Publications Growth Through M&A: Promise And Reality

- Publications

Growth Through M&A: Promise And Reality

- Christopher Kummer

SHARE:

By Iain Bamford, Nik Chickermane, Jessica Kosmowski – Deloitte

Contributors: Candace Hakim, Lisa Zhao, Francesco Orselli, Louise Chang, Delphine Jacquin, Connor Bogin

“The secret of success is constancy to purpose.” — Benjamin Disraeli

It isn’t unusual for a company pursuing a merger or acquisition to express high hopes that the deal will be a growth engine. The intention, quite reasonably, is that the resulting combination of products, people and pipelines will take the business to new heights. Then reality sets in. The combined business has to deal with a presence in multiple markets, a larger and more diverse customer base, a more complex product and services portfolio, and a high level of people and operational complexity. Cost synergies, a tangible and often quickly attainable goal, take precedence over the grinding work of formulating, isolating and tracking revenue metrics and growth efforts. Cost reduction goals can even conflict with revenue growth opportunities.

Little wonder then that a majority of M&A deals intended specifically to enable growth fail to achieve their expressed growth objective. While M&A can be a road to growth, the decision to make the deal is only the first of many decisions that will affect its outcome. What can acquisition-oriented businesses do — especially those pursuing transactions with strategic growth as a goal — to increase their chances of success?

By the numbers

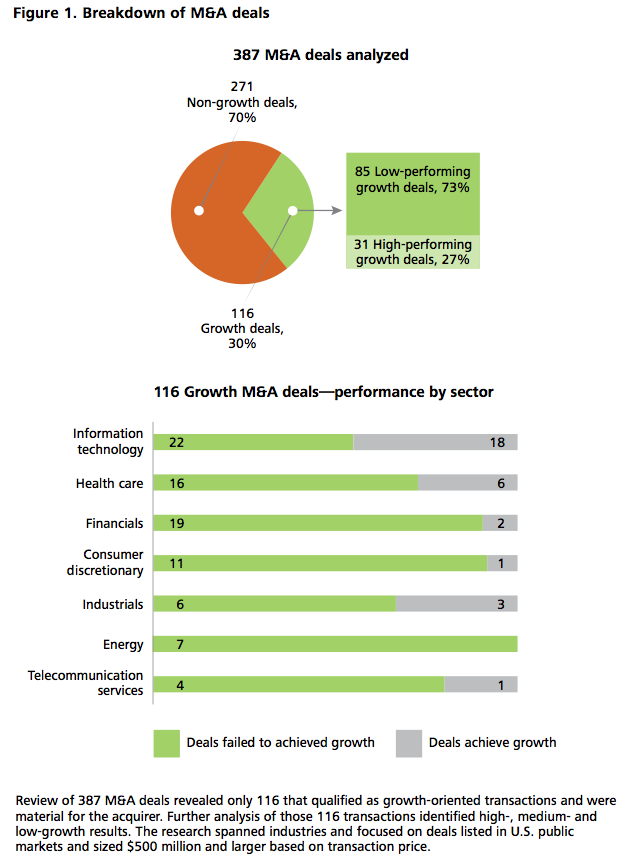

Our exploration of these issues began with an analysis of nearly 400 M&A transactions executed from 2001 through 2007. We then narrowed the list to just over 100 deals in which the target revenues were material to the acquirer; growth was the expressed intention of the deal; and cost synergies were incidental. We then applied an analytical framework to the selected deals to determine which ones fulfilled those intentions and studied the various strategies and tactics utilized with respect to the rest of the transactions.

We stringently defined the study set as deals in which the acquirer had stated its intention to acquire a target with characteristics such as: a growth rate substantially higher than the acquirer’s; adjacent or complementary products for cross-selling; a portfolio or pipeline of innovative products and services; or, a presence in fast-growing markets. Also included were deals in which the acquirer publicly stated revenue synergy targets to the financial community.

We then identified actions—or inaction—that appeared to have contributed to success or failure in “growing the business.” Finally, we assessed those actions and outcomes to affirm the findings and develop a framework to help businesses prepare for successful growth though M&A.

Based on criteria we established to define “pure growth deals,” our refined dataset contained 116 revenue synergy-focused deals (see figure 1). Further analysis revealed that:

- Twenty-seven percent of the deals were what we classified as high-per-forming growth deals. These acquirers were able to consistently grow the combined businesses faster than the separate companies were likely to have grown absent the deal and in excess of industry growth.

- Forty-five percent were medium-performing growth deals. They were able to grow the business, although inconsistently and at a slower rate than their pre-deal growth or industry growth rate.

- Twenty-eight percent were low-performing growth deals, consistently producing flat or declining revenues with respect to their pre-deal revenues and in comparison to their industry growth rate.

The acquirers associated with the high-performing deals grew faster than they would have before those acquisitions. These companies reported higher actual revenues three years after the deal closed than what was projected based on historical and projected compound annual growth rates (CAGR) and after accounting for revenue-impacting internal or industry events within the three years after the deal close.

Eight priorities: making expectations a reality

What characteristics, then, distinguished the high performers from the others? How were those companies able to beat the odds and achieve sustained growth post-integration?

Eight customer-focused priorities emerged as important enablers of successful growth associated with M&A transactions. We found that successful acquirers remained intensely focused on them from the earliest stages of a deal until they achieved their desired end state, no matter how far into the future that was. Equally important, they clearly understood the connectivity and dependencies between these eight areas and planned accordingly.

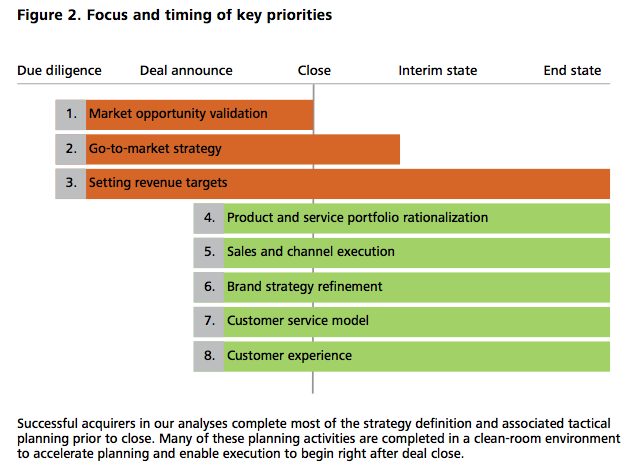

The first three priorities are strategic: They explore how an acquirer must identify specific opportunities created by the deal, develop strategies to capture them, and set financial targets and accountability for growth. The remaining five priorities address the tactical—the steps required to achieve the deal goals and realize the potential of the acquisition based on the strategic priorities. The timing of the activities around these priorities varies by acquirer, but successful acquirers generally began to focus on these activities before deal close, deploying “clean teams” as required to accelerate planning using competitively sensitive data (see figure 2). They then developed clear short- and long-term plans around the initiatives that were most critical to driving growth and had the discipline to see these through to completion.

Priority 1: Market opportunity validation

- How are we, as a combined company, positioned in our existing markets, and how can we sustain our differentiated capabilities to sustain our growth?

- What new opportunities are available to pursue as a result of the deal, and which of them have the highest growth potential?

- How will our target markets shift as a result of this merger or acquisition?

The first question in a growth-oriented deal is whether the growth opportunity is real and the combined entities can realistically capture that growth. We found that successful acquirers clearly prioritized specific opportunities based on agreed-upon criteria such as revenue growth potential or margin improvement.

Market analysis using primary and secondary research can identify potential opportunities by product, customer segment, market size or region. The deal model will be an input to this process, but it is typically not nearly detailed enough—having been created by bankers and the deal team with relatively little time and data. While plans cannot be discussed externally before deal close, customers may be consulted about what they expect from a deal, along with market analysts and specialist advisors.

This analysis typically covers the specific solutions the target offers and how they map into the acquirer’s portfolio; the strength of the target’s competition; and how well the combined company can penetrate markets going forward. This disciplined approach to analysis and prioritization forms the foundation for the success of the other priority areas—helping to ensure that all planning efforts are centered on the highest-value opportunities.

In assessing opportunities, it is important to involve people who will ultimately be accountable for obtaining results. Together, the functional and business unit personnel responsible for making the deal happen, and ultimately successful, must drive the analysis and buy into its results.

When the time comes for the integration team to present a promising opportunity to corporate leadership, realism should also trump optimism. A deal can be attractive from a product or market standpoint, but the numbers also need to make sense.

In a recent transaction involving two software companies, for example, the strategic rationale offered by the acquirer for pursuing the target company assumed that it would grow revenue fivefold over the first five years after the acquisition. However, the M&A team’s market opportunity analysis ultimately determined that revenue was likely to grow only threefold, and that even reaching that level would require specific actions on the part of the acquirer. This helped the acquirer adjust the integration plan and better understand what measures would need to be put in place to accomplish such growth. By digging deeper into the market opportunity analysis, supplemented by proactive planning, the acquirer is currently on track to plan its growth to achieve its revenue projections.

Priority 2: Go-to-market strategy

- What are the specific market segments for both companies, and what is our combined value proposition for each segment?

- How should specific market segments be targeted—via direct and/or indirect sales channels?

- Does the new entity create channel conflict, and if so how much?

With specific market opportunities identified, the next step is determining how these must be attacked. A coherent go-to-market strategy is critical to achieving the growth objectives of the deal, maintaining business continuity, and deploying the talent and resources of both companies in the most efficient and effective way.

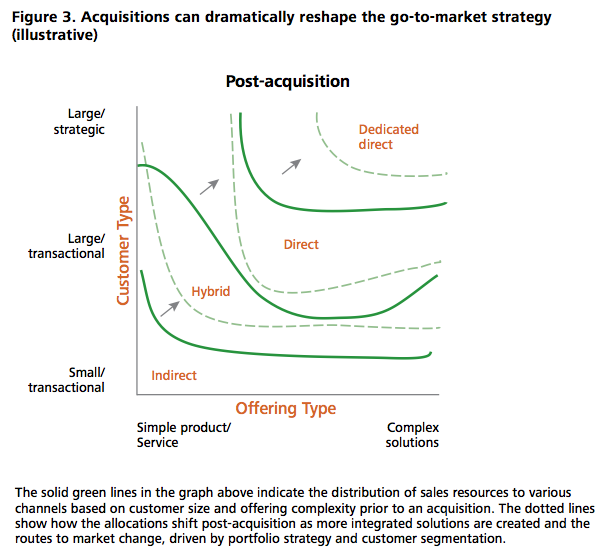

Adding the target company’s offerings to the acquirer’s product and service mix can shift the go-to-market approach in dramatic ways. Figure 3 is derived from our observations and illustrates the point. The solid green lines indicate the distribution of sales resources to various channels based on customer size and the complexity of offerings prior to an acquisition. The dotted lines show how the strategy shifts post-acquisition. Product-offering complexity has increased with the creation of more integrated solutions combining the products and services of the target and acquirer. The routes to market have therefore changed, and more offerings are pushed toward indirect and hybrid channels, allowing the direct channel to focus on the higher-value and most complex solutions. Such a visualization of the go-to-market strategy can help both the dealmakers and the people ultimately responsible for carrying out the strategy to understand and buy into the vision of the deal.

Go-to-market strategy should translate strategic inputs into an actionable, growth-focused structure defined by segment, market, product, channel and sales. It can be challenging to identify and prioritize the most critical strategic inputs, but doing so will determine the effectiveness of the deal vision, structure and subsequent decision-making when executing post-close.

This planning can enable better alignment of the post-merger sales channels with the post-merger product portfolio. A software company that primarily operated with an indirect sales model (selling via channel partners) was considering the acquisition of a SaaS company with a direct sales model and its own sales force. To achieve growth objectives, the acquiring company focused resources upfront to determine the right mix of direct versus indirect sales based on the market strategy it established, as well as whether it needed to build additional specific capabilities. Based on this the company was able to plan necessary adjustments to its sales channels after deal close, accelerating the time to results.

Priority 3: Setting revenue targets

- What are our revenue and margin goals for this acquisition?

- Who will be accountable for the results?

- How will initiatives be tracked?

It’s been said that an obsessive focus on the business case is a key to M&A success. One way to actualize this focus is to establish specific revenue and margin goals for the deal and assign accountability for them to the right business leaders.

Many companies, though, tend to track cost savings more closely than revenue impact—simply because these savings are typically shorter term, specific and measurable. In many cases, revenue and margin goals for the new business unit are adjusted, and there is no separate tracking of synergies. Using this approach, company leaders may know they are obtaining some growth, but they don’t know what they may be leaving on the table or whether the business unit is in fact executing against the strategy that led to the acquisition.

In a recent deal, a technology manufacturer acquired a services company that historically had provided solutions agnostically, incorporating hardware from various vendors. The acquirer expected to improve the business unit’s margins by replacing the equipment from other suppliers with its own. Unanswered, however, was the question of whether the services operation’s customers would be willing to switch to the acquirer’s gear. Determining the impact of such a shift required working with the sales force to determine how customers were likely to react to the change, in some cases down to an account-by-account basis. Which products would they be willing to swap out? Would they resist the switch because of solution complexity or other concerns? Such analysis, completed before the deal closed, was essential to establishing realistic sales projections and factoring them into the sales team’s goals and compensation structure.

Priority 4: Product and service portfolio rationalization

- What products and services will be included in our post-deal portfolio?

- How will they be bundled in terms of value proposition and priced?

- To what extent will we need to rationalize redundant products and services?

- How do we confirm portfolio alignment with our business and go-to-market strategies?

Determination of which products and services the combined company will take to market is driven by the market opportunity validation conducted at the outset of the deal exploration. Specific consideration should also be given to short-versus long-term opportunities. In the short term, steps may be taken to quickly create new product bundles or solutions, or there may be “quick hit” product improvements courtesy of technology brought in by the acquired business, or pipeline analysis might highlight specific in-process opportunities to leverage the value proposition of the combined entities.

Longer-term product alignment decisions are inherently more difficult because of factors such as customers’ unwillingness to “switch horses,” employee loyalty to products they have spent years creating, and sheer technical and operational complexity. However, it is important to put a stake in the ground early on to guide how to organize resources and achieve more in-depth integration of products or to pool R&D resources to drive more collaboration. Messages should convey the M&A story and quickly reassure customers and markets concerning the go-forward strategy.

A high-level product road map provides a starting point for rationalization. What offerings are in the product pipelines of the two companies, and when will they be ready to go to market? Does one company have a product that can be enhanced through integration with a product developed by the other? How can products be combined and marketed as solutions differently because of the deal? The services portfolio presents similar yet distinct considerations. One company may be charging for services while the other provides them at no cost. How will services be described, packaged and sold?

The merger of two biotechnology companies provides insight with regard to how these rationalization questions can be addressed. Both companies offered gene sequencing systems that determine an organism’s DNA, as well as gene splicing processes for artificially joining pieces of genetic material. It was evident that one company had superior sequencing systems, while the other was stronger in splicing. Leaders of the soon-to-be combined enterprise carefully considered how customers of both companies might be affected by the rationalization process. They examined how to meet the needs of customers possessing the weaker solutions in the short term, how to migrate them to the stronger offerings during their next purchasing cycle, and how to structure pricing, incentives and other offering features.

Inevitably, some existing products that customers have invested in may need to be retired. In such cases, delivering the news early and in a constructive way to both customers and sales personnel will reduce confusion and anxiety, as well as lay out a migration path to other solutions.

Priority 5: Sales and channel execution

- How should our sales organization be structured in terms of territories and assigned coverage?

- What is the new sales incentive or compensation model, and how will it be communicated and administered?

- What is the right mix of channels to reach customers?

- How will our partners be affected by the proposed new model?

The next series of critical execution decisions are around how sales resources should be deployed and how external channels and partners can best be used to support them. Again, it is important to start with the identified market opportunities and confirmed go-to-market strategy.

Customer segmentation is the thread that ties everything together, yet every company has a slightly different way of segmenting its customers. Therefore, when conducting a merger it is essential to understand which target segments are most important across the combined companies and then decide how to dedicate or redeploy the sales force to match the highest-priority clients. They are more likely to succeed if they are deployed in the right market segment with the right sales quota and incentives.

The experience of a life sciences company illustrates how consideration of sales issues can boost deal performance by reducing customer churn and protecting base revenues. In the process of acquiring a larger competitor with similar product lines, the company established a “clean room” for a team to analyze the two companies’ sales environments and identify key products and customers to drive future growth. The “clean team” determined what it regarded as the optimal market footprint and customer segmentation for the combined company.

The resulting go-to-market strategy and rollout plans—including sales performance and training and development plans—were approved soon after deal close by executive leadership with support from cross-functional and regional leaders. A playbook was created for the sales force to help them focus on key short-term opportunities, consistently communicate deal value drivers to customers, and look out for specific customer risks. Also, specific rules of engagement were defined to govern areas of potential customer and sales team confusion, e.g., account with overlapping sales teams positioning for similar products. This careful planning contributed to a disruption-free deal close, above-market revenue growth, and attainment of revenue synergy targets.

Priority 6: Brand strategy refinement

- What associations do customers have with both companies’ product and corporate brands, and which will resonate more strongly given the go-forward strategy?

- How can we improve the power and strength of the two portfolios and brands?

- What is our plan to transition to the new brand strategy? What specific marketing campaigns are required?

Branding must be considered at the corporate level, the product level and the service level. It is one of the first visible indicators of a combined company’s direction and sends strong signals to both customers and employees. Despite this, brand decisions are often rushed or made for political and emotional reasons.

An acquirer may choose to retain one of the brands and build its business around it, or develop an entirely new brand. The latter can be more complex than it appears, because brands underpin strong emotional ties with both customers and employees. Major, high-profile branding decisions therefore require a deep understanding of what those customers and employees value. Based on the deal strategy, does it make sense to pick one brand or the other, or develop something new?

When two online travel service companies merged, consideration was given to applying one or the other of the names to the combined enterprise, and extensive customer research was undertaken to determine which brand had the strongest and most positive levels of customer awareness. Ultimately however, the company decided to use an entirely different name that reflected its goal of diversifying away from legacy markets—a new brand that had much lower levels of customer awareness but also less “baggage.” Customers and employees embraced the new identity, and the company grew into its new brand successfully.

Product and service brand decisions go hand in hand with product and service strategy. The brand decision is often one of the clearest embodiments of the integration strategy—keeping one brand over another signals control within the company. Effective choices hinge on an understanding of how much customers care about the product brand. How employees react to branding decisions is another key consideration, in large part because what they think about the brand will send a strong signal as to the company’s direction.

Priority 7: Customer service model

- How will we maintain and enhance our service levels post-deal-close?

- How does our service model need to scale up to support growth?

- Can we develop a common service model that supports the vision of the combined capability?

In the best of cases, a merger or acquisition can be an opportunity to improve the customer service of the combined company. Creating a broad customer service strategy can be vital to retaining customers post-transaction and preventing the deal from negatively affecting service.

Achieving these goals can be difficult, however. The combined companies may have widely varying service strategies and capabilities. Overlapping or redundant contact center footprints and capabilities may exist, or different outsourcing models may exist. Effort is required to understand the market position of both companies compared with their competitors’ servicing capabilities and performance. Customer service is especially important in some industries and deals, particularly those that are consumer facing, and in those cases should be a focal point of implementation planning.

By way of example, the acquirer of a software company realized that the service model was going to be an important factor in realizing the promise of the acquisition to its customers. This approach required a fundamental rethinking of the business operating model while making sure that the customer service model could scale up and meet ongoing demand from cross-selling and up-selling. This required the acquirer to develop a clear services strategy, well aligned with the sales strategy, to support the integrated technology solutions created through the acquisition. This new strategy was communicated internally through the use of a services playbook to confirm consistent customer messaging and internal process alignment. The goals: to drive a consistent customer care experience to support its growth strategy and to retain its most important customer base.

Priority 8: Defining customer experience

- How does the customer experience of the combined company compare to leading practices?

- Does the acquisition present an opportunity to create something better?

- What changes, if any, are expected in the customer experience life cycle based on all areas of the integration plan?

The quality of customer touch points with the combined company can be impacted by even the slightest changes in product, sales or services strategy. Understanding these changes and what they mean to customers can make the difference between strong customer retention and a major uptick in customer churn. Understanding these changes and what they meant to customers can make the difference between strong customer retention and a major uptick in customer churn. A deal can create several customer experience-related issues. Customers may hear confusing, unclear or contradictory messages about the transaction and its potential impact on their services or products.

Inadequately preparing all customer-facing employees to deal with customer questions or new processes can also irreparably damage relationships.

To prevent such issues, all customer touch points need to be evaluated. Critical to this is understanding where the real “moments of truth” for customers are—those points in the relationship life cycle that drive strengthened loyalty or cause customers to look elsewhere. The integration team should walk in a customer’s shoes and understand the impact of any proposed changes. If positive, how should value be maximized? If negative, what mitigation plans are needed?

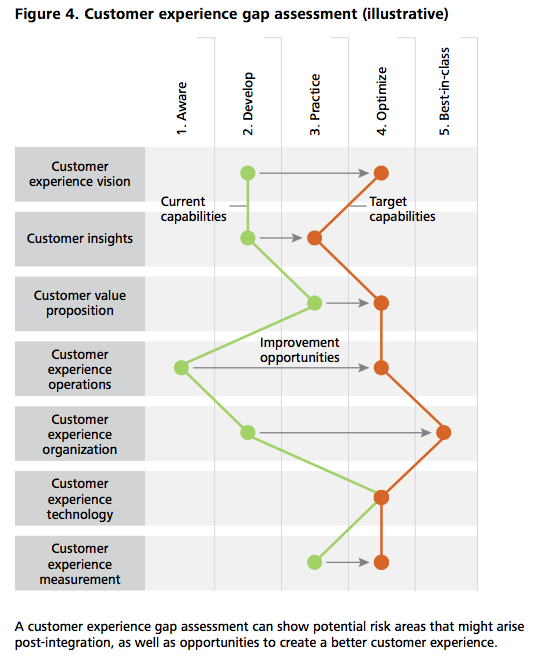

In any merger, it’s highly unlikely that all of the services, products and customer interaction processes will remain the same. Therefore, it is important to define the characteristics of the new customer experience up front, map potential changes to bridge the gap between the old and new environment, and determine the best way to bring customers along (see figure 4).

In a recent banking merger, a large national institution acquired a smaller regional competitor. The target’s customers were widely understood to value the “community-focused” approach of the bank and felt strong loyalty to its brand as well as to specific employees in local branches. The integration plan involved moving all target processes and customer touch points (in branches as well as digital) to the acquirer model, which would mean numerous changes in how the bank interacted with its customers. To address this, specific research was undertaken in the early planning stages to understand what was really important to customers, and detailed “journey maps” were created to walk though how proposed changes would look and feel to customers in different segments. This enabled the bank to prepare more focused communications to address the concerns of specific customer types, as well as to confirm that customer-facing employees were ready and prepared to deal with potential issues. It also highlighted some areas where improvements could be made on the acquirer side based on approaches taken by the target.

Leveraging smart planning to forge solid growth

M&A transactions almost always offer viable opportunities to achieve cost synergies and drive efficiency. But growth-oriented companies should not allow themselves to become trapped by a short-term focus and simply attempt to save their way to the deal success target. Success in growth-oriented M&A hinges on taking a disciplined approach based on a real understanding of the actions and initiatives required to drive short- and long-term value. By addressing the eight priorities outlined here, both early in the deal process and throughout the integration, companies can emerge as high performers that capture the expected value of their growth opportunities.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter