Publications People Risks In M&A Transactions

- Publications

People Risks In M&A Transactions

- Christopher Kummer

SHARE:

By Jeff Cox, Chuck Moritt – Mercer

EXECUTIVE SUMMARY

Offering robust data and analysis as well as unique insights and guidance, Mercer’s first annual research report on people risks in M&A transactions provides an in-depth view of the human capital issues buyers and sellers are facing in the marketplace. In addition, this report identifies practical solutions and strategies organizations are deploying to effectively hedge these risks and drive deal value.

Our findings are drawn from three distinct data sets:

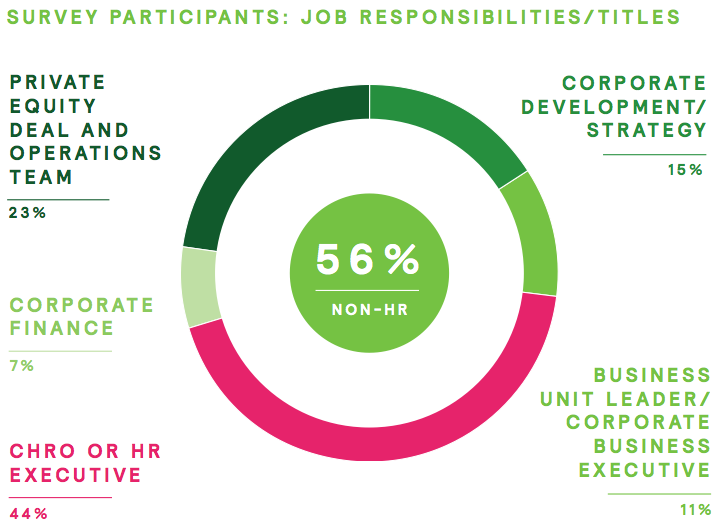

- Survey responses from 323 M&A professionals on both the buy (93%) and sell (58%) sides. In addition to HR executives, 56% of respondents were from private equity deal teams and operations, finance, corporate development, and operational leadership positions.

- Seventy-eight interviews with corporate and private equity clients, investment bankers, and M&A advisors between August and November 2015.

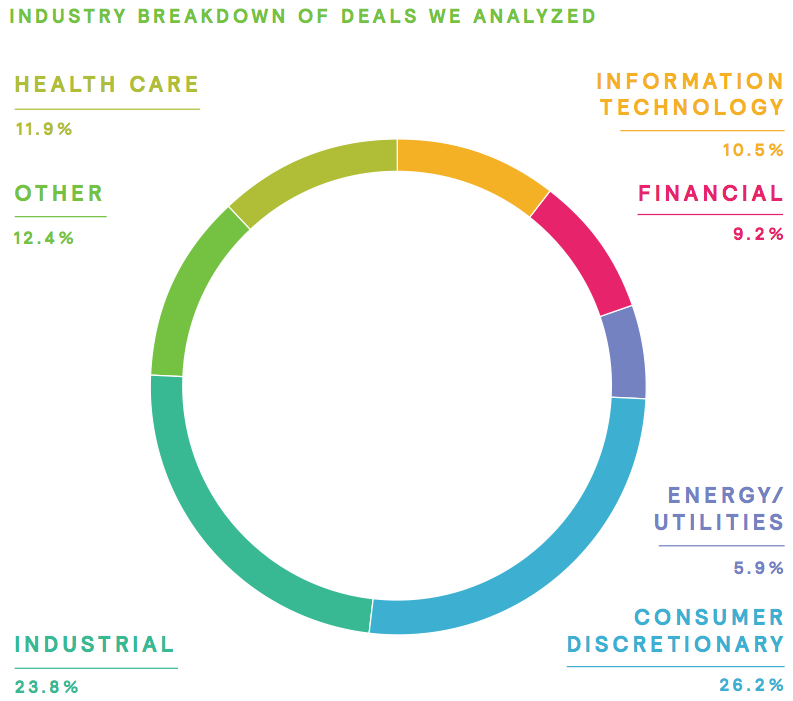

- Analysis of nearly 450 M&A transactions (of which almost 60% were cross-border deals) during 2015.

RECORD GLOBAL DEAL ACTIVITY IS DRIVING BUYERS TO TAKE INCREASED RISKS

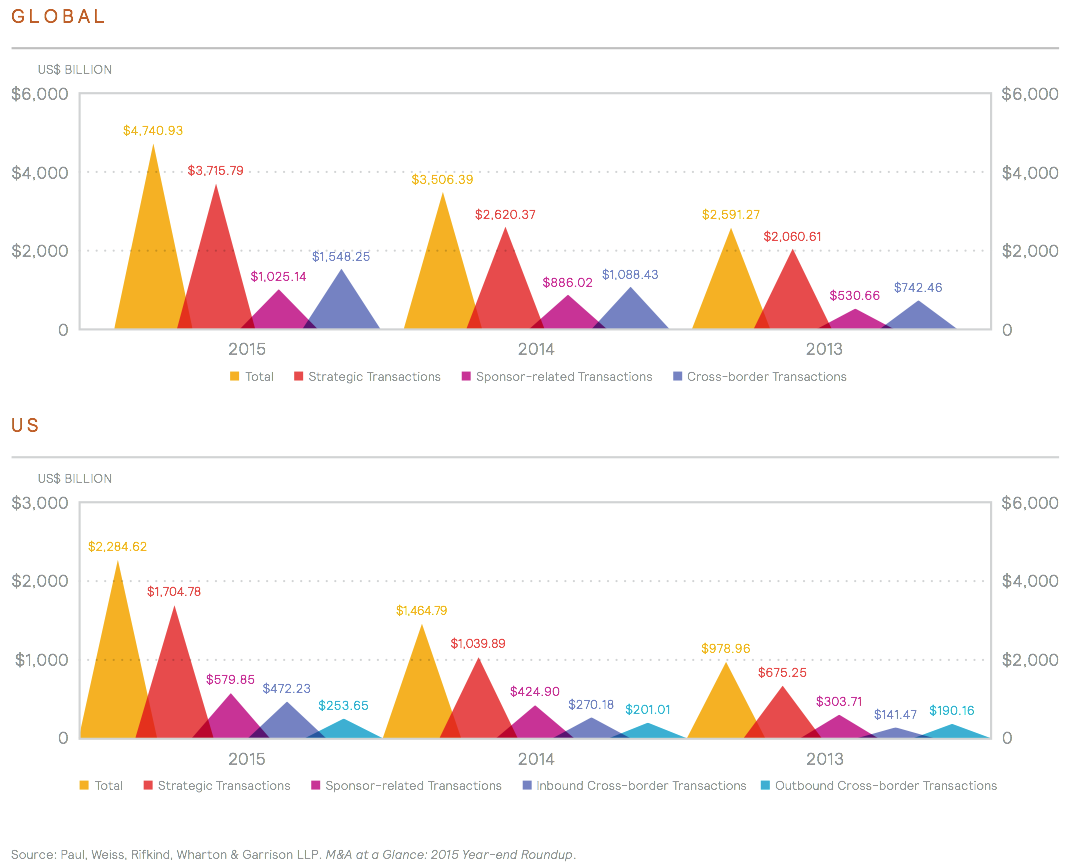

Worldwide M&A totaled $4.7 trillion last year (a 42% increase over 2014 levels), making 2015 the strongest year for dealmaking on record. M&A activity was up 32% globally in 2015; in addition, cross-border M&A activity escalated by 27% over 2014 levels, totaling $1.6 trillion and accounting for one-third of overall M&A volume.

With global merger and acquisition activity at an all-time high, buyers face a new reality characterized by increased risk, truncated auction timelines, and shrinking access to critical information.

BUYERS MUST NAVIGATE A HOST OF NEW COMPLEXITIES

Buyers face a host of new complexities as they enter unfamiliar geographies and industries, often enticed by the promise of reduced costs in emerging markets. Our findings show that nearly 25% of buyers are more inclined to consider multicountry transactions than they were prior to 2014. Almost 50% of buyers are willing to consider taking on pension and post-retiree medical obligations.

In addition, 41% of buyers surveyed report having less time to complete due diligence before making a binding bid compared to prior years, and 33% say that sellers are providing less information about the asset for sale. This trend is expected to continue, as companies conducting multicountry deals anticipate sellers disclosing less information in the future, due to the competitive nature of transactions.

SELLERS SEEK NEW STRATEGIES TO MAXIMIZE PRICE

Although it’s clearly a sellers’ market, sellers are not immune to risks. Over one-third of those surveyed are spending more time than in the past on HR issues when preparing for divestitures. Armed with more than $100 billion in capital, activist investors continue to pressure more companies to unlock value for shareholders.

Sellers choosing to divest assets that include defined benefit pension and other long-term employee obligations must navigate pension volatility during the auction process. This risk is evident in the turbulent equity markets witnessed at the start of 2016 as many US pension funds lost roughly 10% of the value of their equity portfolios in the first few weeks of the year. Strategies that demystify pension obligations and limit downside risk for the buyer differentiate sellers that are looking to maximize exit price.

“The human capital side is the most important part of this [merger].”

Current headlines show that companies recognize that a strong focus on people is paramount to success. When asked about his approach to the $120 billion Dow Chemical and DuPont megamerger/split, Edward Breen, DuPont’s chairman and chief executive and future CEO of the new company, DowDuPont, emphasized that the people issues — particularly reassuring and motivating employees — are a top priority.

MORE THAN EVER, THE CHALLENGE OF MANAGING TALENT — ESPECIALLY IN THE FACE OF ORGANIZATIONAL TRANSITION — IS WHAT MOST CONCERNS M&A PROFESSIONALS

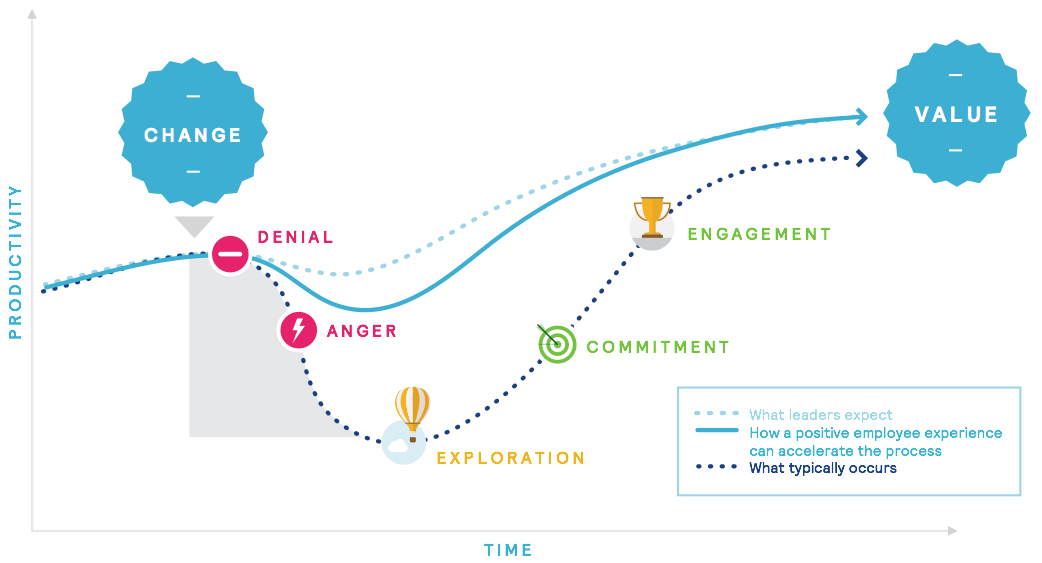

The root of people risks in M&A transactions lies with individuals’ inability to manage uncertainty and embrace change — which can lead to declining organizational performance and loss of transaction value.

These risks can have serious implications for companies and their employees if left unchecked. Buyers and sellers must manage and mitigate people-related risks in order to preserve key customer relationships and maintain productivity.

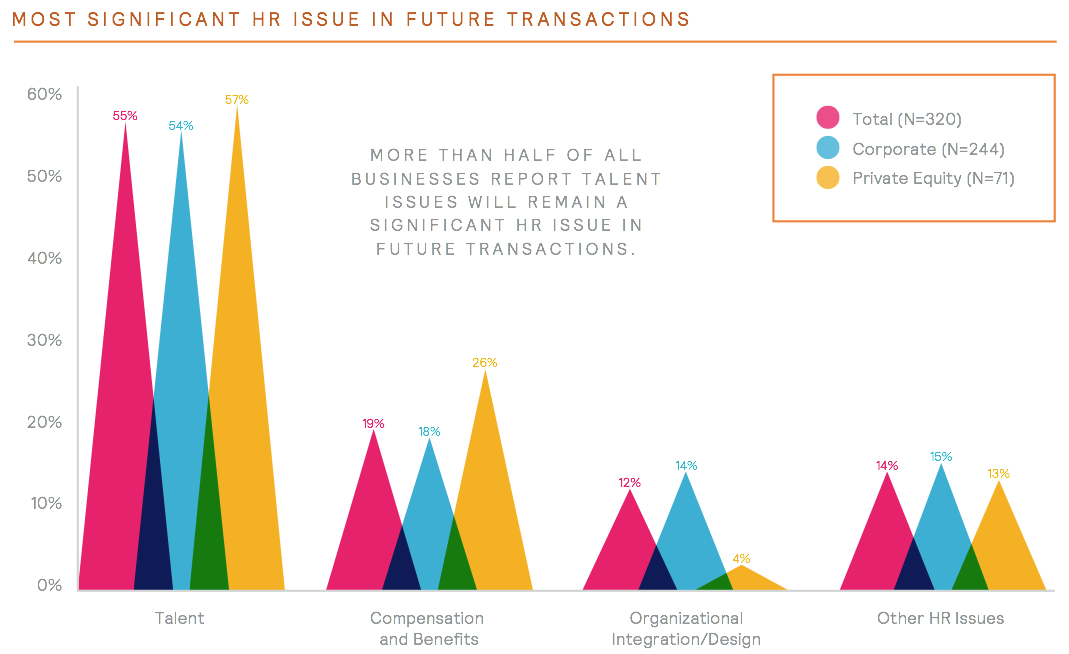

More than half (55%) of buyers surveyed, including both corporate and private equity buyers, report that talent challenges will remain a significant HR issue in future M&A transactions.

Employee retention is cited as the number one perceived risk, followed by cultural fit and leadership team concerns such as selection, skills/ capabilities, and attraction and retention.

Buyers are increasingly recognizing that the people aspects of running a business are fundamental to driving return on investment. When evaluating a deal, buyers are not just looking at customers, products, and access to markets — they’re also looking at the people spend and ROI associated with the deal.

This approach is critical in helping organizations anticipate and avoid people risks in M&A transactions, which can impact the business being acquired in one or more of the following dimensions: strategic, financial, and operational.

“Buyers have the opportunity to manage the people spend with the same discipline and rigor as other capital investments (property, plant, equipment, R&D, M&A, among others).” – Jeff Cox, Global M&A Transaction Services Leader, Mercer

STRATEGIC

People risks in this category result from misalignment between the people strategy and the business strategy. These risks can take the form of employees failing to make needed behavior changes to successfully support the new business.

FINANCIAL

Financial risks relating to employees that are identified during due diligence can be material and must be factored into the business valuation. According to our research, defined benefit pension liabilities, retiree medical program liabilities, the Affordable Care Act (in the US), and compensation and benefit compliance issues are some of the most significant financial risks that can be uncovered during diligence.

Once a deal is consummated, select financial risks relating to people include unwanted turnover and loss of productivity and engagement, which can adversely impact the business and destroy value.

OPERATIONAL

Achieving operational excellence requires the right go-forward operating platform that will allow the buyer to differentiate its business, and attract and retain the best talent while flawlessly executing on the basics of the function, such as payroll, benefits administration, on-boarding, and compensation management.

“A seller can maximize deal value by playing an active role with the buyer in transition strategy, planning, and implementation.” – Chuck Moritt, North American Multinational Client Leader, Mercer

PEOPLE-RELATED VALUE DRIVERS FOR BUYERS

Assess leadership team and key employee capabilities.

Use skills inventories and competency assessments to gauge selection and ability to execute on strategy, effectively govern, lead people, drive culture change, and deliver business results.

Develop effective retention strategies.

Segment key stakeholder employee groups (beyond the executive team) to determine appropriate severance programs, stay and retention bonuses, roles, and decision-making authority during and after the transaction. This helps keep customer relationships intact and allows for an orderly transfer of the knowledge required to operate the business going forward.

Have a clear culture, communications, and change management plan.

Determine the right pace and amount of disruption, and communicate frequently and transparently so employees understand the new culture, performance expectations, business objectives, and their role in the change.

Evaluate HR service, delivery, and design needs.

Ensure on day one the basic measures are in place to deliver paychecks and benefits to employees while positioning the HR function to enhance business results.

Enlist experienced resources to speed the transition process and make it more efficient.

A project management office (PMO), integration management office (IMO), or separation management office (SMO) will accelerate decision-making, execution, implementation, and, in turn, operating results.

Adopt an enterprise or global view to effectively manage benefits.

The approach to benefits can vary widely in different countries (on average, country benefits costs range from 18% to 50% of base salary). Avoid unnecessary costs and compliance risks by adopting a comprehensive governance strategy for global benefits.

Understand the market competitiveness of rewards, and leverage your total reward programs to attract and retain the right talent.

This includes base pay and total cash to market, internal equity, incentive metrics/targets, and noncash rewards.

Identify critical employee groups and consider a retention program.

Programs targeted at employee groups that influence key customer relationships or important operating initiatives can minimize any pre-close exit disruption and maximize the purchase price.

Leverage experienced sell-side advisors and separation specialists (including SMO resources).

Taking a rigorous approach to sell-side diligence (including the auction management process and dissemination of key data, insights, and facts) can help improve the purchase price and expedite the sales process.

Consider providing a sensible, appropriately priced (cost-plus) transition services agreement (TSA).

These arrangements allow you to mitigate reputational risk, cover your costs, and create an orderly exit. If a TSA is not an option, consider standing up the organization prior to sale.

Document a clear talent management/staffing plan.

Establish and communicate the infrastructure of the entity being sold, and determine which employees will stay with the parent and which will go to the new organization.

Applying these principles throughout a transaction will help organizations — whether they’re buying or selling — mitigate risk and maximize return on exit.

ABOUT THE REPORT

Our findings are based on 847 unique data points, including survey responses from 323 M&A professionals, 78 interviews, and analysis of nearly 450 transactions (of which almost 60% were cross-border deals) during 2015.

Forty-four percent of firms we surveyed had more than 10,000 employees, and 39% had revenue exceeding $5 billion.

323 corporate and private equity buyers and sellers surveyed

78 interviews with deal professionals and advisors

446 transactions analyzed

A total of 323 corporate and private equity buyers and sellers were surveyed between April and August 2015 by our research partner SSRS, a leading independent research company with deep expertise across multiple industries, including health care, technology, and financial services. In addition to human resources (HR) executives, 56 percent of respondents were from private equity deal and operations teams, corporate development, finance, and operational leadership positions, bringing a diverse range of perspectives to our research.

Mercer also conducted interviews with 78 private equity and corporate clients across a broad range of industries between August and November 2015. We interviewed business unit leaders and M&A advisors and consultants; executives in corporate development, strategy, and finance; private equity deal teams and operations teams; and CHROs and HR executives to find out how they’re responding to the heightened challenges of this competitive marketplace.

In addition, we analyzed 446 transaction-related projects from 2015 to identify the top areas of focus for buyers and sellers in managing the people-related risks involved in transactions. Approximately 60% of the transactions we analyzed included more than one country.

KEY FINDINGS

INTRODUCTION: RISING RISKS FOR BUYERS

With worldwide M&A totaling nearly $5 trillion last year (a 42% increase over 2014 levels), 2015 was a record year for dealmaking. In an increasingly competitive marketplace, shorter deal timelines and shrinking access to information are compelling both strategic and financial buyers to take on new and greater risks.

2015 DEAL VOLUME BY TRANSACTION TYPE

In an M&A environment driven by excess capital, rising competition, global economic volatility, and companies’ fundamental need to grow, buyers are facing a host of new complexities. Potential buyers must not only manage the high costs of the sales process, but also navigate an intensely competitive marketplace.

Investment bankers are running aggressive sales processes, often allowing multiple bidders to participate in the late stages of bidding. In response to the competitive tension, select buyers are attempting to pre-empt the entire process by swiftly offering up one large “best price” bid to knock out the competition

Buyers are also considering joint ventures and other unconventional transactions to avoid auctions and uncover sole-sourced deals.

Our research shows that buyers are responding in several key ways.

BUYERS ARE ENTERING NEW AND UNFAMILIAR GEOGRAPHIES

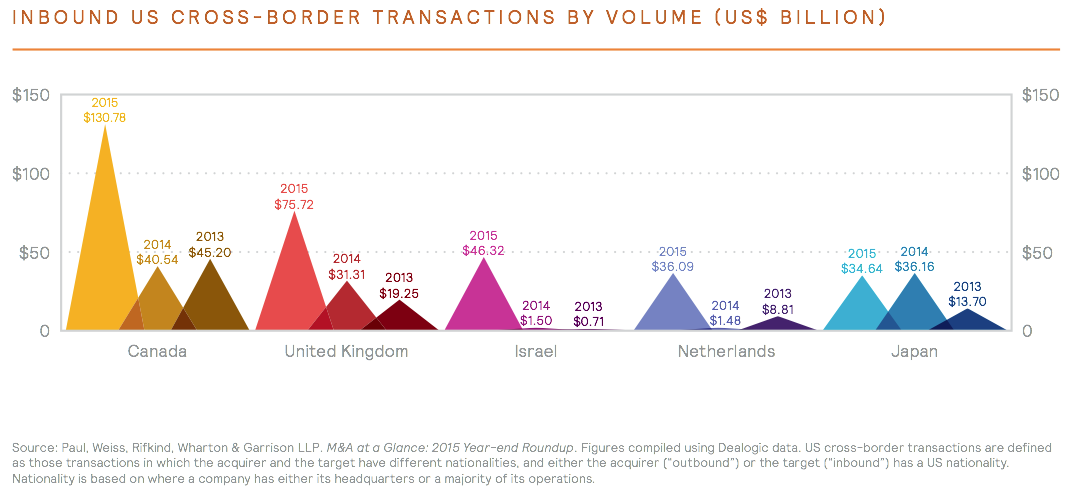

Businesses are aggressively looking to new geographies for fresh deal opportunities. Half (50%) of survey respondents reported involvement in cross-border deals. And nearly one-quarter of the businesses surveyed say they are now more inclined to consider a multicountry transaction.

Emerging markets are enticing many buyers with potential exclusivity, the promise of a lower purchase price, and a higher return on exit. But they’re also presenting new complexities related to labor laws, local customs, and ways of doing business that many buyers may not be prepared for or understand — and that may pose compliance risks.

24% of businesses surveyed are more inclined to consider a multicountry transaction than they were prior to January 2014.

“We are not prevailing in auctions and are being forced to think of new, creative ways to put capital to work. We cannot afford to sit on the sidelines now because of high valuations. We need to leverage our imagination and creativity to deploy capital now and not be skittish. Bottom line is, we need to take new and different risks.” – Senior Private Equity Executive, $20 Billion+ in Assets Under Management

“Everyone is looking for opportunities for growth, especially now that China is cooling off. We and others in the industry are now looking beyond traditional emerging markets to the Middle East and Africa.” – Vice President Human Resources and Chief Ethics Officer, Fortune 500 Company

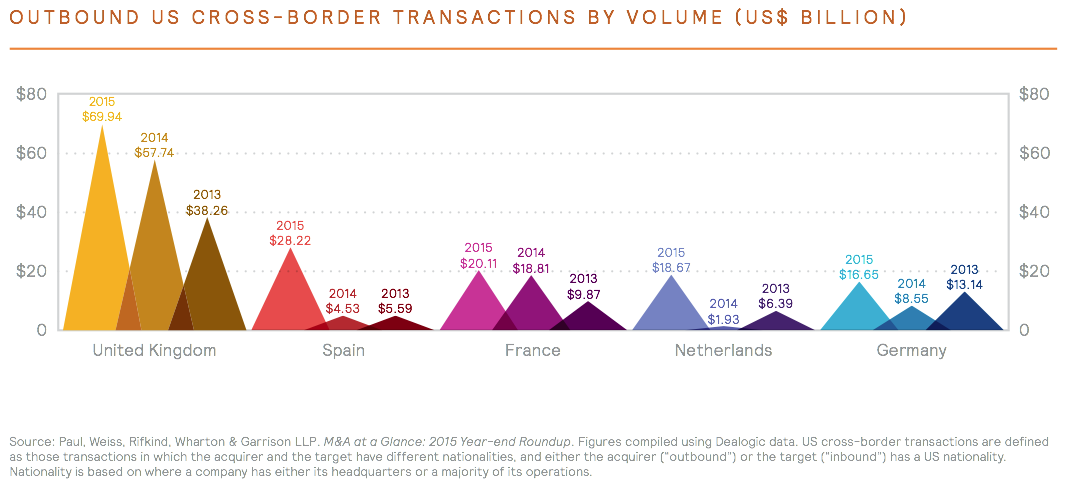

TOP 5 COUNTRIES OF ORIGIN OR DESTINATION FOR 2015 US CROSS-BORDER TRANSACTIONS AND PRIOR YEAR COMPARISONS

GOING GLOBAL: TAKING ACTION

Before going global, prepare thoroughly by considering global HR governance in context.

By adopting a global view, buyers can mitigate risk by gaining a fuller picture of the issues that can impact deal success. A comprehensive global strategy will instill financial discipline and compliance.

Almost 50% of respondents are willing to consider taking on pension and post-retirement medical obligations.

Buyers are demonstrating greater risk tolerance by purchasing assets that include pension and other long-term employee obligations. Taking on pension debt and risk is now the minimum cost of entry into select second-round competitive bidding exercises.

In fact, one in four of the transactions we analyzed included single or multiemployer pension plans.

WHAT MATTERS FOR BUYERS DURING DILIGENCE WHEN DEFINED BENEFIT OBLIGATIONS ARE INVOLVED IS AN UNDERSTANDING OF THE:

- Inherent financial risk of the obligations

- Preferred post-close pension strategy

- Potential risk management options

- Valuation model impact of the post-close pension strategy

ADDRESSING BUYERS’ CONCERNS

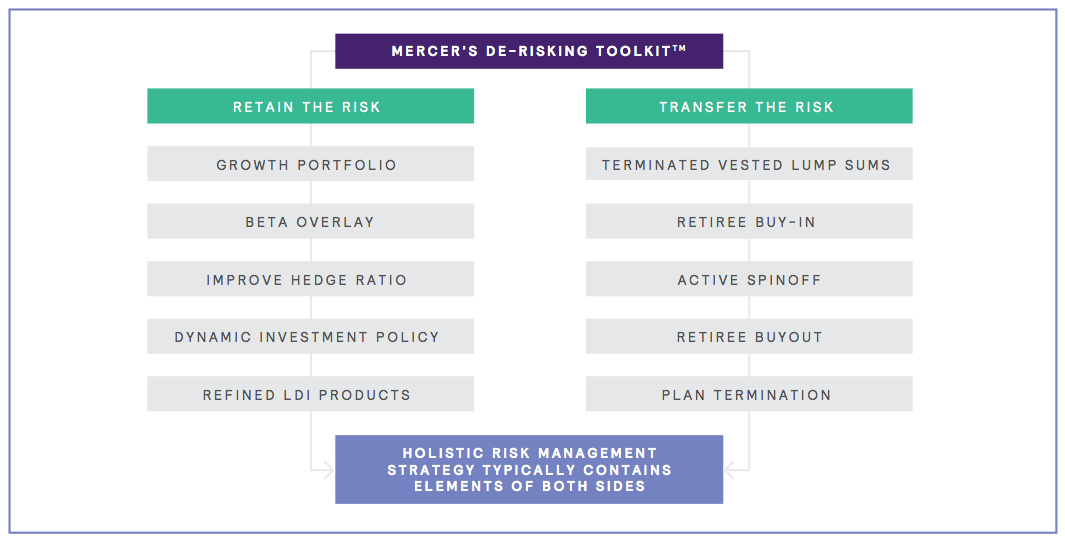

Apply risk mitigation tools that provide greater clarity and stability. Many buyers’ willingness to consider the assumption of defined benefit obligations is influenced by the ability to measure the relative risk of these obligations and implement de-risking solutions post-close. Over the past several years, the pension marketplace has introduced a number of new, more affordable solutions to support organizations wanting to implement de-risking or risk transfer strategies (refer to “Establishing a Competitive Edge With Mercer’s Pension Debt Solution”).

Use of representations (reps) and warranty insurance is increasing.

Due to rising competition among acquirers, transactional risk insurance on M&A deals is growing rapidly. Demand for reps and warranty insurance rose 15% globally during the first half of 2015. Both private equity and corporate dealmakers in the Americas, EMEA, and Asia-Pacific are increasingly using insurance capital to help close deals. For the full year 2015 in North America, Mercer’s sister company Marsh (the global leader in insurance brokering and risk) saw an increase of more than 20% in the number of policies issued and an increase of over 50% in the amount of insurance placed.

“We expect the global trend of increasing usage of reps and warranty insurance to continue in 2016 as more corporations and private equity firms, and their advisors, become more aware of the utility and benefits of this product.” – Craig Schioppo, Transactional Risk Practice Leader, Marsh

PROACTIVE DEAL PROTECTION

Representations and warranty insurance serves to protect deal value. These insurance policies offer protection against financial loss suffered as a result of breach of the representations and warranties contained in the purchase and sale agreement. Private equity firms are the largest users of transactional risk insurance as they seek affordable ways to reduce indemnity requirements when buying, though corporate buyers are using this insurance with increasing frequency.

BUYERS MUST OVERCOME RISKS TO CREATE VALUE BEYOND PURCHASE PRICE

An ultracompetitive marketplace, shorter auction timelines, and shrinking access to information are posing big challenges for buyers. Our research identified the following trends:

Buyers are making quicker decisions, but with less data available to them.

Forty-one percent of buyers report less time to complete diligence prior to making a binding bid compared to the prior three years. And 33% say that sellers are providing less information about the asset for sale. Companies conducting cross-border (37%) or domestic (24%) deals expect sellers to disclose less information in the future, due to the competitive nature of transactions.

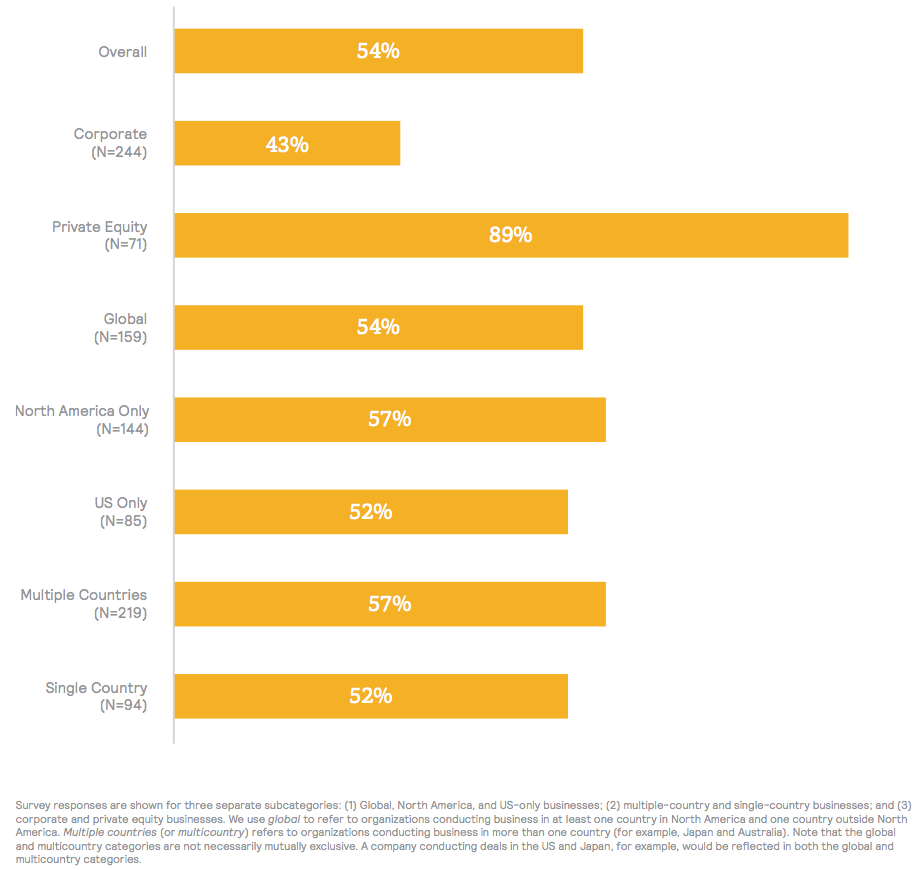

Buyers are engaging advisors later in the diligence process.

Time is short, budgets are tight, and competition is fierce. Buyers are engaging advisors later in the process to minimize broken deal fees. But by shortchanging the diligence process, buyers ultimately may be doing themselves a disservice by taking unnecessary risks.

The large majority of the businesses we surveyed use advisors during comprehensive due diligence. Private equity businesses (89%) are significantly more likely to engage external advisors during the diligence phase than corporate businesses (43%). Corporate businesses are more likely to be familiar with the industry of a deal and have more internal functional resources, whereas private equity businesses look for outside help in an industry with which they are less acquainted.

35% of sellers globally are reluctant to share information with anyone other than a winning bidde

“Truncated due diligence periods are the new reality. To stay competitive, we need to ‘go at speed’ — that is, at the seller’s speed — but still ensure we operate effectively. It’s HR’s biggest challenge.” – Global Corporate Mergers and Acquisitions Executive, Fortune 100 Company

PERCENTAGES OF BUSINESSES ENGAGING ADVISORS TO EVALUATE HUMAN CAPITAL-RELATED RISKS

Buyers are often solely responsible for ensuring day one readiness.

Sellers have the upper hand in today’s marketplace when it comes to transition service agreements (TSAs). They don’t want to use resources and time to support a transition unless it’s absolutely necessary to maximize exit price. Nearly half of the buyers we surveyed (49%) say that sellers are not providing a TSA post-close. This means that many buyers must be ready on day one.

More than 50% of businesses surveyed experienced delayed closing of global deals (60% for US-only deals).

Regulatory requirements and the seller’s unwillingness to offer a reasonable TSA, or no TSA at all, were the reasons most frequently cited.

“The first 60 days is about us executing the basics — such as getting people paid and taking care of benefits.

As a serial acquirer, we also focus immediately (in the first 100 days post- close) on culture integration.

We want employees to feel like they’re part of our family as quickly as possible. We do a lot of employee branding and communication around business priorities and the voice of the customer.” – Senior HR Manager, M&A, Multinational Technology Company, $8 Billion in Enterprise Value

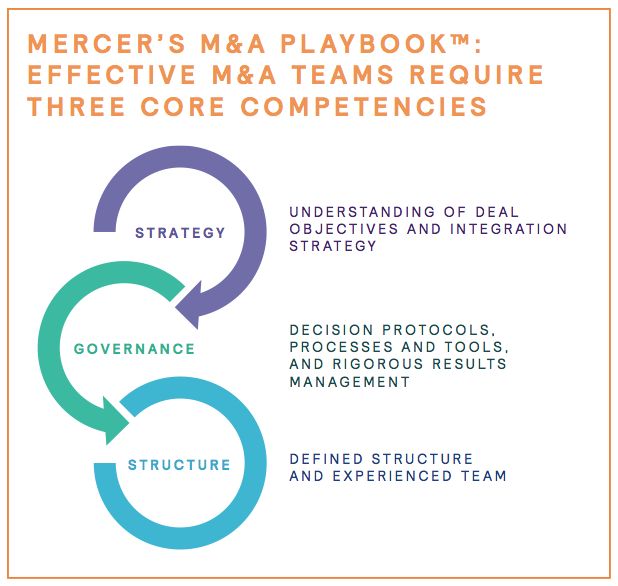

ESTABLISHING A COMPETITIVE EDGE

Transaction readiness is the key to success.

It is not uncommon for serial acquirers to create a detailed and comprehensive multifunctional playbook ahead of deal activity.

Companies that are serious about HR readiness are investing in education for their functional managers and leaders focused specifically on such topics as:

- Pre-deal strategy.

- Due diligence.

- Purchase agreements.

- Organizational culture.

- Communication.

- People practices.

- Integration/execution (PMO).

SELLERS MUST RESPOND TO CHALLENGES TO MAXIMIZE PRICE

Although it’s clearly a sellers’ market, sellers are not immune to the risks posed by an unpredictable deal environment. Many are under pressure to generate new shareholder value and quick returns or are involved in the sale of companies with complex operating challenges.

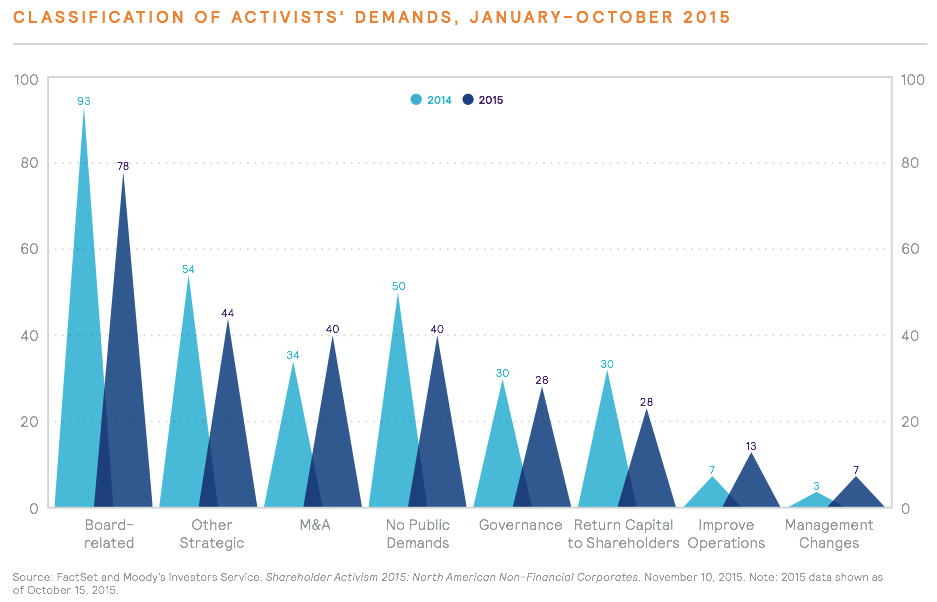

Armed with more than $100 billion in capital, activist investors continue to pressure more companies to unlock value for shareholders.

The figure below shows the various demands activists are making of organizations. The resulting actions driven by these demands include cost-cutting to cash dividends, outright sales, divestitures, spinoffs, and split-ups.

According to Linklaters’ proprietary data analysis, 860 shareholder activist actions had been launched globally through October 2015. This represents an increase of 170% since 2011.

Separating a highly intertwined and complicated conglomerate structure can cause costly delays and unplanned resource drains for the seller. A disciplined and planned approach is essential.

“It’s harder to divest than to acquire — everything is so intertwined.” – Chief Financial Officer, $20 Billion Global Conglomerate

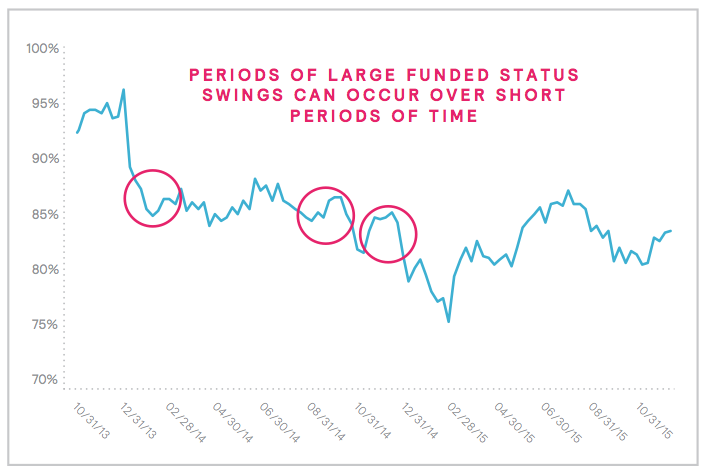

Sellers that choose (or that are compelled) to divest assets that include defined benefit pension and other long-term employee obligations must navigate short-term volatility during the auction process.

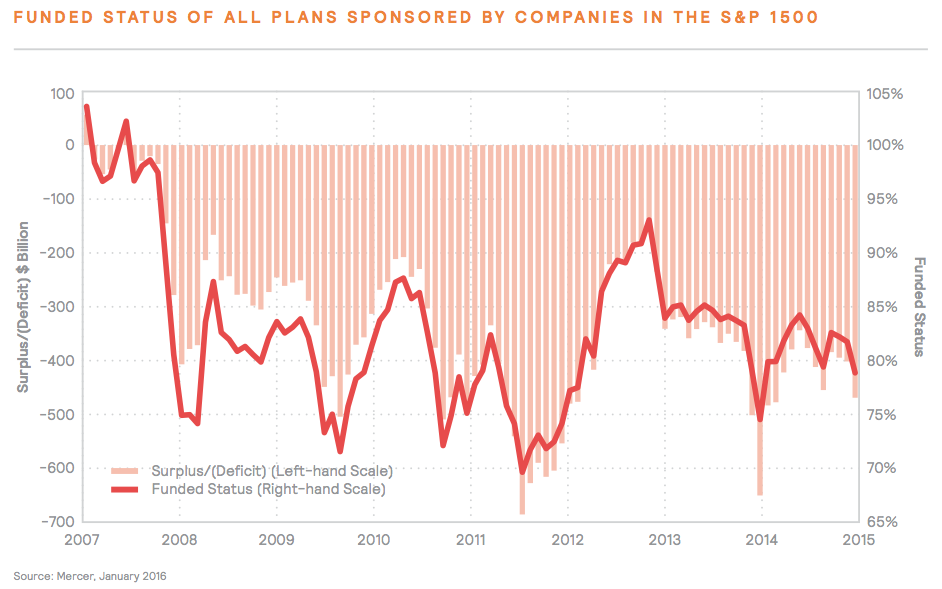

The S&P 1500 pension funded status gains in 2015 (see the figure below) were wiped out by volatile January 2016 declines in just one month.

Sellers are deploying strategies pre-auction to demystify pension obligations for the buyer, limit downside risk, and maximize exit price.

SELLERS ARE ADOPTING A SHARP FOCUS ON PEOPLE ISSUES DURING DILIGENCE

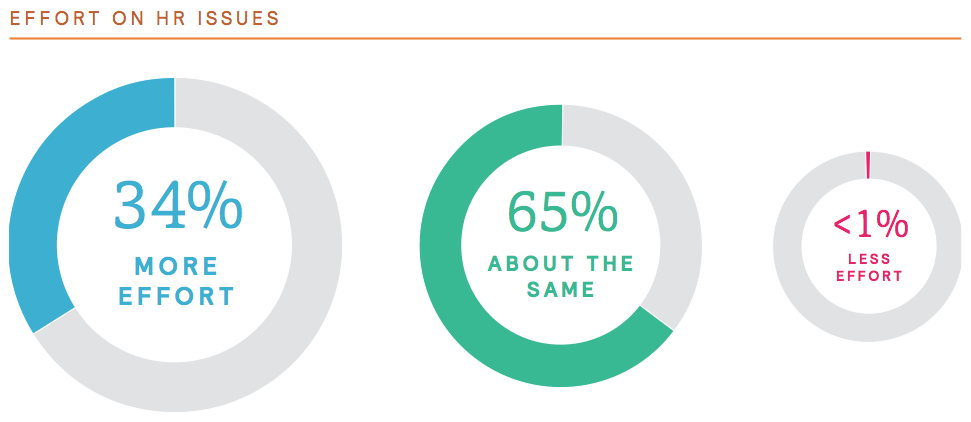

As they plan for and execute transactions, many sellers are finding that HR issues require increased focus and attention in order to reduce risk and maximize deal value. This new reality means that many deals demand an increased allocation of resources to address people issues. Of those surveyed, over one-third indicated that they are spending more effort on HR issues when preparing for divestitures than in the past. This also means that already stretched resources are being strained further — creating risk for the remaining business entity as well.

More than one-third of those surveyed spend more effort on HR issues when preparing for divestitures.

A BALANCED APPROACH TO DRIVING RETURN ON EXIT

Take steps to help buyers understand available de-risking options.

Buyers’ willingness to assume pension obligations is heavily influenced by de-risking opportunities. Sellers with defined benefit obligations can help potential bidders understand the risk management solutions available to bidders and can reduce pension volatility that can occur during the sale process (see “Establishing a Competitive Edge With Mercer’s Pension Debt Solution”).

Leverage experienced sell-side advisors and separation specialists like Mercer.

Taking a rigorous approach to sell-side diligence (including the auction management process and dissemination of key data, insights, and facts) can help improve the purchase price and expedite the sales process.

Consider providing a sensible, appropriately priced (cost-plus) transition services agreement (TSA).

These arrangements allow sellers to mitigate reputational risk, cover their costs, and create an orderly exit. If a TSA is not an option, consider standing up the organization prior to sale. (See “Unlocking Value Through Split-ups and Stand-ups”)

Document a clear talent management/staffing plan.

Establish and communicate the infrastructure of the entity being sold, and determine which employees will stay with the parent and which will go to the new organization.

RISK CONSIDERATIONS: PEOPLE MANAGEMENT PRACTICES IN TRANSACTIONS

DILIGENCE FOCAL POINTS

Sixty-four percent of our respondents indicated that talent-related issues are the most significant focus of due diligence.

Building on that concept, we asked respondents to think back over the past 15 months and rank the top three people-related issues (in order of importance) that were a significant aspect of diligence and that impacted price determination, deal negotiation, and/or willingness to acquire. Forty-six percent of survey participants identified the leadership team and key talent retention as the top two people-related issues, followed closely by culture and organizational fit.

64% of companies surveyed say talent is the most significant aspect of due diligence.

TOP 3 PEOPLE-RELATED ISSUES DURING DILIGENCE

- Leadership team

- Key talent retention

- Culture and organizational fit

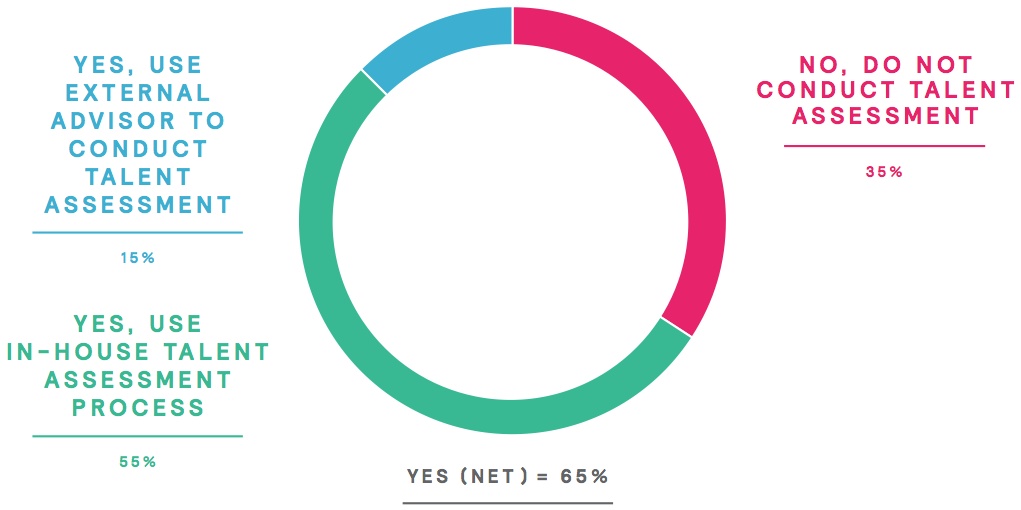

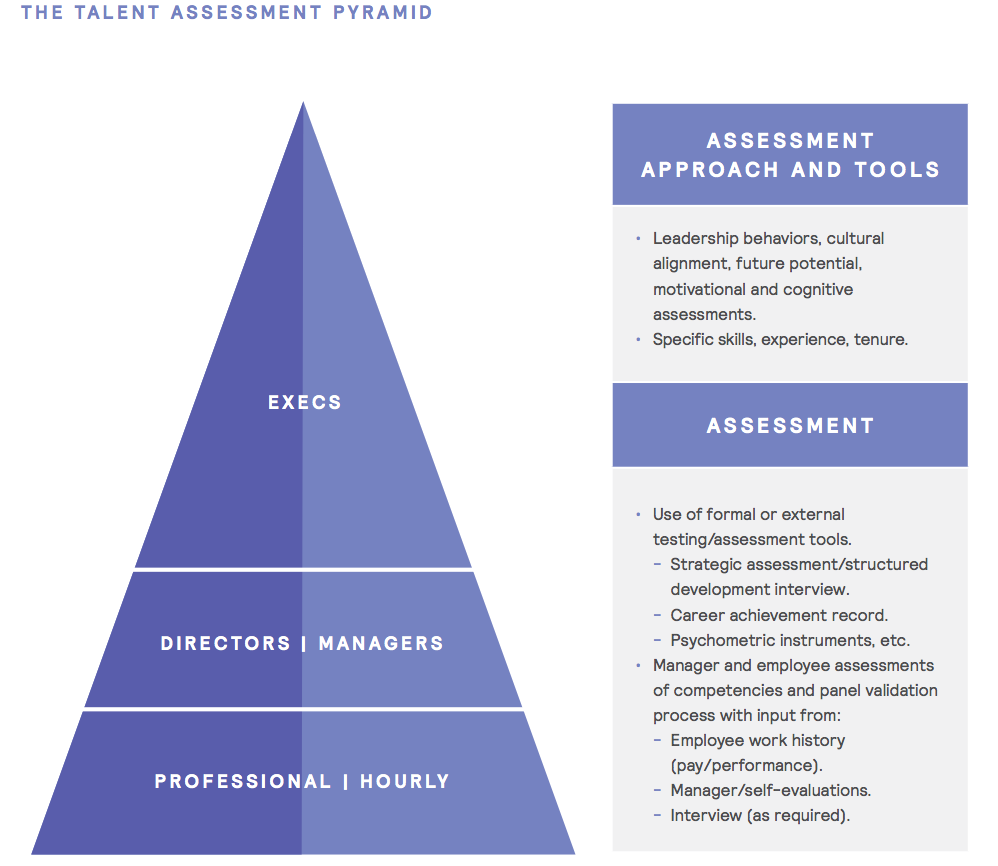

Talent assessment plays a key role during diligence.

The focus on talent-related issues during diligence is not surprising if we consider that people are, ultimately, a company’s most valuable asset. It’s a company’s employees who are largely responsible for on-the-ground delivery of the business plan, profit, and revenue growth. Therefore, an important aspect of due diligence is learning about the key talent associated with businesses involved in a deal. Formal talent assessments provide that insight.

When asked whether their companies conducted a formal talent assessment process on key employees during their diligence, nearly two-thirds of participants indicate that they conduct some type of assessment by using either a formal in-house process or an external advisor.

“The greatest perceived people risk — without question — is acquiring C-suite talent with the ability to execute on the plan.” – General Partner, Private Equity Firm, 20+ Portfolio Companies, $6 Billion in Assets Under Management

EVALUATING REWARDS IS A KEY FINANCIAL ASPECT OF DILIGENCE

Understanding the pay and benefit practices relative to industry benchmarks for all components of rewards is key during diligence. This includes base pay and total cash to market, internal equity, incentive metrics/targets, and noncash rewards.

Private equity businesses (33%) were more likely to mention this issue than corporate businesses (28%) as a diligence focus. This finding is influenced by the industry of the target business, its cost structure and expected future state cost structure, and whether or not the business strategy underpinning the transaction is reliant on cost savings (e.g., industry consolidation).

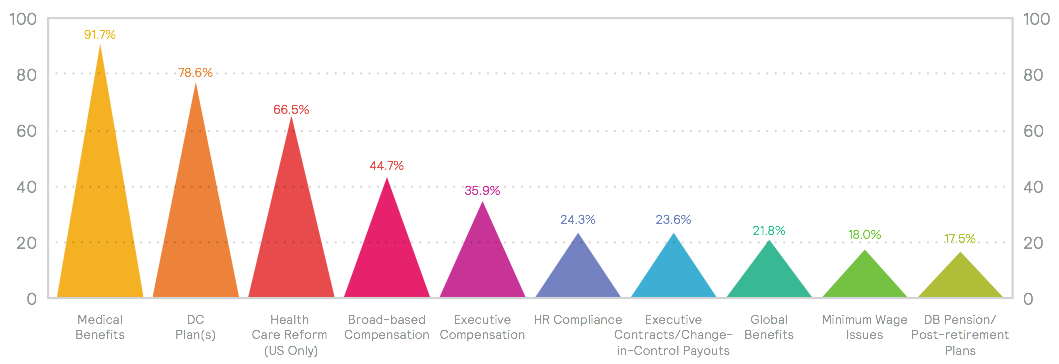

Our analysis of nearly 450 randomly selected transaction assignments (conducted by Mercer’s M&A Transaction Services team in 2015) revealed that the top rewards-related issues included medical benefits, which was a key area of focus in 91.7% of the projects. This is not surprising given the dynamics of health care spend globally and specific health care reform compliance risks in the US.

The chart below illustrates the prevalence of key rewards-related areas that were analyzed in our project work. In addition to medical benefits, a standard area of review is the evaluation of defined contribution plans, which are widespread in the marketplace and can be a significant issue for buyers if there are compliance problems or integration complications.

Approximately 80% of the transactions we analyzed included an evaluation of defined contribution retirement plans, and almost 20% of transactions included an evaluation of defined benefit pension plans and/or post-retiree medical plans.

POST-CLOSE 100-DAY PLANS

As companies create a post-close 100-day plan, talent remains top of mind.

Nearly 89% of the companies we surveyed included talent issues among their top three integration challenges overall. Ensuring a good cultural and organizational fit, retaining key talent, and making sure the best leadership team is in place are the top people issues cited by those surveyed.

Based on the results of Mercer’s interview findings, most corporates (64%) focus on senior talent acquisition and retention. This focus includes retaining essential talent, upgrading skills, and scaling for growth. For 57% of private equity businesses, leadership team effectiveness is the top HR issue in transactions.

“Our primary focus in the first 100 days is on senior talent acquisition: upgrading talent, searching for vacant positions, and scaling for growth.” – Managing Director, Private Equity Portfolio Operations Executive

66% OF COMPANIES SAY TALENT ISSUES ARE THE MOST IMPORTANT HR INTEGRATION CHALLENGE THEY FACE POST-CLOSE.

Employees have new roles, new bosses, and new terms of engagement: Dealing with these types of changes causes distraction and results in productivity loss. A clear communications and change management plan mitigates such risks by enlisting support from key stakeholders, defining critical changes and timing, and maintaining a focus on execution.

Amid the uncertainties that come with major change, getting people issues right becomes paramount — and engaging employees requires strategic, consistent communication. Effective, frequent communications are also important to sustaining employee morale. When changes impact employees in multiple countries or regions, communications about those changes must be orchestrated appropriately. Employees in one country who haven’t yet received information about their own transition likely will not appreciate hearing that their peers in another country already have a transition plan in place.

Although global messaging should be consistent, local input is important, too. Cultural needs vary — between offices, between countries — and should be considered when crafting a transition plan. For example, a company shouldn’t ask new employees to sign their offer letters online if they live in a country where a face-to-face meeting is customary practice.

There are practical considerations regarding culture, too. For instance, a company may need a notification letter to support its new employees’ transition, but because the transition is happening in multiple countries, the letter will need to be translated into the local languages. Challenges like these make the transition process more complex.

“Communication, communication, communication … We tell acquired employees how important they are to us. We tell them how they fit into the organization. And we repeatedly tell them, ‘You are core to our business.’ ” – CHRO and Chief Ethics Officer, Multinational Chemical Company, $2 Billion in Revenue

Culture was identified by our survey respondents as the No. 1 HR integration challenge.

“When we talk about culture risks, what we’re really talking about are productivity and profitability risks.” – Mergers & Acquisitions HR Executive, Multinational Aviation and Aerospace Company

Given the importance of this topic, Mercer took the opportunity to delve deeper into this issue during our 78 interviews (with corporate and private equity clients, M&A attorneys, and other advisors) to better understand the definition of a successful culture. Consistently, those interviewed defined a culture of winning to include the following characteristics, behaviors, and outcome expectations:

- Leadership alignment.

- Specific, deliberate behavior definition and reinforcement.

- Clarity of purpose.

- High collaboration.

- Honest and frequent communications.

- Well-socialized risk profile.

- Owner-like accountability.

- Performance-based environment.

- Transparent governance.

- Agile and empowered decision-making.

- Progress measurement and celebration.

“Culture is big on our diligence scorecard. Our approach to cultural integration involves having both teams working together toward the same goal. We want integrated teams that work well together. … We bring in target leadership early so we can assess culture fit.” – Private Equity Executive, Digital Software and Services Company

MOVING AHEAD: PEOPLE PRIORITIES PRE- AND POST-CLOSE

Conduct a deliberate and thorough talent assessment process.

Focused and rigorous evaluations of leadership team and critical employee capabilities ensure that the acquirer’s talent decisions are optimized to meet the current and future needs of the new organization.

Use skills inventories and competency assessments to gauge selection and ability to execute on strategy, effectively govern, lead people, drive culture change, and deliver business results. (For a deeper discussion of the questions company leaders should ask when assessing talent, see “What Matters: Talent Assessment in M&A”)

Develop effective retention strategies.

Segment key stakeholder employee groups (beyond the executive team) to determine appropriate severance programs, stay and retention bonuses, roles, and decision-making authority during and after the transaction.

This helps keep customer relationships intact and allows for an orderly transfer of the knowledge required to operate the business going forward.

Have a clear culture, communications, and change management plan.

Determine the right pace and amount of disruption, and communicate frequently and transparently so employees understand the new culture and their role in the change.

Getting the message out early and often — and through multiple people and mediums — paves the way to successful consolidation and integration. A clear and purposeful communication plan allows company leaders to engage people in a targeted and timely way, and combat such pitfalls as talent attrition and reduced productivity. (See “A Balanced Approach to Culture Integration”)

“Our biggest risk is retention — keeping the key revenue generators, the key operators, and the client-facing employees.” – Corporate Development Executive, $15 Billion Insurance Industry Organization

People practices will remain a priority in future deals.

Talent is a main focus of current diligence processes, and this trend is expected to continue according to our survey respondents. More than half of all businesses report talent issues will continue to be the most significant HR issue in future transactions, followed by compensation and benefits. Compensation and benefits are of particular concern for private equity buyers, with more than a quarter of respondents citing this as a significant area of focus in future transactions.

THE TOP FIVE PEOPLE ISSUES IDENTIFIED (IN RANK ORDER)

- Employee retention

- Cultural and organizational fit/integration

- Leadership team (determining the quality of the management team/executives for the new company)

- Compensation and benefit levels (market pay concerns)

- Talent availability and identifying, assessing, and placing talent

These responses reinforce — overwhelmingly — that talent issues (particularly the availability, retention, and assessment of key talent) are the most pressing people-related risks.

FOR THE MAJORITY OF BUSINESSES, EVALUATING A DEAL AFTER CLOSING INCLUDES TRACKING HR SYNERGIES AGAINST BUSINESS PLAN EXPECTATIONS

More and more buyers are demanding that their advisors provide a post-closing executive summary geared towards HR operational efficiencies.

These include compensation and employee benefit alignment to market, HR technology assessment, and an evaluation of cultural drivers for success. Execution during the first year of ownership is key to maximizing the return on investment.

Just under two-thirds of the total businesses we surveyed track HR synergies after a deal. To help ensure they’re positioned to capture people-related value after the transaction, most businesses are taking steps to make sure their people strategy is aligned with, and fully supporting, their business strategy.

“Our approach is to offer only 12-month retention packages, which allows us to review new talent sooner rather than later.” – HR M&A Executive, Fortune 50 Company

CONCLUSION

The research behind People Risks in M&A Transactions echoes Mercer’s 70+ years of experience in managing deals for both financial and strategic clients around the globe. Disciplined, experienced, and dedicated project management resources on both the buy and sell sides — whether insourced, co-sourced, or outsourced — are key to maximizing value for both parties. They are also an important form of risk management.

Mercer’s dedicated global M&A transaction teams provide a unique combination of world-class processes, tools, and methodologies along with core HR subject matter expertise to deliver PMO, IMO, and SMO services. In addition to speed and agility, clients value our:

► Focus on key priorities and people issues, in one or multiple countries, that influence value creation.

► Urgency and drive for project delivery.

► Ownership and accountability.

► Rigorous governance standards.

► Timely identification of dependencies and risks.

► Effective communication protocols.

► Comprehensive project infrastructure.

In today’s environment, buyers must move with urgency to initiate their change agenda immediately after close. The pre-close period and the first 100 days post-close are not the time to let deal fatigue slow down change and implementation.

The change agenda should include aligning behaviors to new priorities via frequent, concise, and transparent messaging. Savvy buyers immediately align rewards (such as short-term incentives and profit-sharing) with business objectives, and harmonize or reduce benefits — for example, 401(k) or other retirement vehicles; medical, short- and long-term disability; and company-paid life insurance — to simplify administration, hedge compliance risk, and achieve more manageable cost levels.

Customer alignment, sales force structure, and related sales incentive plans are also frequently targeted for change in the first 100 days post-close.

The following represent people-related best practices in diligence pre- and post-close:

BUYERS — BEST PRACTICES

- Assess leadership team and key employee capabilities.

- Develop effective retention strategies.

- Have a clear culture, communication, and change management plan.

- Evaluate HR service, delivery, and design needs.

- Enlist experienced resources to speed the transition process and make it more efficient.

- Adopt an enterprise or global view to effectively manage benefits.

- Understand the market competitiveness of rewards, and leverage your total reward programs to attract and retain the right talent.

- Retain experienced M&A and core HR dedicated tool and project management resources.

SELLERS — BEST PRACTICES

- Identify critical employee groups and consider a retention program.

- Leverage experienced sell-side advisors and separation specialists.

- Consider providing a sensible, appropriately priced (cost-plus) TSA.

- Retain experienced M&A and core HR dedicated tool and project management resources.

This research and our experience working on approximately 1,000 transactions annually reinforce that organizations bringing the same discipline and rigor to addressing people issues as they do to managing balance sheet risk and other key operational aspects of a deal ultimately realize the most value from the transaction.

DIGGING DEEPER INTO PRACTICAL SOLUTIONS

WHAT MATTERS: TALENT ASSESSMENT IN M&A

Leaders know the success of a new company formed as the result of an M&A transaction depends on ensuring that the right people land in the right jobs. Unless the deal involves nothing more than physical assets — which is the exception in today’s M&A world — the acquirer needs engaged, high-performing talent to ensure that the new company achieves its potential.

Talent decisions often involve more complexity than other integration decisions (e.g., products, markets, customers) yet may be made with less rigor, discipline, and data. For M&A leaders to be successful, they need to “raise their game” in talent assessment.

M&A transactions trigger the need to make challenging and sometimes emotional decisions about individuals — including long-term productive employees. For example, a merger often produces redundancies: Suddenly, there are two CFOs, two customer service vice presidents, and so on. Questions swirl about who should stay, who should go, and who should be placed in a different role.

Ultimately, the acquirer must determine whether incumbents from the target (the acquired company) are the best people to achieve the new organization’s objectives.

Our experience dictates that successful buyers develop a keen understanding of the following questions early in the talent selection process:

- What skills and competencies do our leaders/managers need in order to deliver on the new business objectives?

- Does the candidate have a leadership/management history of mature decision-making that produces results and is consistent with the new organization’s risk profile?

- Does the individual possess skills essential to the business’s longer-term success?

- Will the individual be able to work effectively in the new company culture?

- Does this leader/manager have a track record of successfully developing talent?

- How long might this candidate stay with the firm and remain motivated?

“We realized we needed to better define how to view transaction success — and needed to identify different success metrics that would focus on talent alignment and organizational culture fit as opposed to only financial metrics.” – HR M&A Manager, Leading Multinational Energy Company

The more information about existing employees an acquirer has before closing a deal, the better, because it can make decisions sooner. But for many practical reasons — including insufficient time, data, and access to personnel — it is rare for the acquirer to have a comprehensive organizational structure established when the final papers are being signed. As a result, the lion’s share of talent assessment happens after closing.

Although formal employee evaluations may not be possible in a deal’s early stages, quite a few informal strategies can yield an initial read on people’s strengths and potential risks. These include observing behavior during management presentations, reviewing CVs provided in the data room, and taking note of employee interactions during informal operational/functional meetings conducted as part of due diligence. Being intentional and diligent in these initial evaluations can inform a more formal structured assessment once the deal is approved.

Compiling a list of an employee’s leadership skills and behavioral attributes begins to tell the story of whether an employee will fit into the go-forward organization or confound the business intentions behind the deal. The formal process of determining someone’s suitability for the new organization typically comprises the following five steps.

1. Clarify the business imperatives.

Begin with the deal’s objectives and the new organization’s expectations. For example, is a quick turnaround of the business needed, or is there a focus on entering new markets? An individual’s talent must be measured against his or her potential to fulfill those objectives and expectations.

2. Define success criteria.

Identify the skills, experience, and leadership capabilities needed to meet the new company’s business objectives.

3. Develop role profiles.

Outline the job requirements for the target roles, as well as the requisite skills and knowledge necessary to carry out those job requirements. Create a system that allows each employee to be measured against a job-specific set of criteria.

4. Assess the talent pool.

To select the best people for each role, gather relevant data on candidates through management interviews, individual interviews, and/or third-party assessment interviews. Aim for rigor, fairness, and consistency in the talent assessment. Review this information against the chosen selection criteria — for example, leadership ability, past performance, and future potential. The figure at right offers some ideas about parameters to keep in mind.

5. Review and select talent.

Use the results of the assessment process to make informed personnel choices.

Thorough, focused, and rigorous evaluations of leaders and key positions ensure that the acquirer’s talent decisions are optimized to meet the current and future needs of the new organization.

“Ultimately, the talent the new company employs can mean the difference between winning and losing in today’s competitive and volatile marketplace.” – CHRO, Fortune 100 Company

UNLOCKING VALUE THROUGH SPLIT-UPS AND STAND-UPS

Split-ups and stand-ups account for much of the recent restructuring activity in the marketplace, with companies increasingly selling subsidiaries or carving out noncore businesses. What’s driving this surge in splits? The desire to unlock value.

In the right circumstances, splits make a lot of sense. Many companies, after re-evaluating their strategic priorities, find they may be better off operating independently as separate entities instead of as a conglomerate. Splits can provide big benefits, allowing companies to seize new opportunities, focus on a core strategy, attract talent, and achieve greater value.

Although these transactions offer great advantages, they also present significant challenges. Poorly executed split-ups and spinoffs can result in some real and unfortunate outcomes — unanticipated resource needs, costly ongoing transition service agreements, long and painful separations, and loss of key employees — all of which can destroy value and damage reputation.

HOW TO GET THE MOST FROM A SPLIT

1. Have a plan. The Separation Deal Flow Process organizes the process into defined phases and clarifies the objectives, process, and actions needed to achieve the desired goals. Breaking things down into manageable steps helps define key milestones, promote coordinated action, and monitor progress.

“When we announce a divestiture, there’s an immediate ‘us versus them’ mentality. Keeping ‘about to be divested’ employees engaged is a huge challenge. If these employees get demotivated, it has a business impact that can drive down price.” – HR M&A Executive, Fortune 50 Company

2. Focus on people. Successful deals require keen attention to the people-related issues. Never is this more true than in the case of a split, which often requires even greater process and rigor to handle the complicated people challenges that invariably arise:

Identifying and retaining key employees

A separation involves reconsidering organization design and how to source, and keep, talent. Identifying those key players you can’t afford to lose and creating incentives for them to stay are essential to an effective retention strategy.

Rethinking HR policies

The people questions, especially in cross-border transactions, are wide-ranging and deserve careful consideration:

- Will the entity being spun off use the same programs as the parent organization?

- What is affordable for NewCo?

- What type of HR infrastructure needs to be in place to ensure things are running smoothly and day-to-day concerns — like payroll, benefits administration, compliance, and governance — are addressed?

Communicating transparently

Spinoffs bring major change, which often means productivity loss. A clear communications plan brings the end vision to life and keeps employees engaged and focused on execution.

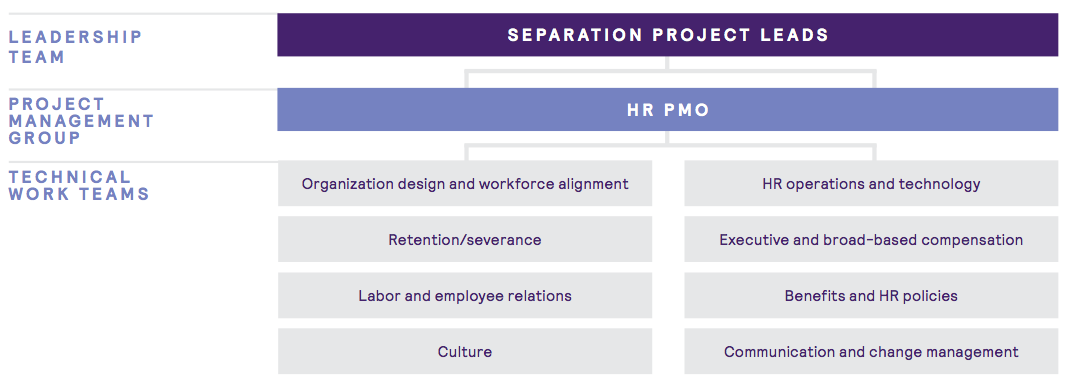

3. Get the right support. Organizing the right teams to launch the separation work is critical. Identifying dependencies within work streams, HR, and business/functional areas allows the separation work to unfold in a logical, efficient way. Dedicated teams bring synergy to the process:

The strategic group steers the separation work, aligning it with the strategy.

The HR project management office (PMO) allocates resources to complete the day-to-day transition tasks.

Technical work teams complete activities to finalize the separation and work with the HR PMO to resolve issues.

When managed effectively, a split-up can accelerate a company’s transformation and unlock value.

ESTABLISHING A COMPETITIVE EDGE WITH MERCER’S PENSION DEBT SOLUTIONTM

Q&A WITH MERCER EXPERTS DOUG JOHNSON AND CHAD HUEFFMEIER

Q: Can you provide an overview of the solution?

Doug Johnson: Mercer’s Pension Debt SolutionTM provides efficient, independent, mark-to-market sell- and separation-side analysis of defined benefit (DB) pension plans, along with a range of risk management solutions (from de-risking options to real-time risk transfer pricing). These solutions demystify for potential buyers the risks associated with assuming a DB plan in a transaction.

This solution identifies value opportunities from a corporate debt and financial economics perspective, based on the debt and operational characteristics of the plans included in the transaction. Mercer’s Pension Debt Solution provides a buyer’s road map with solutions that range from temporarily protecting funded status through the transaction process to reducing risk in the long term.

Q: What benefits does Mercer’s pension debt solution offer sellers looking to package their pension program for sale?

Chad Hueffmeier: DB pensions raise red flags for potential buyers. These plans often are underfunded, lack cost certainty, and have significant exposure to asset-liability mismatch risk. DB plans can make the business being sold appear less attractive to potential buyers: Some buyers may decide not to bid; others may require compensation for the underfunding and for taking on the additional risk.

Pension volatility also poses risks for sellers during the sales process. An example: The average funded status of US pension plans dropped from 87% to 81% from June 30 to September 30 in 2015. This level of volatility is not atypical; many DB pension funds follow policies that reflect long-term investment horizons — and accept the short-term volatility that comes with them.

But if DB plans are transferring, a seller’s investment horizon is measured in months, not decades: For organizations with $100 million in DB obligations, there is a 1 in 6 chance this could translate to more than a $6 million loss within three months. Standard deal pricing will treat the underfunding of DB plans as debt, often with an explicit purchase adjustment at close in the sale agreement.

To address these challenges, Mercer’s Pension Debt Solution can be implemented quickly to temporarily stabilize the funded status of the DB plan once the sale process starts. Our solution can significantly reduce short-term volatility to protect the plan’s funded status and thereby hedge much of the financial risk to the seller during the sale process.

Our solution also helps sellers eliminate buyers’ misconceptions about pension risk. In 2015, Mercer collaborated with CFO Research (2015 CFO PENSION RISK SURVEY) to survey more than 200 organizations about their pension risk management practices. Our findings showed a continued trend toward de-risking.

In response to this trend, much progress has been made: A growing number of market solutions and strategies have been developed to support the risk management of DB plans.

To support the sales process, our solution offers a spectrum of realistic de-risking and risk transfer options, ranging from taking on more comfortable levels of risks, to moving to a fully hedged position to minimize funded status volatility. When sellers can help buyers better understand the risk solutions that are available and take actions before the sale to reduce risks, it increases the chances of a successful transaction.

Q: We’ve talked about advantages for the seller. What are the advantages for the buyer?

Doug Johnson: Implementing this solution allows the buyer the luxury of time — time to set up the governance committee the buyer will need to administer the plan and turn a short-term asset back into the long-term asset that it was intended to be. It also provides stability: Following closing, our solution can remain in place for a period of time determined by the buyer. This creates space for the buyer to make decisions about how to go about managing the plan after the sale.

Mercer’s Pension Debt Solution also gives buyers clarity about what it is they’re getting, in terms of both assets and liabilities. Buyers can corroborate their diligence findings by comparing them with the seller’s findings to get a clearer picture and inform decision-making. Buyers can also access real-time information that can provide them with a more accurate view of the mark-to-market environment.

Q: Does Mercer’s pension debt solution apply to plans of any size assets versus funding status?

Chad Hueffmeier: Our solution applies to plans of any size. However, the size of the plan affects how we implement the solution. For example, for large plans, we would implement the stabilization strategy synthetically, with equity and treasury features and/or exchange rate options. For small plans (e.g., $20 million in assets), we would generally change the physical allocation of assets because the time and additional costs associated with a more sophisticated solution wouldn’t necessarily be warranted.

Q: What characteristics need to be present in the deal for this solution to make sense?

Doug Johnson: How the pension plan is currently being managed matters: If the plan is being run with high exposure to equities and it’s got that level of risk in it, then this solution makes a lot of sense. Evaluating the size of the pension obligations relative to the business is also important — if the pension plan obligations are significant, Mercer’s pension debt solution offers substantial value.

A BALANCED APPROACH TO CULTURE INTEGRATION

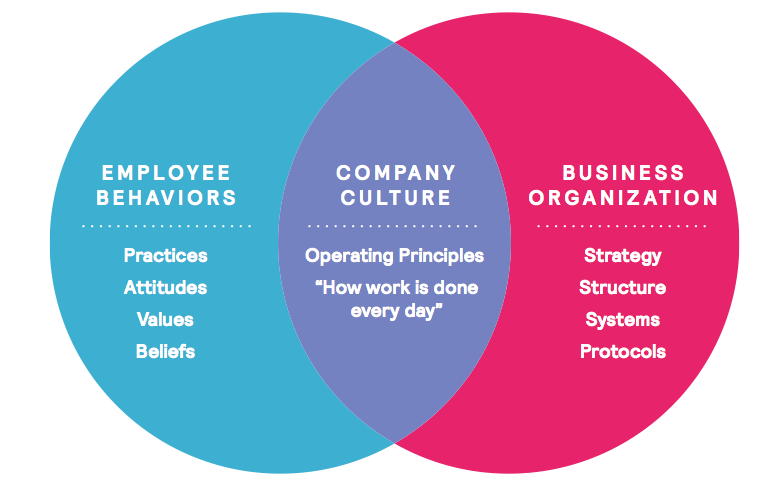

When all the financing is done, the hard work of integration begins. When two organizations come together to form a new entity, they must meet the challenge of determining how they will work effectively together.

Getting employees from two legacy organizations to work well together in the new organization won’t happen on its own: It’s only by building a strong culture that new ways of working can take hold. Because culture is inextricably linked to how a business achieves results, it’s a key factor in managing change and driving performance. By being deliberate and purposeful in articulating the vision of the future and clarifying the new behaviors needed to move the business forward, leaders can promote the desired culture and effectively manage an integration.

Our research shows that successful organizations embrace the following principles at the outset:

1. CULTURE CHANGE AND INTEGRATION TAKE TIME AND SUSTAINED EFFORTS.

Organizations that look for a “silver bullet” that will solve their culture issues quickly — and permanently — are soon disappointed. The reality is there’s no easy antidote or one-size-fits-all solution. Taking a systematic and long-term approach to culture and change management is key: Understanding the deal context and completing a culture diagnostic to determine gaps between the current and desired state are critical first steps in shaping an effective integration strategy, reconciling legacy cultures, and organizing a program of targeted activities that will engage employees and move them toward a unified goal.

Building culture is a long-term, ongoing effort that requires a well-thought-out plan.

STEP 1: SET CONTEXT

- Understand deal thesis:

- Business strategy.

- Integration drivers.

- Performance expectations.

- Purchase agreement commitments.

- Critical milestones.

STEP 2: DIAGNOSE

- Analyze current culture and behaviors.

- Identify desired future culture and behaviors.

- Test change readiness.

- Identify strengths and barriers.

STEP 3: DESIGN

- Define priorities.

- Segment audiences and related concerns.

- Clarify business and behavior outcomes.

- Align with other internal initiatives.

- Identify culture-building ideas/tactics.

STEP 4: PLAN

- Document core dimensions of the culture.

- Craft internal messaging framework.

- Identify specific programs and recommendations.

- Develop implementation and cascade plan.

STEP 5: IMPLEMENT

- Set up the governance, team, and protocols.

- Execute programs.

- Monitor success and measure the impact.

- Ensure constant reinforcement and sponsorship.

2. LEADERS AT ALL LEVELS OF THE ORGANIZATION MUST UNDERSTAND, BUY INTO, AND CHAMPION THE CHANGE.

The CEO and executive leaders must invest in and actively sponsor culture and change management efforts. Although HR helps facilitate these efforts, it’s business leaders who must lead the change. By bringing the future vision to life, clarifying priorities, and building the desired capabilities within their teams, leaders can engage employees to become agents of change. But if leaders themselves aren’t fully invested in the change, employees won’t be either — and the inevitable results will be organizational confusion, missed opportunities, and loss of value.

3. EFFECTIVE COMMUNICATION ACCELERATES THE PATH TO VALUE.

In the absence of facts, people will make assumptions that are often inaccurate. Getting the message out early and often — and through multiple people and mediums — paves the way to successful consolidation and integration. A clear and purposeful communication plan allows company leaders to engage people in a targeted and timely way, and combat such pitfalls as talent attrition and reduced productivity. Tailoring the message to different groups also helps capture the hearts and minds of employees by helping them better understand how they’re affected and what they need to do to help drive the change.

4. BEHAVIOR CHANGE IS THE BEDROCK OF SUCCESSFUL INTEGRATIONS.

Although communication is absolutely critical during an integration, communication campaigns alone will not motivate people to change their behaviors and adopt new ways of working: “Evidence overwhelmingly suggests that the most fundamental problem in all stages [of large-scale change] is changing the behavior of people.” To get people on board and to promote participation in change, leaders must “walk the talk” by modeling behaviors congruent with the new culture. Institutionalizing new approaches and developing new systems and processes to reinforce new behaviors can help accelerate the integration, as well as offering focused training and support that help employees meet new demands.

“Top three actions to mitigate risk during an acquisition: Disciplined change management and communication from the top. Clear messaging about the purpose of the deal and what behaviors are required for the deal to be successful for all stakeholders. And getting acquired company senior leadership on board and engaged around the deal early.” – Chief Human Resources Officer, Leading Global Provider of Environmental Solutions

5. SUCCESSFUL CULTURE CHANGE REQUIRES CONSISTENCY AND FOLLOW-THROUGH.

Put simply, organizations must do what they say they will do. Actions and behaviors, systems and processes, and communications and change programs must be consistent to ensure all employee populations are engaged in the change. All transformation efforts (whether pre-, during, or post-integration) should be driven by a focus on people and aligned with business objectives.

THE PASSION FOR THE DEAL GETS LEADERS OUT OF THE GATE; THE HARD PART IS SUSTAINING THE EFFORT OVER TIME.

Culture provides the means to sustainment: It serves as a powerful vehicle through which organizations can embed positive change by enhancing employee engagement, customer retention, organizational efficiency, and synergy realization. By adopting these five core principles of success, organizations can achieve their integration goals to realize the full return on the deal investment.

HR OPERATIONS AND TECHNOLOGY READINESS

In today’s complex transactions environment, investment in HR operations and technology is increasing for a variety of reasons, including capacity constraints, aging technology, inadequate and risky manual processes, and insourcing initiatives to ultimately reduce costs, among others. Regardless of the deal type or size, the most successful acquirer, in our experience, is focused on three key areas from the outset of the transaction, beginning with diligence.

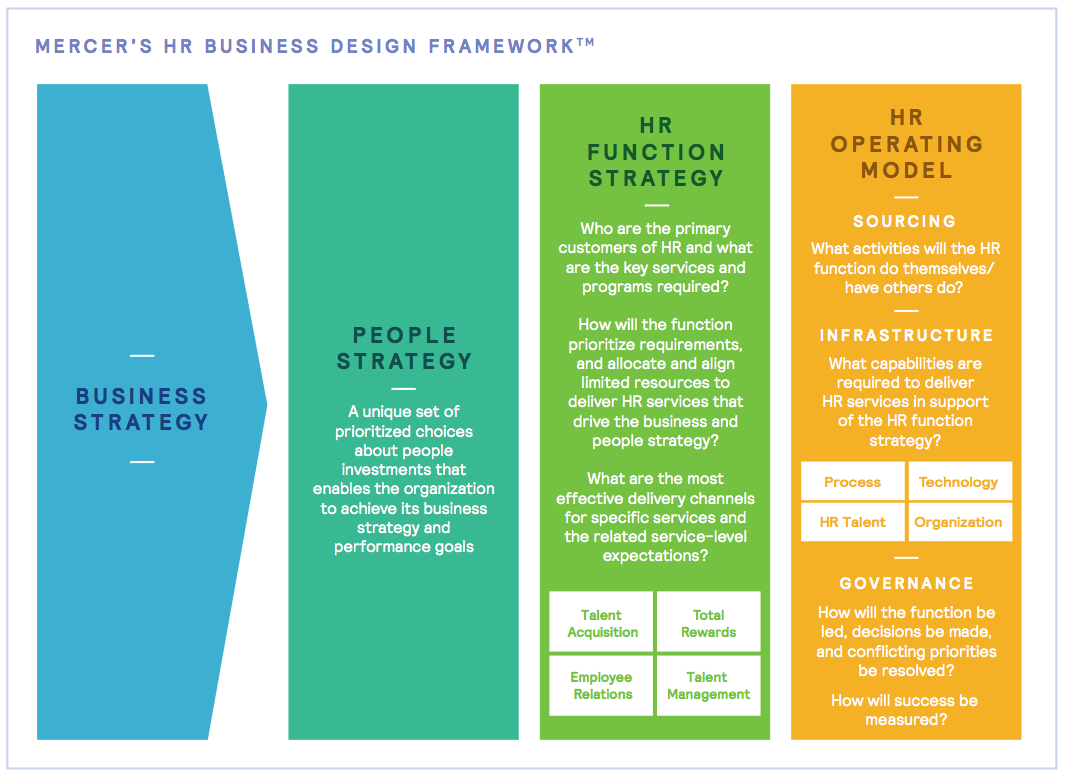

1. HR FUNCTION STRATEGY AND OPERATING MODEL

A successful HR operating model is not accidental. Rather, it is purposely derived from a clear understanding of the people strategy, which is specifically designed to support an organization’s unique business strategy. According to our experience, skilled acquirers around the world understand the importance of these interdependencies, as illustrated in the figure below.

“Merging our two organizations required us to rethink how we deliver HR services. It was both a requirement for success and an opportunity for significant improvement.” – CHRO, Global Health Care Solutions Company

Successful organizations understand that HR is more than compensation, benefits, and payroll processing — it is a “business” delivering complex services and products to HR customers.

An effective HR operating model addresses sourcing, infrastructure (people, technology, process, and organization), and governance. Depending on timing and priorities, operational levers can take on different prominence post-close:

- How will we source and deliver payroll services and benefits administration?

- How can we better leverage employee and manager self-service to optimize efficiency?

- What HR structure and decision governance are required to enable day one, interim, and future state capabilities?

- How will we source HR services after the TSA expires?

- Can we leverage current processes, infrastructure, and technology to deliver on our new business objectives?

Best practices dictate investing the time to understand and align the HR functional strategy and operating model with the new business objectives. It is simply unreasonable to assume that the current state will adequately support the future business direction (e.g., headcount growth/reduction, geographic expansion/contraction).

Organizations that assume the status quo during diligence often face major challenges post-close — including disrupted payroll and benefits administration, inability to effectively support the function’s business partners, failure to communicate changes to key employee stakeholder groups, and reduced employee productivity.

“Our go-forward M&A strategy required new HR technology that could keep pace with innovation and enable rapid integration of future acquisitions.” – Managing Partner, Private Equity Firm, $2 Billion in Assets Under Management

2. HR TECHNOLOGY

Modern HR systems are evolving rapidly and are becoming more affordable, with a clearer line of sight to ROI. Savvy buyers are investing in diligence resources to evaluate HR operations/technology and are negotiating with sellers to extend TSAs to provide buyers time to procure new HR technologies that drive efficiencies and differentiate people practices.

“We assumed the current HR systems were adequate, and we were very wrong. This oversight set us back several months on our synergy targets.” – SVP HR, Leading Medical Benefits Management Company

HR technology applications that were installed only a few years ago are already outdated in many cases. Poor functional operating and technology support choices result in costly manual workarounds, redundant processes, compliance risks, reduced employee and manager engagement/productivity, and turnover.

In response to the rapid pace of innovation in HR technology solutions, many organizations look to external experts to assist with the assessment, selection, and implementation of new HR technology. Smart organizations are leveraging experts like Mercer in the diligence process to map out functional priorities and competencies. In the time leading up to close and during the initial TSA period, these experts work with buyers to procure solutions and/or providers that deliver a range of service levels that include the basic day-to-day HR support (such as payroll, benefits, and on-boarding) as well as more strategic capabilities (for example, employee relations, performance management, and succession planning).

In response to the rapid pace of innovation in HR technology solutions, many organizations look to external experts to assist with the assessment, selection, and implementation of new HR technology. Smart organizations are leveraging experts like Mercer in the diligence process to map out functional priorities and competencies. In the time leading up to close and during the initial TSA period, these experts work with buyers to procure solutions and/or providers that deliver a range of service levels that include the basic day-to-day HR support (such as payroll, benefits, and on-boarding) as well as more strategic capabilities (for example, employee relations, performance management, and succession planning).

3. HR TALENT AND SKILLS

More than half of all businesses that participated in our survey report talent and skill gaps as a significant issue. This includes, at times, suboptimal HR talent. Take, for example, the divested organization with only a handful of HR staff coming over who will require six months of on-the-ground resources from third-party vendors to support HR while they source and staff an HR function. Without the right HR skills and talent, the cost of a transaction will inevitably rise.

Sizable gaps in the key skills, experiences, and competencies required to deliver the future HR operating model are also not uncommon. Consider, for example, the midsize organization that triples its size over two years as a result of multiple acquisitions, resulting in a functional leadership team that doesn’t have the experience required to navigate the HR complexities of the much larger organization.

High-performing organizations use proven methodologies, tools, and processes to assess and build the capabilities of HR talent. As result, they have higher-performing HR functions with improved contribution to business performance. The figure below offers an example of a tool that assesses current HR competencies against future requirements, enabling the systematic design of a plan to address key skill gaps and build capability. Organizations that agree that HR is more than just payroll and benefits view HR talent as a strategic enabler. These organizations readily support disciplined investments to address skill gaps and grow capability, and see the ROI as self-evident.

High-performing organizations understand the importance of getting HR operations and technology right at the outset of the deal, setting the stage for a smooth integration and creating the crucial foundation needed to enable the business strategy. Companies that embrace HR operations and technology as strategic imperatives — rather than dismissing them as mere tactical concerns — have the best chance of realizing the full potential of the deal.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter