Publications Effects Of Mergers On Corporate Performance: An Empirical Evaluation Using Ols And The Empirical Bayesian Methods

- Publications

Effects Of Mergers On Corporate Performance: An Empirical Evaluation Using Ols And The Empirical Bayesian Methods

- Christopher Kummer

SHARE:

By Abdul Rashid, Nazia Naeem – Borsa Istanbul Review

Abstract

In this paper, we empirically examine the impact of mergers on corporate financial performance in Pakistan using data on the deals occurred during the period 1995–2012. Ordinary least squares (OLS) and empirical Bayesian estimation methods are applied to carry out empirical analysis. The OLS regression results suggest that the merger deals do not have any significant impact on the profitability, liquidity, and leverage position of the firms. However, the estimates indicate that the merger deals have a negative and statistically significant impact on quick ratio of merged/acquirer firms. We show that the results of the empirical Bayesian method are largely consistent with the OLS results.

1. Introduction

One of the fundamental objectives of a corporate firm is to achieve the highest, effective, and sustainable growth level. However, most of firms, which are expected to spread their business, have limited resources due to lack of internally generated funds, inadequate access to financial markets, small scale of business etc. Therefore, in order to achieve their goals, corporate firms have several other options in their hands. For instance, organic and inorganic growth strategies are among the most famous strategies for improving growth of business, sales expansion etc. Under organic growth strategy, firms expand their business by new product development, productivity enhancement, increased output, cost reduction, finding new markets, and customer base expansion. On the other hand, inorganic growth is the process of growth of assets and sales expansion by occurring new businesses through, mergers, acquisitions, divestitures, spin-offs, take-overs etc. Although, as compared to organic growth, inorganic growth strategy is a fast way for corporate firms to expand their business, it introduces several risks to merged/acquirer firms as well. Indeed, realize of the inorganic growth proves to be difficult and not fully free of risk. For instance, losing existing customers and a conflict in firm cultures are two of the major risks faced by the merged/acquirer firms.

In financial and economic perspective, inorganic strategy is one of the most important strengths for corporations across the world (Vanitha & Selvam, 2007). Among several strategies of inorganic growth, merger and acquisition (M&A) is one of the important characteristics of this strategy. According to Weston, Mitchell, and Mulherin (2004), through mergers and acquisitions firms are able to overcome the problem of limitation by efficient use of limited resources. Further, it generally believed that mergers and acquisitions (M&A) are expected to fuel the rate of growth of business and sales. Mergers and acquisitions are also important to improve the competitiveness of a firm and performance of firm managers (Huh, 2015). Many corporate firms consider mergers and acquisitions a best way to expand their ownership boundaries (Dash, 2010). Similarly, firms also pursue mergers and acquisitions to increase their market power, diversification, efficiency (both production and cost efficiency), achieve internationalization, and to get operation, financial, and managerial synergies (Moeller & Brady, 2007; Petitt & Ferris, 2013). Recently, owing to globalization, liberalization, improvements in technology, and competitive business environment, mergers and acquisitions are becoming more important throughout the world (Leepsa & Mishra, 2012; Usman, Mehboob, Ullah, & Farooq, 2010).

Finance theories suggest both positive as well as negative effects of mergers and acquisitions on corporate firms‘ performance. According to merger and acquisition theory, successful merger and acquisition deals increase the profitability of the merged/acquirer firms. This increase in profitability could be result of improved monopoly or an increase in efficiency (Beena, 2000). On the other hand, according to the managerial theory of a firm, mergers and acquisitions have a negative impact on merged/acquirer firm‘s financial performance and profitability specifically (Ghatak, 2012; Kumar & Bansal, 2008). There is also empirical evidence that merger and acquisition deals do not significantly influence the profitability and financial performance of corporate firms (Al-Hroot, 2016; Bhabra & Huang, 2013; Pilloff, 1996; Poornima & Subhashini, 2013).

Mergers and acquisitions may also have either negative or a positive impact on a firm‘s leverage position. As in Lewellen (1971), owing to mergers, especially in conglomerate merger deals,1 if the income flow becomes more stable, then the lenders can enhance the limits on lending to the newly created firm and this limit would be greater than the sum of the original limits that would be available for the merging firms independently.

Another motive behind mergers and acquisitions is the expected enhancement in the liquidity of the merging firms (Pawaskar, 2001). Liquidity is important for firms like blood for human body to survive (Beena, 2000). Liquidity position of a business can be evaluated with the help of current ratio, quick ratio, and working capital etc (Kumar & Bansal, 2008). Many researches have documented that higher value of these ratios show safe liquidity position of the firm and if these values are small the firm is at risk (Kumar & Bansal, 2008; Pawaskar, 2001; Poornima & Subhashini, 2013). Merger and acquisition deals can affect liquidity in either way, that is, it may improve or decline liquidity position of merged firms.

Merger deals can take place among the firms of similar industries as well as in different industries. On the basis of this reality, mergers have basically three types: horizontal, vertical, and conglomerate mergers. When two or more firms get together in same industry in finance such deal is known as horizontal merger. This can be explained with the help of an example that a textile firm merges with another textile firm. The merger of two firms dealing in same business takes shape of horizontal merger, which bring about synergetic gains in terms of increased market share, cost saving, and exploring new market opportunities. Similarly, a vertical merger may occur, when textile firm buys its own dealer/supplier of cotton. The vertical merger is likely to decrease operating costs of operations and reduce costs by expanding economy of scales. The third type of mergers is a conglomerate merger in which two distinctively irrelevant companies from different industries merge together. For instance, textile firm buys an Art College or a restaurant chain. The primary objective of such merger deals is to reduce concentration risk through diversified capital investment.

Merger and acquisition trend in Pakistan has increased over the years. However, it is not in that much higher numbers as it happening over the entire world, especially in our neighbor countries India and China. The total number of merger and acquisition deals from June 1995 to February 2012 is 122, highest being 39 deals in 2004. Out of total 122 merger and acquisition deals only 36 deals have been placed in non-financial sector. Although few studies have been done on this area in Pakistan, a comprehensive study has not yet been conducted, especially in manufacturing sector. Hence, our analysis is an effort to evaluate merger deals and their impacts on financial performance of the listed non-financial companies of Pakistan. It should be noted that almost all of these 36 merger deals are horizontal with few exceptions. These exceptions are Nagina cotton mills limited, which was acquired by Ellahi electric company limited, and D.G. Khan Cement, which was acquired by D.G. Khan Electric.

The main objective of this study is to evaluate the financial performance in terms of profitability, solvency, and risk position of the non-financial merged/acquirer companies of Pakistan. Specifically, regression analysis is carried out to analyze the impact of mergers on profitability, leverage, and liquidity position of firms. As the selected sample size is relatively small, so we also have applied Empirical Bayesian Estimation method in addition to ordinary least squares (OLS) technique in this study to acquire more precise results. Because empirical Bayesian technique provides better results as compare to the traditional OLS estimation in case of small sample. In this study, we seek the answer of the following questions.

- Does merger and acquisition affect profitability positively in non-financial sector companies in Pakistan?

- Does merger and acquisition impact liquidity position positively in non-financial sector companies in Pakistan?

- Does merger and acquisition influence leverage positively in non-financial sector companies in Pakistan?

The significance of this study rests on several grounds. So far in Pakistan, large number of mergers and acquisitions has taken place in financial sector that is 86 out of total 122 merger and acquisition deals from 1995 to 2012. This is why, in Pakistan, most of empirical studies have been conducted in banking sector (Kemal, 2011). In Pakistan, there is limited empirical evidence on the effect of mergers and acquisitions on a firm‘s financial performance in terms of profitability, liquidity, and leverage position for non-financial sector companies. Only few studies have been conducted to find the effects of mergers and acquisitions on financial position of non-financial merged/acquirer firms. In this respect, Usman, Khan, Wajid, and Malik (2008) examined the operating and financial performance of merged companies in the textile sector of Pakistan for the period of 2001e2005 (only 5 merger deals are taken as sample).

Usman et al. (2010) evaluated the financial performance of merged firms from manufacturing sector of Pakistan by using the accounting based approach for pre and post merger period relative to their industrial peers (14 merged firms are included in sample). The above-mentioned studies are not comprehensive. This is because Usman et al. (2008) covered only textile sector while other sectors are ignored altogether. However, Usman et al. (2010) selected only 14 firms and used ratio analysis technique only for comparison purpose. We have extended our sample size to 25 merged/acquirer firms, out of total 36 merger and acquisition deals concluded in non-financial sector of Pakistan as well as time period that is about 18 years (1995e2012). Remaining 11 firms are dropped from our analysis because of either non-availability of important data or those are group merger deals. This is tangible contribution in literature of mergers and acquisitions for corporate sector from Pakistan. Further, non-financial companies intending to plan merger and acquisition can obtain substantial guidance from the findings of this study.

The rest of the study is organized as follows. The next section presents a brief review of the studies that examine the effects of mergers and acquisitions on corporate firms‘ performance. Econometric methodology and data are discussed in Section 3. The empirical results and their interpretation are given in Section 4. Finally, Section 5 presents some concluding remarks.

2. Literature review

Mergers and acquisitions (M&A) are becoming famous among financial as well as non-financial sectors of corporate world. When we review the empirical literature we find several studies that have examined the impact of mergers and acquisitions in financial sector. Similarly, for non-financial sector, enough literature is available for different countries, specifically for India, the USA, China etc. Nevertheless, the empirical literature on the effects of mergers and acquisitions in non-financial sector is very limited. Further, the available studies for Pakistan are limited in their scope and objectives.

After reviewing literature carefully we come to know that many tools and techniques are available for analyzing the effects of merger and acquisition deals. Analysis of financial ratios is widely used by researchers to find out the effects of mergers and acquisitions. Yet, different results are found in different studies (Kumar and Bansal, 2008). We have divided the existing studies into two parts according to their results.

2.1. Positive impacts of M&A on financial performance

Several studies have found that merger events have a positive effect on the financial position of a firm specifically profitability, leverage, and liquidity. For example, Pandit and Srivastava (2016) explained that valuation of merger deal is essential aspect while comparing the performance of mergers. According to authors valuation method is important for effective negotiation. They took interview of ten executives of merged companies and also analyzed secondary data of financial ratios. They have concluded that only fair valuation prudent post merger management can create synergies and positive effects on corporate firms‘ performance.

Arikan and Stulz (2016) compared different theories and established that younger firms can create a more valuable and well-diversified merger as compare to old firms. Their findings are consistent with neoclassical theories that showed that acquirer firms performed better and also created wealth through acquisitions of nonpublic firms. Furthermore, their findings are consistent with agency theory because their findings depicted that older firms have negative stock price reactions for public firms.

Drees (2014) used meta-analysis on 204 studies to assess the corporate strategies for this purpose he took joint ventures, mergers and acquisitions, and alliances as data. He concluded that joint ventures and mergers and acquisitions enhance substantive performance. He also found that merger deals have more positive effects on accounting based and market based performance as compared to joint ventures and alliances.

Andreou, Louca, and Panayides (2012) investigated the valuation effects of merger deals in the transportation industry taking 59 merger deals as sample for the time period of 1980e2009. Their study found that mergers create synergy, specifically those tender offers which are consistent with the observation that transportation mergers take place for synergistic reasons rather than management‘s want for bonus consumption. They have discussed that though both kinds of shareholders (target and bidder firm‘s shareholders) are better off, the target firm‘s shareholders enjoy most of the synergistic gains. Further, they found that vertical mergers have greater valuation effects than horizontal mergers and the wealth effects of bidders are greater for open mergers.

Leepsa and Mishra (2012) examined the effects on post merger financial performance in companies dealing in manufacturing sector of India. They also observed the long-term changes in post merger performance of these companies. The study was carried out for 4-year period under consideration using accounting based approach and using three different financial parameters that are liquidity, profitability, and leverage. Average of before and after merger financial ratios were compared to examine if there is any noteworthy change in financial performance due to mergers, using paired two sample t tests. The liquidity position of the firms was found improving so does the profitability of firms which also improved in terms of return on capital and decreased in terms of return on net worth of firms. The improvement was noticed in solvency position terms of networking capital. Overall, an improvement was seen in the financial performance of the firms after merger in terms of liquidity that is current ratio, quick ratio and in terms of profitability that is return on capital. Similarly, the study showed improvement in terms of leverage that is interest coverage ratio. Nevertheless, most of their results were not statistically significant.

Ghatak (2012) studied the impact of mergers on the financial position of Indian pharmaceutical companies by taking 52 listed drugs and pharmaceutical companies (2005e2010) as a sample. He found that the size, selling effort, exports, and imports intensities of firm positively influence the profitability after merger. It was also found that merger deals showed insignificant positive effects on profitability of firms in the long run on the account of X-inefficiency and free entrance of new firms into the industry.

Indhumathi, Selvam, and Babu (2011) compared the sample of merged companies from the years 2002-2005. They analyzed the performance of the both target firm and buying firms using data for three year before and after occurrence of mergers by using ratio analysis and t-test. They found that the wealth of shareholders of the buying firms increased after the merger deal. Kumar and Bansal (2008) argued that increase in profits and synergy gain is not only possible by only getting into the merger deals. By using ratio analysis for 74 merger deals for the time period 2000-2006, they found that in large number of the merger deals, the acquiring firms had generated synergy in the long run in form of higher cash flows, more business diversification, and decreasing costs.

Chatfield, Dalbor, Ramdeen, and Harrah (2011) examined financial position in form of supernormal profits for 26 target and 171 buying firms in restaurant merger deals. Their empirical results showed that target entities in restaurants had enjoyed significantly positive returns. These results indicated that these results are may be synergistic gains from mergers. Figueira, Nellis, and Parker (2009) investigated mergers activity in the EU banking system for the years of 1998-2004 by using Data Envelopment Analysis (DEA) technique for the purpose of assessing performance of banks. They recognized that banks involved in merger events are more efficient after the merger deal when compared to the other large banks.

DeYoung, Evanoff, and Molyneux (2009) provided an evaluation of financial mergers and acquisition of more than 150 research articles from literature. They found that North American bank mergers have positively affected the efficiency. The event-study literature showed a mixed picture concerning stockholder wealth creation. Efficiency gains were found in the literature of European bank mergers as well as stockholder value improvement in the study. They found mixed impact of geographic and product diversification through merger whereas, the findings of financial institution mergers showed unfavorable impacts on certain types of borrowers, depositors, and other external stakeholders.

Al-Sharkas, Hassan, and Lawrence (2008) investigated the effects of cost and profit efficiency of banking sector merger events on the US banking sector by using the Stochastic Frontier Approach (SFA) and Data Envelopment Analysis (DEA) to study the production structure of merged and non- merged banks. The results depicted improvement in cost efficiencies and profit efficiencies after a merger deal. In addition to this, their results showed that non-merged banks have higher costs than merged banks because merged banks were focusing on technical efficiency as well as allocative efficiency. Frederikslust, der Wal, and Westdijk (2008) discussed the wealth creation and redistribution theories of mergers in their study by taking a sample of 101 merger events (1954-1997). They showed that more than 50% of the buying companies had a positive response to share value at the announcement of merger, while 82% of the merger deals showed that share price performance for target firms improved.

Vanitha and Selvam (2007) compared the financial position of 17 merged entities out of 58 manufacturing firms in India (2000-2002) by employing ratio analysis and t-tests. They found that it was possible for the merged firms to get success in financial performance because the merging firms were taken over by those firms that had good repute and also efficient management. Similarly, Pawaskar (2001) has evaluated the financial position of firms using data for 36 merger deals. He compared the state of operating performance before and after merger of the companies. Significant changes in the financial performance of the firms involved in merger activity were seen. According to his findings, the mergers seemed to lead to financial synergies and a one-time growth only.

Gugler, Mueller, Yurtoglu, and Zulehner (2003) contributed a large cross national assessment of the effects of mergers in the literature of effects of mergers on profitability. They used ordinary least square estimation technique for projection taking 14269 merger deals as sample from different countries for the time period of 1981-1998. They considered only those merger deals where more than 50% of the equity of target firm was acquired. They found that 56.7% of all mergers resulted in higher than projected profits but almost the same fraction of mergers resulted in lower than projected sales. Further, they found that market power and efficiency is the reason for different results for profit and sale for the same data set.

Ramaswamy and Waegelein (2003) examined the financial position using financial data of 162 merged firms and industry adjusted cash flow returns as performance criterion taking 5-year pre and post-merger period. They found that after merger, performance was negatively related with size of target firm and have positive relationship with long-term motivation recompense plans. Firms that were in different industries also showed improvement in financial performance. They used regression analysis to conclude whether there was any improvement in performance after merger as compare to the financial performance before merger. They found improvement in after merger operating and financial position calculated by industry-adjusted return on assets for selected sample.

2.2. Negative impacts of M&A on financial performance

In contrast to the studies cited above, the several other studies have documented that merger deals have also affected negatively or insignificantly the financial position of the merged firms. For example, Al-Hroot (2016) attempted to analyze impact of merger deals on financial performance of merged Jordanian industrial companies. He took a sample of 7 merged companies from 2000 to 2014 and applied ratio analysis. By using paired sample t-test, he showed that overall financial performance has insignificantly improved in post merger time period. He used profitability, liquidity efficiency, and liquidity ratios. He further found that different industries showed different results for impact of merger deals.

Huh (2015) investigated the impact of corporate acquisitions on performance of steel industry. He focused on technical efficiency and PER of acquiring steel firms from 1992 to 2011. The study separates acquiring firms in steelmakers and financial institutions to discuss the impact of acquisitions. The findings showed that operating performance of acquired steelmakers by financial institutions has been deteriorated insignificantly, while PER has increased significantly.

Ahmed and Ahmed (2014) took sample of merged manufacturing companies of Pakistan and analyzed financial performance after merger deals. Like other studies, their findings also showed insignificant improvement in profitability, liquidity and capital position. Similarly, the results for efficiency showed insignificant deteriorated performance.

Kandzija et al. (2014) studied the Croatian merged companies and found that failure or success of merger depends on industry structure. They found that the performance of the target company significant depends on the concentration ratio of the target company‘s industry. Specifically, they found that the target firm‘s performance would be higher if the concentration ratio is lower.

Leepsa and Mishra (2014) tried to develop a scientific approach that can help to analyze the multiple financial ratios in pre and post merger time periods. They tried to explore those factors that affect post merger performance of manufacturing firms of India. They developed a composite index score by using Principal Components Analysis for before and after merger period. They utilized different financial ratios from 2000 to 2008 and found that return on capital, method of payment, size of acquirer, quick ratios, industry relatedness, debt ratio and interest coverage ratios are determinates of success or failure of a merger deal.

Braguinsky, Mityakov, and Liscovich (2014) explored the effects of change in ownership and executive control due to mergers on productivity and profitability. Authors used financial, operational and ownership data of Japanese cotton spinning industry to conduct their research. Their findings showed that after merger firms were less profitable. Bhabra and Huang (2013) examined 136 sample merged Chinese companies (1997-2007). They found that the acquiring firms experience positively significant stock returns in 3-year after mergers. Yet, their findings also showed that operating performance has not changed in post merger time period.

Sharma (2016) analyzed the post merger performance of metal industry. She took nine metal companies from India for the period 2009e2010. She applied paired sample t-test for the comparison of pre and post merger performance. Her findings showed minor but insignificant improvement in liquidity and leverage position of metal industry after merger. Profitability in this study declined significantly in terms of RONW and ROA. She suggested that synergy through mergers is possible to generate in the long run with efficient use of resources. She further concluded that success of a merger depends on integration process, keeping eye on this process and timings of decision etc.

Poornima and Subhashini (2013) using paired sample t-test examined the performance of 33 merged companies for the time period 2009e2010 for India. They examined the profitability ratio, the leverage ratio, the liquidity ratio, and the managerial efficiency ratio to carry out their empirical analysis to compare the pre and post merger performance. They found that there is no significant improvement in the profitability of the firms after being acquired. They also reported that other financial ratios also do not show any significant change after the merger deal.

Chang and Tsai (2012) studied the long-run performances of 4288 merged firms during the period 1990e2007 in the USA. Their results depicted a declining performance of acquirer firms. They further examined superior stock performance of acquiring firms before occurrence of merger. They found that investors might anticipate earlier good performance and that the long-run returns correct the overestimation as result of announcements of merger decision. Likewise, Kemal (2011) analyzed the four year (2006e2009) post merger financial statements of Royal Bank of Scotland (RBS) in Pakistan by taking 20 fundamental ratios. The result of his case study showed that merger deal did not improve the financial position of RBS in terms of profitability, liquidity, cash flows, and asset management.

Doytch and Cakan (2011) in their paper analyzed the impact of merger deals on economic growth. The analysis was carried out on primary, manufacturing, and services sectors. Mergers sales were divided according to sectors, domestically and also in cross-border merger. The sample of the OECD countries was studied. By using a Generalized Method of Moments (GMM) estimator, they did not find any significant evidence for that mergers activity added to economic growth, apart from growth of the services sector. Both, financial and non-financial domestic mergers in services sectors had a positive impact on growth of service sector, while mergers of primary and manufacturing sectors affected sectors growth rates negatively. The negative impact of mergers on growth was also found at the aggregate economic level.

Singh and Mogla (2010) compared the pre-merger and post-merger operating performance of merged companies of India by taking sample of 153 companies merged during the years of 1994 and 2002. They used accounting based approach for empirical analysis. Their results exposed that the profitability has significantly decreased after the mergers and the profitability of matching firms also showed a significant decrease over the same time period. They concluded that the decreases in profitability couldn‘t be credited to mergers alone. They also used regression equation for same data and found that the current ratio, the debt equity ratio, and firm size were negatively associated to profitability, and the positive impact of interest coverage ratio and the age of firms on profitability. Firms working in groups were better performed than non-group firms.

Usman et al. (2010) examined the financial condition of merged companies of manufacturing sector of Pakistan. They used the accounting based approach and took average financial ratios pre and post merger relative to their industrial peers. For their analysis, they took 14 firms as sample and used paired sample t-test to examine any noteworthy change between the controls adjusted three year pre and control adjusted three year post merger periods. Their results showed insignificant performance of the merged firms after merger as compare to their control adjusted firms for the control adjusted net profit margin, return on total asset, and gearing ratio measures. The control adjusted return on equity, return on capital employed, earning per share, and total asset turn over showed insignificant declining trend after the three-year post merger period.

Usman et al. (2008) analyzed the textile mergers in Pakistan to check any noticeable influence on the operating and financial position of merged companies taking five merger events during the period of 2001e2005. By employing t-test, they found a decrease (although insignificant in statistical sense) in the operating performance of merged firms due to merger deal. Moreover, they projected performance using ordinary least square method and found an insignificant rise after merger event. Mantravadi and Reddy (2008) studied the effects of merger deals on the operating performance of target firms in different industries by using accounting based approach of ratio analysis. They took 68 mergers from different industries for the period from 1991 to 2003. The results showed differential effect of mergers for different industries. They concluded that the industry type does not create a difference to operating performance of merged firms.

Lipson and Mortal (2007) explored those factors which can affect liquidity position of firm by investigating the relationship between liquidity changes and changes in characteristics of firms during mergers. By taking sample of 1464 firms during the period from 1993 to 2003 and by applying regression analysis, they found that profits of firms decline as the number of analysts, shareholders, market makers, firm size, and volume rise or as volatility reduces. Further, they concluded that increased volume, firm size, and decreased instability are associated with increased depth. Ooghe, Laere, and Langhe (2006) took 143 merged Belgian companies be- tween 1992 and 1994 for examining the financial position of the merged firms after the occurrence of merger, using statistical analysis of industry-adjusted variables. They found a decline in profitability and the liquidity position of most of the merged companies. They also found that the productivity of labor increases due to mergers, but this was just because of improvement in gross added value per employee.

Bhuyan (2002) argued that vertical merger had become an important business strategy to react to the needs of a consumer led marketing system. He took a sample of 43 US food-manufacturing firms and examined the impact of vertical mergers on profitability. He showed that vertical mergers negatively impacted profits due to the fact that vertical mergers failed to create differential advantages, such as cost savings, for the integrated firm.

Meschi (2000) in his survey reviewed the hypothetical and empirical literature on the causes and consequences of mergers and acquisitions. The empirical evidence on the performance of mergers exhibited that mergers are not always positively profitable. The author concluded that in most of merger cases, the shareholders of the acquiring company got lose as the value of their stock holdings decline in post merger. Moreover, the acquired company is most likely to experience a fall in profitability, market share, or productivity. The author also showed that only the shareholders of the acquired company achieved considerable returns from mergers. Taking into account the effect of mergers on market structure, it is found that mergers have no effect on concentration levels and market shares in the USA, while they seem to have a positive effect in the UK.

Berger et al. (1997) analyzed the effects of mergers in banking sector on small business lending by taking data of around 6000 US Bank merger deals. They estimated the energetic reactions of other local banks first time in the USA. They found that the stationary effects of mergers decreased small scale business financing.

Pilloff (1996) examined 36 merger deals (1980e1992) taken place in banking industry and found considerable consolidation on the account of mergers among large financial institutions. The study showed little change according to performance measures after merger. He found correlation among low target profitability, acquirer total expenses, and high target absolute and relative size with successive performance improvements. Abnormal returns of merged firms were related to expense-related variables. Correlations of abnormal returns with performance procedures were constantly insignificant, provided direct proof that market expectations are not related to subsequent gains of mergers.

After reviewing literature of mergers and acquisitions carefully we observe that deals of merger and acquisitions have different effects on financial performance of merged/acquirer firms. In a few cases, we found that mergers and acquisitions improve significantly all underlying indicators like profitability, liquidity, and solvency. On the other hand, we observed that mergers and acquisitions have also affected the overall financial performance negatively. There are several studies in which we found that post merger performance has mixed results, for instance, profitability improved but liquidity position did not improve. When we review the literature of mergers and acquisitions in Pakistan, we see a big gap that need to be filled. In Pakistan, the relevant literature is not comprehensive. The previous existing studies did not analyzed mergers and acquisitions of non-financial companies in comprehensive way. Further, most of the exiting studies have just used t-test to carry out their empirical analysis and none of the study has conducted the regression analysis to find out the impact of mergers and acquisitions on financial performance of merged/acquirer companies. Departing from the existing studies, we have extended our data, time period, and carry out regression analysis to see the impacts of merger deals on the financial performance of manufacturing companies listed at Pakistan Stock Exchange (PSX). We further enrich our study by using a very sophisticated technique, namely empirical Bayesian technique, that has not been used so for by even a single study in mergers and acquisitions literature. Thus, our study significantly contributes into the existing literature.

3. Methodology and data

We applied regression analysis (OLS, Bayesian Estimation) to check the impact of merger deals on profitability, liquidity, and leverage position of nonfinancial companies of Pakistan. We took 25 merged and acquired non-financial firms that are listed on Pakistan Stock Exchange during the period from 1995 to 2012. We obtained data from ‘Balance Sheet Analysis of Non-Financial Companies’ published by State Bank of Pakistan (SBP). We used 3-year pre and post merger average of financial ratios in our empirical analysis. Specifically, we considered the following ratios.

i. Profitability Ratios (Return on Asset, Profit Margin)

ii. Leverage Ratios (Debt to Equity Ratio, Interest Coverage Ratio)

iii. Liquidity Ratios (Current Ratio, Quick Ratio)

3.1. Regression analysis

We estimated various models to find out the impact of mergers on profitability, liquidity and leverage position of merged/acquirer firms. Given the objectives of the study, we developed various models by altering the independent variables (control variables) and considering the profitability, leverage, and liquidity as the dependent variable. We included different control variables in our specification to ensure the robustness of our results and mitigate the possibility of multicollinearity.

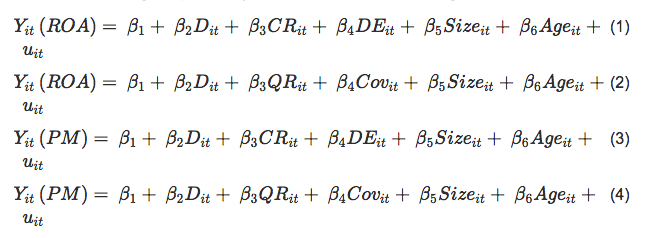

3.1.1. Impact of mergers on profitability

To examine the effect of mergers on profitability in terms of return on asset (ROA) and profit margin (PM) we estimate four models. We have checked the effects of merger and acquisition on profitability through dummy variable considering it 0 for pre merger period and 1 for post merger period, while; age, size, leverage (debt to equity ratio (DE), coverage ratio (COV)), and liquidity (current ratio (CR), quick ratio (QR)) of merged/acquirer firms are used as control variables. The sign of the estimated coefficient of dummy variable suggests whether the merger has a positive or negative effect on financial performance of firms. Specifically, the positive (negative) and statistically significant coefficient of dummy variable indicates that merger deals positively (negatively) affects the underlying financial performance indicator. We prefer regression analysis to ratio analysis to evaluate merger deals as it allows us to examine the merger effects in presence of other variables in the model that may significantly affect performance of corporate firms.

The leverage and liquidity proxies have been used in following models in such a way that each of two has been appeared in one model at a time as did by Singh and Mogla (2008, 2010). Firm size is defined by taking log of net assets of a firm and age of a firm is taken from date of listing of firm on Pakistan Stock Exchange up till occurrence of merger. Specifically, the models take the following form, where uit is error term having zero mean and constant variance, subscripts i and t denote ith firm and time, respectively. In a similar fashion, we have constructed the models for finding the impact of merger on leverage and liquidity.

3.1.2. Impact of mergers on leverage

In order to examine the impact of merger deals on leverage we used debt to equity (DE) and interest coverage (COV) as dependent variable in this section, whereas size, age, profitability (ROA, PM), and liquidity (CR, QR) are considered as control variables. To examine the impact of mergers we added dummy variable as 0 for pre merger and 1 for post merger period. Specifically, the following equations are estimated.

3.1.3. Impact of mergers on liquidity

Finally, we examine the effects of merger deals on liquidity positions of the merged/acquirer firms. We estimate several different by considering alterative control variables. In particular, the following equations are constructed where dependent variables are current ratio (CR) and quick ratio (QR).

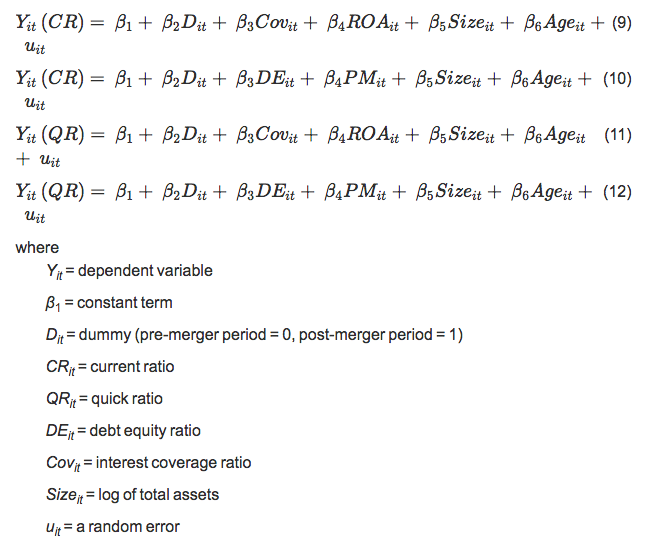

3.2. Modeling for empirical Bayesian

As mentioned earlier that data set in this study is a small sampled data, therefore, empirical Bayesian estimation has also been opted. Many researchers have applied either ratio analysis and OLS techniques or both to find out the post merger financial performance of merged/acquirer firms. One should note that empirical Bayesian estimation method has not been used so far for in this literature. Yet, empirical Bayesian estimation technique is preferred over other comparable techniques, for being more suitable for small sample size. Empirical Bayesian technique provides precise results as compared to the traditional OLS technique, because it uses priors (averages of data). The results obtained from this technique are more reliable as standard deviations tend to decrease because of priors.

In order to apply empirical Bayesian estimation, from Equations (1) – (12) we took dependent variable Yit in matrix form. Similarly all of the dependent variables in their respective equation were considered Xit matrix. Firstly, priors have been estimated by taking the average values of financial ratios, age, and size of the merged non-financial firms. These averages are treated as ![]() matrix and

matrix and ![]() matrix in order to apply empirical Bayesian technique.

matrix in order to apply empirical Bayesian technique. ![]() is the classical Bayesian estimate and following formula is used to find these estimates.

is the classical Bayesian estimate and following formula is used to find these estimates.

It is important to highlight that the empirical Bayesian model has so far not been applied to examine the impact of financial performance of firms after mergers and acquisitions. However, this technique has been widely used in other studies. Since the sample size of study is small, therefore, empirical Bayesian technique has been used to increase the reliability of results in comparison to traditional OLS regression analysis because this technique entails usage of priors that increase the precision of data.

4. Empirical results

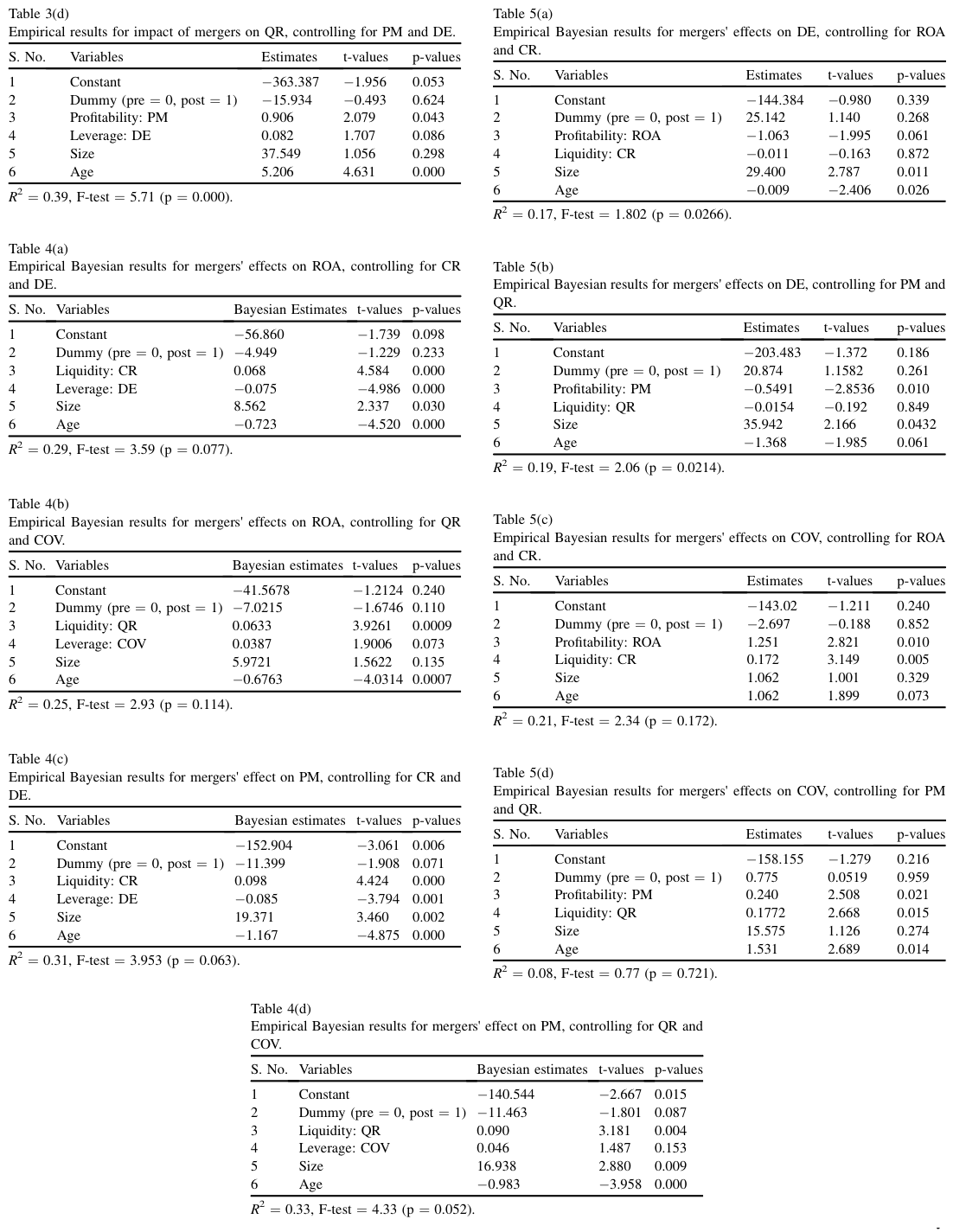

The impact of mergers on profitability, leverage, and liquidity position on the basis of OLS regression analysis are presented in Tables 1-3 respectively, while the results from the empirical Bayesian estimation are presented in Tables 4-6, respectively.

4.1. Impact of M&A on financial performance: regression analysis using OLS

We have estimated various regression equations to find out the impact of mergers on profitability (ROA and PM), leverage (DE and COV), and liquidity (CR and QR) position of merged/acquirer firms. Specifically, we estimated four models for profitability, four models for leverage, and four models for liquidity ratios following Singh and Mogla (2010). We estimated our empirical models with different specification to check the robustness of our empirical results. Following section of the study provides detail of these models and results for all respective financial ratios.

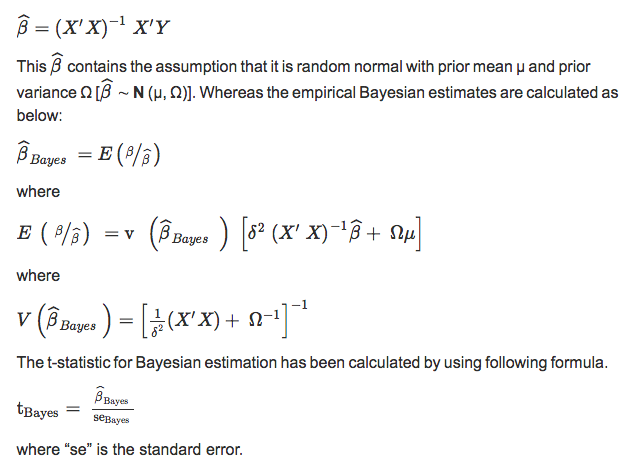

4.1.1. Impact of M&A on profitability (ROA, PM)

To examine the impact of mergers on profitability, we use two different proxies, namely ROA and PM. The results in Table 1(a) show that merger deals have statistically insignificant but a negative impact on ROA as coefficient of dummy variable (pre merger = 0, post merger = 1) is –12.552 with p-value 0.216. The contribution of debt to equity ratio (DE) and age has found to be negative towards ROA with coefficient values of –0.101 and –1.146, respectively. This contribution is statistically significant; the age coefficient is significant at 1% level of significance, while the coefficient of DE is significant at the 5% level. These findings suggest that the relatively older firms and the firms with higher debt to equity ratios are less profitable. The estimates also suggest that role of current ratio and size of the firm is positive towards ROA as CR contains positive value of 0.103 and size has 25.318. Both these confident appear statistically significant at the 5% level of significance. Our findings are similar to Singh and Mogla (2010) and Loderer and Waelchli (2010). The variables are statistically significant except dummy variable. Further, the coefficient of determination being 37% reflects that model has adequately explained variation in the dependent variables (profitability).

The above exercise has also been carried out for quick ratio (QR) and interest coverage ratio (COV) and the findings are presented in Table 1(b). We can see from the table that the impact of merger deals on ROA is negative with coefficient value of –13.442 but it again appears statistically insignificant, as its p-value is 0.236. Turning to the effects of control variables we observe that the interest coverage ratio (COV) is positively related to ROA but statistically insignificant. However, the quick ratio (QR) has a significantly positive effect on ROA with coefficient value of 0.090. In this model age having coefficient value –0.842 is negatively related to ROA. Finally, Firm size has a significant and positive impact on the profitability of firms. The value of R-square and F-statistic indicate that the estimated model is a good fit to the date.

We next estimate profit margin equations (Equations (3) and (4), respectively) in order to find the impact of mergers after controlling for CR and DE, QR and COV. The results of these two models are presented in Table 3(c) and 3(d), respectively.

In Table 1(c), we found that the effect of mergers on PM is negative with coefficient value -9.639 but once again it appears statistically insignificant at any acceptable level of significance. This implies that mergers and acquisitions do not have any significant impact on profit margin of merged/acquirer firms. Liquidity in terms of current ratio (CR) exerted significantly positive effects on profit margin bearing coefficient value of 0.105 with p-value 0.010. Leverage in terms of debt to equity ratio has also a positive effect on PM with coefficient value of –0.093 and also it appear statistically significant, as the p-value is 0.018. Our these findings suggest that more liquid firms are likely to have more profit margin, whereas firms with high debt to equity ratio are likely to have less profit margin. Size of the firm in this model has a significant and positive relationship with profit margin having coefficient value of 28.209. Finally, the estimates reveal that there is a negative (–0.059) relation of age and profitability in terms of profit margin. The overall model also appears as a good fit to the date.

We re-estimate the PM equation by replacing the liquidity ratio (CR) with (QR) and the leverage ratio (DE) with interest coverage (COV) ratio. The results are presented in Table 1(d). These results indicate that after merger deals, profit margin have decreased as coefficient value of dummy variable is –14.153. However, this decline is again statistically insignificant. We also found statistically insignificant positive relationship between PM and interest coverage ratio (0.013), whereas, Quick ratio (QR) and size of the firm have significant positive impact on profit margin (PM) with coefficient values of 0.093 and 24.904 correspondingly. Moreover, age of the firm has a significant negative effect on profit margin with coefficient value of –0.919 and p-value 0.005.

The results provided in Table 1(c) and 1(d) are similar to Loderer and Waelchli (2010) and Singh and Mogla (2008, 2010). These results suggest that merger deals have statistically insignificant impact on profitability in terms of profit margin. The values of coefficient of determination and F-test also support our models presented in above tables because conditions of overall fitness of model are satisfied.

4.1.2. Impact of M&A on leverage (DE, COV)

In order to examine the impact of mergers on leverage (DE, COV) position of merged/acquirer firms, we have run regression Equations (5)–(8). The results are presented in Table 2(a)–2(d), respectively.

Table 2(a) shows the empirical results for the impact of mergers on debt to equity (DE) ratio, where return on asset, current ratio, size, and age of firms are taken as independent variables in order to control firm-specific effects. We use merger dummy to see the impact of merger deals on DE. The results provide evidence that merger deals have a negative but statistically insignificant impact on debt to equity (DE) ratio, as coefficient value of dummy variable is –5.100 with p-value 0.894. Profitability (ROA) and age have negative and statistically significant impacts on debt to equity (DE) ratio. On the other hand, the current ratio and size of the firm have positive and significant effects on debt to equity ratio.

Following Singh and Mogla (2008, 2010), we also run another equation of DE where return on assets (ROA) is substituted with profit margin (PM) and current ratio (CR) is replaced with quick ratio (QR). The results are reported in Table 2(b). The impact of mergers on the debt to equity ratio remains statistically insignificant with coefficient value of dummy variable –0.784. This suggests that the insignificant impact of mergers on the debt to equity ratio does not change even when we use different firm-specific control variables. The estimates of firm-specific variable indicate the both PM and age of firm have a significant and negative relation with the debt to equity ratio. Furthermore, firm size and quick ratio have positive and statistically significant impacts on the debt to equity ratio. Overall, the estimated model appears statistically significant, as the p-value associated with F-statistic is less than 0.05.

To examine the impact of mergers on the leverage decision of merged/acquirer firms we extended our analysis by taking interest coverage ratio as dependent variable. We come up with same findings that mergers have not statistically significant impact on leverage position of merged/acquirer firms of Pakistan. Table 2(c) shows that ROA, CR, and, firm size have positive significant impacts on interest coverage ratio. The relationship of age and interest coverage ratio remains negative and statistically insignificant.

In continuation of the analysis we replaced ROA with PM and CR with QR and re-estimate the model. The results are presented in Table 2(d). We observe that mergers have not significant impact on leverage position of the merged/acquirer firms in term of interest coverage ratio. We also observed that other variables included in the model that are profitability (PM), liquidity (QR), size and age of the firm have similar effects. But in this model the coefficients of size and age of the firm appears statistically insignificant. The coefficient of determination is 17%, which indicates only 17% variation in interest coverage ratio can be explained by this model.

Overall, impact of mergers on leverage position of merged/acquirer firm found insignificant in Pakistani non-financial companies.

4.1.3. Impact of mergers on liquidity (CR, QR)

This section deals with the financial performance of merged firms in terms of liquidity (CR, QR). Return on assets and interest coverage ratio are used as control variables. The results presented in Table 3(a) provide weak evidence of the positive effect of merger deals on the current ratio of firms. Specifically, we found that the estimated coefficient of dummy variable is 14.623, which shows that the impact of mergers on liquidity positions of firms is positive but it is insignificant statistically. All of the independent variables, ROA, COV, and age of firm, have positive significant impacts on current ratio of the merged/acquirer firms. However, firm size appears insignificant statistically. The estimated value of F-statistic suggests that the overall model is a good fit to the data.

In Table 3(b) we replaced ROA with PM and COV with DE, and again found insignificant impact of mergers on the liquidity position of firms. Thus, we can conclude that merger deals have although positive but statistically insignificant effects on the current ratio of firms. The results regarding control variables are generally similar (in terms of sign and statistically significant) to the previous model. The coefficient of determination is 42% and the F-statistic is 6.471 (p-value 1⁄4 0.000) indicate that the overall model is a good fit.

Following the methodology of Singh and Mogla (2008, 2010), we replaced current ratio with quick ratio to check the impact of mergers on liquidity position of merged/acquirer firms. The estimated coefficient of dummy variable (coefficient = –21.756; p-value = 0.502) suggests that although mergers have a negative impact on quick ratio, the effect is statistically insignificant. The results about control variables suggest that interest coverage (COV) and size are positively but insignificantly related to QR, whereas, return on asset and age of firm have positive and statistically significant impacts on the liquidity (QR) position of the merged/acquirer firms. The overall model also appears statistically significant, as the estimated value of F-statistic is significant at any acceptable level of significant.

Finally, Table 3(d) presents the results for the model where we examine whether mergers influence the liquidity of firms in terms of quick ratio with alternative control variables. The results presented in the table indicate that mergers have not any statistically significant impact on quick ratio of merged/acquirer firms as well. All of the firm-specific control variables, namely age, firm size, profit margin (PM), and debt to equity have statistically significant and positive impact on quick ratio except firm size, which appears statistically insignificant. The coefficient of determinant (R-square) of this model is 39% and F-statistics is 5.71, which indicate that overall model is a good fit. In sum, we found that merger deals have positive effects on the current ratio, whereas the deals have negative effects on quick ratio. However, in both cases, the effects of mergers are statistically insignificant.

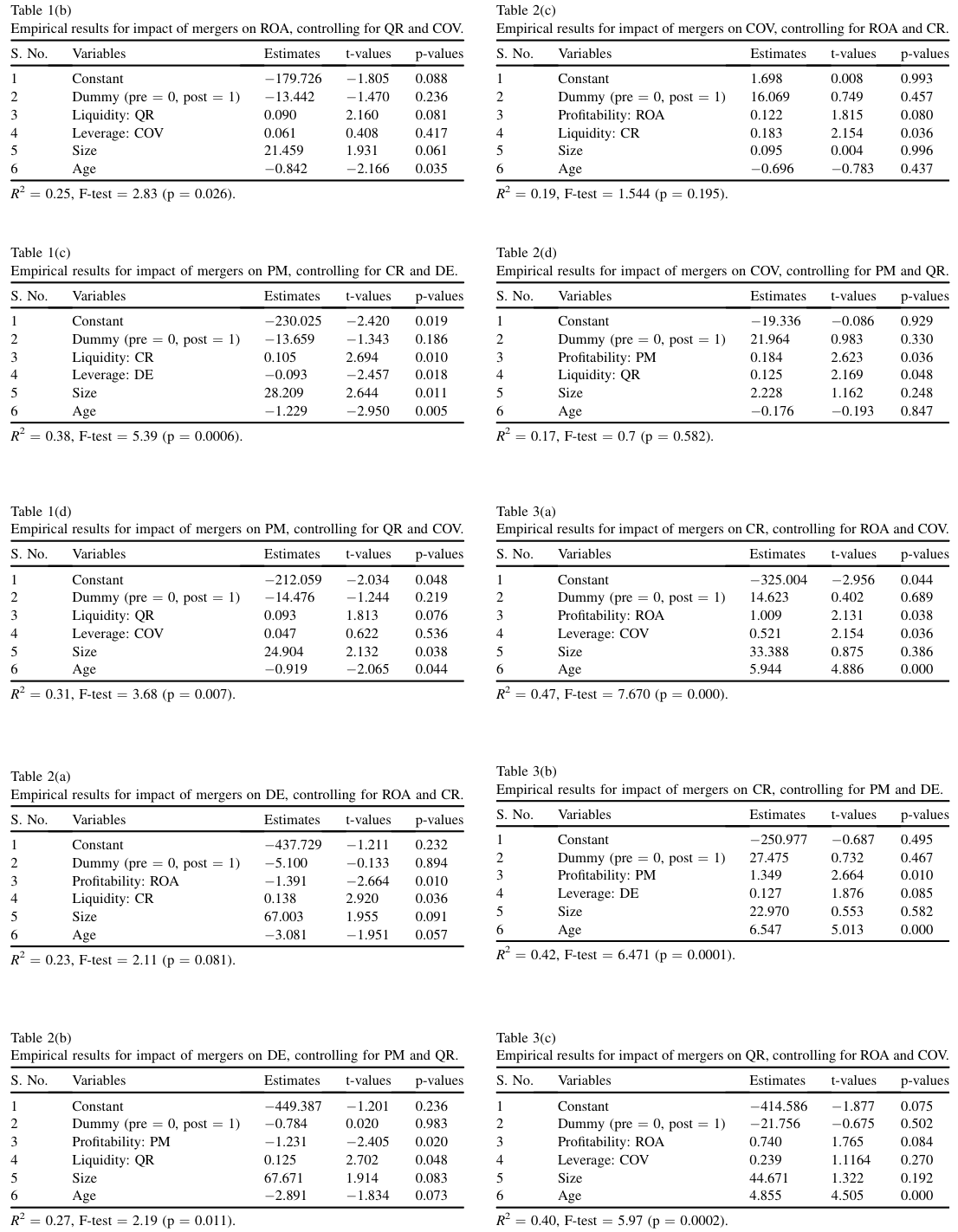

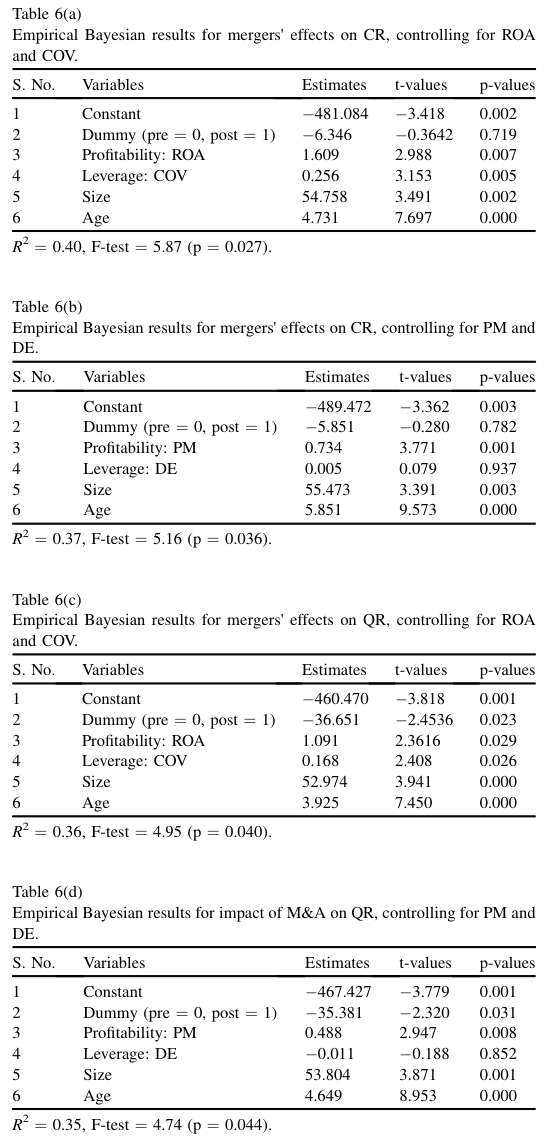

4.2. Empirical Bayesian (EB) estimation results

As we have mentioned earlier that empirical Bayesian technique provides more precise and reliable results than OLS estimation, specifically when sample size is small. Our sample size is also a small sample that includes 25 non-financial merged/acquirer firms of Pakistan for the period 1995–2012. Therefore, we also applied empirical Bayesian estimation technique in addition to OLS estimation method. In this section, we present the results from all 12 equations presented in the methodology chapter by applying empirical Bayesian method.

4.2.1. Impact of mergers on profitability (ROA, PM)

To find out the impact of mergers on profitability, we have applied empirical Bayesian estimation technique for Equations (1)–(4). The dummy variable has been constructed, which takes value 0 for pre merger period and 1 for post merger period. Table 4(a) shows that merger deals do not have any significant impact on the profitably (ROA) of merged/acquirer firm as the coefficient of dummy is –4.949 but it is not statistically significant. The current ratio has a positive and statistically significant contribution to return on assets bearing coefficient value of 0.068. On the other hand, the debt to equity ratio has a negative significant impact on ROA (coefficient = –0.075; p-value = 0.000). Finally, firm size has positive, while age has negative impact on profitability (ROA) with coefficient values of 8.562 and –0.723, respectively. Both of these coefficients are statistically significant. These findings indicate that the impacts of both liquidity and leverage positions of firms on merged/acquirer firms‘ profitability are similar to those we reported by applying OLS.

In Table 4(b) we replaced debt to equity (DE) with interest coverage (COV) ratio and found that profitability has decreased during post merger period, but it appears statistically significant at 11% level of significance. The coefficient value of dummy variable is –7.0215 and it is statistically insignificant. The current ratio, interest coverage ratio, and size of the merged/acquirer firms have a positive contribution towards return on assets of firms and these findings are statistically significant. The age of firm is influencing the profitability of firm negatively and significantly. The results for dummy variable, size, and age are similar to OLS estimates. The overall findings confirm the results of OLS.

Next, we examined the impact of merger deals on profitability by taking profit margin (PM) as a measure of financial performance of firms and leverage (DE, COV) and liquidity (CR, QR) position as independent variables with age and size of the merged/acquirer firms. The empirical Bayesian estimation technique confirms our earlier findings presented by using OLS technique. Specifically, the results given in Table 4(c) provide evidence that profit margin of a merged/acquirer firm has decreased due to merger deal as the coefficient value is –11.399 for dummy variable but it is statistically significant at the 7% the level of significance. The current ratio and firm size both have a positive and statistically significant impact on profit margin of a merged/acquirer firm with coefficient values of 0.098 and 19.371, respectively. Finally, both the debt to equity (DE) ratio and firm age are negatively affecting the profitability in terms of profit margin. The estimated model appears a good fit to the data.

The results reported in Table 4(d) reveal that merger deals have a negative impact on profit margin with –11.463 coefficient value of dummy variable. Interestingly, this negative impact of mergers on PM is statistically significant at 9% level of significance. One should note that it was insignificant in case of OLS estimation. We have also replaced current ratio with quick ratio and debt to equity with interest coverage ratio. The findings show that QR, firm size and interest coverage (COV) have positively impacted the profit margin of the merged/acquirer firms. These results are also statistically significant except interest coverage ratio. Loderer and Waelchli (2010) also found same results in their study that interest coverage has insignificant impact on profit margin.

4.2.2. Impact of mergers on leverage (DE, COV)

For robustness of the findings of OLS estimation we applied empirical Bayesian method on leverage equation as well. Table 5(a) provides evidence that merger deals do not have any significant impact on leverage in terms of the debt to equity ratio. The results regarding all of the other control variables that are return on asset (ROA), current ratio (CR), size, and age of firms are similar to the OLS results that we reported earlier.

Table 5(b) presents the results of empirical Bayesian results for the impact of mergers on the debt to equity ratio, while profit margin (PM) and quick ratio (QR) are taken as control variables with size and age of firms. The impact of mergers remained statistically insignificant with 20.874 coefficient value of dummy variable. Firm age and profit margin have negative significant contributions towards the debt to equity ratio of merged/acquirer firms. Firm size is positively significantly related the debt to equity ratio but surprisingly we found insignificant impact of quick ratio on debt to equity ratio. The overall model is also statistically significant.

Continuing the process of altering variables to find the impact of mergers on financial performance, we present another set of results in Table 5(c). These results indicate that interest coverage ratio of merged/acquirer firms have not been influenced due to merger deals. However, return on asset, current ratio, and firm size have positive significant impacts on the interest coverage ratio. Yet, firm age is showing insignificant contribution towards the interest coverage ratio.

Table 5(d) provides evidence that mergers are not statistically significantly related to the interest coverage ratio (COV) when profit margin (PM) and quick ratio (QR) are considered as control variable with size and age of the firm. Specifically, as we can see from the table, the estimated coefficient of merger dummy is positive but it appears statistically insignificant at any acceptable level of significant. The overall model is also not a good fit to the data.

4.2.3. Impact of mergers on liquidity (CR, QR)

Final part of this section is dealing with examination of the impact of mergers on liquidity position of merged/acquirer firms using empirical Bayesian approach. We altered control variables one by one while examining the impact of merger deals on firms‘ liquidity position. We use two proxies, namely CR and QR for firm liquidity. The results from the model where we consider CR as dependent variable are given in Table 6(a). The results provide evidence that although the impact of mergers is negative, it is not statistically significant. This finding is consistent with OLS results that we presented earlier. The estimates of firm-specific control variables are in line with the theory and appear statistically significant.

The results from the model where we consider QR as a proxy for firm liquidity are given in Table 6(b). These results indicate that merger does also not affect CR. Specifically; we observe that the coefficient of merger dummy is negative but it is statistically insignificant. The results of all other variables are similar to the results reported in Table 6(a) except DE, which is now statistically insignificant.

In Table 6(c), we present another set of results where we consider QR as a proxy for firms‘ liquidity position. The results provide evidence that merger deals have a negative and statistically significant impact on QR of merged/acquirer firms. This finding implies that firms significantly decline their QR after getting M&As. The results of all other firm specific variables are in accordance with theory and consistent with our OLS findings.

The results provided in Table 6(d) show that the negative impacts of merger deals are robust to different control variables in the regression model. Specifically, this set of results also indicates that the coefficient of merger dummy is negative and statistically significant. All other variables except DE have positive and significant impacts on liquidity position of merged/acquirer firms.

5. Conclusions

In this study, we empirically examine the impact of mergers on corporate financial performance in Pakistan. In order to analyze merger effects on profitability, leverage, and liquidity position, OLS regression analysis is carried out using data on the deals occurred during the period 1995-2012. As the selected sample size is relatively small, so we also applied empirical Bayesian estimation method to check the robustness of the results.

The results suggest that merger deals do not have any significant impact on the profitability, liquidity, and leverage position of the firms. However, the estimates suggest that the merger deals have a negative and statistically significant impact on the quick ratio of merged/acquirer firms. It is important to mention that the empirical Bayesian method has been first ever used in this study to examine the impact of mergers and acquisitions. This is substantial addition to existing literature available on the topic. Overall the results of the empirical Bayesian method are consistent with the OLS results. The findings of regression analysis that we reported in this study are similar to Singh and Mogla (2008, 2010).

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter