Publications Mergers & Acquisitions Quarterly Switzerland – Fourth Quarter 2012

- Publications

Mergers & Acquisitions Quarterly Switzerland – Fourth Quarter 2012

- Christopher Kummer

SHARE:

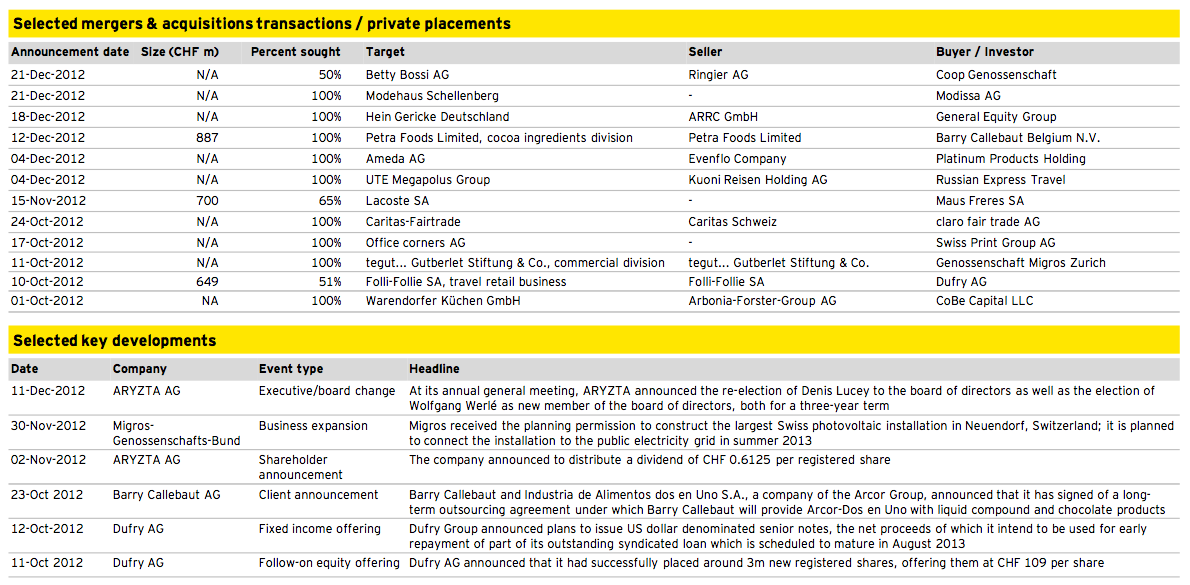

In the fourth quarter of 2012, Swiss M&A market activity was on the rise based on an increase in disclosed deal volume and number of transactions compared to the previous quarter. As a result, the Swiss M&A market environment recorded a solid performance for the full year 2012.

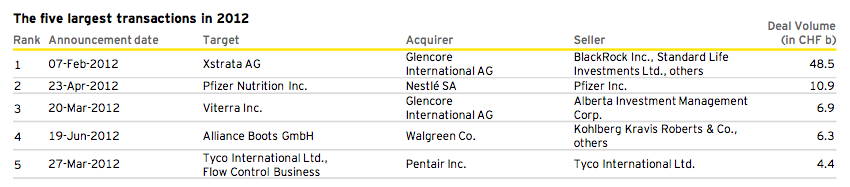

Calendar year 2012 also included one mega deal (Glencore/Xstrata) and was characterized by the coexistence of solid small and mid-cap M&A activity as well as high market volatility. With enduring market uncertainties in Europe still taking a toll on the prospect of further economic recovery, GDP growth in Switzerland is forecast at 1.3% for 2013. Although 2013 is expected to result in moderate Swiss M&A activity, more transactions might be taken into consideration by corporations if ongoing economic challenges and uncertainties subside.

Swiss M&A market Q4 12 and outlook 2013

M&A Market Q4 12

In the fourth quarter of 2012, the Swiss M&A market experienced an upward trend compared to the prior quarter. With 165 announced M&A transactions, the number of deals in the fourth quarter increased by over 16%. Disclosed deal volume reached CHF10.3b and rose by approximately 86%. When compared to Q4 11, the number of announced transactions remained fairly steady while deal volume increased by more than one third.

For the full year 2012, 606 transactions with an approximate deal volume of CHF 110.9b were recorded, representing a decrease of 16% in terms of number of deals, but an increase of about 116% in deal volume, compared to 2011. However, the significant rise in deal volume is largely attributable to Glencore/Xstrata’s announced mega deal in Q1 12. Nonetheless, excluding this transaction totaling CHF 48.5b, deal volume would have increased by about 21% in 2012, in comparison to the previous year.

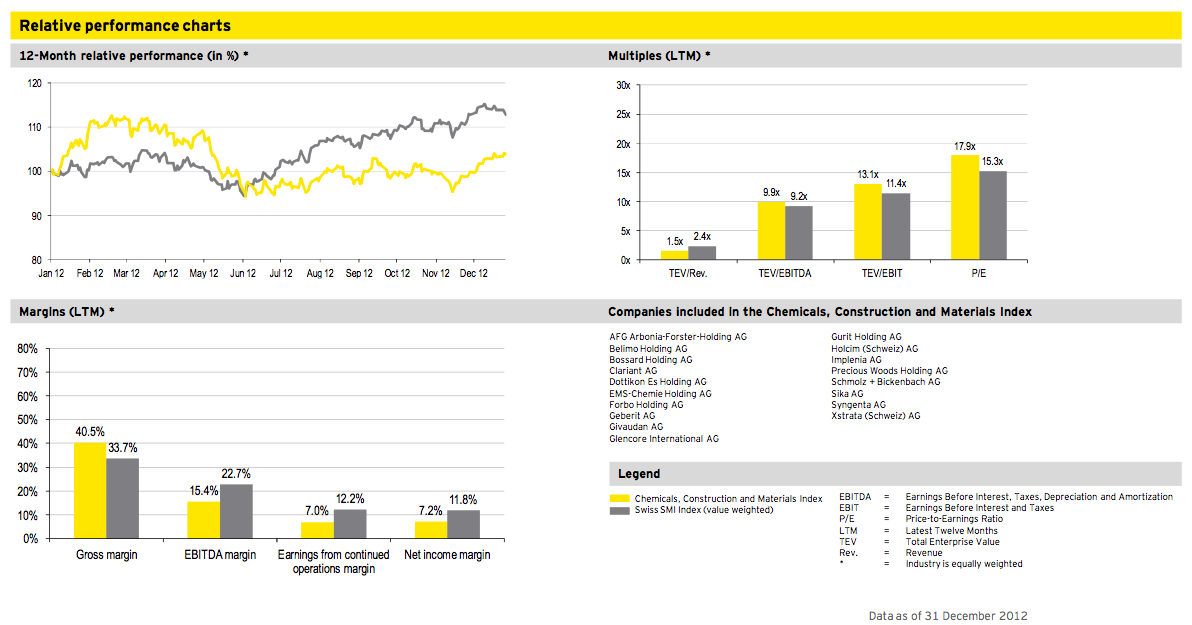

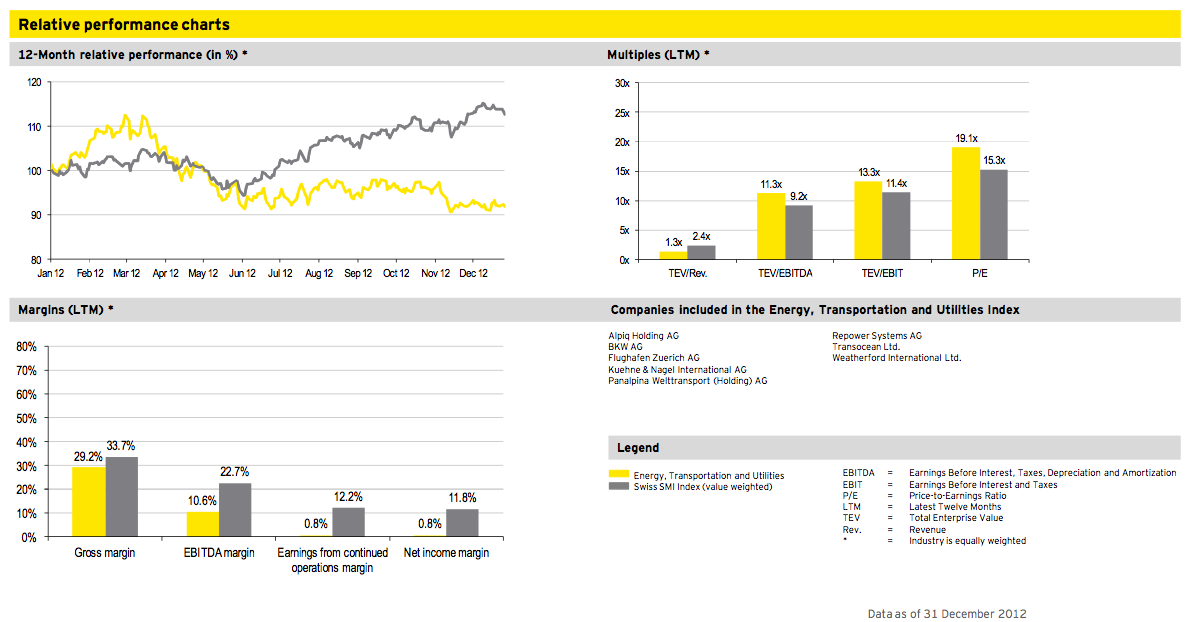

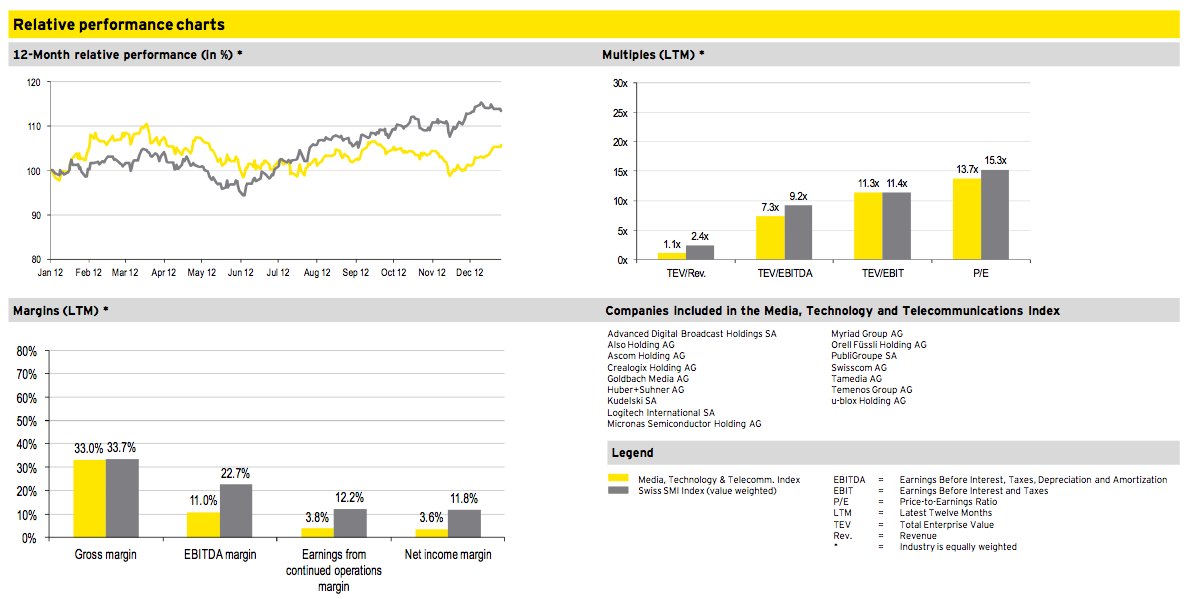

As in Q3 12, the Swiss Market Index (SMI) continued its upward trend, ending with a gain of more than 3% in the fourth quarter 2012. Following the SMI’s annual low in June 2012, markets regained confidence in stabilizing measures by the European Central Bank and were able to recover its losses incurred in the first half year of 2012. All in all, the SMI closed with a solid double-digit 12-month performance of around 13% in 2012, despite the European debt crisis and uncertain economic climate.

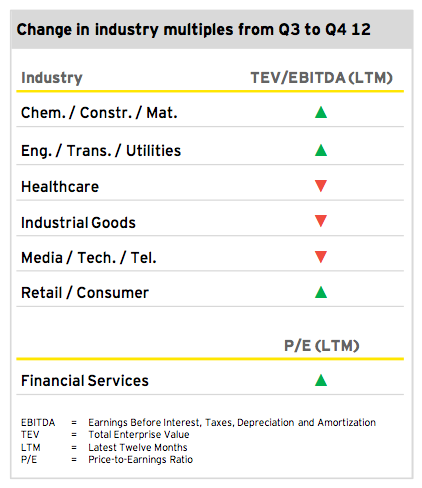

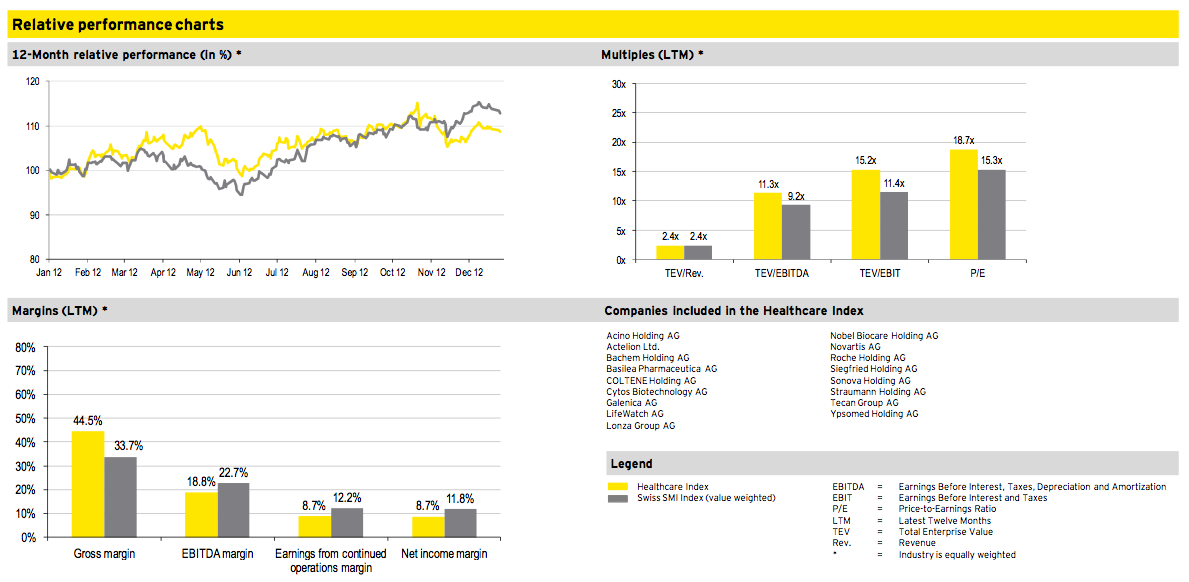

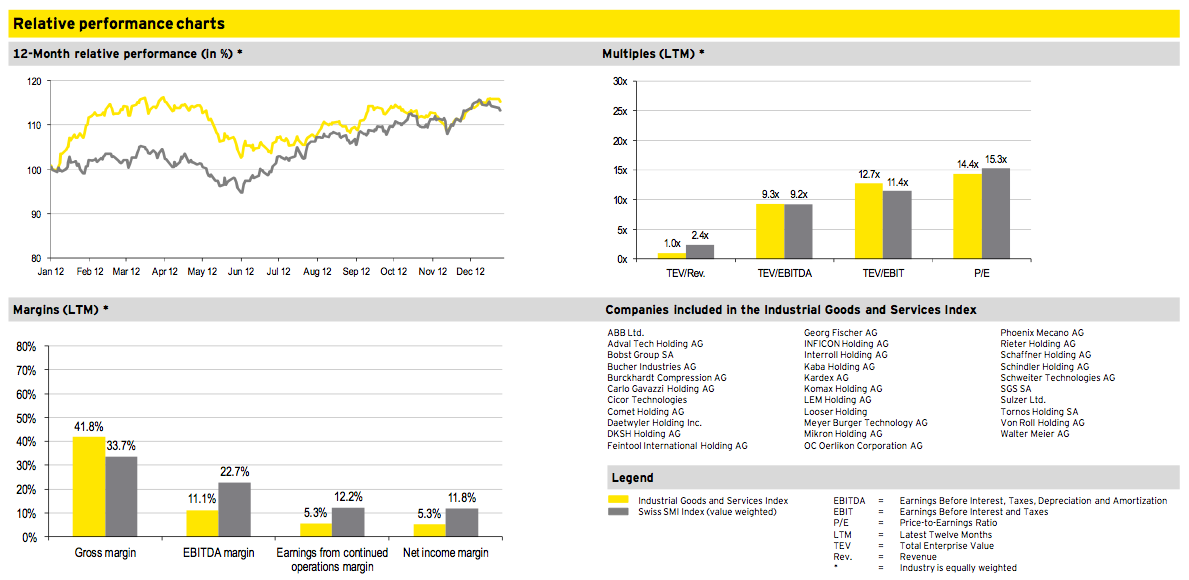

Except for Energy, Transportation and Utilities, all of the equally-weighted industry sectors achieved a positive stock performance in 2012. For the last twelve months, the best performing industry was Industrial Goods & Services with an increase of about 15% mainly due to exceeding earnings expectations of several industry players followed by the Healthcare sector, reaching a positive performance of about 9%.

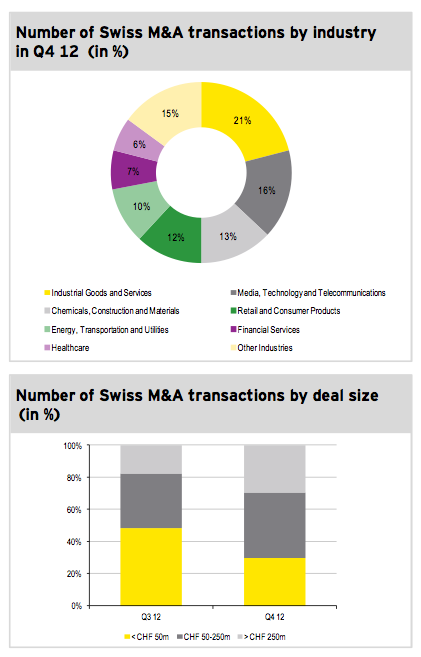

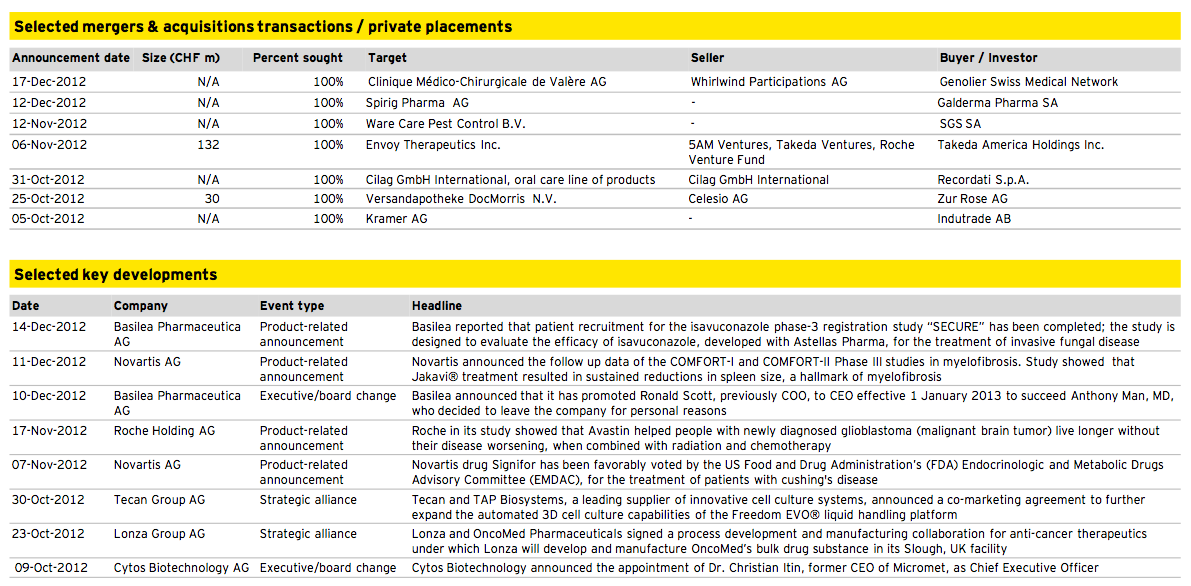

Transactions by industry and size

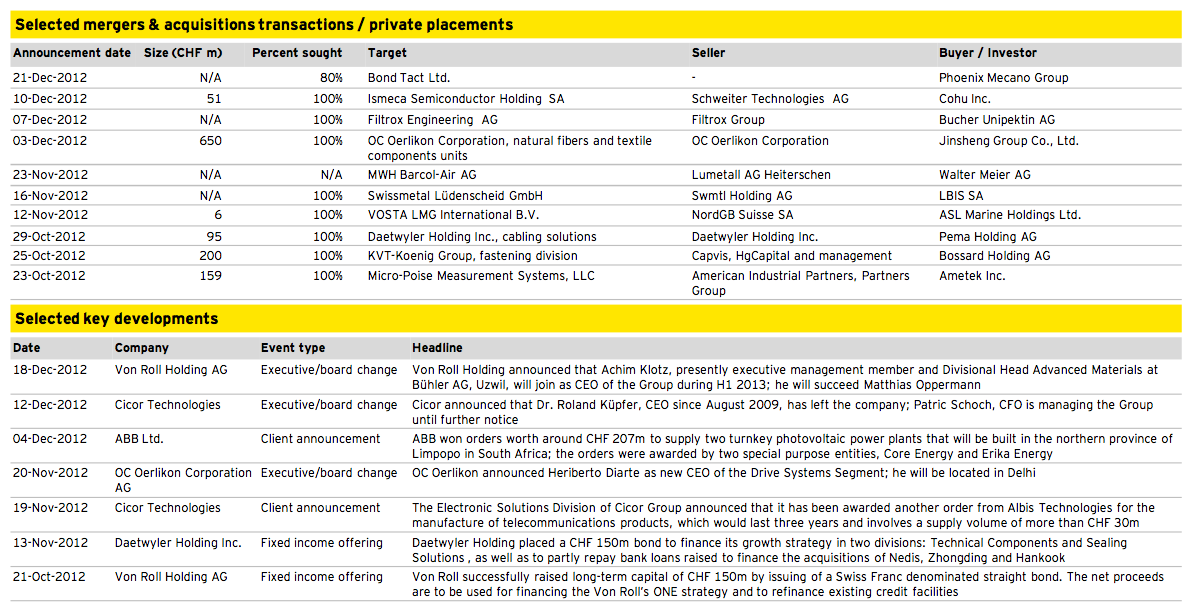

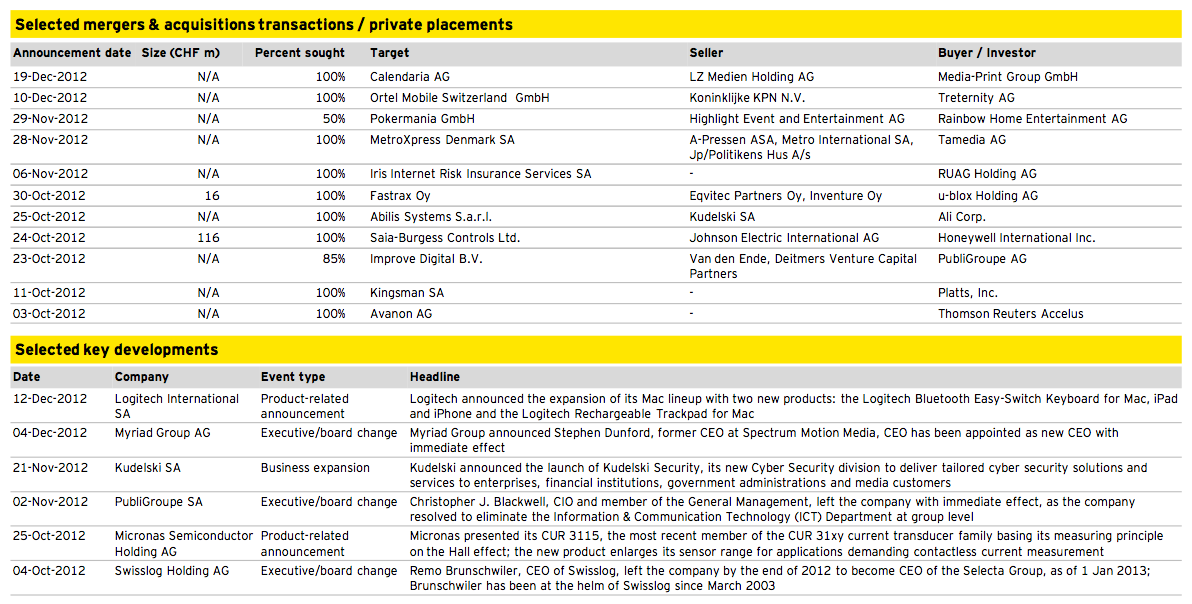

In the last quarter of 2012, Industrial Goods and Services was the most active industry regarding number of M&A transactions accounting for about 21% of all deals; followed by Media, Technology and Telecommunication and Chemicals, Construction and Materials which contributed 16% and 13%, respectively. The three top sectors together represented almost half of all Swiss-based M&A transactions in Q4 12.

The two largest announced transactions in the Industrial Goods and Services sector were the acquisition of OC Oerlikon’s natural fibers and textile components business units by Jinsheng Group and the takeover of KVT Koenig Group’s fastening division by Bossard Holding AG. The former transaction was valued at CHF650m and is also featured as our Deal of the Quarter. KVT was sold by Capvis, HgCapital as well as members of management for approximately CHF 200m.

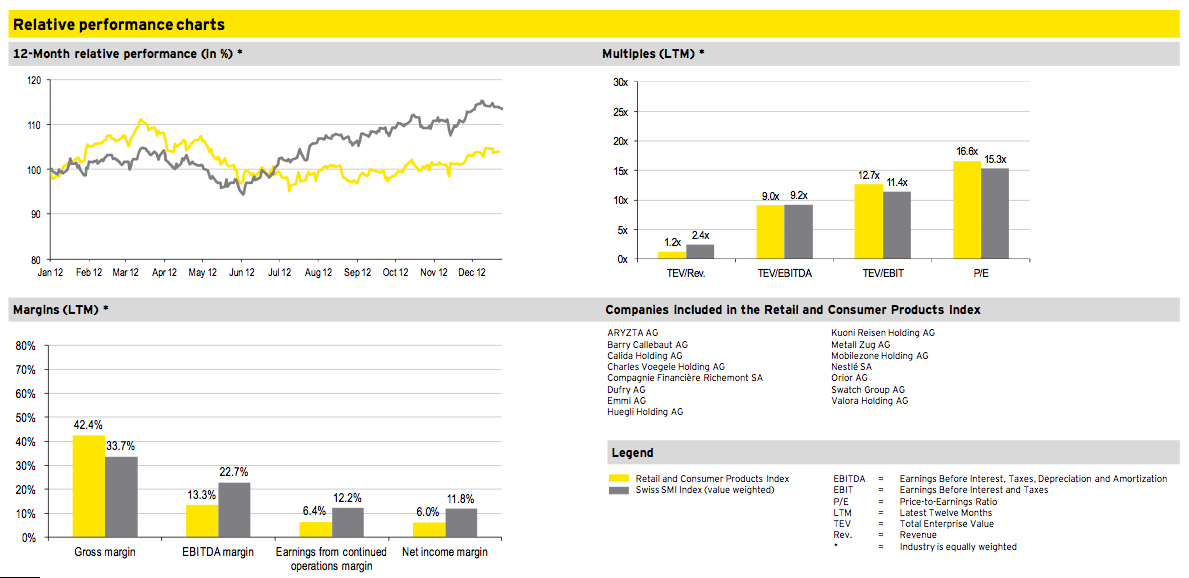

In comparison to the third quarter 2012, the number of deals in Industrial Goods and Services clearly increased the most by about 9 percentage points, followed by Chemicals, Construction and Materials, growing from 9% in Q3 12 to 13% in Q4 12. Financial Services also improved their share in transactions, resulting in an increase of approximately 2 percentage points. The number of deals in other sectors declined, in particular Retail and Consumer Products as well as Healthcare decreased by about 6 and 5 percentage points, respectively. Media, Technology and Telecommunication also lost about 1 percentage point; whereas Energy, Transportation and Utilities remained stable compared to the previous quarter.

During the last three-month period, mid-market transactions increased from 34% in the third quarter to 40% in Q4 12; while smaller transactions with disclosed deal size below CHF 50m decreased from 48% to 30% of all transactions in the fourth quarter of 2012. Large transactions with an announced deal size of over CHF 250m were also on the rise and accounted for 30% of the total number of transactions, up from approximately 20% in Q3 12. In Q4 12, the deal size was disclosed for 22% of all announced transactions.

Outlook 2013

According to its last publication in December 2012, the Swiss State Secretariat for Economic Affairs (SECO) lowered its 2013 GDP growth forecast to 1.3%, representing a slight decrease from its previous estimate of 1.4% in September 2012. Notwithstanding the most recent downward corrections, Switzerland’s economy is still expected to outperform its neighboring European countries, mainly due to its robust domestic business environment and the established exchange rate floor to the Euro by the Swiss National Bank (SNB). Given the ongoing European debt crisis and challenging current economic conditions, the SNB is expected to maintain its exchange rate intervention and keep its historically low interest rates in 2013. All in all, the latest economic projections by SECO and KOF Swiss Economic Institute, the business cycle research institute of the Swiss Federal Institute of Technology (ETH) Zurich, forecast a stable performance of the Swiss economy in the year ahead.

As long as the Euro zone crisis remains unsolved, it will continue to be one of the dominating factors for moderate Swiss M&A activity in 2013 and hamper the risk appetite of potential buyers. The current volatile economic climate is not expected to encourage management boards to pursue risky M&A strategies, but rather continue to accumulate cash on balance sheets. Nonetheless, the ongoing stabilizing measures by the European Central Bank and Greece’s recent upgrade in credit rating by Fitch, after successfully completing a debt swap, point towards a slight upward trend, which may lead to augmented M&A activity.

Due to the ongoing European trough though, companies from overseas, in particular in Asia, are looking to acquire distressed European targets at low valuations. This might also affect domestic M&A activity, as many export-oriented Swiss companies are still suffering from margin pressure and, hence, could also become potential takeover targets if economic conditions worsen.

In view of the sovereign debt crisis, an ailing global economy and accelerating austerity measures by many European countries, M&A activity in Switzerland throughout 2013 is expected to remain on a modest level. Nonetheless, as the Swiss economy shows a relatively stable economic outlook, a slight upward trend in deal activity might be possible if supported by an overall European economic recovery.

Private equity statistics: GSA and Europe

Private equity Q4 2012

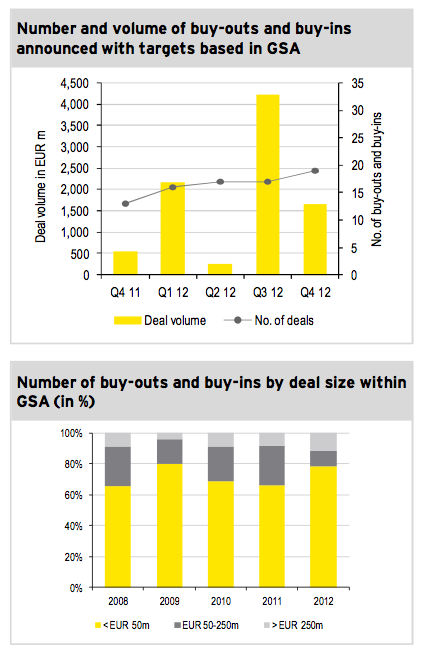

In the fourth quarter of 2012, private equity (PE) activity in Germany, Switzerland and Austria (GSA) increased slightly by approximately 12% in terms of transactions, when compared to the previous quarter. Nevertheless, due to the record deal volume in the third quarter of 2012, deal volume declined sharply by approximately 60% compared to Q3 12. Deal volume in the previous quarter was a result of a number of large transactions announced in Germany, for instance the acquisition of Bartec by Charterhouse Capital Partners from Capvis or the disposal of BSN Medical by Montagu Private Equity. With a total of 69 transactions announced in 2012, the number of GSA PE transactions remained at a similar level as in 2011. In respect of deal volume, GSA PE activity rose significantly by 27% to approximately EUR 8.3b compared to prior year.

In 2012, the bulk of PE activity stemmed from transactions with a size of less than EUR 50m, which accounted for approximately 78% of total deal volume. Buy-outs and buy-ins in the mid- and large-cap market represented 10% and 12%, respectively. Relative to 2011, the overall distribution in respect of deal volume for the 12-month period ended December 31, 2012 showed that large and small transactions increased its share in overall deal flow at the expense of mid-market transactions, i.e. larger than EUR 50m but smaller than EUR 250m, which in turn declined.

The number of buy-outs and buy-ins in the GSA PE market constituted over 17% of the total number of PE deals announced in Europe during the fourth quarter of 2012, whereas GSA PE deal volume accounted for over 15% of European PE transaction. In comparison, the UK market outnumbered the rest of European countries by far, not only in number of deals but also in terms of deal volume. With a deal volume of more than EUR 4.8b and 37 deals in Q4 12, the number of PE deals and deal volume in the UK represented roughly 34% and 46% of European PE deal activity, respectively.

Industry overview

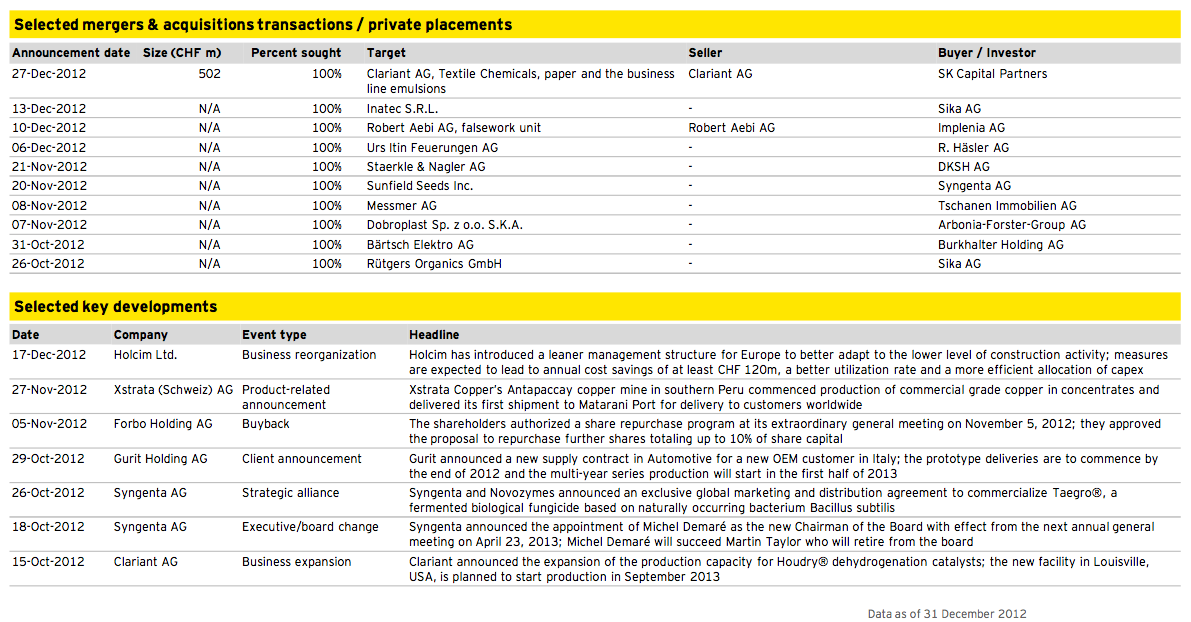

Chemicals, Construction and Materials

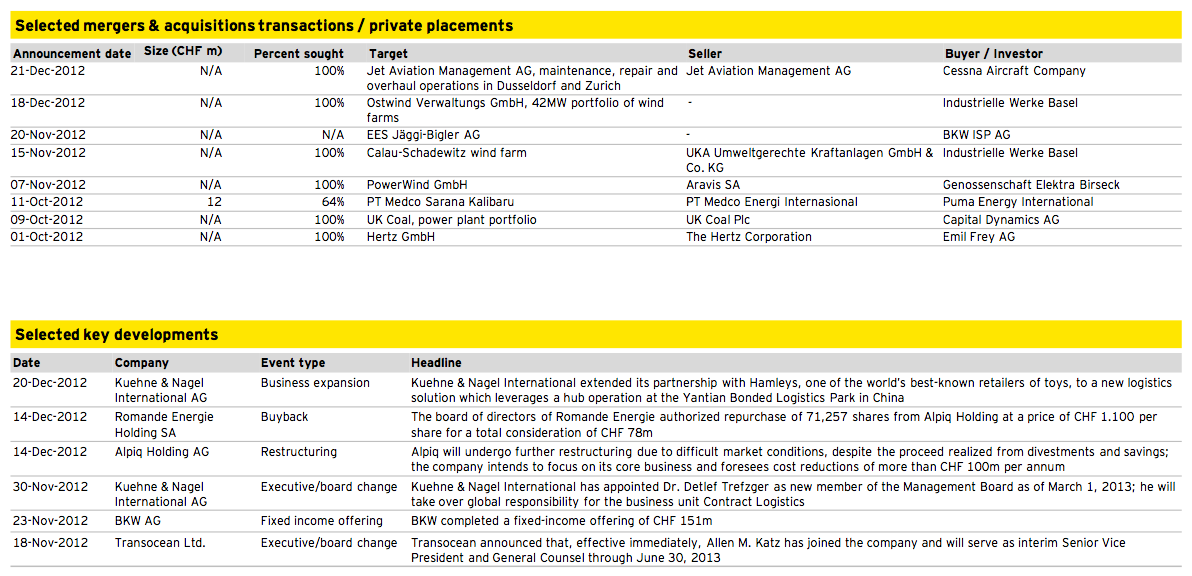

Energy, Transportation and Utilities

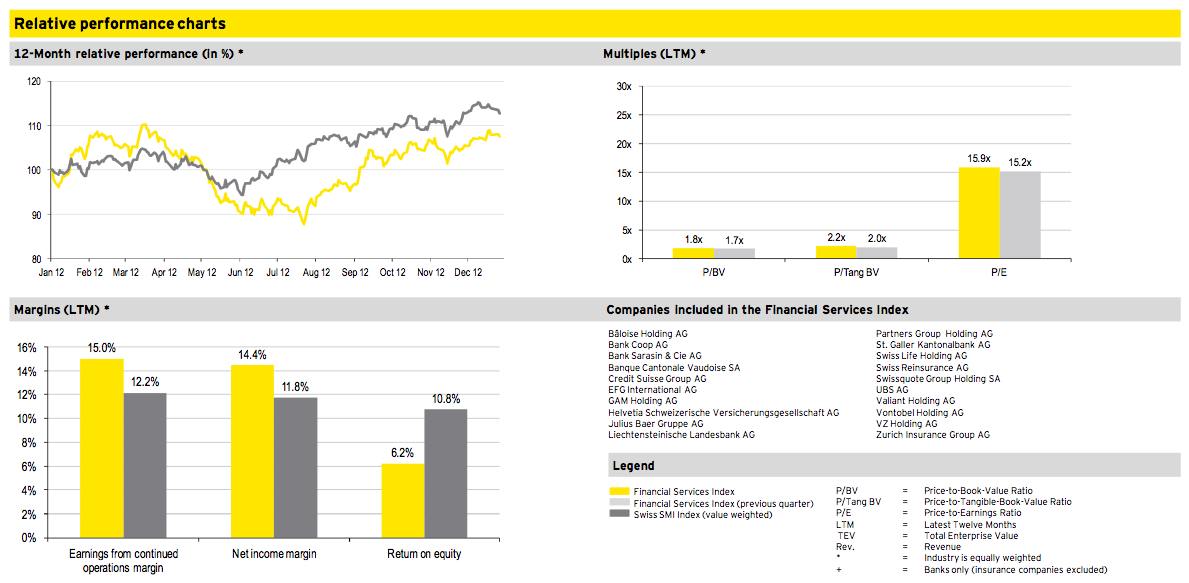

Financial Services

Healthcare

Industrial Goods and Services

Media, Technology and Telecommunications

Retail and Consumer Products

Deal of the quarter

Transaction overview

Deal summary

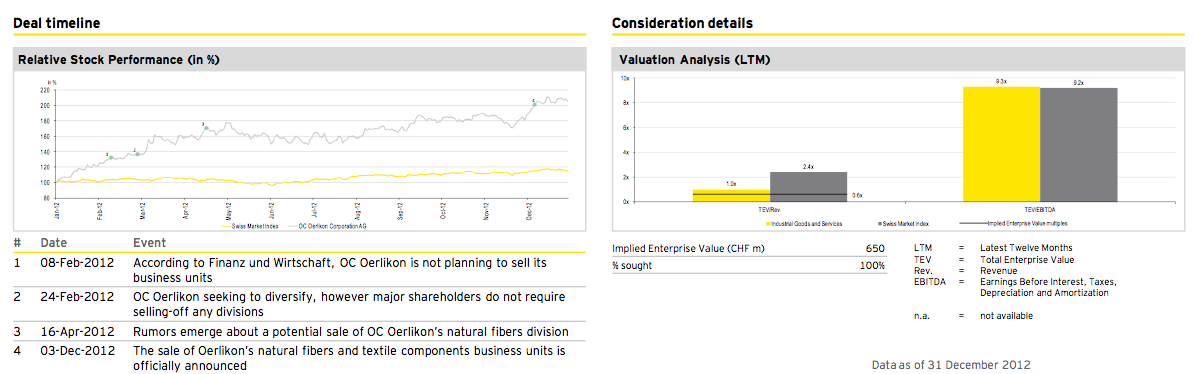

In the fourth quarter 2012, our deal of the quarter features the acquisition of OC Oerlikon’s natural fibers and textile components business units by Jinsheng Group, announced on December 3, 2012. Following the disposal of its solar unit and the textile segment’s business Melco this year, OC Oerlikon signed an agreement to divest part of its textile business to Jinsheng. Founded in 2000, the China-based company is a manufacturer of high-end CNC machines & tools, regenerated cotton fibers as well as saliva-based test technologies. The acquisition includes Swiss-based Oerlikon Saurer as well as German-based Oerlikon Schlafhorst and Oerlikon Textile Components. The buyer has agreed to pay an enterprise value of about CHF 650m. Closing is expected in Q3 13. OC Oerlikon gained control of the target business when it acquired Saurer AG in 2006.

Deal rationale

► From OC Oerlikon’s point of view, it is a further step towards rebalancing its business portfolio and reducing overall exposure to the textile industry. Post-closing, OC Oerlikon’s textile segment will represent 33% of total post-sale group revenue in 2011, compared to 53% before the divestment.

► Further, it will allow OC Oerlikon to focus on its remaining less cyclical, higher-margin manmade fibers business.

► Jinsheng will gain access to state-of-the-art technology and to the well-known Saurer brand; the acquired OC Oerlikon textile segments are expected to continue its businesses in newly established Saurer Group.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter