Publications Taxation Of Cross-Border Mergers And Acquisitions: China 2014

- Publications

Taxation Of Cross-Border Mergers And Acquisitions: China 2014

- Christopher Kummer

SHARE:

Introduction

The People’s Republic of China’s (PRC) tax provisions relevant to mergers and acquisitions (M&A) changed significantly with the introduction of the new Corporate Income Tax (CIT) law system in 2008. The 2010 edition of this publication outlined such matters as the introduction of a general anti-avoidance rule (GAAR), transfer pricing, thin capitalization and controlled foreign company (CFC) rules, new rules on corporate reorganizations, new corporate tax residency rules and new arrangements on accessing benefits under double tax agreements.

The intervening period has not seen quite as many radical new changes. However, as the new system has bedded down, the State Administration of Taxation (SAT) has issued myriad clarifying circulars and the local tax authorities have been observed applying the new rules in practice. As a result, the real significance of these rules for M&A transactions has become apparent.

The recent developments section of this chapter highlights the most significant developments in this regard, which relate to the rules dealing with offshore indirect disposals, treaty relief claims, reorganizations and value added tax (VAT) reform.

The chapter then addresses the three fundamental decisions faced by a prospective purchaser undertaking M&A transactions in the PRC:

- What should be acquired: the target’s shares or its assets?

- What will be the acquisition vehicle?

- How should the acquisition vehicle be financed?

Recent developments

Offshore indirect disposals

The previous edition of this publication, drafted in 2011, noted that the SAT issued Circular 698 in December 2009. The circular allowed the PRC tax authorities to apply the PRC GAAR to disregard the existence of offshore holding companies used to facilitate perceived tax avoidance arrangements.

The proposal to tax indirect disposal gains derived by non-residents under Circular 698 was partly inspired by the Vodafone case in India, which adopted a similar approach to tackle similar perceived tax-avoidance transactions and partly designed to formalize the approach.

Circular 698 requires that, where a foreign shareholder indirectly transfers shares in a PRC company by selling its shares in a holding company in an intermediary jurisdiction having an effective tax rate of less than 12.5 percent, then extensive information on the transaction must be reported to the authorities. Where the indirect transfer is determined to constitute a tax avoidance transaction, then the PRC tax authorities may use the GAAR to re-characterize the transaction as a direct disposal of the shares in the underlying PRC company and impose PRC withholding tax (WHT) at 10 percent on any capital gains derived.

While the precise enforcement approach was initially unclear, a series of high-profile cases involving well-known private equity investors, public listed companies and others made it clear that the PRC authorities have applied the GAAR as a ‘weapon of choice’ in dealing with perceived abuse in offshore disposal structures. Circular 698 has now become the ‘hot button’ issue in cross-border M&A in China, undermining the historical practice of an offshore indirect exit. While Announcement 24 issued in March 2011 clarified some of the notification and tax settlement requirements, significant uncertainties remain in relation to (among other things):

- how the ‘substance’ in the offshore holding company can be enhanced so it is not regarded as an avoidance arrangement

- how tax pursuant to Circular 698 interacts with reorganization relief and foreign tax crediting arrangements

- how capital gains and thus WHT should be calculated and, in particular how should the tax cost base should be determined

- how purchasers will be treated in relation to their future dealings with their investment where the seller has not complied with its Circular 698 obligations.

This uncertainty is compounded by the uneven and inconsistent way that China’s many local tax authorities apply the provision. The official position may evolve further following the finalization and implementation of the draft supplementary circular to Circular 698 (although it is unclear when this supplementary circular will be issued).

Also in relation to offshore indirect disposals, the Vodafone–China Mobile case, first publicized in April 2011, highlighted that the gain on the sale of an offshore company may simply be regarded as PRC-sourced, giving the right to the PRC tax authorities to tax that gain on the basis of the offshore company’s deemed PRC tax residence under PRC domestic tax laws (broadly based on place of effective management). This approach was applied in a recent Circular 698 reporting case in the Heilongjiang province of China. This indicates the PRC tax authorities may have stepped up their efforts to look at the registered and unregistered tax resident status of foreign incorporated enterprises controlled by PRC residents and use this to tax gains from the disposal of Chinese equities offshore by foreign investors, including those in the M&A space. This additional exposure needs to be monitored and factored into M&A transactions where foreign investors make offshore indirect acquisitions and disposals of Chinese investments. Negotiations may be further complicated where investors seek to obtain warranties and indemnities that the deal target is not effectively managed from the PRC.

Offshore direct disposals and treaty relief claims

In 2009, the PRC tax authorities took measures to monitor and resist granting tax treaty relief to perceived treaty shopping through the use of tax treaties to gain tax advantages. Circulars Guoshuifa 124 and Guoshuihan 81, issued in 2009, introduced procedural requirements that make it easier for the tax authorities to identify cases where the taxpayer is relying on treaty protection. Circular 601 sets out the factors that the Chinese tax authorities take into account in deciding whether a treaty’s beneficial ownership requirements are satisfied. To provide further clarity, the SAT issued Announcement 30 in June 2012 and Circular 165 in April 2013 to provide guidance on the interpretation of the negative factors for determining beneficial ownership for purposes of tax treaty relief claims. In order to be considered the beneficial owner under Circular 601 and Announcement 30, the income recipient should not constitute a shell or conduit company and should not exhibit a number of negative factors that indicate the company is not the beneficial owner.

Under Circular 601, a company not only must control the disposition of the income and the underlying property but also ‘generally should conduct substantial business operations’.

The many enforcement cases observed in the meantime indicate the extent to which the PRC tax authorities are focused on the business substance of the foreign company applying for treaty benefits (e.g. hiring of staff, lease of premises, and conducting other activities). This has led many commentators to conclude that the Chinese beneficial ownership concept functions as a hybrid of the international concept of beneficial ownership and anti-abuse rules aimed at preventing treaty shopping.

Further, while the capital gains tax clauses in China’s tax treaties do not contain beneficial ownership requirements, the PRC tax authorities have repeatedly denied treaty relief for capital gains on the grounds of substance and the list of negative factors in Circular 601.

As a result, Circular 601 has become a hot button issue for foreign investors into China, including those in the M&A space, and created a need for groups to examine their existing or proposed holding company structures, consider their robustness and take remedial action where appropriate. Significant uncertainties arise in this area as well, in particular with respect to whether the substance in group companies in the same jurisdiction as the claimant (or in another jurisdiction with equivalent treaty provisions) can be referred to in supporting a treaty relief claim.This was partly addressed by Announcement 30, which introduced a safe harbor for certain listed company structures. However, the issue remains unclear for non-listed structures.

Reorganization relief

The reorganization relief in Circular 59, issued in April 2009, provided in relation to change of legal form, debt restructuring, share acquisition, asset acquisition, merger and demerger, has been found to be somewhat restrictive in practice. Circular 4, issued in September 2010 and Announcement 72, issued in December 2013, clarified some of the administrative requirements concerning the corporate tax reorganization relief. Announcement 13, issued in February 2011, and Announcement 51, issued in September 2011, respectively provided a VAT and business tax (BT) exclusion for the transfer of all or part of a business pursuant to a restructuring. However, certain limitations in the practical applicability of the relief still exist.

In particular, difficulties have been encountered in satisfying the relief conditions concerning the percentage of business assets that must be transferred and the percentage of consideration that must take the form of equity. Further, the lack of specific coverage for a horizontal merger and the limited circumstances in which the relief is available in a cross-border context have repeatedly frustrated taxpayers wishing to seek relief under such provisions.

VAT reform

The rollout of VAT reform in China will affect many industries that adopt the BT system. This needs to be considered in evaluating potential targets that could have a different tax cost structures due to the proposed changes. The rollout is expected to be as follows.

Pursuant to the VAT reform pilot program under Circular 110 and Circular 111, enterprises engaged in transportation and the modern services industry (which includes the cultural and creative industry, including the transfer of trademark and copyright, etc.) in Shanghai became subject to VAT, instead of BT, from 1 January 2012. Further, pursuant to Circular 37, applicability of VAT for the transportation and modern services industry has been nationwide from 1 August 2013, while the VAT reform has been expanded to railway and aerospace transportation and postal industry starting from 1 January 2014 under Circular 106. Details of the VAT reform to financial and real estate industry are expected to be released/implemented by the end of 2014. For all of the industries previously within the BT regime, the BT will be replaced by VAT by 2015.

Asset purchase or share purchase

In addition to tax considerations, the execution of an acquisition in the form of either an asset purchase or a share purchase in the PRC is subject to regulatory requirements and other commercial considerations.

Some of the tax considerations relevant to asset and share purchases are discussed below.

Purchase of assets

A purchase of assets usually results in an increase in the cost base of those assets for capital gains tax purposes, although this increase is likely to be taxable to the seller. Similarly, where depreciable assets are purchased at a value greater than their tax-depreciated value, the value of these assets is refreshed for purposes of the purchaser’s tax depreciation claim but may lead to a clawback of tax depreciation for the seller. Where assets are purchased, it may also be possible to recognize intangible assets for tax amortization purposes. Asset purchases are likely to give rise to relatively higher transaction tax costs than share purchases. On the other hand, for share purchases, historical tax and other liabilities generally remain with the company and are not transferred with the assets. As clarified in this chapter’s section on choice of acquisition funding, it may be more straightforward, from a regulatory perspective, for a foreign- invested enterprise to obtain bank financing for an asset acquisition than for a share acquisition.

The seller may have a different base cost for their shares in the company as compared to the base cost of the company’s assets and undertaking. This, as well as a potential second charge to tax where the assets are sold and the company is liquidated or distributes the sales proceeds, may determine whether the seller prefers a share or asset sale.

Purchase price

For tax purposes, it is necessary to apportion the total consideration among the assets acquired. It is generally advisable for the purchase agreement to specify the allocation, which is normally acceptable for tax purposes provided it is commercially justifiable. It is generally preferable to allocate the consideration, to the extent it can be commercially justified, against tax-depreciable assets (including intangibles) and minimize the amount attributed to non-depreciable goodwill. This may also be advisable given that, at least under old PRC Generally Accepted Accounting Principles (GAAP), goodwill must be amortized for accounting purposes, limiting the profits available for distribution.

Goodwill

Under CIT law, expenditures incurred in acquiring goodwill cannot be deducted until the complete disposal or liquidation of the enterprise.

Amortization is allowed under the CIT law for other intangible assets held by the taxpayer for the production of goods, provision of services, leasing or operations and management, including patents, trademarks, copyrights, land-use rights, and proprietary technologies, etc. Intangible assets can be amortized over no less than 10 years using the straight-line method.

Depreciation

Depreciation on fixed assets is generally computed on a straight-line basis. Fixed assets refer to non-monetary assets held for more than 12 months for the production of goods, provision of services, leasing or operations and management, including buildings, structures, machinery, mechanical apparatus, means of transportation and other equipment, appliances and tools related to production and business operations.

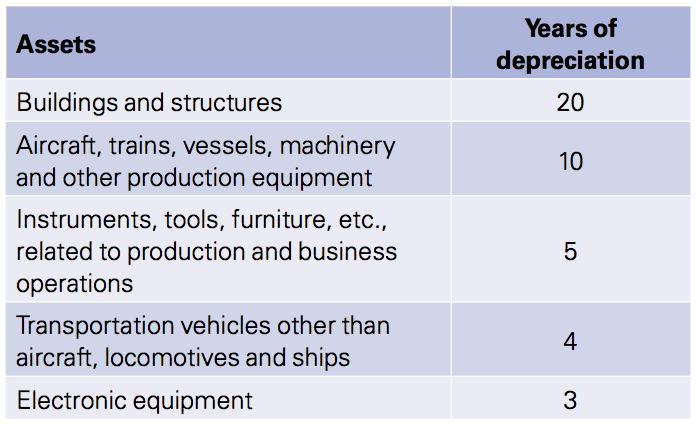

The residual value of particular fixed assets (i.e. the part of the asset value that is not tax-depreciable) is to be reasonably determined based on the nature and use of the assets. Once determined, the residual value cannot be changed. The minimum depreciation periods for relevant asset types are as follows:

Any excessive accounting depreciation over the tax depreciation calculated based on the above minimum depreciation period should be added back to taxable income for CIT purposes.

Certain fixed assets are not tax-depreciable, including:

- fixed assets, other than buildings and structures, that are not in use

- fixed assets leased from other parties under operating or

- finance leases

- fixed assets that are fully depreciated but still in use

- fixed assets that are not related to business operations

- separately appraised pieces of land that are booked as fixed assets

- other non-depreciable fixed assets.

Tax attributes

Generally, tax attributes (including tax losses and tax holidays) are not transferred on an asset acquisition. They generally remain with the enterprise until extinguished.

Value added tax

VAT is levied at the rate of 17 percent (except for small-scale taxpayers) on the sale of tangible goods and the provision of processing, repair and replacement services within the PRC territory. As of 2009, the purchaser of fixed assets is entitled to claim full input VAT credit on fixed assets against the output VAT.

As of 2012, VAT has gradually replaced BT, levied at the rate of 6 percent, 11 percent or 17 percent (except for small-scale taxpayers). VAT applied initially on the provision of transportation and modern services within the PRC territory, and then expanded to apply to the railway, aerospace transportation and postal industries as of 1 January 2014. It is expected that the other industries currently still subject to BT will become subject to VAT by the end of 2015.

The transfer of a business as a going concern, however, is outside the scope of VAT, provided certain conditions are met. A sale of assets, in itself, may not be regarded as a transfer of a business as a going concern and hence should not enjoy the VAT exemption. Announcement 13, issued in February 2011, clarified that a VAT exclusion may be available for the transfer of part of a business.

Transfer taxes

Stamp duty is levied on instruments transferring ownership of assets in the PRC. Depending on the type of assets, the transferor and the transferee are each responsible for the payment of stamp duty of 0.03 to 0.05 percent of transfer consideration for the assets in relation to their own copies of the transfer agreement (i.e. a total of 0.06 percent to 0.10 percent stamp duty payable). Where the assets transferred include immovable property, deed tax, land appreciation acquisition tax and BT may also need to be considered.

However, under the VAT reform to be implemented in the real estate industry, KPMG in China expects that VAT, in place of BT, will apply on the sale of immovable property. However, it is unclear how and at what rate VAT will apply. Details of the reform are expected to be released by the end of 2014.

Purchase of shares

The purchase of a target company’s shares does not result in an increase in the base cost of that company’s underlying assets; there is no deduction for the difference between underlying net asset values and consideration. There is no capital gains participation exemption in PRC tax law, so a PRC seller is subject to PRC CIT or WHT on the sale of shares, unless the consideration primarily consists of shares in the buyer and the reorganization relief (discussed in the section on equity later in this chapter) can be obtained.

Tax indemnities and warranties

In a share acquisition, the purchaser assumes ownership of the target company together with all of its related liabilities, including contingent liabilities. Therefore, the purchaser normally needs more extensive indemnities and warranties than in the case of an asset acquisition. An alternative approach is for the seller’s business to be hived down into a newly formed subsidiary so the purchaser can acquire a clean company. However, for tax purposes, unless tax relief applies, this may crystallize any gains inherent in the underlying assets and may also crystallize a tax charge in the subsidiary to which the assets were transferred when acquired by the purchaser.

As noted earlier in the recent developments section, a pressing new issue that must be dealt with through warranties and indemnities concerns the impact on purchasers of shares in offshore holding companies where the seller has not complied with the Circular 698 reporting requirements. Although the law is unclear on this point, purchasers may be subject to WHT obligations in the case of a Circular 698 enforcement or ultimately have the base cost in their shares adjusted downwards by the tax authorities to recoup tax that would otherwise have been levied on the seller on their offshore disposal. Purchasers may ask the seller to warrant that they have made the reporting or indemnify them for tax ultimately arising.

To identify such tax issues, it is customary for the purchaser to initiate a due diligence exercise, which normally incorporates a review of the target’s tax affairs.

Tax losses

Under the CIT law, generally, a share transfer resulting in a change of the legal ownership of a PRC target company does not affect the PRC tax status of the PRC target company, including tax losses. However, since the introduction of the GAAR, the buyer and seller should ensure that there is a reasonable commercial rationale for the underlying transaction and that the use of the tax losses of the target is not considered to be the primary purpose of the transaction, thus triggering the GAAR’s application.

Provided that the GAAR does not apply, any tax losses of a PRC target company can continue to be carried forward to be offset against its future profits for a maximum period of 5 years from the year in which the loss was incurred after the transaction. PRC currently has no group consolidation regulations for grouping of tax losses.

There is a limitation on the use of tax losses through mergers.

Crystallization of tax charges

The PRC does not yet impose tax rules to deem a disposal of underlying assets under a normal share transfer, but the purchaser should pay attention to the inherent tax liabilities of the target company on acquisition and the application of GAAR. As PRC tax law does not provide for loss or VAT-grouping, there is no ‘degrouping’ charge to tax (although care must be taken on changes of ownership where assets/ shareholdings have recently been transferred within the group and the reorganization relief has been claimed).

Pre-sale dividend

In certain circumstances, the seller may prefer to realize part of the value of the target company as income by means of a pre-sale dividend. The rationale here is that the dividend may be subject to a lower effective rate of dividend WHT than capital gains, subject to the availability of tax treaty relief requiring satisfaction of the ‘beneficial ownership’ requirements, among others. Hence, any dividends paid out of retained earnings prior to a share sale reduce the proceeds of sale and thus the gain arising on the sale, leading to lower WHT leakage overall. The position is not straightforward, however, and each case must be examined on its facts.

Transfer taxes

The transferor and transferee are each responsible for the payment of stamp duty of 0.05 of the transfer consideration for the shares in PRC company in relation to their own copies of the transfer agreement (i.e. a total of 0.10 percent stamp duty payable).

Tax filing requirements for special corporate reorganizations

The special corporate reorganization is elective. To enjoy the tax deferral under a special corporate reorganization, companies must submit, along with their annual CIT filings, relevant documentation to substantiate their reorganizations’ qualifications for the special corporate reorganization. Failure to do so results in the denial of the tax-deferred treatment.

Tax clearance

Currently, the PRC tax authorities do not have any system in place for providing sellers of shares in an offshore holding company with a written clearance to the effect that the sellers have made their Circular 698 reporting and that the arrangement will not be attacked under the GAAR. Consequently, as noted above, purchasers should seek to protect themselves through appropriate warranties and indemnities.

Choice of acquisition vehicle

The main forms of business enterprise available to foreign investors in China are discussed below.

Foreign parent company

The foreign purchaser may choose to make the acquisition itself, perhaps to shelter its own taxable profits with the financing costs. However, the PRC charges WHT at 10 percent on dividends, interest, royalties and capital gains arising to non-resident enterprises. So, if relevant, the purchaser may prefer an intermediate company resident in a more favorable treaty territory (WHT can be reduced under a treaty to as low as 5 percent on dividends, 7 percent on interest, 6 percent on royalties and 0 percent on capital gains). Alternatively, other structures or loan instruments that reduce or eliminate WHT may be considered.

Non-resident intermediate holding company

If the foreign country taxes capital gains and dividends received from overseas, an intermediate holding company resident in another territory could be used to defer this tax and perhaps take advantage of a more favorable tax treaty with the PRC. However, as outlined earlier in the chapter’s recent developments section above, the purchaser should be aware of the more rigorous enforcement of the anti-treaty shopping provisions by the Chinese tax authorities, which may restrict the purchaser’s ability to structure a deal in a way designed solely to obtain such tax benefits.

Circular 698 must also be borne in mind if an offshore indirect disposal is contemplated. However, even in the absence of treaty relief, the 10 percent WHT compares favorably with the 25 percent that would be imposed if the acquisition were held through a locally incorporated vehicle.

Further, as explained in the later section on debt financing, debt pushdown at the PRC level may be difficult, and the PRC corporate law requirement to build up a capital reserve that may not be distributed until liquidation might also favor the use of a foreign acquisition vehicle (however, see the comments on PRC partnerships earlier). Where the group acquired has underlying foreign subsidiaries, the complexities and vagaries of the (little-used) PRC foreign tax crediting provisions must also be taken into account.

Wholly foreign-owned enterprise

- A wholly foreign-owned enterprise (WFOE) may be set up as a limited liability company by one or more foreign enterprises or individuals.

- Profits and losses must be distributed according to the ratio of each shareholder’s capital contribution. Earnings are taxed at the enterprise level at the standard 25 percent rate and WHT applies at standard rate of 10 percent on dividends.

- Unable to borrow or obtain registered capital from abroad for equity investment, so M&A acquisitions must be financed out of retained earnings or issuance of own stock, although this is still not common in practice. Asset acquisitions may be relatively easier to fund from a regulatory viewpoint (see the section on choice of acquisition funding later in this chapter).

- Must reserve profits in a non-distributable capital reserve of up to 50 percent of amount of registered capital.

- May be converted to a joint stock company (company limited by shares) for the purposes of listing on the stock market.

Joint venture

- Joint ventures can be formed by one or more PRC enterprises together with one or more foreign enterprises or individuals either as an equity joint venture or cooperative joint venture.

- An equity joint venture may be established as a limited liability company. The foreign partners must own at least 25 percent of the equity interest.

- Profits and losses of the equity joint venture must be distributed according to the ratio of each partner’s capital contribution, and the tax and corporate law treatment is the same as for WFOEs, as described earlier.

- A cooperative joint venture may be established as either a separate legal person with limited liability or as a non-legal person.

- Profits and losses may be distributed according to the ratio agreed by the joint venture agreement and can be varied over the contract term.

- Where the joint venture is a separate legal person, the earnings are taxed at the enterprise level at the standard 25 percent rate otherwise, the earnings are taxed at the investor level.

- WHT applies at a standard rate of 10 percent on dividends paid by the legal person cooperative joint venture. Distributions by the non-legal person variant may not bear WHT, but the joint venture partner may be exposed to PRC permanent establishment (PE) risk. The structure bears similarities to the partnership form (which is increasingly preferred).

Chinese holding company

- Must have a minimum registered capital of 30 million US dollars (USD), which can be used to provide equity to the Chinese holding company’s (CHC) subsidiaries or to make third-party acquisitions.

- A CHC can finance the purchase of a Chinese subsidiary from another group company through a mixture of equity and shareholder debt, in line with the ‘debt quota’.

- Permitted to obtain registered capital/loans from abroad to finance equity acquisitions (but cannot borrow domestically to finance equity acquisitions).

- Same tax treatment as WFOE (10 percent WHT, 25 percent CIT on profits and gains) and same corporate law restrictions.

- Dividends paid to a CHC from its Chinese subsidiaries are not subject to WHT or to any tax in the CHC as the recipient.

- A CHC can reinvest the dividends it receives directly without being deemed to pay a dividend.

Chinese partnership

- Foreign partners are allowed to invest in Chinese limited partnerships as of March 2010.

- Profits and losses are distributed in accordance with partnership agreement.

- Unlike a corporate entity, there is no capital reserve requirement.

- Taxed on a look-through basis, although there is some uncertainty regarding the taxation of foreign partners.

- For an active business, the foreign partner should be taxed at 25 percent as having a PE in the PRC, which in effect potentially eliminates the double taxation that arises with regard to dividend WHT in a corporate context.

- Where a partnership receives passive income, it is unclear whether a foreign partner is treated as receiving that income (with potential treaty relief) or as having a PE in the PRC.

- Uncertainty regarding treatment of tax losses and stamp duty.

Choice of acquisition funding

Generally, an acquiring company may fund an acquisition with equity or a combination of debt and equity. Interest paid or accrued on debt used to acquire business assets may be allowed as a deduction to the payer. However, as noted earlier, if a PRC-established entity is used as the acquisition vehicle, the State Administration of Foreign Exchange (SAFE) Circular 142 may frustrate attempts to borrow monies or obtain registered capital from abroad to fund an equity acquisition in China. Borrowing locally is normally not possible due to the general People’s Bank of China (PBOC) prohibition on lending to fund equity acquisitions (and the limited interest of local banks in using the legal exceptions that do exist to lend to foreign invested enterprises – FIE). However, a CHC may be in a position to borrow/obtain registered capital from abroad to fund an equity acquisition.

Debt

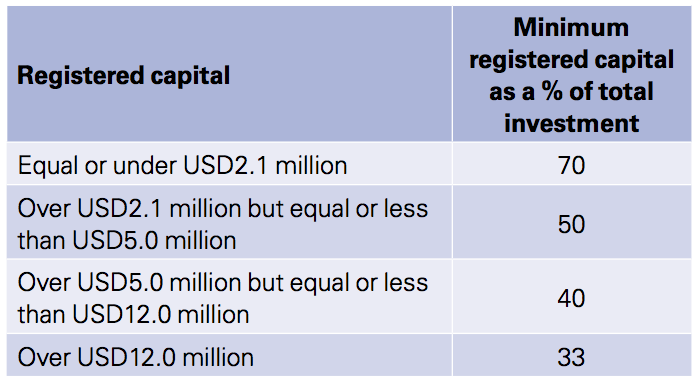

Per Ministry of Commerce (MOFCOM) rules, funding an acquisition with foreign debt is subject to the limitation of the investee company’s registered capital to total investment ratio. The registered capital of an FIE is the sum of the amount of equity that must be contributed by the investors in the enterprise. The total investment of an FIE is the sum of its registered capital and the maximum amount of a foreign loan that an enterprise is permitted to borrow.

The minimum ratios of registered capital to total investment are generally as follows:

Loans from a foreign lender to a Chinese borrower must be registered with the local branch of SAFE. Where an acquisition is funded by foreign debt, the FIE must register the foreign debt within 15 days of signing of the loan agreement. Without the proper registration, the FIE is not legally permitted to remit principal and interest payments outside China.

Any related-party loans also need to comply with the arm’s length principle under the PRC transfer pricing rules.

Deductibility of interest

Under the CIT law, non-capitalized interest expenses incurred by an enterprise in the course of its business operations are generally deductible for CIT purposes, provided the applicable interest rate does not exceed applicable commercial lending rates.

The CIT law also contains thin capitalization rules that are generally triggered, for non-financial institutions, when a resident enterprise borrows money from a related party that results in a debt-to-equity ratio exceeding the 2:1 ratio stipulated by the CIT law. Interest incurred on the excess portion is not deductible for CIT purposes. The arm’s length principle must be observed in all circumstances.

Where a CHC has been used as the acquisition vehicle, it should have sufficient taxable income (from an active business or from capital gains; dividends from subsidiaries are exempt) against which to apply the interest deduction, as tax losses (created through interest deductions or otherwise) expire after 5 years. Alternative approaches to utilizing the losses are not available as loss grouping is not provided for under the PRC law. Thus, CHCs generally are not be able to merge with their subsidiaries (precluding debt pushdown), and problems may arise for a non-CHC in obtaining a tax-free vertical merger.

Withholding tax on debt and methods to reduce or eliminate it

Payments of interest by a PRC company to a non-resident without an establishment or place of business in the PRC are subject to WHT at 10 percent. The rate may be reduced under a tax treaty. BT at 5 percent also arises on interest income earned by the non-resident from the PRC company.

However, under the VAT reform to be implemented in the financial industry, KPMG China expects that VAT, in place of BT, will apply on the interest income derived from the PRC company. Details of the reform are expected to be released by the end of 2014.

Under Notice 124, a taxpayer or its withholding agent is required to apply for approval from the PRC tax authorities to enjoy treaty benefits (e.g. reduced interest WHT rate). As noted above, enforcement actions based on information supplied under Notice 124 applications have stepped up significantly in the recent past.

Checklist for debt funding

- Consider whether application of SAFE and PBOC rules precludes debt financing in the circumstances and in the industry for foreign investment.

- The use of third-party bank debt may mitigate thin capitalization and transfer pricing issues.

- Consider what level of funding would enable tax relief for interest payments to be effective.

- It is possible that a tax deduction may be available at higher rate than the applicable tax on interest income in the recipient‘s jurisdiction.

- WHT of 10 percent applies to interest payments to non-PRC entities unless a lower rate applies under the relevant tax treaty.

Equity

A purchaser may use equity to fund its acquisition, possibly by issuing shares to the seller, and may wish to capitalize the target post-acquisition. However, reduction of share capital/share buy-back in a PRC company may be difficult, and the capital reserve rules may cause some of the profits of the enterprise to become trapped. However, the use of equity may be more appropriate than debt in certain circumstances, in light of the foreign debt restrictions highlighted above and the fact that, where company is already thinly capitalized, it may be disadvantageous to increase borrowings further.

Provided that the necessary criteria are satisfied, Circular 59 provides a tax-neutral framework for structuring acquisitions under which the transacting parties may elect temporarily to defer recognizing the taxable gain or loss arising on the transactions (a qualifying special corporate reorganization).

One of the major criteria for qualifying as a special corporate reorganization is that at least 85 percent of the transaction consideration should be equity consideration (i.e. stock-for-stock or stock-for-assets). Other relevant criteria include:

- The transaction is motivated by reasonable commercial needs and its major purpose is not achieving tax avoidance, reduction, exemption or deferral.

- The ratio of assets/equity that are disposed, merged or split-off meets the prescribed threshold ratio for share transfers, that is, at least 75 percent of the target’s shareholding needs to be transferred.

- The operation of the reorganized assets will not change materially within a consecutive 12-month period after the reorganization.

- Original shareholders receiving consideration in the form of shares should not transfer such shareholding within a 12-month period after the reorganization.

For qualifying special corporate reorganizations, the tax deferral is achieved through the carry over to the transferee of tax bases in the acquired shares or assets, but only to the extent of that part of the purchase consideration comprising shares. Gains or losses attributable to non-share consideration, such as cash, deposits and inventories, are recognized at the time of the transaction.

Certain cross-border reorganizations need to meet conditions in addition to those described earlier to qualify for the special corporate reorganization, including a 100 percent shareholding relationship between the transferor and transferee when inserting an offshore intermediate holding company.

Where the cross-border reorganization involves the transfer of the PRC enterprise from an offshore transferor that does not have a favorable dividend WHT rate to an offshore transferee that has a favorable dividend WHT rate with China, Announcement 72 clarifies that the retained earnings of the PRC enterprise accumulated before the transfer are not entitled to any reduction in the dividend WHT rate even if the dividend is distributed after the equity transfer reorganization. This measure is designed to prevent any enjoyment of dividend WHT advantages for profits derived before a qualifying reorganization.

Share capital reductions are possible but difficult. As PRC corporate law only provides for one type of share capital, it is not possible to use instruments such as redeemable preference shares. Where a capital reduction was to be achieved and was to be financed with debt, in principle, it is possible to obtain a tax deduction for the interest.

Hybrids

Consideration may be given to hybrid financing, that is, using instruments treated as equity for accounts purposes in the hands of one party and as debt (giving rise to tax-deductible interest) in the other. There are currently no specific rules or regulations that distinguish between complex equity and debt interests for tax purposes under PRC tax regulations. Generally, the definitions of share capital and dividends for tax purposes follow their corporate law definition, although re-characterization using the GAAR in avoidance cases is conceivable. In practice, however, hybrids are difficult to implement in the PRC, particularly in a cross-border context, because of a restrictive legal framework that does not provide for the creation of innovative financial instruments that straddle the border between debt and equity.

Other considerations

Company law

The PRC Company Law prescribes how the PRC companies may be formed, operated, reorganized and dissolved.

One important feature of the law concerns the ability to pay dividends. A PRC company is only allowed to distribute dividends to its shareholders after it has satisfied the following requirements:

- The registered capital has been fully paid-up in accordance with the articles of association.

- The company has made profits under PRC GAAP (i.e. after using the accumulated tax losses from prior years, if any).

- CIT has been paid by the company or the company is in a tax exemption period.

- The statutory after-tax reserve funds (e.g. general reserve fund, enterprise development fund and staff benefit, and welfare fund) have been provided.

For corporate groups, this means the reserves retained by each company, rather than group reserves at the consolidated level. Regardless of whether acquisition or merger accounting is adopted in the group accounts, the ability to distribute the pre-acquisition profits of the acquired company may be restricted, depending on the profit position of each company.

Where M&A transactions are undertaken, regard must be had to MOFCOM rules in the “Provisions on the Acquisition of Domestic Enterprises by Foreign Investors (revised)” issued in 2009. The provisions of the national security review regulations, issued by MOFCOM in March 2011 and affecting foreign investment in sectors deemed important to national security, must also be borne in mind. The consent of other authorities, such as State Administrations of Industry and Commerce and specific sector regulators such as the China Securities Regulatory Commission may also need to be considered.

Group relief/consolidation

There are currently no group relief or tax-consolidation regulations in the PRC.

Transfer pricing

If, following an acquisition, an intercompany transaction occurs between the purchaser and the target, failure to conform to the arm’s length principle may give rise to transfer pricing issues in the PRC. Under the PRC transfer pricing rules, the PRC tax authorities are empowered to make tax adjustments within 10 years of the year during which the transactions took place and clawback any underpaid PRC taxes. These regulations are increasingly rigorously enforced.

Dual residency

There are currently no dual residency regulations in the PRC.

Foreign investments of a local target company

The PRC CFC legislation is designed to prevent PRC companies from accumulating profits offshore in low-tax countries. Under the CFC rule, where a PRC resident enterprise by itself, or together with individual PRC residents, controls an enterprise that is established in a foreign country or region where the effective tax burden is lower than 50 percent of the standard CIT rate of 25 percent (i.e. 12.5 percent) and the foreign enterprise does not distribute its profits or reduces the distribution of its profits for reasons other than reasonable operational needs, the portion of the profits attributable to the PRC resident enterprise has to be included in its taxable income for the current period. Where exemption conditions under the rules are met, the CFC rules do not apply.

Comparison of asset and share purchases

Advantages of asset purchases

- Purchase price may be depreciated or amortized for tax purposes and buyer gains a step-up in the tax basis of assets.

- Purchaser usually does not inherit previous liabilities of the company.

- No acquisition of a historical tax liability on retained earnings.

- Possible for the purchaser to acquire part of a business only.

- Deduction for trading stock acquired.

- Profitable operations can be absorbed by a loss-making company if the loss-making company is used as the acquirer.

- May be easier to obtain financing from a regulatory perspective.

Disadvantages of asset purchases

- Purchaser needs to renegotiate the supply, employment, and technology agreements.

- Government licenses pertaining to the vendor are not transferable.

- May be unattractive to the vendor (high transfer tax costs to the vendor if the value of the assets has appreciated substantially), increasing the price.

- It may be time-consuming and costly to transfer assets.

- Accounting profits and thus profit distributability of the acquired business may be affected by the creation of acquisition goodwill.

- Benefit of any losses incurred by the target company remains with the vendor.

Advantages of share purchases

- Purchaser may benefit from existing government licenses, supply contracts and technology contracts held by the target company.

- The transaction may be easier and take less time to complete.

- Typically less transactional tax arises.

- Lower outlay (purchase of net assets only).

Disadvantages of share purchases

- Purchaser is liable for any claims or previous liabilities of the target company.

- More difficult regulatory environment for financing equity acquisitions.

- No deduction for purchase price and no step-up in cost base of underlying assets of the company.

- Latent tax exposures for purchaser (unrealized gains on assets).

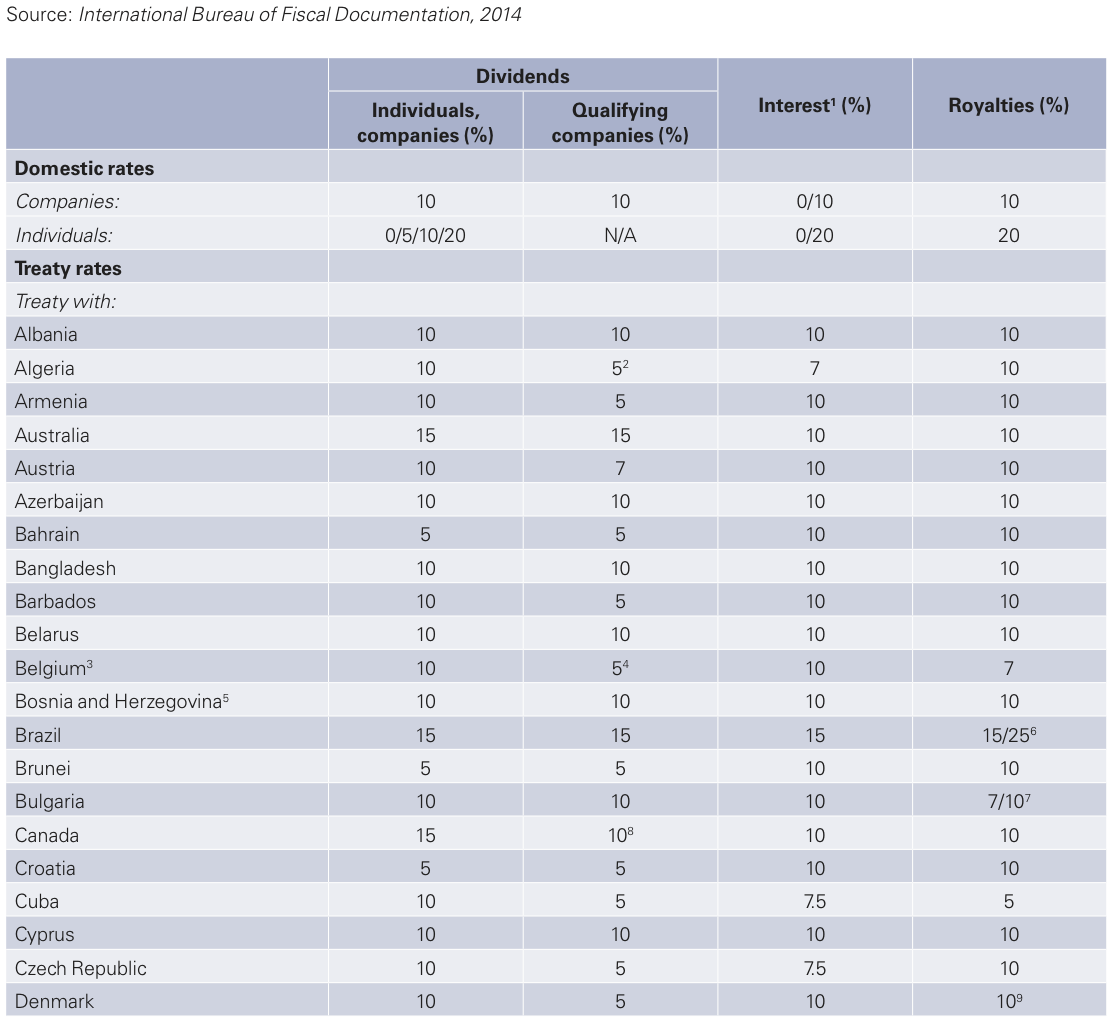

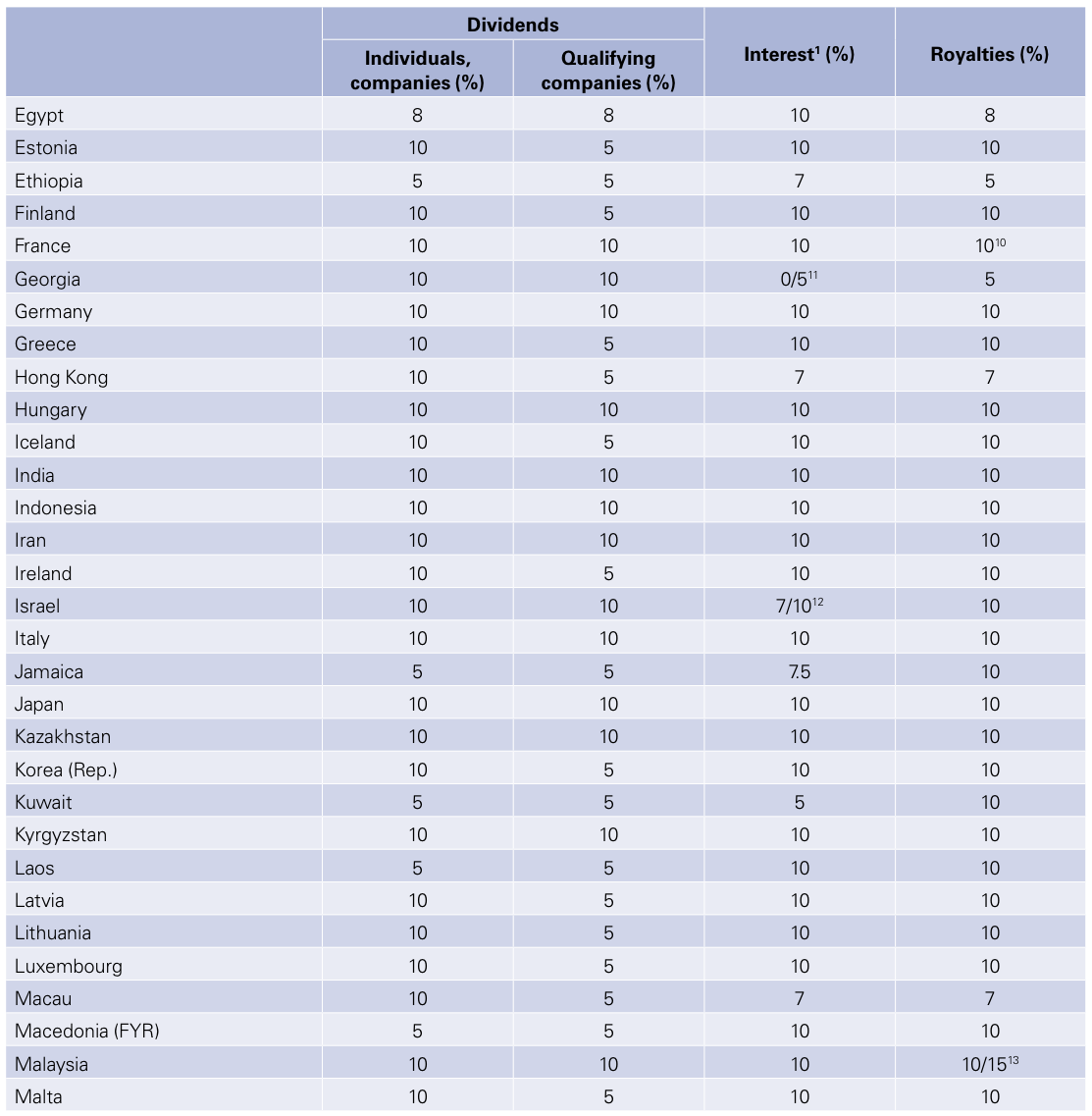

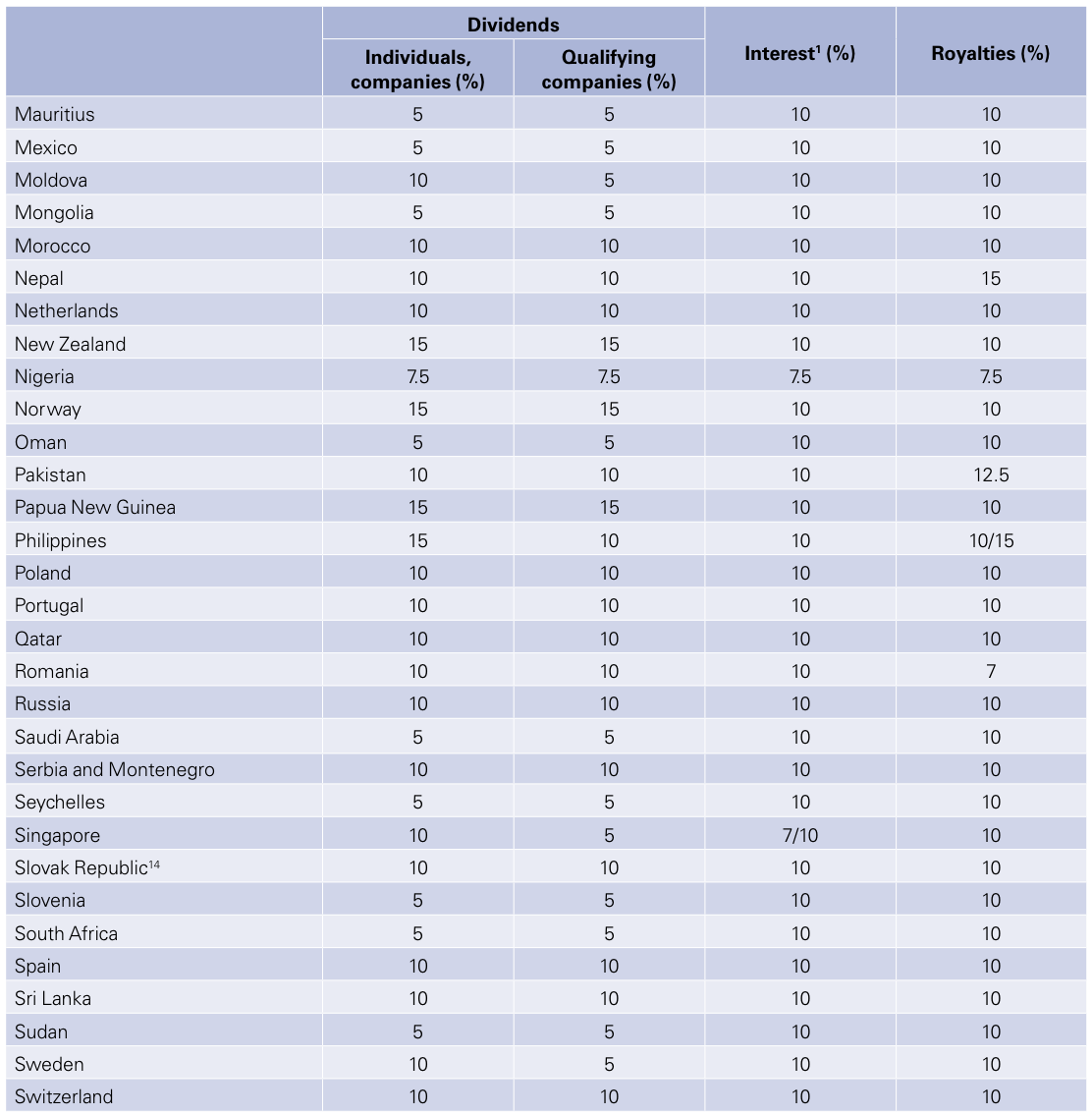

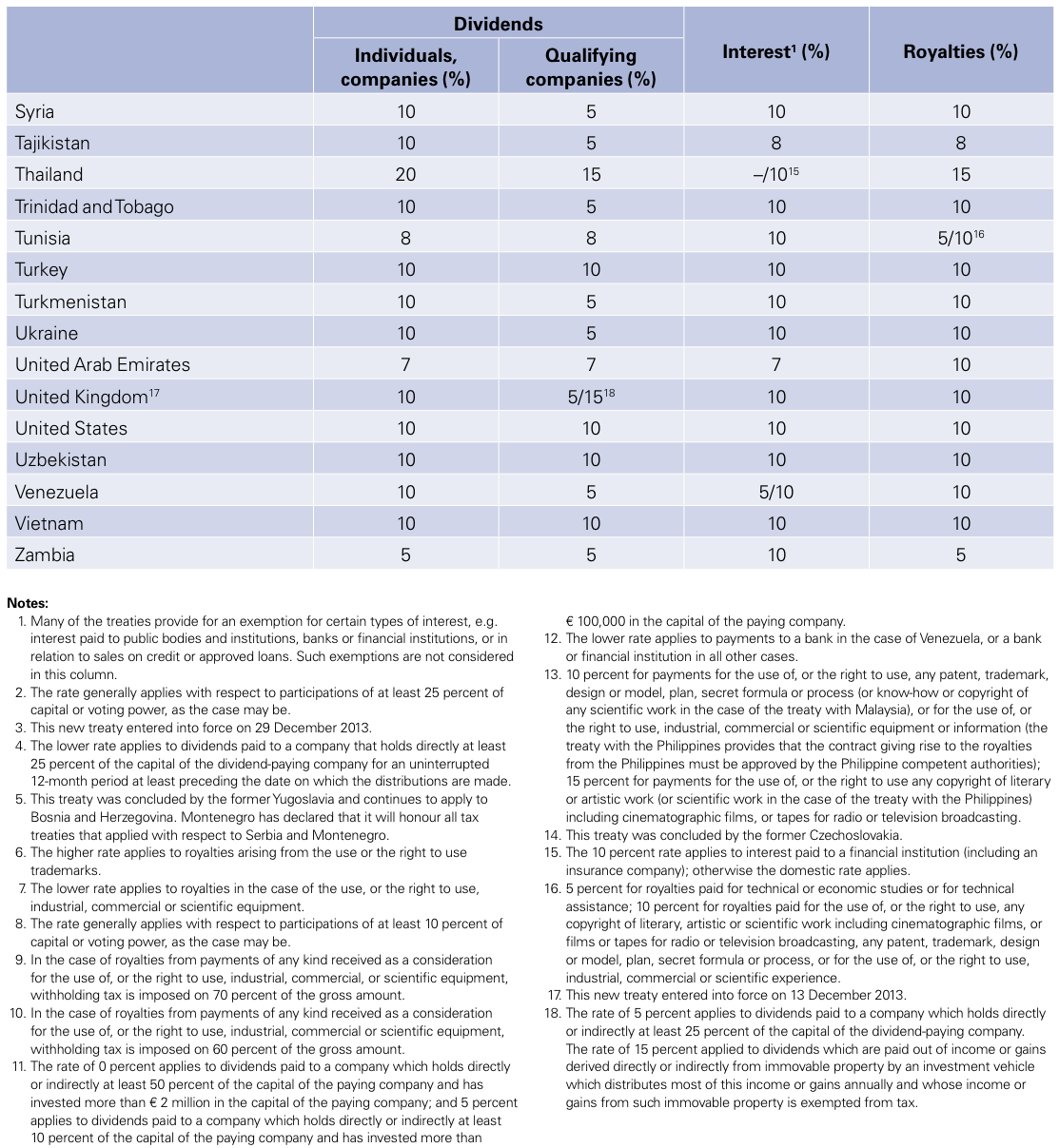

China – Withholding tax rates

This table sets out reduced WHT rates that may be available for various types of payments to non-residents under China’s tax treaties. This table is based on information available up to 14 March 2014.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter