Publications Build Your M&A Muscle: Why Serial Acquirers Win At Value Creation

- Publications

Build Your M&A Muscle: Why Serial Acquirers Win At Value Creation

- Christopher Kummer

SHARE:

By Greg Schooley, Mike Phillips – A.T. Kearney

Like athletes in training, frequent buyers build acquisition muscle that empowers them to do more deals and do them more effectively.

M&A Is Not a Bad Idea

Raise your hand if you have read an article—or several articles—in a leading business publication that suggests pursuing mergers and acquisitions (M&A) is a surefire way to destroy shareholder value. Or, maybe you’ve read that the only reason companies pursue M&A is to satisfy a CEO’s inflated ego. We too have read these articles and other sources that indicate about 50 percent of buyers underperform relative to the market following a merger and that short-term profitability is flat or reduced more than 70 percent of the time. Undoubtedly, there have been M&A disasters, such as the AOL and Time Warner merger.

But if M&A is such a bad idea, why do so many world-class companies buy into it? The short answer: because M&A works. Companies aggressively use M&A as part of their value growth strategies because these deals help them to generate more value than their peers. A.T. Kearney research finds that frequent buyers not only tend to create more shareholder value than less frequent buyers, but also investors value these companies more highly for every dollar of profit earned. Additionally, those that frequently pursue M&A tend to get better at it over time. Like an athlete in training, they develop best practices in M&A that help them do more deals and do them more effectively.

Frequent Buyers Create More Value

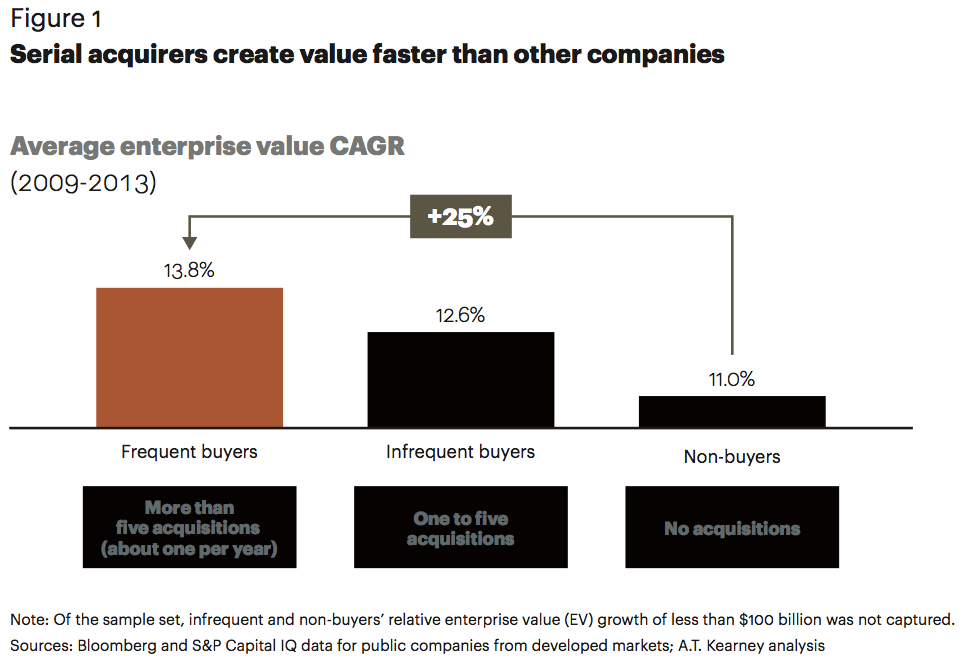

In our recent analysis of acquisitions and value creation at 500 public companies in developed markets, frequent buyers—those with more than one acquisition on average per year—increase value faster and Wall Street puts higher value on these buyers over infrequent buyers. In fact, the enterprise value (EV) growth rate of frequent buyers is 25 percent higher than the growth rate of companies that had no acquisitions during the same four-year time period (see figure 1). And infrequent buyers, those with one to five deals in this time period, generated somewhat higher value growth than non-buyers. You might say, so what’s the big deal? The big deal is that of the companies in our review, the slower value growth rate of non-buyers equates to roughly $100 billion in lost enterprise value.

Unlike other research, our analysis is based on a four-year horizon that looks past immediate deal-related share price fluctuations and instead focuses on the long-term impact of M&A on value. We also considered that value growth and valuation multiples can be driven by scale, rather than M&A activity, because frequent buyers are often larger companies. But when segmenting companies into small, medium, and large groups, we find the same dynamics. When compared to companies of similar scale, frequent buyers generate higher growth rates in enterprise value and valuation multiples relative to non-buyers. In fact, of companies in our sample with less than $1 billion in revenues, the average EV growth rate of frequent buyers was roughly double that of non-buyers from 2009 to 2013.

The enterprise value growth rate of serial acquirers is 25 percent higher than the growth rate of companies that had no acquisitions.

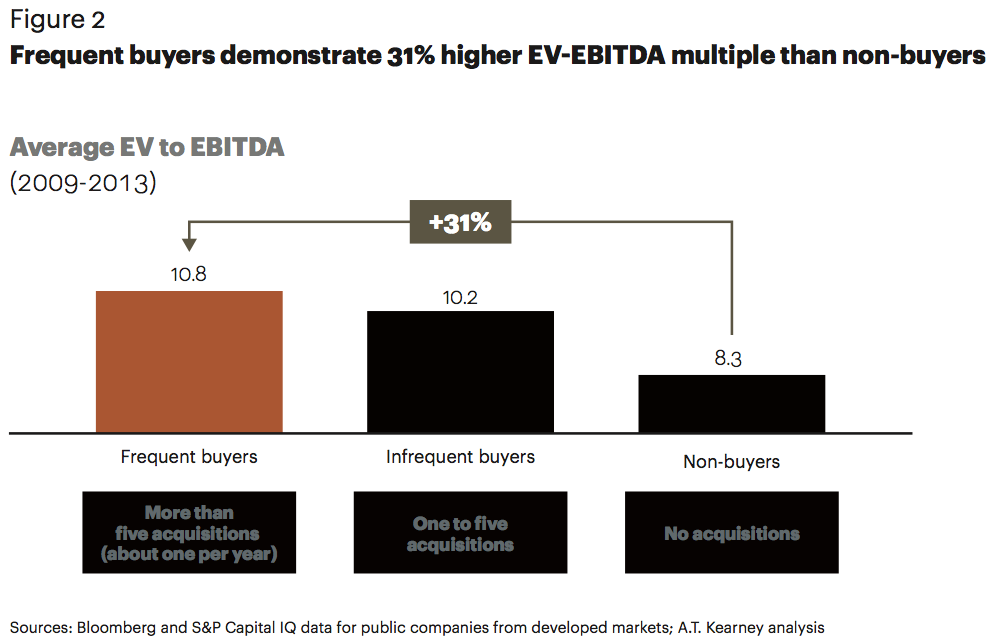

Wall Street appears to be very aware of M&A value creation. On average, investors value a dollar of profit from frequent buyers 31 percent higher than a dollar of profit from non-buyers, as measured by the EV-to-EBITDA multiples of the companies in our database. This indicates that Wall Street is willing to pay a premium for the cash flow of frequent buyers and gives these companies a higher valued equity currency, which they can use to fund more deals. Frequent buyers demonstrate an average 10.8 EV-to-EBITDA multiple, while non-buyers demonstrate an average 8.3 multiple (see figure 2).

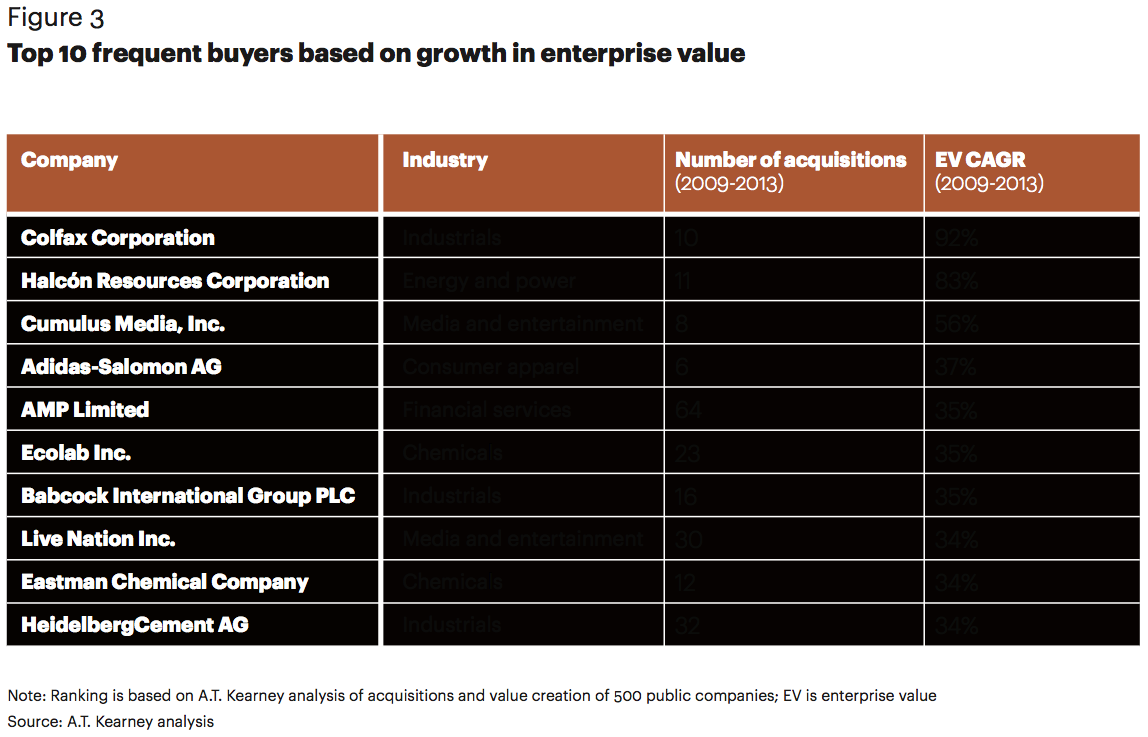

Frequent buyers from a variety of industries have generated significant value. Figure 3 provides a snapshot of 10 frequent buyers with the highest EV growth in our sample.

M&A Is Not Easy

Before you rush out to call your favorite investment banker to pursue a multibillion-dollar deal, it is vital to understand that performing effective mergers and acquisitions is a challenge. Companies spend years developing their M&A capabilities, with frequent buyers developing the best practices. We have grouped the lessons learned from our analysis into four areas:

Strategy-driven, not ad hoc

One crucial element of M&A success is pursuing the right deals for the company. Corporate strategy should drive M&A decision making. Governance should be in place to ensure that business leaders identify opportunities that meet specific criteria with a clear link to strategic objectives.

Consider one frequent buyer, a life sciences technology company. Between 2009 and 2013, the company completed 10 acquisitions, focusing on M&A as a growth strategy to support its transformation into life sciences. In 2014, the company split off its test and measurement equipment business after developing a critical mass in life sciences. “M&A becomes a natural option when you are trying to obtain new capabilities and technologies,” explains the vice president of strategy. “Our strategy drives our M&A agenda completely, not the other way around. We have three business divisions, and each division has a clear M&A plan and criteria that aligns and is driven by the company strategy. We don’t have a budget for putting capital to work per se. We just make sure our M&A moves are aligned with our company strategy.”

The company enterprise value increased at a CAGR of 14 percent relative to 13.8 percent for other frequent buyers in our sample. In addition, the company maintained an enterprise value to EBITDA multiple of 14.7 versus 10.8 for frequent buyers.

Discipline, discipline, and more discipline

Once a deal is identified, it is important to develop a deep understanding of the target’s business, industry, and competitors to inform a fact-based decision about the deal’s attractiveness. Quantifying synergies that are unique to the buyer’s capabilities helps to differentiate its bid and ensures teams have the correct focus during integration. When auction processes result in valuations that exceed identified standalone and synergy values, three moves are vital: maintain discipline, keep a cool head, and let some deals go to another buyer.

For example, 3M, a $31 billion diversified manufacturing company, completed 20 acquisitions between 2009 and 2013. “Before we buy a company, we have a good idea how we will create value once 3M owns it,” explains Jack Cardwell, director of 3M’s Integration Management Office. “We pursue acquisitions that utilize 3M’s core strengths—global reach, technologies, brand, manufacturing—where we can drive value faster than a standalone company.” During this period, 3M increased its EV-to-EBITDA multiple 14 percent and its enterprise value 57 percent.

The VP of strategy at the life sciences technology firm agrees with Mr. Cardwell, adding: “We are fairly disciplined and very strict on deal metrics. We have a long process that is well documented and many times we walk away from deals because we do not lose sight of the financial hurdles or the returns that we expect.”

Well-trained muscle to capture more deals, more effectively

Frequent buyers dedicate highly skilled M&A professionals, both internal executives and external advisors, to develop robust processes for managing a pipeline of potential deals—from identification to outreach to deal execution and integration.

“We’ve consolidated business development and M&A into one team,” says the VP of strategy at the life sciences tech firm. “We have people working full time on valuations and transactions, others on technology licensing and merger integrations, and still others doing classic strategy and business development work; they identify the majority of our deals, which they then feed to others on the team.”

Effective integration to realize all-important synergies

Frequent buyers tend to have time-tested integration processes and tools that provide clarity and alignment quickly across teams to allow for sound decisions, seamless transitions, and rapid executions. “3M’s integration process is very detailed and includes planning, execution, and performance monitoring,” adds Cardwell. “We have an internal integration team that manages each integration with a project management approach. The corporate-level integration experts partner with the division or subsidiary to effectively integrate the business on day one and going forward.”

Furthermore, buyers that quantify synergies and publicly disclose them when the deal is announced see 42 percent higher enterprise value growth and 25 percent higher EBITDA growth compared to buyers that do not disclose this information. “Synergies and reporting are expectations, and experienced buyers disclose this information,” adds the VP of strategy at the life sciences tech firm. “Those that don’t disclose are probably less clear about why they do the deals.”

Exercise the Power to Perform

M&A plays an important role in many companies’ value growth strategies, according to our research. As macroeconomic conditions continue to create a favorable environment for deal activity, now is a good time for other forward-thinking companies to consider M&A as a source of value.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter