Publications Global Capital Confidence Barometer – Buying And Bonding: Alliances Join M&A As Engines Of Growth

- Publications

Global Capital Confidence Barometer – Buying And Bonding: Alliances Join M&A As Engines Of Growth

- Christopher Kummer

SHARE:

Companies look to protect themselves against disruption by acquiring innovation and forging alliances with unconventional partners

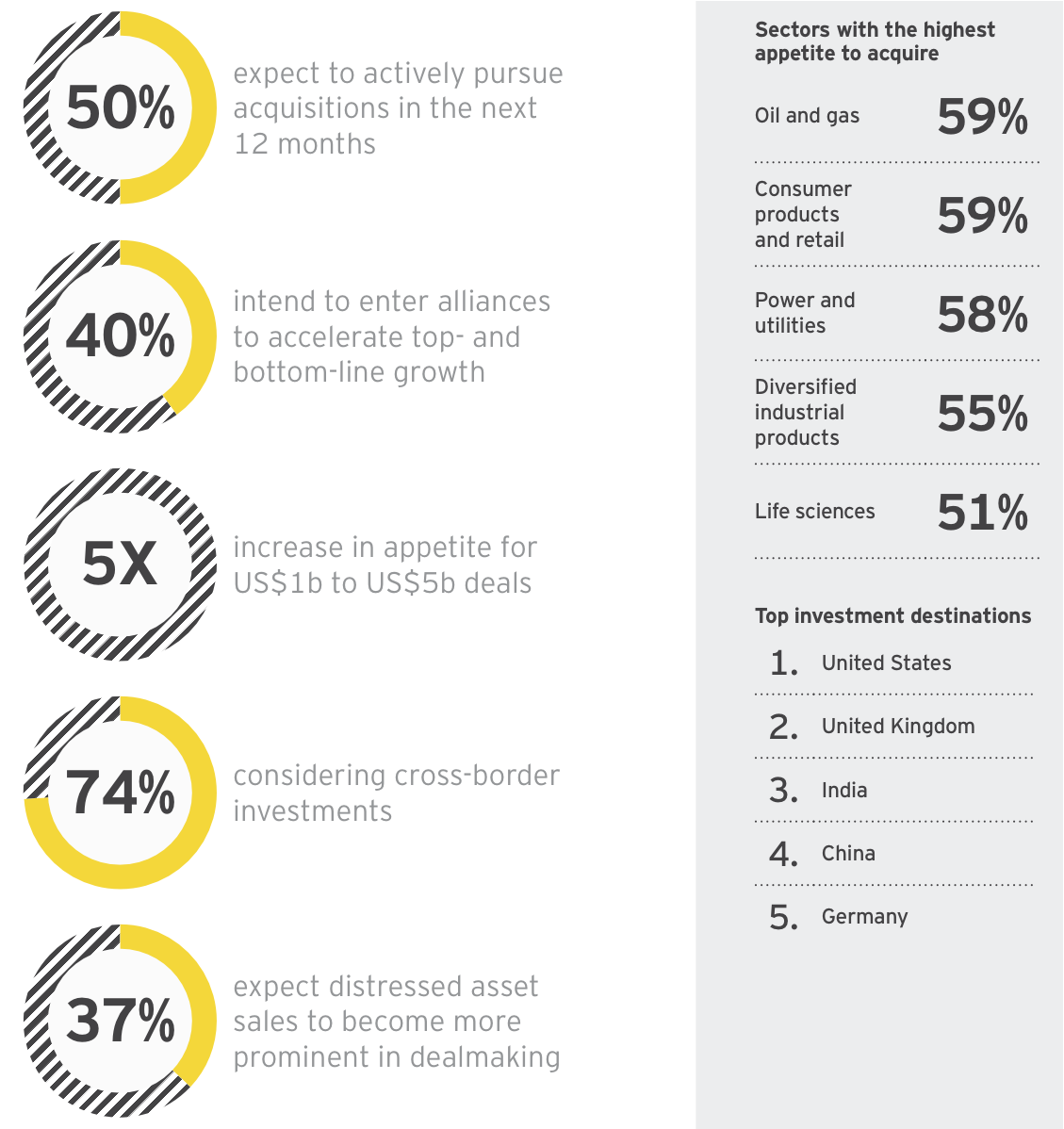

Our latest Global Capital Confidence Barometer continues to find a strong acquisition appetite together with a growing inclination to forge new alliances. Prolonged economic challenges are driving investment decisions, leading companies to ally and cooperate to generate growth as well as compete and acquire to gain market share.

The macroeconomic environment remains challenging. Economic growth remains subdued. Low inflation endures. Price sensitivity becomes ever more intense. Within this complex environment, disruption continues to fundamentally challenge current business models.

Increased innovation and sector convergence are accelerating the emergence of new competitors across many industries. Changing customer preferences and shifting consumer behaviors are transforming the business landscape. In a digital “sharing economy,” where peers pool their access to goods and services, past performance is neither an indicator nor a guarantee of future success.

Executives now find themselves planning for multiple possible futures. Buying and selling can be a transformative means to reshape and refocus the business. M&A remains a strong option to accelerate strategic plans and offer the prospect of game-changing competitive advantage.

At the same time, alliances are becoming more attractive as companies seek new sources of revenue and earnings while looking to manage costs and risk. Increasingly, companies are taking this option to bolster their research-and-development processes. As sectors converge, the evolutionary paths of industries are unclear. Companies are shrewdly spreading risks as they pursue growth.

In this bold new world, those companies that best achieve commercial advantage through combining strategic M&A and cooperative responses to new challenges will be best positioned to win. Buying and bonding are now key features of the corporate growth agenda. (Pip McCrostie, Global Vice Chair Transaction Advisory Services)

Key M&A findings

Macroeconomic environment

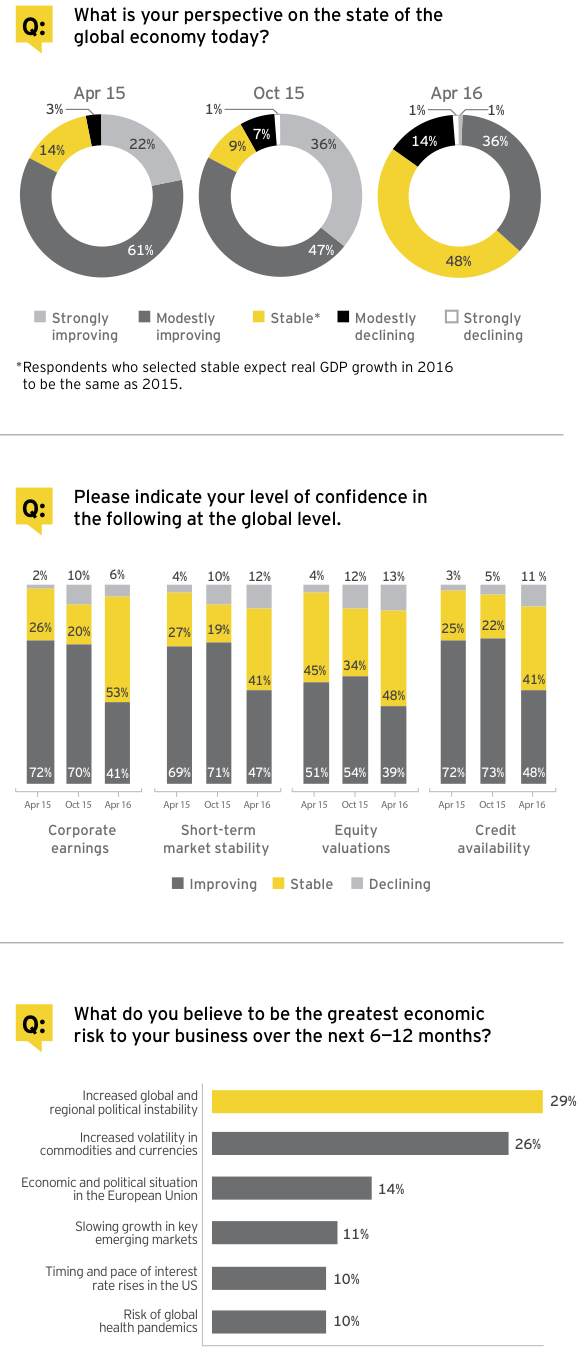

Companies are creating their own tailwinds amid a persistently low-growth environment. Despite high market volatility, executives do not envisage major systemic risks.

48% of executives expect GDP growth to be the same as in 2015

• Executives look to build their own momentum

Currently, none of the world’s major economies looks likely to spark strong growth in 2016: China’s economy is decelerating as it rebalances to a consumer-led, services-driven model, the eurozone has yet to show a strong upward trajectory, and US growth is steady but not outstanding.

Set against this backdrop of uncertain economic performance, executives see little potential for a strong acceleration of the global economy. While they view the global economy as stable, it is stability with persistent low growth for the foreseeable future. As such, management teams are more determined than ever to identify new avenues for growth. Acquisitions will continue to be part of the growth roadmap. Increasingly, alliances will play a more central role as well.

• Volatility across asset classes not overly troubling executives yet

High volatility in equities, commodities and currencies in the second half of 2015 and the start of 2016 has yet to deter companies’ investment behavior. The prevailing view is for stability across key economic and capital market indicators. In particular, despite many different headwinds, the outlook for corporate earnings is surprisingly positive.

Our findings reinforce what companies have been reporting in their full-year 2015 and first-quarter 2016 results: tough market conditions but no signs yet of systemic shocks in capital markets or impending asset bubbles.

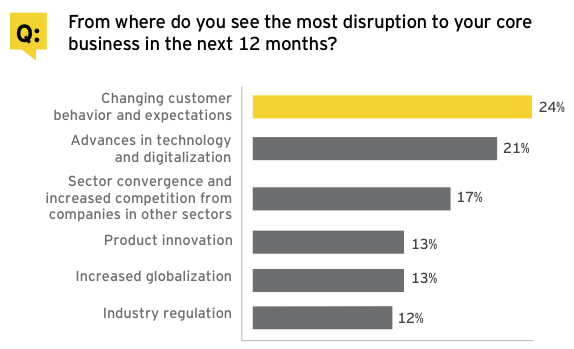

• Geopolitical concerns continue to pose corporate challenges

Heightened global and regional political instability, especially in the Middle East, the Korean Peninsula and the South China Sea, are seen as key risks to many businesses.

In addition, volatility in commodity and currency markets, which began in earnest in 2014, is now entering its third year. While the impact has been positive in certain sectors and geographies, prolonged volatility may hamper companies’ ability to plan over the short to medium term. Hedging exposure to currency and commodity changes also becomes a heightened risk management issue.

The myriad challenges facing the European Union, including the upcoming UK referendum and the refugee crisis, are concerns for companies across all regions.

These issues, while very serious, have not altered medium- to long-term capital allocation strategies.

Corporate strategy

In an ever-changing business landscape fueled by disruptive competition, executives are increasingly utilizing alliances to accelerate growth.

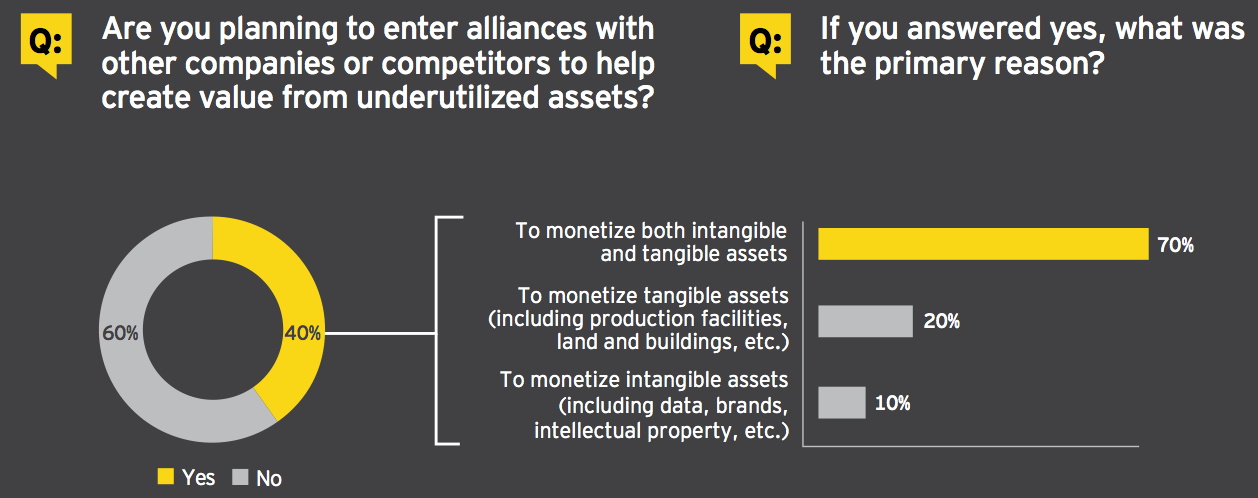

40% plan to enter alliances with other companies or competitors to help create a value from underutilized assets

• Disruption creates both threats and opportunities

Digital technology is changing the way companies across all sectors interact with their customers. The influence of digital is facilitating changes in customer behaviors and expectations, causing measurable core business disruption. Additionally, increased sector convergence and cross-industry innovation are increasing the number of competitors companies face.

While these developments pose a major challenge, they also provide opportunities as companies seek to carve out new markets to boost their own revenues and earnings. Those companies taking a proactive attitude to perpetual change and challenges to their core business will be best positioned to take advantage of new market opportunities.

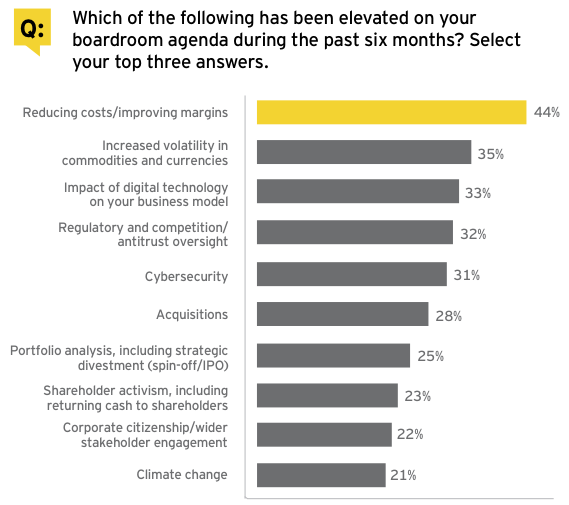

• Digital at the heart of boardroom thinking

Executives have already firmly established control of costs and margins as a top corporate priority. Their acceptance of prolonged low economic growth has elevated this discipline even further on the boardroom agenda.

Another factor feeding into this cost-control mentality is the price sensitivity caused by the shift to operating in a digital environment. Customers and consumers now have the ability to access many suppliers and, more importantly, compare pricing and reviews instantaneously.

This ever-greater focus on digital is leading companies to review their business models more generally, including sales markets and channels. At the same time, the shift to digital has raised concern that cyberattacks may affect both brand and revenue, bringing cybersecurity to the heart of companies’ operations.

Executives are also concerned about the impact of regulatory and antitrust oversight. One area in which regulators are becoming increasingly interventionist is large industry consolidations, a key driver of the current M&A market. This may have an effect on the number of megadeals (US$10b+) we see in the next 12 months.

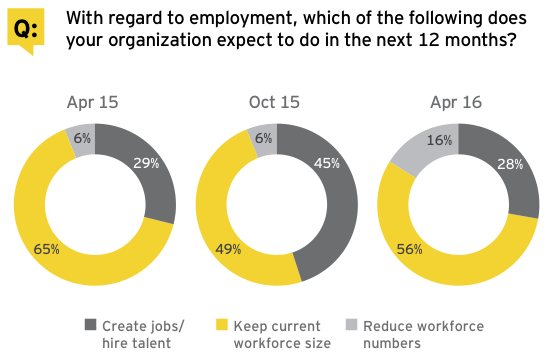

• Companies still plan to create jobs, even in outperforming economies

Globally, the trend is toward employment stability and growth, but regional variations are more disparate.

US companies continue to post stronger hiring intentions, and UK companies are still creating jobs, even as they both approach what was previously considered full employment. Continental Europe is steadier than it has been for several years, while Chinese and Japanese companies are more inclined to reduce their workforce.

Corporate alliances

Alliances join M&A as driver of growth

Alliances seen as lower-risk route to growth in a complex environment

As companies look for new sources of revenue and earnings amid a fast-changing industrial landscape, alliances — in addition to and sometimes in place of acquisitions — are becoming more attractive as growth vehicles. Forty percent of executives in this year’s Barometer are planning to enter alliances with other companies, including competitors, to help create value from underutilized assets and take advantage of the expertise and reach of others.

Alliances form where companies have decided to share resources to undertake a specific, mutually beneficial project. They are usually more informal and less permanent than joint ventures, in which companies typically pool resources to create a separate business entity. In an alliance, each company maintains its autonomy with a view to creating a shared opportunity. An alliance could help a company develop a more effective process, expand into a new market or develop an advantage over competitors, among other possibilities.

Relationships between companies are becoming more fluid and complex as business models are reinvented. These unprecedented collaboration and relationship opportunities involve customers, suppliers — and competitors. These alliances often replicate features of the so-called sharing economy, the internet-enabled ecosystem of facilitated peer-to-peer resources. Companies will commit underutilized assets, or assets that others are better positioned to exploit, in exchange for capabilities more efficiently owned by collaboration partners.

Digital is transforming traditional business models

As well as M&A, executives are increasingly looking to alliances to help respond to digital transformation across their business environment. Companies are often outsourcing innovation and traditional services to more nimble and agile service providers to stay ahead of this digital revolution.

Digital is a powerful leveler, giving small start-up companies and nontraditional competitors the same market access as established companies. Developing technologies, such as social media and mobile, are empowering customers who expect greater choice and convenience. Always-connected devices give customers the ability to perform transactions any time anywhere, forcing businesses to re-engineer traditional product and supply chains to focus even more on customers.

At the same time, devices and algorithms are more active in the decision-making process, and connectivity is also accelerating the growth of datasets that are both open and for sale. Taking advantage of connectivity and applying analytics to these datasets presents enormous opportunities for enterprises to reinvent business and delivery models, transform existing products and enter new markets.

Within this disruptive context, harnessing the full power of alliances enables businesses to engage differently — and more effectively — with customers, suppliers, partners and employees — and even competitors.

Internet of Things to underpin many alliances

The Internet of Things (IoT) is the network of physical objects — devices, appliances, vehicles, buildings — embedded with electronics, software, sensors, and network connectivity enabling the collection and exchange of data.

IoT ecosystems require so many moving parts, involving very different disciplines, that it would be a huge challenge for one organization to accumulate and manage all the necessary assets through M&A.

In most industries, realizing IoT opportunities requires not only domain expertise and customer relationships but also capabilities in big data analytics, cloud services, wireless connectivity, software development and cybersecurity. It’s unlikely that any one incumbent in any industry possesses all those resources or has the ability to acquire them all.

Instead, consortia of industry participants, through alliances, are better equipped to mount virtual IoT solutions. Each enterprise brings a portion of the needed capabilities or assets to the table.

Preparing for multiple futures

Companies are also looking to alliances as a safer way to bolster their own research-and-development processes. As sectors converge rapidly, partnerships with companies in other industries, especially technology, may be a safer way to conduct R&D.

In short, alliances allow companies to plan for multiple futures, especially in a business environment marked by disruption. Many companies are not yet certain of the evolutionary path of their industries, and alliances can be a lower-risk form of exploration. Executives’ increasing willingness to consider alliances shows their growing sophistication in balancing capital allocation and strategic direction.

Flexibility, agility and speed differentiate alliances

Providing a strong foundation for success entails having a clear understanding of the alliance’s goals, scope and roadmap. These elements must emphasize the potential win-win outcomes alongside balanced distribution of value for all participants.

One area where alliances differ from traditional joint ventures is that there can be flexibility to the parties, structure and governance protocols. New collaborative partners can be introduced more easily and existing ones can drop out if the alliance no longer suits their strategic objectives.

The more informal nature of alliances also enables an environment where collaboration efforts can quickly respond to changes in the external market. They can provide the ideal opportunity for larger industry players to quickly engage with start-ups, especially those with emergent or disruptive technologies. For the start-ups, alliances allow them to leverage the expertise of established companies, giving access to experts and infrastructure.

Such deals are often structured in a way that partners can bring specific portions of their operations to the deal, narrowly defining the parameters in ways that insulate their other areas of business. Ideally, these arrangements accelerate innovation by enabling greater collaboration while reducing dealmaking risk. New business models need new ways of partnering for success.

Alliances can potentially accelerate innovation by enabling more collaboration with less dealmaking risk.

M&A outlook

A proactive response to disruption sustains dealmaking intentions.

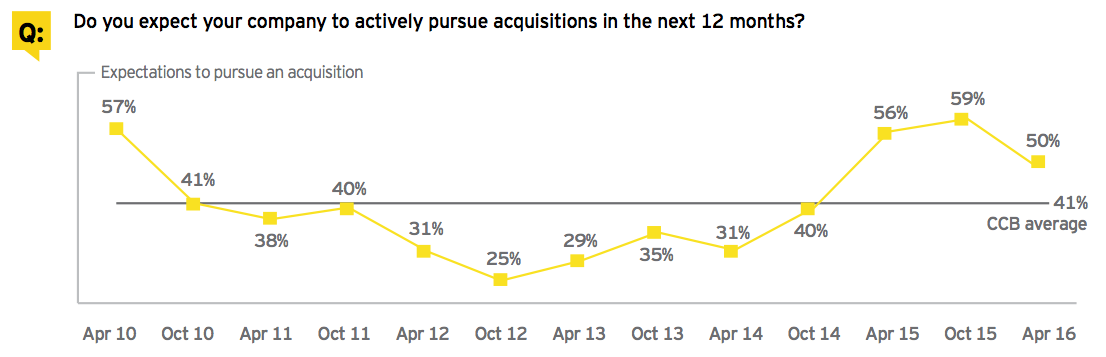

50% of companies expect to actively pursue acquisitions in the next 12 months

• Deal intentions remain robust as companies continue to search for growth opportunities

While deal intentions have tapered slightly from the heady figures of 2015, they have largely held up well above the long-term Barometer average. Once again, just half of all respondents plan to pursue an acquisition in the next 12 months, and executives see little sign of a major M&A downturn.

In an entrenched low-growth economy, executives are using deals to generate their own tailwinds. They recognize the need to consider combinations to grow earnings and acquire competitive advantage.

Another spur to making deals is the need to respond positively to disruption and complexity. In many sectors, buying rather than building innovation is a better and faster option. This is especially true in sectors where the rate of innovation is accelerating and barriers to entry are being eroded.

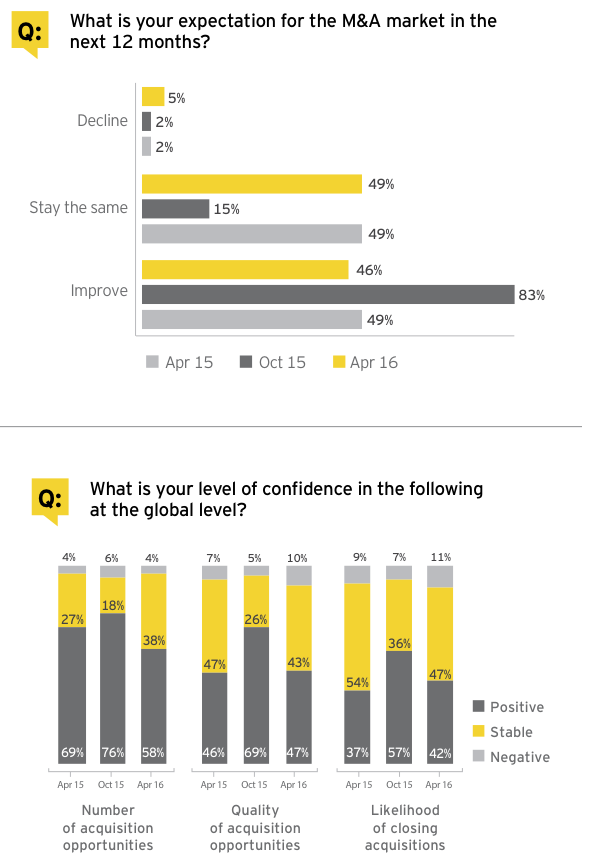

• After a record 2015, M&A expectations shift toward stability

Companies have continued to execute deals in the first quarter of 2016, reassuring executives that the M&A markets are unlikely to materially subside. While our latest Barometer shows a decrease in the number of executives predicting market improvement over the next 12 months, the general shift is toward stability, suggesting that executives see the M&A market as strong and sustainable.

• Deal fundamentals remain supportive of a healthy M&A market

Executive confidence in the number and quality of acquisition opportunities, and in the likelihood of closing deals, remains supportive of a sustained positive M&A market.

Billion-dollar deals to spur dealmaking

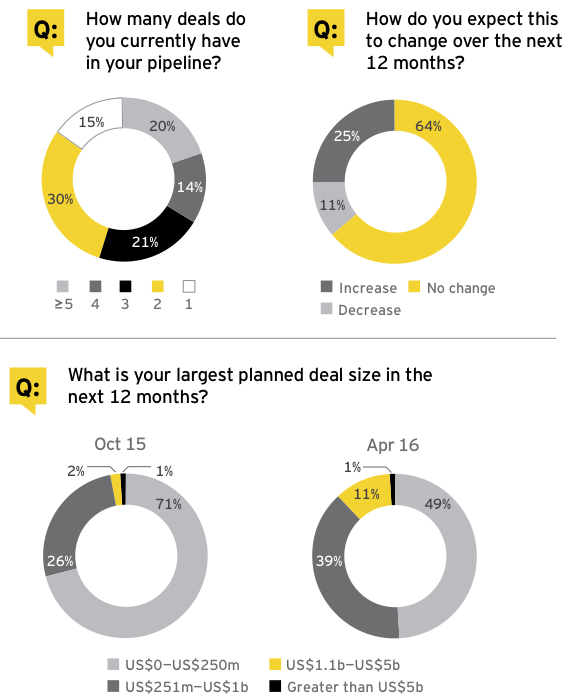

• Pipelines underpin dealmaking intentions

Deal pipelines remain robust, with a particularly strong outlook over the short term. There remains a solid sentiment for dealmaking.

Companies see deals as a necessity to grow the top line. At the same time, digital innovation, technological and industrial advances, and sector convergence are causing companies to assess a wider range of potential targets.

• Companies shift toward bigger, bolder deals

Those companies looking to M&A for growth are shifting their focus to bigger, bolder acquisitions. This trend is demonstrated by a big jump in intentions toward the upper-middle-market range. Intentions to do deals in the US$250m—US$1b range increased by 50%, continuing the upward trend seen since 2014. Our Barometer also finds a strong increase in plans to acquire assets in the US$1b—US$5b range.

The move to larger deals is to be expected. Meaningful growth requires bolder moves. The complexity of dealmaking is not related to the size of the acquisition. As companies have become more comfortable with dealmaking over the last three years, they have become more comfortable doing larger deals.

Executives regard M&A as a means to revenue and earnings growth, which encourages them to look at more substantial and meaningful acquisitions.

• Valuations move to a stable footing

Our Barometer finds both current assessment of the valuation gap and the outlook for asset prices supporting a stable outlook for M&A. A majority of executives view the valuation gap as less than 10%, a signal that negotiations on price will be less difficult. Similarly, nearly three quarters expect assets to retain their value over the next 12 months.

There has been an increase in the number expecting downward pressures on valuations over the next year. However, this pressure would have to increase substantially for it to affect the high appetite for dealmaking we see elsewhere in the survey.

The importance of valuations in dealmaking sentiment cannot be overstated. Dealmakers need to be able to correctly judge not only the current levels to execute deals. They also must be reassured that there will be no significant downward pressure on the price or value of assets in the near term.

Dealmaking trends

Focusing on the buy side

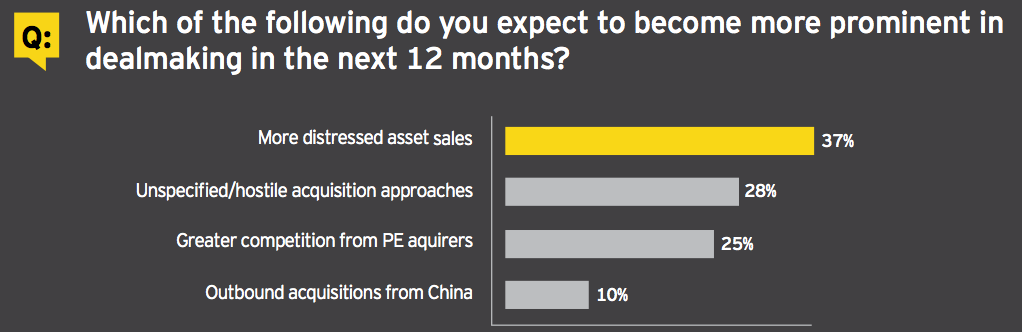

An increase in distressed asset sales may drive dealmaking

One theme expected to dominate headlines this year is distressed asset sales. More than one third of respondents say these deals will become more prominent in the next 12 months.

Commodity-based sectors will likely be at the center of activity. Although there has recently been an uptick in commodity prices, the prolonged downturn will force an increasing number of companies to sell assets to maintain liquidity.

Nonetheless, this trend is likely to involve virtually all sectors and geographies. Already in 2016, there have been numerous announcements of companies conducting strategic reviews, often with a view to selling the enterprise or an underperforming asset. The pressure to maintain earnings in an environment characterized by price-driven competition is fierce.

Aggressive approaches becoming more prominent

Our survey respondents expect to see a greater number of unsolicited and hostile deals as companies aggressively target materially synergistic competitors.

During the past year, there has been a shift in the way companies respond to unsolicited approaches. During the last M&A cycle, boards often felt safe immediately rejecting an approach on the assumption they would have shareholder support. However, in the current activist environment, there are several examples of shareholders defining the outcome of the deal. This has been a natural progression, as institutional investors are becoming more vocal and hands-on with their investments.

PE firms shift focus to deployment

Our respondents also expect private equity (PE) firms to play a more substantial role in dealmaking on the buy side over the next 12 months.

Over the last three years, PE firms have been busy selling the bulk of their portfolios. This realization cycle is winding down, and firms are entering a new deployment cycle. While part of this will be dependent on valuations going forward, as well as the health of the financing markets, the multiyear trend may be an increase in buyside activity.

Buyout firms have about US$465b to invest, and when other asset types such as real estate, growth capital, venture, etc., are included, that climbs to more than US$1.3t. A great deal of money is on the sidelines waiting to be deployed.

China outbound to become an increasingly important M&A market driver

Chinese outbound acquisitions accelerated through 2014 and 2015 and continue to make headlines in early 2016. One driver is China’s need to acquire intellectual-property-rich assets to support the rebalancing of the domestic economy. The other is the upward move of Chinese companies along the value chain in many sectors. In both cases, Chinese businesses are buying high-quality assets, especially in Western Europe and the US.

Strong deal sentiment across many sectors driven by volatility and disruption

59% Oil and gas

The downward pressure on oil prices has been central to concerns about global growth over the first quarter of 2016. More oil and gas companies are expected to succumb to stress in the sector, which will drive transactions in 2016.

Declining crude prices coupled with an uncertain outlook challenged transactions in 2015. Now, with greater consensus around a “lower for longer” outlook shrinking the valuation gap between buyers and sellers, it is likely more deals will come together. Companies that have shown resilience amid US$40 to US$50 per barrel are beginning to face insurmountable distress as the price sinks below US$40. All signs point to a more opportunistic market for M&A activity.

Upstream companies are pairing their ongoing focus on cost-cutting with optimizing their portfolios. This may lead to a consolidation of ownership around core assets as companies seek to increase control over their overall capital outlay and maximize opportunities to use their operational capability to deliver value.

Renewed interest from a wide range of financial players, not only distressed funds but also PE firms, family offices and infrastructure funds, have been increasingly active in the sector. Depressed oil prices will continue to unearth opportunities for these investors to expand their product offerings and to diversify their activities in the market.

59% Consumer products and retail

Low growth, margin pressure and changing consumer behavior continue to disrupt traditional consumer products and retail approaches to value creation. The need to make significant changes to business operations to sustain profitable growth will be the primary driver of M&A over the next 12 months.

Consumer products and retail companies have been operating in an increasingly volatile, complex and uncertain marketplace. Challenges to pricing and margins are compelling companies to focus on revenue, market share and profitability in a different way to previous business cycles. With growth subdued and patchy, companies will have to be more granular in identifying which markets, channels and categories they invest in to ensure revenue growth is profitable.

The uptick in synergy-driven combinations between food and beverage companies in 2015 should continue over the next 12 months. Rationalization of supply chain and distribution networks will be key drivers of such deals.

The changing relationship with consumers will also be a key imperative to dealmaking in the near term. This will be a consideration for dealmaking and alliances across the sector, both for reimagining routes to market, and also acquiring new capabilities.

58% Power and utilities

Power and utility (P&U) companies are using M&A as a strategic tool to adapt to changing dynamics in the sector. Many companies are also looking to meet compliance requirements and long-term asset valuation, as global agreements move regulators and capital investors toward clearer long-term, sustainable climate targets.

In addition, the sector will be transformed by businesses offering storage solutions and other disruptive technologies as the consumer market turns toward off-the-grid and self-sustainable energy solutions.

P&U companies are seeking to add on technology capabilities, creating energy storage solutions to support this trend of self-sustained energy generation among consumers.

Integrated utilities will shed low-growth assets on the back of continued low wholesale energy prices as economic growth and power consumption are further decoupled. A further trend may see utilities begin to work more closely across industry borders, joining forces with financial and technology firms to capitalize on synergies and shared expertise.

Cross-border M&A activity may increase as companies seek higher-growth assets in foreign markets. Finally, regulated and renewable assets may continue to exchange hands, with financial investors emerging as key buyers.

Percentage reflects those who intend to actively pursue acquisitions in the next 12 months.

55% Diversified industrial products

As growth in industrials is typically tied to gross domestic product, M&A is often necessary to achieve above-market returns in this industry. Consolidation in high-end capital goods has been a significant trend, especially from companies in China looking to move up the value chain.

Given the low-growth environment, portfolio management will continue to be a major focus, especially for those industrials companies affected by the slowdown in resource-based industries and the rebalancing of China’s economy. For these companies, cost reduction remains an imperative.

Industrials are also in the midst of a technological revolution, with accelerating industrial automation and robotics, combining with increasingly sophisticated design software, challenging the fundamental business model of many sub-sectors. Advances in 3-D printing are also set to disrupt supply chains. This has led to a big increase in the number and value of acquisitions in the technology and digital sector by industrial companies. This trend is set to continue over the next 12 months.

There is also strong demand for high-quality industrial companies from PE buyers, particularly in sub- sectors supplying the automotive and aerospace sectors.

51% Life sciences

Following two years of record M&A for the life sciences sector, deal sentiment appears to be easing slightly in 2016. Specialty pharma no longer dominates as high levels of debt and shrinking equity valuations have combined to decimate its aggregate firepower. Big pharma has emerged from its dormancy to capitalize on its significant share of firepower for strategic dealmaking, with a focus on honing portfolios and shedding non-core assets to gain scale in targeted therapeutic areas.

Also notable is the medtech segment, which has been buoyed by the US market. Suspension of the medical device excise tax has reinvigorated activity. It is the only segment with deal activity already exceeding its 2015 total deal volume.

Despite a prolific year for drug approvals in 2015, rising payer pushback on new drug pricing is exacerbating revenue growth gaps for biopharmas. This is fueling M&A as large biopharmas look to dealmaking to offset such gaps. M&A optionality is also rising as more companies are partnering on late-stage pipeline assets.

While 2016 may not see new M&A records, underlying industry forces — including payer consolidation, rising health care costs and companies’ growth imperatives — will continue to sustain what is still a very robust “new normal” deal climate.

46% Telecommunications

Telecommunications operators continue to capitalize on convergence via M&A, particularly as cross-selling strategies become more important in the residential bundled market.

Consolidation in mobile markets is also helping to create more rational market structures, yet regulatory support for such deals remains uncertain, and other routes to synergy realization such as network sharing still have an important role to play.

Emerging market operators remain keen on mobile tower sale-and-leaseback agreements, and such approaches are now finding more traction in developed markets, where competition remains intense.

Meanwhile, the need to overhaul business models and gain new expertise is driving more ambitious players to acquire capabilities in adjacent market segments, from

IT services to mobile advertising. Nevertheless, operators worldwide are primarily focused on M&A that can expand market share and customer reach in core services. While appetite for M&A remains high, attractive deal opportunities are narrowing, reflecting high levels of deal activity in the last two years. In such scenarios, partnerships offer a number of benefits for carriers.

Uneven global economic growth propels companies to look for options across all markets

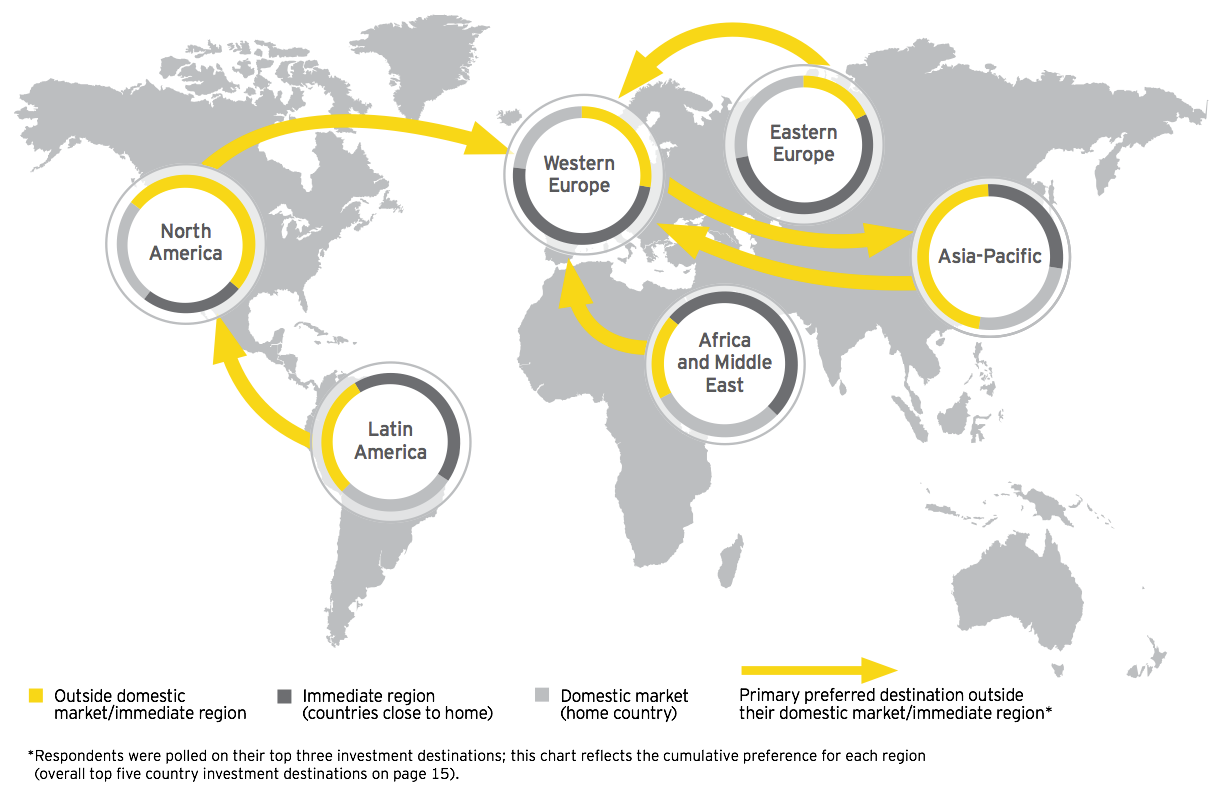

• Companies increasingly looking outside their home markets in search for growth

With global growth subdued and uneven, companies continue to review portfolios and are focused as much on where they are operating as what they are doing. Our survey finds companies eager to look abroad to find pockets of growth, with three quarters primarily looking for cross-border acquisitions.

A deeper analysis of responses also shows a shift in investing patterns. There is no longer a binary choice between developed and emerging markets. Investing in emerging markets has become more focused: it is about finding the countries that provide the best outlook for each company’s products and services.

• Companies’ preferred investment destinations outside their domestic market or immediate region

M&A trade flows reinforce the desire of companies to look across a wide range of geographies for best-fit assets to support their strategic goals. Western Europe is again the primary region of choice as companies look to take advantage of relatively lower valuations and cheaper financing. A sustained uptick in economic conditions in Europe will likely accelerate the pace of inbound acquisitions, especially from China, Japan and the US.

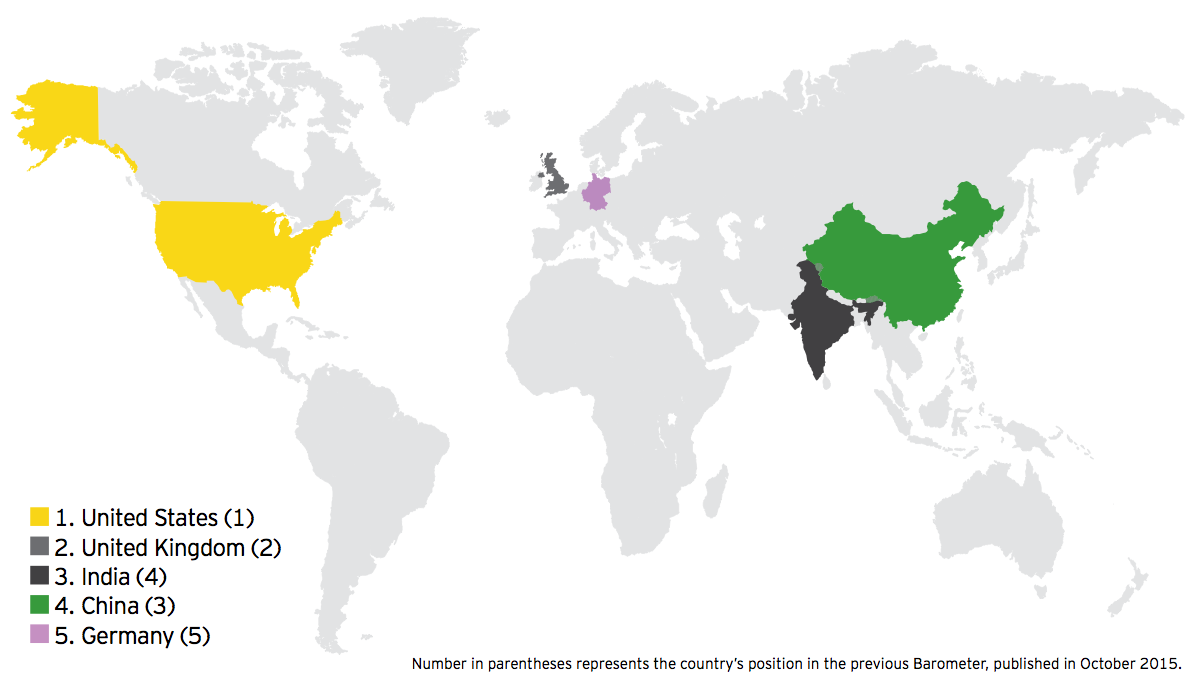

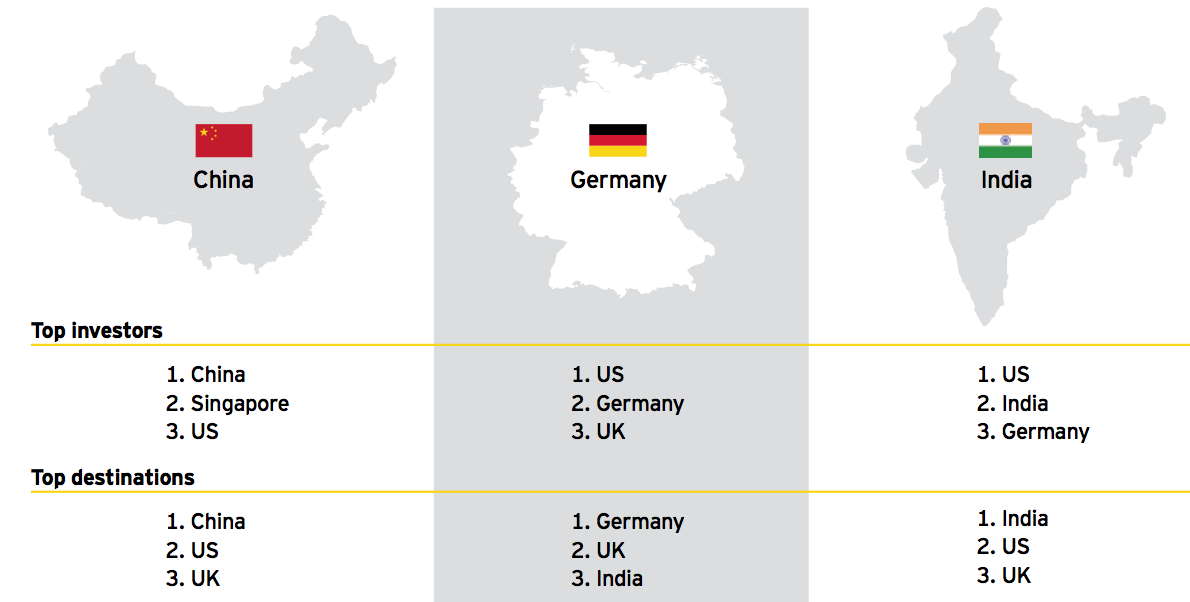

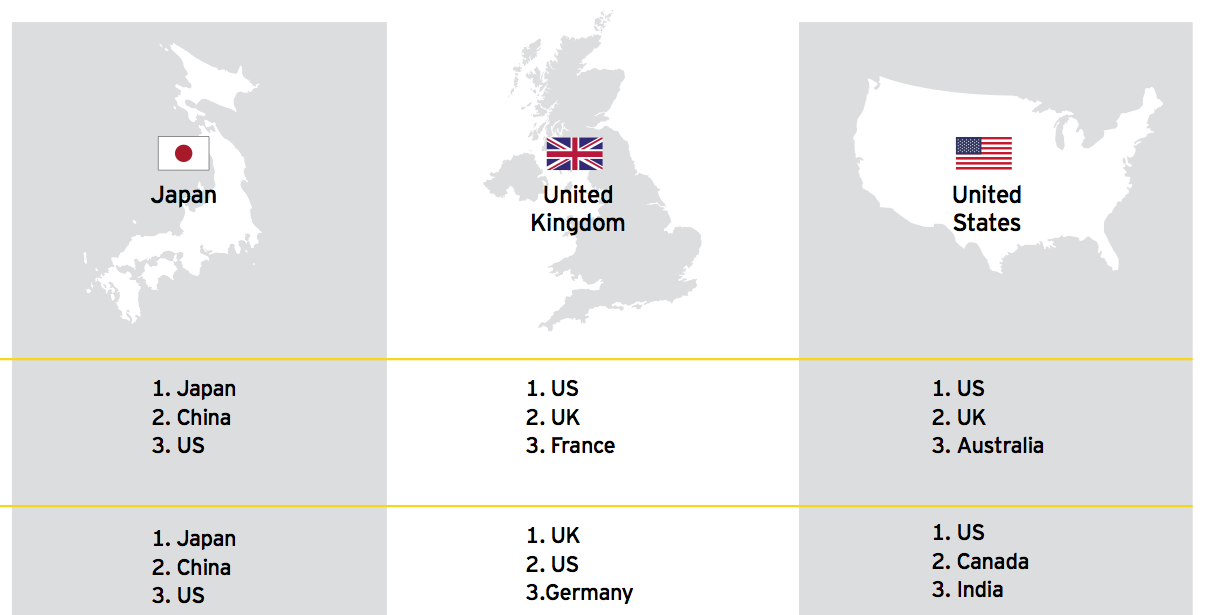

Global economic powerhouses remain top destinations of choice

Stronger growth in the United States and United Kingdom and the attractiveness of high-quality assets in Germany are making these countries popular destinations for investment. China and India also remain attractive destinations for investors, notwithstanding recent concerns about the wider Asia-Pacific region’s economic growth and stability.

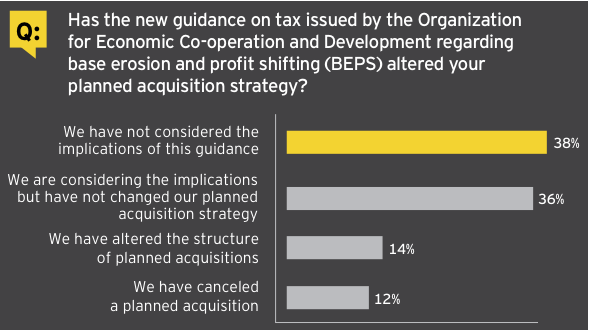

New tax rules challenge cross-border M&A

Since the release of the OECD’s final BEPS guidance in October 2015, local country adoption and legislation have started to emerge globally. Our survey finds a range of attitudes toward the changes in tax regulations, with over a third yet to consider the implications. There has been a direct impact on current dealmaking, with more than a quarter stating that they have altered or cancelled planned transactions in response to the guidance.

For those who have not yet considered the implications of BEPS, this may be due to the level of uncertainty given that many jurisdictions have not yet adopted BEPS guidance into local law; however, this is beginning to shift as countries implement changes into local legislation.

As additional countries adopt the various BEPS Action Points and there is more clarity on local implementation, these changes will have a more tangible impact on transactions. Companies will need to carefully consider their current corporate structure as well as their future investment destinations within this new and complex environment.

Top M&A markets and their key characteristics

China continues to dominate news headlines, both in terms of economic outlook and dealmaking. The government, which is rebalancing China’s economy toward a consumer-focused, supply-led model, plans to double gross domestic product (GDP) and per-capita income by 2020. That would entail average annual growth of at least 6.5% in 2016–20 (the growth target for 2016 was set at 6.5–7%). This economic rebalancing has already had an impact on M&A, with increases seen in both domestic combinations and outbound acquisitions. A record level of outbound M&A has already been recorded in the first quarter of 2016. Domestic dealmaking may increase, in large part due to the government’s planned combinations of state-owned enterprises. Inbound investment may also experience an upturn, especially in consumer-focused sectors.

Top sectors

Media and entertainment

Power and utilities

Consumer products and retail

After a weaker second half of 2015, there are signs that economic recovery in Germany regained momentum in early 2016 with domestic GDP expecting to expand by 1.7% this year. A strong pickup in consumer spending, employment and wage growth have accelerated economic activity. The increasing interest shown by German companies to invest in innovative start-up businesses can be seen as a sign that digital transformation may further support the economy. Germany’s high-quality corporate assets, especially in the industrials, chemicals and automotive sectors, are attractive to foreign acquirers, seeing notable acquisitions by Chinese companies in the first quarter of 2016. However, an increase in political tensions within the country may lead to a pause in dealmaking, both domestically and inbound.

Top sectors

Media and entertainment

Diversified industrial products

Life sciences

While the outlook for many emerging markets remains subdued, India stands apart as a beacon of potential economic expansion. GDP growth is running above 7%, with a consumer-led economy, and a strong desire by the Indian government to boost private and inbound investment. Its working-age population is expected to grow strongly over the next two decades, and the middle class is on course to expand. India’s persistently low labor-unit costs — among the lowest of the BRIC economies — continues to make the country competitive in international markets.

With so much positive momentum, hopes for a pickup in dealmaking are strong. However, concerns remain with regard to the country’s regulatory challenges, which the Government hopes to improve with recent reforms, including the deregulation of FDI, and the “Make in India” campaign, which aims to turn the country into a global manufacturing hub.

Top sectors

Life sciences

Diversified industrial products

Automotive and transportation

Japan continues to suffer from weak domestic economic growth combined with persistently low inflation. However, the recent introduction of negative interest rates has demonstrated policymakers’ determination to resolve the country’s economic malaise. Unfortunately, Japan faces major exposure to the slowdown in China, a key market for Japanese exports. As for M&A, Japanese companies have increasingly shifted toward outbound acquisitions, especially in the financial services, industrials and consumer products sectors. A strengthening of the yen during the first quarter of 2016 may accelerate outbound investment, even as it puts downward pressure on exports. M&A may be further boosted over the medium term as Japanese companies are forced to more aggressively reassess their portfolios.

Top sectors

Automotive

Financial services

Telecommunications

The United Kingdom has long been a favored destination for foreign firms accessing the wider European Union. With relatively strong domestic growth in 2015, and similar levels forecast through 2016, the UK should be able to maintain its unique status as a global M&A hub. The UK has several sectors poised to continue driving M&A. Life sciences and technology companies continue to be strong innovators. The financial services sector appears to be robust. UK consumer products companies are globally recognized. UK companies in all of these sectors are likely considering acquisitions both domestically and abroad, and they will likewise be attractive to foreign acquirers. As for downside risks, the impending UK referendum on EU membership, as well as uncertainty regarding the timing of an expected interest rate increase, may check the deal markets.

Top sectors

Real estate, hospitality and construction

Oil and gas

Diversified industrial products

The M&A market in the United States is expected to maintain both its upward momentum and its attractiveness to foreign investors. Positive US economic fundamentals and low interest rates are strengthening boardroom confidence. Continuing positive economic releases and an upward turn in corporate results will support this bullish outlook. The US dollar’s increasing value, which has put pressure on exports and overseas earnings, should make outbound deals appealing. For US-based dealmakers, the main potential downside concern is the pace of interest rate normalization. However, recent Federal Reserve announcements have likely pushed back further rate hikes after the widely expected increase in December. The other potential downside is growing political uncertainty over the US presidential election.

Top sectors

Diversified industrial products

Oil and gas

Financial services

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter