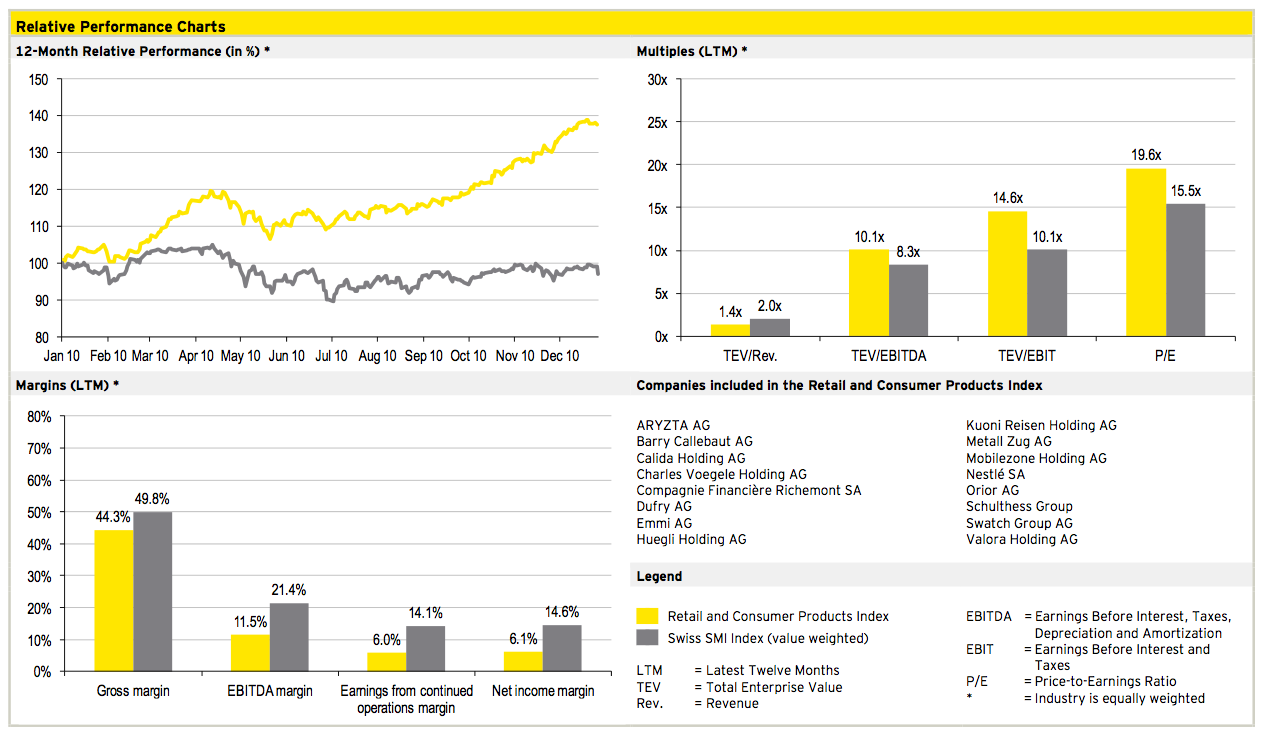

After a positive performance of 2.2% in the fourth quarter of 2010, the Swiss Market Index closed with a loss of 1.7% in 2010 as a whole, compared to a gain of 18.3% in 2009. The strongest industries in terms of stock performance during the last year were industrial goods and services, retail and consumer products as well as media, technology and telecommunication. All three sectors rose by at least 35%. Healthcare companies underperformed the overall stock market in 2010.

Transactions by industry and size

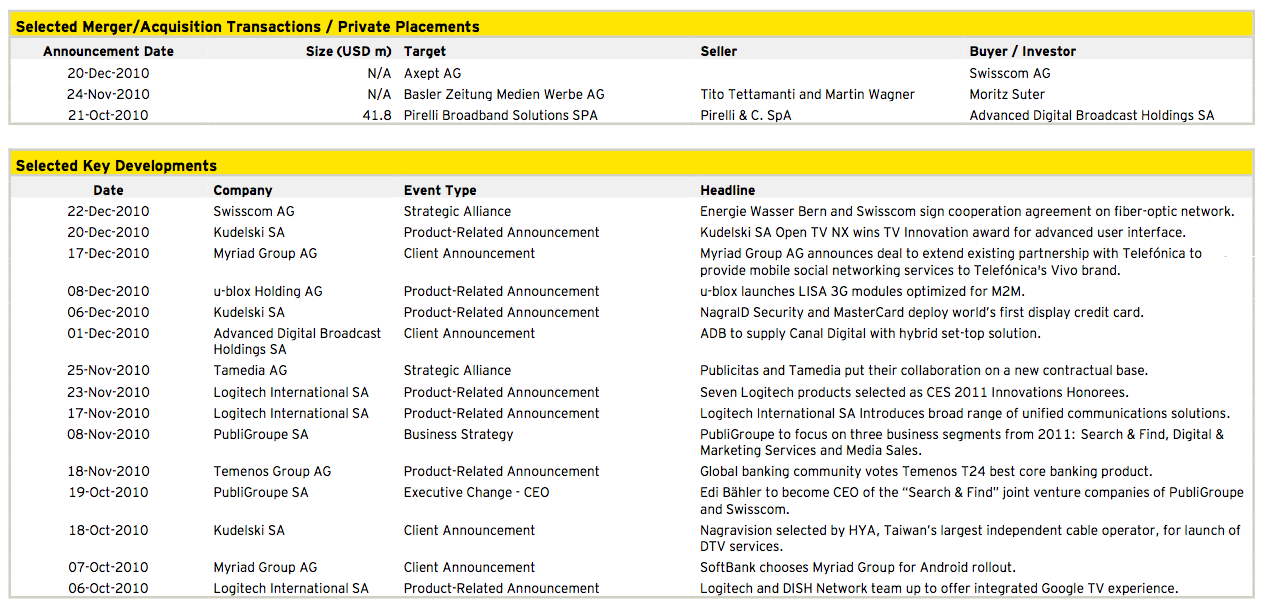

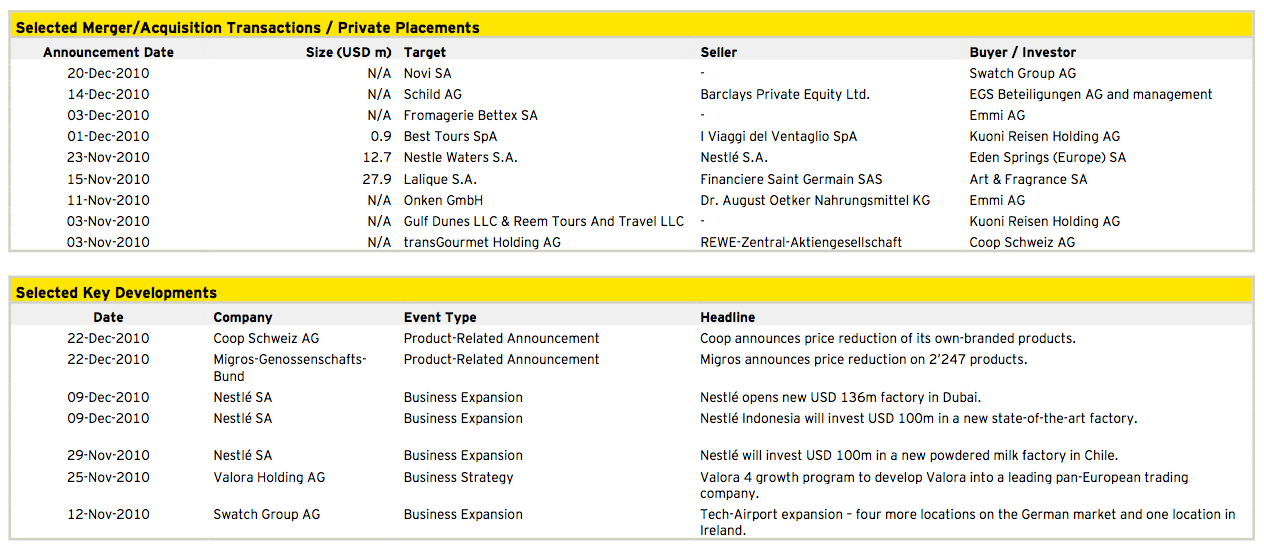

The retail and consumer products sector was the most active industry in terms of number of transactions during the fourth quarter of 2010, accounting for every fifth transaction. In line with previous quarters, the industrial goods and services sector as well as the media, technology and telecom sector accounted for a large portion of the Swiss M&A market with 18% and 15% of all Swiss M&A transactions, respectively.

In the fourth quarter of 2010, one of the largest transactions in the retail and consumer products sector was the acquisition of transGourmet Holding AG by Coop Schweiz AG from REWE-Zentral-Aktiengesellschaft. transGourmet was established in early 2005 as a 50/50 joint venture between German-based REWE and Swiss-based Coop in order to build up a wholesale catering supplies and wholesale distribution business. Today, transGourmet employs over 21’000 people and generated revenues of around EUR 5.8bn in FY09, making it the second-largest cash & carry and food service company in Europe, according to company sources.

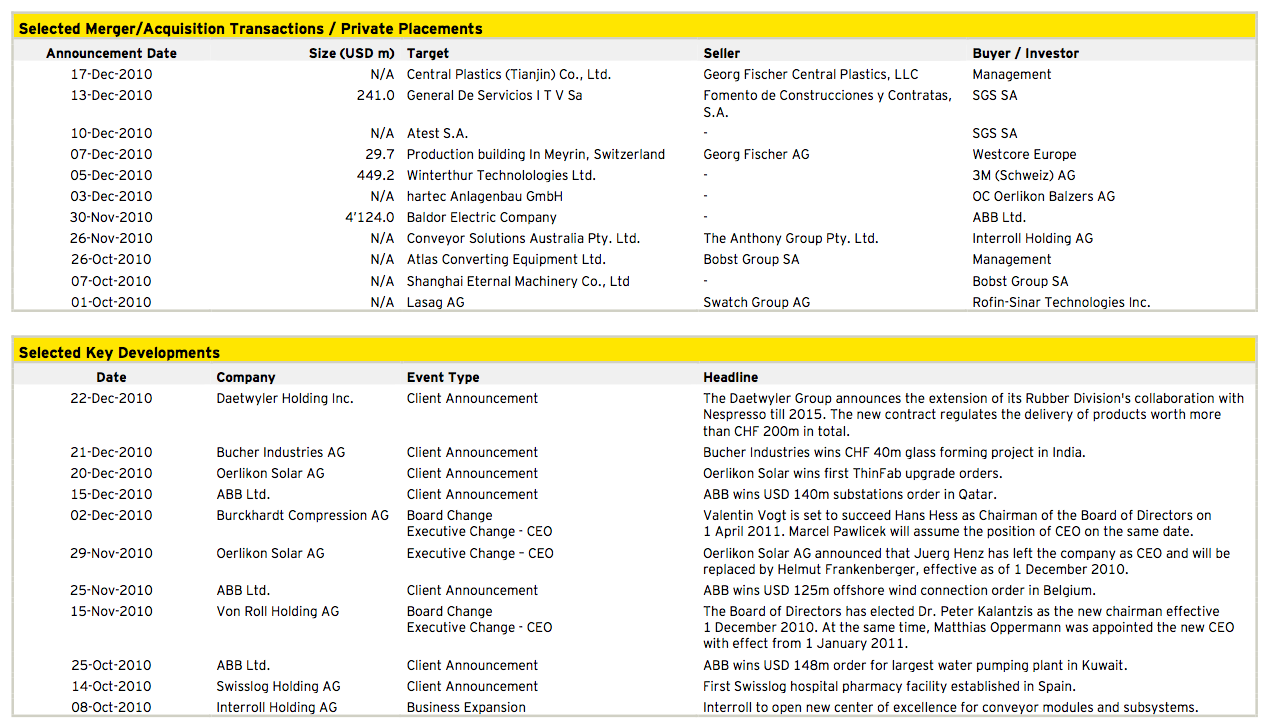

In the industrial goods and services sector, ABB continued to be a key player in the Swiss M&A market and entered into a definitive agreement to acquire Baldor Electric Co. on 30 November 2010. This transaction is described further in our deal of the quarter section.

During the fourth quarter of 2010, large transactions remained fairly stable at 30% of all Swiss deals. However, the midmarket segment experienced a significant decline, with the ratio of deals between USD 50-250m reduced by half in comparison to Q3 2010. This decline, however, was offset by an increase in small transactions, which accounted for more than half of all Swiss M&A deals in Q4, as compared to 38% in Q3 2010.

Outlook 2011

The most recent estimate of the Swiss State Secretariat for Economic Affairs (SECO) shows GDP growth of 2.7% for 2010. For 2011, SECO slightly increased its expectations from 1.2% in September 2010 to 1.5% in its most recent GDP forecast in December 2010. Although SECO believes that the ongoing strength of the Swiss Franc will have a negative impact on exporters, this effect is expected to be partially compensated by robust domestic demand. With this development, M&A activity within Switzerland is anticipated to remain strong, in line with the fourth quarter of 2010. Domestic firms may take advantage of the strong local currency resulting in an increased outbound deal flow, while inbound transactions may suffer due to the strong Swiss Franc.

In general, 2011 is expected to be significantly stronger than 2010 in terms of Swiss M&A activity as the corporate world’s appetite for deal-making has returned. The last quarter of 2010 was an indication of the improvement of the Swiss M&A market. However, M&A professionals do not anticipate M&A deal activity to reach pre financial crisis levels yet. Most industry experts forecast a potential return to these levels by 2012 or 2013.

As domestic economic growth expectations remain moderate, companies are expected to target top line growth through acquisitions in order to also allow their earnings to grow. In addition, Swiss companies still have strong cash reserves which can be deployed for transactions or alternatively paid out to shareholders.

Emerging markets such as China, India or Brazil are becoming an increasingly important aspect of M&A deal activity as Swiss companies search for growth opportunities. Hence, it is expected that the number of Swiss companies acquiring targets in emerging markets will increase significantly in 2011 and ensuing years.

From an industry perspective, retail and consumer goods is expected to continue to be among the most active areas for M&A transactions. Furthermore, industrial goods and services as well as technology and healthcare firms are forecast to generate significant M&A interest in Switzerland.

Deal of the quarter

Deal Summary

In Q4 2010, our deal of the quarter features the acquisition of Baldor Electric Company by ABB Ltd. for USD 4.1bn announced on 30 November 2010. The transaction value includes USD 1.1bn in net debt.

ABB offers Baldor shareholders USD 63.5 per share in cash, which represented a 41% premium to Baldor’s closing stock price on 29 November 2010. The transaction was unanimously approved by each company’s Board of Directors and is expected to be closed during the first quarter of 2011.

Deal Rationale

► ABB is expected to establish itself as a leader in the North American industrial motor business and a global leader for movement and control in industrial applications.

► Baldor’s product portfolio is considered highly complementary to ABB’s. Furthermore, the transaction is expected to close the gap in ABB’s North American automation portfolio.

► ABB estimates more than USD 100m in annual cost synergies and significant revenue synergies of at least the same amount due to Baldor’s strong North American market access and ABB’s global distribution network.

► In addition, new energy efficient regulations in the US are expected to provide further growth potential.

► ABB expects the transaction to be accretive to its earnings per share from year one.

Industry overview

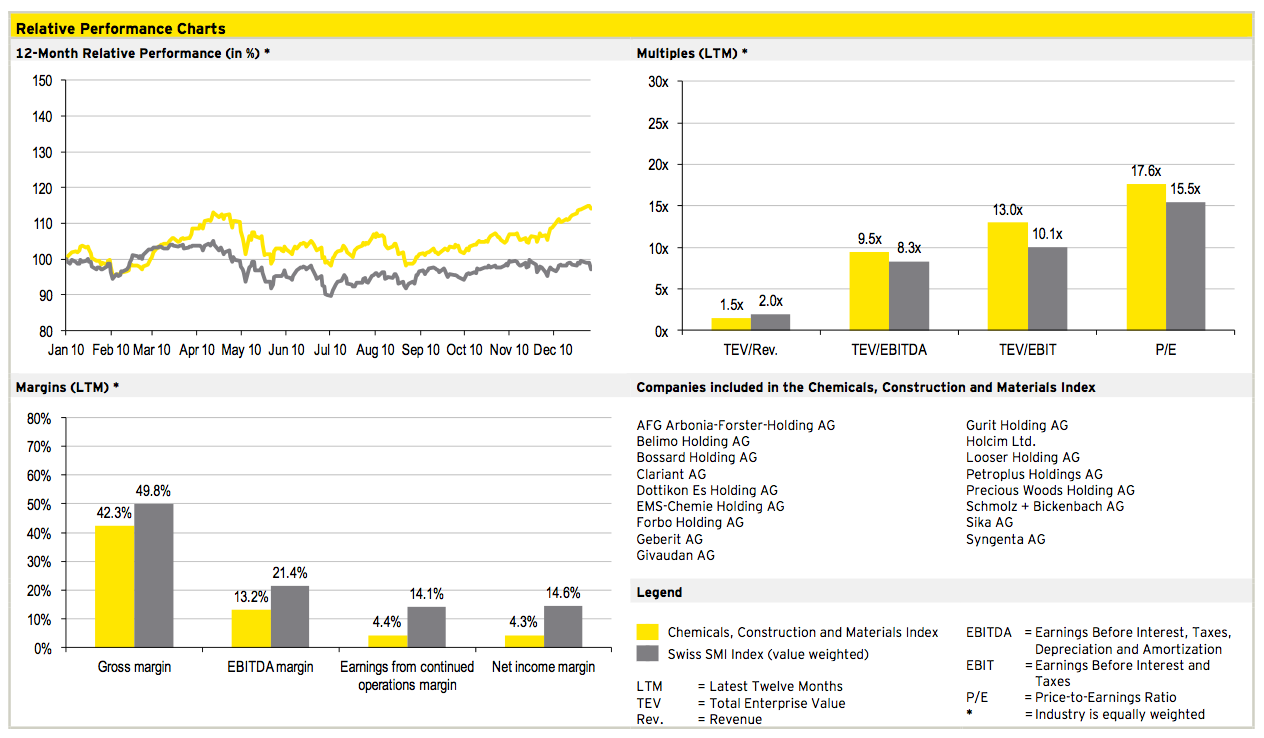

Chemicals, Construction and Materials

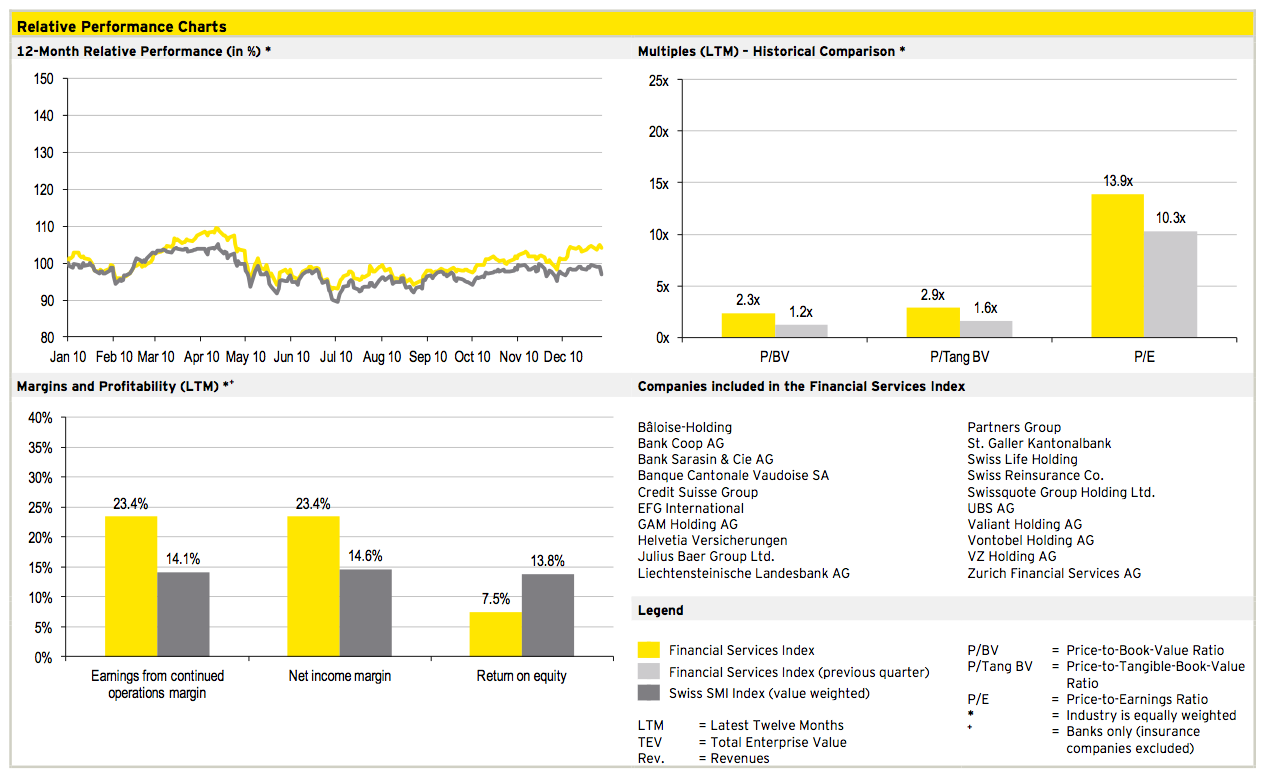

Financial Services

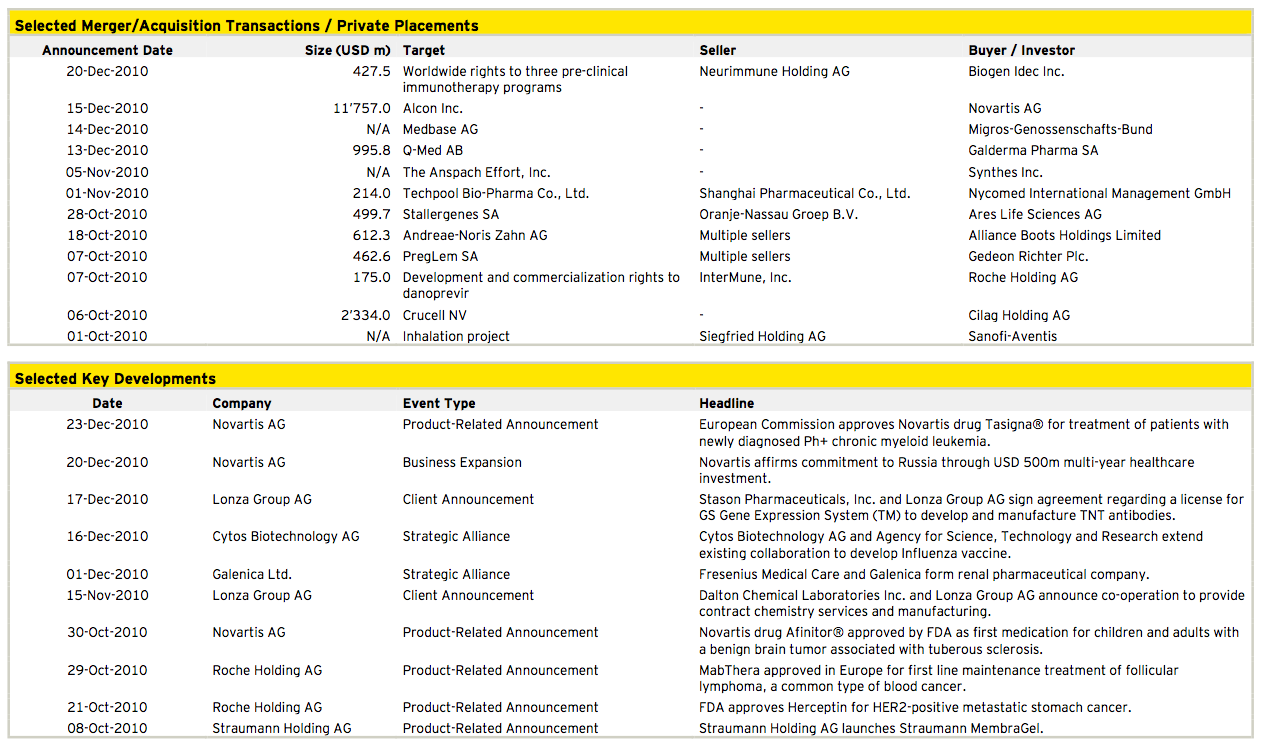

Healthcare

Industrial Goods and Services

Media, Technology and Telecommunications

Retail and Consumer Products

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter