Publications How Investors And Equity Analysts View The Value Of Companies’ Advanced Information Strategies

- Publications

How Investors And Equity Analysts View The Value Of Companies’ Advanced Information Strategies

- Christopher Kummer

SHARE:

DATA AND ANALYTICS: A New Driver of Performance and Valuation

By Bradley Fisher, Wilds Ross, Christian Rast, Nicholas Griffin, Alex Miller – KPMG, Institutional Investor Research

Welcome to “the battlefield of the future”

Investors who control large institutional portfolios and the equity analysts who advise them believe the use of data and analytics (D&A) has a substantive and often dramatic impact on the companies and sectors they cover. D&A will alter the competitive landscape—rewarding some companies and punishing others— especially in the longer term.

In response to companies’ more ambitious use of data and analytics, investors and analysts alike expect that D&A will play a greater role in investment decision making and valuation. “Across all industries, there’s no escaping it,” says an investor focused on the technology industry.

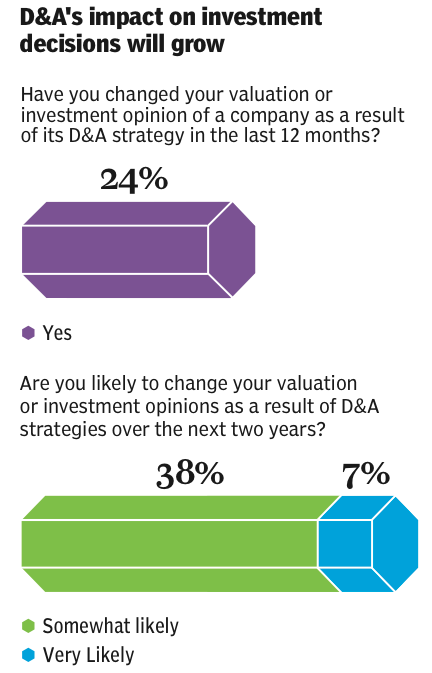

Nearly one in four investors and analysts report changing an investment decision or valuation as a result of a company’s data and analytics strategy, according to a 2015 survey of more than 250 portfolio managers, analysts, research directors, and other decision makers at large financial institutions. Their enthusiasm for D&A is poised to grow substantially in the years ahead, as 45% of survey respondents anticipate relying on companies’ D&A strategies as a major factor in their decision making.

Investors have always taken a keen interest in how companies deploy new equipment and innovation to generate revenue, control cost, and mitigate risk. But as technology becomes increasingly embedded in nearly all types of business activities, companies can realize — or overlook — great value from the data generated by new technology.

What’s behind this growing interest in data and analytics? Technologists’ have argued that, with enough software and computing power, Big Data will yield a new world of valuable insight into commercial, social, medical, and economic behavior. In this study, we sought to understand how those who control investment dollars view the value of data and analytics. Do they pay attention to D&A, and if so, how does it inform their decision making? Do they see D&A as a source of revenue, cost containment, innovation, risk management, or other factors? Similarly, how do investors get information about companies ambitious use of data and technology? These are among the questions we sought to examine in this study.

Big Data will yield a new world of valuable insight into commercial, social, medical, and economic behavior.

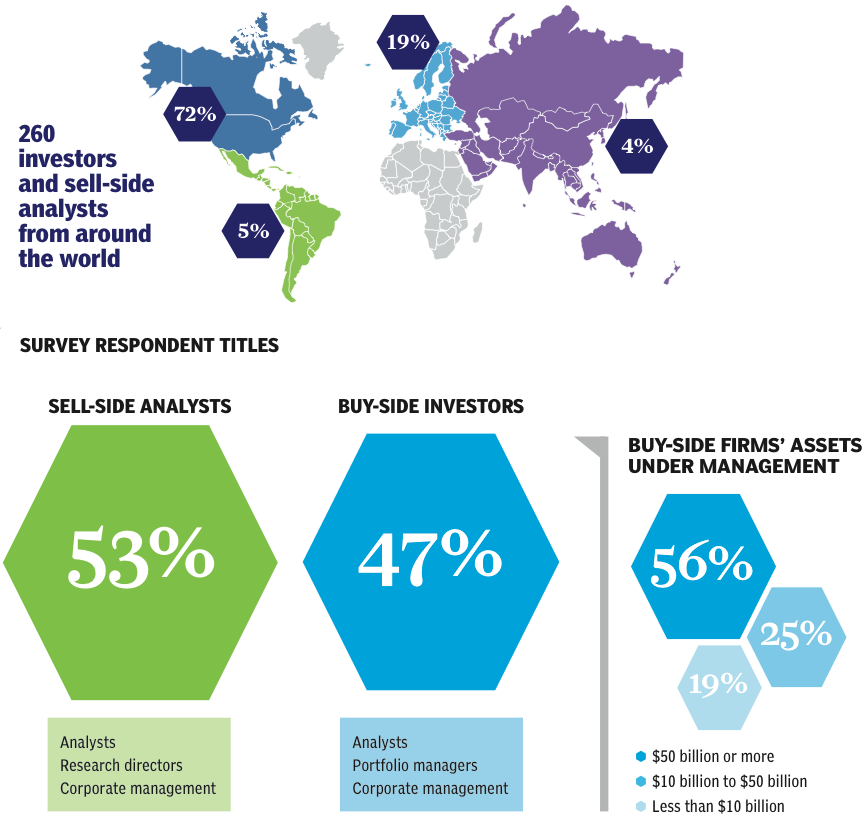

To do so, we surveyed 130 investors from buy-side firms such as pension funds, foundations and endowments, sovereign wealth funds, mutual funds, asset management firms, and insurance companies. Similarly, we surveyed 130 sell-side analysts at broker-dealers, who offer investment opinions on particular companies, sectors, and strategies to buy-side firms. We supplemented this quantitative research with a series of interviews with investors and analysts. See the methodology of this study below.

More on “ the battlefield of the future”

Many investors are likely to use companies’ D&A strategies in investment decision making in the years ahead. What do these investors know? “Data is the battlefield of the future. [It can] create huge efficiencies and a massive advantage, especially for global multinational companies,” says one portfolio manager.

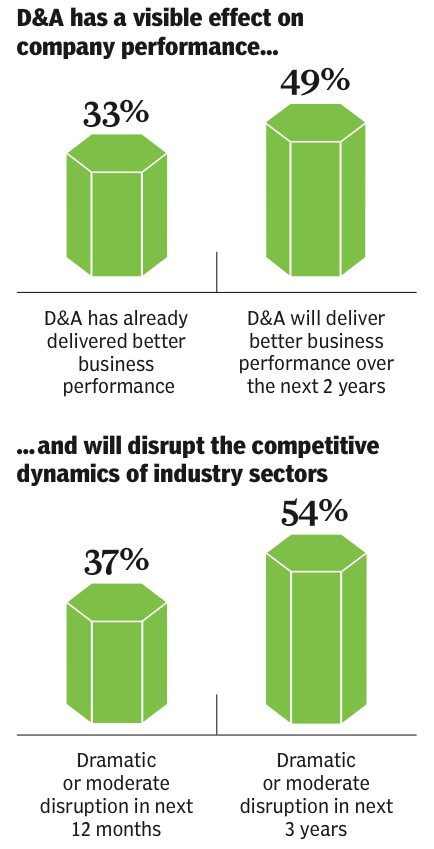

Like other shifts in technology—think of the rise of the PC in the 80s, the Internet since 1995, and wireless connectivity most recently—data and analytics is disrupting the competitive dynamics of markets and companies. And like other catalysts of market disruption, D&A will create opportunities for innovation from new entrants and pose threats to market incumbents that are less able to extract value from the data that underlies their businesses.

Data and analytics “is going to favor the incumbents initially,” says a buy-side analyst focused on health care. In his view, “first movers that can collect more data are going to create a high hurdle” for new market entrants, and, in the near term, large companies that have the infrastructure to support ambitious D&A initiatives are likely to prevail. In the longer term, he says, “It’s going to evolve. Initially we’ll see some first-mover advantages, but, over time, that will erode very quickly, much like you see in technology sectors.”

Amid this disruption lies great opportunity that can be realized through sophisticated application of data and analytics. A portfolio manager in Australia explains how the expansion strategy of a global shipping and logistics firm is threatened by new data-centric competitors. He cites new data-driven companies that are “100% more appealing” than capital-intensive incumbents with big investments in fixed assets.

“This global shipping company has huge warehouses, networks, and fleets of airplanes and trucks. It’s a very asset-heavy company, whereas the newer companies have a greater focus on software. They’re much more ‘asset-light.’” As a result, he says, these new companies are able to respond to market opportunities faster and to achieve higher returns by drawing on, rather than duplicating, the asset networks that are currently in place. “I think their speed to market is quicker. Their returns on capital are far higher. Their scale is much better. It’s not about rolling out this huge network of assets. They don’t need to reinvent this network. They just need a more efficient software platform. That’s hugely appealing to investors, I think, because the companies can grow a lot faster. They’ve got a huge competitive advantage, and investors get superior returns. Their return on capital is just massive.”

“First movers that can collect more data are going to create a high hurdle” for new market entrants, and, in the near term, large companies that have the infrastructure to support ambitious D&A initiatives are likely to prevail.

Strategies for navigating disruption

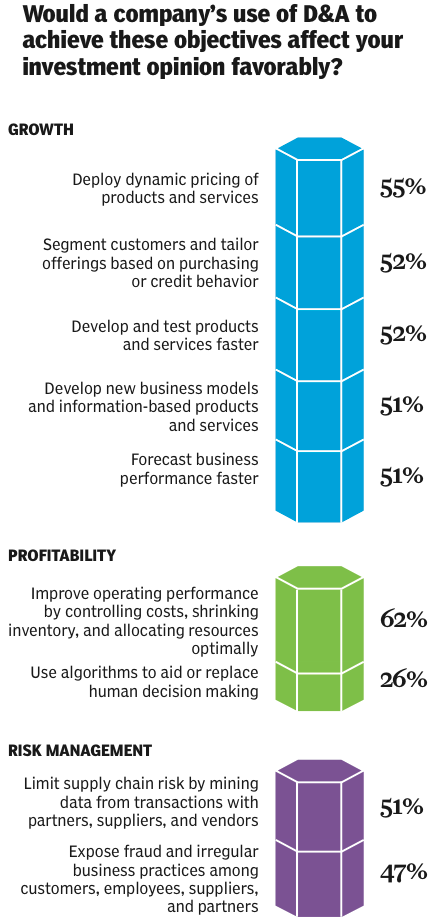

As D&A reshapes the competitive dynamics of industry sectors, investors and analysts remain focused on finding great new investment opportunities and monitoring companies’ financial and operating performance in search of latent strengths and weaknesses. Indeed, no one knows what moves share prices as well as investors and equity analysts. With this in mind, we asked survey respondents how the application of D&A to achieve various business objectives would affect their investment opinions. In aggregate, investors and analysts respond most favorably to D&A’s application to cost-related operating activities.

But investors’ and analysts’ views about how D&A could best be used differ according to the sectors on which they focus. One buy-side investor lauds a well-known retailer for its use of D&A to cultivate customer loyalty and to price dynamically. “Here’s a huge department store in an industry that is very tough, very competitive, using its data to offer customers discounts specific to their tastes,” says this portfolio manager focused on consumer and retail industries. “When you’re walking around in the store, they are able to track where you’re going and then use that data in the future.” With the aggregated data, the company can ask, “What do you like? Which areas of the store did you visit? Which products were you looking at?” he says. “That’s a huge advantage in industries like retail that are very competitive. Companies that use data smartly can create a huge competitive advantage, gain market share, and improve customer loyalty.”

Similarly a U.S. hedge fund partner cites a European manufacturer of women’s clothing that scans photographs published by users on social networks to identify popular colors. By using such information to test new designs and colors, the company is able to bring new products to market “in less than two months, whereas the normal department store will take a year” to do so. “The company,” he continues, “is gathering information from users really quickly, pretty much like guerrilla marketing, and then incorporating it into its construction and production really fast.” As a result, the company “can catch trends and ride them a lot faster. It becomes a trend maker as opposed to a trend follower. And usually, you’ll find, the trend followers will have problems.”

Two leading vendors of industrial automation gear earn high praise from analysts. One firm’s “huge installed base of industrial automation controls generates critical manufacturing data, which can be used to build insights and improve customers’ operations,” says a sell-side analyst, while another cites a close competitor of the company, saying, “It has moved quickly to be a prominent force in the industrial Internet. It aligns resources with market opportunity and has developed a platform for industrial data and analytics.”

Across sectors, investors and analysts also reveal that they expect D&A strategies to be a part of a company’s broader strategic plan. Various respondents focused on the financial services sector, for example, criticize a well-known credit card issuer for devoting resources to unrelated businesses while overlooking valuable sources of customer information. Says one investor, “Despite a huge trove of customer data, [this card issuer] prefers to spend on nonadjacent lending businesses.”

Business strategy — not data — is the weak link

The massive investments in IT over the last generation have in many cases paid off. The flood of money from both customers and investors has built a vibrant high technology sector, which develops new products used by firms and consumers alike in nearly all their activities. These activities generate vast troves of data which, if accessible, are ripe for harvest by D&A applications. Investors and analysts reveal, however, that while companies generally have ready access both to data and the tools to analyze it, their integration of data, analytics, and business strategy often falls short.

According to a portfolio manager in Asia, “data is a huge advantage for a company, but it’s not just all about the collection of data. It’s about how you use the data in planning a strategy.” Deriving strategic value from data is a formidable challenge for companies, he explains. “You’ve got to become much more customer-focused on what type of data you’re collecting and how you use it. Even how you display it matters. You’ve got to be able to make sense of it. There’s just so much stuff that can be gathered today.” The pressing question to answer, he says, is: “How do I actually put this data into something that’s sensible—that someone’s going to be able to use—and get that competitive advantage from it?”

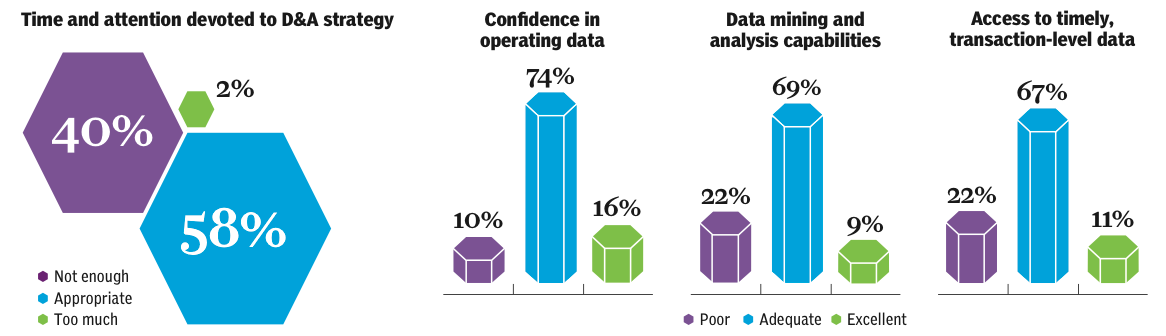

Investors and analysts have broad faith in the quality of data and technical capabilities of the companies in their sectors. Nine in ten respondents say companies have adequate or excellent confidence in their data on operating activities. Nearly 80% of respondents say companies have access to timely and accurate transaction-level data on day-to-day business activities and have adequate or better technical abilities to mine and analyze data.

What’s missing, it seems, is the integration of these building blocks into a strategy for data and analytics that supports business strategy. Fully 40% of analysts and investors say the companies in the sectors they cover don’t devote enough attention to D&A strategy. Technology teams have done their part by providing access to data and the technology to distill value from it. The hard work that remains, however, is the business problem of integrating data, technology, and business strategy.

Demonstrate the business value of D&A strategy

While companies, investors, and analysts have high hopes for data and analytics in the years ahead, they seem to struggle to express and to understand how D&A will shape their world. What’s missing? A sophisticated discussion between the providers and users of D&A information on the metrics, benchmarks, and standards for evaluating data and analytics.

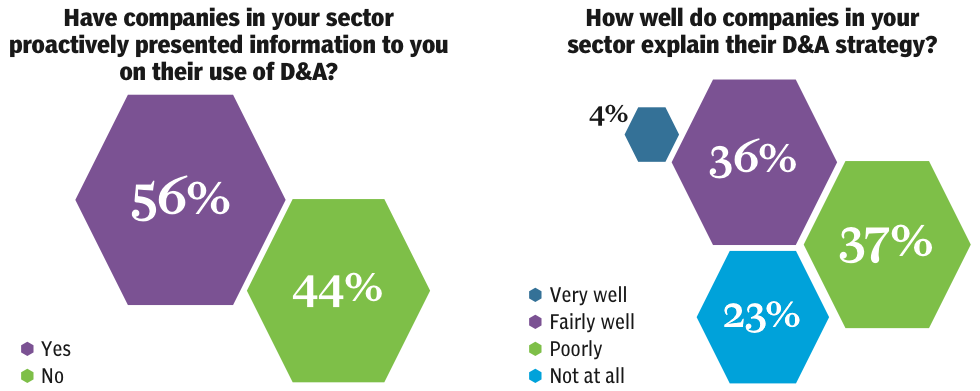

In the last 12 months, just more than half (56%) of respondents have had one or more companies proactively present them with information about their D&A strategies. In addition, investors and analysts believe companies seldom do a good job of explaining how D&A contributes to their overall business strategies; only 40% of all respondents say companies in their sector explain D&A strategies very or even fairly well.

Companies that tell their D&A stories to investors and analysts persuasively are at a clear advantage. “We want to hear about data and how companies are using it. We want to know that they’re factoring it in and they’ve built the business case internally for using data to build competitive advantage,” says an Australian portfolio manager. If a company’s management has little to say about D&A, “we question it and weigh it. We ask ourselves, ‘Is it going to be a huge competitive disadvantage if they’ve got no strategy?’”

How can companies tell their D&A stories more effectively?

As the interest in D&A strategy and expectations of its disruptive influence across sectors rise, companies should ensure the links between D&A and their broader business strategy are clear. Survey respondents’ comments reveal a few important lessons for companies in the discipline of D&A presentation:

- Make your D&A information clear and concrete. Use “fewer trendy buzzwords” and offer “simple and straightforward explanations,” advises an analyst covering technology. Others advise companies to “be transparent in releases about data and analytics” and to “demonstrate by example.”

- Offer investors and analysts who are more D&A savvy detailed but relevant D&A information. An investor who follows consumer businesses suggests companies offer “analyses of strategic plans with clear measures of achieving financial and operational goals, as well as standards and tolerances in risk management.” And an investor focused on technology says investors seek “the ‘why’ of the market position and better explanations of what the data shows. We want companies to actually talk about D&A strategy, rather than being vague.” Similarly, an investor focused on financial services calls for companies to “let IT-competent people present” their D&A strategies.

- Focus on business outcomes—the ultimate contributions to financial and operating performance made by D&A efforts—rather than on intermediate steps or processes. A technology-focused investor suggests companies describe “how the use of data has differentiated the firm from others.” Similarly, an analyst focused on financial services companies recommends that companies explain “how D&A spending has improved your performance.”

However, companies beware: It is probably impossible to apply all of this advice in the same D&A presentation. The reason, of course, is that these comments are from investors and analysts who themselves have different levels of D&A sophistication and knowledge. Realizing this provides yet another excellent tip about presenting your D&A story: Know the level of D&A sophistication of your audience.

Investors recognize the complexity of D&A

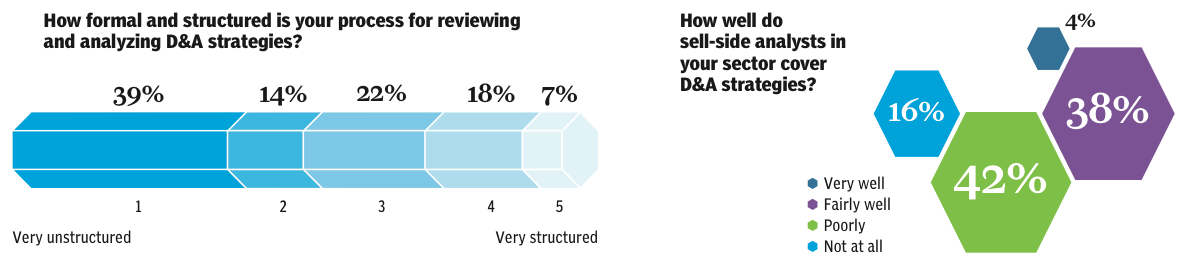

In this early stage of D&A, investors and analysts are still figuring out how to get the D&A information they consider important to their decision making. And since data and analytics is as much a matter of business strategy as it is technology, investors use an expansive, unstructured approach to evaluating it.

As in other highly valuable forms of analysis, investors and analysts assemble a mosaic of information from many sources and look for patterns when evaluating data and analytics. And survey respondents by a wide margin say they use an unstructured rather than structured approach to D&A analysis.

This unstructured approach comes in many forms, say buy-side and sell-side respondents. “We look into the company’s data culture, look at who owns the data, think about the opportunity to improve operations with the use of data and analytics, but also consider the opportunity to monetize the data and generate new revenue,” says a sell-side analyst who covers capital goods and industrials. An investor focused on energy companies says that, when making investment decisions, investors should compare the data holdings of different companies: “How does their data compare? What are the assumptions and benchmarks they’re using?”

Respondents also advise caution when reviewing the technical dimensions of companies’ D&A strategies. One investor focused on the financial sector says, “You need to be skilled at IT to understand D&A strategies.” An investor focused on the technology industry advises peers evaluating companies’ D&A to “read out of the data, not into it.” And a sell-side analyst focused on financial services says, “Look for robust, scalable data and analytics systems, especially for newly public companies and companies that are growing to large-cap size.”

Respondents’ experience in acquiring good information to weigh in their decision making is at best uneven. In the last 12 months, when considering potential investments in their sectors of interest, only half of buy- and sell-side respondents proactively sought information about at least one company’s use of D&A. And sell-side analysts’ coverage of D&A seems to fall short of investors’ expectations nearly 60% of the time, according to buy-side investors. Nearly 70% of sell-side analysts say their clients have expressed minimal or no interest in D&A.

Why might analysts and investors have such tepid reactions to each other’s approach to D&A? Perhaps because sell-side analysts do not see investors’ interest in data and analytics directly. Instead, what they likely see directly is investors’ “show me the money” enthusiasm for a company’s business performance, which is, of course, the result of its strategies, including its D&A strategy.

In the words of the VP of research at a U.S. asset management firm, “We’ll never say, ‘We’re not going to invest in a company because it’s bad in D&A,’ but we certainly wouldn’t invest because a [drug] company hadn’t brought any new drugs to the pipeline in the last couple years, and poor data might be one of ten reasons” for this poor performance. As investors progress in their D&A maturity, they are likely to express their interest in D&A more directly.

The road ahead for D&A

D&A is already changing the competitive dynamics across sectors—and the effects are likely to increase dramatically in the next three years. Some companies will be rewarded. Others will be punished. The path to success is tied to applying data and analytics to business strategy.

Any disruption of competitive dynamics brings with it opportunities and risk. Such is the case with the disruption—across all industries—that has begun to be felt due to companies’ use of data and analytics. As a result, we are already seeing D&A winners and D&A losers. And, in the years to come, many more companies will fall into one of these two ranks.

How can a company ensure its place among those that successfully realize the opportunities offered by D&A? The results of this research study suggest the following guidelines:

- Apply D&A to the business objectives that are aligned with core strategy. Investors and analysts most strongly support—with increased company valuations—the use of D&A strategies to accomplish different business objectives in different industries. The most beneficial D&A-driven objectives are likely to differ from company to company. The question is, How does D&A support and reinforce overall business strategy?

- Realizing the opportunities of D&A is largely a strategic problem, not an IT problem. Build the right D&A business strategies out of your data and analytics capabilities, to achieve your chosen objectives. Having high-quality data and analytical capabilities is not enough.

- Effectively communicate D&A strategies and results to investors and sell-side analysts. Because companies often explain their use of D&A poorly or not at all, those that tell their D&A stories well to this audience are at a clear advantage. As one Australian portfolio manager says, “We want to hear about data and how companies are using it. [If a company’s management has little to say about D&A,] we ask ourselves, ‘Is it going to be a huge competitive disadvantage if they’ve got no strategy?’”

The most beneficial D&A-driven objectives are likely to differ from company to company. The question is, How does D&A support and reinforce overall business strategy?

Be assured that investors and analysts are already factoring companies’ D&A efforts into their investment decisions and valuations. Of all respondents, nearly half says that they are, in the next two years, very or somewhat likely to change investment opinions as a result of companies’ D&A strategies. This is a striking increase from the 24% who did so during the last year—and could have a meaningful impact on company valuations.

As the payoff from companies’ effective D&A strategies becomes more visible and the influence that companies’ D&A plays in investors’ decision making increases, we can also expect:

• Investors and sell-side analysts to seek more and better D&A information proactively from companies

• Analysts to improve their overall coverage of companies’ D&A

• The companies with which you compete to become better at explaining their D&A strategies to investors and analysts

For companies across all industries, D&A will soon be, as one portfolio manager for a large Australian asset management firm says, “the battlefield of the future.” It would serve companies, investors, and analysts well to be ready.

Methodology

In 2015, KPMG commissioned the Custom Research Group at Institutional Investor Research (IIR) to examine investors’ and sell-side analysts’ views on the use of data and analytics (D&A) by public companies. We surveyed 260 investors and sell side analysts and supplemented the survey findings with interviews with six investors and four sell side analysts.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter